August 20, 2025

August 20, 2025

Have you noticed that when our stock market turned red yesterday, panic seemed to dissipate instantly? Just like the VIX fear index, market sentiment can change in the blink of an eye.

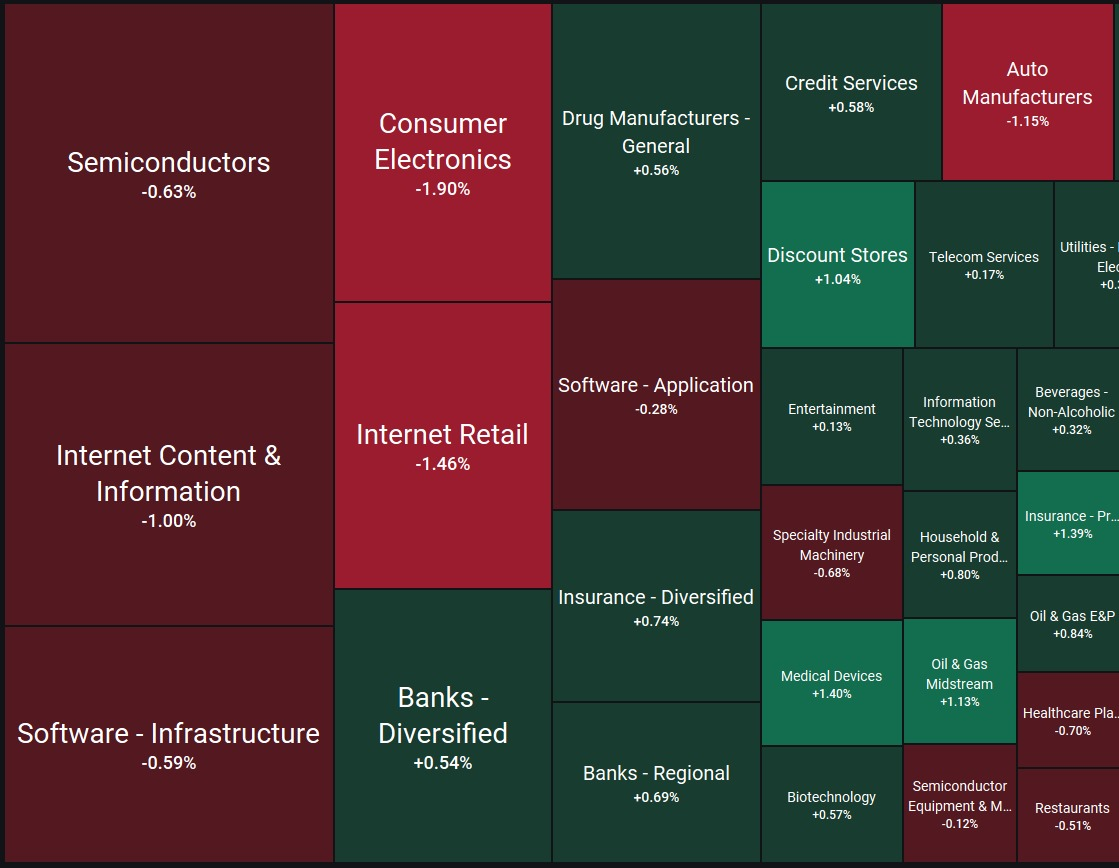

Today, tech stocks were broadly weaker before the opening bell, with Nvidia down 3.5%, Palantir plunging 9.4%, and the S&P 500 index down about 0.6%. Meanwhile, the VIX fear index continued to decline, currently hovering around 14.99, below yesterday's 15.09, indicating a general easing of panic sentiment. Notably, despite pressure on the tech sector, the real estate, consumer staples, and utilities sectors have strengthened, serving as safe havens for the market.

Market attention has shifted to the upcoming Jackson Hole meeting, which will influence the future direction of monetary policy.

What do these data mean?

They tell us that in short-term market volatility, high-quality assets and rational logic are the core of stable confidence. I will share investment insights with you from multiple dimensions—not only including economic data but also covering the performance of real-world companies and technical signals.

Before we begin today's strategy class, I would like to discuss a topic that is just as important as investing—love, confidence, and faith.

I often say: Love is about giving. True love is selfless, seeking only the best for the other person; confidence is about reliance—when you are willing to entrust part of your judgment to mature methods and discipline, your heart will find stability; faith stems from the accumulation of confidence—after repeated verification, you will become more certain of the path you have chosen.

Why start here?

Because I learned a profound lesson in 2008. During the financial crisis, I nearly plunged into ruin by short-selling. At the time, I believed I “understood the trends” and was “sufficiently mature.” Looking back, that was merely overinflated confidence—the same logic that leads many retail investors to lose money in a bull market: boldness without a method is mere luck; judgment without discipline will eventually backfire.

Ridiculous? Looking back now, it certainly is. But I’ve never been afraid to admit my mistakes, and I’m even more willing to acknowledge others’ excellence—because acknowledging and learning are precisely the first steps to climbing out of a low point.

Replace emotions with a verifiable CoreX quantitative trading system;

Manage uncertainty through position and risk control;

Build true confidence through long-term review and accumulation.

