August 13, 2025

August 13, 2025

Before the market opened today, S&P 500 and Nasdaq futures were performing strongly, with market sentiment clearly benefiting from inflation data in line with expectations and signs of easing Sino-US trade tensions. Investors are generally betting that the Federal Reserve will begin a new round of interest rate cuts in September.

Short-term hotspots are concentrated in the technology and cyclical sectors, but the risks of chasing highs should not be overlooked. For those holding the CoreX 40/60 investment portfolio, it is recommended to maintain a stable allocation, let the market work for you, while paying attention to the opportunities presented by short-term volatility, and strategically positioning

innovative assets such as CXON tokens.

Friends, perhaps you have just joined this NextLeap investment education community and are still adjusting to the pace, but this is not a one-way lecture. On the contrary, it is a space where everyone can participate and inspire each other.

I hope that every participant can speak freely in class—whether it be asking questions, sharing insights, discussing market observations, or sharing investment experiences—all of which can bring new perspectives to the group.

You’ll find that some share their trading experiences, others bring the latest market trends, and still others offer completely different perspectives on the same phenomenon. This diversity in discussion is precisely what makes our learning more vibrant and valuable.

So, don’t hesitate—speak your mind in class.

Your question might be exactly what others are wondering; your perspective could be the key to others making the right decisions.

I look forward to hearing your voice in the discussion.

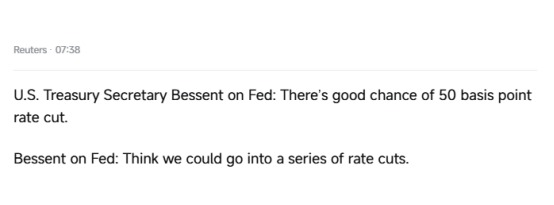

As the market focused on the latest speech by U.S. Treasury Secretary Benson, pre-market stock index futures performed strongly overall but remained within a manageable range, with mostly minor fluctuations. Benson stated that the Federal Reserve is highly likely to cut interest rates by 50 basis points at its next meeting, potentially marking the beginning of a series of rate cuts.

Pre-market futures reflect market expectations, so the stock index is likely to open higher today. The current mild volatility is more a result of a wait-and-see attitude, as investors are generally waiting for clearer policy signals before a sustained upward or downward trend may emerge.

In this policy-expectation-driven market environment, we should moderately reduce position concentration in our strategy, maintain liquidity, and be prepared to quickly adjust direction once signals are confirmed.

Over the past two trading days, I have been closely monitoring the key signal that the Federal Reserve is about to initiate a rate-cutting cycle, and have developed a response strategy for everyone based on historical patterns. Whether or not you already hold technology stocks, this is a valuable opportunity worth discussing in depth.

History shows that whenever a rate-cutting cycle begins, high-quality tech stocks that have previously faced setbacks or been overlooked by the market often see capital inflows and valuation recovery first. The logic behind this is straightforward: rate cuts lower the cost of capital and increase the discounted future earnings value of growth-oriented companies. When these tech leaders have no obvious fundamental issues, market participants continue to harbor FOMO (fear of missing out) sentiment toward them, driving stock prices to continue their upward trend after short-term fluctuations.

My view is: although the short-term market may experience fluctuations due to data and sentiment, as long as the policy direction is clear, the technology sector—especially companies with core competitiveness within their industries—will become the core beneficiaries of the next round of market trends. Now is the critical time to pre-screen and position these targets.

So what exactly is FOMO psychology?

FOMO stands for “Fear Of Missing Out,” which refers to the fear of missing out on opportunities.

In the stock market, FOMO psychology refers to investors who fear missing out on market gains and make impulsive, irrational investment decisions as a result.

To put it simply, FOMO is like a “fear of missing out” mentality.

When you see your friends investing in a particular stock and making a lot of money, you may feel anxious, worried that you're missing out on a chance to get rich.

This anxiety can drive you to blindly follow the crowd, even if you don't understand the stock or the market is already overvalued.

Manifestations of FOMO

*Blindly following the crowd: Blindly chasing popular stocks and buying them without thinking.

*Panic selling: When the market declines, fearing losses and irrationally selling stocks.

*Frequent trading: Frequently buying and selling stocks, trying to capitalize on every short-term fluctuation, but often ending up losing more than gaining.

*Ignoring risks: Pursuing high returns while ignoring the risks of investment.

