August 1, 2025

August 1, 2025

I imagine you may already be considering your plans for the weekend: perhaps spending time with family, preparing a meal, or simply enjoying a quiet moment with a book or a walk. Regardless of the form it takes, the ability to manage your time with ease is, in itself, a significant achievement in life.

This is precisely the significance of our commitment to investing and continuous learning: to gain greater autonomy in choosing the pace of life you desire.

The market is always fluctuating, and our goal has never been merely to “make money.” Rather, it is to navigate those fluctuations while still living life with composure and confidence.

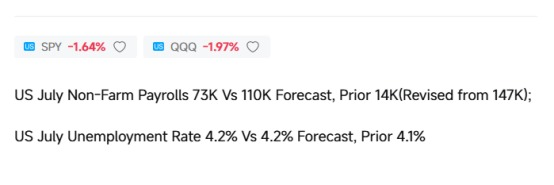

Today marks the first day of August and the first key observation window of the month—the nonfarm payrolls data will be released during the morning session.

This data has a profound impact on the market. It not only reflects the true resilience of the U.S. economy but also directly influences whether the Federal Reserve will officially initiate its rate-cutting process in September.

Over the past year, the Federal Reserve has maintained a high-interest-rate policy to curb inflation. Although the core PCE slightly exceeded the target in June, the overall trend has slowed, leading to a noticeable market rebound by late July. Now, the focus is on one question:

Is the job market still strong?

If job growth remains robust, it indicates the economy still has resilience, and even if rates aren't cut immediately, the market can maintain confidence and continue the rebound;

but if the data is weak, the market may interpret it differently: even if rates are cut, it's not a positive signal but a “bailout signal.” This will lead to more complex expectations and greater volatility.

In short — today's data may determine the direction of the market over the next few weeks.

Are you ready to handle it?

I have always believed that true winners don't wait for luck to come their way; they make decisions today to lay the groundwork for tomorrow. Think back to the truly successful moments in your life—weren't they all the result of a clear-headed judgment or an early plan?

Those with true strength quietly accumulate resources where others cannot see; those with true foresight are never swayed by the noise of the present.

If you are willing to persist in learning and continuous growth, I believe—the one standing in the spotlight of the future will undoubtedly be you.

Recently, I have become increasingly aware that NextLeap is not just a platform for learning about investment, but also a journey of collective growth for a group of people.

Every question and piece of feedback serves as a reminder: the core of investment education is not merely about imparting methods, but about accompanying each individual in establishing a clear direction and avoiding unnecessary detours.

This sense of being needed is both a responsibility and a source of motivation.

I firmly believe that as long as we maintain our passion for learning, even if we start with just a little, we can gradually move toward a more stable and free life.

And it all begins with the moment you choose to think deeply and take proactive steps.

This is where you start your journey into our family. We've got a special welcome gift for you and will show you the way to safe investing and smart growth.

Here, we've been doing one thing—helping more people see the truth about investing and avoid taking the wrong path. And you are the companion we've been waiting for.

Starting now, share your questions and experiences about investing, and we'll use our genuine support and expertise to illuminate the path ahead for you.

Welcome aboard—the future will be more complete because of you.

For example, every Friday, we hold a “Lucky Wheel Draw Day”—using a lottery system, we invite learners from all over the country to participate together and experience a moment of joy. This is not just a lottery; it is a ceremony that connects us all and spreads positive energy.

Have you received your raffle code yet?

If not, now is the perfect opportunity:

Complete today's interactive quiz

Respond to the investment advisor's questions

Share your stock observations or trading strategies

All these activities will earn you more raffle opportunities.

Is the wheel only one chance? Or multiple chances? — You decide. Wishing you good luck, and may fortune shine upon every moment of your efforts!

Happiness alone is not enough; true happiness comes from financial growth and inner peace of mind.

This is why I persist in offering investment courses, investment strategy services, and options signals—not to give you a fleeting sense of excitement, but to help you build a long-term, sustainable wealth system that delivers tangible results.

Whether you are just starting out or have years of experience, as long as you are willing to enhance your understanding, optimize your methods, and master the rhythm, we can go further together.

Currently, all these services are available for free during the promotional period, with the hope that you can avoid detours and get a head start.

In life, it’s not the low starting point that matters, but the inability to see the direction clearly.

This time, let us use our expertise to truly place you on the starting line of wealth growth.