In today's lesson, we will apply these abstract concepts of “love, confidence, and faith” to the most concrete execution:

How to demonstrate “giving” by sharing replicable strategies and rules;

How to demonstrate “dependence” by replacing subjective fluctuations with data and discipline;

How to demonstrate “faith” in a system that can withstand backtesting and live trading verification.

I am willing to openly share the pitfalls I have encountered and the paths I have taken over the years, presenting them as they are. This is both “giving” and my respect for all of you.

These issues still exist today—when I place these methods in your hands, will you be able to catch them?

At that time, what truly helped me transition from confusion to clarity was my mentor.

The selfless care he provided allowed me to reignite my dream of “the city on the hill” during my lowest point, guiding me back to the essence of investing—not chasing fleeting gains or losses, but cultivating trust, relying on methodology, and believing in this beautiful and powerful nation. It was that pivotal moment that turned my fortunes around, propelling me toward the first peak of my life.

It was also inspired by this experience that I conceived the idea of creating the NextLeap investment education community to disseminate investment knowledge.

From the initial “CoreX V1.0 Investment System” in 2011, to the mature “Quantitative Trading System” by 2024, and later, recognizing the impact and potential of artificial intelligence, we upgraded and developed the CoreX Quantitative Trading System you often hear about today.

Though this journey was fraught with hardships, including financial struggles that caused my family to suffer, these memories remain vivid.

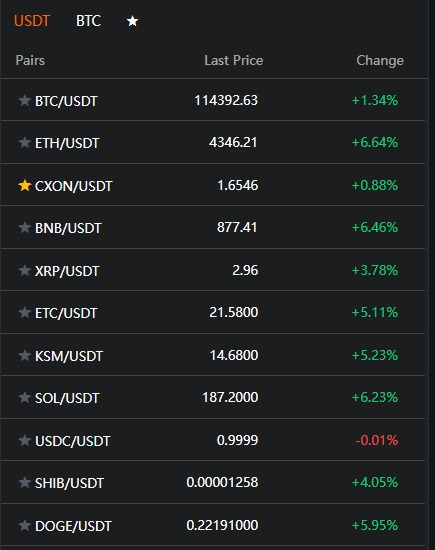

Fortunately, it has lived up to expectations, and through everyone's efforts, it now holds a valuation of hundreds of millions of dollars—you can see this reflected in the CXON token price and its whitepaper.

Love is giving!

My mentor lived by this principle, and I believe our NextLeap investment education community has consistently upheld this life philosophy. Therefore, I have distilled two key educational principles: Technology-driven, investment breakthroughs, and innovation shaping the future.

Thus, our NextLeap institution does not prioritize shareholder interests like a publicly listed company.

Although our growth is slow, every step we take is solid and grounded. We do not pursue fame and fortune as our primary goal.

I believe success is not about how much wealth one accumulates, but about making one’s own family happier and bringing happiness to more families!

I believe this is the essence of investment and the pursuit of success. This is what I have learned from my work in investment, and it makes me optimistic, happy, fulfilled, and content…

Understanding that “love is giving, and the essence of confidence is reliance” can not only improve our interpersonal relationships but also help us make better investments!

In the investment market, I believe confidence comes from data; we rely on data, which is science.

The most certain thing in the investment market is that uncertainty always exists, and price fluctuations are also disorderly.

However, science can address these issues. The core philosophy of my quantitative trading approach was to calculate success rates using historical data from this model; the CoreX system features machine learning capabilities, which is its scientific advantage and unparalleled strength.

Artificial intelligence makes our lives better, and the same applies to investing. This is what I am currently working on, and you will certainly be glad you chose to stay here today.

I believe you have already begun to feel the appeal of CoreX's scientific approach, haven't you?

If investing more in $TSLA during adversity is primarily to support a visionary—to support Elon Musk's beliefs and foresight—then all recent market judgments actually stem from calm data analysis.

In fact, many institutional funds have been consistently buying $TSLA recently, which also reflects the overall market sentiment.

When the entire market was in panic, the CoreX quantitative trading system accurately interpreted the turning point of the Federal Reserve meeting;

On May 12, the system detected that $NVDA was approaching a critical point near the upper band of the Bollinger Bands;

When $MSTR tested the middle band of the weekly Bollinger Bands, the system identified an excellent opportunity for strategic positioning;

Additionally, the system's predictions of the VIX fear index, identification of sell points S1/S2/S3/S4 for the US 10-year Treasury (US10Y), and ability to track the downward trend of the US dollar all validate the system's forward-looking capabilities.

Not only that, but yesterday I shared two key reasons why $MSTR is benefiting from the Bitcoin bull market (newcomers can read my investment courses through my investment education advisor or official website), and drew conclusions from data from the three previous bull markets:

1. Bitcoin's current price

Bitcoin is currently trading around the $113,300 range, down approximately $1,450 from last week's high, undergoing a mid-term consolidation. While it hasn't reached the extreme targets previously envisioned, this price level reflects structural repair following short-term volatility in the crypto market.

