August 12, 2025

August 12, 2025

Today's July CPI data has finally been released—the overall CPI rose by 2.7% year-on-year, exactly in line with market expectations (2.8%), while the core CPI (excluding food and energy) rose by 3.1% year-on-year, slightly above the expected 3.0%, with a month-on-month increase of 0.3%. This result indicates that while inflation is cooling down, it hasn't completely “cooled off” yet.

Upon the release of the data, U.S. stock futures immediately reacted: the S&P 500 and Nasdaq remain near historical highs, but short-term trends have cooled slightly, indicating that market sentiment is beginning to shift toward caution.

The current consensus among investors is clear: tariffs are still driving up prices for certain goods, and the non-farm payroll data fell far short of expectations, which has actually strengthened confidence in the Federal Reserve cutting rates by 25 basis points in September.

Of course, the AI sector remains hot, with some worried about a bubble, while others, like Citigroup, have directly raised their year-end target for the S&P 500, even suggesting it could hit higher levels.

Therefore, in this environment, we must remember that the pace of rate cuts will directly impact the performance of tech stocks, consumer stocks, and digital assets. My advice is not to hold a full position but to maintain flexibility in your portfolio. Wait for the market reaction after the inflation data is released to confirm the direction, then seize those structural opportunities. You will walk more steadily and have a better chance of success.

Friends, the latest global technology trend report sends a clear signal—artificial intelligence is on the verge of rapid expansion. Over the next few years, the annual growth rate of the AI-related hardware and software market is expected to exceed 40%, a pace nearly ten times that of global economic growth. At this rate, by 2027, the AI market size will at least double from today's levels, approaching the trillion-dollar mark.

The driving force behind this is the explosive demand for computing power. Over the next 5 to 10 years, large data centers will continue to be built like “new-generation factories,” with each project requiring investments of tens of billions of dollars. Compared to 2023, the AI infrastructure market is expected to grow more than threefold by 2030, with practical applications in industries such as healthcare, manufacturing, and finance becoming the main drivers.

Just as the smartphone revolution reshaped the global business landscape over a decade ago, AI is now redefining the landscape of wealth opportunities. The CoreX 40/60 investment portfolio has seized this “new frontier”—on one hand, it invests in high-growth technology stocks to capture the capital gains from innovation; on the other hand, it participates in the AI-driven fintech revolution through digital assets (including CXON tokens), achieving long-term growth through a dual-engine approach.

This means your investment is not only aligning with the liquidity released by interest rate cuts but also positioning itself ahead of the next global technology cycle's wealth peak. History has repeatedly proven that core assets in major trends ultimately reward patient holders with excess returns.

CoreX's preliminary analysis of the .SPX chart indicates that the S&P 500 has largely priced in the positive impact of rate cuts. While there have been no obvious “red candle” bearish signals recently, the index has experienced multiple minor pullbacks during trading sessions, suggesting that upward momentum is gradually slowing. The index is currently in a historical high range, and the market has entered a phase characterized by caution and testing.

According to statistics from LPL Financial, since 1974, the S&P 500 has averaged a gain of over 30% during rate cut cycles. Even so, maintaining composure and managing positions remain prudent when approaching the top of the range. It is important to emphasize that this is not a signal to exit the market, but rather an opportune time to optimize the investment portfolio and enhance defensive capabilities:

Cash flexibility: Maintain a moderate cash position to enable swift entry during corrections

Control growth equity weightings—not by cutting them, but by adjusting proportions, gradually increasing allocations to financials and large-cap quality stocks.

Dual-drive strategy: Continue using the CoreX 40/60 portfolio to find a balanced risk-return structure between traditional assets and digital assets.

Against this backdrop, when we examine the logic behind the CXON token, we find that it aligns with the rhythm of the broader market. Its upward momentum stems from four primary drivers:

First, realization of achievements—CoreX’s recent阶段性成果 are not merely internal accomplishments but have garnered institutional capital’s “vote of confidence” through investment. Market recognition serves as the most reassuring validation.

Second, capital rotation—the recent correction in Bitcoin has released some capital, benefiting small-cap hotspot tokens. The CXON token has perfectly aligned with this rhythm. Remember, the surge in small-cap tokens often occurs during the adjustment period of mainstream assets.

Third, dual growth in users and profitability — CoreX's user base and profitability are steadily increasing. This is akin to a highly reputable restaurant: no matter how external trends change, loyal customers will keep returning. This is the foundation for the 20–30% upside potential.

