August 22, 2025

August 22, 2025

It's Friday morning before the market opens, and we've already seen positive upward momentum in stock index futures. What factors are driving this rally?

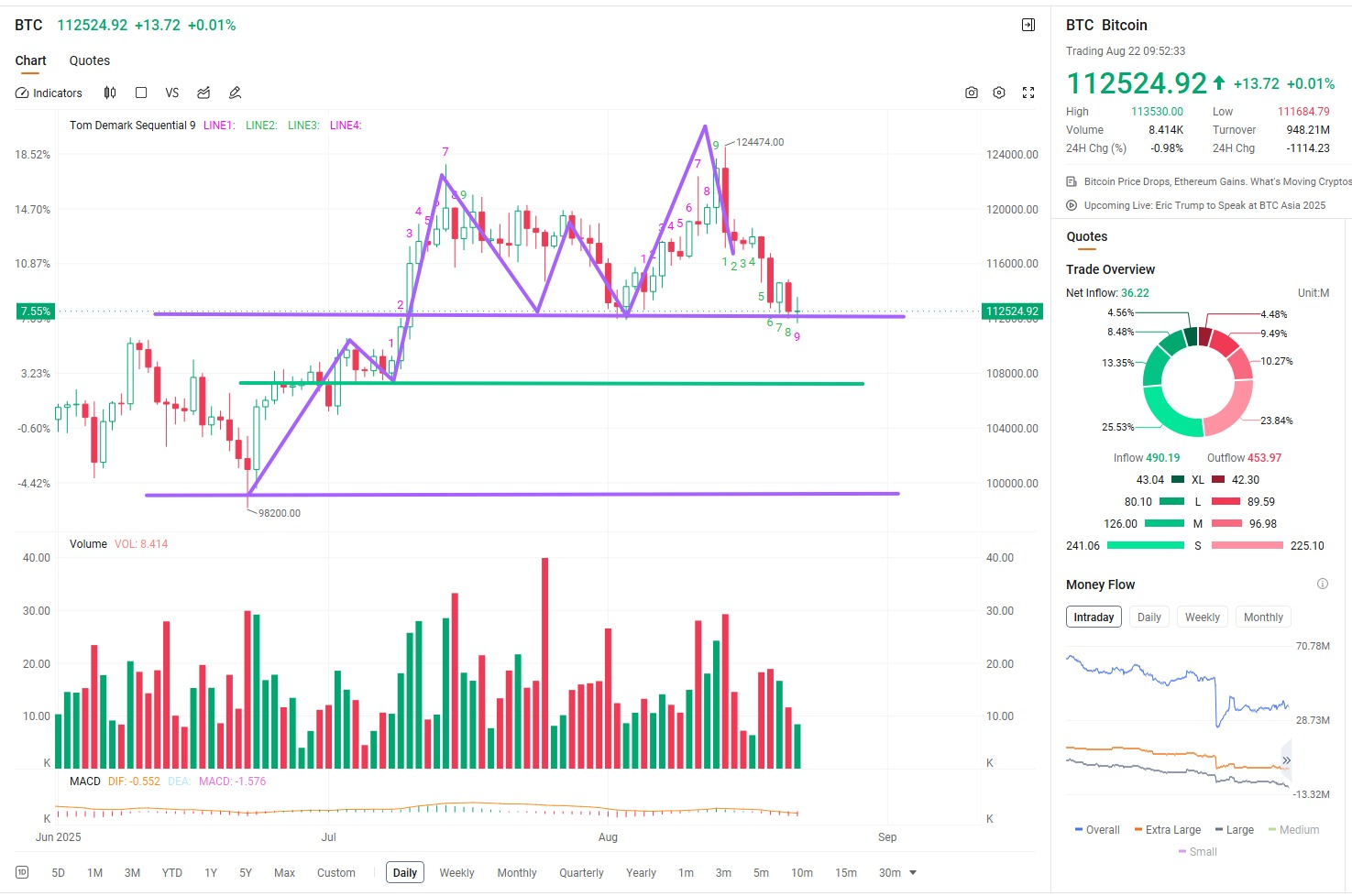

Meanwhile, digital currencies, especially Bitcoin, are also showing signs of a comeback. What forces are driving this? These are the questions we will explore today.

More importantly, around 10 a.m. today, Federal Reserve Chair Jerome Powell will deliver a speech at Jackson Hole. This will be one of the most closely watched moments for the market. His remarks could bring investors greater certainty and confidence, or they could lead to a true “climactic showdown” in the market. Friends, are you ready?

I want to remind everyone: This is a historic moment. Being able to witness the market dynamics leading up to each Federal Reserve rate cut alongside you holds great significance for me. What does this mean for you? Is it a learning opportunity? A turning point for wealth? Or a moment to redefine your investment perspective? The answers lie within today's session.

