August 19, 2025

August 19, 2025

I am very happy to see everyone's letters and interactions. Investing is a journey that requires daily accumulation and persistence, while maintaining a positive, optimistic, and healthy mindset, which is especially important.

Meanwhile, the three major stock indices showed slight divergence before the market opened: U.S. stocks remained stable, with the Dow Jones Industrial Average down approximately 0.08% and the Nasdaq Composite Index up 0.03%, both remaining close to their historical highs. Recession concerns are intensifying: uncertainty surrounding Federal Reserve policy, coupled with rising stagflation risks, has exacerbated market panic.

So the questions arise:

Is today the right time to exit, or a new opportunity to enter?

How should we objectively interpret this data?

Does the current investment portfolio need to be adjusted promptly?

In the upcoming discussion, I will analyze these key issues one by one, combining market logic and strategy.

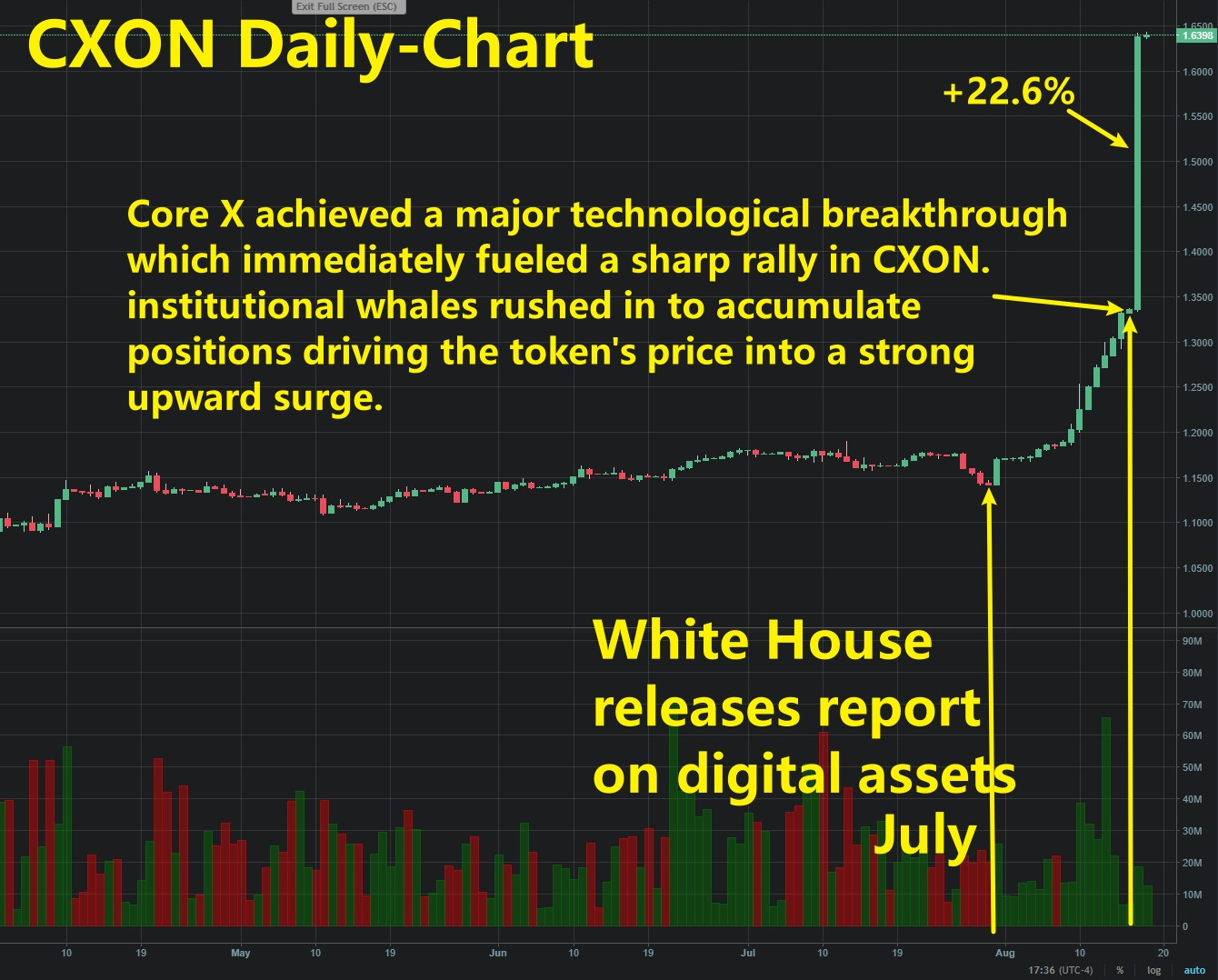

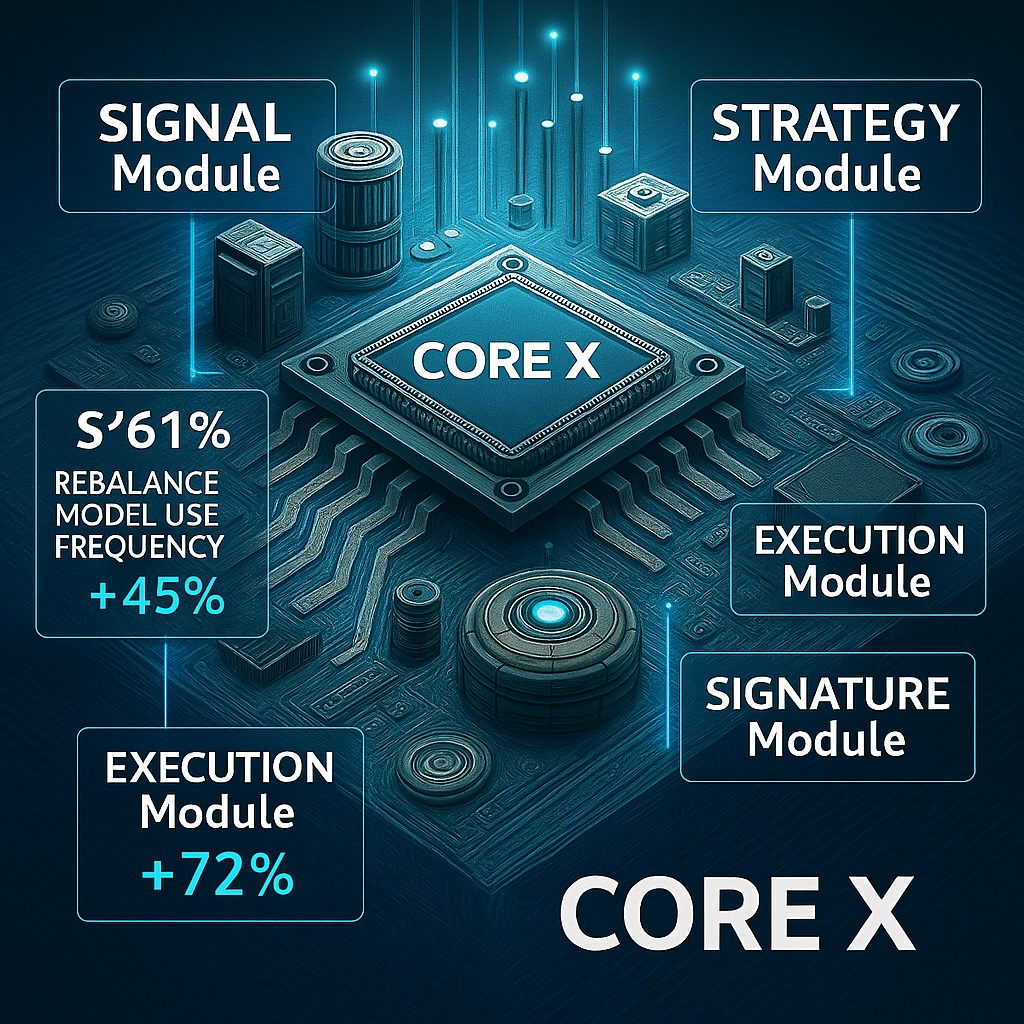

Additionally, I would like to share an important event that occurred yesterday: the CoreX system has completed its latest upgrade. This breakthrough not only enhances the accuracy of our model in trend detection and buy/sell point identification but also directly drives the revaluation and appreciation of the CXON token.

The entry of institutions and whales is validating our logic:

Technological breakthrough → enhanced market recognition;

Capital inflows → Accelerated diffusion of confidence;

Scarcity attributes → Enhanced price appreciation momentum.

This also reminds us that investment opportunities often stem from two sources: macro-level data changes and micro-level technological and model upgrades. Yesterday's performance of CXON is the best illustration of this logic.

First, let's take a look at some important information displayed by the CoreX quantitative trading system.

