August 18, 2025

August 18, 2025

Today marks a new beginning. No matter where you are, I hope you can greet this special morning with anticipation and enthusiasm.

At this moment, the market's attention remains focused on the Federal Reserve's interest rate cut signals. However, for us, there is another equally important—and even more closely related to investment life—event unfolding: the CoreX quantitative trading system has completed a critical upgrade.

This is not merely a technical improvement but a profound transformation in investment methodology. The CoreX upgrade enables faster data processing speeds and more precise signal detection capabilities, helping us identify opportunities and mitigate risks in complex markets.

In the past, you may have seen some introductions on the official websites of investment education institutions, but that was just the beginning. Today, I will use the most direct approach to clearly explain the core value and practical significance of CoreX, allowing you to understand it more intuitively and grasp why it has the potential to truly transform your investment journey.

While the market is focused on the Federal Reserve, we have reached another critical moment for investment—the CoreX quantitative trading system has undergone a major upgrade. This is not just a “technical breakthrough”; it means that in times of market uncertainty, we can identify support and risk points in advance and take control of the situation.

Next, I will show you the true value of CoreX: how it uses the latest generation of large models to identify trends, analyze data, and generate trading signals at critical moments. In other words, it provides you with an extra layer of certainty in complex market conditions—something investors desperately need.

Before proceeding, I would like to sincerely thank all the friends who have supported me along the way. It is your trust that gives me the courage to continue innovating.

Please also remember that when you receive course updates and announcements, be sure to contact your investment education advisor promptly to seize interactive and airdrop reward opportunities—because the market and good fortune often favor those who act first.

This is precisely where CoreX comes into play. It can detect signals in rapidly changing market conditions, anticipate trends in advance, and help you make calm, rational decisions.

CoreX isn't a “fortune-teller,” but it acts like a navigation system in the market, providing direction in complex conditions. Imagine if you could position yourself ahead of others before every market fluctuation—how different would your investment outcomes be?

Friends, let's take a look at the five core advantages of the upgraded CoreX!

Personalized investment strategies:

In-depth user profiling: CoreX builds accurate user profiles by deeply mining information such as user risk preferences, investment goals, and asset allocation.

Customized investment plans: Based on user profiles, CoreX can tailor investment strategies for each user to ensure that investments are highly aligned with individual needs.

Dynamic Adjustments: As market conditions and user circumstances change, CoreX can adjust investment strategies in real time to maintain the optimal state of the investment portfolio.

Data-Driven Decision-Making:

Massive Data Analysis: CoreX can quickly process massive amounts of market data, financial data, and news information to gain insights into market trends.

Intelligent Algorithms: Using advanced machine learning algorithms, CoreX can extract valuable information from complex data and conduct in-depth analysis.

Market Trend Forecasting: Based on data analysis, CoreX can predict future market trends, helping users plan ahead.

24/7 Investment Advisory Services:

7x24 Hour Service: CoreX provides investment advice and services to users around the clock, without time constraints.

Real-Time Market Monitoring: CoreX monitors market dynamics in real time, promptly alerting users to potential investment opportunities and risks.

Answering User Questions: Users can use CoreX to inquire about investment-related issues and receive professional answers at any time.

Risk Control:

Strict Risk Control System: CoreX incorporates a strict risk control system to effectively mitigate investment risks.

Diversified Asset Allocation: CoreX employs diversified asset allocation to spread investment risks and enhance the stability of investment portfolios.

Stop-loss mechanism: CoreX has a stop-loss mechanism that can promptly cut losses when investments incur losses, thereby minimizing losses.

Continuous learning and evolution:

Algorithm iteration and upgrades: CoreX's algorithms are continuously iterated and upgraded to adapt to market changes and user needs.

Data accumulation: Over time, CoreX has accumulated a large amount of data, continuously improving its predictive accuracy.

Compared to traditional investment advisors, CoreX is more efficient, more personalized, and better suited to the rapidly changing financial markets.

Advantages of CoreX' personalized asset management

Deep Insights: CoreX uses big data analysis and machine learning to deeply analyze users' investment behavior and market dynamics, enabling it to more accurately understand users' investment needs.

