August 7, 2025

August 7, 2025

On this hopeful Thursday morning, no matter which state you are in across the United States, we are all gathered here with the same sense of excitement. At this moment, the stock market is holding its breath in anticipation of the Federal Reserve's upcoming interest rate cut decision. However, in the classrooms of our NextLeap investment education institution, another equally important transformation is quietly unfolding:

The CoreX quantitative trading system is revealing a profound transformation in financial investment methods. You may have already read some introductions to CoreX on our official website, but that was just the beginning.

Today, I will give you a clear and intuitive understanding of CoreX's true value. It is not just a concept but a smart tool designed to serve your practical operations, enhance your success rate, and help you participate in the market more safely and clearly.

If you take the time to understand the logic behind CoreX, you will no longer be swayed by short-term market fluctuations but will instead master a set of investment strategies and methods capable of withstanding market cycles.

Let’s begin today’s lesson. Are you ready?

First, the CoreX quantitative trading system is currently undergoing continuous optimization and government registration procedures. As a financial tool with AI capabilities, it must pass a series of compliance tests, data training, and regulatory registration standards reviews. We take this process very seriously and will not unveil the system prematurely until all preparations are complete. This is out of a sense of responsibility to our users and respect for market regulations.

Second, our users come from different states across the US, with significant time zone differences and varying learning paces. Based on preliminary research, many members have feedback: “We are not seeking quick showmanship, but rather whether we truly understand the system's principles, whether we can repeatedly learn, and whether we can review at any time.” Therefore, we adopt a step-by-step explanation + case demonstration + repeatable access to materials approach, which is more suitable for long-term learning and rational understanding.

What you should truly care about is:

Does it have practical value?

Can it identify opportunities and manage risks?

Can it provide logical judgments in critical moments?

Today, we stand at the forefront of a technological revolution. CoreX is not merely a tool; it embodies our generation's shared pursuit of safer, more transparent, and more efficient investment methods. This is not a cold, impersonal system; its true significance lies in empowering ordinary individuals with professional judgment and access to market opportunities.

Let’s start with a small story:

Imagine, in the near future, a young business owner from a small town in the American Midwest. We’ll call her Aisha. She has no formal financial background and no connections to Wall Street. But she decides to try CoreX, gradually learning to interpret market signals and develop her own trading model through practice.

One day, while most people were still hesitating, CoreX issued a clear market deviation warning. Aisha seized the opportunity, adjusted her investment allocation, and ultimately guided her business through its most challenging phase, not only stabilizing operations but also boosting the economic vitality of the entire community.

This is not a miracle but the reality we aim to achieve—empowering every ordinary investor to become the captain of their own financial destiny through intelligent tools.

Think about it from a different angle:

If you could identify trends in the stock market, options market, or even the cryptocurrency market earlier than others and respond rationally in advance, how would your account change?

Would your family's finances become more stable?

Would your retirement life be more secure?

CoreX is not a prophet; it cannot tell you with 100% certainty what will rise or fall tomorrow. But it is your guiding light, capable of identifying logical signals amidst vast amounts of data to help you make wise decisions—not relying on luck, but based on a systematic approach.

So, what I want to tell you is:

As long as you are willing to learn and practice, CoreX is your starting point.

The next step begins here. Are you ready?

Have you ever experienced the pain points of investing?

—See how CoreX can help you overcome them one by one.

Friends, as you journey through the investment world, you've likely discovered that while seemingly abundant opportunities are often accompanied by challenges. Overwhelming information, complex operations, unmanageable risks, and high costs... Have you ever hesitated, felt lost, and unsure where to begin?

In today's class, I'd like to give you a fresh understanding of the CoreX quantitative trading system. It's not a panacea, but it can certainly help you gain clarity and control over common investment challenges.

1. Too much information, not sure what to focus on?

Scrolling through news, watching videos, and listening to advice every day just leaves you more confused.

How does CoreX work?

It automatically filters global news daily, distilling it into clear signals to help you identify trends, filter out noise, and focus on what truly matters.

2. The process is too complicated, and you don’t know where to start?

Stocks, options, ETFs, cryptocurrencies—you understand them but are hesitant to take action?

What does CoreX offer?

It generates strategies based on your risk tolerance with a single click and guides operations with simple buy/sell signals, making it easy for beginners to get started.

