August 15, 2025

August 15, 2025

This week, we have seen the release of inflation data, the repair of the US Treasury yield curve, and the rotation of sector funds, with the market rhythm gradually becoming clearer. Today is not only the final trading day of the week but also the much-anticipated Friday lottery event in this market context.

Looking back at this week, we have navigated the market's ups and downs, seized opportunities, and faced risk challenges. These processes are not merely changes in account numbers, but also repeated tests of our investment mindset and judgment. The key signals today will directly influence our future trading decisions.

As the weekend approaches, may the sun continue to shine into your life, and may the fruits of your investments accompany the joys of life. September is just around the corner, not only a warm season for gathering with family and friends, but also marking the farewell to summer and the beginning of a new cycle.

In today's session, we will first review this week's investment operations, identifying profitable highlights and areas for improvement; then, we will help you identify potential sectors and hot opportunities for next week, enabling you to take the initiative in the next round of market trends. Finally, I would like to extend my heartfelt gratitude to those who have consistently checked in and actively participated in interactions. It is precisely because of you that our learning, investing, and communication have formed a long-term, healthy positive cycle, allowing us to continuously progress and profit in the market.

On Friday before the market opened, the three major stock index futures remained firm, showing a clear rebound trend, which means that the market is likely to open slightly higher after the opening. However, whether it can continue to strengthen depends on two key supporting factors:

First, the July retail sales data released today was very strong, but at the same time, it provides a solid basis for the Federal Reserve's interest rate decision meeting next month, and the market generally believes that this will be an important support for interest rate cuts.

Second, $ABBV rose before the market opened, indicating that the options market's digestion process is nearing its end. However, considering the “double kill” factor in options, it is likely to trade within a volatile range today, with possible minor fluctuations during the session.

These two factors have further reinforced the market's optimistic expectations for today's opening. Overall, the market sentiment today is positive. As investors, we should make good use of this momentum, not only focusing on short-term opportunities but also considering how to gain a competitive edge in next week's market trends.

According to CoreX's latest big data analysis, the market is already speculating on the magnitude of the Federal Reserve's rate cut in September. The focus is not on “whether to cut rates,” but rather on whether the cut will be 25 basis points or 50 basis points. The key to determining this magnitude will depend on the performance of core economic data from late August to early September, particularly the nonfarm payrolls report.

If the employment data comes in significantly below expectations, it would indicate a cooling labor market and insufficient economic momentum, prompting the Federal Reserve to opt for a more substantial rate cut to stimulate growth. Therefore, from now until the Federal Open Market Committee (FOMC) meeting, market sentiment will fluctuate with each economic data release. This presents both a critical window for close observation and a valuable opportunity for strategic positioning.

In this context, some capital is more inclined to flow into stable sectors with long-term yield prospects, such as the utilities sector—which features stable cash flows and low sensitivity to interest rates, making it a “safe haven” in a rate-cutting environment.

At the same time, some capital is flowing into high-volatility, high-elasticity digital assets, particularly Bitcoin and similar assets. Although their overall scale is smaller than traditional assets, their ease of trading and high volatility make them significantly more attractive in a rate-cutting environment.

Whether it is the defensive public utilities sector or the offensive digital assets, both are attractive within their respective risk tolerance ranges. The key lies in how investors balance their positions and timing.