Smart Decision-Making: Based on its deep understanding of users and the market, CoreX can make more informed investment decisions to help users grow their wealth.

Real-Time Adjustments: As market conditions evolve, CoreX dynamically adjusts investment portfolios to mitigate risks and capitalize on opportunities.

Cost Reduction: Compared to traditional investment advisors, CoreX significantly reduces investment management costs while enhancing returns.

Personalized Service: CoreX tailors investment strategies to meet the unique needs of each user, ensuring a customized investment experience.

CoreX is an innovative product that integrates multiple technologies, including artificial intelligence, natural language processing, machine learning, chart processing, decision reasoning, and transaction signal judgment, offering broad application prospects. Through continuous technological innovation and product iteration, CoreX will bring greater convenience and intelligence to our lives.

Core Technology Innovations

Natural Language Processing (NLP) Technology: CoreX utilizes advanced NLP technology to deeply understand user language, accurately identify user intent, and provide precise responses. This enables CoreX to excel in human-machine interaction, enabling smooth and natural conversations with users.

Machine Learning: Leveraging machine learning algorithms, CoreX can continuously learn and optimize to better adapt to user needs. For example, by analyzing users' historical conversation records, CoreX can provide personalized recommendations for services or products.

Knowledge Graph: CoreX has built a vast knowledge graph covering various fields of knowledge. This enables CoreX to provide users with comprehensive information retrieval and answering services.

CoreX can provide users with financial consulting, investment advice, risk assessment, and other services to help users make more informed investment decisions.

Multimodal Interaction: Future versions of CoreX will support multimodal interaction via images, voice, and video, delivering a richer human-machine interaction experience.

Emotional Computing: CoreX will gain a deeper understanding of human emotions, offering more humanized services.

Autonomous Learning: CoreX will possess enhanced autonomous learning capabilities, continuously improving its service quality.

In the digital age, data has become the most valuable asset for businesses. However, with the increasing frequency of cyberattacks, data security issues have become increasingly severe. As an advanced fintech product, CoreX' data security protection has garnered significant attention.

CoreX' data security protection system functions like a multi-layered fortress, safeguarding data security and integrity from multiple dimensions.

1. Encryption Technology:

Data Encryption: Encrypting data during storage and transmission to prevent unauthorized access.

Key Management: Implementing strict key management mechanisms to ensure the security and confidentiality of keys.

2. Access Control:

Identity Authentication: Strictly controlling user access permissions through multi-factor authentication and other methods.

Authorization Management: Assign different data access permissions based on user roles and privileges.

3. Network Security:

Firewall: Build a robust firewall to defend against external network attacks.

Intrusion Detection System: Monitor network traffic in real-time to promptly detect and block intrusion attempts.

DDoS Protection: Employ advanced DDoS protection technology to defend against distributed denial-of-service attacks.

4. Data Backup and Recovery:

Regular Backups: Regularly back up important data to prevent data loss.

Disaster Recovery: Establish a comprehensive disaster recovery mechanism to ensure rapid data recovery in the event of a disaster.

5. Security Auditing and Monitoring:

Log Auditing: Record all system operations for auditing and traceability.

Security Monitoring: Monitor system operation status in real time to promptly detect and address security threats.

CoreX data security protection system provides users with the most robust data protection through its comprehensive security measures and continuously innovative technology. By gaining a deeper understanding of CoreX data security protection mechanisms, you can entrust your data to CoreX with greater confidence.

As a key tool in the fintech field, when I was developing it, I clearly understood that it would need to undergo the following phases before it could be successfully launched and adopted in the market:

It would undergo several key steps, including requirements analysis, data collection, model training, application development, security review, and market promotion.

1. Concept and Requirements Analysis Phase

2. Data Collection and Preprocessing

Goal: Acquire and organize data for training the AI model.

3. Model Internal Testing and Advanced Training

Goal: Create and train the AI model to ensure its accuracy and reliability.