Friends, this week is crucial for the market—CRWV's financial report is about to be released. The results will not only affect one company, but may also have a ripple effect across the entire US stock market, like a pebble thrown into a lake.

Looking back over the past two months, the market experienced a period of volatility and adjustment from late June to early July, but by mid-August, it rebounded with a beautiful deep “V” curve. Currently, the S&P 500 index is nearing its historical high, and the Nasdaq index is only about 4% away. In this context, a strong financial report could further boost the upward trend of tech stocks and AI-related sectors; however, if performance falls short of expectations, market sentiment could quickly cool.

CRWV holds a key position in the AI supply chain, and its performance mirrors the true state of the entire industry. Especially if demand for AI chips and computing power remains robust, this will not only inject momentum into the company itself but also serve as another catalyst for the tech sector. CoreX's big data analysis even suggests that the options market has hinted at over 9% upside potential for CRWV's stock price, a trend that has already sparked a noticeable FOMO (fear of missing out) mindset among market participants—fear of missing out on a major upward trend.

At my age, the most important thing in investing is to pursue progress while maintaining stability. Seize opportunities without missing them; manage risks without blindly chasing highs. In the following discussion, we will explore how to strategically seize opportunities in such a market environment while adhering to one's own bottom line.

My personal assessment is that the strong upward trend in CRWV is not coincidental but stems from a genuine increase in demand for AI infrastructure. Meta's recent performance once again demonstrates the benefits of AI-driven applications—advertising efficiency improvements of 5% to 9% have significantly boosted advertising revenue. AI is no longer just talk; it is now a key driver of revenue growth.

For tech giants, AI is a strategic battle they cannot afford to lose. Compared to the dot-com bubble era of 2000, CRWV's technological lead today far surpasses that of Cisco at the time. Back then, Cisco's price-to-earnings ratio reached an astonishing 300 times, making the bubble's bursting understandable; however, today, CRWV is achieving revenue doubling—this quarter's revenue reached $1.21 billion, with net losses still present but significantly narrowed compared to last year. Crucially,

it is expanding sustainably with a healthy adjusted operating margin of approximately 16%;

the company has raised its full-year revenue forecast and secured major orders such as an expansion agreement with OpenAI;

from a technical perspective, it remains in an auxiliary rebound phase. Although P/E ratio data is not available, a valuation adjustment to 46 times is not unfounded—what matters is that this logic must be grounded in the actual results of the financial statements.

In other words: CRWV is a company at the core of the AI infrastructure boom. AI applications are demonstrating tangible results in new scenarios, and the financial statements reflect growth momentum and improved profitability. What is more important now is how we can use these real data to support investment decisions in the classroom, rather than relying on unfounded speculation.

1. CRWV's Q2 earnings report is regarded by the industry as one of the most closely watched tech earnings reports of the quarter, akin to the “Super Bowl of earnings season,” and is seen as a barometer of current market confidence in AI infrastructure spending.

2. Second-quarter results exceeded expectations:

Revenue reached a record $1.213 billion, representing a year-over-year increase of approximately 207%.

Gross margin remained strong, with a non-GAAP adjusted operating margin of 16%, indicating that expansion efforts have not slowed. The revenue backlog stands at $30.1 billion, providing assurance for the sustainability of future performance.

3. Company raises full-year and Q3 guidance:

Annual revenue target increased to $5.15–5.35 billion, above previous expectations.

Q3 revenue is expected to be between $1.26–1.3 billion, reflecting continued expansion trends.

4. However, the market reaction was rational:

Despite strong revenue, CRWV's stock price fell by approximately 10% in after-hours trading, primarily due to a larger-than-expected loss per share (loss of $0.60 vs. estimated $0.20).

This indicates that the market remains cautious about the sustainability of profitability.

5. Dual Support from Technological Structure and Industry Leadership:

Although profitability remains volatile, CRWV's leading position in AI infrastructure and clear order book support provide upside potential for its share price structure.

If an earnings inflection point emerges in the future, its potential upside remains promising—this not only reflects performance but also the logic of future technological trends.

Friends, have you ever thought about what a big data engine that truly understands investing could do for you?

CoreX is like my investment partner. Not only can it collect historical data accumulated over many years, but it can also find connections between data points and infer future stock price trends—it's like someone telling you in advance how to make your next few moves.

More importantly, it can help you identify, organize, and calculate the complex stock information—whether it's financial reports, capital flows, or technical indicators—and use objective logic to provide reasonable predictions, while also alerting you to potential risks. This way, your investments are no longer based on intuition but on the security of data-driven insights.