2. $MSTR's current market reaction and analyst views

$MSTR is currently trading at approximately $336.57, with significant intraday volatility but an overall trend that remains intact.

MarketBeat data shows that Wall Street analysts' average forecast for the next 12 months is $552.50, implying a potential upside of approximately +64%.

TipRanks also has a similar forecast: the average target price is approximately $529.57, with a high of $650, corresponding to a +75% upside potential. CCN data shows that based on surveys over the past three months, the average target price is $554.42, representing a nearly 38% increase from the current price. Barron's reported that over the past year, $MSTR's stock price has risen by over 450%, far outpacing Bitcoin's gains, reflecting its high volatility and market enthusiasm. This is why I place such importance on the current buying opportunity and remain optimistic about its future prospects.

Later, I will add an important point through important historical data on gold to help everyone better invest in this important and practical bull stock.

Of course, there are two key points that everyone must understand:

1. Medium- to long-term investments may not show results immediately, but I firmly believe that these data will not disappoint us. Believing in the predictive capabilities of data and machine learning is believing in science.

If you prefer short-term trading, you can message my assistant, and we can tailor a strategy specifically for you.

2. When I analyze stock indices, my views on individual stocks are not explicitly mentioned. However, my views on stock indices already represent my views on individual stocks.

For example, yesterday morning, before the session ended, I specifically analyzed the stock indices and emphasized the importance of short-term retest buy points.

We welcome your suggestions and are eager to accept them, aiming to genuinely assist every friend.

Next, I will share a set of important data, followed by today's course.

Friends, I have been researching the gold market for many years.

I have reviewed a lot of data and, combined with this chart, I would like to share with you my core views on $MSTR. Please take the time to understand this carefully, as there is an interesting pattern hidden within.

Think back to when the gold spot ETF was first launched—didn't the price of gold experience a very noticeable surge? Today, the situation with Bitcoin is almost identical to that of gold back then. Its price curve closely mirrors the trend observed when gold ETF were first introduced.

Drawing on the historical experience of gold ETFs, we can make some reasonably reliable projections about the future of Bitcoin ETF. In other words, Bitcoin may be following a similar “major trend” path to that of gold in the past. This is not merely a story about digital currencies but rather the inevitable logic of market evolution.

Friends, believing in data is believing in science. The scale of capital in the investment market 10 years ago cannot be compared to today's.

Gold's primary attributes are risk hedging and value preservation. However, these investment attributes cannot be compared to blockchain technology, which is set to become the core technology of the Fourth Industrial Revolution.

To achieve rapid compound growth of wealth and financial freedom through investment, one must seize the trend.

For example, blockchain technology and artificial intelligence are the trends!

In the future, I will expand on investment knowledge in this area, including topics such as blockchain, the halving mechanism, and the inevitable rise of the cryptocurrency market.

My enthusiasm for $MSTR is no less than my enthusiasm for $NVDA.

Given my strong expectations for Bitcoin’s future, do you now understand why I say that this bull market for $MSTR will be robust and powerful?

Since we are optimistic about it, what should we do?

Should we pay more attention to this promising stock and the trends in the cryptocurrency market?

Should we optimize our investment portfolio and concentrate our positions to manage it effectively?

Share your thoughts with your investment education advisor and your understanding of today's lesson.

I want to see how many of you share my perspective, and I hope you can offer valuable suggestions, as the NextLeap investment education community belongs to society and to each and every one of you.

So, how can we effectively manage this promising stock?

You can find the key points in the upcoming CoreX course: how to use Bollinger Bands to assess trends.

Friends, have you ever had this experience: you held a super bull stock, but after you sold it, the price increased several or even dozens of times?

The fundamental reason is that you may not have correctly understood what a trend is.

The Bollinger Band, a classic trend-based technical indicator, is simple, intuitive, and effective for judging trends.

Generally, the middle line of the Bollinger Band represents the direction of the trend.

There are three types of trends:

1. Uptrend: When the middle band of the Bollinger Bands is moving upward, the price generally follows an uptrend.

2. Downtrend: When the middle band of the Bollinger Bands is moving downward, the price generally follows a downtrend.

3. Sideways oscillation: When the middle band of the Bollinger Bands is moving sideways, the price generally follows a sideways oscillation within a range.