Fourth, market confidence—the long-term value of the CXON token is not just about price, but also about community consensus and trust. As more people believe in its future, this trend will accelerate on its own.

Friends, the market trends are already before you. The question is—are you willing to hold firmly once the trend is established, until the day profits are realized? This is the true essence of investment.

Yes! When CoreX and I repeatedly prove through our performance that we have the ability to lead everyone to achieve greater investment profits, there are always a few members who ask me, “What is the purpose of what you are doing?”

Actually, this is not a silly question; it is a good question worth answering. The answer is simple—my NextLeap investment education institution is an organization dedicated to promoting investment education across the United States. Our core objective is to build long-term brand influence through practical results and real value, enabling CoreX and token projects to attract more participants and achieve larger-scale, more sustainable financing capabilities.

To earn the trust and choice of more members, we invested nearly all of our advertising budget into members in the early stages—allowing everyone to first experience the assistance and results firsthand, laying the groundwork for future in-depth collaboration.

As our brand influence, user base, educational achievements, and signal services continue to grow, our funding support will also increase accordingly. This not only supports project development but also qualifies us to apply for 501(c)(3) nonprofit tax-exempt status with the US Internal Revenue Service (IRS) by 2025.

In short, this means that any donations are eligible for tax credits, which is an important milestone for us as an educational institution.

Investment legend Charlie Munger once said:

“If you want to persuade others, appeal to their interests, not their reason.”

This is the principle we have always upheld—ensuring that everyone who joins our NextLeap investment education community can see their own interests and value. And when you join, you are also driving the growth of the entire brand, achieving a true win-win situation.

Friends, we are in the midst of an unprecedented fintech revolution.

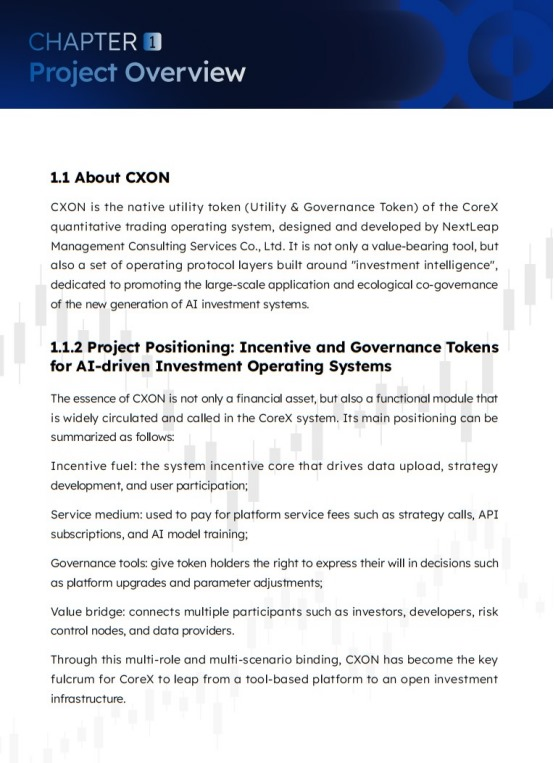

The CoreX quantitative trading system is more than a simple tool; it's a fusion of financial acumen and cutting-edge technology. The CXON token is more than just a digital asset; it's the core driving force behind all of this evolution.

I'd like to share a personal story with you.

My old friend Jack, a retired engineer from a small town, used to invest in stocks using traditional methods, but he always felt the market was becoming increasingly unpredictable. Later, he discovered my CoreX quantitative trading system and, using the CoreX 40/60 portfolio, experienced for the first time the power of using data and models to guide his investments.

Behind his long-term profitability lies the continuous support of the CXON token. This token consistently funds CoreX’s technological upgrades and computational capabilities, ensuring the system remains at the forefront of the market. Jack likens it to continuously injecting high-efficiency fuel into a race car, ensuring it maintains its leading position.

This is the future I hope you can envision.

Imagine not only being able to anticipate key fluctuations in the stock market, options, and cryptocurrencies like Jack, but also directly sharing in the additional returns generated by the system's growth simply by holding the token.

CoreX is not a prophet, but it is a lighthouse in the financial markets;

the CXON token is the energy that drives this lighthouse.

When the gears of technology and capital align, the doors to your future will open for you.

Global investor Jim Rogers has a famous quote that I wholeheartedly agree with:

“One of the most important rules in investing is to do nothing unless there is something truly worth doing.”