This is the appeal of cutting-edge financial technology. Future investors will undoubtedly need such tools. And I believe that CoreX is the key that will give you an extra edge in the market.

Friends, looking back at today's intraday performance, panic sentiment has indeed continued to escalate as I had anticipated. The market never tilts in one direction; different factions of capital are engaged in intense competition, and today's “beneficiary” is none other than the stock $QBTS.

I didn't mention it for the first time today; as early as Monday and Tuesday, I and my mentor Bird Grant had repeatedly emphasized its importance. Whether you entered through short-term trading or positioned yourself at lower levels in advance, as long as you acted after the class, you should be enjoying the profits from this wave today.

Remember last Thursday's class? I specifically discussed how to identify and leverage panic sentiment, and analyzed $QBTS's technical patterns and trigger conditions. I believe many of you who listened carefully have capitalized on this opportunity in real-world trading.

My advice is—before the market closes on Wednesday, lock in these profits and convert your unrealized gains into actual cash. This is the habit of a mature investor: act decisively when you should, and don't be greedy when it's time to exit.

When the market becomes concerned about the uncertainty surrounding CRWV's financial reports, this sentiment can easily spill over into other trading sectors, with the digital currency market being the first to be affected.

Why does the earnings report of a technology company cause cryptocurrency prices to fluctuate in advance? The answer is—the essence of investment is the transmission of sentiment. When panic begins to spread, whether in the stock market or the cryptocurrency market, traders' psychological states are similar: they tend to seek safety, reduce risk exposure, and even take profits early.

Additionally, CRWV's position in the market is not merely a profitability indicator for a single company but a “barometer” for the tech sector. If the earnings report falls short of expectations, it could not only trigger a broader decline in tech stocks but also, through sector correlation, drag down cryptocurrency-related stocks with strong tech ties. Especially in the current landscape where AI, computing power, and blockchain intersect, this linkage effect becomes even more pronounced.

Therefore, when interpreting CRWV's earnings expectations, one should not merely focus on its stock price but also pay attention to its impact on sentiment transmission and capital flows along the entire chain from technology stocks to digital currencies. Understanding this will enable you to respond half a step ahead of others.

From the price trends of digital currencies and BTC, based on candlestick chart technical analysis, BTC is currently at a critical support level. The recent decline is more likely a “false sell-off” driven by panic sentiment rather than a trend reversal, and capital is likely to flow back in here.

Among ETF and mainstream public blockchains, SOL' price movement also shows signs of support and stabilization. Although short-term corrections are significantly influenced by market sentiment, on-chain activity and ecosystem development remain robust, indicating that the decline is primarily due to emotional fluctuations rather than deteriorating fundamentals.

As for our token CXON, despite significant price volatility recently, the lack of a decline in trading volume indicates that mainstream capital remains firmly held and has not experienced large-scale selling pressure. In this environment, choosing to maintain or even slightly increase holdings of ETFs, SOL, and CXON within the support range is not impulsive but rather the wisdom of mature investors in capturing opportunities amid volatility—just as bluefin tuna can only be caught in the turbulent waters of the deep sea, where danger and rich rewards often coexist.

