August 11, 2025

August 11, 2025

Today, the three major US stock index futures rose across the board before the market opened, reflecting positive market sentiment.

JPMorgan recently adjusted its expectations for the Fed's interest rate cuts, predicting that the Fed will cut rates by 25 basis points at each of its next four meetings, ultimately lowering the policy rate to 3.5%.

Additionally, President Trump has nominated economist Stephen Miran to replace current Federal Reserve Board member Adriana Kugler, which may influence the Federal Reserve's policy direction.

These factors have collectively fueled rising market expectations for rate cuts, with investors closely monitoring future economic trends.

Whether it's cryptocurrency or the stock market, today's pre-market performance has been strong, fully in line with my forecast from last Friday. A new profitable trading day has begun—are you ready to make the most of this opportunity-filled day?

Currently, the market widely expects the Federal Reserve to cut interest rates in September, with a high probability of a 25-basis-point reduction. This assessment is not unfounded—recent economic data indicates that inflationary pressures are easing and economic growth is slowing, aligning with the Federal Reserve's criteria for a rate cut. According to the CME Group's FedWatch tool, the market probability of a rate cut in September has reached nearly 90%.

In this context, investors should focus on three key factors:

Small and medium-sized enterprise (SME) financing costs: A rate cut will lower loan rates, alleviating financing pressures for SMEs and thereby stimulating investment and consumption.

Stock market performance: Rate cuts typically benefit the stock market, particularly technology and consumer goods stocks.

Bond market reaction: A rate cut may lower bond yields, thereby affecting bond prices and capital flows.

Meanwhile, the release of this week's inflation data will also be a market focus. The consumer price index (CPI) is expected to rise 2.8% year-on-year in July, up from 2.7% in June. A Reuters survey showed that some economists are concerned that President Trump's import tariff policy is pushing up the prices of certain commodities. Signs of tariff-driven cost increases were already evident in the June CPI report, and if this trend persists, it could impact the Federal Reserve's policy pace and market expectations.

For investors, this means opportunities and risks coexist—the prospect of rate cuts brings favorable liquidity conditions, but uncertainty surrounding inflation and tariffs remains.

The optimal strategy at this time is to maintain flexible position management, monitor both policy and data developments, and ensure that one remains in a proactive position amid market volatility.

The CoreX 40/60 portfolio tells us: Investing is not a sprint, but a marathon.

Many novice investors think this way: “I just want to make $100 today, so today is a success.”

It sounds reasonable, but the problem is—the market doesn't pay out according to your calendar. Investment returns don't arrive on a daily schedule; they're nonlinear and often deliver decisive growth at just a few key moments.

I often tell my students that investing is more like a baseball game than a dice roll. You won't score on every pitch, but if you capitalize on those home run opportunities, you'll win the season.

If you focus solely on daily price fluctuations, like fixating on the outcome of every pitch, you might end up missing the strategic objectives of the entire game.

This is why portfolio position management and strategy optimization are crucial. Investing isn’t an isolated gamble; it’s an ongoing process of learning, adjusting, and accumulating advantages. Stay on the right track, and time will become your ally.

So why does an economic recession cause the US stock market to fall?

Friends, let's first clarify the logic behind this.

When the Federal Reserve cuts interest rates by 50 basis points in one go, this is typically not “good news,” but rather a signal that the economy may be facing serious problems. This can trigger market concerns or even panic.

Once a recession is confirmed, it typically triggers a series of chain reactions:

1. GDP decline — the national economy slows down.

2. Rising unemployment rate — companies lay off employees, leading to more people losing their jobs.

3. Decline in consumer spending — people lose confidence and reduce spending on non-essential items.

4. Decline in investment — companies are uncertain about the future and reluctant to invest in new projects.

5. Decline in industrial production — factories reduce operations, leading to lower output.

6. Weak real estate market — home prices fall, and transaction volumes decrease.

Historically, the 2008 financial crisis is the most typical example: GDP contracted significantly, the unemployment rate approached 10%, and housing prices plummeted, ultimately triggering a deep recession.

Therefore, in the current environment, any economic data alleviating recession concerns can be viewed as positive news, driving the U.S. stock market higher.

Therefore, the market is unlikely to see consecutive gains on Monday, as panic sentiment continues to dominate the trend, and such volatility may become more pronounced.