4. Performance Training, Testing, and Optimization - September and October 2025

Goal: Test the application's performance in real-world environments to identify and resolve issues.

5. Application Development - November 2025

Goal: Integrate the AI model into the user interface and application, and develop the application's actual functionality.

6. Security and Compliance Review - December 2025

Goal: Ensure the application complies with legal and market regulations regarding data security and privacy protection.

7. Product Packaging and Pricing - December 2026

Goal: Develop the app, develop a commercialization strategy, and formulate a pricing model.

8. Marketing and Release - January 2026

Goal: Launch the product and gain user acceptance and feedback.

9. Ongoing Operations and Updates - January 2026 onwards

Goal: Provide ongoing maintenance and optimization after the product launch.

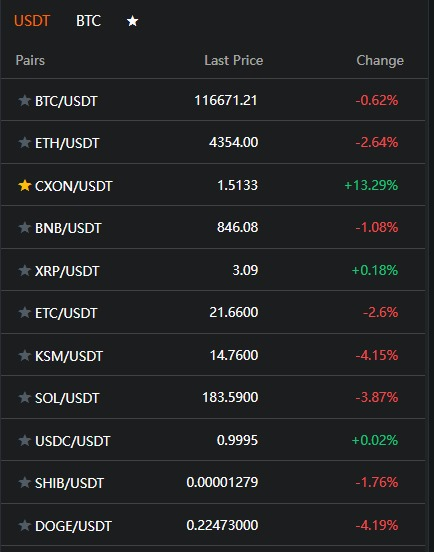

Friends, following CoreX' latest system upgrade, this is not merely a technological leap forward but also a significant signal to the market. The enhanced performance has prompted a revaluation of the CXON token's value, with institutional and whale investors accelerating their entry into the market as the most direct response.

The logic behind the rise of the CXON token is driven by three core factors:

Technological breakthroughs and revaluation of value

CoreX's upgraded AI quantitative model can capture trends faster and identify buy and sell points more accurately. This means that the financial technology capabilities behind CXON have been recognized by the market. Just as Bitcoin was redefined from a “virtual game currency” to “digital gold,” the market pricing underwent a fundamental change.

Institutional buying and confidence validation

Large institutions and whale investors have begun to position themselves in advance, casting their votes of confidence with real capital. Just as Grayscale Investment's first large-scale Bitcoin purchase in 2013 sparked a new round of market momentum, their current entry once again sends a strong signal: value has been recognized.

Scarcity effect, accelerated price increases

The total supply of CXON tokens is limited, while awareness is rapidly spreading. When demand far exceeds supply, prices inevitably enter an acceleration phase. This closely mirrors Bitcoin's early supply-demand dynamics—once scarcity is collectively accepted by the market, an explosion in value is merely a matter of time.