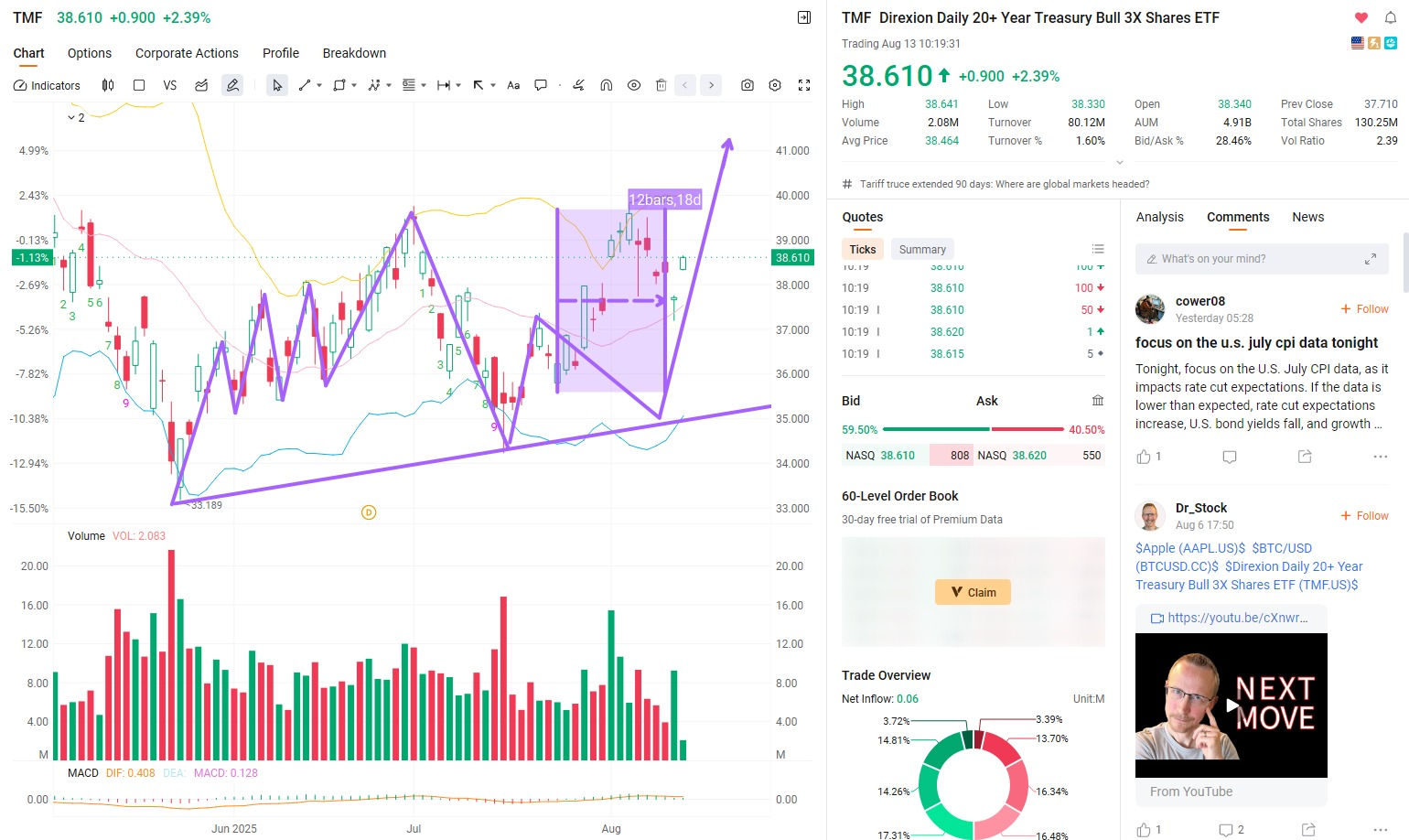

In the current market volatility storm, $TMF and $TLT have bucked the trend and strengthened, which not only indicates that risk-averse funds are precisely flowing into the long-term bond market, but also once again validates my forward-looking judgment on portfolio allocation. Have you been following my holding strategy and consistently tracking the signal trades?

Guys, do you want to truly experience the power of volatility?

Tomorrow (Thursday), why not spend a few hours feeling the intraday fluctuations and the pressure of the volatility market?

Remember, the .VIX can also generate significant returns. The volatility futures index ETF it corresponds to was a key case study in last Thursday's class. If you missed that session, please contact the investment education advisor to access the recording and catch up on this critical knowledge.

We'll continue our in-depth discussion tomorrow. Students, see you then!

——————————————————————————————————————————————————————————

In the sixth (and final) episode of the final season of Game of Thrones, Daenerys Targaryen's death occurs when she leads her army to capture King's Landing and then, despite the city's surrender, burns the entire town down with dragon fire, sparking fear and resentment among her allies and the people. Jon Snow talks to her in the Hall of the Iron Throne and tries to persuade her to change her ways, but Daenerys Targaryen insists on continuing the war by "freeing" the world. Jon Snow embraces her and kills her with a dagger to the heart.

Drogon melted the Iron Throne with his dragon flame, but instead of hurting Jon Snow, he grabbed Daenerys Targaryen's body and flew east, disappearing into the sky. Jon Snow assassinated Daenerys Targaryen in the final episode, and her remains were taken by Drogon and flown to the east - her life and death have not been explicitly accounted for since.

And based on speculation, with no footage of the body being burned or buried given in the show, the direction Drogon flew off in could have been Volantis, where the forces of the Red Priests hold the mystical power of resurrection, opening up the possibility of Daenerys Targaryen's resurrection.

