August 17, 2025

August 17, 2025

The wind and snow lash against the face, howling like the long night of Winterfell descending once more. The sound of trumpets echoes above the city walls—a warning from the market. On Friday, the investment market appeared calm on the surface, but beneath the surface, turbulent currents swirled. The three major indices remain standing, showing no signs of a significant collapse, much like the distant city walls that still stand firm. However, the actual danger lies not on the surface, but in the shadows.

Individual stocks surge like wave after wave of White Walkers, crashing into the city gates in droves. The red declines, like flickering flames in a snowy night, are blinding and chaotic, obscuring the path ahead. Many have discovered that the profits in their accounts have been swallowed up in just a few hours, like torches before the city gates being extinguished by wind and snow. That sense of helplessness compels one to grip one's weapons tightly, heart racing, as if the city gates are about to be breached at any moment.

However, the real storm did not come from within the market, but from the power games outside the city. The meeting in Alaska failed, with Trump and Putin failing to produce any ceasefire agreement, let alone a future "roadmap." Just like the lords of the North in the cold council chamber, they spent a sleepless night, yet none were willing to reveal their true intentions.

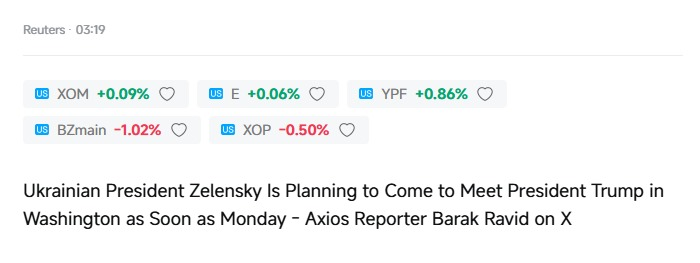

Meanwhile, new variables are brewing—Zelensky is preparing to travel to Washington for further negotiations. The situation has neither completely broken down nor seen any real easing. Thus, the market is forced into a delicate "no breakthrough + some expectation" state: neither collapsing nor at ease.

Capital flows have become unusually consistent: funds are withdrawing bets from high-volatility assets and redirecting them toward "safe-haven" assets like U.S. Treasuries and cryptocurrencies.

It means that the situation has not deteriorated to the point of being out of control, but it is also not good enough to reassure the market immediately.

Taken together, these two events constitute a situation that is "seemingly unsolvable, but with underlying tensions":

1. No breakthrough at the summit; short-term risk aversion persists

The talks between Trump and Putin in Alaska did not yield any substantive results, not even a "roadmap." In other words, the market's hoped-for "ceasefire glimmer" has faded, and short-term risk aversion remains. Gold and US Treasuries continue to serve as temporary safe havens for capital, while pressure on high-volatility assets persists.

2. Zelensky is about to visit the US; negotiations are not dead yet.

Although there was no breakthrough in Alaska, Zelensky is about to visit Washington, indicating that diplomatic efforts have not ceased. This signal is crucial: negotiations are continuing, but the rhythm has shifted from "bilateral bargaining" to "trilateral interaction." "complete pessimism," but will enter a "wait-and-see" mode.

3. Market Interpretation: Unclear Direction, Rebalancing of Positions

In the short term, these two pieces of news combined mean that significant funds will continue to maintain a defensive stance:

Risk assets under pressure: especially high-elasticity stocks that have seen significant gains earlier, which are prone to being used for cash-out;

Safe-haven assets favored: cryptocurrencies and U.S. Treasury bonds continue to be supported by buying interest.

Energy sector volatility: oil and gas prices are more sensitive to geopolitical developments, and short-term price fluctuations may intensify.

4. What does this mean for us?

It is the "market convergence effect"—when significant external variables remain uncertain, capital tends to reduce risk collectively. What we should do is not chase gains or cut losses, but rather:

Confirm the stability of defensive layers (mainstream assets like SOL);

Focus on assets with strong counter-trend performance (such as CXON, which has value-backed support);

Wait for signal confirmation rather than being driven by emotions.

In a nutshell:

The Alaska talks ended in a stalemate, and the Washington meeting is still ongoing. The market is currently experiencing no breakthroughs, yet high expectations surround it. For trading, this is not a sign of a real crash, but rather a period of position adjustment.

