August 14, 2025

August 14, 2025

The pre-market today sent out several signals worth paying attention to: CRWV rebounded after its earnings report but remained near its recent adjustment range, indicating that the market is still cautiously digesting earnings pressure.

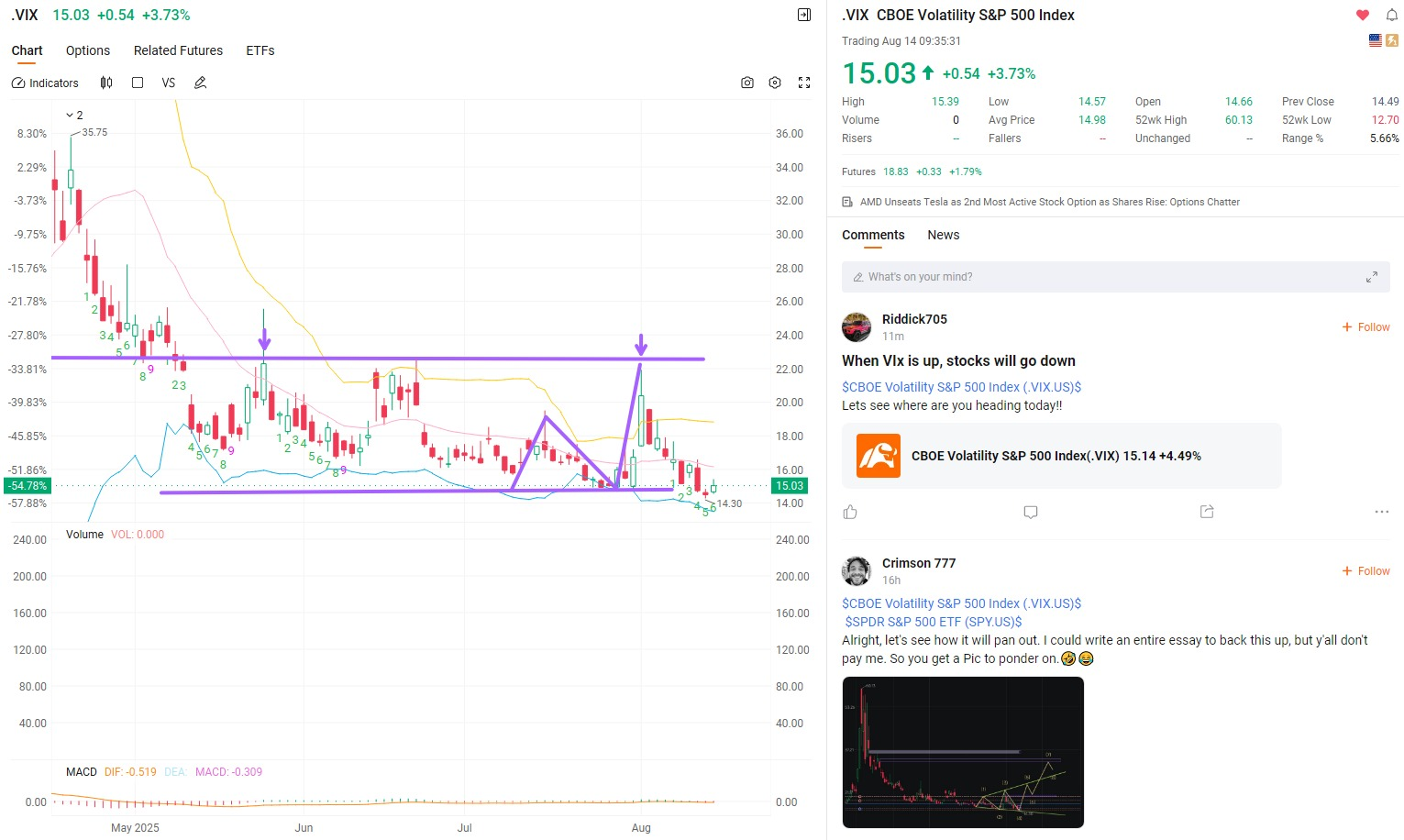

The VIX is nearing its annual low, indicating a noticeable improvement in market sentiment; the inversion of U.S. Treasury yields has ended, suggesting that the risk of an economic recession is cooling; Bitcoin has broken through its historical high, indicating that risk appetite among investors is continuing to strengthen.

We analyze data not to blindly chase rallies, but to assess market trends—the moment a signal appears is often the starting point for action.

Are you ready to proactively seize opportunities when the signals become clear today?

As a professional and mission-driven investment education institution, we are at the forefront of the industry, committed to building a new era of investment value consensus with investors across the United States. We not only impart knowledge but also promote mature investment education concepts, enabling investors to achieve safe, stable, and sustainable results even in volatile markets.

We believe that the right investment knowledge and actionable strategies are the core competitive advantages for every investor in the market. Whether you are a newcomer to the market or a seasoned veteran with years of experience, we aim to provide the most robust support for your investment journey through systematic courses and practical experience.

By 2025, we will apply for 501(c)(3) nonprofit status with the U.S. IRS—meaning that donations will not only qualify for tax deductions but also ensure the long-term sustainability of this investment education initiative, benefiting more people. Your participation today is not just about enhancing your own investment capabilities; it is also about advancing a long-term, sustainable educational mission. That is the significance of your involvement.

If you have taken the time to read this far, I know that you must want to invest more steadily, for longer, and with better results—and your choice today is the right start.

Whether you are just joining us or are not yet fully familiar with our past trading ideas, strategy guidance, and investment education content, I would like to welcome you on behalf of NextLeap Investment Education Institution, as its founder and mentor, with the utmost sincerity. May you not only find good fortune here but also steadily improve your investment skills and results.

In the days ahead, we will provide you with systematic courses and practical training—on each trading day, we will analyze real-world cases, distill key knowledge, break down chart trends, and share some tips (TIPS) to help you turn theory into actionable strategies, enabling you to gradually build your own investment system.

Why is NextLeap, an investor education institution, conducting online promotions across the United States?

We have several clear objectives:

1. Apply for nonprofit status — laying the groundwork to apply for 501(c)(3) tax-exempt status with the U.S. Internal Revenue Service (IRS) by 2025, ensuring the institution’s long-term stability and sustainability.

2. Brand building — to increase investor awareness and trust in the mission and value of investment education institutions.