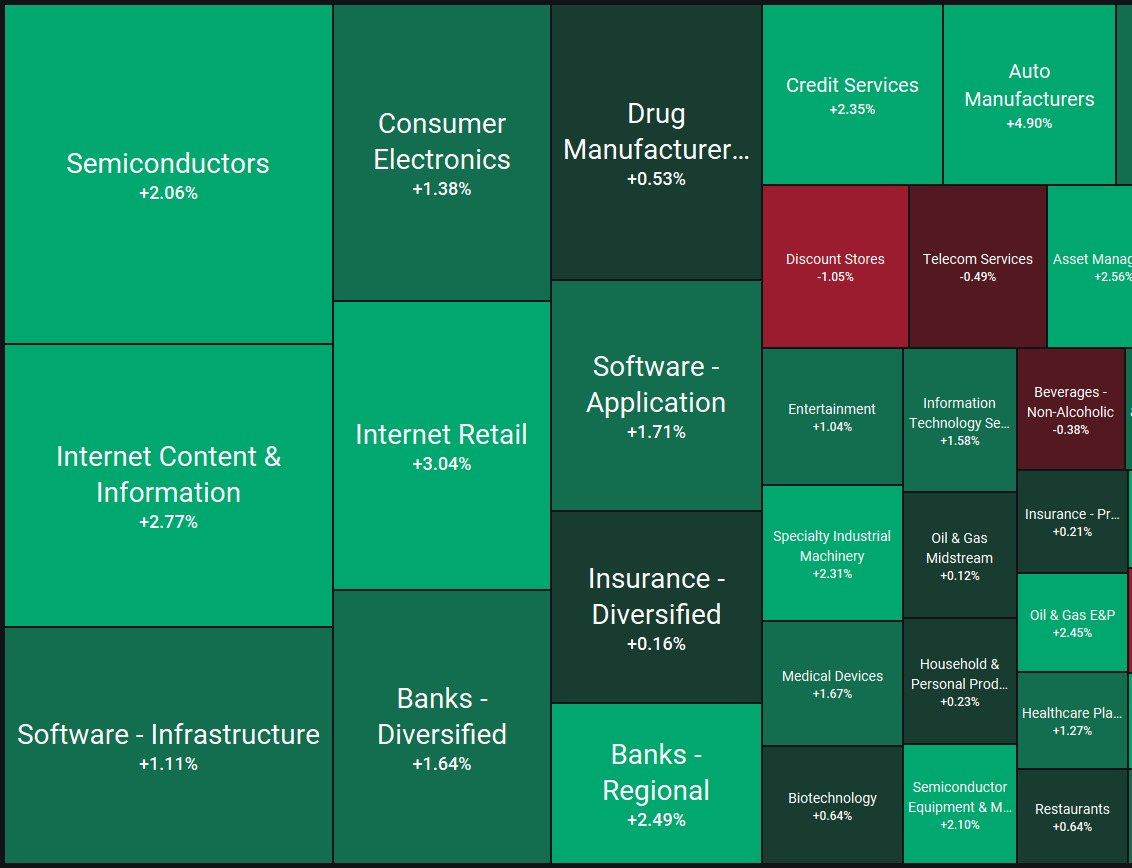

Due to the rapid decline in the VIX fear index after the market opened, the market has already picked up on some important signals. Based on the current benchmark interest rate level, the market estimates that long-term interest rates should be cut by approximately 1.75%. This is driven by statements from other Federal Reserve officials, which investors interpret as indicating that the magnitude of the rate cut may exceed expectations. This is undoubtedly the key factor driving the rise after the market opened on Friday.

However, I would like to remind everyone: the real focus remains Powell's remarks. The market's premature realization of positive news is not entirely a good thing, as it may cause short-term volatility due to “news exhaustion.” However, the positive side is that this at least hints at a glimmer of hope, suggesting that Powell's remarks are likely to convey positive guidance. For us, this is precisely the right time to hold or even increase positions.

So the question arises: how should we approach Friday's trading?

Several Federal Reserve officials have already expressed support, and although the market has seen some pullback, it remains focused on the expectation of “significant rate cuts.” Based on historical experience, Powell's remarks often serve as a precursor to policy signals, making his speech this Friday particularly important.

Moving forward, we should monitor several key data points:

July PCE Price Index: Released at the end of the month, inflation data will directly influence the magnitude of rate cuts;

August Nonfarm Payrolls Report and Inflation Data (early September): This is a critical variable that could tip the scales; if the data deviates significantly from expectations, the market may experience sharp volatility;

September 17–18 FOMC Policy Meeting: The final decision on whether to cut rates and the magnitude of the cut will be made.

This also means that from now until September 18, U.S. stocks will largely trade around the “rate cut expectations.” Meanwhile, the tail end of earnings season may also present new opportunities. For example, NVIDIA will release its earnings report on August 28. Regardless of the results, the market will focus on third-quarter expectations.

Finally, I would like to remind everyone: the flow of hot money is also worth watching. When funds flow out of U.S. stocks, it may drive a rotation rally in safe-haven assets like gold and cryptocurrencies.

The overall direction of the US stock market has largely been set. What the market is truly concerned about now is not whether interest rates will be cut, but by how much. This is what is known as “expectation management” — the ability to keep investor sentiment and expectations within a reasonable range is a hallmark of a mature market.

In my personal judgment, under the current macroeconomic environment, the US stock market as a whole does not face significant short-term issues. However, it is important to note that as subsequent economic data is gradually revised, especially after inflation and employment data are released, the market may re-adjust valuations. At that point, the currently high-flying tech stocks may struggle to maintain their strong upward momentum.

According to historical data from CoreX, the U.S. stock market has historically followed a pattern of “more gains than losses” around the time of the Jackson Hole Global Central Bank Symposium hosted by the Federal Reserve. This year's schedule follows the same pattern: Thursday typically features the opening banquet, while the more significant workshops and roundtable discussions begin on Friday.