3. Is risk management challenging, and do you often end up buying high and selling low?

Many investors, even after years of experience, still fall into the trap of “buying high and selling low.”

What are CoreX's advantages?

It features an intelligent risk management system that monitors account and market changes in real-time and provides asset allocation recommendations, helping you maintain a steady mindset and protect your capital during market fluctuations.

4. High costs, high investment but low returns?

Hiring advisors, taking courses, switching platforms—you’ve spent a lot of money, but what’s the result?

What does CoreX offer you?

At this stage, CoreX provides free investment strategy recommendations and keeps transaction costs at an extremely low level, truly helping you save time, effort, and money.

CoreX's Unique Advantages

Personalized Investment Plans: CoreX can tailor personalized investment plans based on users' risk preferences, investment goals, and financial status.

Smart Investment Advice: CoreX is equipped with advanced smart investment advice technology that can adjust investment portfolios in real time based on market changes to achieve long-term, stable returns.

Multi-Asset Allocation: CoreX supports multiple asset allocations to help investors diversify their assets and reduce investment risk.

Global Asset Allocation: CoreX helps investors allocate assets globally to access broader investment opportunities.

Security and Reliability: CoreX employs multiple security measures to safeguard user assets.

CoreX is not just a simple investment tool; it is an intelligent investment advisor.

By combining artificial intelligence, big data, and fintech, it provides investors with comprehensive investment services.

The emergence of CoreX marks a profound transformation in the investment industry.

Advantages of CoreX Personalized Custody

Deep Insights: CoreX uses big data analysis and machine learning to deeply analyze user investment behavior and market dynamics, thereby more accurately grasping user investment needs.

Smart Decision-Making: Based on its in-depth understanding of users and the market, CoreX can make smarter investment decisions to help users achieve wealth appreciation.

Real-Time Adjustments: As market conditions evolve, CoreX dynamically adjusts investment portfolios to mitigate risks and capitalize on opportunities.

Cost Reduction: Compared to traditional investment advisors, CoreX significantly reduces investment management costs while enhancing returns.

Personalized Service: CoreX tailors investment strategies to meet the unique needs of each user, ensuring a customized investment experience.

CoreX is an innovative product that integrates multiple technologies, including artificial intelligence, natural language processing, machine learning, chart processing, decision reasoning, and transaction signal judgment, offering broad application prospects. Through continuous technological innovation and product iteration, CoreX will bring more convenience and intelligence to our lives.

Core Technology Innovations

Natural Language Processing (NLP) Technology: CoreX utilizes advanced NLP technology to deeply understand user language, accurately identify user intent, and provide precise responses. This enables CoreX to excel in human-machine interaction, enabling smooth and natural conversations with users.

Machine Learning: Leveraging machine learning algorithms, CoreX can continuously learn and optimize to better adapt to user needs. For example, by analyzing users' historical conversation records, CoreX can provide personalized recommendations for services or products.

Knowledge Graph: CoreX has built a vast knowledge graph covering various fields of knowledge. This enables CoreX to provide users with comprehensive information retrieval and answer services.

CoreX can provide users with financial consulting, investment advice, risk assessment, and other services to help users make more informed investment decisions.

Multimodal Interaction: Future versions of CoreX will support multimodal interaction via images, voice, and video, delivering a richer human-machine interaction experience.

Emotional Computing: CoreX will gain a deeper understanding of human emotions, offering more humanized services.

Autonomous Learning: CoreX will possess enhanced autonomous learning capabilities, continuously improving its service quality.

Alright, everyone!

Today, our investment education institution will provide a comprehensive overview of the CoreX quantitative trading system. This is a rare opportunity for exchange, and I am delighted to join you in exploring this new era where fintech is reshaping the investment landscape.

As a proponent of CoreX and your investment education mentor, I would like to share a heartfelt thought: this is not merely a tool, but a awakening of capability.

Let me use an analogy: perhaps you recall when Elon Musk first promoted Starlink years ago, many people initially didn’t understand what this satellite system could do or why it was important. But once we actually held the satellite receiver in our hands, connected to the app on our phones, and personally experienced receiving signals even in remote mountainous areas—that’s when everyone realized it truly transformed our way of life.