3. Promoting fintech tools — to demonstrate the practical applications and investment value of the AI-powered financial tool CoreX quantitative trading system to the public.

4. Promoting safe investment concepts — to promote the SEC's anti-fraud education initiatives and enhance the institution's annual credibility rating.

Why are we currently providing educational services free of charge and offering gifts or cash packages?

1. Policy alignment — Responding to the SEC's anti-fraud education program to secure government funding subsidies.

2. Brand promotion investment — Treating education and gifts as part of advertising expenses to build trust through concrete actions.

3. Long-term conversion — Providing paid services and advanced courses after establishing trust through interactions with learners.

4. Product promotion — Enhancing the visibility and market acceptance of CoreX products through gifts and educational services.

Come on, friends! Let me interpret the issues mentioned above based on the stock market's performance after the opening bell:

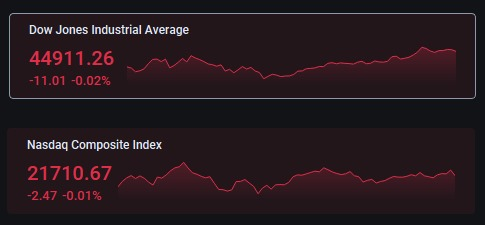

First, the VIX continued to decline after the opening bell, approaching its lowest level of the year, indicating that market sentiment is rapidly improving.

Earlier, I had already positioned my VIX strategy on Monday and Tuesday, and on Wednesday, I decisively locked in profits—this is the difference between mastering the emotional cycle and poor positioning.

The next opportunity is likely to come when the non-farm payroll data is released. At that time, will you choose to wait and see, or take proactive action?

Yesterday, CRWV closed with a sharp decline of 20.83%, a classic example of market sentiment and short-term selling pressure converging. However, we need to remain calm today:

Meanwhile, the CoreX quantitative trading system has already identified potential rebound opportunities within this scenario. If you hold call options, while the strategy remains conservative, you may consider closing positions or partially booking profits before today's market open. However, if you remain confident in CRWV's AI infrastructure growth logic—namely, its rapid market share expansion, strong revenue growth, and traceable long-term orders—then the current position may also present a favorable opportunity to increase holdings, especially when combined with the leverage advantage offered by high implied volatility.

Investing involves seeing rational value in a sharp decline and adhering to long-term logic amid panic.

The key today is not to avoid risks but to continue creating opportunities with the right strategy. Are you ready to capitalize on the next rebound?

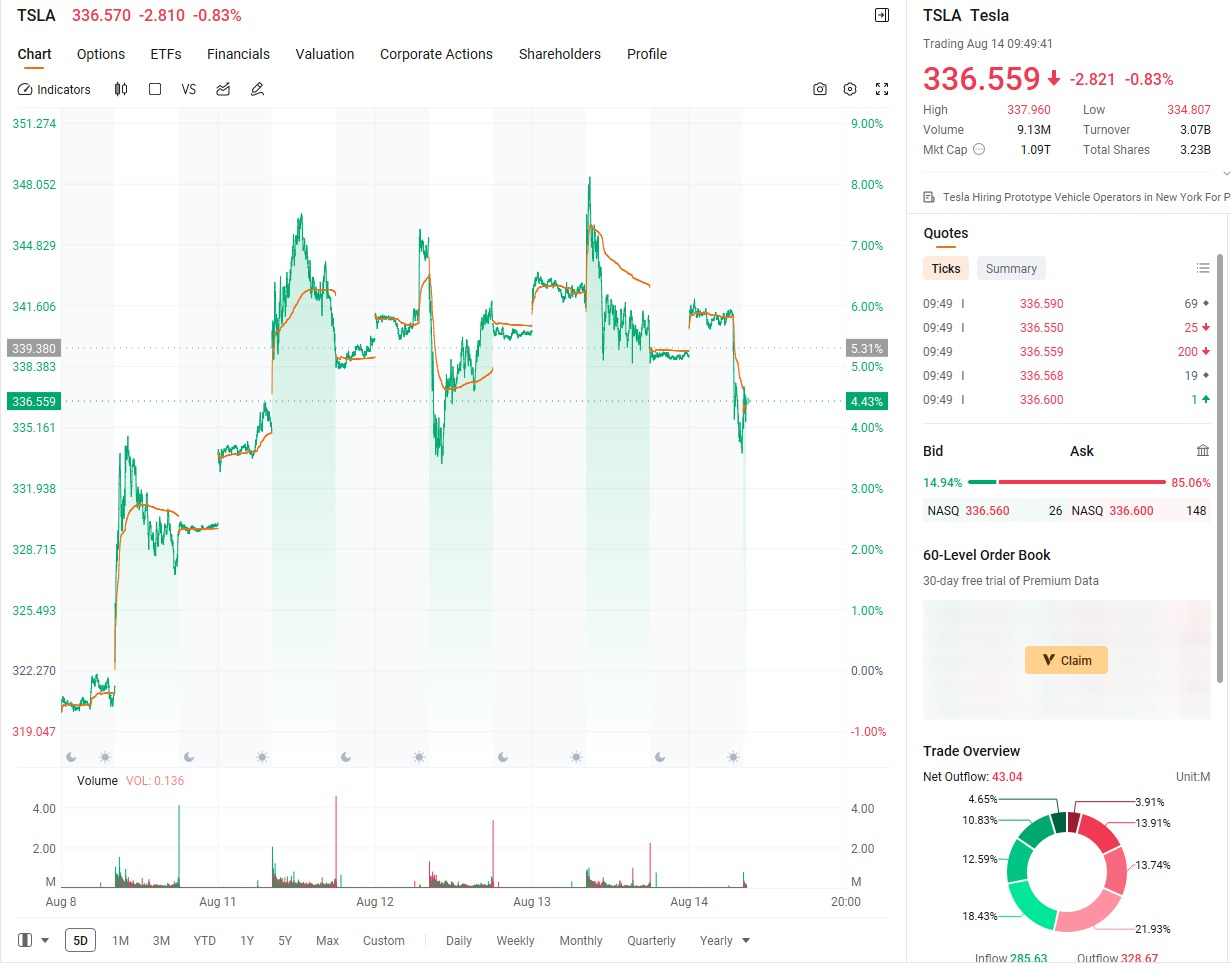

Friends, before analyzing Tesla's performance today, let's first focus on a few key points:

Yesterday's sharp decline did indeed trigger market concerns, but TSLA rebounded quickly after opening lower today, breaking through the $339 mark during trading, indicating that selling pressure is being absorbed and buying momentum is returning to the market.