Therefore, Powell's remarks are of critical importance. I believe he will provide sufficient reassurance on this topic today, which could boost market confidence. Based on historical experience, we may witness another round of upward momentum triggered by the Jackson Hole Symposium over the next two weeks.

Personally, I expect Powell to assure the market that the Federal Reserve will begin cutting interest rates in September. However, he is likely to remain vague about the magnitude of the rate cut, avoiding a clear statement on whether it will be 25 or 50 basis points. For example, he might say, “We will first adopt a gradual pace of rate cuts; but if the labor market weakens further, the Federal Reserve is ready to accelerate the pace at any time.”

Therefore, there is no need to overly worry about a significant market decline on Friday. The overall trend remains bullish for stocks. The only uncertainty may stem from market sentiment digestion over the weekend, which could lead to some volatility as investors remain cautious. However, this could actually present an excellent opportunity to add positions or make purchases.

The distinctive feature of my predictions is that I always anticipate things that will not come to pass...

...partly because the market can influence expected events...

...reflexivity does not have predetermined outcomes; outcomes are determined by the evolution of the process."

1. Only unforeseeable things are risks; risks that are predicted can actually influence the occurrence of negative outcomes.

2. All “predicted” risks have already been priced in and are reflected in stock price movements. Therefore, the saying “the candlestick chart contains everything” is not entirely without merit.

3. So-called “reflexivity” refers to how prevailing opinions can influence the course of an event itself, potentially reinforcing trends or, conversely, preventing risks from materializing due to collective anxiety over them.

On Friday, we will witness the success of this prediction! More importantly, how have my held stock strategies performed?

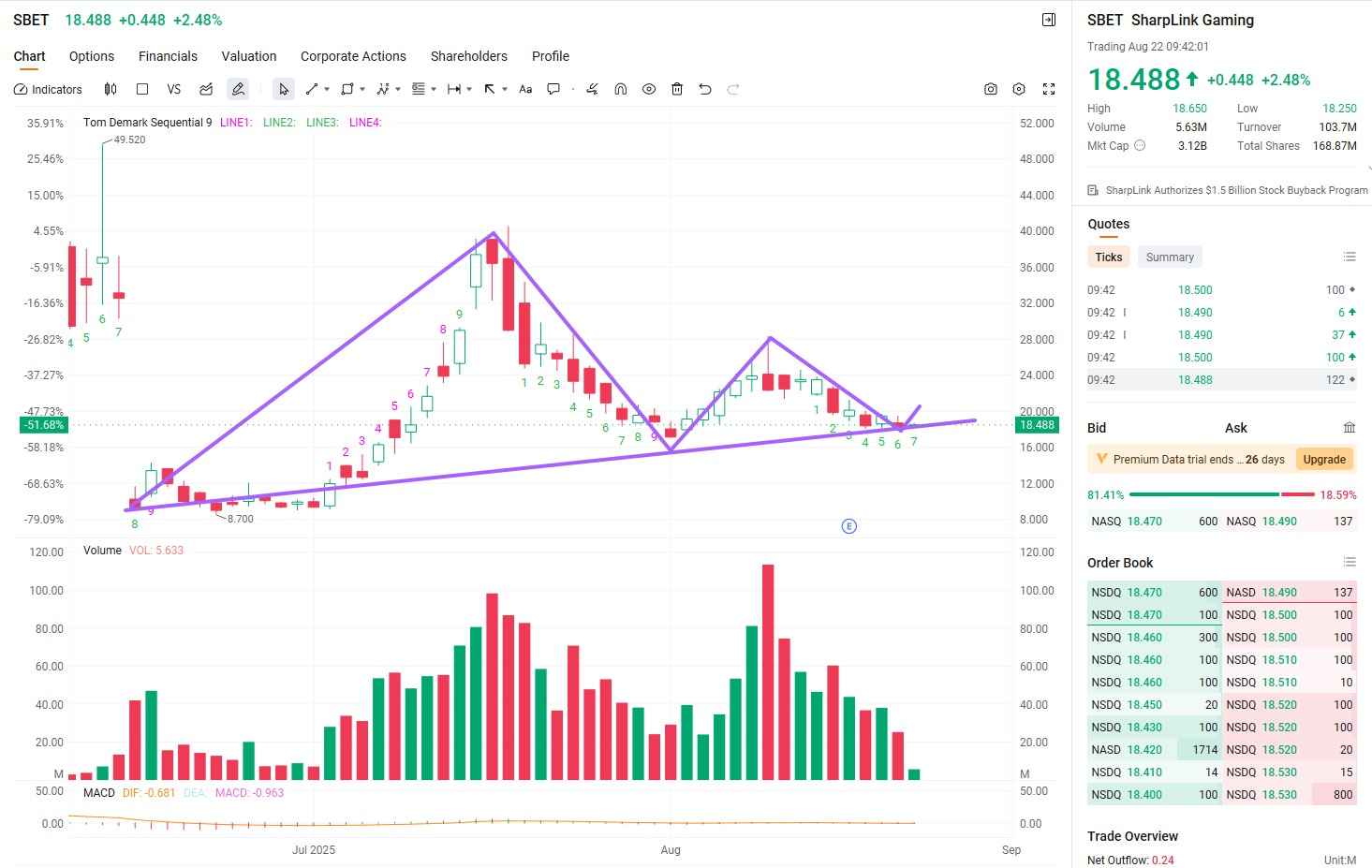

Continuous accumulation + holding: $SBET, $BTBT, $MSTR

Friends, I emphasize these three assets because they are all likely to be the biggest beneficiaries of this round of interest rate cuts. Why are Bitcoin and digital assets receiving so much attention in a rate-cutting environment? The logic is clear: falling interest rates not only increase the price elasticity of bonds and derivatives but also release more liquidity, driving up the valuations of risk assets, particularly cryptocurrencies.