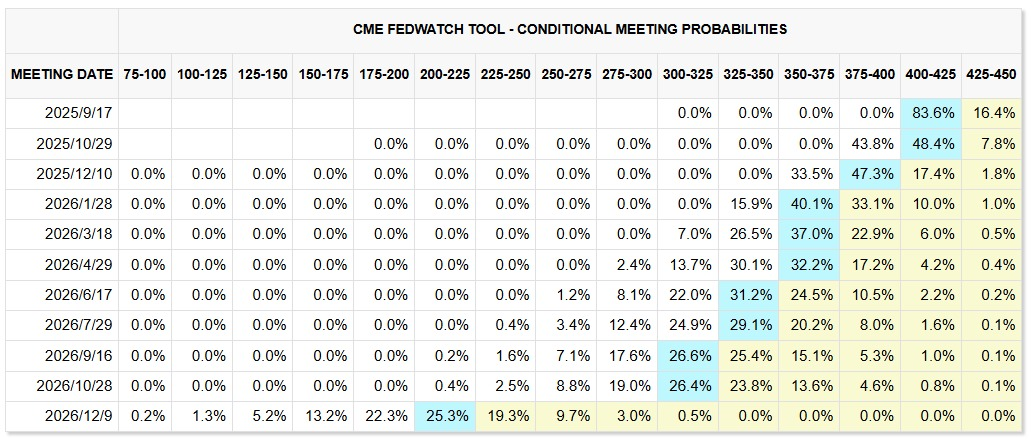

1. Many investors are waiting for the Federal Reserve to cut interest rates in September. Why?

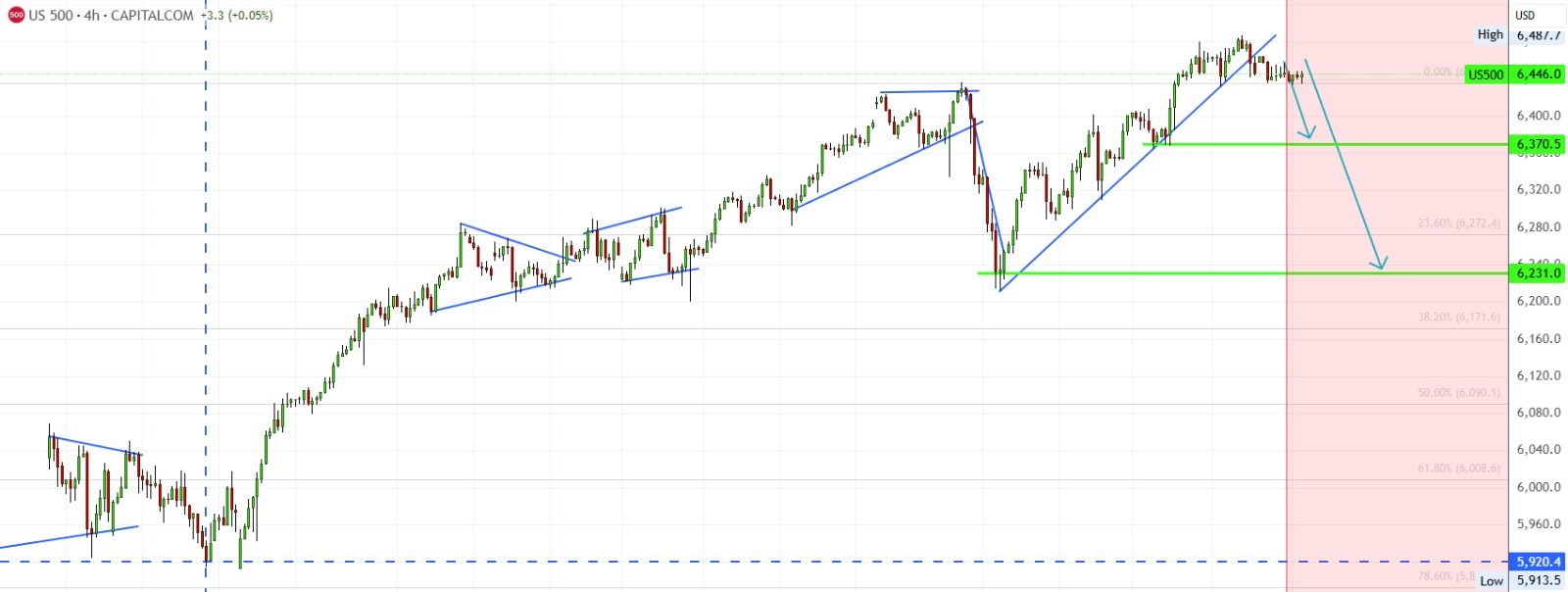

Because the S&P 500 is now above 6,400 points, with a year-to-date gain of nearly 10%. This is supported by the performance of tech giants, but what truly encourages the market to buy at these high levels is the belief that the Federal Reserve will lower interest rates at its September meeting. If this expectation is not met, the market may lose its support.

2. The Fed's key inflation indicator—core PCE—remained at 2.6% year-over-year in June, far above its 2% target. In other words, inflation has not been truly contained. Additionally, tariffs have increased corporate costs, which are likely to be passed on to consumers, leading to further price increases. If the Fed were to cut rates prematurely now, it could make inflation even harder to control.

3. Consider the signals from the bond market. The yield on two-year U.S. Treasury bonds has fallen from its April peak of 4.06% to 3.73%. This suggests that the market is betting on multiple rate cuts. However, the issue is that this expectation may be overly optimistic. If data over the coming months does not support this outlook, U.S. Treasury yields could rebound to 4% or higher, potentially triggering a significant correction in the stock market.

Friends, the Federal Reserve's interest rate decisions are one of the most closely watched events by global investors. They directly determine the direction of the US dollar, the flow of capital, and the rhythm of the stock market. In other words, interest rate cuts serve as a barometer for the current market, affecting not only Wall Street but the entire global market.

If the Federal Reserve does choose to cut rates in September, what impact will it have on the market?

The logic is actually quite simple:

If the Federal Reserve's actions exceed expectations, with larger and faster rate cuts, the market will perceive lower funding costs and ample liquidity, which could drive the stock market to a short-term high. However, the risk lies in the possibility of optimism being overextended, potentially leading to a “sell-off” in the short term.

If the Fed's rate cut is smaller than expected or even delayed, the market may experience disappointment, triggering a rapid correction. However, for prepared investors, this could be an excellent opportunity to enter the market.

Friends, do you understand and agree with this logic?

On the other hand, tech stocks have delivered strong earnings reports, with the total amount of stock buybacks by listed companies this year nearing the trillion-dollar mark; simultaneously, ceasefire negotiations between Israel and Hamas have made significant progress, and international crude oil prices have declined, providing further support for market sentiment. In other words, these positive factors combined have created a favorable entry window for us.

Key Recommendation: $MSTR

This stock benefits from the current strong cryptocurrency bull market. The listing of Bitcoin spot ETFs will attract more institutional and investor funds; moreover, the bullish trend in the entire cryptocurrency sector is expected to intensify further.