Although the delivery volume for the second quarter of 2025 fell short of expectations, short-term challenges remain. However, Tesla's AI strategy has shifted toward collaborating with top-tier chip suppliers and accelerating the commercialization of Robotaxis (autonomous ride-hailing vehicles). These medium- to long-term positive factors are being re-priced by the market.

If holding put options (BUY PUT), today's break above the $340 level presents a favorable opportunity to lock in profits and secure gains; If holding Tesla stock or call options (BUY CALL), this technical rebound combined with the future narrative logic of artificial intelligence and autonomous driving still warrants patient holding.

The wisdom of investing lies in distinguishing short-term sentiment from long-term value amid volatility. Tesla is on a transformative journey; we must acknowledge current volatility while seizing future opportunities.

When Tesla once again claimed the title of the most valuable company on the US stock market, it was not merely a victory for its stock price; it signaled that the core drivers of the US stock market are returning to their roots. This tells us that the application of AI technology is moving from the laboratory into everyday life, and it is no longer a distant prospect. In the future, it will integrate deeply into our daily lives, much like electric vehicles and renewable energy, through Tesla's cars, energy products, and autonomous driving systems.

Looking back, did Tesla truly bring electric vehicles into the mainstream market?

Did it raise global awareness of clean energy and energy storage systems?

Did it drive the widespread adoption of autonomous driving and in-vehicle AI technology?

Next, Tesla will redefine transportation with AI and Robotaxis (autonomous taxis), just as it once transformed the automotive industry with the Model S and Model 3. Technology has always been the engine of civilizational progress, and this time, Tesla stands at the forefront of driving societal change.

For this reason, I am even more firmly convinced that—in the financial investment sector—AI-driven fintech tools like CoreX can also become leaders. They will attract investors' attention like a beacon, not just across the United States but around the world. What we must do is seize this technological wave and position ourselves at the heart of this transformation.

In a market environment characterized by frequent fluctuations and rapidly changing information, what investors lack most is not opportunities, but the ability to conduct efficient analysis and make swift decisions—the challenge lies in quickly identifying certainty amidst vast amounts of data, constantly evolving market conditions, and diverse asset classes.

CoreX was created precisely for this purpose. It is not a traditional quantitative model but a next-generation AI-powered financial technology tool I initiated and exclusively developed, integrating multiple technological advantages such as intelligence, automation, reasoning, and iterative upgrades. It is dedicated to addressing the core pain points in investing:

Chart recognition and trend reasoning

Data tracking and in-depth analysis

Data aggregation and classification processing

Rapid extraction and application of multi-market information

CoreX supports automated managed strategies across multiple markets, including stocks, cryptocurrencies, options, futures, forex, and gold, helping investors efficiently allocate assets across diverse asset classes.

Its goal is to achieve high synergy between investors' thinking and AI, training the optimal trading state, while incorporating multi-layer security protection mechanisms. Just like using ChatGPT in your daily life, CoreX will become increasingly familiar with your trading habits as you use it and continuously optimize strategies for you.

What is an inverted yield curve for U.S. Treasury bonds?

The yield on U.S. Treasury bonds refers to the annualized return investors receive when purchasing U.S. government bonds.

Under normal circumstances, the yield on long-term bonds (e.g., 20-year bonds) is higher than that on short-term bonds (e.g., 10-year bonds),

as investors require higher returns to compensate for the risks associated with holding bonds for extended periods.

When this normal yield curve inverts, meaning that short-term bond yields exceed long-term bond yields, it is referred to as a yield curve inversion.

This is often seen as a warning sign of an impending economic recession, as investors anticipate slower future economic growth and declining inflation, leading them to prefer holding short-term bonds to ensure the safety of their funds.

How can we understand the inversion of US Treasury yields in layman's terms?

Imagine you want to buy a house. If everyone generally believes that house prices will fall in the future, you might choose to rent or buy short-term bonds to hedge your risk. Conversely, if everyone is bullish on house prices, they will actively buy houses in pursuit of higher returns.

The inversion of the 10-year and 20-year U.S. Treasury yields has ended, much like a shift in housing price expectations from decline to increase, indicating that the market is more optimistic about the long-term economic outlook. For investments, this typically signals an increase in risk appetite, with risk assets such as stocks and digital assets potentially performing better.

What does the end of the 10Y-20Y yield curve inversion in U.S. Treasuries mean?

When the 10Y-20Y yield curve inversion ends, it indicates that the market's expectations for the long-term economic outlook have improved, and investors are beginning to favor long-term assets.

This suggests:

Greater confidence in future economic growth: Investors believe that the economy will maintain stable growth and that inflation pressures are manageable, so they are willing to hold long-term bonds to earn higher returns.

Monetary policy may shift toward easing: The Federal Reserve may adopt easing policies such as interest rate cuts to stimulate economic growth, thereby causing long-term bond yields to rise.

Risk appetite increases: Investors are more willing to take on greater risks to achieve higher returns. This is favorable for the explosive growth of the cryptocurrency market!

Friends, here is the current holding strategy and its underlying logic. I hope you can see the rationality and growth potential behind it:

$NVTS: Continue to hold as the company's fundamentals and trends remain positive.

$MSTR: Continue to add to and hold positions, as the upward momentum of Bitcoin prices and expectations of interest rate cuts are driving its rise, creating a “double engine” effect.

$SGMT: Continue to hold. This is a clinical-stage biotech company focused on developing fatty acid synthase (FASN) inhibitors for the treatment of metabolic-associated steatohepatitis (MASH) and acne. With positive clinical progress, it holds long-term growth potential.

$TMF / $TLT: These two Treasury bond ETFs are positioned for long-term holding due to market expectations of interest rate cuts. TMF offers three times the leverage of Treasury bond yields, while TLT serves as a stable bridge to long-term U.S. Treasury bonds. Plans to continue holding, awaiting actual interest rate cuts to benefit from enhanced yield flexibility.