Since the Fed began raising rates in 2022, digital assets have undergone a significant correction. However, over the past three months, Bitcoin has rebounded by +20% to +25%, and Ethereum has risen by +15% to +20%, indicating a return of market confidence.

The real key lies ahead: once the Federal Reserve clearly signals rate cuts, the upward trend for BTC and ETH will continue, and CXON tokens will迎来 a new round of stronger momentum. By aligning with our CoreX 40/60 investment portfolio strategy, you can capitalize on this cyclical wealth opportunity.

Friends, have you got it?

As shown in the chart, Bitcoin is currently still in the mid-term phase of its upward trend. According to the reasoning and identification from CoreX's Nine-Turn Chart, we are currently at approximately the 7th upward signal. Based on historical experience, it is often not until the 9th signal appears that a trend reversal may occur. This is the powerful reference value that data reasoning provides us with.

Combining this with the macroeconomic environment, interest rate cuts often lead to capital flowing out of dollar-denominated assets. The era of relying on high interest rates is coming to an end, so where will this capital flow? From a market logic perspective, digital currencies, especially Bitcoin, are gradually becoming the “best investment destination” in global asset allocation. While gold is also a safe-haven option, it lacks the global blockchain ecosystem and spirit of freedom that Bitcoin possesses, making it difficult to achieve the same scale in this round.

Do you want to own this star? Even if you own $MSTR, it is still an indirect way to own BTC. This is the choice of the wise winner.