No one knows if Daenerys Targaryen will fall or make a comeback. The same goes for these two tickets; the position is at the line of life and death, a big green candle may announce the return of the king, or a pullback may make the drama go downhill.

Whether it is a reversal or a fall? It will leave us to guess - tomorrow's opening, the market will answer.

Good day after the bell, I'm Bird Grant, Mr. Profit Falcon of NextLeap Management Consulting, LLC. It wasn't a quiet close for the market today; it wasn't a smooth day. Yesterday's rally had good momentum, but today's selloff in $NVDA and $CRWV put the brakes right on the Nasdaq and S&P 500.

It reaffirms what I've said before - $NVDA has become a thermometer for this market, and every sharp drop in it is immediately reflected in overall sentiment and money flow.

Over the past few weeks, we have been preaching a core logic - the rhythm of the market is often shaped by a combination of macro catalysts and structural signals.

Today, the volume of that catalyst was turned up - U.S. Treasury Secretary Bessent went on record as saying that there is a high probability that the Fed will cut rates by 50 basis points in September, and that it could enter a cycle of consecutive rate cuts.

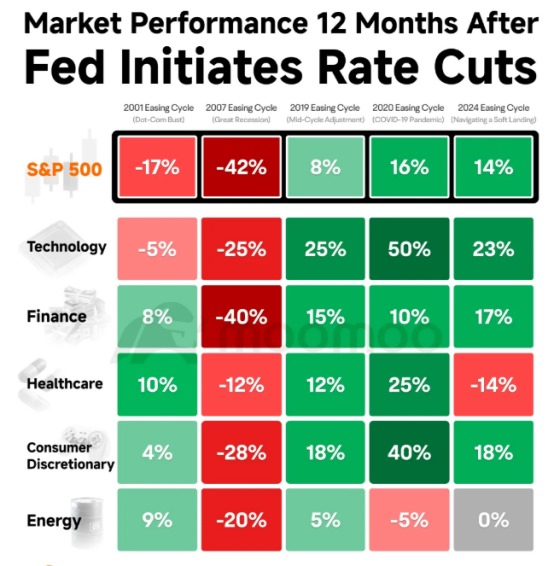

It's not an isolated story. Combined with the July CPI in line with expectations, institutional bets on the early start of easing, as well as the performance of the sector after each round of rate cuts over the past 20 years, we see a familiar picture emerging:

In the early stage of easing, funds first flocked to lagging blue chips, looking for a haven; as sentiment heats up, low growth stocks, especially the wrongly killed technology stocks, will begin to be funds' "flop";

If the economy can land softly, the rhythm of this structural rotation may last 6 to 12 months.

History can't be replicated exactly, but it can provide coordinates. In 2001 and 2007, interest rate cuts did little to alleviate the pressure on the technology sector. However, in 2019 and 2020, following these cuts, technology stocks surged 25% and 50% in one year, respectively.

That's what we're going to cover next - which directions are likely to repeat historical strength in this potential rate cut cycle? Which historical pitfalls need to be avoided?

In the past decade, the end of this "liquidity spillover" has more and more frequently fallen on the cryptocurrency sector - especially BTC, ETH, the assets with the highest degree of market consensus.

Suppose the rate cuts start in September and are consecutive. In that case, the effect will be twofold: capital easing will improve dollar liquidity, risk appetite will rise, and mainstream coins will be driven up. Sentiment diffusion occurs after mainstream coins rise, with funds spilling over to second-tier stars (e.g., SOL, LTC) and then to thematic tokens (AI, DeFi, etc.).

In other words, the rate cut is not just a stock market story; it could also be the "first clarion call" for the crypto sector to kick off.

Next, we will explain which on-chain assets are worth pre-empting in this possible liquidity release. Which are the gas pedals for the return of sentiment?

This chart presents the upward trend of Bitcoin after the Fed implemented a rate cut. The green block in the chart represents the rate cut cycle, while the price curve pulled up quickly after the rate cut, reflecting the release of market liquidity and risk appetite.

Bitcoin rose as much as 375% from February 2020 to February 2022 during the rate cut cycle.

Not a guessing concept, but a reasonable expectation supported by historical data:

Funding support: rate cuts move capital markets, traditional market risk assets heat up, and crypto naturally picks up the slack.