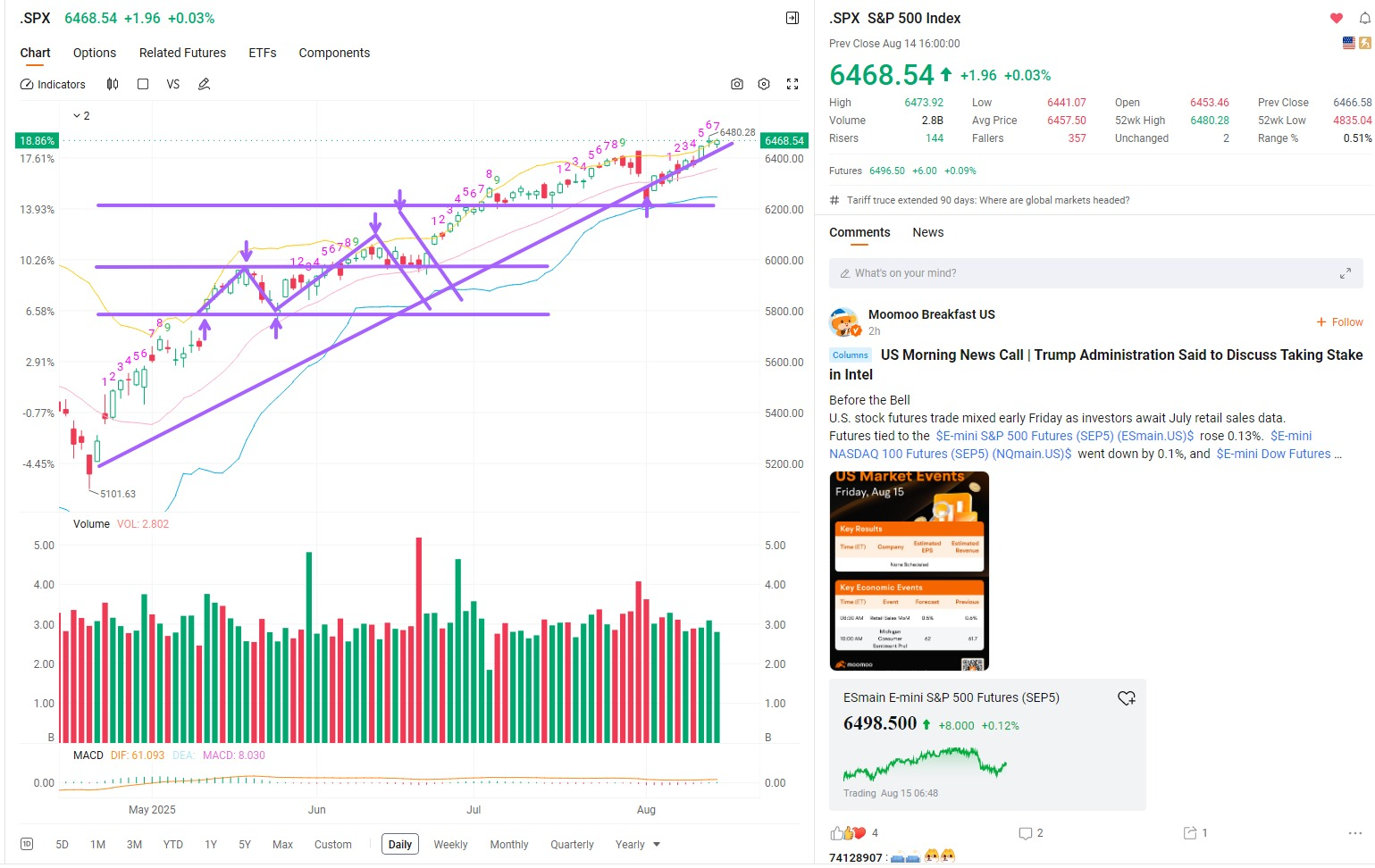

The market's focus in August remains on whether the S&P 500 Index (.SPX) can reach a new all-time high. From a technical chart perspective, the index has broken through its previous key consolidation range and is now at a critical juncture where it must choose its future direction. The strength or weakness of expectations for interest rate cuts may also serve as an important catalyst in determining whether this key level is broken.

If it breaks above the new high, it may signal the start of a new round of upward momentum, potentially extending until the Federal Reserve's interest rate meeting in mid-September; if it breaks below this level in August, it may indicate that the market is facing resistance at historical highs.

From the current market sentiment, the fear index has continued to decline, indicating relatively optimistic market sentiment on Friday; Additionally, the rise in $ABBV has further boosted market sentiment. However, this performance may also be related to profit-taking and capital outflows ahead of the upcoming holiday.

Overall, a critical turning point is approaching, and whether the market will break through or retreat is likely to become clear in the coming trading days. Do you think the market will break through under the influence of optimistic sentiment, or will it remain cautious and wait for the release of key data?

According to CoreX big data analysis

As of August 15, Eastern Time, the market demonstrated resilience amid unexpectedly high inflation data (July PPI rose 0.9%, far exceeding expectations) and cooling expectations for interest rate cuts. Dow Jones futures rose approximately 0.6%, the S&P 500 edged higher, and the Nasdaq fell slightly, with Amazon surging nearly 3% to provide support;

Berkshire Hathaway increased its holdings in Nucor and UnitedHealth while reducing its stakes in Apple and Bank of America, indicating that large institutional investors are shifting away from high-valuation tech stocks toward value and defensive sectors;

Meanwhile, Kyivstar, Ukraine's largest mobile operator, listed on the Nasdaq today, becoming the first Ukrainian company to list on U.S. markets, adding a new focus on geopolitical and capital flow dynamics to the market.