So, what is our core trading strategy in this environment?

First, maintain positions in Treasury ETF

Continue to maintain a 20% position in Treasury ETF, such as TMF. Regardless of how many basis points the Federal Reserve cuts rates, Treasury ETF are clearly the beneficiaries, and the larger the rate cut, the stronger the upward price momentum.

Second, hold the “Three Musketeers” of profit growth.

$RBOT, $BMNR, and $WULF remain the optimal representatives of the current portfolio, with an upward trend, fundamentals benefiting from rate cut policies, and steady yet strong performance. Since the trend is on our side, let the profits keep rolling in.

Third, seize the long-term layout of CXON tokens

As one of the key assets of our NextLeap institution, CXON tokens not only embody the technological value of the CoreX trading system but will also gain higher market recognition as the project ecosystem expands. Against the backdrop of the global crypto market gradually recovering, CXON is in the early stages of value realization. The earlier you hold them, the more you can lock in future appreciation potential.

If you hold these assets in your portfolio, take a look at the current returns and ask yourself: Is this the combination of stable growth and future potential you are seeking?

In addition to maintaining the profitability of government bond ETFs and the “Big Three,” our CoreX 40/60 investment portfolio also includes a powerful profit enhancer—$MARA, $MSTR, and BTC, ETH, SOL.

Bitcoin is not only the technological core of blockchain but also a symbol of the global “decentralized” philosophy. Earlier today, Trump explicitly stated in a live broadcast: “Cryptocurrency really has the potential to become something special. It's still young and growing... I believe in that.” He also emphasized that the United States needs to establish a legal framework for cryptocurrency because this industry is a “very powerful market.”

From a technical perspective, Bitcoin's price is currently in a steady upward trend, meaning it could be the biggest beneficiary of interest rate cuts releasing liquidity funds for an extended period and the first “reservoir” to absorb funds from a depreciating dollar.

So I ask you:

Have you already positioned yourself for it? More importantly—is your holding large enough to share in this long-term growth dividend?

Many people have yet to fully grasp just how astonishing the value of Bitcoin has been over the past decade or so.

Let’s use a familiar point of reference—the iPhone—for a simple comparison.

Think back: which generation of iPhone have you used? Which model was your favorite?

More importantly, were you even aware of Bitcoin’s existence at that time? Did you understand the underlying value logic behind it?

In Bitcoin’s early days, paying for an iPhone might have required dozens, or even hundreds, of coins; today, the number of Bitcoin needed for the same iPhone might be just a fraction of what it was back then.

This gap is truly staggering. That iPhone you loved so much might now be electronic waste; yet Bitcoin continues to redefine scarcity and value to new heights.

This is the difference between consumption and investment—and the realization of vision and understanding.

True wealth comes from daring to hold onto something before its value is widely recognized.

Today, the CXON token is in a similar position to Bitcoin in its early days—scarce supply, gradually expanding use cases, and backed by clear ecosystem planning and financial support.

If Bitcoin was the wealth legend of the past decade, then CXON could very well be the new chapter for the next decade.

Looking back, you’ll realize that the choice you make today might just be the step you’re most proud of in the future.

As an investor, what you really need is not just the courage to get on board, but a belief—a belief that comes with the determination to hold on. CoreX has learned and recorded vast amounts of historical data, and it constantly reminds me: this is the most critical moment in the next two years, and the most memorable year in the next twenty years.

On this Monday filled with passion and imagination, we sparked ideas through discussion and witnessed the most beautiful kindness in humanity through our educational efforts.

Remember, true victory lies not only in gains but also in gratitude. Those who have helped you, those who reached out when you were lost—when you reach your own moment of glory, please take the time to say “thank you” to them in person, for it is these very forces that have brought you to where you are today.

Since history has already determined the importance of today, the achievements of CoreX will undoubtedly surpass everyone's expectations!

More importantly, we will have special quiz giveaways and interactive Q&A sessions every week.

This is not just an event; it is an opportunity. By participating in the quizzes and interactions, you will have the chance to receive exclusive rewards in the form of NextLeap Institution tokens (CXON).

However, before you claim your rewards, I hope you’ll take a moment to truly understand its value and future potential—

Click on the NextLeap institution’s official website: https://url.chycat.live/b455bcc1 to browse the token whitepaper, just like reading its “value statement.”