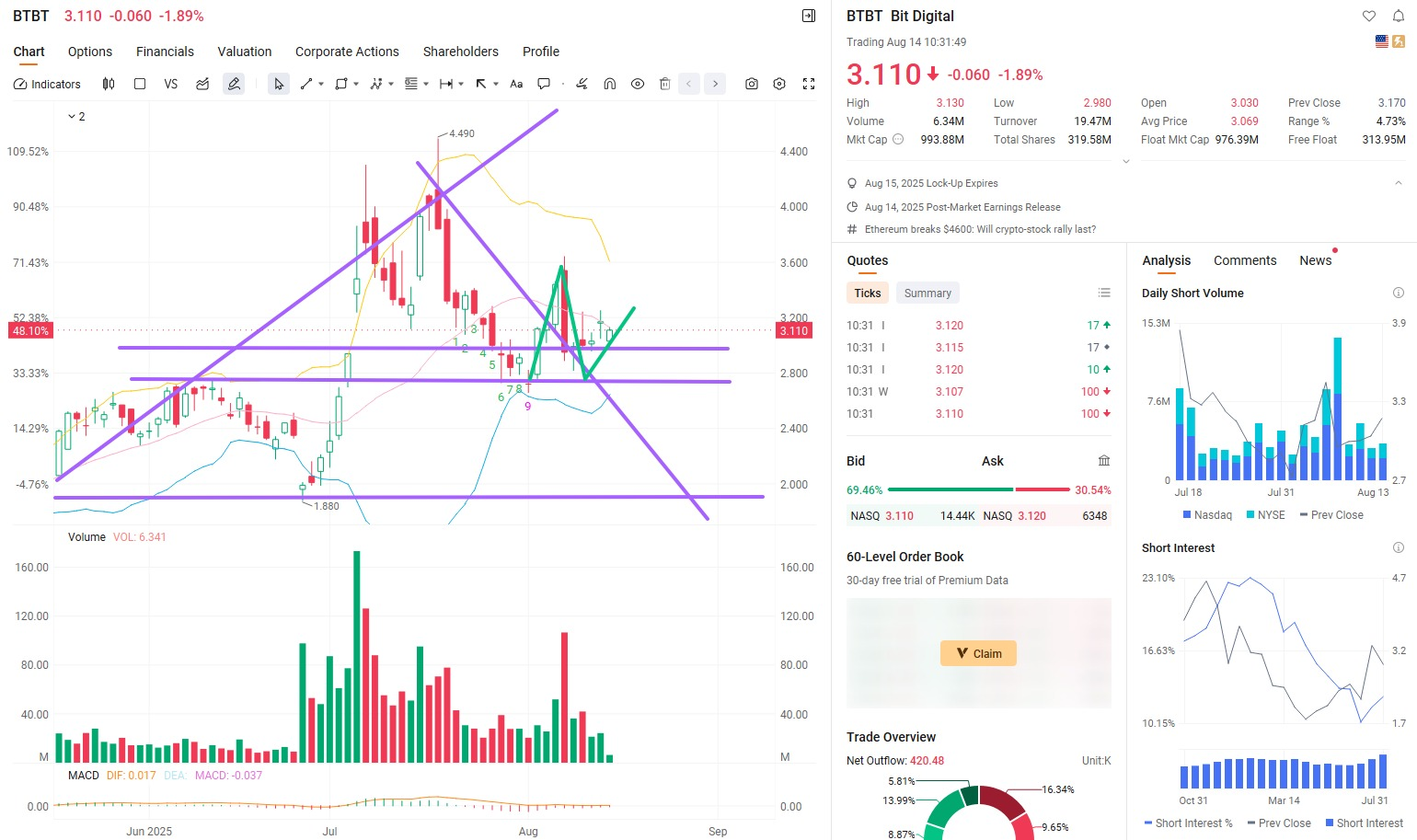

Added a position in an important stock on Thursday: $BTBT

Target price: $4.45 (approximately 40%–45% increase)

Position recommendation: 10%–15% of total stock account balance

Investment horizon: 5–12 trading days

Risk level: $2.5

BTBT is a company focused on Bitcoin mining and digital asset infrastructure. In an environment of declining interest rates, its financing costs have decreased, which helps expand its computing power and improve profit margins. Additionally, as U.S. Treasury yields are expected to continue declining over the next year, the digital currency market as a whole may benefit from a more favorable funding environment, potentially providing upward momentum for BTBT's stock price.

Thursday's market trends perfectly aligned with our trading rhythm—this is the opportunity window we've been waiting for, signaling the arrival of a new era of interest rate cuts!

Some may still be hesitating: is the timing truly right?

Looking back over the past three days, our strategy—from weathering panic-driven volatility, navigating market turbulence, to capturing the rhythm of digital currencies—has been executed flawlessly, yielding impeccable results. The allure of investing lies in the unknown; it tests not luck, but your ability to manage expectations.

The investment seminar will continue tomorrow morning. We will combine today's real-world cases with theoretical analysis to help you refine your trading strategies.

Remember, we are not merely reviewing past operations; we are laying the groundwork for the next offensive. See you tomorrow morning!

————————————————————————————————————————————————————————————————

Yesterday, we discussed how Drogon carried the deceased Daenerys Targaryen eastward in Game of Thrones, sparking endless speculation.

Drogon's choice was not merely about grief and farewell. Its inner world was complex. Its loyalty to Daenerys Targaryen was unwavering—from the "Dragonfire Baptism" of the Lannister army to the destruction of King's Landing, it repeatedly became her weapon of war, aiding her in conquering the world. But years of warfare and endless slaughter had begun to weary it of war and awaken a longing for peace.

So when Jon Snow's dagger pierced Daenerys' heart, Drogon did not choose revenge. Instead, it used dragonfire to melt the Iron Throne, a symbol of absolute power, and then flew eastward with her remains.

It was not a simple departure, but a message to the world of a greater truth: when a force expands excessively, bringing suffering, slaughter, and famine, another force will inevitably emerge to balance it. When such conflict cannot be contained and threatens to escalate into an even greater disaster, cracks will appear within the so-called "just" force, undermining the will that has gone out of control.

In the macrocosm, this is like an invisible hand constantly maintaining a fragile yet necessary balance between power and power, between extremes and extremes.

Good afternoon, I am Bird Grant from NextLeap Management Consulting Co., Ltd., nicknamed Mr. Profit Falcon. The way capital markets operate is not much different—they also follow the ebb and flow of these forces.