Therefore, against the backdrop of expectations of interest rate cuts and loose liquidity, the market continues to stabilize and rebound, with trading volume remaining high. In the short term, it remains one of the representative stocks in the digital asset and crypto infrastructure sectors, and we recommend continuing to monitor it closely.

In addition to index and sector opportunities, our recent individual stock positions also warrant review:

AbbVie ($ABBV): A high-quality, high-dividend biopharmaceutical stock with growth potential, exhibiting a steady trend. The relative strength score has improved from 64 to 71, and strong earnings reports have driven an upward revision of the full-year guidance. If it can break out of the consolidation zone around $218, it may have the potential to initiate a new round of upward movement.

WULF: A representative of the high-growth sector, it has surged rapidly over the past few weeks, with a nearly 60% gain yesterday, reflecting strong investor interest in AI and crypto infrastructure. It is suitable for short-term participation, but position sizing and timing must be managed to avoid chasing highs.

Take BTBT, for example. This company specializes in Bitcoin mining and crypto infrastructure development. This year, driven by the rebound in digital asset prices and increased demand for computing power, its stock price has experienced several periodic rebounds. From a technical perspective, BTBT has recently stabilized after adjustments, accompanied by increased trading volume, suggesting potential for further recovery in the short term.

In an environment of interest rate cuts, digital asset companies often benefit from both capital inflows and improved market sentiment, making this sector a worthwhile focus. Do you believe that when liquidity returns to the market, the S&P 500 will break through on the back of optimism, or will you remain cautious and wait-and-see until key data is released?

Against the backdrop of interest rate cuts and liquidity injections, digital currency-related stocks have also been active. How have they become a target for some capital?

First is MicroStrategy (now renamed Strategy, $MSTR)

This company has fully transformed into a “Bitcoin vault-type enterprise,” holding approximately 628,946 Bitcoins as of mid-August, with a market value of nearly $75 billion, accounting for about 3% of the global Bitcoin supply. The latest quarterly financial report shows that the company recorded significant unrealized gains due to the appreciation of Bitcoin, with EPS far exceeding market expectations, and the stock price maintaining strong performance. Meanwhile, it continues to raise funds through issuing new shares and preferred shares to purchase Bitcoin. This strategy, while increasing holdings, also elevates financial leverage risks. The current strategy is to maintain holdings, but close attention must be paid to Bitcoin price fluctuations.

Next, let's look at BIT Mining ($BTCM)

This company primarily engages in Bitcoin mining, data center operations, and mining equipment manufacturing, with business operations in mainland China, the United States, and Hong Kong. The current stock price is approximately $3.37, with a daily decline of nearly 12%. Over the past 52 weeks, the lowest price was $1.22 and the highest was $8.07, demonstrating extremely volatile price movements. For investors seeking direct exposure to the cryptocurrency mining sector, BTCM offers a high-elasticity entry point, but this also entails high risk and volatility, necessitating strict position management and stop-loss strategies.

Under these conditions, the afternoon session may see some pullback, but it is likely to remain within the current trading range. What concerns me more is whether the market will exhibit new dynamics after September, especially under the dominance of rate cut expectations. Therefore, I will continue to monitor the latest developments with everyone when the market reopens on Monday.

As for today's trading opportunities, $TMF / $TLT are expected to see a slight uptick—as risk-averse funds flow back ahead of the holiday, driving steady gains in U.S. Treasury prices. Before the holiday, I recommend maintaining flexible positions, avoiding aggressive moves, and focusing on pre-positioning for promising sectors next week. Folks, stay calm, adapt to market fluctuations, and we'll see you on Monday!

Good afternoon, I am Bird Grant from NextLeap Management Consulting Co., Ltd., also known as Mr. Profit Falcon. Do you remember what I said last night? The market won't always be sunny and rosy. Confirmed winners are those who hold onto their swords even in the darkest of nights. As the old saying from Winterfell goes, "The long night is coming, and I will stand guard until the end.”