Guys, the moment you get to know it is the beginning of your long-term relationship with it.

Use your wisdom to win it over, and let it bring you returns beyond imagination in the future!

Friends, discovering the value of NextLeap's investment education institution also involves a core interpretive factor—token economics.

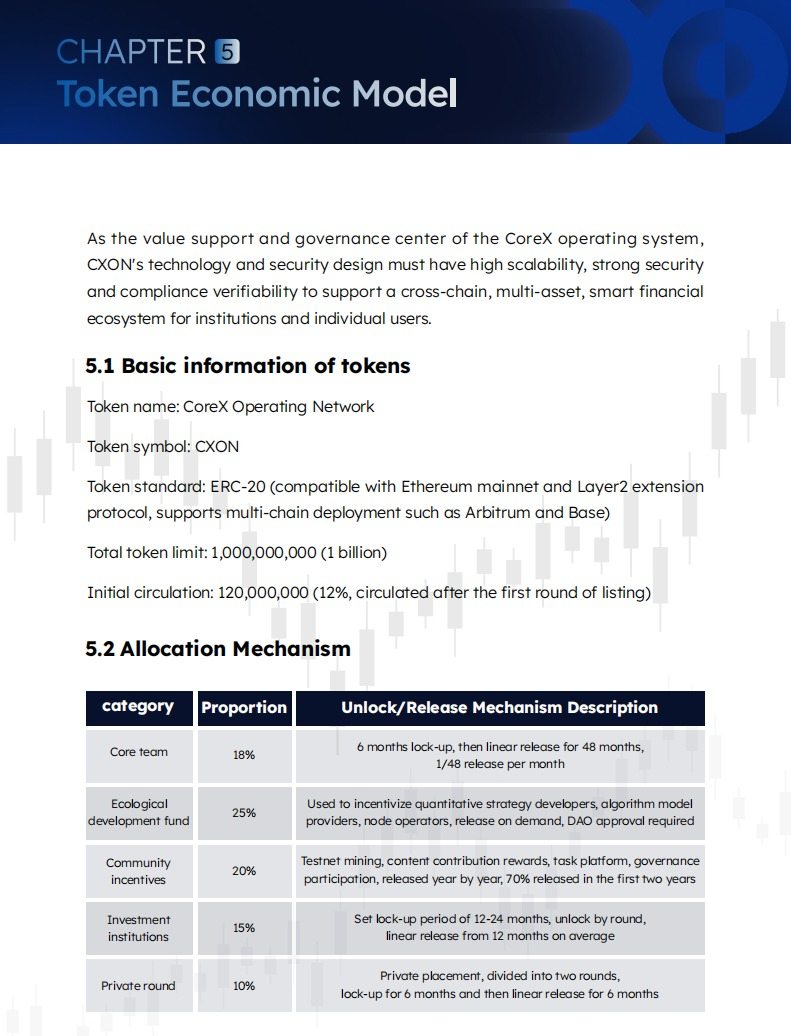

As shown in the figure, our total token issuance is 1 billion, with the following specific distribution:

Charity Foundation: 15% — Used to support long-term charitable projects, aligning wealth creation with social responsibility.

Company and Institutions (including shareholders): 20% — Ensuring that the core team and institutions' interests are aligned with token value, sharing in the fruits of growth.

Public IDO: 15% — Openly issued to global investors, enhancing market participation and liquidity.

Market and Ecosystem Operations: 30% — To drive brand development, market expansion, and ecosystem construction, ensuring the token truly “thrives” in the market.

Research and Technology Development: 20% — To continuously invest in CoreX technological innovation, maintaining long-term competitiveness.

Except for the portion already in circulation on listed exchanges, all remaining tokens are subject to a lock-up period.

This means — our token's market circulation is extremely scarce, and scarcity is often a key driver of price increases.

Price increases may not only exceed my expectations but also bring holders exceptional returns.

Guys, are you looking forward to getting it soon?

When scarcity meets value, this is the moment investors should seize!

Daily quizzes, interactive Q&A sessions, and weekly giveaways aren’t just fun activities—they’re your first step toward truly engaging with the NextLeap institutional token.

Why do I say this token is worth your time to understand?

Because its economic data is akin to researching a company’s top ten shareholders in stock investing—you’ll care about: Who holds it? What is the circulating supply? Does the team behind it have the experience and capability to steadily advance the project?