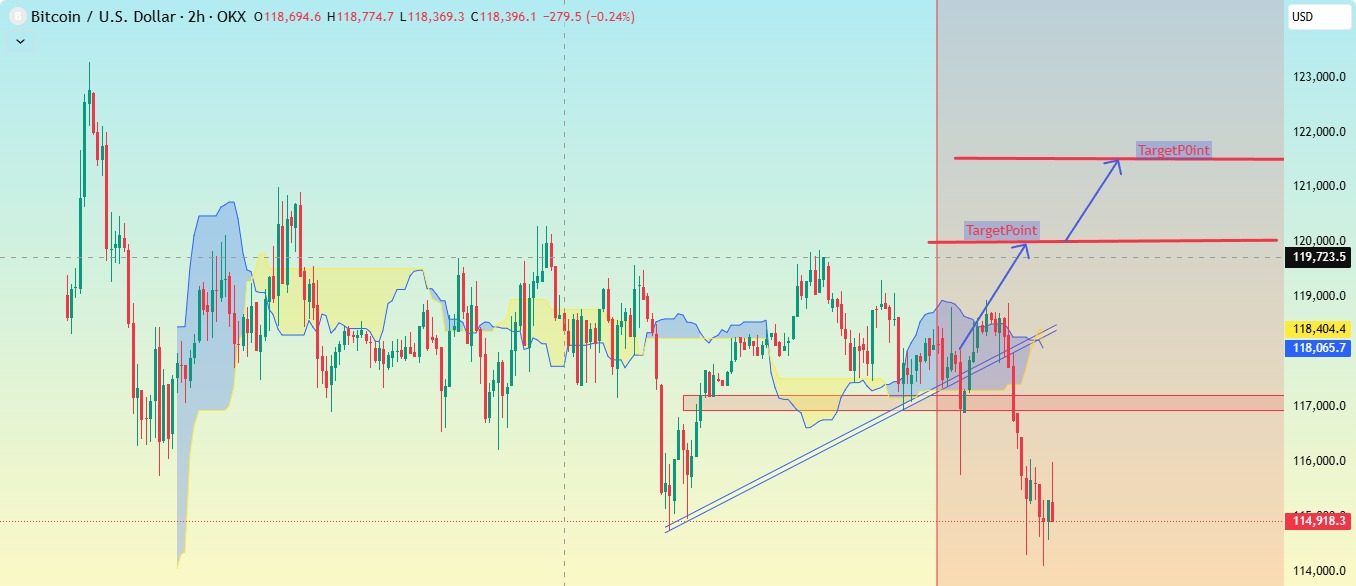

That's right. Although the overall market declined today, this is not entirely a bearish signal. Rather, it reflects the market's re-evaluation and re-prioritization of various asset values against the backdrop of accelerating expectations for interest rate cuts.

I have always emphasized that the true order of beneficiaries in an interest rate cut cycle is: interest rate futures > digital currencies > gold/copper/aluminum > U.S. Treasury bonds > stock markets. This is not theory, but a reality that is being gradually validated by the market.

By 2025, the U.S. government's stance will be extremely clear:

The White House has already included Bitcoin and Ethereum in the national strategic asset reserve, and the SEC officially approved the “physical exchange mechanism” on July 29, enabling Bitcoin and Ethereum spot ETFs to truly connect with the market.

This means that institutional capital will flow into the crypto market on a larger scale and with higher efficiency, with institutional benefits fully unlocked.

Meanwhile, companies like MARA and MSTR have already heavily invested in the crypto space.

Among them, MicroStrategy's Bitcoin holdings have generated over $14 billion in paper gains, not only driving up the company's market value but also boosting its overall profit expectations, making it a typical representative of this crypto bull market.

You don't need to allocate all your assets at once; even holding just one share of MARA means you've already boarded the first carriage of this wealth-building train.

Amid market volatility, the main trend is already clear—the key is whether you are willing to seize the moment now.

True opportunities never emerge only after everything becomes clear; rather, they are seized by those who dare to act ahead of the market when it hesitates, enabling them to truly position themselves at the forefront of trends.

Although the market has experienced an overall correction today, this is precisely the phase of building momentum for the next stage. Especially against the dual backdrop of “imminent interest rate cuts + institutions continuing to increase their exposure to digital assets,” such short-term volatility is more akin to a golden opportunity to enter the market rather than a risk signal.