Today's tape wasn't exactly pleasant — broad-based selloff, with plenty of names taking heavy hits. Even crowd favorites like $BTBT, $SBET, and $NVTS saw sharp pullbacks. For many, it was a sea of red, with several days' worth of gains wiped out in just one session. On our side, positioning stayed light and core risk had already been locked in — so a day like this is more of a "stress test for the defense system" than a portfolio-crushing blow.

we've already set up our defenses—the Core X 40/60 combination.40% SOL, like the Unsullied guarding the city gates, fearlessly withstanding the first wave of attacks, steadfastly holding the line, and continuously advancing the defenses; while 20% CXON is the elite force deep within the inner city, quietly waiting to sever the enemy's advance route the moment they show a weakness.

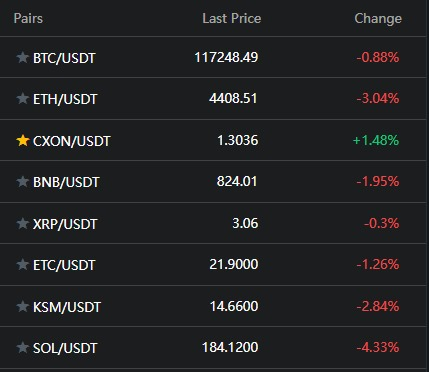

Today's market was like a sudden night raid—almost all assets fell, with BTC and ETH both correcting, and most crypto assets following suit. But look at our CXON, which bucked the trend and not only held its ground but also pushed forward. It's the power of being prepared in advance.

It proves a simple yet often overlooked truth: in times of crisis, only assets backed by intrinsic value and supported by liquidity can withstand the tidal wave.

That's why we have no reason to panic in today's widespread decline. Our positions are not bets but strategically positioned defenses validated by system signals, aligned with macroeconomic conditions, and confirmed by capital flows.

Remember, actual battles are never decided in a day or two. It is those who endure through the darkness until dawn who will ultimately emerge victorious.

The red zone is expanding, and market sentiment has quickly shifted from yesterday's warm tone to a low-pressure environment.

At such times, the initial reaction is often one of concern, doubt, or even the urge to liquidate positions. However, I want to remind everyone: our position structure and direction are not based on intuition, but rather the result of the Core X quantitative trading system's multi-signal verification process.

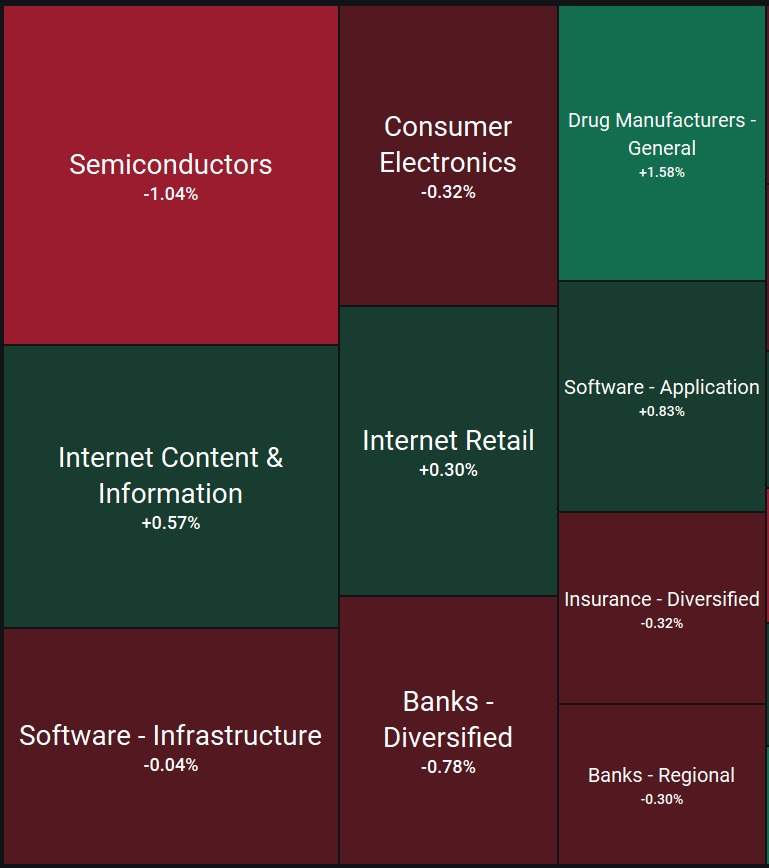

Today's market shows a certain "disconnect between indices and individual stocks". While the indices haven't fallen much, most individual stocks are declining, with many stocks experiencing declines far exceeding the index. What is the true driving force behind this?