According to the whitepaper, our total token issuance is 1 billion:

Charity Foundation: 15%

Companies and Institutions (including shareholders): 20%

Public IDO: 15%

Market and Ecosystem Operations: 30%

Research and Technology Development: 20%

Currently, NextLeap holds a significant portion of the tokens and is raising funds through the CoreX project.

At the current market price of 1.2 USDT, the 40% funding share of CoreX corresponds to a market capitalization of 480 million USDT.

In other words, the current funding scale is approximately 168 million USDT.

This indicates that the token plays a crucial role in CoreX's initial funding phase.

What about the future? I believe it could even surpass 10 USD.

Yes, I’m referring to 1 USD = 1 USDT.

So, folks, when you actually own it tomorrow, do you want it to just sit idle in your account, or become the most dazzling part of your wealth curve?

The choice is yours.

The winners of the future—especially those who are already profitable:

When the market on Monday played the melody of wealth amid the wave of interest rate cuts, were you also the one dancing most gracefully on the dance floor?

I sincerely thank you for your trust and support in NextLeap, and for joining us with sincerity and passion. It is precisely because we possess a spirit of unity, a proactive mindset, and an unwavering belief in investment success that, no matter how much hardship and waiting you have endured, please continue to join me in moving toward a brighter, broader future.

Old friend, let the elevator of appreciation continue its ascent, and let CXON spread its wings and soar freely. You’ve heard my call before—since you’re already on board, there’s no reason not to enjoy the journey!

Review your positions today, and tomorrow in class we’ll continue to refine our strategy, turning opportunities into tangible returns.

——————————————————————————————————————————————————————————————————

Good afternoon, today's market is more refreshing than your coffee. I'm Bird Grant from NextLeap Management Consulting, LLC. I'm Bird Grant from NextLeap Management Consulting, nicknamed Mr. Profit Hawk, and today's market reminds me of a story Peter Lynch told in "Beat Wall Street".

In the 1970s, Americans were shifting their coffee drinking habits from their homes to the chain stores down the street. At that time, Lynch noticed that in the Boston area, every morning, during rush hour, there was a store called Dunkin' Donuts; rain or shine, there was always a long line of people in front of the door. He realized that it was not only locals, but also commuters who would make a detour to buy coffee and doughnuts.

Lynch went back and looked through the company's financial reports and saw a steady stream of profitability, an ever-increasing number of stores, and a model that was just as quick to gain a foothold when entering new cities. Wall Street at the time wasn't paying attention to it, thinking there was little growth potential in selling coffee. But Lynch knew that real growth was often hidden in such undervalued, everyday consumer habits. So he bought in and held on for the long term, and eventually the investment paid off handsomely.

He later summarized: "You don't have to wait for the media to make a big deal out of it, and wait until everyone knows about it before you act. Good opportunities are usually found in places that have already been started, but most people don't realize it yet."