As one of the listed companies holding the largest amount of Bitcoin spot assets, $MSTR is poised to be the biggest beneficiary of this round of the US stock market bull run and the cryptocurrency supercycle.

Strategy Recommendations

Position Allocation: 10% of total account assets

Short-Term Target Price: $730 (estimated increase of approximately +102%)

Mid-Term Target Price: $1,400 (estimated increase of approximately +288%)

Bull Market Target Price: $4,136 (estimated increase of approximately +1,047%)

Those who already hold the stock can adjust their positions to increase their exposure to $MSTR; those who have not yet entered the market can open positions at the current price.

After completing the purchase, please send a screenshot of your holdings to the investment education advisor for subsequent strategy tracking and signal alerts.

Today's inflation data remains high, and the increase in tariffs has further pushed up production costs for businesses. Logically, this should exacerbate inflationary pressures, leading the market to worry that the Federal Reserve may delay interest rate cuts or even tighten liquidity, thereby putting pressure on stock indices.

However, the market today showed the opposite trend—stock indices not only did not fall, but opened higher. Why?

Reason 1: Progress has been made in the Middle East ceasefire agreement, leading to a significant drop in oil prices.

The decline in crude oil prices has directly alleviated market concerns about inflation. Weaker oil prices mean lower costs in transportation, manufacturing, and other sectors, which can partially offset the cost pressures caused by tariffs. This gives the Federal Reserve more room to maneuver, leading the market to expect that future monetary policy will not be overly tightened, thereby supporting the stock market.

Looking at the 4-hour trend chart of UKOIL, prices have broken below key support levels and the lower band of the Bollinger Bands, with the middle band also turning downward—a classic signal of a strengthening bearish trend. Weaker oil prices are favorable for the stock index to stabilize and rebound.

Reason 2: Corporate buybacks and market sentiment support.

Although inflation indicators are high and tariffs are pushing up costs, the market has not chosen to decline. A key reason for this is that corporate buybacks are continuing. Last year, the amount of buybacks in the US stock market set a new record, and this trend is continuing this year. Buybacks reduce the number of shares in circulation, directly increasing earnings per share (EPS), which provides investors with a stable “safety cushion.”

Meanwhile, strong earnings reports from tech stocks have further bolstered market confidence. Investors believe that as long as corporate profitability remains robust, coupled with buybacks, the stock market has reason to continue performing at elevated levels. In other words, market sentiment is not fixated on the negative factors of “inflation + tariffs,” but rather places greater emphasis on the resilience and liquidity support of corporations themselves.