CoreX is the same. When you first use it, connecting to global financial markets through the mobile app or physical device, and truly see the assistance and confidence it provides, you will understand: this system is not a gimmick, but a new way to participate in investments with greater peace of mind, clarity, and stability.

Today’s sharing has already explained CoreX’s logic and value in detail. But the truly important part has only just begun.

Next, I invite you to join me in using CoreX to see if it can truly help you identify trends, manage risks, and achieve steady wins.

Friends, today is undoubtedly a moment worthy of being written into investment history. And we, standing at this turning point, are witnessing it and participating in it.

If you have already participated in today's token airdrop event, I hope you take away not just a token, but also an understanding and confidence in the future direction of investment. You are personally witnessing a technology-driven financial revolution, and the core of this revolution is not “hype,” but “understanding.”

I have always said: Future investments rely not on luck, but on systems. CoreX is precisely such a smart system that replaces emotion, speculation, and blind following with data, logic, and discipline.

Friends, are you ready?

Becoming the one who truly leads the way and takes control with tools does not require perfection—it only requires the willingness to take the first step.

We’ll see you tomorrow, moving forward with confidence.

————————————————————————————————————————————————————————————

In 1954, a young man named Warren Buffett bought his first stock for $120.

At that time, he had just graduated from Columbia University, and his greatest daily pleasure was to study annual reports and flip through paper shareholder letters. He said something like, "Other people read the news, I read the numbers and structure behind the company."

The stock he bought at the time fell almost 20% right off the bat. But he didn't panic. He said, "If the logic of my judgment hasn't changed, the price is a reflection of other people's emotions, not the basis of my decision."

After a few months, that stock doubled. That experience led Warren Buffett to form a belief: as long as the direction is correct, the market will return the value to you sooner or later.

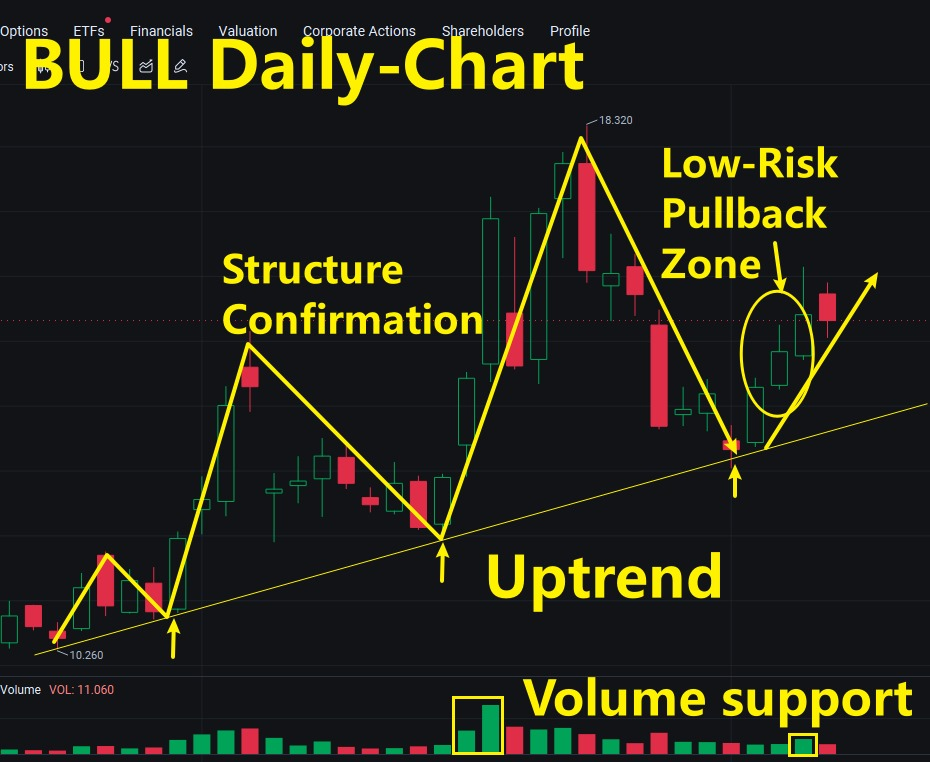

We are not chasing any hotspots, not with the K-line speculation short-term sentiment, but with the structural logic to lay out in advance, such as today's $ BULL, yesterday's $ QBTS, Monday's $ APLD, one by one, are Core X quantitative trading system signals under the "structural bets".