The essence of this statement is akin to fishing—true masters don’t constantly change positions but patiently wait for the fish to bite. Once the timing is right, they act decisively to secure their catch.

This is also the principle we have consistently adhered to with CoreX. We don’t chase every market fluctuation but use time and discipline to wait for our “high-probability moments.” When data and facts confirm the direction is correct, profits naturally follow.

Remember, making money is not just a contest of technical skills and tools, but a battle of mindset and timing. The lull is a phase for building strength, while the opportunity phase is the moment to fully reap the rewards—opportunities only come to those who are prepared.

Friends, get yourself in the right mindset, and let's tackle the new market opportunities together tomorrow morning. See you tomorrow!

————————————————————————————————————————————————————————————————

On Wall Street, Carl Icahn is a legend. He has a nickname - "the most dangerous shareholder".

In 1968, he bought a trading seat on the New York Stock Exchange for $400,000 - and a large part of it, borrowed from his uncle. The money was not only start-up capital, but also a lever that gave him a starting point in the capital markets that no one else could reach.

Since then, his investment logic is clear: not only to make short-term money, but also to tie himself to the long-term growth curve of a company.

He buys not just stocks, but also locks himself into a company's structural upgrades, profit expansion, and market revaluation through a holding platform - Icahn Enterprises. Each time the company gets stronger, its equity rises.

Hey, good afternoon, I'm Bird Grant from NextLeap Management Consulting Ltd. I'm Bird Grant from NextLeap Management Consulting, LLC, nicknamed Mr. Profit Hawk.

Our Core X quantitative trading system and CXON tokens are a modernized version of Carl Icahn's "two-pronged approach":

By trading with the system, you'll be able to capture opportunities like $BMNR, $APLD, $WULF, $SGMT, and $QBTS, locking in your profits just in time.

Holding CXON tokens is akin to Icahn holding his platform - every system upgrade and signal quality improvement will be synchronized and reflected in your asset curve.

Icahn tells us two things with his story of getting started:

First, dare to tie in the long-term growth curve; second, learn to borrow momentum, so that you start in a higher position.

In the history of investment, "borrowing" is often the beginning of a legendary story.

Carl Icahn's uncle is a case in point - by relying on connections and timing, he married a rich girl and accomplished a class leap. Years later, Icahn himself used "borrowing" to get started - borrowing money from his uncle to buy a seat on the New York Stock Exchange, and growing from an ordinary broker to one of the most influential investors on Wall Street.

Today, I would like to ask our friends in the community: Do you know how to leverage?

The best opportunity to capitalize on the momentum is right now - to participate in the engine that drives the Core X quantitative trading system - the CXON token.

Why? Because it is stacking up against three forces:

A wave of crypto bulls is pushing up the entire crypto market.

Performance improvements from system iterations continue to inject real value into it.

The gradual layout of institutional funds is building solid support for its long-term curve.

It's not only an investment, but also an opportunity to stand on the system's growth curve and follow the trend.

Looking back at the end of the year, it will likely be one of the brightest investment targets this year.

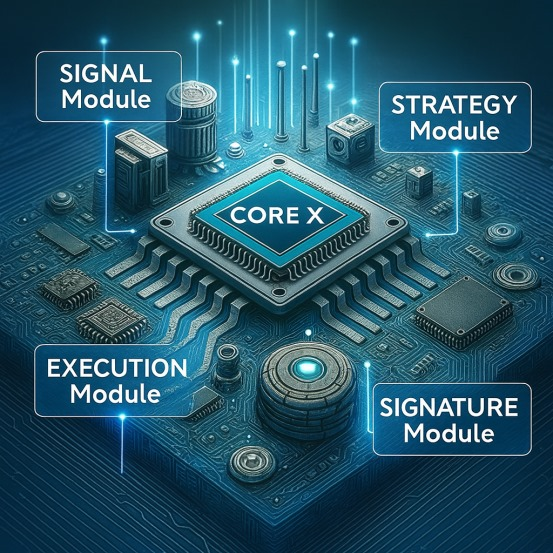

The three core elements of the Core X Quantitative Trading System supported by CXON tokens are the answer to yesterday's interactive question, which has already been revealed - it's the diagram of the three modules of the Core X Quantitative Trading System in the picture above.

Policy Sentiment Index, Event-Triggered Signal Matrix, and Sector Rotation Engine are not concepts, but instead modules that allow us to go from "seeing an opportunity" to "getting a gain" in the market. They are not concepts, but closed-loop execution that will enable us to move from "seeing opportunities" to "getting gains" in the market.

