August 3, 2025

August 3, 2025

The winds of innovation have always swept through our Capital Markets, sometimes like a hurricane. In 1792, it stirred the leaves of a buttonwood tree under which more than two dozen stockbrokers gathered to sign an agreement, creating the precursor to the New York Stock Exchange. That handwritten, parchment document, consisting of less than a hundred words, inaugurated an elegant system that has governed the order of capital flows for generations.

The above paragraph is a speech by Paul S. Atkins, Chairman of the U.S. SEC, delivered on August 1, which is a deep tribute to the evolution of the financial order and system, a section of the capital market civilization of the grand opening. He stated that the U.S. aims to establish a global crypto capital, reform the securities regulatory framework, and transition financial markets to the chain. What an ambitious project this is, and it makes me believe in the phrase, Make America Great Again!

Just the right amount of sunshine to shut up the market - good afternoon, everyone! I'm Bird Grant from NextLeap Management Consulting LLC, nicknamed Mr. Profit Hawk.

Let's take a look at what happened in the financial markets this week.

The key word for this week's market is not "higher", but rather structural adjustment and momentum switching: S&P 500 ($SPX): down about 1.4% for the week, closing lower for several consecutive days, with significant outflows from the tech-heavy sector; Nasdaq ($NDX): a much larger adjustment, down nearly 2% week-over-week, with the AI sector under pressure to retrace its highs; Dow Jones ($DJI): relatively resistant to the downturn, but dragged down by the financial and industrial sectors, closing slightly lower on the weekly basis.

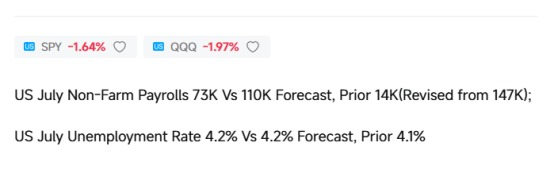

Core X quantitative trading system of the market signal interpretation: this round of retracement is not a panic kill, more like the previous strong plate into the realization period, while superimposed on the policy expected to disturb the result. At the data level, this week's non-farm payrolls data was cold, significantly lower than expected. The unemployment rate also rose significantly. The market quickly adjusted to the expectation of interest rate cuts, causing safe-haven assets like gold, U.S. bonds, utilities, and other sectors to attract funds. At the same time, crypto assets and their related proxy stocks moved significantly this week, becoming the most active category in the process of capital switching.

The resignation of a Federal Reserve governor and the dismissal of the Bureau of Labor Statistics commissioner signal potential shifts in policy direction and data credibility.

Here's what it comes down to: it's not a general decline in the market, but rather the funds in the "Non-farm payrolls data has landed, and rising rate cut expectations are lifting market sentiment" in the background, which is driving the initiative to position rebalancing.

Friday's non-farm payrolls report didn't just come in soft — it outright collapsed, with the economy adding only 73K new jobs, the worst in nearly three years, and the unemployment rate rose to 4.2%, with the previous value revised sharply lower. The market reaction was immediate: expectations of a September rate cut were significantly advanced and priced in at over 60%. Long bonds, gold, and the growth stock sector generally put in an upward move.

The Fed's period of silence is coming to an end this week. Starting next week, the FOMC officials will continue to speak out. Although the market has been ahead of the expected price in interest rate cuts, the real problem is: is the Fed willing to take this ball?Will someone come out to step on the brakes and redirect the market? It's the most significant variable in the next few days.

The government reiterated "willing to support interest rate cuts"; the policy tone is left-leaning. The White House has been saying, "Inflation is under control; the next step is to restore jobs." It's not neutral; it's a decidedly looser policy tone, and the Democrats need a "rebounding economy" story to hedge against weak polling.

Core X Quantitative Trading System Perspective: The political side has already begun to "get on the bandwagon" of rate cuts, which could affect the pace of fiscal policy, public spending, and even accelerate a shift in the Fed's tone.