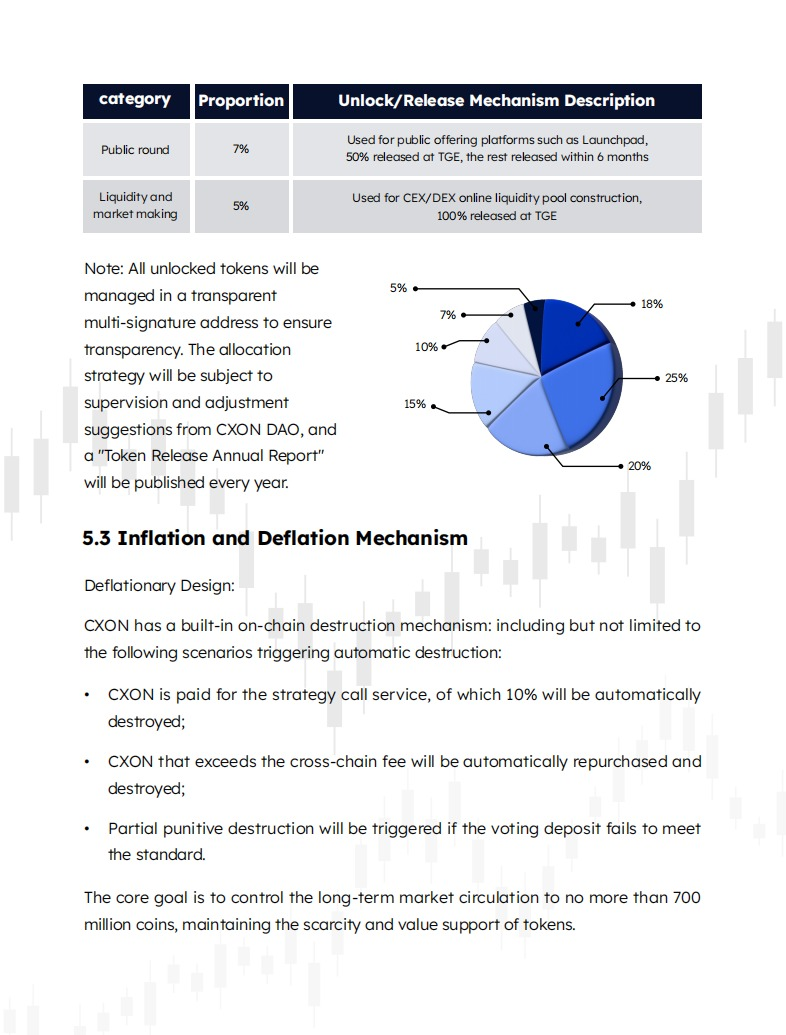

Today's outflow of semiconductor money and the full-on kick-start of crypto proxy stocks have me feeling the same way. eTH's breakout above 4,300 isn't just a numerical change in price; it's a signal that all three strands of the chain-liquidity, institutional money, and policy support-are working at the same time.

If you already have an allocation like Core X 40/60 in your portfolio right now, this change won't just be market news - it'll translate directly into tangible gains in your account like the crowds Lynch saw lining up at Dunkin' Donuts back in the day.

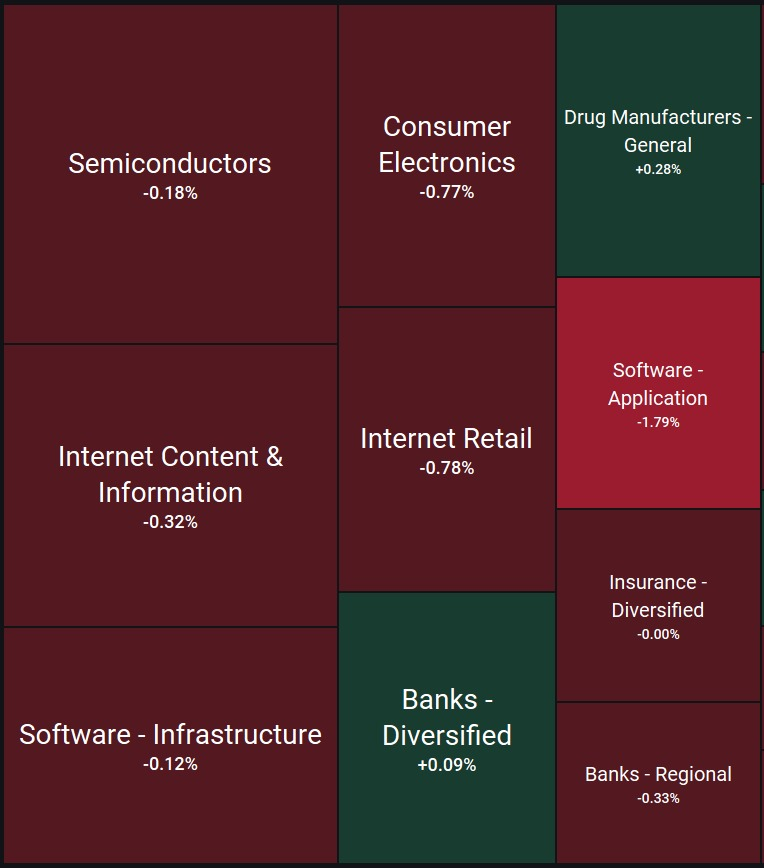

Today, in our Core X 40/60 portfolio, we locked in profits on $BULL and $WULF. As for $SBET, which we bought this morning, it pulled up to +18% during the session, but fell back significantly before the close. The main reason for this was the news of the private placement financing, which triggered short-term funds to cash in their profits, concerns about potential dilution, and the typical "cash on the upside" reaction.