Current recommendations:

During this structural window of opportunity, we suggest seizing the chance to position at lower levels and moderately increasing attention and allocation to core assets such as INJ, SOL, and MARA. By leveraging the strategic guidance of the CoreX investment portfolio, one can systematically capture the next wave of digital asset dividends.

Stay committed, sow at lower levels, and reap the rewards at higher levels.

Friends, today is Friday, so let's take it easy and not always focus on the market. Today, I want to talk to you about a more fundamental question: what is the difference between wealth and true wealth?

How do you understand “wealth”?

How do you view “wealth”?

I’ve always used four dimensions to distinguish between them, because only by truly understanding them can we establish genuine investment values and cultivate a mindset that leads to long-term success.

This not only influences our current choices but also determines whether a family can achieve true legacy and prosperity.

Are you ready to rethink your perspective on wealth?

We often say, “We want to become wealthy,” but what is true wealth?

I believe that true “wealth” in life is not just about money, but is composed of four dimensions:

1. Money and resources: This includes the assets, knowledge, and skills you possess, as well as the relationships and resources that can bring you sustained value;

2. Physical and Mental Health: This is the fundamental ability that allows you to enjoy life and achieve your goals;

3. Disposable Time: The ability to freely arrange your time and enjoy high-quality, meaningful moments is a rare form of freedom;

4. Emotions and Relationships: This includes family, partners, friends, and your connections to society and nature, which determine the warmth and stability of your life.

These four elements are like the “four core subjects” of life, and each of us is constantly learning and refining them.

Do you agree? Which subject do you think you've mastered well?

What I care about more and pursue together is wealth.

Wealth naturally encompasses the material foundation of the first layer of service, which includes the stage of affluence;

more importantly, it encompasses three layers of abundance: the ability to manage one's time, enjoy physical and mental health, have a intact family, a loving and happy partner, and the ability to promote ecological balance on Earth and engage in charitable work to enjoy the noble sentiment of helping others;

Yes, this is the wealth perspective I practice, and I strongly advocate that my students pursue these things as well!

Have you noticed the difference? What is your perspective on wealth?

Alright, friends, this week, we have all grown.

I have received a lot of feedback and suggestions from students, some expressing gratitude, others raising questions. But this is precisely the essence of teaching and mentoring—it is not a one-way lecture, but rather a process of mutual adjustment and growth. True value lies not in the applause of the moment, but in the long-term trust that endures through the ups and downs.

You have also gained something:

Perhaps you’ve learned a new trading tool, gained a deeper understanding of investment logic, or simply realized that “I should do more to prepare for my future.” That’s enough, because change often begins at this starting point.

Use this weekend to reflect on your growth this week.

Also, prepare mentally and strategically for next week’s market rhythm.

We’ll see you next week—let’s continue on this journey together.

Hey friends, it's Friday. Is the status still online? I'm Bird Grant from NextLeap Management Consulting LLC, nicknamed Mr. Profit Hawk. On a lighter note - it's sweepstakes time!

The raffle process is now open for this week's draw. If you haven't picked up your raffle code yet, please get in touch with your investment advisor to register as soon as possible. This session is a system recognition and connection confirmation between us. Whether you are present or not, and whether the system recognizes you or not, are all established from this moment of behavioral input.

For those of you who have already received a system prompt to win, regardless of the prompt to win, please follow the process to complete the confirmation and approach your Investment Education Advisor to claim your prize; don't worry if you haven't yet done so - we'll be opening up a new round of the mechanism every week, and the system will always be reserving a participation lane for you as long as you're willing to be present.

It is not a one-time task, but the starting point for you to enter the system and gradually participate in the co-construction. The system is still running, and the relationships in the chain continue. Whenever you decide to access it, it recognizes you and supports you from that moment on, and the opportunity will not be absent.

He said very clearly: the real investment advantage is never to wait for the market to confirm, but rather to determine whether the expectations have not yet been realized, with the structure of the judgment to complete the field.

Especially before key data like non-farm payrolls, land, the pricing logic of assets, and the behavioral structure of funds have often been written in the market in advance.