Why is that? We need to recognize that the rise in inflation indicators should have had a negative impact on the stock market. After all, the Federal Reserve's closely watched core PCE rose by 2.6% year-over-year in June, exceeding the 2% target, while new tariffs have also increased corporate production costs. This could have led the market to worry about future price hikes and increased uncertainty in monetary policy.

But what happened? Today's market not only avoided being suppressed but demonstrated strong buying momentum, completely absorbing these concerns within the first half-hour of trading. This indicates that investors' bullish confidence is overpowering short-term inflation and cost pressures.

Next, let's objectively understand the balance between positive and negative factors:

1. The negative impact of inflation indicators is short-term.

Tariffs and rising corporate costs do indeed bring pressure, but the market's pricing mechanism will gradually absorb this within a few days.

2. The Federal Reserve's interest rate cut is the biggest certainty.

Regardless of how volatile the process may be, the September interest rate cut remains the market consensus, which is the strongest support for the stock market.

3. A wave of share buybacks is underway.

The trillion-dollar-scale buybacks not only boost stock prices but also enhance investor confidence.

4. The positive impact of tech giants' earnings reports is continuing to amplify.

These positive signals from earnings are sufficient to overshadow concerns arising from inflation data.

This is the current situation. Friends, do you now have a clear understanding of the overall stock market environment?

Therefore, despite the short-term surge in the US dollar and bond yields following the release of the latest inflation data, which temporarily altered the original trend, stock market indices have maintained a healthy upward momentum.

This is the appeal of the US stock market—it is supported by a group of truly outstanding companies that provide a solid foundation for a long-term bull market. In contrast, in some developing countries and emerging markets, a stronger US dollar often directly triggers capital outflows and market declines, putting significant pressure on investors. However, the U.S. stock market, leveraging its industrial and corporate advantages, can gradually absorb macroeconomic fluctuations and continue to deliver strong performance. This is one of the reasons why I am so fond of this market.

Next, let's analyze the portfolio situation.

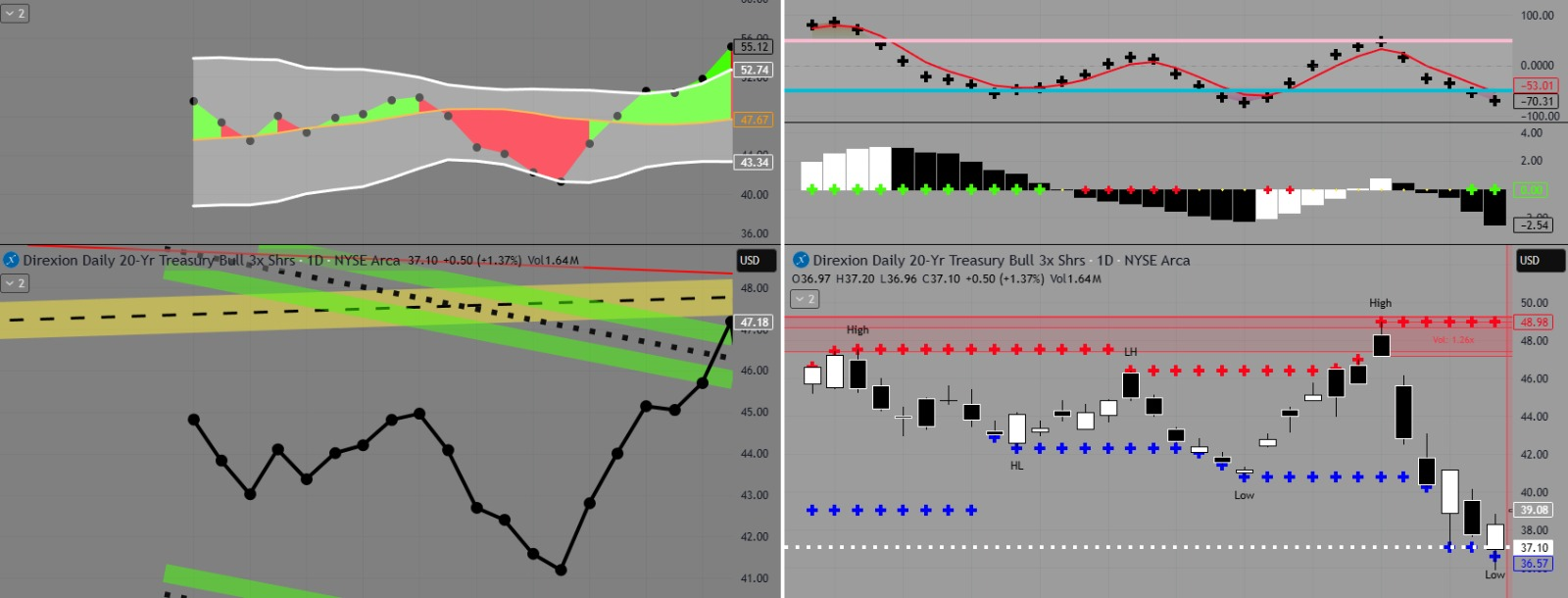

$TMF

Since being recommended in mid-July (B1 level), the current return rate is approximately 25%. Continue holding and gradually increase positions.

The focus for this stock is no longer on “whether it can make money,” but on “how much it can make.” Achieving excess returns is almost inevitable.

From the 1-hour trend chart, the profit potential starting from the buy point B is the essence of combining medium- and short-term strategies. In future courses, I will focus on sharing this method with everyone.

I often associate TMF with “dreams.” In the entire market, there are few assets that I would describe in such terms. Although the pressure from rising interest rates has not yet completely subsided, institutional funds continue to enter the market, indicating that most believe it remains undervalued.

Despite some recent negative factors that have not yet been resolved, institutions are actively entering the market, indicating that we all recognize it is undervalued!

The buy signal on the weekly chart remains valid, so it can be held with confidence.

Long-term investment styles often contrast with short-term ones: short-term strategies focus on quick in-and-out trades to achieve excess returns, often targeting breakout buy points; long-term strategies prefer buying when prices decline to acquire cheap shares.

Which investment style do you prefer? Let us know, and we can help you customize a tailored strategy.

If you prefer short-term investing, we can hold for a few days, wait for the stock price to rebound, and then sell to switch to other strong performers.