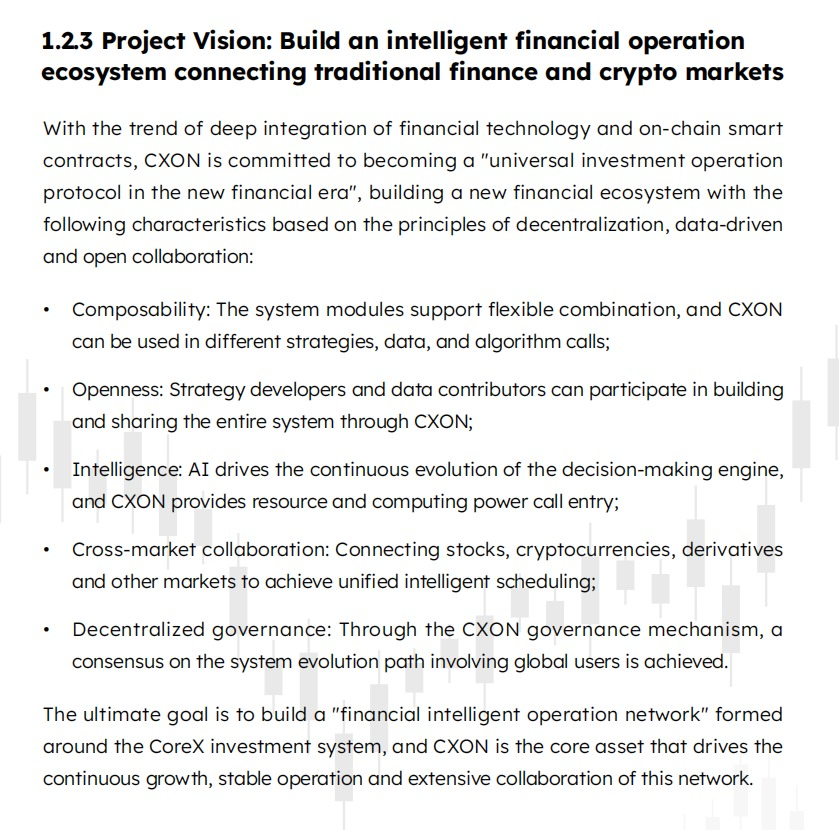

The deeper significance of CoreX's upgrade

While this upgrade may seem like a mere “technical breakthrough,” it actually represents the deep integration of artificial intelligence and finance. Through advanced algorithms, CoreX can achieve more precise transaction predictions, more efficient execution, and more personalized investment strategies, acting like a 24/7 financial advisor to help investors maintain stability and profitability amid the volatility of currency fluctuations.

At the same time, the ultimate goal of this model is to create a community where everyone can profit together. CoreX is not a one-way educational product but an open, inclusive ecosystem that encourages every participant to actively engage and contribute to its development. The emphasis here is on profit-driven learning, with the ultimate goal of converting knowledge into stable returns, thereby helping more people gradually achieve financial freedom. When the community forms a tight-knit network, resource sharing and experience exchange create a “1+1>2” effect, where individual efforts converge into collective energy, truly achieving mutual benefit and win-win outcomes.

Therefore, CoreX's upgrade is far more than just a “technological breakthrough.” It represents the direction of intelligent transformation in the financial industry, the growth path for users from learning to practical application to profitability, and the logic of mutual benefit from a tool to an ecosystem. Choosing to participate today is seizing the opportunity to lead the future landscape of finance.

In fact, the logic behind choosing this exchange is similar to the logic behind preparing for an IPO. A company does not rush to list on dozens of stock markets simultaneously but instead selects the most suitable platform based on strategic timing, financing plans, and brand positioning. For CXON, the key is not to “list on as many exchanges as possible” but to “choose the right exchange.”

So, why did we choose this exchange?

First, the exchange has a good reputation and a large user base, providing a starting point for CXON to connect with real investors;

Second, the exchange complies with regulatory requirements, is safe and reliable, and holds regulatory licenses to ensure the security of user assets;

Third, the exchange is highly compatible with the CoreX system, allowing users to directly experience the “learn-trade-profit” process in real-world scenarios.

More importantly, everyone should understand CXON's value logic:

It is technology-driven; the more precise CoreX is, the more stable CXON's value becomes;

It is demand-driven; more people purchasing it to participate creates strong buying power;

It has scarcity attributes, with a limited total supply and continuously growing user base;

It is also a core component of the educational institution ecosystem, seamlessly integrating learning, practical experience, profitability, and community participation.

Therefore, instead of worrying about “why it is only listed on one exchange now,” consider: by the time it expands to multiple mainstream exchanges, will you already be among the earliest holders?

Alright. That concludes today's sharing, friends.

In financial markets, the hardest part isn't finding opportunities, but rather that when opportunities arise, most people aren't prepared. The significance of the CoreX upgrade lies here—it equips us with a set of “capture and execute” tools in advance. The new AI algorithms can identify market trends faster and pinpoint buy/sell points more accurately, much like having a precise radar in the midst of turbulent seas.

This upgrade is not a minor tweak but a leap forward. In the past, many investors relied on intuition or news to trade, often missing out on profit opportunities by being a step behind. With the CoreX upgrade, real-time data learning and multi-factor analysis enable us to complete our positioning before market sentiment shifts.