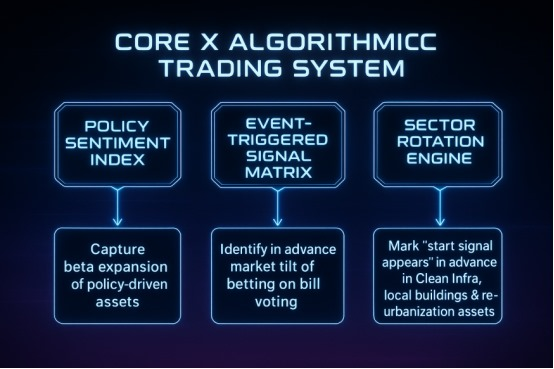

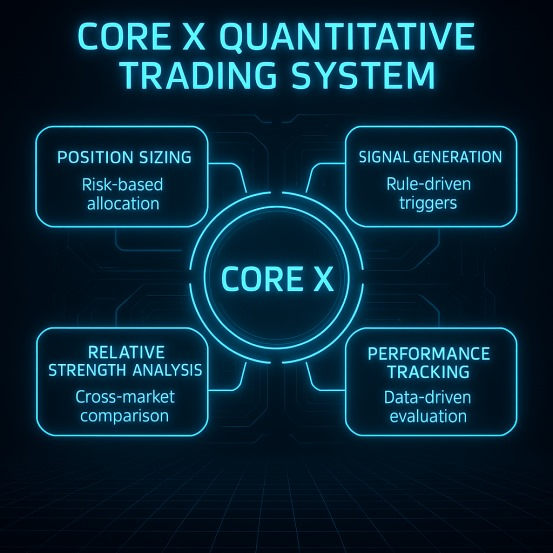

The Core X quantitative trading system reminds us that most people act after the news is realized, while the winners are already present when the structure is established. This is precisely why the Core X system exists - it's not a predictive tool, but rather a way for you to act in ambiguity, take informed positions, and avoid falling out of line or chasing highs.

So when Mentor Blake Shaw says, "Winners don't wait for news to hit the ground, they are there when the structure is in place," - he's not talking about emotional judgment, he's talking about systemic judgment.

This is precisely why the Core X Quantitative Trading System exists.

It does not try to "predict the non-farm payrolls up or down", what it does is, before the data land, through the factor changes, liquidity distribution, and capital pricing structure, to extract a higher probability of operation direction. For example, today's pre-morning system model has captured the following sets of signals:

Gold: Momentum structure continues to rise, with liquidity strength exceeding the average value before the regular data release. This suggests the market is already anticipating the "softening of employment + interest rate cut expectations strengthened" scenario.

U.S. bonds: Curve expectations have begun to reverse; the system suggests that medium- and long-term interest rate assets will re-enter the effective allocation window.

Highly valued technology stocks: The system indicates that multi-factor gains have converged, but funds have not flowed out. The current price behavior reflects the release of short-term profit-taking. The system did not identify that the trend structure is destroyed; the main framework remains valid.

Non-farm payrolls have not yet landed, but the system has identified directional clues based on structural changes.

The next more critical question is: once the non-farm payrolls land and the Fed's rate cut path starts to become clear, how do we follow our allocations?

The Core X quantitative trading system handles it this way: instead of "all in", it adjusts exposures according to structural weights. The system reallocates funds to a balanced structure between bonds, interest rate-sensitive equities (e.g., utilities, REITs), and technology growth.

Watch for "mispriced" assets to recuperate. For example, mid-cap growth stocks, which have sold off recently, are in a re-coverable zone as soon as modeling signals confirm this.

Strategy characteristics for the pre-Fed rate cut cycle: add gold and medium to long-term Treasuries (defense), follow the system's suggested "high sensitivity strategy groups" including AI, clean energy, and healthcare services, and reduce the weighting of banks, raw materials, and other highly interest rate-sensitive sectors.

So, you're not betting on the NFP data itself; instead, you're using the Core X system to anticipate the structure of the data before it happens. Is "before the news, based on the structure" of systematic investment.

Non-farm payrolls data released today, the results are far below market expectations: only 73K new jobs, far less than the expected 110K, the previous value of a substantial downward revision from 147K revised to 14K, the unemployment rate rose to 4.2%, reflecting a significant cooling of the job market, the market interpretation is obvious: the Fed's path of interest rate cuts has entered the countdown.

So what does the Core X system think?