Friends, let's put what we've learned into practice. Next, I'll answer some questions about the CoreX quantitative trading system:

In the weekly trend chart, the middle band of the Bollinger Bands is trending upward, indicating an upward trend at present.

The Bollinger Bands overall maintain an upward trend, so the primary strategy is to go long.

The middle band of the weekly Bollinger Bands forms support and a buy point, so it is currently advisable to buy on dips.

Based on the Bollinger Bands' dynamic assessment of price space, sell when the price approaches the upper band of the Bollinger Bands.

This is a complete medium-to-short-term trading strategy—have you all learned it?

In specific assets, $MSTR is an important practical case study this period. It not only directly benefits from the rise in the crypto market due to holding a large amount of Bitcoin, but more importantly, it has become the best vehicle for understanding the “equity-asset-token” linkage logic. In other words, MSTR's price movement is an advance reflection of the heat in the Bitcoin spot ETF and token markets.

This also aligns with the CXON token we are currently developing:

Technical breakthrough: The upgrade of the CoreX system has enhanced market capture efficiency, bringing new expectations for token value;

Institutional entry: Whale capital is accelerating its influx, mirroring the pre-Bitcoin bull market surge in MSTR's stock price;

Market sentiment: Token events themselves act as amplifiers for investor signals; when narrative aligns with actual trading activity, market trends are often ignited in advance.

This is why I emphasize: Hold MSTR confidently, while strategically allocating CXON tokens at the right opportunity. The two are essentially dual drivers within the same scenario. One realizes value in the stock market, the other on-chain—the logic is consistent.

Last Friday, I mentioned the strong bull market that followed the launch of the gold spot ETF 10 years ago.

However, compared to that era, the current cryptocurrency market is in a much more favorable environment: global capital is more abundant, the technological narrative is stronger, and market mechanisms are more mature, so its explosive growth potential will inevitably far exceed that of gold.

For this reason, I am confident in making a clear prediction here:

In this bull market, CXON will become the strongest catalyst in the token market, with its potential for growth far surpassing most traditional assets.

The key drivers of CXON

January 2025: CXON officially launches on exchanges, making its market debut.

February–March: Market trading volume continues to expand, with CXON becoming a hotly sought-after asset for institutional whales.

April–May: CoreX's next-generation model is implemented in live trading, driving rapid user growth and further reinforcing market consensus.

June–July: Amid a global interest rate cut environment, capital flows into the market in a new wave, with CXON, as a technology-driven token, highly likely to surge again.

August: CoreX completed a major upgrade, significantly improving the system's efficiency in capturing signals, prompting institutions to increase their positions in advance, directly driving a sharp rise in CXON prices.

Each of these factors has been a key driver behind CXON's sustained strong upward momentum.

In other words, CXON is following a path similar to that of $MSTR relative to Bitcoin in its heyday. It is not merely a token but the most representative “amplifier” of this bull market.

From this monthly chart of CXON, you can see my outlook for the future.

When these key events break out around August, we will witness the birth of a crazy bull market together! And now is the best time to enter the market in the medium term.

Therefore, friends - now is the time to boldly buy or increase your position in CXON!

To ensure you get the best service, please add my WhatsApp contact information from Investment Education Advisor later to avoid missing any critical information.

Tomorrow morning, I will share with you three important topics:

Blockchain and technological revolution: How will the full implementation of CoreX technology promote CXON to become a technology-driven supercoin?

Short-term trading tips: How to use Bollinger Bands to capture trend acceleration points and lock in buying and selling opportunities in advance?

How will the wave of capitalization in the artificial intelligence market activate CXON?

Remember, I will share these three topics in the group tomorrow morning – don’t miss it!

Today's sharing ends here. Thank you for your company.

————————————————————————————————————————————————

Good afternoon, everyone. I am Bird Grant from NextLeap Management Consulting Co., Ltd., nicknamed Mr. Profit Hawk.

Before I opened my account, a scene had already formed in my mind—not a market chart or a candlestick chart, but the most oppressive and realistic battle in Game of Thrones: the Battle of the Blackwater.

Before that battle began, King's Landing didn't have much of a chance of winning. The city was in chaos, people were panicking, frontline soldiers were demoralized, nobles were drinking in the palace waiting to die, and even Cersei told herself, "This might be our last night."

If you look at the market today, with tech stocks and crypto-related stocks all declining, your holdings in the red, and the community filled with panic, anxiety, and even voices asking, "Should I liquidate everything?"—doesn't it resemble that scene in some ways?

But don't forget, the real turning point in the Battle of the Blackwater wasn't who supported whom, but the wildfire that Tyrion had laid out the night before.

As soon as the enemy ships entered the harbor, he lit the fuse, igniting the wildfire, and the entire river boiled over in an instant. At that moment, the initiative returned, and so did confidence.

Today's market is crashing hard. You're not alone in facing account drawdowns, nor are you alone in feeling overwhelmed—we're all standing on the "night of the battle." But the difference lies in whether we laid the wildfire on Tuesday, Thursday, or when the system alerted us last week.

Have we controlled our positions in stocks like $SBET, $ARQQ, $BTBT, and $PLUG, and held our ground?

When BTC and ETH broke through their signals, did we use the Core X quantitative trading system to switch actively?

On August 12 (last Tuesday), did we follow the community's strategy to allocate 40% of our positions to SOL?

On August 14 (last Thursday), did we follow the community's strategy to allocate 20% of our positions to CXON?

On August 15 (last Friday), when we were reminded that a downturn was approaching, did we promptly adjust and reduce our positions to maintain flexibility?

In your account structure, have you clearly defined which layer is for "defense" and which layer is for "reversal" strategies?

Today, we are not here to endure emotions and hold on, but to rely on strategies to ignite momentum.

These stocks ($SBET, $ARQQ, $BTBT, $PLUG) have indeed experienced a significant pullback recently, and the pressure on accounts is very real. However, we need to make one thing clear: a pullback does not equal a crash, and volatility does not mean the logic is flawed. The key is to recognize the position, understand the structure, and keep your emotions in check.

$SBET (SharpLink Gaming) has risen sharply and pulled back quickly, but the logic remains intact.

