August 4, 2025

August 4, 2025

The new week has brought sudden changes in market trends.

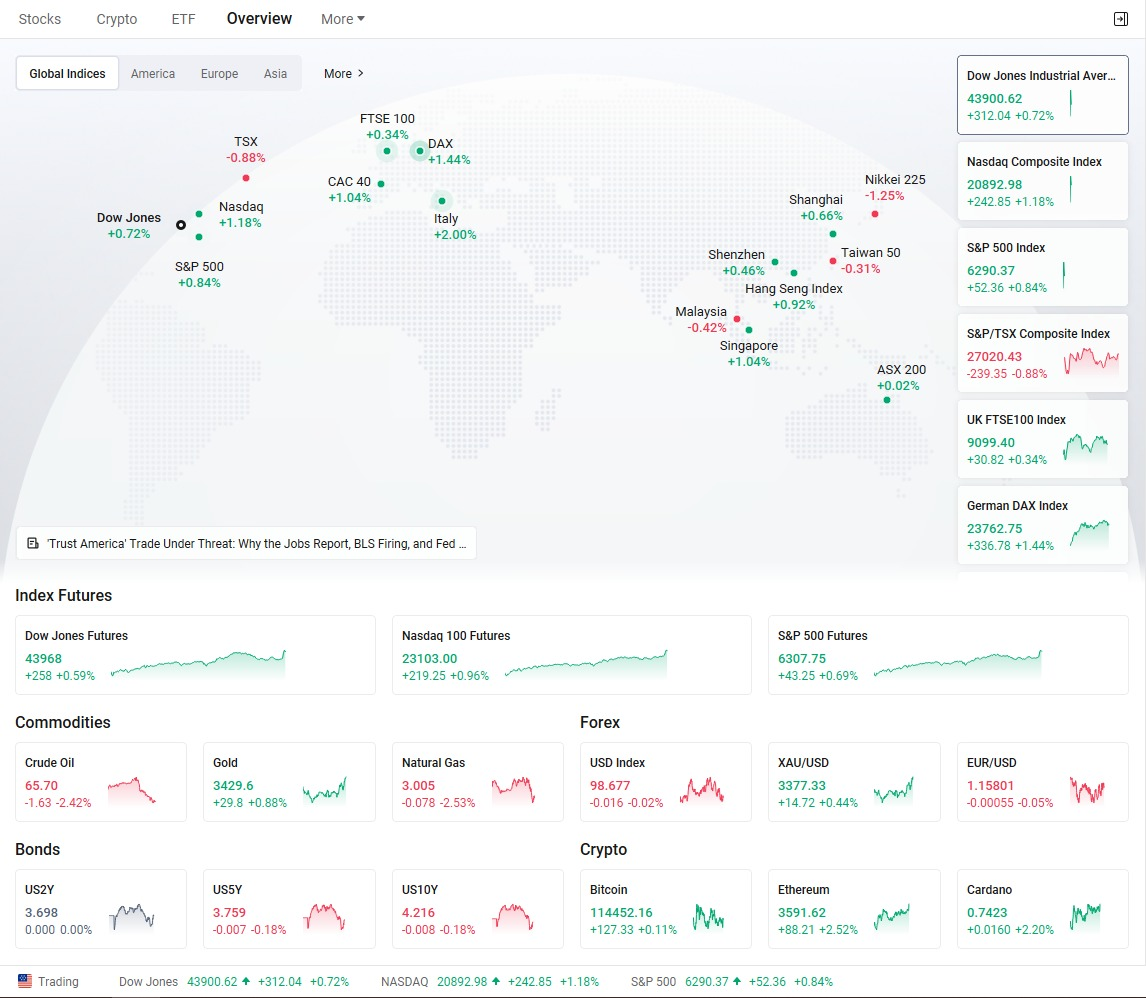

Last week, nonfarm payrolls increased by only 73,000, and the unemployment rate rose to 4.2%, clearly indicating that the labor market is cooling down; OPEC+ announced increased production in September, reshaping the global crude oil landscape; Geopolitical tensions continue to escalate, with the strike at U.S. East Coast ports compounded by tensions in the Middle East, driving safe-haven assets higher, with gold briefly hitting its weekly high.