Don't be overly nervous about this volatility in $SBET - these kinds of short-term pullbacks on private placement news are common. Its technical structure is still solid, and the money flow is still there. Once the market has digested the dilution expectations, there is still a chance that the trend will continue.

SharpLink's ETH holdings are expected to be worth over $3 billion. The point is - $SBET's current market capitalization is also only $3 billion. It means that it is in a clear value gap, which is a potential upside once the market reprices itself.

The new allocation scheme is:

40% (defense): highly resilient defensive assets - AI, semiconductors, crypto proxy stocks. These sectors have two advantages: first, they have their growth logic, and second, even if crypto experiences a pullback, they are supported by independent flows and will not collapse instantly.

60% (Offense): Directly target the core cryptocurrency assets, especially SOL, BTC, and ETH, which are currently entering a strong trend.

Why use "highly resilient" assets on the defensive side?

Because in the early to mid stages of a crypto bull market, a traditional "gold + bonds" defensive portfolio will not protect the value of the portfolio, but may slow down the growth of the portfolio's net worth.

Assets such as AI, semiconductors, and crypto proxies, though volatile, are highly correlated to crypto in terms of underlying logic and funding, and can help us hold onto our "bull market beta" while not being entirely subject to sentiment fluctuations in the chain.

SOL is now one of the rare targets where the three forces of on-chain liquidity + institutional funding + policy support are all working at the same time:

On-chain liquidity

Solana's trading activity in ecosystems such as DeFi, NFT, and on-chain gaming continues to reach record highs, and its single-day on-chain trading volume has exceeded that of Ethereum many times. It is not based on short-term speculation, but rather the deposition of funds brought about by the real growth of application scenarios.

Institutional funding

Since this year, several institutions, including VanEck and Grayscale, have applied for or launched Solana-related financial products. The funding curve involves quietly building a position first, followed by a focus on pushing up. SOL is currently in the transition window from the first phase to the second phase.

Policy Support

The US policy on blockchain infrastructure is beginning to loosen, and international financial centers such as Dubai are issuing crypto derivatives licenses in bulk, which is tantamount to opening the door to global compliance for high-performance public chains like Solana.

We are now adding SOL, not to chase the heat, but its underlying logic has been validated. When chain liquidity, institutional funding, and policy support intersect, every similar situation in history has yielded multiple gains, sometimes dozens of times.

Today, we will increase the allocation of SOL on the offensive side, placing it at the core of Core X's 60% offensive position. The goal is clear: maintain the defensive trend and capitalize on the primary offensive uptrend, ensuring this market round is both profitable and sustainable.

My friends, you can take a 10-15% position in SOL right now.

Friends, this is a problem I want to talk about once and for all today. The pain point is straightforward: relying solely on "eyesight + experience" may occasionally yield a good opportunity, but in today's fast-paced, highly volatile market, consistently achieving the proper long-term outcomes is almost impossible.

The reason is straightforward: there is too much information, too much noise, and emotions change too quickly. You only have to miss a switch point once, and the rest is often a vicious cycle of chasing up and down.

It is the significance of the existence of Core X quantitative trading system - "see → judgment → execution → review" into a repeatable, auditable pipeline, do not rely on luck, do not eat the loss of emotional fluctuations.

How can we better understand the Core X Quantitative Trading System?

As we all know, OpenAI's products are not just about writing texts; its product matrix is changing the way information is processed and decisions are made.

Let's use a few real-life scenarios to get a feel for it:

1, quick summary and marking

FOMC minutes, official speeches, bills, and financial reports into the GPT, within a few seconds to distill the key points, and labeled as "hawkish / dove / uncertain". Others are still reading the second paragraph, but you already have a preliminary judgment.

2, semantic search

news, research reports, and regulatory documents to quantitative storage. When the market moves, immediately find the history of similar cases and the best response strategy. Decision-making does not rely on memory; it relies on facts and cases.

3、Automated execution

Capture the resonance of the three signals "movement + mood + turnover", the system automatically runs backtesting, wind control, refreshes the candidate list, reduces delays, and avoids missed opportunities.

4、Data quality control and review

AI automatically marks abnormal data to ensure signal stability. After the market closes, you only need to perform the next day's factor analysis, trade reviews, and candidate reviews.