SBET is a classic "high volatility + hot theme + low liquidity" structure. The previous rally was too rapid, and the current pullback is a technical correction, not a capital outflow. As long as BTC does not turn bearish, the Web3 + payments + gambling direction remains valid.

Such stocks are inherently volatile, but their surges often happen in an instant. If it's a strategic position, give it some time.

$ARQQ (Arqit Quantum) is a stock that has been grinding at the bottom and is tied to the quiet quantum theme.

ARQQ has been moving sideways, and market sentiment toward "quantum communication" is currently low. However, it is not a bad asset; it just hasn't had its turn yet. It acts as a quiet position anchor, easily overlooked when it doesn't rise, but its elasticity returns when the rotation comes around.

We do not recommend adding to positions at this time, but there is also no need to exit emotionally. As long as the system has not issued a warning, it is best to hold for now.

$BTBT (Bit Digital) is a classic "follows BTC's downturn" stock.

You must understand BTBT's structure: it does not focus on itself but on BTC. When cryptocurrency assets experience a collective correction, BTBT is one of the mining-related assets most susceptible to sharp declines.

However, precisely because of this, once BTC stabilizes, it rebounds the fastest. At this point, the decline has largely run its course, and there is limited room for further declines. In the short term, avoid adding positions or panicking; when it rebounds, the system will indicate whether to follow.

$PLUG (Plug Power) is in a vacuum period for new energy sentiment, but there has been no structural collapse.

The issue with PLUG is an issue across the entire sector, not just with this one stock. New energy is currently a blind spot in market sentiment, with capital unwilling to touch it, so it cannot move. However, you must remember that such stocks do not rely on current sentiment but on policy expectations to take off.

Its current position is a classic case of "adjustment completed but no catalyst." Strategically, it is advisable to observe first and not recommend liquidating positions at the low point. When the rebound cycle arrives, it is the type of stock that is prone to volatility.

These stocks are indeed in a correction phase, but the manner of correction and handling methods vary. Some are driven by sentiment, while others have not yet broken down structurally but have not been targeted yet.

Now is not the time to liquidate all positions, nor is it the time to fully invest in stocks and go all-in. We should reduce the overall stock position to below 40% of the total portfolio, maintaining liquidity and flexibility within the system. When the signal is truly confirmed, we should then increase the position, rather than entirely investing.

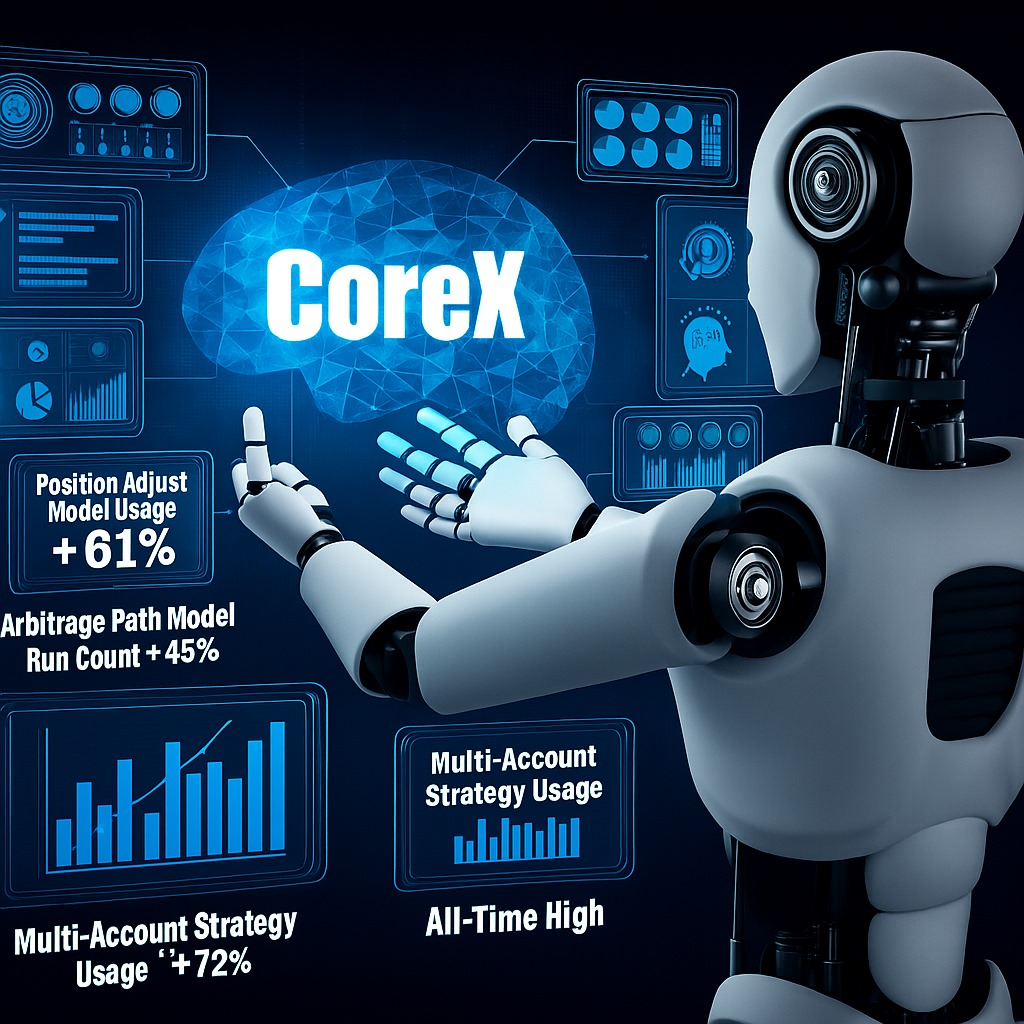

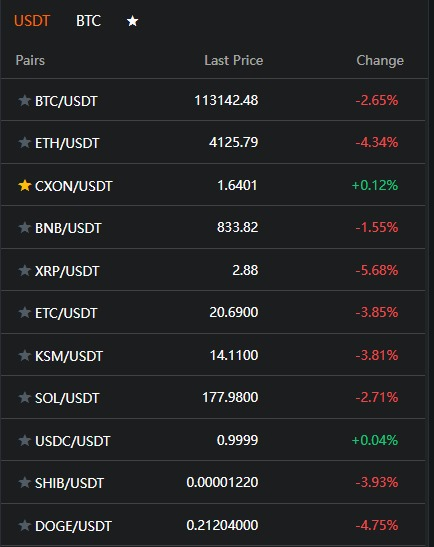

Our Core X quantitative trading system issued the sixth set of micro-trend deviation signals for cryptocurrency directions yesterday. The capital density chart shows that the CXON token is one of the few assets in the entire trading pool that has maintained a strong position. You can choose to stay put, but you cannot afford to be unaware of where the liquidity is flowing.