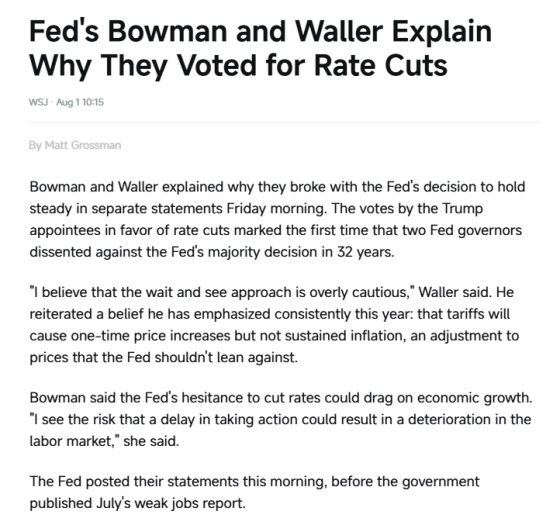

Let's take a look at a pretty rare thing that just broke inside the Fed: two Fed governors - Bowman and Waller - voted against the FOMC leaving rates unchanged, and instead, they directly called for cutting rates now". It's the first time in 32 years that two officials have simultaneously opposed a Fed majority opinion.

What they said is also quite interesting:

Waller: It's too prudent to wait, and a short-term tariff-induced price. The market must not confuse short-term volatility with sustained inflationary pressure。

Bowman: If we don't cut rates, it's not prices, it's jobs.

And both of these statements came out before the non-farm payrolls data was released. In other words, they have anticipated labor market problems, but the Fed has not yet formally stated its concerns; consequently, the market has not yet fully reacted. If officials are starting to sound off in advance, is your position ready?

The market does not wait for people; now, the most critical issue is not whether the market is up or down, but how you make decisions.

Are you relying on your own experience accumulated over the years, repeatedly turning over the charts, looking for news, sets of models, studying the flow of funds, trying to dig out the "most worthy of betting on the value of the clues" in the hundreds of votes every day? Or have you returned to the system itself, following a clear structure and a clear signal system model, and implemented the verified direction?

So what are you doing now? Are you still going with your gut, brushing up on your charts, and betting on the market? Or have you switched to a clear structure and signal system, focusing solely on good execution?