If you understand what OpenAI can do, it's easier to understand why you need to invest in the Core X Quantitative Trading system:

In today's fast-paced markets, it's hard to consistently make the right moves with "eyesight + experience" alone. There is too much information, too much noise, and emotions change too quickly, so once you miss a switch, you are stuck chasing highs and lows.

The value of the Core X quantitative trading system is to make "seeing → judgment → execution → review" into a repeatable, auditable, and evolvable pipeline.

Its three core modules:

Policy Sentiment Index: plugs AI's sentiment labeling directly into the strategy, taking positions on rate-sensitive assets and style switches in advance.

Event-Triggered Signal Matrix: Using scenario libraries and AI event recognition to find executable signals within 48-72 hours before and after significant events.

Sector Rotation Engine: Combine capital flows, momentum, and valuation spreads to label sector rotation beats in advance.

When you combine OpenAI's product capabilities with the execution closure of Core X's quantitative trading system, you'll realize - this is not a gimmick, nor is it selling a concept, but an inevitable choice to solve real trading problems with real technology.

Friends, we've talked about this so much today, not to show off our skills or talk about a bunch of cool-sounding terms, but to make you understand - when you combine this kind of information-processing power and execution into your investing, you'll be standing in a position that no one else can even see.

And by standing in such a perspective, opportunities in the market become very different - instead of running after a hot spot, you'll be able to lock on to it just as it's raising its head. Just like $BMNR, which we caught before, we have already laid out our groundwork before it was hotly debated by mainstream money.

Well, today, such an opportunity has arisen again, and the signals are obvious. Here's what I'm talking about - the stock I want to focus on today.

ARQQ (Arqit Quantum Inc.) is currently running at $32.89 and is in a powerful intermediate-term uptrend. Over the past three weeks, it has not returned to its pre-breakout range after breaking out of the key $28 pressure level, but has steadily pushed higher along its 10-day SMA - a classic strong stock-control structure.

On a short-term basis, the stock has just undergone a healthy 3-4% retracement, confirming that support at $32 is valid. Today's rally is accompanied by a pickup in volume, implying that funds are actively taking up on the lows. The first target pressure above is at $35. If it breaks through and stabilizes, it could quickly challenge the previous highs in the $38-40 range.

Core X Quantitative Trading System Signals

The Core X Quantitative Trading system lit up two key modules for ARQQ after today's close:

Event-Triggered Signal Matrix

Captures multiple catalytic events in the direction of quantum crypto - including U.S. Defense-related contract progress, and integration testing with blockchain security solutions. This type of event is a highly weighted signal in the system, as it triggers a "follow-on" increase in funding.

Sector Rotation Engine

Sector Momentum indicates that Quantum Computing + Cybersecurity has experienced a five-day increase in flow strength, accompanied by an accelerating momentum curve. In the system's historical samples, this acceleration, in conjunction with a high consolidation breakout setup, has significantly increased the positive win rate over the next one to two weeks.

Conclusion: $ARQQ is not a low-level speculation, but a high-level strong trend target. With a healthy structure and strong capital take-up, a re-advance after a retracement often signals the start of an acceleration leg. For the Core X 40/60 portfolio, it can be placed in a highly resilient asset on the defensive side of the ledger - one that locks in the trend.

The value of the CXON tokens that underpin the Core X quantitative trading system is further emphasized when we see the high-quality stocks marked by the Core X quantitative trading system go up beautifully time and time again.

What you hold is not a "symbol", but an evolving system of on-chain participation credentials; the more mature the system, the deeper the participation, the thicker the equity.

Now, the value of CXON is being recognized by an increasing number of investors.

As attention increases, capital flows in - and that's usually when the price takes off.

At the end of today's lesson, I would like to ask you a question.

How does the Core X Quantitative Trading System make "Seeing → Judging → Executing → Reviewing" into a repeatable closed loop? Please name at least three core modules.

Send your answer to your advisor for a chance to win CXON tokens!

As the Gospel of John says, "You will know the truth, and the truth will set you free."

In the market, the truth is that those trading logics that stand the test of time, freedom, that is, you can stabilize your position and confidence in any market.

That's all for today's sharing. Please strike the next trading day with strategy rather than emotion, and close with conviction rather than fantasy. We will see you next time.