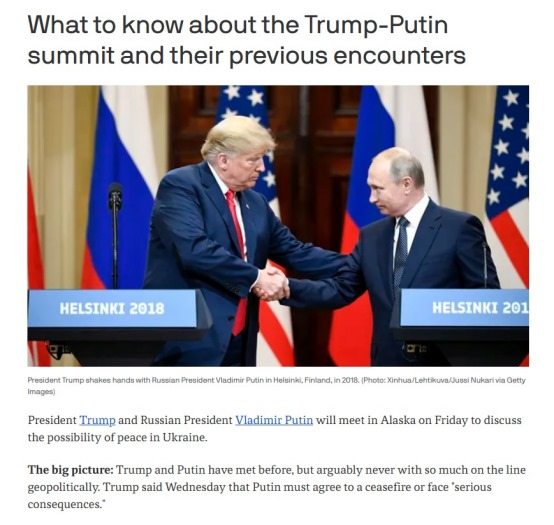

One of the main reasons is this sudden geopolitical event:

Today, Trump and Putin met in Alaska to discuss the possibility of a ceasefire in Ukraine. Historically, these two leaders have met in Helsinki, but this time, the geopolitical stakes are higher. Trump even directly stated that Putin must agree to a ceasefire, or else face "serious consequences."

What does this news mean for trading?

Short-term risk aversion is on the rise: funds are preferring to move into "safe-haven assets" like gold and US Treasuries rather than buying high-volatility assets.

Proactive profit-taking: especially for stocks that have seen significant gains recently, which have become the fastest source of "cash flow";

Sector-wide selling has led to today's market landscape, where the index is slightly up but individual stocks are broadly down.

It's why, despite the index not showing a significant decline today, many stocks have already entered a defensive mode.

However, this is not a signal of panic selling but rather a position rebalancing driven by the event—funds will temporarily exit the market to observe. Still, once the situation clarifies, they will quickly shift back to high-elasticity assets.

1. The profit-taking cycle is accelerating

Over the past two weeks, many high-volatility sectors and strong stocks have accumulated significant gains, prompting short-term capital to take advantage of events to lock in profits. This "opportunistic selling" is not bearish, but rather a simple cash-out to reduce paper risk.

2. Expectations of tightening liquidity

Although rate cut expectations persist, some institutions are beginning to anticipate that the Federal Reserve may not provide the market with additional liquidity "sweeteners" in the short term, especially given the slight rebound in inflation data. This expectation has led short-term trading capital to avoid high-leverage, high-valuation assets.

3. A lull in sector rotation

Mainstream sectors such as technology, cryptocurrency, industry, and energy lack new catalysts, leaving capital in a state of "withdrawal—caution—waiting for the next wave." During this lull, individual stocks without thematic protection are more likely to be sold off aggressively.

Therefore, today's decline is not a systemic collapse but more like a collective market adjustment process. Funds have not fled the battlefield but have temporarily retreated to a safe zone to await signals. Once new catalysts emerge, they will return faster than anyone else.

Everyone, today's widespread decline is not due to any institution dumping shares or any stock releasing bad news. Its essence is the market's convergence effect.

What is the convergence effect?

In the trading world, when a sufficiently large external variable appears, such as geopolitical conflicts, central bank policy signals, or major macroeconomic events, the first reaction of funds is not to analyze its logic and correctness, but to consistently engage in "risk hedging."

Institutions will simultaneously reduce their positions in high-volatility stocks.

Algorithmic models will trigger defensive signals in sync.

Mid-to-short-term capital will tend to lock in existing profits.

This consistent action, occurring within the same time window, amplifies market volatility. As a result, you will see that—regardless of industry or fundamentals—any high-elasticity assets are being sold off today.

Even if you are bullish on a particular company and confident in its value, the collective decision of capital today is to "pull out first," even if the reason is simply that "others are pulling out too." It's the herd mentality of the market—when the majority is doing the same thing, individual independent judgment is temporarily suppressed.

Therefore, when faced with such a market situation, what we should do is not to speculate on "who is selling off," but to return to structural thinking:

Which positions are our unmovable defensive layer (SOL in the Core X portfolio)

Which positions are in the offensive layer with capital support against the trend (today's performance of CXON is an example)

Which positions should be reconsidered for increasing after the herd mentality effect subsides?