As a result, a significant amount of buying capital has made a consistent choice: first reduce exposure to high-volatility assets and shift to "cold positions" such as cryptocurrencies and U.S. Treasury bonds. The outcome is that while the three major indices appear to have declined only slightly, individual stocks have seen significant declines.

For us, this is not an apocalyptic signal but more like a stress test during a defensive phase.

Looking back at this week's market performance, the most reassuring aspect is that we were not swept up in the market-wide decline but had already completed our position transformation in advance. While others were still debating whether to cut positions or hold on, we had already allocated our core resources to the Core X 40/60 portfolio, with 60% of our positions in cryptocurrencies.

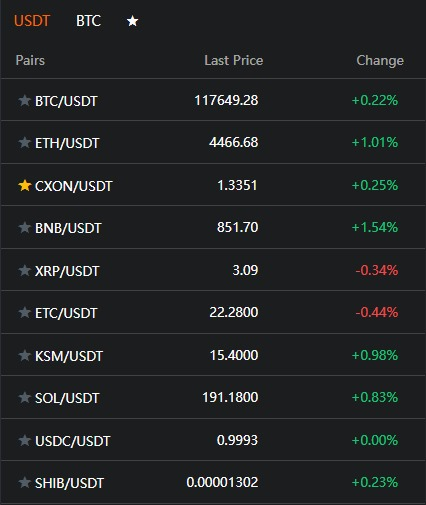

Let's look at the results—the market is validating our judgment. BTC and ETH have already led the rebound, followed closely by SOL, while CXON continues to hit new highs. These signals tell us that crypto is not an emotional refuge, but a real gathering point for capital.

Please note that this does not mean we are abandoning stocks and moving into a completely unfamiliar new field. The stock market correction is a fact, and we have chosen to reduce our positions to minimize risk exposure significantly. The crypto market is not "niche"—it has gradually become the core stage where global capital competes. Trump has explicitly stated his intention to turn the US into the "world's crypto hub." It means that future regulation, taxation, and policy support will be heavily tilted toward the US, with global capital flowing into the US crypto ecosystem in waves.

Our decision to increase our positions in cryptocurrency assets is not driven by blind emotional following, but instead marks the starting point of a steeper profit curve.

In July 2010, the price of Bitcoin was first publicly disclosed, at approximately $0.0008. Today, its price has surpassed $110,000, representing a staggering increase of over 140 million times. BTC has provided the most straightforward proof: its price appreciation, global liquidity, and long-term certainty make any traditional stock pale in comparison. The resilience of SOL and CXON's counter-trend new highs further validates the Core X 40/60 allocation logic:

The outer layer consists of "high-liquidity assets" like BTC, ETH, and SOL to absorb shocks and rebound first;

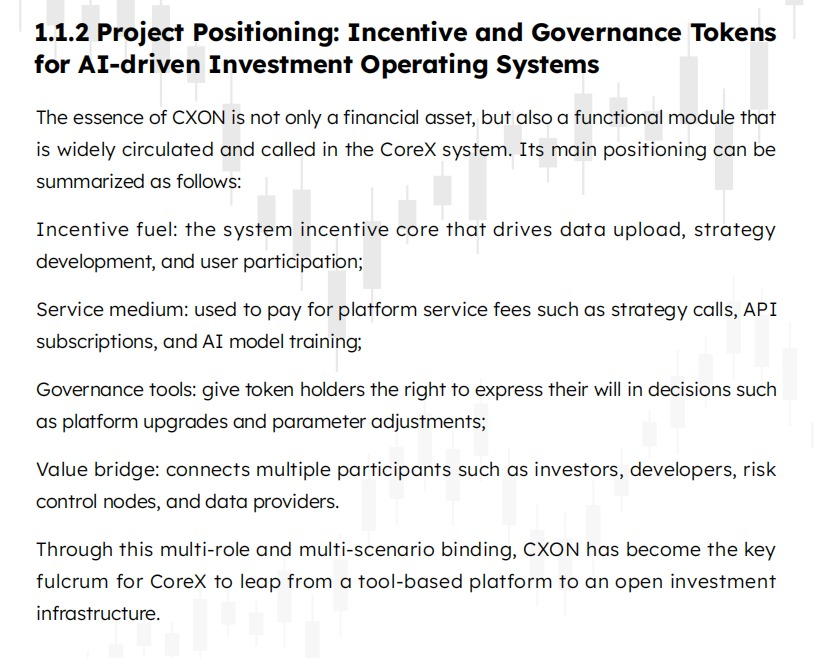

The inner layer features structural support assets like CXON, which, driven by the system's actual consumption and deflationary mechanisms, can carve out an independent trajectory.