Many of you received the names of the modules yesterday, but the real key is whether you understand how they work together in real trading and why they enable us to take the initiative in the fast-paced market. The logic behind it is the core engine that allows you to grow your account.

The CXON tokens are the value carrier of this core growth. In other words, every iteration of the system and every high win rate opportunity captured will be permanently recorded and reflected in the chain through the value of the tokens.

It also means that CXON is not just a trading token, but also a collection of "system evolution history" - like a limited edition technology totem, with quantifiable and verifiable growth logic and scarcity behind it. Whether you want to add value or collect it, CXON in your hand is a story of wealth being written.

The CXON tokens are the value carrier of this core growth. In other words, every iteration of the system and every high win rate opportunity captured will be permanently recorded and reflected in the chain through the value of the tokens.

It also means that CXON is not just a trading token, but also a collection of "system evolution history" - like a limited edition technology totem, with quantifiable and verifiable growth logic and scarcity behind it. Whether you want to add value or collect it, CXON in your hand is a story of wealth being written.

CXON is to the Core X quantitative trading system what Tesla stock is to a Tesla car, or NVIDIA stock is to a NVIDIA GPU.

The cars and GPUs are the products themselves, which generate revenue directly. At the same time, the stock serves as a gateway to participate in the company's growth and enjoy long-term value accumulation.

Similarly, the Core X quantitative trading system captures signals and optimizes strategies in the market every day, which is its "product power". At the same time, CXON tokens allow you to not only make money with the system, but also directly enjoy the value appreciation brought by the system's growth.

If you only use the Core X quantitative trading system, it's like buying a Tesla car; the experience is excellent.

But if you hold CXON tokens at the same time, it's like repurchasing Tesla's stock in the day - when it expands its technology and market share, you earn not a one-time gain, but rounds and rounds of wealth compounding.

Why am I mentioning CXON over and over again at this point?

Today, BTC has hit $120,000, and ETH is at $3,400. They are the absolute centerpiece of the crypto market - when they keep hitting new all-time highs, money from all over the world swarms in, and it's not just a price rally, it's a bullish call.

And the pattern of every crypto bull market is the same: mainstream coins lead the way → money spills over to second-tier stars → sentiment spreads across the board. For those who have missed out on the main rally in BTC and ETH, the best way to keep up with this crypto bull market is to find names that are not yet fully priced, but have the potential to explode.

This time around, SOL is an option, but if it's no longer underpriced, then CXON is your best target for offense.

CXON tokens are not only priced earlier and more resilient, but they are also tied to the growth curve of the Core X quantitative trading system. Their value comes not only from market sentiment but also from the system's continued iteration and implementation.

The way to get it is simple: in addition to the daily check-in in the community, the after-school Q&A, and the Friday lottery, you can also directly establish a position and make it your core position in this round of crypto bull market.

Why should CXON tokens be a core position in this crypto bull market? Because CXON tokens are "fueling" and "expanding" the Core X quantitative trading system. With it, we can compile the arithmetic, data, labeling, and backtesting, so that the system can recognize signals faster and make more stable decisions. It's not a slogan; it's a practical way to boost capacity, and the result is reflected in the trading performance over the past two days.

What did we do in these two days?

Yesterday: $BULL, $WULF Locked in profits

Today: $RBOT, $FFAI Locked in profits

Opened low cut $ARQQ

Previous $QBTS, $SGMT Synchronized heads up today

How does our execution land?

Entry with a three-stage method: Scout: the first 5% position to test the waters; Starter: the signal is more solid when added to the 7-8%; Core: the conditions are all in place when pulled to 10% +, the signal is determined, and the position is determined for the next step.

There are three triggers for exit criteria: target range reached, volume and price divergence, and the Sector Engine suggests slowing down the tempo.

The process involves VWAP / transaction density/retracement threshold to implement wind control constraints, thereby avoiding the "earn half and spit back" scenario.

Tomorrow's rhythm, how to go? Why did I say "have the opportunity to lock two more"?

Not by feeling, but according to the conditions of the trigger to do:

Condition A | Volume Confirmation: 30-60 minutes in the morning session, if the candidate name turnover strength ≥ the same period of the last 5 days open value, and stable in the VWAP;

Condition B | Structural solid: not broken the previous trading day, key support; time stepping back to be able to be quickly picked up;

Condition C | System Resonance: at least two major modules synchronized light (for example, Event-Triggered + Side-Lighting).