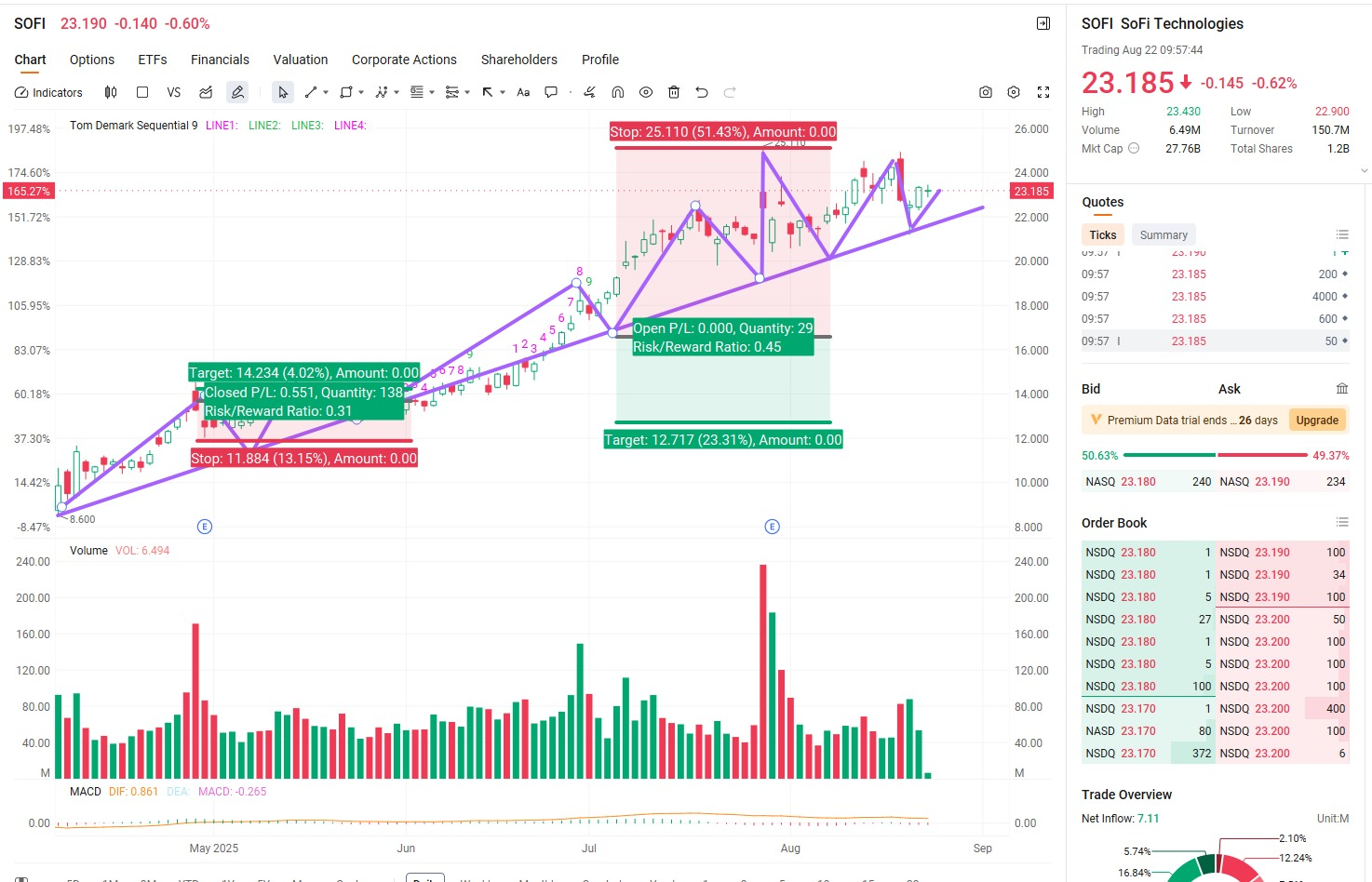

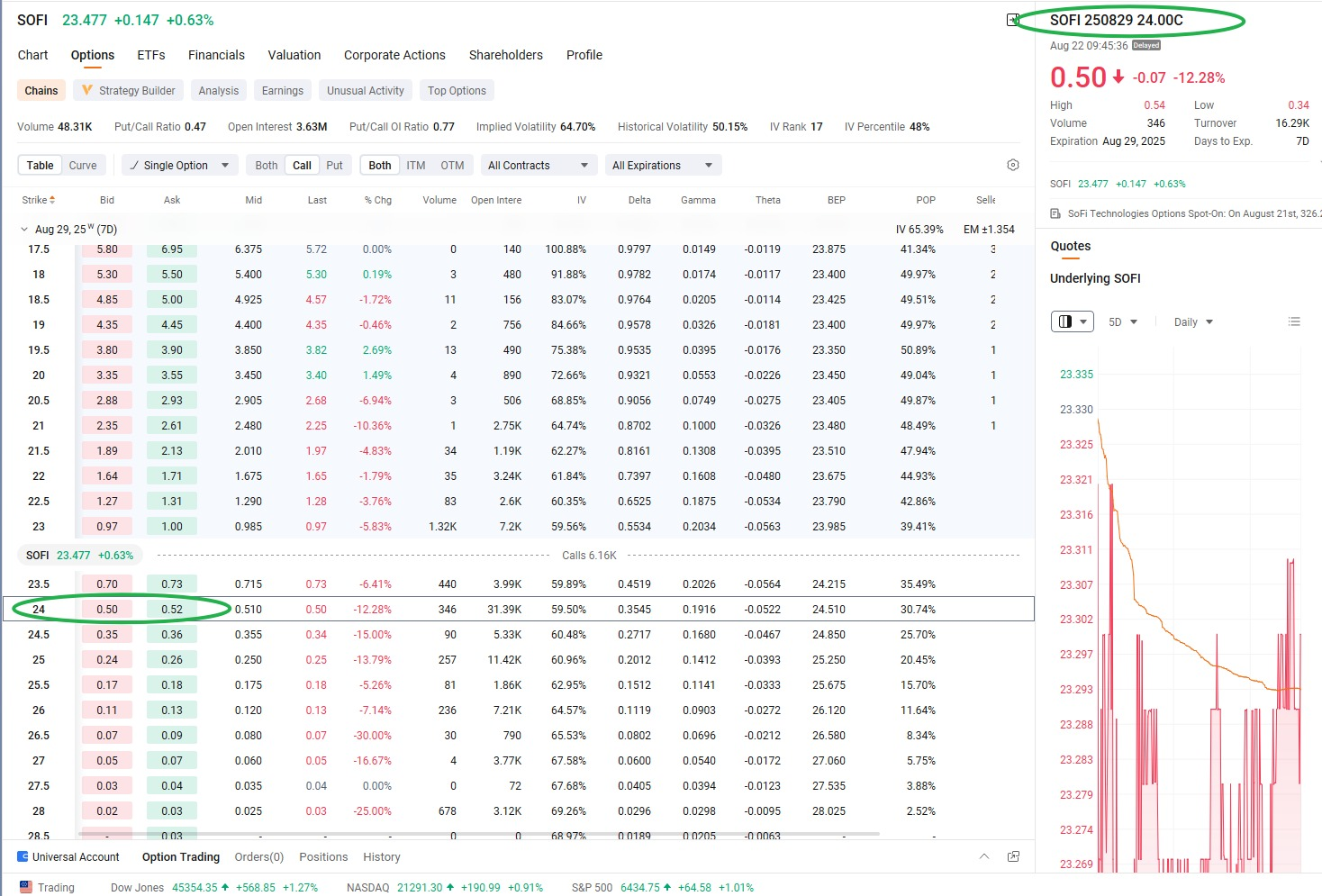

Friends, today we are no longer limited to buying stocks, but are participating in the market in a more flexible and interesting way—that is, through options trading.

From a market perspective, US stocks are under pressure overall: Walmart's earnings warning dragged the Dow down by about 0.3%, while the S&P and Nasdaq also saw slight declines; at the same time, Bitcoin fell to around $112,700. Risk sentiment remains present, but tech stocks are experiencing greater volatility due to fluctuating policy and earnings expectations, which presents an opportunity for us to capitalize on.

Rather than blindly buying stocks, it is better to participate through options. SOFI's technical chart is in a low-range zone, offering value for swing trading. Our signal today is:

BUY SOFI 2025-08-29 24.00 CALL

We recommend participating with 5–30 contracts, with the current premium around 0.5 USD.

The advantage of this approach is: using limited costs to speculate on short-term volatility rather than risking a heavy position in the underlying stock. Remember, the key to options trading is to control position size, set stop-losses, and make investing a rational pleasure rather than gambling.

Options Trading Strategies Explained

From a technical perspective, SOFI has seen multiple historical buying opportunities within the $20–$22 price range, indicating that a consensus has formed among market participants regarding future expectations. In other words, this price range is often viewed by investors as a “margin of safety,” providing a certain level of emotional support.

