August 24, 2025

August 24, 2025

If you recall the first season of "Game of Thrones," Westeros had not yet descended into chaos. The old king occupied the Iron Throne in King's Landing, the North was still functioning in peace, and the threats beyond the Wall were dismissed as mere legends in taverns.

But some had already sensed something amiss—the Night's Watch lost contact for the first time, the White Walker howled across the snowfields, and Bran had that "dream he shouldn't have seen."

The market is now at such a turning point: on the surface, it appears calm, and some even say the bull market has returned; but if you can analyze charts and structures like the Core X Quantitative Trading System, you will discover: prices are forming confirmation patterns, behavior is shifting, and the direction of policy is slowly changing.

This week, we witnessed three key events:

Powell hinted for the first time at Jackson Hole that "current interest rates may need to be adjusted," opening the window for a rate cut in September.

Employment data continued to weaken, with "focus on employment" once again becoming the Fed's priority, marking a turning point in policy focus.

The market experienced a sustained downturn from Monday to Thursday. Still, after Powell's remarks on Friday, some assets began to form a reversal pattern, with increased volume confirming a preemptive recovery of the platform—not a full-scale breakout, but a localized initiation.

If you're focusing on the headlines, what you see is "temporary optimism"; but if you're using the Core X quantitative trading system, you've already seen: the underlying assets have started to move, behavior has strengthened, and CXON's on-chain consumption has begun to amplify.

Just like in the first season, no one believed Bran's dreams, no one cared about the Night's Watch's signals, but in the end, the ones who truly survived were those who were willing to believe from the start that the structure was changing.

This week, market attention extended from Jackson Hole to the global stage: policy signals, capital flows, asset sentiment, and technical triggers—everything is changing. And these changes correspond precisely to the four dimensions tracked by our system—macro signals, behavioral capital, asset structure, and sentiment pricing. Let's see how key news events confirm each of these:

Fed remarks spark market volatility.

On Friday morning Eastern Time, Powell hinted at Jackson Hole that "a rate cut in September is possible," though his remarks were cautious, they were still seen by the market as a signal. As a result, the Dow and Nasdaq both rose by approximately 1.89%, the S&P 500 rose by 1.88%, while the dollar and bond prices came under pressure simultaneously.

Global capital flows adjust.

According to LSEG data, global equity funds saw net inflows of approximately $2.27 billion this week, compared to nearly $19.29 billion in net inflows last week. In contrast, bond funds and money market funds remained active, recording sustained capital inflows.

ETH Becomes the World's Most Watched Asset

On August 21, Ethereum (ETH) surged from $4,200 to $4,880 in a single day, capturing global attention. Over the past 24 hours, its search volume and social media buzz have surpassed those of any stock or national asset globally, instantly making it the most closely watched trading asset worldwide. It's not just a price fluctuation but a true reflection of market sentiment.

Market Focus on NVIDIA's Earnings Report and AI Sentiment Trends

Financial media outlets are closely monitoring NVIDIA's upcoming earnings report scheduled for the 27th of this month, with the market widely expecting it to provide direct guidance on the AI chip sector and overall tech sentiment.

International Focus: India Hosts Leaders Forum

Over the weekend, Indian Prime Minister Narendra Modi will attend the "World Leaders Forum" to discuss global economic and strategic cooperation trends with foreign ministers and other international political and business leaders.

The key point is how these news items are structured, how the Core X quantitative trading system reads them, and how they are converted into the starting point for trading behavior.

When the policy window opens, structural opportunities arise — Powell's remarks serve as a signal point for the initiation of structural behavior. As we have consistently emphasized, the true advantage in trading lies in who first recognizes the onset of structural dynamics.

Changes in capital flows reveal behavioral preferences — Stock capital continues to flow out, but ETH saw a single-day inflow accompanied by a clean breakout. This divergence indicates that capital behavior is shifting from emotional tug-of-war to setup validation. Capital is saying: We want sustainability.

Tech giants remain the focus of short-term risks — NVIDIA's earnings report could either support short-term sentiment or trigger structural rotation; closely monitor price behavior before and after the data release.