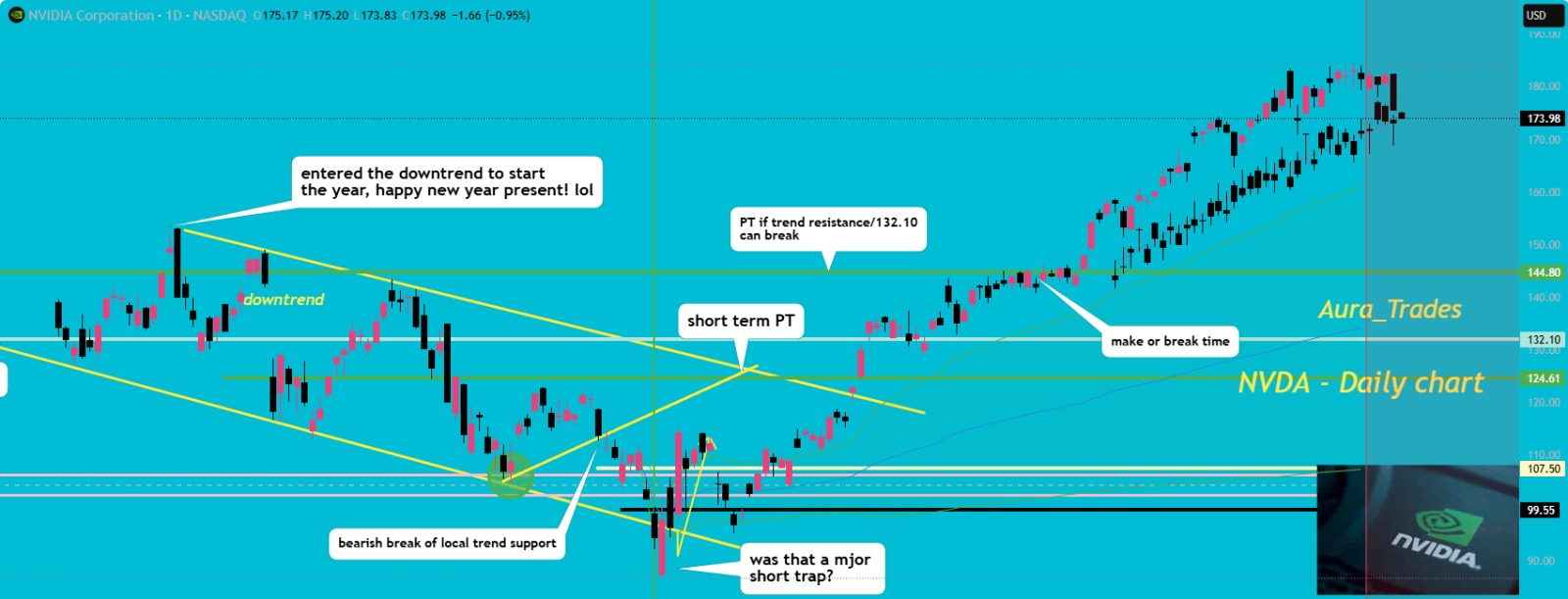

For example, in the weekly trend chart of one of my favorite super-performing stocks, $NVDA, the three types of trends are marked as follows:

Friends, today's results review and rewards

Once you learn something, you should put it into practice immediately. Today, I have prepared two “mini-quizzes” for you. After completing them, you will receive a raffle code:

Trading Strategy Practice (1 raffle code)

Please combine the three key techniques I shared about Bollinger Bands:

Determining the dynamic space of price movement

Using resistance levels to identify buy/sell points

Determining the direction of the trend

Using the weekly chart of $NVDA as an example, try to develop a medium-to-short-term trading strategy. Write down your thoughts, and you’ll receive 1 lottery code.

Portfolio Considerations (1 raffle code)

Please share your thoughts on the three top-performing stocks I’ve shared: $NVDA, $TSLA, and $MSTR:

Do you have confidence in this portfolio?

Which one do you prefer? Why?

Or do you have any other ideas or suggestions?

Upon completion, you will also receive 1 raffle code.

It's heartening to see everyone making progress and taking notes diligently. This course not only gives everyone a chance to win a raffle code, but also helps everyone improve quickly. I will also focus on nurturing outstanding students who are committed to learning.

Tomorrow is Thursday, and the key topics for this session include:

How to use Bollinger Bands to identify genuine buy and sell points in the market;

Why institutional funds tend to favor tech leaders and cryptocurrencies;

How to scientifically construct an investment portfolio in a super bull market.

These topics will help you apply classroom knowledge to real-world trading and lay a solid foundation.

That’s all for today’s sharing. See you in class tomorrow morning!

——————————————————————————————————————————————————————————

What I said today at Jackson Hole—"Price signals don't come from news headlines, but from the actual behavior of people on the chain."

It was like Jon Snow in the hall at Winterfell, laying out the body of a White Walker before a group of noble lords with their agendas, saying, "I'm not interested in persuading you. I'm only telling you the truth. The war has begun, and we must unite—or we all die."

That moment wasn't a battle, but it was more critical than any battle because it shattered illusions and laid bare the actual underlying threat before everyone's eyes.

Good afternoon on this crucial Wednesday. I am Bird Grant from NextLeap Management Consulting Co., Ltd., nicknamed Mr. Profit Hawk. Today, I was invited to attend the Blockchain and Financial Systems Cross-Industry Summit held in Jackson Hole, Wyoming.

Without snow, Jackson Hole looks like a peaceful valley. But the discussions in the conference hall were sharper and more real than any traditional financial forum I've been to. It wasn't because anyone's speech was awe-inspiring, but because we've truly reached a point where we need to redefine the underlying structure of finance.

A "mini-clash" erupted instantly: Federal Reserve Board member Waller stated on stage that Bitcoin could serve as a store of value but was not the optimal solution for a payment system.

A mining industry representative retorted, "But it is the only tool we have to establish dollar computing power in Asia."