This time, we are not positioning ourselves based on the company's fundamental performance growth but rather leveraging market sentiment fluctuations for our operations. Therefore, participating through options trading is a more prudent and secure approach—using a small investment to speculate on short-term market movements.

Of course, the greatest risk is the loss of premium. The amount you invest depends on how many options contracts you purchase, and risk and reward are always proportional.

I have demonstrated this strategy multiple times in class. Interested students can review past lessons and combine today's case study to deepen their understanding.

Alright, everyone!

In the midst of a strong rebound in global markets, we have successfully navigated this week—from Monday to Thursday, and now today, each step has been taken with confidence. The market has already signaled that a rate cut is inevitable, and the focus now shifts to the magnitude of the rate cut.

Several key indicators deserve special attention:

PCE inflation rate: As of June, it stood at 2.6%, with core PCE at 2.8% and the Dallas Fed's trimmed PCE at 2.7%. The next data release is scheduled for August 29.

Nonfarm payroll report: The next report will be released on September 5 at 8:30 AM (Eastern Time), with July showing 73,000 new jobs and an unemployment rate of 4.2%.

Cleveland Fed forecast: August annualized PCE may be 2.74%, with core PCE at 2.92%, indicating that while inflation remains above target, there are signs of moderation.

These data points are the “ticket” for future rate cuts. They will determine how the market adjusts its expectations and which sectors will lead the way.

Today's steady trading stems from our advance preparation. Remember: Those who win in the future are those who start preparing today.

I will continue to await your timely arrival at next Monday's forum. See you soon, friends!

Let's rewind to the first season of Game of Thrones, when Westeros had not yet descended into all-out civil war. The North remained neutral, the White Walkers had just appeared beyond the Wall, and King's Landing was still immersed in superficial prosperity and power struggles.

North of the Wall, the Night's Watch patrols encountered the White Walkers and the wights. It was not some "visible crisis" in the market, but rather a breakdown of the underlying structure: capital had no direction, traditional models failed to predict outcomes, and macroeconomic signals were chaotic. It's the "White Walker" of modern finance—systemic risk, behavioral misalignment, and disordered pricing mechanisms—a true reflection of market conditions from last Friday to this Thursday. And you'll find that while most people are still scrolling through news headlines, panic and fear have already taken hold within the market.

By the time analysts start talking about a "turning point," the chain has already begun executing. The Federal Reserve is publicly discussing the possibility of decentralized systems at Jackson Hole, Wall Street fund managers are huddled around iPads studying the Core X quantitative trading system, and the market is beginning to respond to structural data. Just as no one initially believed in the White Walkers, no one paid attention to on-chain behavior when it first emerged. But once you see the tokens it burns, the funds flowing in, and the strategies being executed, you realize—this isn't prophecy, it's a system already in operation, and one that underwent a significant upgrade on Monday: the Core X system.

Today's rebound is more like a scout returning than a victory signal. The $SBET, $BTBT, $MSTR, and $WULF you see may not be the strongest or most popular, but they were the first to return to the structure, bringing back real signals: capital is in motion. Their rebound from the downturn is like the chill brought back by night walkers, indicating that capital is indeed entering the chain. It's not a full-scale outbreak, but it is the part where the Core X quantitative trading system first senses, capital first follows, and the structure first repairs. It indicates that strength is not an isolated occurrence in individual stocks, but the result of on-chain behavior and capital feedback working together.

Today, if you are still standing on the sidelines, watching to see if this will collapse, you have already missed the structural validation phase of the Core X quantitative trading system. But if you have joined the ranks, you already know: the focus of the story is not about how much you earn, but about entering the structure and securing your own share. This is not fantasy. It's the on-chain reality unfolding before us.

Good afternoon, everyone. It's Bird Grant . I am the co-founder of NextLeap Management Consulting, also known as the "Profit Hawk." Today's market performance can be summed up in one word: clean and strong. Our portfolio is also performing well, with several holdings rising in tandem. It's definitely a Friday worth celebrating.

Just this morning at 10 a.m., Federal Reserve Chair Jerome Powell delivered his official speech at Jackson Hole. While his language remained cautious, the market picked up on the key signal: "If the data permits, we are ready to act."

The market has begun to react to the possibility of a rate cut in September: the S&P is rising, the Nasdaq is rebounding, the dollar is weakening, and capital is flowing into risk assets. For those who have already positioned themselves, this market movement is not a surprise but a validation.

The system had already flagged structural repair signs in several key targets after the market closed the previous day, with $SBET, $WULF, $BTBT, and $MSTR all entering accumulation zones. The reversal model, trading density, and capital control pathways were all clearly visible on the charts.

As we mentioned yesterday, confidence isn't something that comes after the market moves; it's naturally generated after the system identifies the path in advance.

In his Jackson Hole speech on Friday at 10 a.m. Eastern Time, Powell hinted at a possible rate cut in September. Still, his tone remained cautious, emphasizing that decisions will continue to be data-driven. Despite signs of weakness in the labor market and inflation not yet returning to target levels, he reiterated that political considerations would not influence policy decisions. Upon the speech's release, the market reacted positively: stock prices rose, the dollar and bond markets moved in opposite directions, and expectations for a rate cut significantly increased.

In his speech today at Jackson Hole, Powell delivered the most critical statement: "Current interest rates remain restrictive, and as the economic outlook evolves, we may need to adjust our policy stance."