Although the S&P 500 and Nasdaq indices saw a slight rebound in pre-market trading, the overall market remains in a volatile consolidation phase. Market uncertainty is rapidly accumulating, and high volatility has become a reality.

This is a critical moment when judgment and execution begin to diverge. If you wish to position yourself in advance and respond precisely to this round of volatility, the following strategic insights are crucial:

We will focus on three core areas—nonfarm payroll data signals, energy supply disruptions, and geopolitical variables—to update the CoreX 40/60 investment portfolio model and provide clear short- to medium-term asset allocation recommendations. Additionally, we will anticipate inflation trends, liquidity changes, and potential policy inflection points to establish the logical foundation for the next round of asset allocation.

Trends are brewing, and the rhythm has already begun.

The decisive factor lies in the “opportunity window before confirmation.” Are you ready?

CoreX Latest Update: OPEC+ Launches Two-Year Strategic Production Increase Cycle, Oil Market Pricing Mechanism Enters New Phase of Negotiations

Last Sunday, OPEC+ formally finalized a two-year strategic framework for crude oil production and announced an increase in daily output of 547,000 barrels, reversing the deep production cuts planned for 2023 one year earlier than originally scheduled. This marks the oil-producing nations' alliance accelerating its return to the market to reclaim lost ground.

While this decision temporarily provides stability signals for the global energy market and suppresses expectations of rising crude oil futures prices, key uncertainties remain:

The 1.66 million barrels per day of unutilized production capacity has yet to have a clear timeline for activation;

OPEC+ officials stated that whether to continue restoring this portion of capacity will be decided flexibly based on market conditions, and may even pause production increases or reverse cuts during periods of falling oil prices;

The next key meeting will be held on September 7, at which point further guidance may be provided

From a market perspective, this strategy on one hand helps to stabilize oil prices in the short term and alleviate input-driven inflationary pressures; on the other hand, it also brings the crude oil market back into a highly sensitive phase of “policy-driven speculation.”

So, what is the key takeaway for investors?

As the oil market enters a new phase characterized by policy maneuvering and uncertainty, the CoreX 40/60 portfolio views the energy sector as a tactical defensive asset, particularly suited to addressing external shocks such as geopolitical conflicts, inflationary pressures, and supply chain tensions

At this stage, our focus is not on predicting whether oil prices will rise, but on maintaining a steady pace amid market volatility—by positioning at lower levels and adjusting at higher levels to flexibly respond to market changes