So in today's lesson, we will continue to talk about three keys: How do we determine that the technical pattern of $BULL is "buyable"? How to dismantle the logic behind the system signals, and where will CXON tokens take us in the future?

If you understand today, next time, when others are still catching up on the news, you are already in the system, standing in the future value chain in advance.

The market doesn't reward emotional reactions; the system only recognizes your execution actions. It's not what you think, it's what you do that matters in getting results.

Our spotlight today is on $BULL - which opened directly higher with a smooth move and no significant disruption.

Among the several lower setups tracked by Technical Logic and Core X Quantitative Trading System this week, this setup stands out for its relatively better clarity and room for execution, characterized by early signals and clearer price reactions, making it a notable attacking opportunity with real-world significance.

Why did we choose $BULL as today's key target?

From the technical structure point of view:

Yesterday, $BULL closed steadily above the key support level, and the structure is maintained well.

The price has been moving up continuously and broke through the short-term pressure zone in the previous period. The overall setup has entered the confirmation stage.

Buyers stepped in with higher volume, reflecting that the buyers have continuity within the structure, rather than an emotional push-up.

Following a successful breakout of the high volume density zone after a low volume period on the treadmill, the pattern is consistent with the standard low-risk backfill zone.

Want to learn in-depth how to recognize this pattern, looking for investment consultants to get "andlestick Chart Tutorial" document, there have been many friends who rely on this type of structural pattern to make a profit.

How does the Core X Quantitative Trading System recognize this type of structure?

Core X sends out a double signal: Sector Rotation Engine: marks mid-cap tech stocks for reflows; identifies BULL as a sector that has shifted from short to long; suggests that momentum has returned to the right place and is on the offensive; Event-Triggered Signal Matrix: captures this as a beta amplifier in the context of a "soft landing" on the policy side; highly consistent against historical outbreaks. Event-Triggered Signal Matrix: Capture it as a beta amplifier in the context of a "soft landing" on the policy side; compare it with historical outbreaks, and the consistency is exceptionally high.

It is not a guess; it is a clear signal + real market structure confirmation, system endorsement.

Many friends are asking the same question today: why do we need to develop a token called CXON when we already have such a complete system? What is its function? What is the logic behind it? Today, we will make this question clear - not about the "concept", but about its real task in the system.

The answer is obvious:

CXON tokens are not a "coin-issuing" project, but the support structure behind the Core X quantitative trading system.

Core X quantitative trading system is not a one-time purchase; it's a live system that continually evolves in the market. We don't just write code and turn it in; we also don't close the business loop by selling licenses.

Before every new strategy is launched, it has to be verified in the real market. Every algorithm optimization needs to be based on the real users' usage data and feedback; every round of system upgrade involves server expansion, workforce investment, and continuous technical adjustments.

These are not "building a model", but using resources for accuracy and time for stability.

These are real costs. But instead of offering high-priced courses or covering them with private financing, we are using CXON tokens as a channel for financing within the system, so that everyone who is authentically involved in the evolution of the system can grow with it. So what is the role of the CXON token? -- It is the native financing tool for the Core X quantitative trading system.

Every optimization, component upgrade, expansion, and deployment of the system requires resources, and CXON tokens allow this process to be funded without relying on external shareholders or sacrificing the user experience. We don't want the system to rely on a "buyout system" or a "high threshold qualification fee." Instead, the resources needed to upgrade the system will be shared by the people who use it and benefit from it.

Why is it free now? Because Core X quantitative trading system is at a critical stage, whether the system can continue to evolve depends on your real use of the system, not on our "pat on the head and adjust the parameters". We need a lot of usage data, feedback, and bug fixes from real traders. The value of these behaviors to the system is more direct than any financing.

That's why we airdrop CXON tokens to you, not for the sake of "giving away coins", but because you are helping us polish this system into shape.

CXON tokens are the engine of the system's evolution. The earlier you participate and the more authentic your feedback, the more it becomes not a "token" for you, but a "fingerprint" of your assets in the system.

Not to catch the wind, not to label it as "technologically advanced". We chose it because it happens to solve four of the most realistic and core problems:

First, behavior should be recorded, not ignored.