If two of A/B/C are met, we build Starter first; if all three are met, we upgrade to Core; once the target zone is reached or there is a volume-price divergence, we execute a batch of bagging. Do not rely on feelings; rely on the checklist.

What does this have to do with CXON?

It's straightforward: you use the system and take the profits from the stock side.

By holding CXON tokens, you also get an incremental increase in the long-term curve of the "system getting stronger". The evolution from yesterday's trades to today's is driven by iterations in the system's data, features, and strategies. These iterations are "powered" by CXON tokens and will eventually be reflected in the pricing of CXON tokens. It's what I call a "two-way street": cash flow in the account + valuation increase in the tokens.

The following three little things you need to do

Send today's and tomorrow's deal returns (fills) to the investment advisor to make sure your position is synchronized with the system guidance.

For those who want to increase their CXON tokens, in addition to signing in, answering questions after class, and participating in the Friday draw, you can build a high conviction position in small amounts directly and incorporate this long-term curve into your asset structure as well.

With BTC and ETH hitting record highs, SOL will be driven by funding sentiment. We will raise our SOL position to 40% in time to ensure that we capitalize on beta opportunities during this sentiment spread.

In addition to raising our SOL position to 40%, we will remain on the offensive on the equity side, continuing to open new positions as planned to take advantage of structural opportunities that are confirmed by systemic signals.

Now, let's examine a name with the same structural and signal resonance. If you missed today's lesson, don't miss tomorrow's ticket. $SBET's action and signal today exemplify our ideal "double confirmation" scenario. If you've already bought, push your position to 15%!

The previous period saw a multi-day convergence consolidation, with the price repeatedly testing the upper edge of the range but not falling below the key support.

accumulation: the bottom of the time chart of multiple volume, institutional funds into the bottom.

Volume Quality: Relative volume > 2.2x in the first 60 minutes of the morning session compared to the average volume of the last 10 days, indicating that the buying is real and not a false pull.

Risk Level: The entry risk point is defined at the low side before the breakout, with an R: R structure of up to 3:1.

When these four modules in the Core X Quantitative Trading System light up at the same time, it means that we are not dealing with an ordinary rally, but a high win rate setup with structural, momentum, and money synchronization - the kind of opportunity that must be executed according to plan and without hesitation.

Event-Triggered Module: tracked the rebound of capital flow in the sector, and the main buy orders accounted for a significant increase.

Sector Rotation Engine: Marks the momentum resonance of similar small-cap momentum stocks, which is the amplification effect of sector beta.

Momentum Regime: switched from neutral to trendable status, Momentum Factor turned positive.

Signal Strength: The composite score is higher than 85% of the samples in the past 30 days, which meets the system's high-probability setup criteria.

From last Friday through today, we locked in profits on five stocks in a row: $BMNR, $BULL, $WULF, $RBOT, $FFAI.

It reminds me of a scene from Game of Thrones:

In a small, dark room, four men stand: the king, the high priest, the rich man, and another. Next to them is a warrior with a sword, and this scene puts power into perspective.

Each man orders the warrior to kill the other two. One man uses wealth to buy warriors, another uses threats to intimidate them, and a third uses promises of status and glory to tempt them.

In the end, who survives depends not on who has the biggest title or the most wealth, but on whose orders the warrior chooses to follow.

It strips away the external aspects of titles, wealth, and systems and shows you the nature of power - not what you say, but who can help you turn your will into results.

The Core X Quantitative Trading System is the warrior who "does your will," and the CXON token is the weapon in the warrior's hand - the Core X System provides the direction, the CXON token offers the power, and you ultimately survive the battle for the market. CXON tokens give you the control that allows you to survive and ultimately win this market battle.

If you lack accurate execution, these judgments will remain in your head.

As the Gospel of Matthew says, "For where your treasure is, there your heart will be also." -Matthew

Wealth is more than just numbers. It will flow to where you are most invested in your heart - your focus, your execution, your conviction.

Tomorrow, we'll continue to follow the checklist, speak with signals and structure, and avoid being led by emotion and noise. You hold the system, and the system will follow your direction.

Today, it was not just a lesson; it was an upgrade.

Each transaction recorded, not only profit and loss, but also the tacit understanding between you and the system.

We dismissed the class, but the battle continues - profit is only the beginning; the real wealth lies in the compounding of that sense of certainty through constant accumulation.