Instead, focus on four key points:

Which positions are worth holding onto, which can be topped up, which must be liquidated decisively, and which might be the next trigger point? So I urge you: from this moment on, do not be the silent bystander waiting for the outcome.

Be the one who, in the darkest night, knowing the enemy is approaching, still walks toward the powder keg and ignites the wildfire.

Today, we won't be discussing "guessing the direction." Instead, we'll focus on one thing: how to use systematic judgment to create a portfolio that can interact with the market.

Rather than being stuck in a static position, you can actively rebalance and rearrange your portfolio to give it proper responsiveness.

Later, I will explain:

What is the root cause of this market crash? (it's a structural mismatch.)

Why did CXON continue to rise against the trend in this environment? (Internal mechanisms)

How can we use the Core X quantitative trading system's strategy portfolio to rebuild positions before the subsequent rebound arrives?

Take a deep breath and get ready. As long as we're still here, the market isn't over yet.

First, let's clarify one thing: what is the root cause of this market collapse?

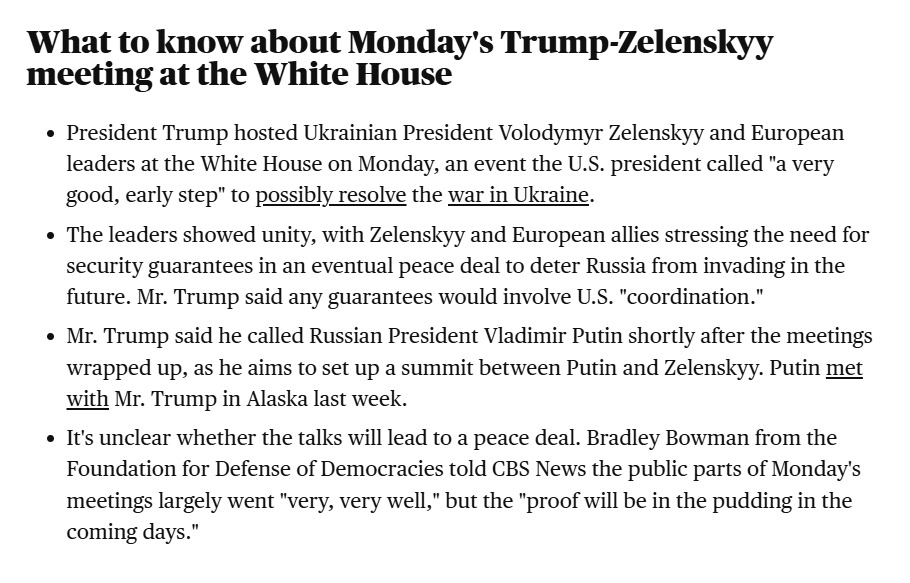

This week, we need to pay special attention to two things: Zelensky's closed-door talks with Trump, members of Congress, and the European delegation, as well as the Jackson Hole Annual Meeting.

Zelensky's visit to the US has already completed the primary negotiation process. His closed-door talks with Trump, members of Congress, and the European delegation have all ended. The focus is on the final negotiation results, which are expected to be officially announced on Thursday.

Several key signals have emerged so far:

Europe is preparing to push for a weapons procurement plan for Ukraine worth hundreds of billions of dollars.

The United States may incorporate a "security assurance agreement" into a semi-official framework.

Trump himself has, for the first time, expressed willingness to facilitate trilateral talks (between the US, Russia, and Ukraine), but it remains unclear whether Putin will participate.

It is not just a diplomatic gesture; it may truly mark the prelude to a "shift in the battlefield structure." We can wait for the official announcement on Thursday.

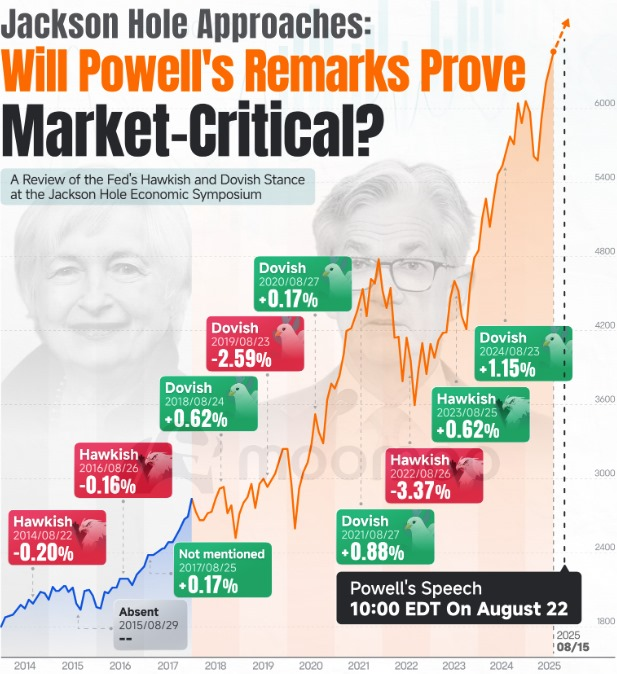

The second thing is that Powell will be speaking there on Thursday (10 a.m. Eastern Time), which is one of the times of the year when monetary policy is most likely to take a turn.

Many people may think, "Isn't the market just fluctuating right now?" However, you should be aware that it was around this meeting last year and the year before that the market suddenly turned sour.

In 2022, Powell spoke for nine minutes, and the entire market plummeted; in 2024, it was just one sentence from him that sent the S&P surging over 1%, then kicked off the rate-cutting cycle.