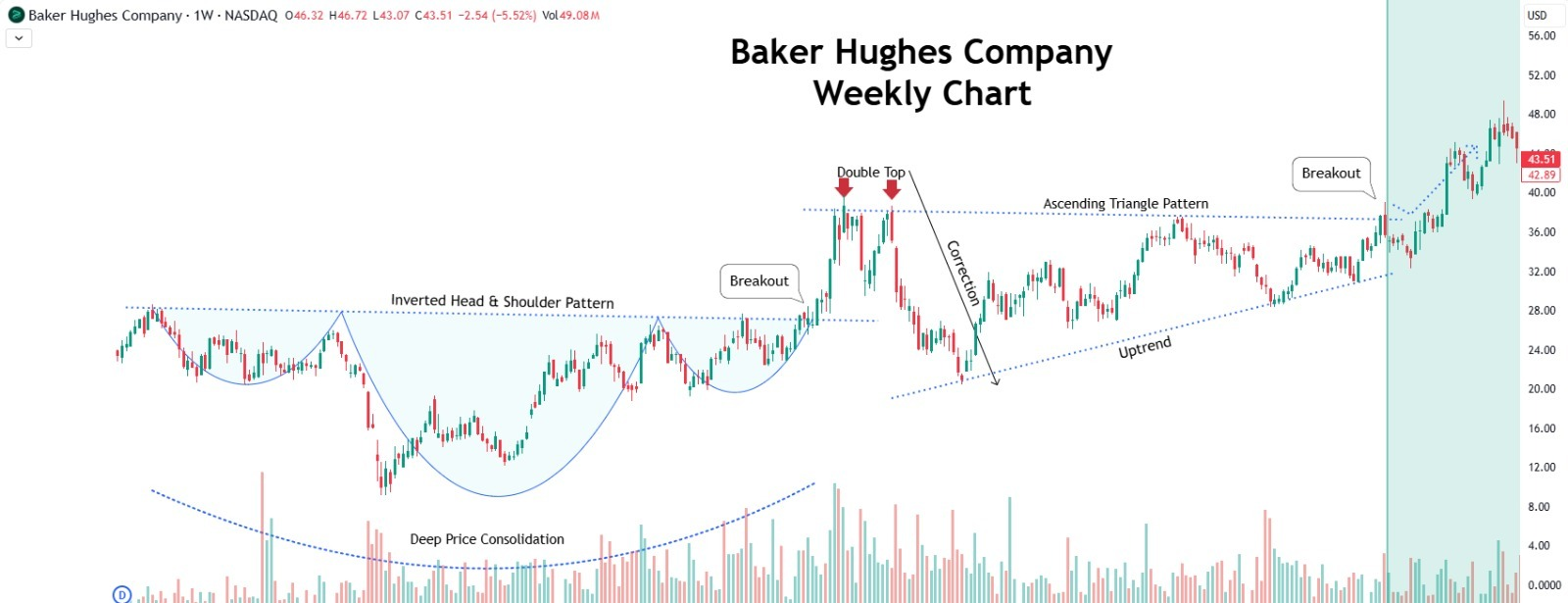

Today's Focus Stock: $BKR

The current stock price is within a reasonable range. The company recently acquired Chart Industries for $13.6 billion, accelerating its expansion into high-potential areas such as liquefied natural gas (LNG) and data center cooling technology. This move not only strengthens its position in the global energy infrastructure sector but also aligns with the trend toward core demand for high-energy support systems in the AI era.

Companies like BKR operate at the intersection of “energy × technology,” combining defensive value with structural transformation potential. They can play a dual role in volatile markets: stabilizing portfolios while driving growth. This aligns with CoreX System's definition of “structural offensive targets”—assets that combine defensive and growth attributes, suitable for short- to medium-term coordinated operations. We recommend adding it to the current core observation list.

CoreX Quantitative System Identifies .SPX Chart Forecast

The market opened with a series of important signals, with all indices opening lower, reflecting growing concerns about the cooling of the US economy spreading globally. Last Friday's non-farm payroll data came in far below expectations, pushing the probability of the Fed cutting rates in September to 90%. This drove the dollar lower, gold prices higher, and US Treasury yields to a three-month low. Meanwhile, OPEC+ announced a production increase of 547,000 barrels per day starting in September, reshaping the crude oil supply landscape and putting short-term pressure on oil prices.

In this complex environment, the CoreX 40/60 investment portfolio strategy recommends maintaining a dual-track approach:

1. Continue to execute the “equity + currency trading” linked strategy: focus on periods of heightened volatility to capture short-term price differential opportunities;

2. Seize the window of opportunity presented by the dollar's correction and weakening interest rate expectations: increase allocations to high-quality safe-haven assets such as gold and U.S. Treasuries, as well as short-cycle sectors (e.g., high-dividend, utilities, etc.)

Meanwhile, although the energy sector is under pressure, if technical rebound signals emerge, moderate participation in structural arbitrage can still be considered to enhance the portfolio's offensive flexibility.