I didn't refute it or say much, just one sentence: "In our system, price signals don't come from news headlines, but from people's real behavior on the chain. Tokens aren't tools; they're language." After saying that, I didn't look at anyone's reaction; I just lowered my head to drink water.

Then Eric Trump clapped lightly, and an hour later, that sentence became the most liked content in the event group.

What truly left an impression on me was not the applause, but what happened offstage.

On the platform of the hotel garden, several Wall Street fund managers and DeFi protocol developers were gathered around an iPad, examining CXON's on-chain transaction charts. A young man looked up and asked me, "Is your CXON designed for real-time trading strategies? Not just for market capitalization?"

I didn't explain much, just said, "Tomorrow, you can check every transaction call in the system yourself. The money we make isn't from storytelling; it's from winning strategies."

He paused for a moment, then nodded, "Then this must be the structural asset of the next era."

Throughout the day, I didn't say much, but the few conversations I had were significant:

Scaramucci said, "Bird, you're not like a traditional crypto person, but you're more like the architect of the industry's underlying infrastructure than many others."

After listening to the Core X quantitative trading system, Federal Reserve Board member Bowman said, "What you're doing is what the financial industry should be doing—digitizing behavior, not commercializing emotions."

A partner from an AI fund in Hong Kong whispered, "This system shouldn't just be used for strategy coverage; it should be integrated with government sovereign wealth fund platforms."

I'm not here to fight for influence or ride the hype. I'm here to build structures. In this industry, we don't rely on hype or trends to boost our value. We rely on systems—on letting algorithms speak for investments and behavior dictate pricing.

So while others are still asking, "Which coin might skyrocket?" I'm already on the chain, focusing on liquidity, call paths, and strategy execution speed. Rather than betting on the next hot topic, we are designing a structure that is effective in the long term. The significance of the Core X quantitative trading system is the reason for CXON's existence.

If you weren't here today, I'll leave this story for you. Not to make you envy anyone, but to tell you: we are seriously building a system that makes finance more real, more human, and more logical. You can participate in it, think about it, and even become a part of it.

Today's scene reminds me of the meeting at Winterfell. Jon Snow tossed the White Walker corpse into the middle of the hall, without any speeches or dramatics, and said, "The war has begun." That wasn't a debate; it was a dividing line—from that point onward, it was a choice between order and chaos. Today, we present you with on-chain behavior, transaction structures, and capital flow paths—just like that White Walker corpse. It may not be pleasant to look at, but it is so real that no one can deny it.

And CXON is not that corpse—it is the elite force that has already been dispatched through the city gates and is heading to the front lines. It is not waiting for the market to recognize it; it is already in action, executing in real-time, consuming fuel on the chain every day, and delivering results. It is not a token; it is your operational code, identity token, and revenue entitlement for participating in this systemic war. Whether you enter the system determines whether you stand within the city walls, defending, or linger outside chasing news headlines.

We do not build confidence through stories; we define belonging through results. The question now is not "do you believe in CXON" or "can it still rise," but: this force has already departed—are you still standing at the gates of Winterfell watching?

Because the system does not wait for anyone, and the structure does not look back. On-chain behavior is evolving into a new generation of asset order, and whether you choose to join this layer of real structure is the proper choice.

Next, let's briefly review today's stock market—especially today's rebound, which confirmed our prediction made in the community on Monday: the window for the retreat of panic sentiment is expected to appear on Wednesday officially. Today is the moment of confirmation.

As we made clear at the time, it's not about someone declaring "the bottom is here," nor is it about a single stock suddenly surging by 30%. Instead, it's about the resonance between systemic liquidity, capital flows, and on-chain behavior to confirm the trend.

Today, you can see that representative stocks in the crypto sector, such as $RIOT, $MARA, and $WULF, have stabilized at key technical support levels.

The AI sector has also begun to recover in the afternoon, with stocks like $PLTR, $NVDA, and $TSM reclaiming their key moving averages.

It's not luck, but a step in the trading structure:

On-chain behavior first stabilized, followed by a test of capital inflows. Weak assets began to stabilize, while leading assets started to rebuild their bottom structure in the afternoon.

We have said that we do not chase highs or lows, but we must identify "structural inflection points" in advance. Today is precisely that point.

According to data from the Core X quantitative trading system, today marks a significant shift, as it is not merely about improved sentiment, but the moment when the trading system begins to rebuild its trading logic after the release of structural pressure.

Therefore, today is not a rebound day, but a validation day. It validates the logic we discussed on Monday, validates the system's accurate assessment of liquidity, and also validates that you did not make the wrong decision at a critical point when feeling anxious.

Let's further validate the stocks analyzed yesterday.

$SBET — SharpLink Gaming

The Core X quantitative trading system identifies this as a high-volatility asset currently in a short-term technical pullback phase with no structural breakdown signals.

The system's short-term volatility intensity score has declined to neutral, but sentiment remains active; behavioral data shows no significant capital outflow structure, and on-chain topic heat remains stable; the price pullback is a corrective behavior following the previous sharp rise, not a strategy failure.