In other words, our portfolio is not just "defensive"—it's "building momentum." Stock market volatility forces most people to adopt a passive approach, but we've adjusted our positions to establish a genuine offensive foothold for the future. As the market gradually recognizes that crypto is the next global capital flow trend, we've already secured our position in advance.

SOL, which accounts for 40% of the total portfolio, plays the role of a "vanguard." It is closely linked to BTC and ETH, but often leads the market rally during rebounds, acting as an accelerator for capital inflows. Like a mobile force, it can absorb shocks and swiftly move forward when the timing is right.

CXON, which accounts for 20% of the total portfolio, serves as the "deep defense." Its logic is never based on emotional trading but instead on value and capital flow support: real on-chain application scenarios, steadily growing transaction demand, and the long-term moat provided by deflationary design.

You will find that this is precisely the unique feature of the Core X system in asset layering:

The outer layer uses SOL to absorb market sentiment fluctuations.

The inner layer uses CXON to stabilize value and structure.

The Core X 40/60 dual-layer defense system proves its worth here: 40% of the total portfolio allocated to SOL stabilizes the outer defense layer, while the 20% allocated to CXON can still perform strongly against the trend in such an environment, demonstrating that the system's layered logic is robust and reliable.

The question is posed to everyone: In this "no breakthrough + high expectations" state, which area do you think will see the flywheel effect take hold faster?

In the face of the current significant uncertainty, position management is not an optional skill, but a necessity for survival.

The stocks we hold can easily lose profits to the market if we do not strictly control our positions, and we may even be forced to swallow even greater losses due to unnecessary risk exposure.

Take August 15 (Friday) as an example: due to a sudden geopolitical event, the investment market plummeted across the board, with most stocks experiencing significant declines.

Without proper position management in place beforehand, that day could have been a devastating blow, resulting in heavy losses; however, if positions had been allocated adequately in advance, risks could have been significantly reduced.

40% is allocated to mainstream cryptocurrencies like SOL to maintain the overall direction.

20% is allocated to CXON as a counter-trend offensive force;

The remaining 40% is diversified across government bonds, ETFs, cryptocurrency proxy stocks, and high-elasticity stocks, balancing offensive opportunities with defensive safeguards.

As a result, even during market downturns with severe volatility, our losses were kept to a minimum, allowing us to remain firmly positioned in the market.

During the recent market turbulence, did you strictly adhere to position management? Or did you passively surrender profits that should have been yours amid the fluctuations?

If you haven't been strictly adhering to position management recently, don't panic.

It is precisely a good opportunity to address any shortcomings.

You can obtain the "Optimizing Position Management" form from your investment advisor and fill in your actual situation:

Please submit this information, and the investment education advisor will forward it to me or Black Shaw Mentor. The two mentors will tailor a detailed position management plan for you.

This plan is not just about telling you "what to buy and what to sell," but more importantly, helping you build a dynamic position framework that can withstand volatility and seize opportunities.

It is essential to understand that stock market volatility will only become more frequent in the future:

Geopolitical events can trigger black swan events at any moment.

Macroeconomic policies can shift abruptly, instantly altering market trends.

Therefore, establishing a scientific position management strategy now is akin to having an extra layer of protection when future storms arrive.

While others panic-sell or chase trends, you can maintain your positions, wait for system signals, and even launch precise counterattacks at critical moments.

"Come to me, all you who are weary and burdened, and I will give you rest." The burdens of the market can sometimes feel suffocating, but proper rest is not the absence of volatility, but the ability to find a stable anchor amidst it.

As the course is about to conclude, I would like to ask everyone two questions:

1. In this state of "no breakthrough + high expectations," which sector do you think will see the flywheel effect take hold more quickly?

2. During the recent market volatility, did you strictly adhere to position management, or did you passively give up profits that should have been yours amid the fluctuations?

Remember to send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

Everyone, take this calmness with you. Today's discussion is like a pre-battle prayer—we've rehearsed, set up our defenses, and now all we need to do is hold our ground.

Close the screen and let the weekend's restful time take over your life; when the trumpet sounds next week, we'll fight side by side once again.