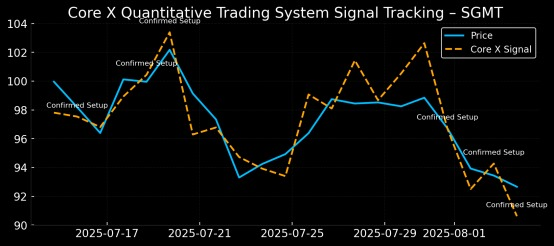

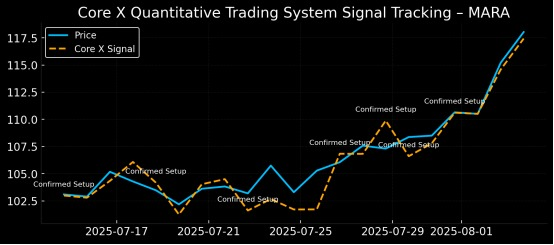

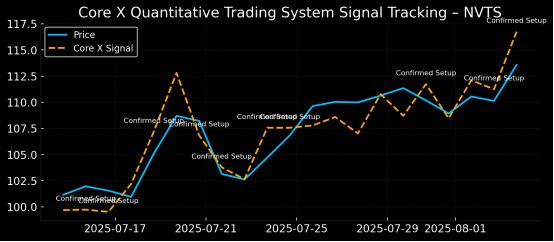

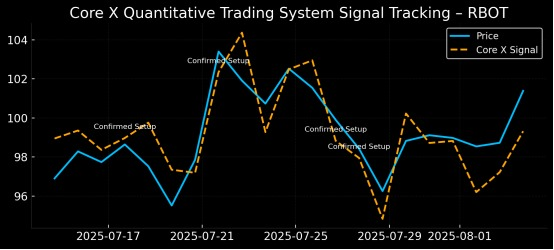

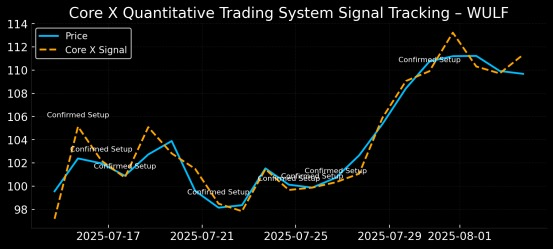

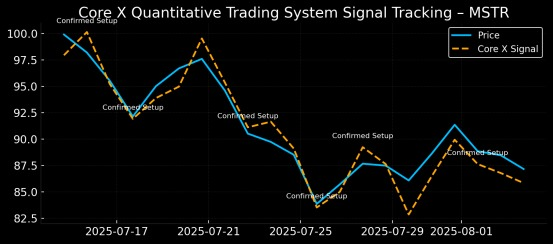

The six charts above illustrate the Core X quantitative trading system's performance in the real market, tracking the stocks you hold daily and providing timely signals based on structural, momentum, and turnover changes.

The charts you see are not just stock price fluctuations, but the entire process of the system recognizing setups, confirming signals, and guiding operations in advance:

We do not trade based on emotion, but instead let the system guide you through the chart, judgment, and execution. The significance of the Core X quantitative trading system is crucial.

Behind every single one of these charts is the fact that we are not guessing; we are executing the direction that the system recognizes.

The six charts above illustrate the Core X quantitative trading system's performance in the real market, tracking the stocks you hold daily and providing timely signals based on structural, momentum, and turnover changes.

The charts you see are not just stock price fluctuations, but the entire process of the system recognizing setups, confirming signals, and guiding operations in advance:

We do not trade based on emotion, but instead let the system guide you through the chart, judgment, and execution. The significance of the Core X quantitative trading system is crucial.

Behind every single one of these charts is the fact that we are not guessing; we are executing the direction that the system recognizes.

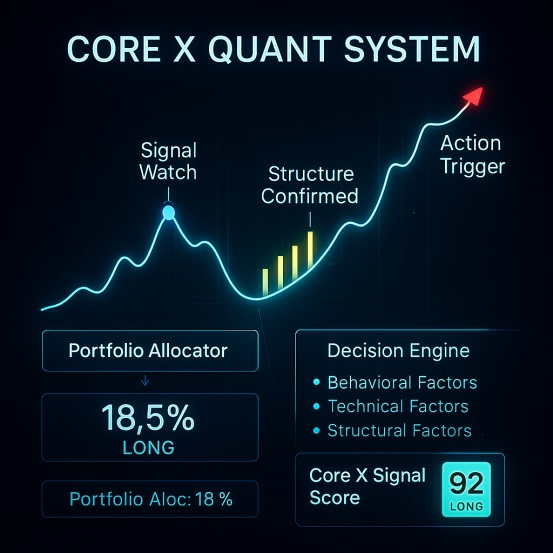

The significance of the existence of the Core X quantitative trading system is not to "pick a ticket" for you, but to filter out 90% of the noise for you. We focus only on the certainty of our execution. You do not need to stay up late to see the charts, do not need a round of staring at the financial reports, Focus on execution, not chasing good news or timing the headlines; the system has based on the factor weighting, capital momentum, the plate structure of the signals calculated in advance, what you have to do is just - in the signals appeared, can you reach out to the execution of a "high win rate action".

It's not just the difference in the way you trade; it's whether you want to be a "surfer in the ocean of information" or a "disciplined, systematic, and feedback operator of the real market." Execution logic changes, the results will naturally change.