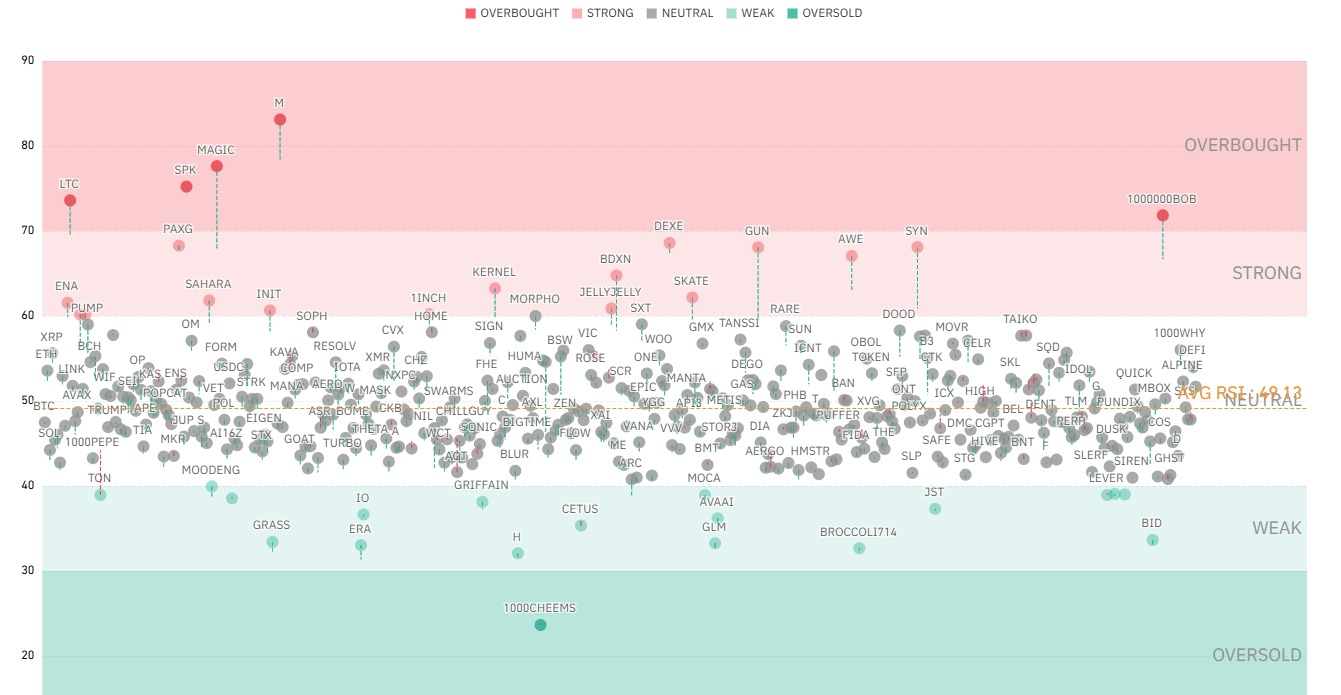

So how does it help us transition from stocks and options into the cryptocurrency arena to achieve a leap in returns?

First, CoreX uses big data analysis to accurately assess the macroeconomic environment. For example, from the end of last year's interest rate hike cycle to the upcoming Fed rate cuts this year, it has already alerted us to which assets will benefit most from changes in interest rate policy, serving as the foundation for our asset allocation decisions.

Next, in terms of position allocation, CoreX automatically optimizes capital distribution based on the “risk levels” of different assets and market sentiment. This not only helps us seize high-probability opportunities but also ensures capital preservation during market volatility.

Finally, in risk hedging, CoreX monitors sentiment indicators like the VIX fear index to issue early warnings. Before the release of key economic data, it prompts us to make short-term hedging arrangements. Even if the broader market corrects, we can capture counter-cyclical returns to offset losses from other sectors.

Do you understand now? This is the secret behind CoreX's quantitative trading system consistently delivering real-market results: it is not just an “allocation model,” but a “decision-making system” that helps you maintain a steady rhythm in complex markets and continue moving forward.

Looking back at the history of financial investment, we have evolved from bartering to stocks and bonds, and from intuitive decision-making to data-driven strategies. However, there has always been a lack of a truly efficient and reliable investment tool.

It wasn’t until the advent of the AI era that this limitation was finally broken.

The CoreX Quantitative Trading System is a product of this era—it not only integrates AI algorithms, big data logic, and real-world trading experience but also makes “more controllable investing” a reality for the first time.