The system caught signs of structural softness long before the data landed. As the data confirmed, the system automatically upgraded its ratings on interest rate-sensitive assets and locked in three key directions simultaneously:

DIRECTIONS 1|US BONDS / GOLD / UTILITIES

This group of assets is typical of rate-sensitive defensive names, with preferred reactivity in an environment of intensified rate cut expectations. For three consecutive days, the system has identified TLT, GLD, and XLU as showing stable capital replenishment behavior, with good momentum structure, entering the sustainable allocation zone.

Direction 2|AI High Growth / Medical Services

As valuation discounting pressure eases, the system suggests that PLUG and TOI have entered the signal confirmation zone, and Mid-cap AI, SaaS, and medical stocks have been included in the watch pool by the system, waiting for transaction verification.

Direction 3|Crypto Assets

The structure stabilizes, and system behavior recognition confirms that the rebound foundation has been established. BTC and ETH successfully stabilized yesterday's key support levels. Following the receipt of today's data, the system identifies it as a confirmation signal and is now focusing on tracking INJ, SOL, ETH, and other medium to high-momentum coins.

It all boils down to this: this is not a window for chasing rallies, but a period of behavioral confirmation that relies on the system to identify signals, pick the right direction, and enter the market in batches.

It is not a window for chasing calls, but rather a confirmation period for the system to recognize signals, pick the right direction, and enter the market in batches.

Regarding the "confirmation period", we need to discuss how the Core X quantitative trading system was implemented in the real market from yesterday to today.