Macro events drive institutional narrative effects — While the India Leadership Forum may not have a noticeable direct impact on markets, it influences long-term expectations for economic cooperation. It warrants attention in strategy models for sudden policy variables.

Behavioral structure shift: The market has shifted from sentiment-driven speculative sectors to structural validation zones, fully aligning with the path identification logic of the Core X quantitative trading system.

Real-time capture: The Core X quantitative trading system marked multiple assets ($SBET, $BTBT, $MSTR, $WULF) that completed bottom formation and saw significant volume rebounds on Friday, demonstrating that the Core X quantitative trading system truly identified the behavioral turning point in advance.

The reversal of these stocks is a direct result of system structure identification. The Core X quantitative trading system not only observes capital behavior in the market but also synchronously reads the real-time feedback of these structures on-chain.

This extension of structure identification is reflected in our on-chain asset CXON.

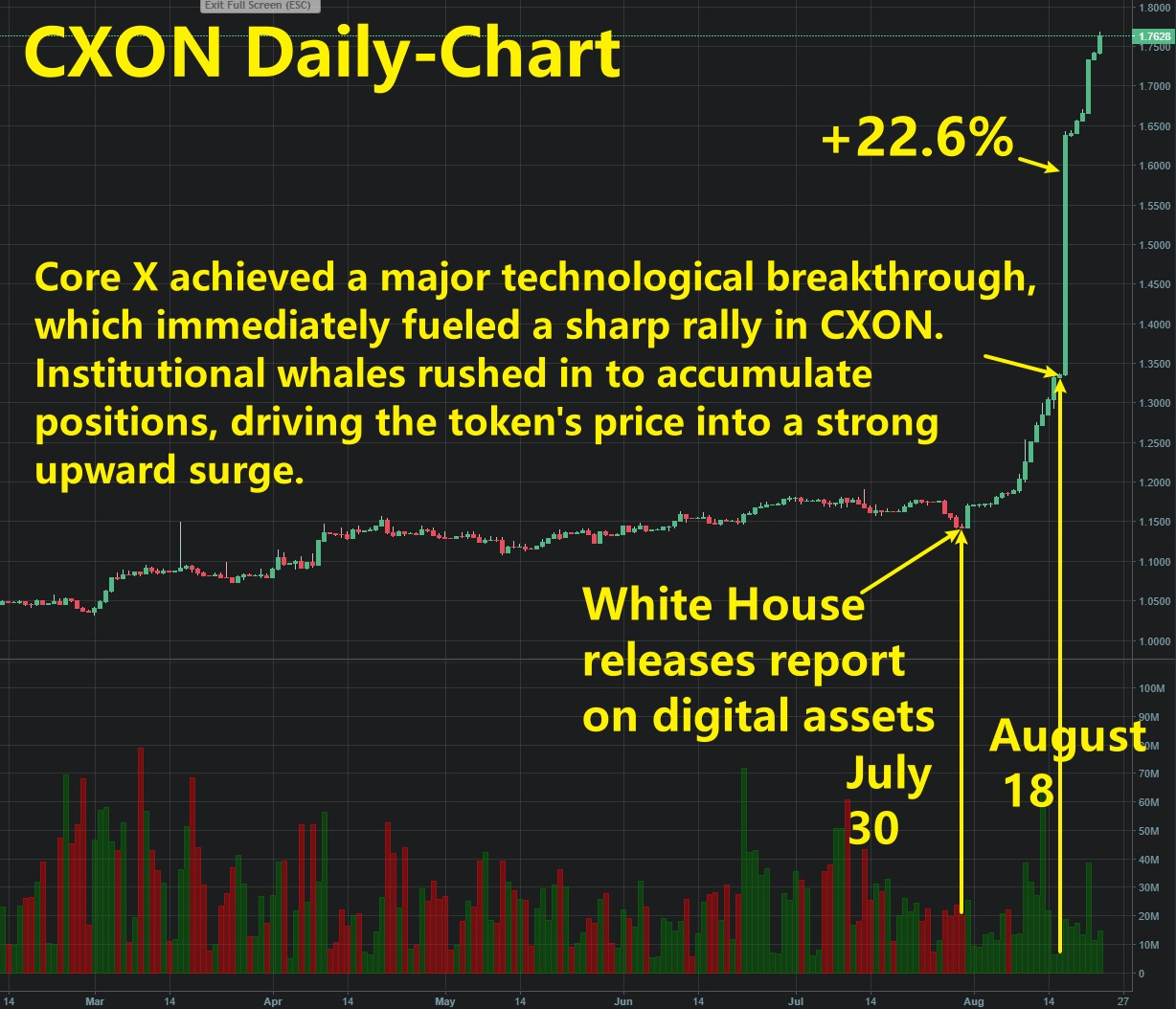

CXON: Following the upgrade of the Core X quantitative trading system, on-chain behavior is actively increasing.

Over the past 72 hours, on-chain data for CXON has shown significant changes: Daily active address count (DAA) has been steadily rising:

Following the system upgrade, the number of wallets interacting on-chain has significantly increased since Monday, reaching a two-week peak on Friday, indicating that an increasing number of strategies are beginning to re-invoke the Core X quantitative trading system interface.

Token consumption has increased: Daily CXON usage has steadily risen, primarily concentrated in the strategy trading module and real-time data reading layer, indicating not only an increase in active users but also a rise in "system calls with trading activity."

Clear signs of capital inflows: Some medium-sized wallets have begun to reinvest, with on-chain activity showing three consecutive days of large-scale, batch-based purchases, aligning with the typical "test + position-building" trading pattern of structural capital.

Price breakout in initial structure: The current price of $1.76 has formed an initial higher-low + breakout attempt structure, with the system currently in the acceleration phase of this structure.

Let's put it more bluntly: the current CXON price is $1.76, and based on our system strategy call frequency, token on-chain consumption growth rate, behavioral inflow magnitude, and daily transaction structure regression model projections, our target is to reach $10 within 60 days. This price is based on a complete "system behavior → market feedback → token price" closed-loop logic. The key point is that this setup is already working, and the data is confirming it.