It is not a predictive model but a real-world commander by your side, helping us navigate uncertainty and make more stable decisions.

Of course, the core resources currently supporting the continuous evolution and upgrade of the CoreX quantitative trading system come from the token project issued by our NEXTLEAP MANAGEMENT CONSULTING SERVICES LTD. With the current token price of $1.17 USD, the total market value is approaching $200 million. This capital is continuously providing stable support for the technical development, strategy optimization, and infrastructure construction of the CoreX system.

As everyone knows, even global top-tier AI companies like OpenAI are still continuously raising new rounds of funding to support model iterations and technological scalability. In other words, the ability to sustain funding is an indispensable component for the long-term growth of AI products.

Compared to traditional financing methods, the token-based approach we employ achieves a more resilient and participatory “community-driven capital support” model, which offers two significant advantages:

Price increases with recognition, creating a positive feedback loop: the more users there are and the more frequently the tokens are used, the broader the application scenarios become, and the stronger the price support.

The upward momentum is driven by real value: it's not about “hyping concepts,” but rather, every practical performance of the CoreX system, every round of profit records, and every functional upgrade contributes to the value of the tokens.

So the question arises: what is the true driving force behind the price increase of CXON tokens?

Friends, let's take a look at the five key drivers behind the recent surge in CXON token prices:

1. Surging interest in the North American market

CoreX's quantitative trading system has garnered widespread attention in the North American region for the first time, driving an initial rise in token prices.

2. Exceptional live trading performance attracts institutional capital

Over the past few weeks, CoreX’s consistent profitability in live trading has been recognized by users, attracting more capital into the market.

3. Currently in the “live trading validation week”

From the chart trend, the white curve is steadily rising. If this trend continues, the token will continue to attract market attention and capital support.

4. Bitcoin adjustments drive capital rotation

As BTC undergoes short-term adjustments, some capital is shifting toward small-cap potential coins, with CXON at the core of this rotation.

5. Real-time trading user growth lays the foundation for long-term support

The number of active trading users in the CoreX system continues to increase, with real-world profit feedback laying the foundation for CXON's medium- to long-term value support.

I don't know how much CXON you currently hold, but one thing is certain: within the next three to five months, it may become the most explosive component of your investment portfolio.

Are you willing to hold firmly and join us to witness the next value peak together?

Why should you hold onto our CXON token?

This is not a short-term speculative investment, but rather a core participation credential in the growth process of our entire CoreX quantitative trading system. Its value comes from three levels:

1. Short-term value

Currently, this token serves as a key financing tool for the CoreX quantitative trading system. As we expand our nationwide promotion and community engagement grows, its market recognition is rapidly increasing. This means that every practical validation becomes a “catalyst” driving price increases.

2. Mid-term value

CoreX is expanding from stocks and options into digital currencies, foreign exchange, and even gold futures markets, while the AI model's reasoning and practical capabilities continue to evolve. You can view it as an increasingly advanced “smart trading partner.” In the future, it will possess stronger logical judgment and asset allocation capabilities, supporting this token to follow a more stable and healthy upward trend in the mid-term.

3. Long-Term Value

The tokens you hold were mostly obtained through early grants or at low prices, effectively positioning you at the forefront of the trend. Imagine if our NEXTLEAP passes the new rating system and officially obtains tax-exempt status, which would significantly enhance our credibility as an institution. Combined with the formal global launch of the CoreX quantitative trading system for subscription, with orders flowing in continuously, would the token still be priced at today's level?

So, I ask you:

Are you willing to miss out on the opportunity to hold it at such a low price?

History has repeatedly shown us: True opportunities never wait for anyone.

During the 19th-century gold rush, tens of thousands flocked to the West, yet only a handful ultimately struck gold;

In the 1990s internet boom, early adopters became the new wealth class;

The multiple booms in the U.S. real estate market also created numerous ordinary families whose assets multiplied;

Meanwhile, many others continued to “wait” and “watch,” only to realize later that they had missed the critical moment when they should have acted.