The herd mentality effect in the market comes quickly and fades quickly. The true trading advantage is not to confront the market head-on during the storm, but to set up defenses in advance so that when the storm passes, we remain on higher ground. Do you agree?

Global risk aversion briefly resurfaced: The trend in US Treasury yields confirms this—it's not that funds have disappeared, but rather that they have temporarily shifted to safe-haven assets.

In Core X's macro factor monitoring, this is classified as a liquidity direction adjustment, with no signs of a trend reversal. It now resembles a market breather rather than a market collapse.

Core X Quantitative Trading System Structure Analysis: Why can SOL and CXON withstand the pressure?

In the Core X 40/60 portfolio, we allocate 40% of the crypto allocation to SOL and 20% to CXON—this is no coincidence:

SOL: A strong beta asset tracking BTC/ETH, it is among the first to benefit when mainstream cryptocurrency trends spill over. It rises quickly when the support typically constrains bullish sentiment returns, but its correction magnitude is comparable to that of mainstream cryptocurrencies.

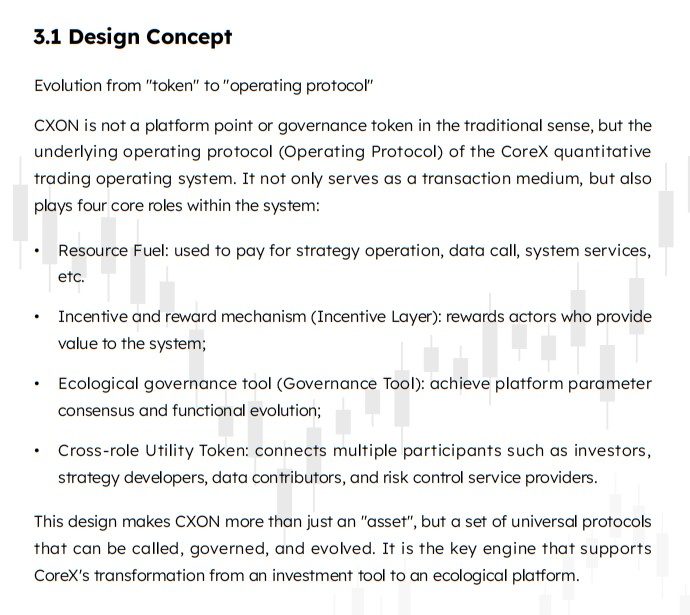

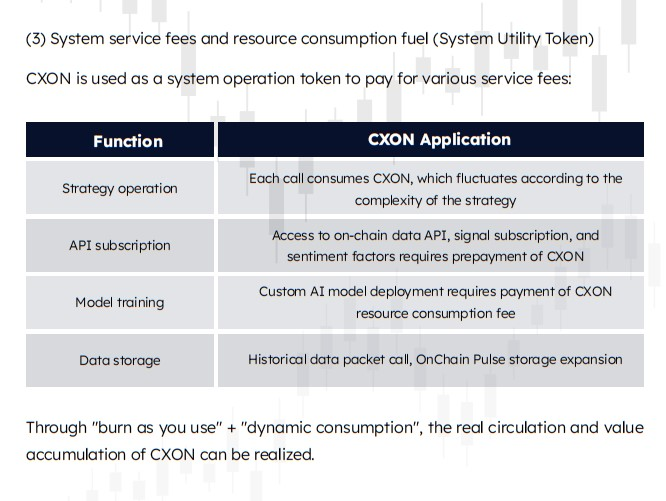

CXON: It does not rely solely on emotional momentum. It has real on-chain applications, stable capital flow growth, long-term growth logic, and a deflationary mechanism. While most cryptocurrencies followed BTC/ETH in their decline today, CXON bucked the trend and rose. It is the power of value support—it is both the fuel for the trading system and the equity certificate for the growth curve, with a naturally different volatility structure.

The Core X quantitative trading system implements asset layering to ensure the portfolio forms a "dual-layer defense" during market downturns:

Outer layer (highly elastic assets like CXON): Capturing emotional waves

Inner layer (value-driven assets like SOL): Providing stable support when emotional waves recede

The differentiated performance of these two layers today directly validates the system's design logic.

The logic behind the Core X quantitative trading system is simple and calm—it tracks structural integrity, not intraday emotional noise.