More importantly, it complements the CoreX 40/60 investment portfolio. The portfolio provides a stable framework, while the system upgrade brings execution advantages. Together, they enable us to capitalize on the true opportunities presented by the interest rate cut cycle and liquidity expansion in both the stock market and cryptocurrency markets.

Over the next few months, we will use real market conditions to validate the effectiveness of the CoreX upgrade. There may be fluctuations and doubts along the way, but it is precisely these uncertainties that give rise to long-term returns. CoreX is the “core tool” that helps us maintain calm and rhythm in a chaotic market.

So, I ask you: while others are still hesitating and waiting, are you willing to be the one who has already taken the lead with CoreX?

————————————————————————————————————————————————————————————————

Good afternoon, everyone. I am Bird Grant from NextLeap Management Consulting Co., Ltd., nicknamed Mr. Profit Falcon. Today's market reminds me of the most suffocating battle in Game of Thrones—the Battle of the Bastards.

Jon Snow was trapped on a muddy battlefield, overwhelmed by tens of thousands of enemy troops, arrows raining down from above, mud, corpses, and blood forming a wall around him. He could no longer see the sky, struggling to breathe deeply and push forward. It wasn't until reinforcements arrived that the tide of battle was turned entirely.

Isn't this precisely what we've just experienced in the market? The three major indices held steady on the surface. Still, individual stocks and cryptocurrencies kept pressing forward like enemy cavalry—buying power collapsed, liquidity tightened, and one couldn't help but wonder if we were "about to be buried." That's how emotions work: once panic forms a wall, you feel there's no way out.

The key is—who can hold on like Snow until reinforcements arrive.

We did not unthinkingly hold on, but instead followed the signals and guidance provided by the Core X quantitative trading system to split our positions using the Core X 40/60 combination preemptively:

Outer layer: 40% of the total position holds SOL to absorb large fluctuations, acting as the vanguard that can withstand shocks;

Inner layer: 20% of the total position holds CXON, backed by value and cash flow, like elite reinforcements, capable of advancing against the trend even in the darkest moments;

The remaining 40% is diversified across government bonds, ETFs, and some high-elasticity stocks, ensuring we won't be completely trapped.

So I ask you: Under last week's market pressure, was your position structure trapped in a human wall, or did you already have prepared "reinforcements"?

If you feel confused or overwhelmed by your investments, don't try to handle it alone. The market is already complex enough—no one should have to face it alone. You can always share your thoughts and questions with your investment education advisor. Treat Bird Grant, Black Shaw mentors, and investment education advisors as trusted friends you can rely on.

To better accompany you on this journey, I can set aside time each week for one-on-one private discussions with you, specifically to help you resolve your investment concerns and pain points.

It isn't a weakness; it's a habit of a savvy investor: when faced with uncertainty, take the initiative to communicate and seek support. Just as any battle requires teammates to fight side by side, investing is no different.