These stories remind us that opportunities never wait for the hesitant.

Achieving financial freedom is not just a dream, but a responsibility—it is about having the choice to spend more time with family, enjoy life, and ensure a legacy. It is not about continuing the same busy routine year after year, but about seizing the window that can truly change the rhythm. Now, the practical results of the CoreX quantitative system have been validated, and the valuation of the CXON token is still in its early stages—what you have been waiting for is already within reach.

The market has signaled that the value window for CXON tokens is opening.

Are you willing to seize this certain opportunity?

See you on Tuesday. We look forward to seeing you take action to write your own success story.

Sir John Templeton is known as the "Father of Global Investing". At the outbreak of World War II, he bought all the stocks on the New York Stock Exchange that were priced below one dollar - 104 stocks in all. He didn't know which companies would survive, but he believed that true investing is not about placing bets when everything is clear, but about getting in early with structure and conviction when others are fearful.

Five years later, this seemingly crazy set of maneuvers brought him a total return of over 400%, setting the stage for his later global placement.

It brings me to the Core X quantitative trading system we are using. Instead of waiting for everyone to see the market before we start trading, we let the system recognize signals that "others don't see yet, but the structure is already in place" and lock in the direction ahead of time.

It's Monday, and the markets just closed. Whether or not this week will be the next real turning point depends not on the news, but on one thing: whether or not you are willing to believe, like Templeton, that structure comes before story. We prioritize execution over hype. We continued to execute our system strategy on $WULF, $MARA, $MSTR, and $SGMT on Friday. They did rally en masse today, not because they were hot or they went up, but because the technical charts were at a key reversal point. The Core X Quantitative Trading System signals confirmed it, and we chose to follow the structure and broaden our participation.

We are not betting on one direction, but rather a complete trading system that consistently identifies valid assets, validates market behavior, and executes with conviction. It's not what the market says that determines whether or not you can win this week - it's whether or not you're ready to read what it's doing.

Now, it's time to open the charts, refresh your system signals, and reset your action coordinates for the week.

I'm Bird Grant, nicknamed Mr. Profit Hawk. Along with my partner, Blake Shaw, I am the co-founder of NextLeap Management Consulting.

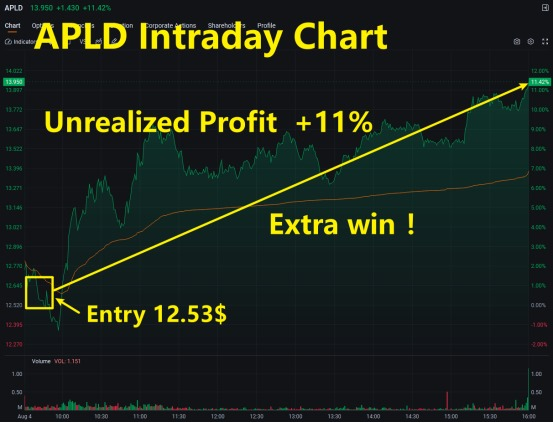

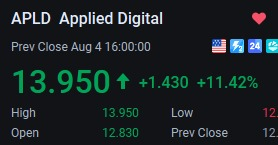

I am, really, really happy! Because - we ate up over +11% on $APLD, and it wasn't "good judgment" or "dumb luck", this is the result of understanding the underlying logic of fundamentals and technicals, as well as the signals sent by the Core X quantitative trading system, our precise execution, and the whole community holding the line together!

It feels like you've been training hard for a whole quarter and you finally hit the bull's-eye on the field of play! It's not just a nice gain; it's a validation of our system's execution, recognition, and your decisiveness in critical moments.

Applied Digital ($APLD) isn't relying on heat behind this latest rally, but rather a solid positive push. According to public information, the scope of cooperation between the company and CoreWeave Inc. has expanded even further. The company may raise the total size of the new contract to $11 billion. It's not just about adding an "order"; it directly elevates the business cooperation between the two parties to a new level of "long-term binding + high-intensity growth". For us, this is a typical case of synchronized resonance of fundamentals + expectations + signals.