The real buyers are already taking advantage of the signals to enter the market, not waiting for confirmation, but starting to build positions when the structure is just taking shape.

The Core X Quantitative Trading System has monitored over the past 72 hours: multiple asset groups have put in volume absorption, + momentum has turned positive, and they are entering the stage of the main money layout.

Now here's the kicker - have you adjusted your position structure in time based on the Core X Quantitative Trading System signals? Is your position structure overly defensive, or ready to attack?

The system has already identified three clear directions in this turnaround setup.

These three clear directions have formed the key guidelines for our operating strategy for the next week, and we have seen them. Direction 1|U.S. Bonds / Gold / Utilities, Direction 2|AI High Growth / Healthcare, Direction 3|Crypto Assets, and the most notable of them all is Crypto Assets. Why?

On Friday, the market broke significant crypto news, enough to reshape the logic of capital pricing and trigger a highly sensitive reaction: the SEC formally launched the "Crypto Plan" to promote the U.S. financial markets on the chain.

In his latest speech, the chairman of the U.S. SEC formally announced the launch of a strategic plan called "Crypto Plan." The goal is to promote the entire U.S. financial market, encompassing securities trading, regulatory, and clearing mechanisms, from traditional architecture to blockchain systems.

He emphasized that this is in response to President Trump's vision of "building the United States into a global crypto financial center" and a strategic shift to prevent the U.S. from continuing to lag behind overseas markets in financial innovation.

The plan marks the formalization of the adoption of blockchain technology at the institutional level in the U.S. financial market into the policy implementation phase, which will not only inject legitimacy into crypto assets but may also bring about a far-reaching reconfiguration of the traditional financial infrastructure.

You heard that right - not opening up a new area, but reorganizing the entire system.

What does this mean? Not simply "supporting crypto", but writing crypto assets into the core architecture of the capital markets. The market is already reacting.

The Core X quantitative trading system had already recognized that several groups of on-chain assets had begun to move in different volumes and reversed their momentum structure a few hours before the news was released.

The system suggests that the crypto sector has entered the stage of "structural confirmation + capital buildup", and the signal validity is higher than the average of the past two weeks.

The Core X quantitative trading system suggests the crypto proxy stocks to follow next week:

$COIN (Coinbase): this trading platform is in the leading position in the industry, and has the structural conditions to benefit from the current regulatory easing.

$RIOT / $MARA: Core X Quantitative Trading System shows that money flows have turned from negative to positive, signaling a structural confirmation of stabilization

$MSTR: has become one of the most representative bitcoin-exposed stocks in the U.S. equity market

$HUT / $WULF / $CLSK: small- to mid-cap resilient stocks, with funds prioritized to sweep into the zone

The cryptocurrency directions to be tracked on the Core X Quantitative Trading System next week include:

ETH: as the core underlying asset of on-chain clearing and DeFi, the structure is solid under the favorable policy.

INJ / SOL: momentum factor is back to positive, turnover activity has increased, the system recognizes it as a high-momentum setup, high-response target;

CXON ecosystem: The structure remains unchanged, with sentiment added. It is a system that links internal signals to verify key targets for monitoring.

Tomorrow we'll go deeper - we'll take you through the core principles of the Core X quantitative trading system:

How does it recognize capital movements? How does it determine trend structure? How does it sift through the hundreds of targets to find the names that are worth following consistently?

These are not static lists; The system dynamically updates them based on real-time factor fluctuations. The more you understand the mechanism behind it, the more you can do in the implementation of the bottom of the heart.

In addition to dismantling the core logic and working mechanism of the Core X quantitative trading system, we will also continue to track the key assets flagged by the system today, including:

Crypto Proxy Stocks: $COIN, $MARA, $RIOT, $MSTR, $WULF, $HUT, $CLSK

Core Coins on the Chain: $ETH, $SOL, $INJ

Eco-Tokens of the System: $CXON (as key targets for in-structure linkage verification)

These names are not "bullish recommendations" but are the result of real-time tracking and continuous updating of factor scores. We'll explain the structural features, entry and exit signals, and money behavior behind them, along with the charts, tomorrow. If you want to keep up with the next phase of trading opportunities, don't miss tomorrow's session.