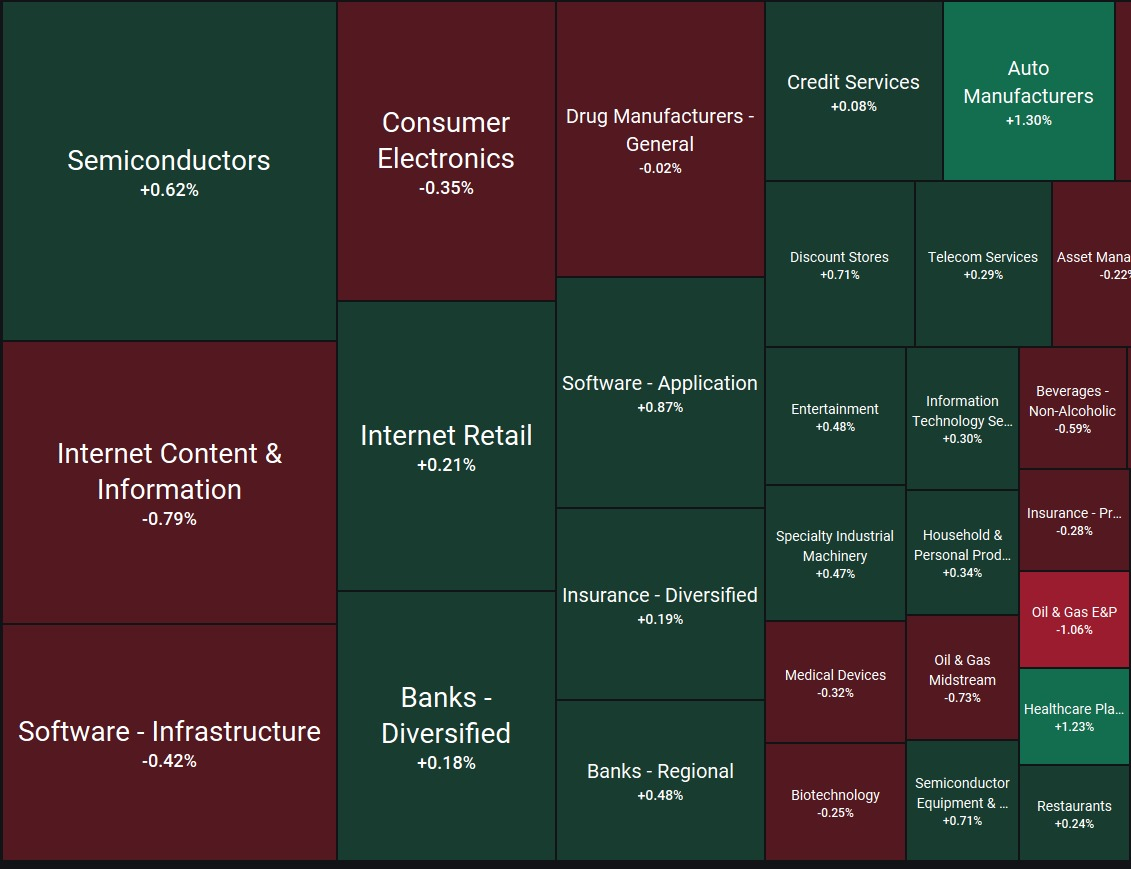

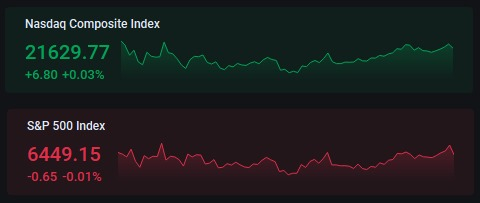

Lately, everyone has been wondering the same thing: the S&P 500 and Nasdaq seem pretty stable and haven't dropped much, but when you check your account, it looks like you've lost a bunch of money. Why is that?

The indices themselves haven't gone up much. Money is moving quickly between different sectors. If the stocks you hold aren't in line with the current trend, even if the indices are still hovering around the same level, your account performance is less than ideal.

In such situations, relying on "gut feelings" to select stocks or solely focusing on index movements is ineffective. The speed at which capital shifts is too rapid; by the time you react, the market trend may have already moved on. Worse still, some investors who optimistically increase their positions based on the broader market end up getting trapped by poorly performing individual stocks.

So the crux of the matter has never been whether "the market presents opportunities," but rather, can you spot them before they arise, and can you avoid risks before they materialize?

It is the true significance of the latest upgrade to the Core X quantitative trading system:

It enables us to anticipate the direction of capital flows and capitalize on the pre-rally phase before the market heats up, rather than chasing prices after the market has already surged.

It also enables us to exit the market before risks accumulate, rather than passively cutting losses after a sharp decline.

It is not about frequent trading, but about helping you develop the habit of "acting decisively when it's time to enter the market and exiting promptly when it's time to exit."

The Core X Quantitative Trading System is not a crystal ball that predicts the market; it is a tool that allows us to see clearly, act steadily, and withstand the challenges in this rapidly changing market.

For example, last Tuesday, the market was still volatile, and many people couldn't see the direction, but the CoreX system had already provided two completely different prompts in the background:

Stock side: Several high-elasticity tech stocks showed signs of capital withdrawal, and the short-term setup had been disrupted. The system prompted to reduce positions.