Strategy recommendation: It is not advisable to be shaken out during emotional volatility. The Core X quantitative trading system presets that the correction amplitude of such assets may exceed the conventional tolerance zone, but once a rebound occurs, it is often event-driven. Continue holding and set a strategy tracking line.

$ARQQ — Arqit Quantum

The Core X quantitative trading system identifies this as a sideways trading period, with the system identifying it as a "core support stock." Volatility is weak, but the structure remains intact.

No significant volume structure has formed, and capital flows remain at low density during the sideways trading phase; the quantum communication sector currently shows no systemic rotation signals. The Core X Quantitative Trading System identifies this as an "asset with potential delayed beta release," suitable for static allocation but not an aggressive target.

Strategy recommendation: The system has not issued signals to add positions or exit. The current state is characterized by holding positions with little to no impact. Maintain the original position, avoid chasing highs or panic selling, and wait for sector rotation signals or changes in capital behavior.

$BTBT — Bit Digital

Following BTC's rapid decline, the Core X quantitative trading system identified it as an "event-driven - waiting for stabilization confirmation."

The current behavioral path closely aligns with BTC price movements, exhibiting a flexible structure, but has not yet formed an entry signal zone. The system monitors its behavioral trajectory, which presents a "rapid release + capital observation" structure, and has not yet formed a confirmatory capital inflow.

Strategy recommendation: Hold positions unchanged; short-term additions are not recommended; the system will reactivate trading signals for this asset when BTC confirms stabilization and exhibits "subjective capital inflow"; flexibility exists, but BTC must first complete its structural reconstruction.

$PLUG — Plug Power

The Core X quantitative trading system identifies this as "risk-free behavior, but lacking active participation flow."

The system tracks this stock as being in a "static adjustment zone," with a stable behavior model but lacking any upward behavioral structure; there are no rotation signals at the sector level, and sentiment factors are at recent lows; technically, it is in a historical support zone with rebound potential, but lacking a catalyst to trigger it.

Strategy recommendation: The system does not recommend liquidating positions, as this is a "non-active zone holding"; wait for sector or policy-driven catalysts. The current structure is a typical "adjustment completed but lacking entry momentum" scenario; do not actively attack, but also do not recommend cutting losses at emotional lows.

Today, at Jackson Hole, we are witnessing a shift in macroeconomic discourse: from the ongoing tug-of-war over stablecoin regulation to a more constructive discussion about how on-chain systems can contribute to the design of future financial infrastructure.

This summit itself serves as a signal—no longer is it about "the crypto community telling its own story," but rather "we are now using on-chain behavioral data to engage with the traditional capital system." The market's response today has been a tangible upward trend.

These assets did not rise or fall in unison, but instead followed a gradual path from on-chain behavior → capital structure → individual stock support, forming today's core feedback: the first to stop falling were chain-linked assets; the first to regain resilience were also them.

Today's market movement is not a random rebound, but a delayed response to last weekend's on-chain behavior + a resonance confirmation catalysed by Jackson Hole. The system pointed out on Monday that the panic window would converge by Wednesday, and today it not only converged but also provided a directional choice.

And that direction is crypto.

Are you willing, after the panic, to correct your mistakes promptly and seize this opportunity in the crypto chain?

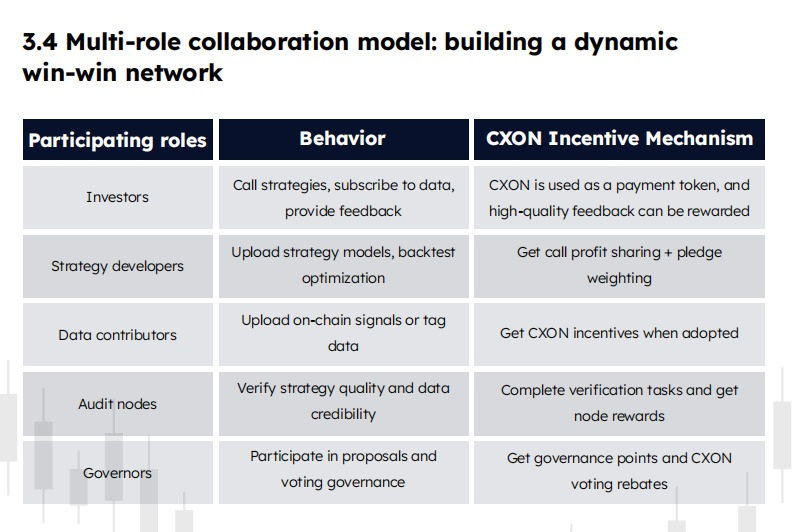

While most people are still asking, "Will this coin go up?" we are already using the Core X quantitative trading system to execute strategies, consume CXON tokens, generate real-time trading behavior, and build structural opportunities.

The recent price rebounds in $SBET, $BTBT, and $RIOT that you see today are not a matter of luck or sudden market improvement. They are the result of the synchronized resonance of system logic, on-chain behavior, and capital feedback.

Within this system, the only token that is genuinely consumed, utilized, and bound to behavioral data is CXON.