You can choose to wait a bit longer. But you also need to think about one thing: in 60 days, when the market really pushes it up to $10, will you tell yourself, "Good thing I bought early," or will you have to start chasing it again at a higher price?

The system has completed its upgrade, usage is on the rise, and on-chain activity is amplifying—and your position is critical. You can choose to observe, but please be clear: in 60 days, the price the market offers may no longer be available to you.

If you understand this mechanism, you know what to do next; if you're still unsure, that's okay—you can fully participate first and use experience to validate every structural judgment we've made.

By the way, a quick reminder: The first wave of early adopters in the community purchased CXON for 1.17 from August 1st to August 4th, while the second wave established their positions at around 1.33 before the Core X system upgrade. Looking back today, they are all already in the profit zone. Are you still just reading news headlines, waiting for the market to run its course before acknowledging its strength? Or are you willing to take the initiative now, using a structured approach?

Tomorrow, we will continue to track CXON's on-chain path and also explain how to leverage the system's analysis—not as speculators, but as structured participants. Are you ready?

In the Gospel of John, Jesus said, "The truth will set you free."

It's not a religious declaration but a reminder of structural choice—true freedom is never found by following the crowd but by being willing to walk ahead into the unknown.

What you see today is not just price fluctuations or system accuracy, but a profound structural awakening. In this system, every action has a basis, every judgment is rooted in reality, and every participant faces a question:

1. Are you willing to believe in the underlying structural logic of CXON?

Just as you chose this week to trust the structural integrity and authenticity of $SBET, $WULF, $BTBT, and $MSTR—they activated after being marked by the system and naturally rose on Friday because the logic was aligned.

2. Are you willing to take the first step before most people have figured it out?

Because you understand the mechanism of structural activation, you are willing to stand at the actual inflection point and make a choice supported by your understanding.

Send your answers to your investment education advisor for a chance to receive CXON token airdrop rewards!

If you're ready, we'll meet tomorrow on the CXON and Core X quantitative trading system chain; if you're still hesitating, that's okay—the system will always be there, waiting for you when you're ready.

I'm Bird Grant. Thank you for joining me through this week's structural validation moment. We'll continue moving forward tomorrow.