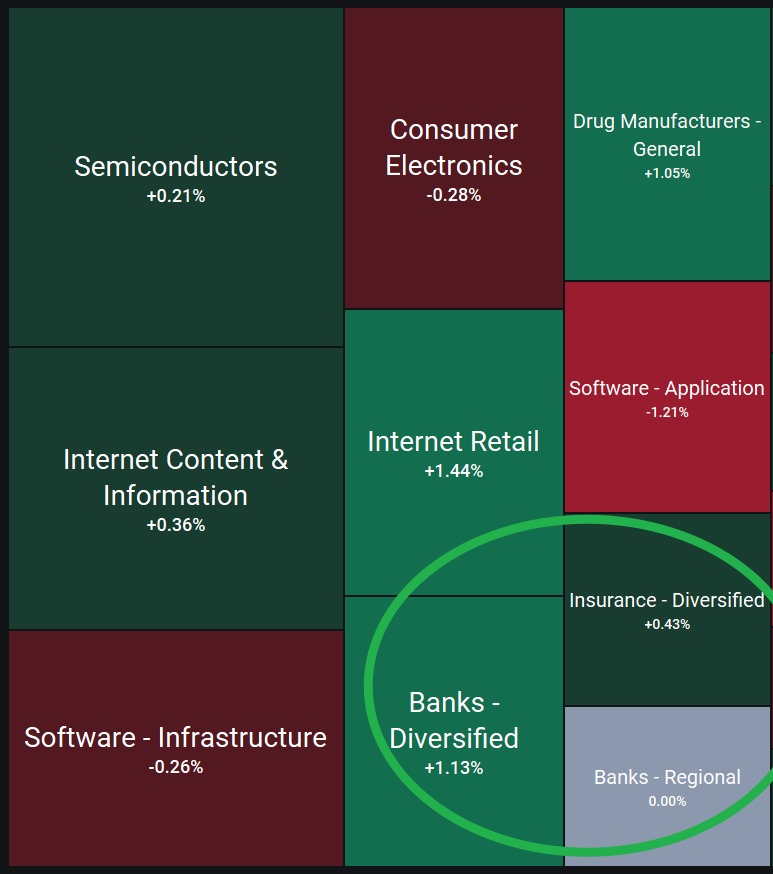

The market is the same—when a particular sector or asset class is pushed to extremes by sentiment, the flow of funds begins to reverse, seeking a new equilibrium. Today, we are witnessing this power shifting: macroeconomic expectations of interest rate cuts are emerging, and liquidity may transition from tightening to easing. In this process, capital is no longer solely fixated on the stock market's "Iron Throne ($NVDA)"; it is beginning to flow toward more resilient, high-return sectors—with the crypto industry at the core of this trend.

The three modules of the Core X quantitative trading system act like our own "Drogon," alerting us to take profits when momentum overheats and signaling new opportunities as they emerge. The CXON token is the "dragon flame" in its hand—driving the system, amplifying opportunities, and enabling us to be not just bystanders but active participants in this battle for liquidity.

Everyone, I want you to experience the thrill of a successful hunt right now!

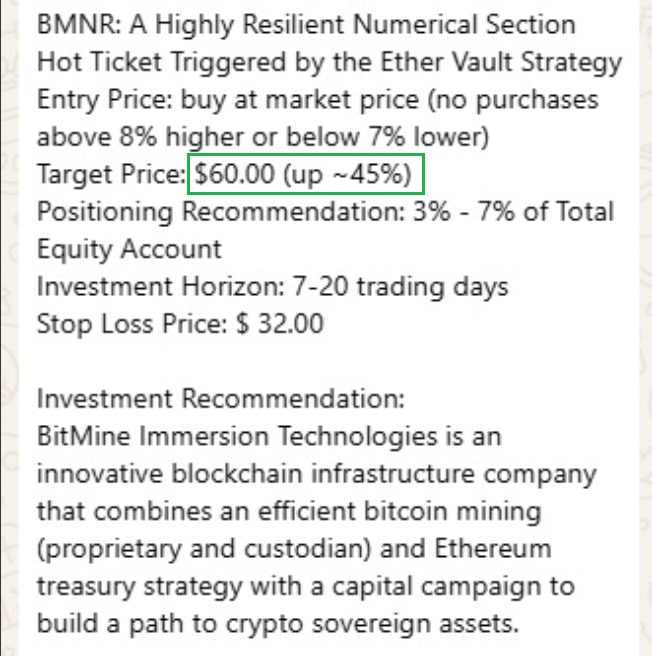

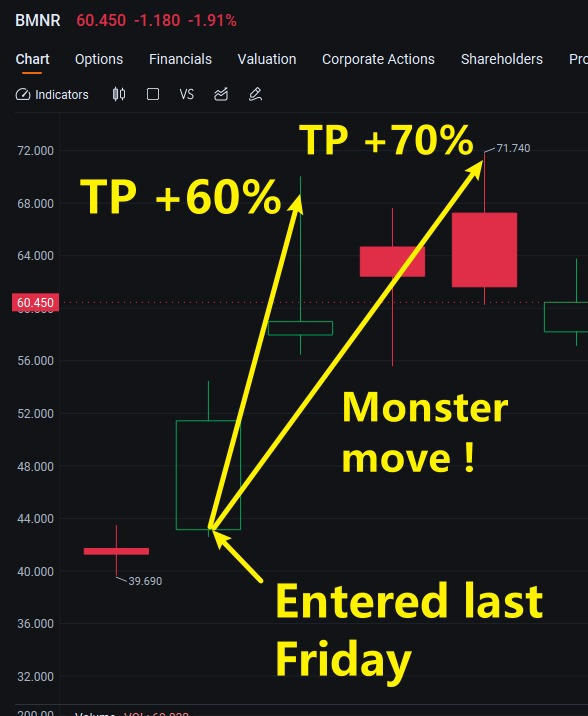

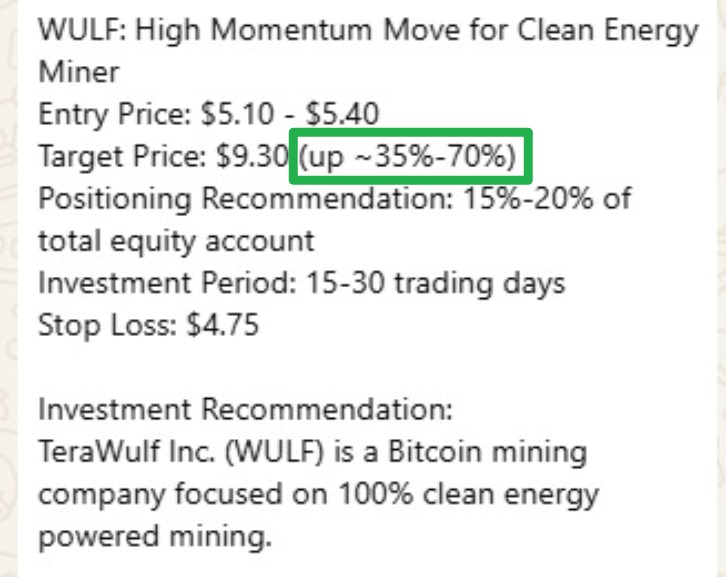

The $BMNR from two days ago surged to +60% on Monday and reached +70% on Wednesday—today, $WULF broke through +60%, and some friends even made even more!