So today, we will only clarify three things:

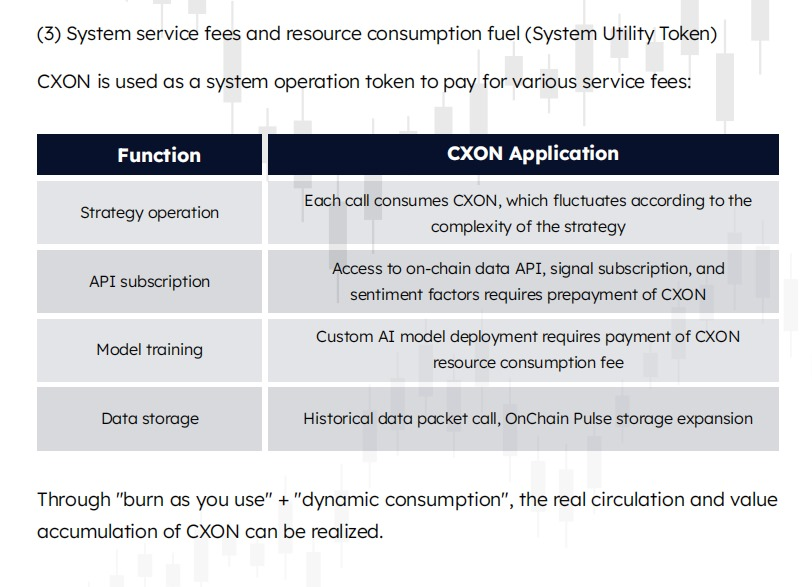

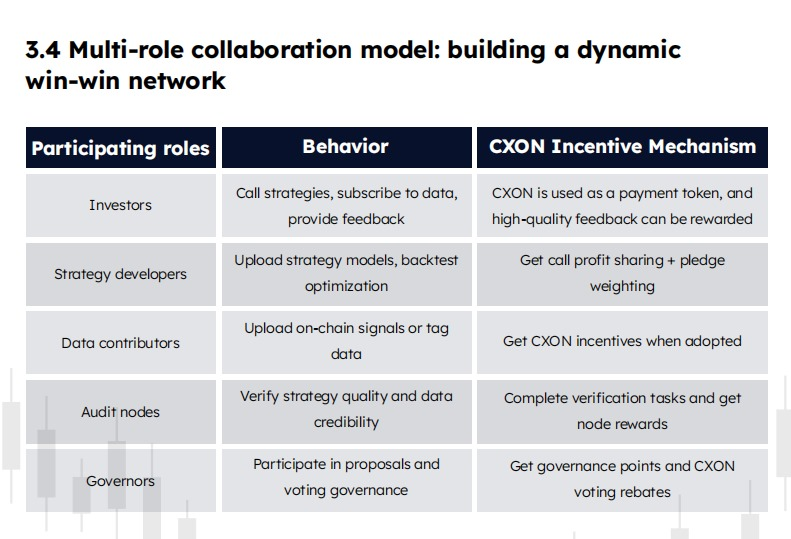

1. What is CXON?

It is not a "project coin" or "platform points." It is the key to entering the Core X trading system, the fuel for the strategy engine, and the credential for participating in the revenue structure.

Without it, you cannot access the system's live trading layer.

without it, you have no right to participate in strategy upgrades or parameter governance;

Without it, even if the system outperforms, you will not receive any share of the results.

It's not a narrative; it is system permission. The system operates independently; if you are not connected to this structural link, you naturally cannot obtain any portion of the structure.

2. Who is using it?

The Core X quantitative trading system calls strategies dozens of times a day, spanning multiple areas such as AI stocks, crypto chains, and tech ETFs. Each strategy execution consumes CXON on the chain.

The actual amount of CXON burned daily by the Core X quantitative trading system—this is not a figure from the white paper, but a record of on-chain calls. Behind every strategy action lies the message: "CXON has been consumed."

3. Why are we discussing this now?

There is no need for us to persuade anyone; on-chain behavior is already underway, strategy signals have been executed, and asset prices have already provided confirmation. Today is about verification, not promotion. If you are present, what you see is not hype, but structure being realized.

Today, the on-chain structure is stable;

System strategies are operating normally.

Cryptocurrency proxy stocks have led the way in halting declines and rebounding.

Fund flows within the system are beginning to reconfigure their return paths. It's not about "concepts being recognized by the market," but about real-world transactions being realized by the market.

Whether you are already part of the structure does not depend on whether you bought CXON, but on whether you have truly participated in the Core X quantitative trading system, used CXON, and bound the strategy execution path.

CXON isn't for betting on price movements. It's your ticket into the live trading system, your identity credential for locking in structural opportunities, and your gateway to participating in the system's profit distribution.

The real question isn't "how much is it worth now," but: Do you want to get in? Can you keep up? Are you willing to receive the actual results the system delivers?