The market immediately understood—this was effectively giving the green light for a rate cut in September. Especially given the recent significant downward revision of the nonfarm payroll data and the fact that inflation has not yet thoroughly cooled, this statement directly confirmed the "rate cut expectations." The stock market responded positively: buying activity returned, and prices rose.

Four key points to remember:

The window for a September rate cut has opened. Although not yet confirmed, the Fed's stance has shifted from a wait-and-see approach to adjusting based on data.

The labor market has become the new focus.

Powell described the current employment situation as "simultaneous weakness in both supply and demand," and any imbalance could lead to a rapid deterioration.

Inflation persists but remains manageable.

The Fed does not want a one-off price increase triggered by tariffs to evolve into a structural inflation issue, but the current risk remains within manageable limits.

The tone is cautious, but the direction has shifted.

It's classic language signaling a shift "from defense to preparation for offense"—while not explicitly stating a rate cut is sure, the Fed has begun "preparing for a cut."

Within a few hours of the speech ending, several stocks marked by our system began to show signs of low-volume trading, platform reversal, and structural reconstruction.

It's not emotional hype, but rather capital beginning to test which stocks can withstand the expected decline in interest rates in the future.

The focus in the future is not on price fluctuations, but on which structures are starting early and which are being repaired.

Today, I will analyze the behavioral patterns of four key stocks: $SBET, $BTBT, $WULF, and $MSTR. Themes do not drive these, but are behavioral reactions identified by the system.

Learning to read structures, identify behaviors, and capture sustainable trends is far more critical than chasing hot topics.

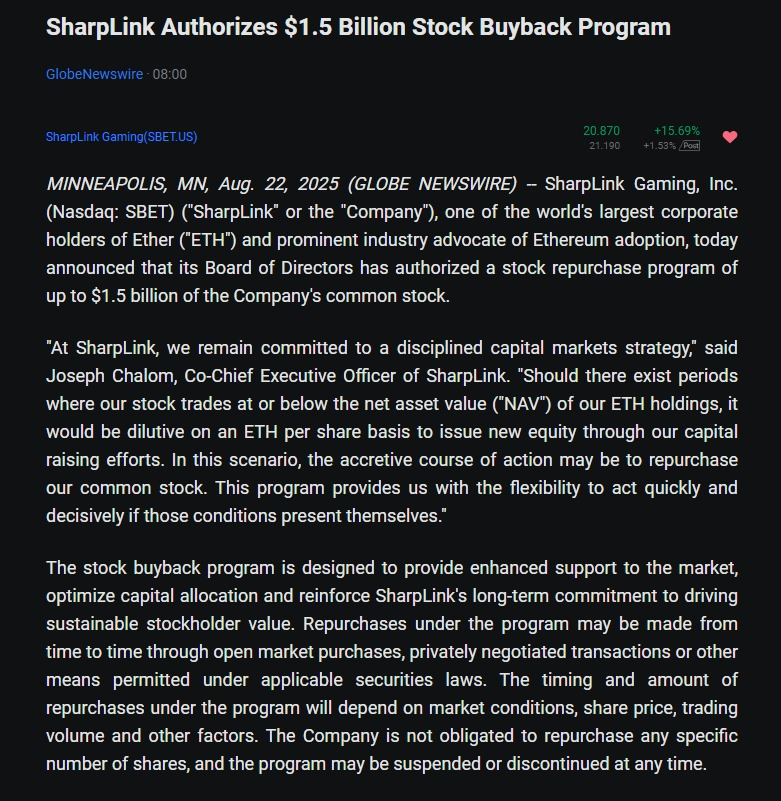

$SBET – SharpLink Gaming

Today is the day for verifying the Core X quantitative trading system. As we mentioned yesterday, it has entered the "structural reconstruction + control testing" phase. Yesterday's pullback confirmation and late-session rebound validated our assessment.

The pullback held the $17.8 price range's dense trading zone, and the closing price reclaimed the $18.2 level—this is an obvious secondary confirmation structure.

The key lies in maintaining control over the rhythm, not the magnitude of the rally. The system identifies this as a "high-quality reversal path continuing." Today, with increased volume, it broke above $20.3, entering an active attack phase.

$ SBET's breakout today wasn't just a technical move — two major catalysts fueled it. First, the company announced a massive $1.5 billion stock buyback program, giving investors a clear signal of confidence and capital discipline. Second, Ethereum ($ETH) ripped to new highs with heavy volume, and since SharpLink is one of the largest corporate holders of ETH, the stock acted as a proxy trade on ETH's strength. When a name lines up both structural setup and real-world catalyst, that's when the system lights up — and that's precisely what happened with SBET today.

$BTBT – Bit Digital

Today is a typical case of "delayed reversal + behavioral correction."

Yesterday, we noted that the structural prototype was incomplete. However, after opening lower and retesting the $2.55 area, we found obvious support. In the afternoon, the price steadily rose and closed above the $2.70 range, beginning to fill yesterday's breakout platform.

It does not yet qualify as a strong primary uptrend structure, but from a system identification perspective, it has taken the first step toward "bottom formation + behavioral restructuring." As long as it does not break below $2.8 tomorrow, it can still be considered part of the short-term continuation setup.