Market Sentiment Resonance: Bitcoin's uptrend often drives broad crypto sector sentiment, spreading from BTC → ETH → thematic tokens (e.g., CXON).

Signal Framework Docking: Those running Core X quantitative trading systems can use these types of macro rhythms as one of the weighted signals for interval sentiment allocation.

Today, this crypto IPO, $BLSH, rose as high as 200% on its first day of trading and closed up +83.78%, giving us a very visual signal:

Market risk appetite for crypto-related assets is rapidly picking up against the backdrop of current rate cut expectations.

This move is not an isolated event, but a typical behavior of funds when releasing liquidity expectations - starting with the most resilient varieties first and amplifying returns in the fastest way.

Looking back at history, with the start of every easing cycle, mainstream coins (BTC, ETH) have strengthened first, and the highly resilient underlying (e.g., CXON), newly listed crypto concepts surrounding them have tended to generate higher returns for funds.

So $BLSH's move today is a microcosm that tells us: if liquidity is going to be released, the crypto sector's move will come faster and hit harder than most equity trades.

History clearly shows us that crypto is often one of the first responders to a rate cut.

Today's charts and data not only tell a story, but also provide logical support for our "crypto sector allocation program".

Especially in the context of BTC and ETH hitting record highs, the market's risk appetite and liquidity expectations for crypto assets are at a stage of amplification, which allows us to not only have data verification of our allocation ideas but also real-time market confirmation.

Next, we will enter the stratification strategy for specific coins/tokens, identifying who belongs to the "first wave of upward movement after interest rate cut" and who is the "sentiment resonance diffusion point".

Yesterday, in our Core X 40/60 portfolio, we allocated 40% of our overall position to the cryptocurrency SOL.

However, that's not enough; we need to add some crypto assets that are currently at low prices but still have tremendous upside potential.

Such assets must have a clear value proposition, because in the crypto market, sentiment-driven quotes can be pulled up very quickly, or all but retracted in a matter of days.

Without real on-chain applications, stable capital flows, verifiable long-term growth logic, and a healthy deflationary mechanism, the upside will be short-lived.

Value support means:

On-chain application: there are actual on-the-ground usage scenarios behind the tokens, such as DeFi protocol, AI arithmetic leasing, cross-chain bridges, NFT ecosystems, etc., which continue to bring in transaction volume and fee income.

Funding flow: not only is there a rush of short-term speculative funds, but we can also see an increase in wallet addresses for long-term positions, stable large-value transfers, and the continued layout of institutional funds.

Long-term growth logic: the economic model (tokenomics) is healthy, inflation is controllable, and the team continues to iterate on technology and expand the ecosystem to keep up with industry trends.

Deflationary mechanism: through the destruction of transaction fees, fixed repurchase destruction, and halving of output, we continue to reduce market liquidity, providing long-term upward pressure on prices.

When these four points are met simultaneously, the token price has a "hard floor", even if short-term fluctuations are not easily broken. Once the macro liquidity is released, this kind of coin often emerges from a sustainable upward structure, rather than experiencing a day or two of emotional peaks.

Over the past period, I have analyzed and compared multiple crypto assets one by one based on my years of real trading experience.

The standard I set is obvious - it must simultaneously meet the four value-supporting conditions of chain application, capital flow, long-term growth logic, and deflationary mechanism before it enters the candidate list.

As a result, I sifted down and found that there are only two types of conditions:

The first category: the mechanism is complex enough to meet the conditions, but the price has been long established; short-term chasing the risk-return ratio is not beneficial.

The second category: the price has not moved, but the mechanism is complex - either the chain application is weak, or the flow of funds is unstable, or the inflationary pressure is too great, and this type of name lacks sustainability even if it goes up.

Out of all the screened names, only one meets all four conditions simultaneously, and its price remains in its pre-launch structural position - CXON.

It means that not only does it have solid value underpinning it, but it also has room for liquidity to come in and amplify the trend during the initiation period.

In other words, it is currently one of the few crypto assets that has both a fundamental hard floor and the potential for a technical explosion. The scarcity of this setup will be further amplified in the current environment of record highs in BTC and ETH and heightened market risk appetite.

What is CXON?

CXON is not just a "token"; it is the driving engine of the Core X quantitative trading system - it is the fuel behind the system's daily strategy operations, data calls, AI model training, and on-chain API subscriptions. Its positioning is closer to an "Operating Protocol Token", which not only settles payments but also connects resources, drives collaboration, and distributes value.