It isn't about luck—it's a perfect trifecta of signals, timing, and execution!

From the moment the setup first emerged, we were like an eagle locking onto its prey—circling, fixating, diving—until today, when we securely brought the prey back!

This move once again proves that my title, "Profit Hawk," isn't just a hollow claim—it's a battle-tested moniker earned on the front lines!

The market doesn't give you this kind of swing every day,

but when it does, we don't just grab it—we clamp down and refuse to let go until profits are dancing in our accounts!

It isn't just trading—it's pure adrenaline, baby!

Tonight we pop the champagne, tomorrow we keep hunting!

What we seek is not a fleeting surge, but a setup backed by a solid underlying logic that can sustain ongoing capital inflows. Take $BMNR over the past two days and today's $WULF as examples.

It's not luck; it is the triple resonance of signals, timing, and execution from the Core X quantitative trading system. The system combines macroeconomic factors, capital flow models, and sector momentum capture to overlay "emotional heat" with "value support," enabling us to lock in targets before market turbulence.

Therefore, when liquidity spills over from blue-chip and growth stocks, we can immediately identify high-elasticity assets and firmly hold onto profits during the breakout window—this is the "profit hawk" strategy.

In this potential rate-cutting cycle, who will be the next target of the emotion + value resonance?

The rate cut did not heat the market. It is not that the market is not excited, but instead that funds are shifting their focus.

There was a surge of sentiment, but the real strong buying did not push up the S&P 500 or Nasdaq. Instead, it flowed directly into crypto assets—BTC surged to $124,000 this morning, and ETH also broke through $4,700, setting a new record high.

Three underlying logics drive this diversion:

Risk-reward alignment

In the early stages of rate cuts, liquidity release is specific, prompting investors to seek assets with high volatility and potential returns. Compared to mature large-cap stocks, cryptocurrencies offer greater price volatility and short-term gains, especially during periods of bullish expectations.

Sentiment and momentum resonance

As the absolute leaders of the cryptocurrency market, every new high set by BTC and ETH triggers the market's "FOMO" psychology (fear of missing out), creating a chain reaction—significant capital flows into mainstream coins, sentiment spreads to second-tier stars, and then to thematic tokens.

Capital Allocation Bias

Institutional behavior over the past two years has shown that when interest rates decline and US dollar liquidity increases, institutions allocate a portion of their capital to cryptocurrency assets to hedge against fiat currency depreciation while seeking excess returns.

From today's capital flows, the first stop for this round of rate cut expectations is not the traditional stock market, but on-chain assets.

If the Federal Reserve does indeed initiate a series of rate cuts starting in September, the momentum in the crypto sector is likely to unfold more rapidly and impact the market more significantly than equities.

Therefore, when strategizing, we must not solely focus on the immediate reactions of the stock market but also discern the proper direction of liquidity—and today's movements in BTC and ETH have already pointed us in the right direction.

For this reason, in the Core X 40/60 configuration, we will not focus solely on BTC and ETH, which have already surged.

Yesterday, we allocated 40% of our crypto portfolio to SOL, which is the first beneficiary of the spillover effect from the mainstream crypto market.

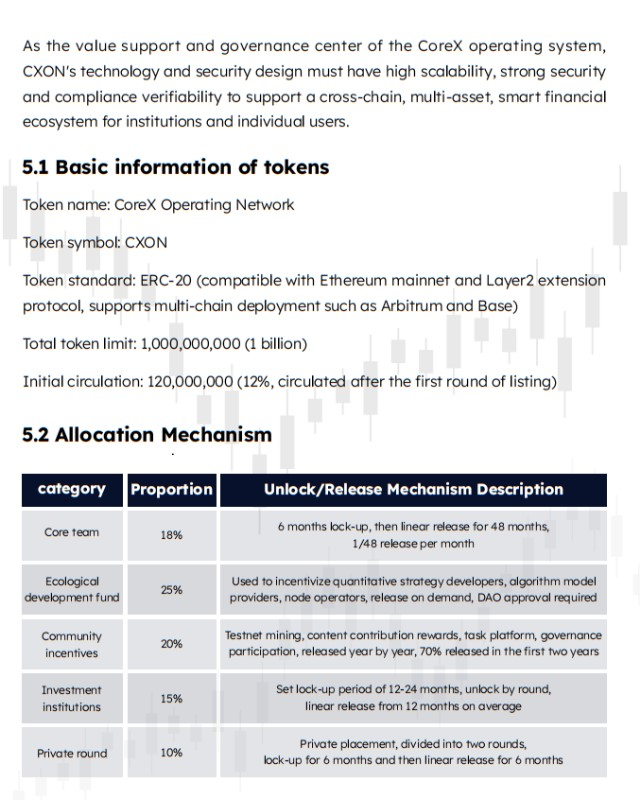

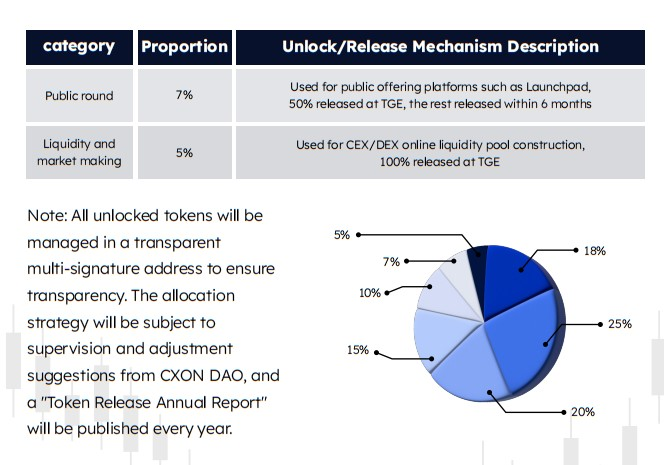

I suggest allocating the remaining 20% to CXON tokens—an asset that is still undervalued but has on-chain applications, stable cash flow, long-term growth potential, and a deflationary mechanism.