$WULF – TeraWulf

$WULF did not exhibit a strong upward trend today but rather a clear capital test. The stock opened with a rapid surge but failed to sustain the momentum, subsequently fluctuating and declining throughout the day, closing below the VWAP. It indicates that capital remains in an observation phase rather than a strong offensive. Despite the price giving back its intraday gains, the system retains its identification label within the "control test" structure. We explicitly highlighted this stock for re-evaluation yesterday, and today it provided a high-quality opportunity with nearly a +9% intraday gain. The system's status remains "structurally intact + consistent capital behavior," qualifying it as a high-conviction setup worthy of continued monitoring.

The closing price of $9.16 validated what we mentioned the previous day: "high system score + structural integrity + genuine capital involvement." The key to such stocks lies in their trajectory, not short-term fluctuations. It is now clearly on the path of trend construction following the reversal.

Tomorrow, continue to monitor whether there is increased volume above $9.30, indicating entry into the main upward trend setup.

$MSTR – Strategy

It's is a classic high-beta strategy name currently undergoing structural validation. Yesterday's dip to $334.85 didn't break key support—it held. That intraday support set the stage for today's recovery move, closing back above $337 and starting to rebuild the broken setup from earlier in the week.

Core X identifies this as a "sentiment-driven name showing strategic accumulation." In other words, this isn't just noise. The price action is orderly, the capital flows are intentional, and the structure is regaining form. The next key level to watch is $345—if MSTR can push through on volume, the setup transitions from repair mode to breakout development.

Three out of these four stocks closed significantly higher today. However, the assessment criteria lie in structure, behavior, and sustainability, not merely in price fluctuations. Price movements are merely outcomes; the key question is: Did you anticipate the structural repair and behavioral validation in advance?

If you are still chasing price movements, ask yourself honestly: Did you truly recognize the structural changes, or did price movements merely draw you in?

Old friends who received the system signals yesterday and entered the market accordingly naturally reaped profits today, but what I really want to emphasize is that new friends didn't miss out on the opportunity either. As long as you understood my teachings on $SBET, $BTBT, $WULF, and $MSTR yesterday, and acted decisively at any point during today's morning session, any of these stocks would have yielded substantial profits.

The key isn't whether you bought or not, but whether you understand the logic behind the move and whether the trend can continue.

If you can understand, see clearly, and keep up, you're already in a stronger position in the market. On the other hand, if you're still hesitating, that's okay—the Core X quantitative trading system will never think you're too late; it only cares whether you're willing to understand honestly.

Whether you're an old friend or a new member, the underlying logic I'm discussing today is actually very valuable to every trader. It's not something I'm casually bringing up; it's the result of over three decades of practical experience in the market, distilled bit by bit.

If you find this easy to understand, keep it up and pay close attention to the daily educational content in our community. You'll discover that actual improvement doesn't come from inspiration, but from understanding the structure and grasping the key points.

But if you feel a bit overwhelmed or find the content a bit complex, don't worry. We designed the Core X quantitative trading system specifically to help you stay steady during such times.

Every buy or sell signal from the system is rooted in the core logic of the trading models developed by me and my mentor, Blake Shaw, over the years, fully embedded in the system's code. You don't have to spend time searching for assets or memorizing patterns—follow the system, and you'll be making decisions with our perspective, using our experience to manage risks and seize opportunities.

You can choose to learn on your own or opt for the system's "hands-off" approach to keep pace—both methods share the same goal: to execute trades correctly.

However, the Core X Quantitative Trading System is more than just a set of rules; it is an intelligent system capable of self-learning, self-correction, and continuous improvement—constantly analyzing real-time data, tracking capital flows, and automatically optimizing strategy paths.

The Core X quantitative trading system is already in operation. Upswings don't just happen out of nowhere; they only reward those willing to pay the price.

Yesterday, we spoke of that night—Jesus did not flee from the cross. He knew that ahead lay humiliation, flogging, silence, blood, and pain. Yet he still walked step by step down that path destined for crucifixion, not because he was weak, but because he knew: someone must first endure suffering for resurrection to have meaning.

And today is the morning of resurrection. It is not a beam of light descending from heaven, but a system that, after continuous validation, behavioral compensation, and structural repair, has written the answer on the chain, on the price, and in the hands of those who genuinely believe and persist.

You see today's $SBET, $BTBT, $MSTR rising, and $WULF with a 9% profit margin in intraday trading—that's no coincidence. It's the system responding to signals from the previous day, the market validating our judgment, and the natural feedback that occurs after the structure is complete.

The Core X quantitative trading system doesn't tell stories; it doesn't stir up emotions or create noise. It simply reads behavior, identifies structures, and tracks real capital flows, one trade at a time. And CXON is the fuel for this execution—the team that doesn't shout slogans but moves forward in the darkness.

Today, I don't want to talk about price movements. I want to ask:

1. When the market was at its most painful, did you flee, or did you wait for the Core X Quantitative Trading System to bring you back?

2. Are you continuing to watch others' stories of revival, or are you beginning to write your own story of structural reconstruction?

Send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

I am Bird Grant. Today is a day of structural reboots, rising confidence, and rewards for actual executors.

I haven't left Jackson Hole yet. I just finished my lecture and decided to stay in this valley for the weekend.

Trading is not a race; it's about whether you're willing to pause at key coordinates, clarify your direction, take a step forward, and then patiently await the outcome.

The market is like the surface of this valley's lake—turbulent by day, calm by evening. But the true force never stops.

The system keeps running, and you should ask yourself: Have you completed your structural repairs this week?

See you on Sunday.