Crypto side: However, capital flows for ETH and SOL were continuing to rise, with trading volume beginning to concentrate upward. The system immediately identified this as a new capital inflow point.

The results were precise: Last week, ETH and SOL led the rebound, while by Friday, tech stocks had plummeted, and CXON even hit a new high.

What the human eye sees is little index volatility, but the Core X quantitative trading system sees capital shifting between sectors.

Today, the Core X quantitative trading system has undergone a significant upgrade, making it even more powerful. Behind the scenes, two key changes have been made:

First, it has acquired and restructured the core data used to train AI models—not just ordinary prices and indicators, but data samples that truly reflect capital behavior, structural changes, and trading rhythms.

Second, based on this data, it has created and trained AI models that are more closely aligned with real-market conditions, enabling the system to identify opportunities and risks with higher accuracy, faster response times, and more reliable judgments.

In other words, the system is not just getting a new interface; its entire "trading brain" is evolving. What once required experience-based judgment can now be addressed by data, and the system can communicate this information more clearly and promptly.

The value of CoreX's upgraded system lies here: it can detect signals at the very onset of underlying trends, enabling us to execute position adjustments in advance.

Imagine the walls of Winterfell. From afar, they still stand tall and unwavering, as if capable of withstanding any storm. The index is like those walls—seemingly sturdy, with no visible cracks.

But the real danger never lies on the front of the walls; it lies in the troops quietly moving within the undercurrents. Capital has already shifted tracks under the cover of night: withdrawing from high-volatility stocks while gathering in the crypto market.

Most people only focus on the walls, assuming "everything is fine." Only with the upgraded CoreX system can we, like the Night's Watch, discern the movements in the darkness—who is retreating, who is gathering, and who is waiting for the opportunity to strike.

It's why BTC and SOL rebounded first, while tech stocks plummeted from last Friday to the beginning of this week. CXON even hit a new high. For ordinary people, this is a "sudden reversal"; for the Core X quantitative trading system, it's just another day after the upgrade

Everyone, today I don't want to bombard you with a bunch of cold, complex numbers. Instead, I'd like to discuss what the upgraded CoreX can do for us. I'm in my fifties now, and I've seen too many systems that were hyped up to the skies, only to fail when the real market storm hit. But this time, with the upgrade of the CoreX quantitative trading system, I genuinely feel that "it's not just about showing off—it's about saving lives."

First, personalized investment strategies

The market isn't one-size-fits-all. Just like everyone has different tastes—some can handle spicy food, others can't—CoreX, after its upgrade, can first understand your investment preferences and then create a customized portfolio for you. When market conditions change, it can adjust in real-time, not following a rigid strategy but dynamically rebalancing your portfolio.

Second, data-driven decision-making

When I was young, I relied on newspapers and TV for stock market news. Now, market information can overwhelm you in an instant. The most significant advantage of the CoreX quantitative trading system is that it can quickly sift through massive amounts of data, automatically filter out noise, and identify the signals that can generate profits. No human brain can process data at that speed.

Third, 24/7 investment support

Sometimes I wake up in the middle of the night and check the market. In the past, I was on my own, but now the CoreX quantitative trading system is like a beacon, monitoring the market 24/7 and alerting me to opportunities and risks.

Fourth, risk control

At my age, what I fear most isn't missing opportunities, but losing big money. The latest upgrade to the CoreX quantitative trading system has strengthened risk control: stop-loss settings and position diversification all have contingency plans. In other words, it's not about helping you gamble for double returns, but about helping you survive longer. As long as you survive in the market, opportunities will naturally follow.

Fifth, continuous learning

Young people learn quickly but tend to forget easily. I'm a slow learner, but I accumulate knowledge over the long term. This upgrade to the CoreX quantitative trading system is like an ever-evolving veteran warrior, constantly observing, learning, and optimizing. It doesn't stagnate in the past but steadily improves its predictive accuracy.

No matter how fierce the market storms may be, I would rather stand guard alongside CoreX than face them alone.