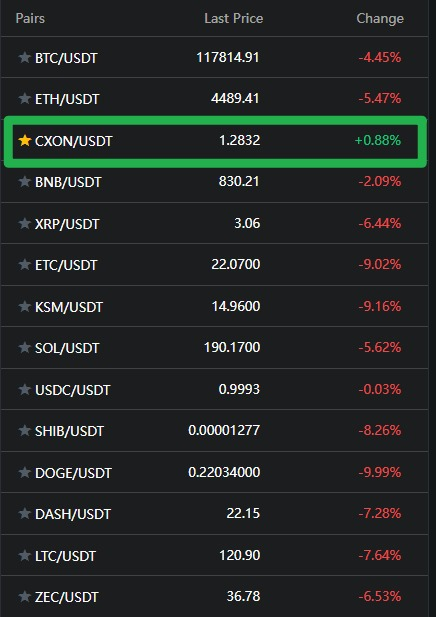

Today's crypto market is clear—almost all names are following BTC and ETH in a short-term correction. Still, CXON is moving higher against the trend, directly validating the direction of our Core X 40/60 portfolio.

It's not luck; it is the result of both structural and signal validation.

Unlike most tokens in the market, which rely on stories, the CXON token is backed by a system that is already generating profits.

This system is the Core X quantitative trading platform, which operates daily and undergoes continuous upgrades.

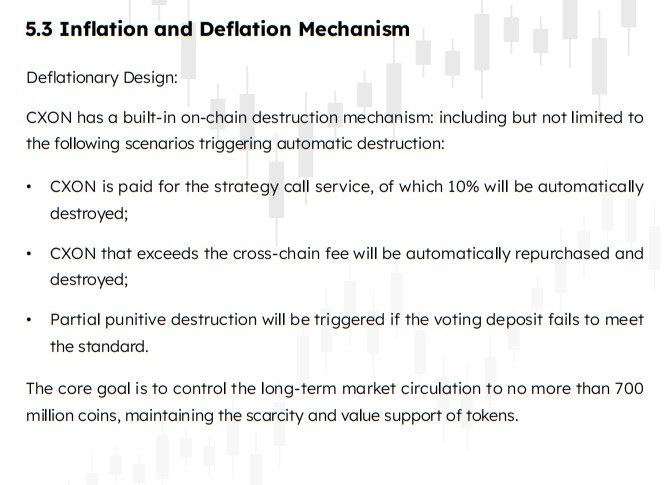

The Core X quantitative trading system has never been a simple stock or token selection tool; it is a trading engine that operates daily and continuously self-upgrades. Its core fuel is the CXON token. The CXON token is not merely a speculative asset but a system equity certificate—every data call, strategy execution, AI model training, and cross-market integration genuinely consumes CXON. It means that holding CXON essentially means having a slice of the system's "computing power" that continuously generates cash flow while possessing deflationary effects.

The value logic of the CXON token is divided into four independent growth drivers:

On-chain consumption aspect: CXON is required for strategy calls, API data access, and AI model training, with each use burning one CXON, directly reducing the circulating supply.

Ecosystem growth aspect: The system integrates with more markets, such as US stocks, cryptocurrencies, futures, and ETFs, and collaborates with external trading platforms and data services to expand the token's use cases.

Revenue Distribution Dimension — A portion of the system's revenue will be repurchased and burned, while data contributors receive token incentives, forming a closed-loop of "revenue-repurchase-burn";

Scarcity Premium Dimension: With a fixed total supply and no additional issuance, as adoption increases, the circulating supply will shrink annually, continuously pressuring prices through supply and demand dynamics.

CXON tokens are the core fuel that powers the Core X quantitative trading system at full speed.

The biggest highlight of CXON tokens is that they have already entered the real-world implementation phase. The Core X system has identified and locked in high-probability trades in the US stock market and crypto markets (e.g., $APLD, $BMNR, $WULF, etc.), with each strategy execution and data call consuming CXON in the background. Signal accuracy has remained consistently high, with expanding trading instruments and API partners, and growing external demand. It's not a theoretical concept but verifiable daily consumption records on the blockchain.

It is also a strategic investment window. Macroeconomically, expectations of interest rate cuts combined with new highs for BTC and ETH have propelled the crypto market into a liquidity acceleration phase. Price-wise, CXON remains at a structural low before its launch. In terms of value, the frequency of system upgrades and consumption is accelerating, with deflationary logic gradually emerging. Holding CXON is not just about profiting from the Core X system; it also allows you to capture the market sentiment-driven segment of the crypto market.

Therefore, when you hold CXON, you are not having an isolated token but a growth equity certificate of the Core X system, a share of the benefits from each future system expansion, and a financial lever that amplifies liquidity cycle returns. Every future version update, market expansion, and partner integration will directly impact its price curve. At the same time, on-chain consumption records will increase, circulation will decrease, and market capitalization will continue to rise.