Our execution framework has always been:

Structure intact → Maintain positions and let the setup run its course naturally, without forcing changes;

Structure broken → The system will issue an early warning, executing position reductions or direct exits, without emotional decision-making.

Today's pullback, as indicated by the signals, is a combination of volatility release and sector rotation, not a structural collapse of the trend. Funds have not collectively withdrawn but are repositioning across different sectors—for example, flowing from previously high-performing tech leaders into defensive and energy-related assets.

In other words, the red market you see now is not a retreat but the market taking a breather. This pause will make the price structure more stable, creating space for the next phase of advancement. The actual danger signal is not today's broad-based dip, but when multiple structures are simultaneously broken and capital flows show sustained outflows.

Therefore, on days like this, the most important thing is not to fixate on P/L fluctuations, but to confirm whether your current positions are still within the framework of the original setup. If the structure remains intact, there is no need to make hasty moves.

On a day of widespread declines, what should we do?

1. Do not liquidate positions during a downturn.

Do not be alarmed by the red numbers during trading hours. The Core X system tracks structural integrity, not today's color. As long as key support remains intact and the price-volume relationship is not disrupted, short-term fluctuations are merely noise. Selling at the bottom is equivalent to handing over future rebounds to others.

2. Do not increase positions

The market is adjusting, like breathing. Increasing positions prematurely before the setup is confirmed is gambling with real money on the "possibility" of a rebound. We wait for the system to verify the setup—that's when the win rate and risk-reward ratio are in our favor.

No action today does not mean no opportunity tomorrow. Once the system signals are aligned—such as Event-Triggered and Sector Engine pointing in the same direction—that is the entry window. Act quickly, accurately, and decisively, relying on the checklist, not intuition.

4. Record data

Today's counter-trend rally in CXON is not a coincidence but a tangible demonstration of value support combined with the system's layered logic. It tells us that even on a broad market decline day, capital will still seek out assets with the fundamental backing and clean structures. Record this data, and when we encounter similar market conditions in the future, we will know what to do.

The investment market doesn't always give us sunshine and roses; sometimes it's more like the long, nights north of the Great Wall.

Today's market conditions are like a battle that requires us to stay up all night. The cold wind howls, snowflakes hit our armor, and our vision is blurred, so we can only see the beacon fires in the distance.

Volatility surges like wave after wave of White Walkers crashing against the city gates, attempting to breach the defenses. Some moments send the heart racing, others compel one to grip their weapons tightly, unwilling to let go.

In such a night, the Core X quantitative trading system remains steadfast like the horn of the Night's Watch—unfazed by the first wave of impact, refusing to swing unthinkingly, but steadfastly holding the line. With every pullback, every dip, the system calculates the position of support lines, monitors the flow of funds, confirms the structure remains intact, and ensures the formation has not been breached.

This defensive strength helps us steady our position in the storm, preventing panic from dragging us into erroneous actions.

We have already established our counterattack lines—the Core X 40/60 combination. The 40% SOL acts like the Unsullied army stationed at the city gates, fearlessly withstanding the first wave of attacks, steadfastly holding the line, and continuously advancing the defense. In comparison, the 20% CXON is the elite force deep within the inner city, quietly waiting to sever the enemy's advance routes the moment they show any weakness.

Once they break through, it's not a probe but a full-scale assault: precisely targeting objectives, penetrating breakthrough points, and cleanly reaping the rewards.

Today, we witnessed the Core X quantitative trading system's defensive capabilities—calm under pressure, precise in execution, and unshakable in structure.

Soon, we will see its offensive side—swift to act, aggressive when it counts, and clean in taking profits.

The market has closed, but the battle isn't over yet. Hold your ground and keep your eyes on the signals. As soon as the light comes on, we'll cross the city gates together and head for our next target.

Then let me pose two questions:

1. In today's market-wide decline, how can we stay steady? How is our Core X 40/60 counterattack defense line positioned?

2. In today's broadly declining crypto market, which asset defied the trend and stabilized our counterattack defense line?

Remember to send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

As John's Gospel says: "I leave you peace; I give you my peace. The peace I give is not as the world gives. Do not let your hearts be troubled, and do not be afraid." Market volatility may temporarily leave one feeling overwhelmed, but true peace is never found in the market's fluctuations, but in the steadfastness and trust within one's heart. Since the battle phase has concluded, let us shut off our screens this weekend and dedicate our time to sunshine, coffee, and good music.