Many of my friends saw APLD pull up today, and their first thought might have been, "Isn't it too high already?" But if you understand some of the technical structure, you'll notice - behind that long lower shadow on Friday was strong buying support. Not only was that position a confirmation zone for the retracement after the platform breakout, but the move came with increased volume, which is very typical of support-turned-confirmation.

If you're not familiar with this graphic structure, that's okay. You can consult with our investment consultant to obtain a graphical interpretation of the information. They will guide you step by step through understanding the system of entry signals, which has been hidden in the figure since before the market began.

In other words, what you see today is up, but what the system sees is the structure. We lay out the structure ahead of time as it takes shape, and today is just a process of cashing in on the results.

We've been teaching stock techniques and logic for a long time now, and we thank you all for making it this far. As more and more of you join us, it is our responsibility to make it clear who we are, what we believe, and what we do. It's not only an introduction to new friends, but also a confirmation of old friends.

Although our team is growing, we have never forgotten the original intention: to be a real force for cognitive growth, real disk enhancement, and strategy co-construction, and the existence of the systematic community.

Here, I would also like to introduce again who we are and what we do:

NextLeap is a company specializing in global macro research, fintech innovation, and trading system development. Blake Shaw leads our team. Our team, led by mentor Blake Shaw, brings together engineers, investors, and educators from a variety of disciplines to create the Core X quantitative trading system - a longstanding service for hedge funds, institutional clients, and a growing number of individual investors who want to build their independent trading capabilities.

The Core X Quantitative Trading System is the result of our years of experience in real trading and AI technology. It is not only a trading tool, but also a set of systematic solutions designed around judgment, execution, and capital efficiency.

Over the past two months, many of our friends have achieved substantial returns in the real market using the Core X Quantitative Trading System.

From the momentum reversal in tech stocks to the structural initiation of crypto assets, we didn't just see the opportunities; we used our systematic judgment to turn those opportunities into real returns.

To put it bluntly, consider this morning's trading. We took you to lay out the $ APLD, which pulled up not long after we got in, and the float ran out on the spot. It's not luck, nor is it blindfolded. The real support for us to continue seizing profits is our understanding of technical and fundamental analysis. Core X is our quantitative trading system that supports us.

So what's so great about this system?

Why can it consistently predict money flows in advance, even before the news breaks?

Why can it repeatedly verify the entry points and continuously improve the hit rate?

Why does it never blindly chase popular subjects, avoiding market noise interference, and always manage to see earlier than most people, while also being more accurate?

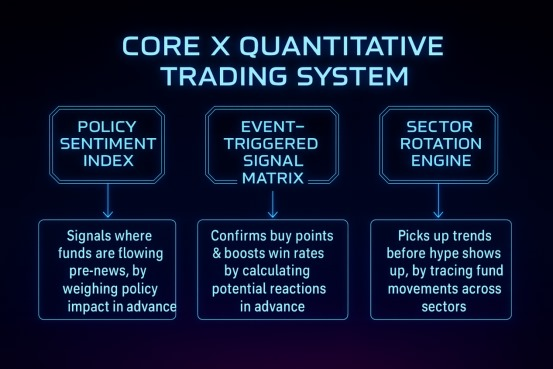

Next, we will explain the structure and the mechanism of the Core X system, including how it works and how it helps us make clear and powerful trading decisions.

The power of this Core X Quantitative Trading System lies not in its ability to "predict the future" but in its ability to read the proper drivers of market behavior in real time. Core X is a set of dynamic factor combination models that continuously track capital flows, volatility structure, volume, and price behavior, rather than waiting for news to come out or for the market to react before making judgments. Instead, it continuously tracks: capital flows, volatility structure, volume, and price behavior patterns. The system captures where the funds are moving—and which asset classes they’re concentrating on—before any news or announcements hit.

In other words, it doesn't rely on "news judgment" but on the system to recognize when behavior is shifting. It's why it can often form a position before the market even realizes it. It's not that it's smarter, it's that it "sees people moving" earlier.