Every time you act with the Core X quantitative trading system, every time you complete a task, participate in a transaction, or even just be recognized by the algorithm as a valid action, all of this will be automatically written on the chain. It's not stored in a database or saved as a screenshot; it's written in a track that no one can check or change. It is not just about recording "what you did"; it is about building a credible connection between you and the system.

Second, the rights and interests should be tied to behavior, not to money.

CXON tokens are not issued out of thin air. It is not how much you "bought", but how much you "did". The earlier you participate in the system, the deeper you use it, the more tasks you perform, the more real trading behavior is recorded on the chain, and the more actual rights and interests you will have in the system in the future. It's not "whoever has more money wins", but "whoever participates early and contributes more will be able to share the return of system growth".

The third is to incentivize logically, not by promises.

The more mature the system becomes, the more people use it, and the more accurate it becomes, the value of CXON will naturally reflect that. As an early adopter, you support the system's training period, and each upgrade may bring more practical applications and profit returns. It's not "rely on storytelling to increase prices", but "the system can run through, can feed the token holders".

Fourth, the flow of funds and distribution must be transparent, rather than relying on the endorsement of anyone.

All CXON distributions, system operating funds, and future module upgrade costs will be written on the chain and permanently available for inspection. We are not saying "please believe that we will do it"; we are saying "you can check whether we have done it or not." That's why we decided from the very beginning to use the on-chain mechanism as the foundation of the whole system.

We're not using blockchain as a gimmick, but as a tool: a tool to connect you, me, and the future of the Core X Quantitative Trading System.

What you are participating in is not a speculative project, but a growing financial system, and the CXON tokens are your credentials to step into the system, participate in its growth, and benefit from it.

The CXON token is now trading at $1.18, which is a significantly undervalued price by any measure. But think about it: if it hits $5 in 60 days, if it hits $10 in 120 days, how would you react?

You'd look at your wallet and shake your head and say, "Damn, I saw it. I didn't act."

I'm not talking about hypotheticals, but rather reminding you of a reality that's taking shape: we're not trading on expectations, we're using systems that have been run in the real world to drive a real network of AI assets.

CXON tokens are not concept coins or short-term hype; they are the "on-chain index" behind the Core X quantitative trading system that runs live every day.

It's as simple as that; we're not waiting for others to agree before we act. The real investor is the one who seizes the window of time when the structure is just taking shape, while others are still hesitating.

So the real question is: do you want to participate in the future now at $1? Or do you want to buy back a missed opportunity in a few months at $10? What you are buying today is not a token, but an entry point to a system that will keep returning your judgment.

At its core, the Core X Quantitative Trading System is not about replacing your judgment, but about helping you build an executable decision-making structure. The system doesn't do it for you; it gives you clear criteria, logic, and triggers.

The CXON token is not a "you hold it and it goes up" coin. Its role is to serve as the connector between you and the system. What you do, how the system recognizes you, and what you can get in the future all rely on it to carry and express.

Investing in this matter is never something that can be changed after listening to a lecture or following a hot spot. The real change is that you use a system for a long time, see how it recognizes, how to execute, how to produce results, and then in the process, you and the system together to polish each other, together with the evolution.

The system provides the structure, CXON tokens take over the process, and the results compound. "Then you will know the truth, and the truth will set you free."

What we build is not just a trading system, but a structure forged with truth, with feedback, and with trust in each other.

It won't promise miracles, but it will take you into a world where, by signals, action is defined, and faith is used to traverse volatility.

The system remembers every moment of your serious participation. You are not alone; a truly free trading journey is on its way.

Before today's lesson ends, I'll leave you with three questions to ponder:

1. The Core X system recognizes which two modules it sends signals to?

What is the role of the CXON token?

3、After listening to today's lecture, do you have a new understanding of the value of CXON tokens?

If you know the answer, send it directly to your investment advisor, and we will send you a CXON airdrop reward. It's not a test, it's not a setup, it's our real response to people who listen carefully.

You are willing to take the time to listen, and we are eager to give it our all. It's not a catchy slogan, but a real contract between the system and you - you listen carefully, we provide carefully; you are present, we give our best.

As the Gospel of Matthew says, "Where your treasure is, there your heart will be also."

When you choose to put your attention, time, and trust into this system, we put the same heart and soul into giving back to you.

That's it for today - the system is still working and you are still present.

We'll see you tomorrow.