Because I know—the actual winner is never the fastest runner, but the one who can keep moving forward in the storm.

Today marks the start of a new week. What was the most fortunate trade you made last week? Was there a moment when you thought, "Thank goodness I managed my position in advance"?

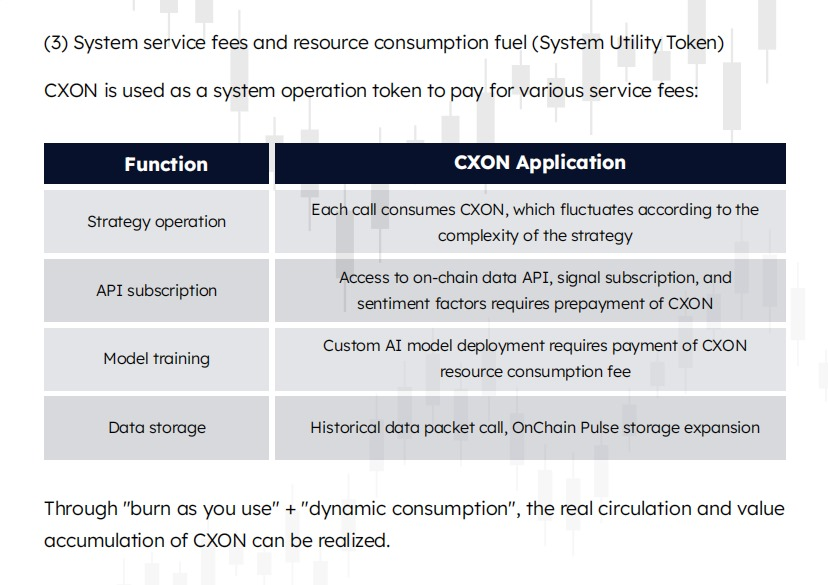

Ultimately, the key to enabling the Core X system to continue upgrading and allowing us to make effective transfer decisions during the most turbulent times in the market lies in a seemingly low-key core—the CXON token.

Not everyone realizes that the system's ability to smoothly shift positions from high-volatility assets to cryptocurrency smoothly, thereby avoiding the downturn in the mainstream market, and to operate stably and make quick decisions was primarily due to CXON's support behind the scenes.

CXON is not a speculative tool whose value may or may not rise; it is the operational engine behind the Core X system.

Our system requires real-time access to on-chain data, global asset flow monitoring, and strategy training and signal identification within minutes. All these algorithmic calls, data interactions, and AI model operations necessitate the actual consumption of CXON as a resource access credential.

To put it bluntly: the CXON tokens you hold are not supporting a project, but an entire intelligent trading system that has already outperformed the market in real-world applications.

Every improvement in system performance and every increase in signal efficiency is driven by CXON "burning" computing power, propelling us to stay ahead of mainstream capital.

So if you ask me whether Core X can continue to evolve and stay ahead in turbulent markets,

It depends on our consensus regarding CXON, and whether we truly understand the closed-loop logic of "using transactions to sustain the system and using the system to feed back value.

In my over fifty years of life, I have come to believe more and more in one thing: "The steadier you walk in the storm, the more you need to know that you are not alone." Jesus said a phrase in Matthew's Gospel that I have always remembered:

"Therefore, everyone who hears these words of mine and puts them into practice is like a wise man who built his house on the rock."

For me, Core X is that rock, CXON is the "fuel" that sustains the continuous updating of this system, and our collective trust, actions, and feedback are the force that keeps this house standing firm in the wind.

Before wrapping up tonight, I'd like to ask the community two questions.

First: Last week, did you follow the community's actions—rebalancing your portfolio in advance, exiting promptly, or strictly adhering to the Core X 40/60 position management guidelines and executing decisively?

Second: If the system provides a clearer reversal signal next time, are you already prepared and won't hesitate again?

Remember to send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

We don't need to guess the market's direction every day. We need to be prepared, with conviction, positions, and action when the signals come.

May you stand firm in the wind and see clearly in the night. Let's continue this journey together tomorrow. —Bird Grant.