There are still a lot of people in the community who don't have a clear understanding of crypto assets, especially CXON. Next week, I will dedicate time to take you through the system - its positioning, mechanism, value anchoring logic, and why we say it is not a "coin" but a key bridge connecting the system to growth.

If you already have CXON in your hands, you must attend that class; if you haven't started to participate in it yet, that class may be the starting point of your cognitive understanding. Remember to follow the course schedule.

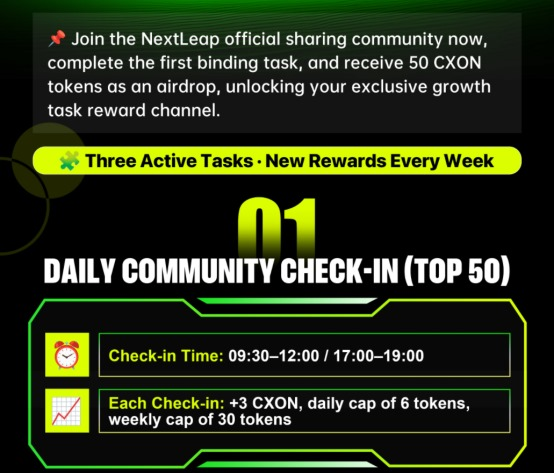

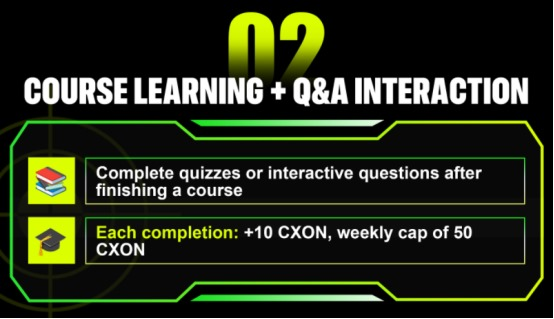

How do you get CXON coins and collect CXON airdrops? Currently, you can participate in the following ways to receive them: daily check-ins, after-school quizzes, and weekly Friday raffles. These are the paths by which you bind to the system and get your initial CXON position.

About the amount you can claim for each task, the arrival of the task, and the existence of a stacking mechanism, please get in touch with your Investment Advisor as soon as you can. They will help you unlock the claiming methods based on your current participation status.

Please don't wait for CXON to go up before you start to understand it; now is the most critical window for you to get involved.

It's not a short-term airdrop of incentives, but a long-term co-construction of awareness, engagement, execution, and trust. I just wanted to let you know that's all we have for today's communication. The system is still moving forward, and you are still present - and that's good enough.

Before we end today's communication, I would like to ask my friends three questions:

1. Are you still relying on brushing and intuition in your trading style, or have you already started to follow the signals of the Core X system to execute operations?

A. Already started to synchronize with the system to make decisions

B. Still hesitant to follow the system

C. Understood but not implemented yet

D. Still looking for direction in my way

A. It's an automated stock picking tool that helps me identify the best performing stocks.

B. A quantitative signaling platform that tells me when to get in and out of stocks

C. It's an intelligent trading system that helps me build awareness, clarify direction, and discipline execution.

D. I'm still learning about it, but I can already feel the stability of its execution

3、After the U.S. policy formally embraces on-chain finance, what do you think is the most worthwhile direction to prioritize?

A. Cryptocurrency main chain (e.g., BTC, ETH)

B. Crypto proxy stocks (e.g., MSTR, COIN, RIOT)

C. Core X ecological token CXON

D. Still observing, not sure for now