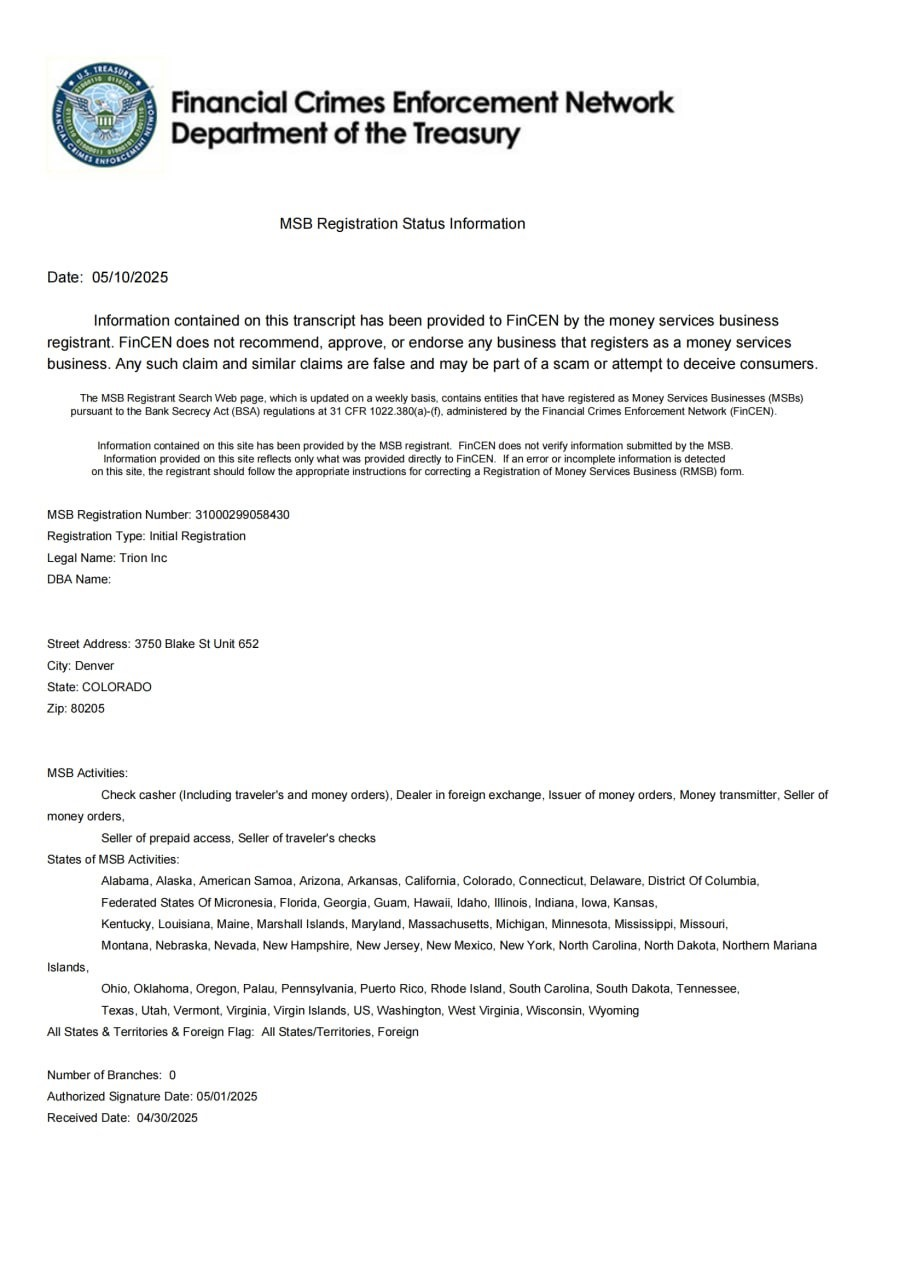

When deciding to allocate 20% of the portfolio to CXON, I first asked everyone a question: What is the biggest concern in the world of cryptocurrency assets? It's not the ups and downs of the market, but whether the money you earn can be safely stored there without disappearing overnight. Over the past two years, we've seen too many wake-up calls—the collapse of FTX, and some overseas platforms being forced to shut down due to compliance issues. Even when the market is booming, investors dare not go all-in.

Therefore, the actual long-term winners aren't the ones that rise the fastest in the short term, but those that can steadily operate within the rules. An exchange's compliance is its foundation—does it have global high-standard licenses? Does it comply with KYC/AML regulations? Are its audits and transparency publicly verifiable? These are the first layer of confidence.

The second layer is credibility endorsement. Does it have backing from major institutions? Does it have long-term partnerships with banks and payment channels? Has it had any security incidents in the past? A platform that institutions can trust to safeguard funds is where we dare to list.

The third layer is security measures. Cold wallet reserves, multi-signature protection, insurance mechanisms, bug bounties. These may sound like technical details, but in critical moments, they serve as the firewall protecting your funds. Without these, even the most enormous liquidity is as unstable as shifting sand.

It is precisely why we have chosen a platform that is compliant, secure, and qualified on a global scale to host CXON's listing. This way, the moment of listing not only brings liquidity but also the security endorsement of a reputable brand, making both institutional and retail investors more willing to join in. CXON is not just listed on an exchange; it is standing on a solid "rock" to uphold long-term value.

This time, we have compliance, qualifications, and a secure foundation to support CXON's listing and circulation. It is why we dare to allocate a full 20% position in the portfolio. The market won't wait for your confirmation to move; now is the window to position this 20%. Miss it, and you'll have to chase it at a higher price.

In the episode of "Game of Thrones" titled "The Battle of Winterfell," when everyone faced the Night King's attack, their greatest fear was not whether they could win, but whether they could survive. The army of White Walkers outside the city walls was vast and powerful. Even with soldiers and weapons, if the city gates were breached and the rear collapsed, all efforts would be in vain.

Therefore, Jon Snow and Daenerys Targaryen did two things before the battle:

Reinforce the defenses—ensure the safety of the rear, allowing the front lines to fight with full force.

Gather the elite—place the strongest forces in the most critical positions to block the first wave of the attack.

In the Core X 40/60 investment portfolio, allocating 40% of the portfolio to SOL and 20% to CXON tokens is akin to placing the strongest walls and most elite warriors at the core of your asset portfolio before this primary battle. It is not an emotional bet but a strategic allocation backed by compliance, qualifications, and a secure foundation, ensuring that when the primary uptrend in the crypto market arrives, you can not only charge forward but also hold onto your gains.

Before the "long night falls" in the market, preparing your defenses in advance is our most tremendous confidence in surviving in Winterfell.

Therefore, allocating 20% of our portfolio to CXON tokens today is not merely a trading decision. Still, a strategic reinforcement of our defensive posture enables us to not only launch full-scale attacks in future market fluctuations but also safeguard the fruits of our victories.

The long night of the market may come at any time, but with sturdy walls and reliable weapons, we can stand on the ramparts at dawn, watching the sunlight shine through the ruins, while our wealth remains safe and sound.

As it is written in the Gospel of John: "Peace I leave with you; my Peace I give to you. Not as the world gives do I give to you. Let not your hearts be troubled, neither let them be afraid."

The market has closed, but our battle is far from over. Finally, I'd like to ask everyone two questions:

1. What investment assets did we discuss using 20% of our total portfolio allocation in today's session?

2. If the September rate cut materializes, which asset class will you see faster and more significant momentum in?

A. Traditional blue-chip stocks

B. High-volatility cryptocurrencies (BTC, ETH, SOL, CXON, etc.)

C. Real estate market

Remember to send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

Tonight, hold fast to your beliefs and prepare your positions. Tomorrow, when the bugle sounds again, we will be ready to charge forward—continuing our march toward victory.