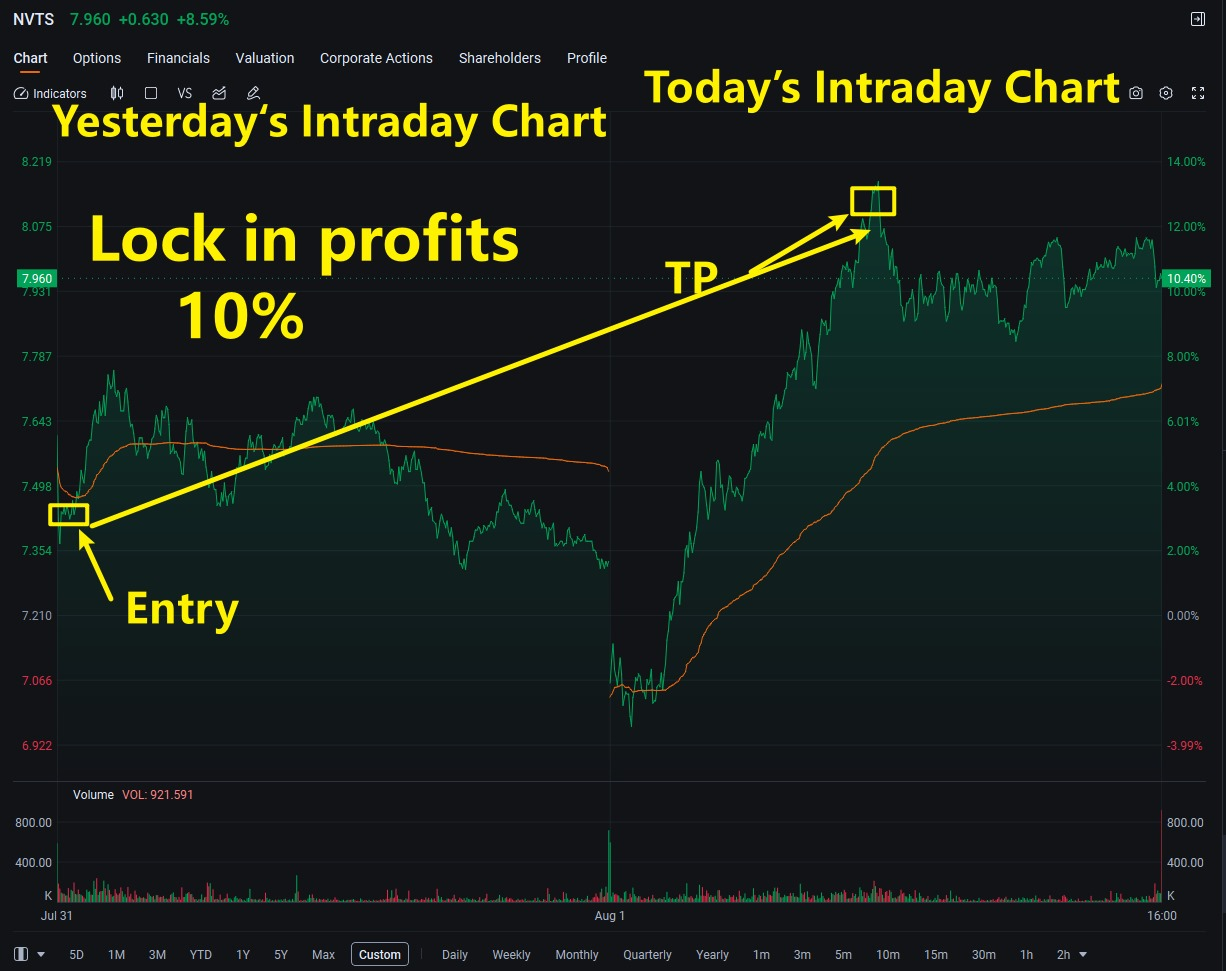

Case Review|$NVTS Precise Reversal Capture

Yesterday morning, the Core X system recognized that $NVTS momentum divergence + structural support was established for the first time, and automatically issued a signal to enter the market. Remind the community of friends to enter the market; most of them entered the market near $7.4, and the market rebounded quickly today, up more than 11% in the morning. The system alerted to lock in profits in the $8.1+ range - corresponding to yesterday's position, with a minimum profit of more than 10%.

It is a standard structure that captures momentum resonance and takes profit control throughout the complete implementation process, driven entirely by the system signal to complete, not by prediction or emotion.

Systematic execution doesn't just happen in the marketplace; it also occurs in the connectivity mechanisms between you and the platform.

CXON is how we build that connection on the chain. It's not an airdrop, it's not a welfare handout, it's your credentials to be in the system - to be recorded, to be recognized, to be given feedback.

Every time you follow a strategy, complete a task, or bind an asset, the system writes it to the chain. These actions make up your execution path, and CXON is the asset-based representation of that path.

In other words, you don't "receive" a token, but instead you use your behavior to declare to the system that you are present, executing, and part of this long-term structure.

CXON is the on-chain credential of Core X AI's quantitative trading system, which is the core engine to upgrade the system's functionality, connect users' participation, and support future commercialization. CXON is not a speculative token, but a multiple carrier of capital flow, user binding, and execution feedback during the growth of the Core X system.

CXON's core function:

It is the financing engine for Core X's quantitative trading system upgrade. Core X is an AI-driven quantitative trading system, and its continuous optimization relies on the processes of model tuning, data retraining, and strategy adaptation - all of which require high-intensity arithmetic power and capital investment.

CXON was created to facilitate the system's transition from lab to live trading and commercialization.

User Binding and Behavioral Feedback Mechanism

CXON binds the behavioral relationship between the user and the system: Did you participate in the strategy invocation? Could you let me know if you completed system interactions? Did you follow the key nodes? The system identifies participants and incentivizes them through these on-chain behaviors.

Confirmation Entrance for Future Commercialization Core X is advancing in the direction of live delivery, institutional access, platform deployment, and other key milestones. CXON will serve as the entrance for on-chain passes in future scenarios involving system service privileges, data invocation, and function unlocking.

Why do we do CXON?

Core X quantitative trading system is not a "write code and sell software" program.

It is a running AI system that must iterate in the real market. Every strategy evolution, data adaptation, and real market training is an essential process for the system to mature. This process does not rely on pre-sale licenses or VC investment, but on CXON to complete the connection between capital and users.

What are you holding now?

What you hold is not just a token, but a chain index of the operating track of an AI trading system, a certificate of access to a future commercialization platform, and a certificate of presence to participate in the process of building a fintech infrastructure.

In the final analysis, CXON serves as the credentials for Core X's quantitative trading system during the upgrade process and as the user connector for its global market entry.

We created CXON not to package a concept or issue a token, but to provide a truly effective trading system with the opportunity to take its full path - to continue training and optimizing in the real market until it can be self-validated and commercially deployed at scale.

You are not "buying a period of market", you are participating in the growth, validation, and globalization of a system landing process.

You, on the other hand, are already embedded in the structure as a system participant; the system is running, optimization continues to advance - what follows is your willingness to be consistently present, in sync with the rhythm of the system, and engaged in the long-term evolution.

As it says in the Gospel of John - "Blessed are those who have not seen and yet have believed." Those who have not seen, yet have believed and acted are blessed.

You are already on your way. We'll continue on Sunday. Stay sharp and stay in touch. See you there.