It consistently identifies valid entry zones because the system model dynamically calibrates factor responses and rigorously filters out non-structural signals. It does not rely on following the wind or the mood of the rhythm, but rather on market mainstream judgment earlier than the inflection point, to more clearly identify the direction.

Core X Quantitative Trading System|System Module Structure

Policy Sentiment Index tracks changes in expectations under the split between policy shocks and officials' attitudes.

Includes signals such as: resignation of Fed governors, collapsing unemployment data, and significant forward pricing of rate cuts.

Used to capture liquidity ahead of time in interest rate-sensitive assets (e.g., U.S. bonds, utilities, gold).

Event-Triggered Signal Matrix locks in the window of significant events (such as the release of non-farm payrolls data, the SEC launch of the Crypto Plan),

The system predicts in advance the strength of the market's capital reaction to these variables,

Determines which direction will quickly switch to the dominant position after the data fall, and provides confirmation signals to build positions.

The Sector Rotation Engine dynamically tracks cross-sector capital flows and currently focuses on:

(1) Switching from traditional technology to AI β, mid-cap growth, and healthcare stocks.

2) Crypto assets and proxy stocks are stabilizing in the direction of positive liquidity.

The system has marked structure confirmation on assets such as BTC, ETH, SOL, INJ, MARA, MSTR, etc., with a window of attack.

The purpose of this system is not to make you spend more time staring at the market, but to help you make better decisions in less time. It's to allow you to read the structure, recognize the signals, and execute with confidence when it's time to strike.

As you may have realized by now, we put so much effort into building the Core X quantitative trading system, not just to improve the winning rate.

Instead, we want to address a more fundamental question: what should investors of our generation rely on to grow?

In this market, new hot spots, K-lines, and narratives emerge daily. However, what truly matters in the long run is not "predictive ability" but structured judgment and execution. You can actively apply this cognitive system repeatedly.

That's why we insist on not only creating the system itself, but also integrating the system, teaching, community, and support mechanism to make a handy, warm, and feedback-driven educational platform.

What we're doing now is precisely this: formally applying to the IRS for tax-exempt status as a 501(c)(3) nonprofit organization.

The purpose is clear - we want this platform to belong not only to our team in the future, but to everyone willing to grow systematically.

It's not just a nice thing to say; this application puts stringent requirements on us:

It can't just be for high-net-worth individuals; it must be genuinely open to the public.

All content must focus on education, rather than setting a threshold to generate revenue.

We must use all funds transparently, audit them fully, and ensure every dollar can be traced back—so that participants genuinely receive their share.

In other words, we're not selling a strategy; we're building a cognitive system that you can use for many years and even pass on to the next generation.

Whether you are new to the market or have been trading for many years, you can find a path to "grow with the system", rather than spinning in information anxiety.

Before we end our communication today, I would like to leave you with three more questions to ponder:

1. The Core X quantitative trading system doesn't tell you what to buy tomorrow—it helps you understand what's happening today so you can act with confidence, but to help you build a set of structured judgments. Have you read the underlying logic of the Core X Quantitative Trading System?

2. In this era of information anxiety, we do not do "pay for knowledge", only cognitive co-construction. It's the idea, but also the choice. Have you ever wondered why we at NextLeap insist on investing in education for free?

3. If there is a platform that not only teaches you how to trade but also helps you build a comprehensive system of cognition, and not just for a short period, but for ten years or twenty years, do you understand what NextLeap's vision is?

If you already know the answer, remember to let our investment advisors know in time - we'll reward you with a CXON airdrop for serious thinking.

It's not just an interaction, but a participation. The sooner you get on the chain, the sooner you get bound to the system, and the dividends of every future system evolution won't miss you.

What we are building is a trading system, but what you are creating is your own investment beliefs and growth path.

It's like that quote from the Gospel of Matthew: "Where your treasure is, there your heart will be also." If you've decided to believe in long-term value, then let every action be more firmly on the side of the future.

The Core X quantitative trading system is in motion, we've charted the course, and the next step is whether or not you are willing to step up and be a part of it.