Where does its value support come from?

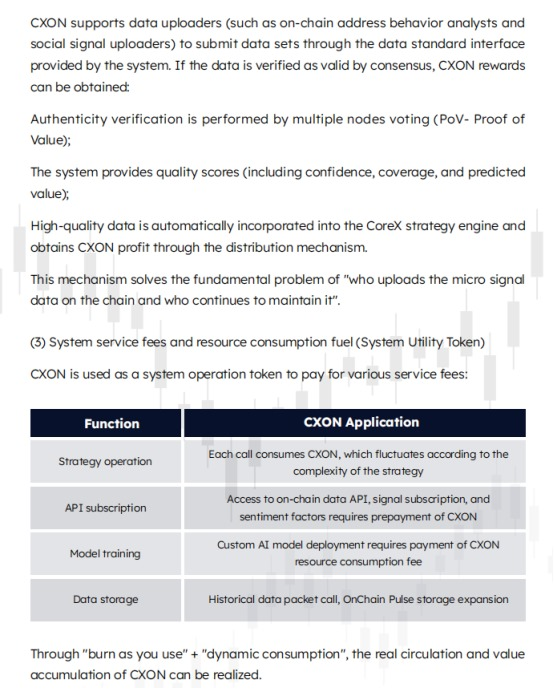

CXON's value is not based on speculation of sentiment, but has hardcore on-chain and in-system application scenarios:

Strategy running fuel: every strategy call consumes CXON; the higher the complexity, the more it consumes.

Data API subscription: access to on-chain data, signal subscription, sentiment factor analysis, all require paying CXON in advance;

AI model training: deploying customized AI models pays for CXON resources;

Data Storage: Historical data packet calling and on-chain storage expansion all rely on CXON.

PoV value verification: on-chain data contributors are rewarded with CXON through multi-node voting verification, which incentivizes continuous data update and maintenance.

It's "use once, burn once" mechanism (burn as you use + dynamic consumption) allows CXON to have real consumption and deflationary effects, and the value accumulation is structural rather than airborne.

Why is now the time to lay out?

We've seen many crypto assets where either the mechanism isn't robust enough or the price has fluctuated significantly. CXON, on the other hand, is supported by its real value and is tied to the growth curve of the Core X system. Consequently, every system upgrade and signal quality improvement will be reflected in CXON's valuation through the chain.

Coupled with the fact that BTC and ETH are both hitting new highs and liquidity is about to be released, the volatility and opportunities in the crypto market will come faster and hit harder than equities, which allows CXON to amplify its resilience at a stage where sentiment and value are resonating.

So, of the 60% on the crypto side, 40% continues to be placed in SOL - it has proven that whenever BTC and ETH make new highs, it can follow the rush and give us steady liquidity and immediate exposure to the primary market.

The remaining 20% can't be left unused and must be allocated to a name within the pre-launch price range, which has a clear value proposition and is tied to a growth engine under our control - CXON.

CXON is not an ordinary token, but a pass-through of equity in the Core X quantitative trading system. Every upgrade to the system, every improvement in signal quality, and every expansion across markets is directly reflected in the price of CXON. Coupled with its "use-it-or-lose-it" mechanism, circulation naturally shrinks as adoption increases, providing long-term upward pressure on the price.

Simply put, SOL allows us to hold on to the current trend, while CXON will enable us to enjoy the long-term premium brought about by the Core X quantitative trading system's growth. It's a dual-driver configuration of momentum + structure.

As the Gospel of Matthew says, "For where your treasure is, there your heart will be also." Your money will flow to where you trust and see the future, and your heart will follow and take root there.

Today, with the Core X System and CXON, we have arranged a dual drive between the present and the future - momentum to capture the present and structure to lock in the future. It is not an isolated transaction, but a layout to grow together with the system.

History has proven that every rate cut cycle that opens pushes liquidity into more highly resilient assets. That's why I want to ask you two questions at the end of the course:

First, if the rate cuts land, who will be the biggest beneficiary of the liquidity release?

Second, when BTC and ETH both hit record highs, who will be the next most resilient crypto asset to be driven by funds?

Please provide the answer you have in mind and send it to the investment advisor. Those who qualify will have the opportunity to collect the CXON token airdrop reward.

Tomorrow, we continue to follow the signals, not betting on emotions, taking the profits we should take, and holding firm on the opportunities we should keep. We are out of class, but the fight continues.