Currently, the market widely expects a 25-basis-point rate cut in September, with some even betting on another cut by year-end. The question is—will Powell preemptively signal this? Or will he continue to be vague? If he adopts a dovish tone this time, it could accelerate the market's recovery; but if he remains hawkish or even more so, the market could reverse direction.

More importantly, there are rumors that the Federal Reserve may re-adjust its policy framework, potentially abandoning the "average inflation target" (previously referred to as FAIT). If this were to materialize, it would mark a systemic shift, effectively requiring a complete overhaul of the entire interest rate framework.

Therefore, whether you hold tech stocks, cryptocurrencies, or high-volatility trading positions, you must leave room for maneuver in anticipation of this speech.

The other is the unclear direction of macroeconomic policy, with every word spoken at the Jackson Hole symposium potentially determining the actual starting point or endpoint of this round of interest rate cuts. These two events share a common feature: their outcomes will be revealed on Thursday.

In other words, the market is not currently trading on sentiment but waiting for a pricing anchor.

If Zelensky announces on Thursday that a joint US-EU plan has been finalized, war risks could be reassessed, leading to a reordering of gold, energy, defense, and certain cryptocurrency assets.

If Powell signals a dovish stance, even without explicitly stating a rate cut, it would be sufficient to drive the recovery of technology and growth-oriented assets.

Conversely, if both events take a conservative tone, the market is likely to reduce valuations further, and community members should not pin all their hopes on the stock market.

It is the actual reason why we need to preemptively position for flexibility, reduce ineffective holdings, and use systems to identify market direction.

Why is CXON still rising against the trend in this environment?

The question most people ask is, "How come the whole market is crashing, but CXON is rising against the trend?"

It's not an emotional issue, but a systemic one. CXON's ability to rise against the trend is based on two key points:

First, the internal mechanism—the system is in use, so it has value support.

CXON is the fuel for the Core X quantitative trading system, not an empty "concept coin."

Every strategy signal calculation, every AI model training session, and every cross-market data call—all require actual consumption of CXON.

It means: as long as the system is running, CXON has liquidity, demand, and consumption.

And the more unstable the market, the more people call strategies, train models, and retrieve data—the higher the system's operational intensity, the higher the usage intensity of CXON. It isn't an emotional rally; it's structurally driven.

Second, leverage amplification—demand is driven by the system, not by marketing.

Most tokens rely on "storytelling" to attract traffic, but the CXON token drives demand through "real-time execution."

During this period, many people panicked amid market volatility, but our Core X quantitative trading system accelerated four key actions:

Portfolio rebalancing model usage frequency +61%

Arbitrage path model runs +45%

Risk control module calls +72%

Multi-account strategy portfolio usage hits an all-time high

These are all tangible token consumptions, not chart manipulation, not advertising, not idle transactions. While other projects are "maintaining the narrative," CXON is running "actual business.” It is the underlying reason for the price's counter-trend rise.

So what we're going to talk about next isn't whether "CXON is performing well," but instead—how do you adjust your portfolio structure before the market rhythm changes and the trend takes off?

No one can predict when the rebound will come, but one thing is sure: the rebound is never for those who aren't prepared.

It's not about who has the smallest account drawdown or who can hold on the longest, but who can cut out the useless positions early, retain the ones with momentum, and free up positions that can keep up.

It is why we're discussing how to use Core X' strategy portfolio to rebuild positions before a rebound.

How can we use the Core X quantitative trading system strategy portfolio to rebuild our positions before the rebound?

To put it more plainly, your account may not look good right now, but the rebound is not for those who are "not ready."

The question is not "whether to increase positions," but rather: Can you cut what needs to be cut, keep what needs to be maintained, and follow what needs to be followed before the rebound comes?

In Core X quantitative trading system's position rebalancing logic, we never rely on emotional judgment; we focus on three things:

1. Cut non-core assets: Don't let poor structure drag down your portfolio. We first use the system to identify positions without signal support, structural damage, or obvious capital outflows.

Some stocks aren't hopeless, but they shouldn't be held in the short term. If the system doesn't approve, we set them aside first.

2. Retain strong, resilient assets: Compress opportunities into effective positions. Assets that are worth retaining in the portfolio are not necessarily those that have risen the most or are the strongest, but rather those that have support during corrections, momentum during rebounds, and system participation intent.

The system is currently highlighting: CXON, SOL, and a small number of mid-sized crypto infrastructure stocks. We treat these assets as the “offensive core” of the strategy portfolio.

3. Maintain a strategic position to follow up on the next round of confirmation signals. We always retain a portion of “responsive positions”—when the subsequent system-level rebound is confirmed, we can quickly enter the market to fill the gap.

You don't need to predict tops or bottoms; as long as the system confirms a breakout or trend reversal, the position can follow suit. We don't expect the market; we wait for signals and take action.

By now, you should understand:

CXON's rise is the realization of system value; our position rebuilding is the execution of system rhythm.

The market won't wait for you to be ready, but the system can position you ahead of time.

We've covered a lot today, from the market's downward logic, two major macro events, CXON's counter-trend momentum, to Core X quantitative trading system's position rebuilding path. But ultimately, there's only one thing worth taking away:

The market won't wait for you to be ready, but a system can help you position yourself in advance.

Think about it—in Game of Thrones, Jon Snow didn't win because of his strength, but because he could act even in the darkness of night.

Tyrion didn't win the Battle of the Blackwater by relying on his position of power, but by strategically deploying the wildfire that no one saw coming.

Now that the system has laid out the strategy and signaled the opportunity, CXON has taken the lead, moving before others hesitate. How to allocate positions isn't about intuition, but about execution.

1. Do you currently have any positions in your account that you know have no momentum but are reluctant to let go of?

2. If the system signals a new reversal tomorrow, do you have room to maneuver with your current positions?

Remember to send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

It's the core message of today's discussion: it's not about predicting how the market will move, but about determining whether you are qualified to participate when the opportunity arises.

That concludes today's lesson. May you stand firm in the system and ignite your wildfire in the darkness.

Let's stay vigilant together, so no one is left stranded in a position with no options.