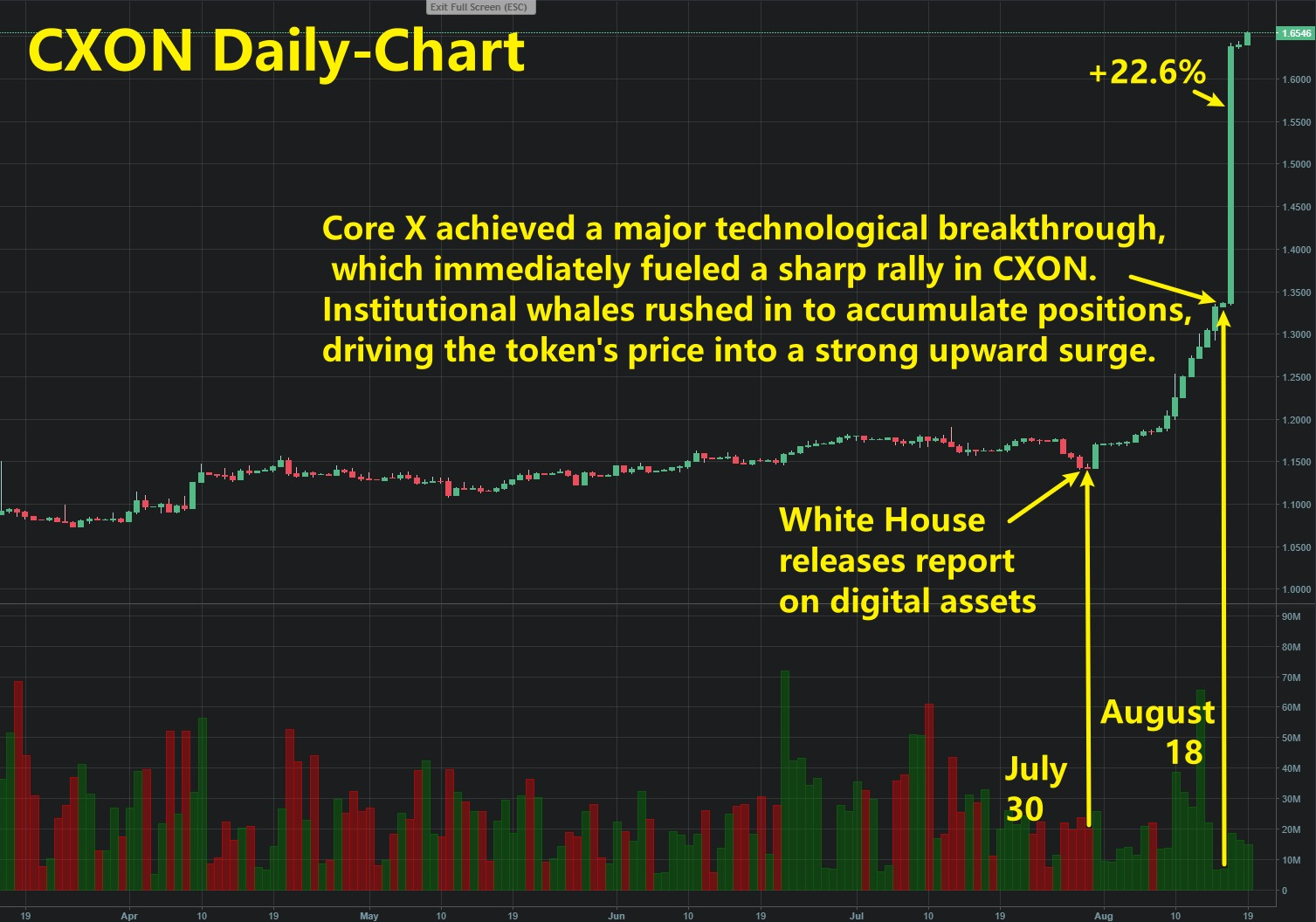

Half a month ago, CXON was $1.18, and now it's $1.65—not because it was "pumped up," but because the system is running live trades every day and burning it every day.

You can view it as a cryptocurrency, or you can see it as your ticket to enter the system, receive dividends, and obtain execution permissions.

In 90 days, if it reaches $10, you might not regret not buying it, but you might regret that you had the chance to enter the system before it closed its doors.

What we're discussing today isn't about price fluctuations, cryptocurrency narratives, or the illusions of capital sentiment. We're talking about a real, functioning system that operates on the blockchain every day. It's not designed to predict the market but to participate in, validate, and realize the structure. CXON is the execution credential for this structure—the sole entry point to access the real revenue pathway.

As the on-chain structure begins to materialize, will you continue to observe from the sidelines or start participating?

"I don't seek the understanding of others, but only that when the truth is revealed, I stand in the right place." — Jesus.

Two questions for those who listened carefully today:

1. If CXON truly reaches $10 in 90 days, would you prefer to have been an early participant in the structure or to stand outside calculating whether it's still worth pursuing?

2. As the system executes strategies on-chain daily, burns tokens, and generates structural behavior, would you continue to understand the market through news headlines or join a proven financial engineering system?

Finally, thank you for taking the time to listen to this account from within the system. Send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

We don't chase the light; we build structures that can shine. You don't need to believe every word we say, but remember: on-chain behavior doesn't lie.

I'm Bird Grant from NextLeap Management Consulting, nicknamed the Profit Hawk. See you tomorrow.