August 5, 2025

August 5, 2025

Today's market expectations are almost clear: the Federal Reserve's interest rate cut is entering the final countdown phase. Have you already felt the market rhythm unleashed by this historic turning point?

In yesterday's morning session, we reviewed the performance of assets during previous interest rate cut cycles and used the CoreX big data analysis model to deeply interpret the response paths of different industries at policy inflection points. The S&P 500 index futures rose before the market opened, with technology stocks leading the gains. Palantir surged after releasing its earnings report, and other large technology stocks like Meta and Nvidia also rose in tandem. The market is gradually validating our judgments.

The unexpectedly weak nonfarm payroll data has sent market expectations for a September rate cut soaring above 84%, with U.S. Treasury yields hitting a three-month low. Safe-haven assets like gold, bonds, and ETFs are attracting significant increases in allocations. These signals clearly indicate: market sentiment is shifting, and our strategic approach must adapt accordingly.

Friends, now is the critical moment to test your asset allocation capabilities and trading discipline.

Our CoreX 40/60 investment portfolio has once again demonstrated its unique combination of stability and flexibility in this market environment.

Through a dynamic strategy combining “stocks + options,” coupled with strategic additions of defensive assets such as gold, cryptocurrencies, and high-dividend ETFs at lower price points, we have not only weathered market volatility but also precisely captured structural opportunities.

This is the power of systematic strategies, and the reward for your knowledge and action.

Our investment education community continues to welcome new members:

Official website: https://www.nextleap.vip/

I am Blake Shaw, founder and mentor of the NextLeap investment education community.

Thank you to all our long-time supporters for your continued trust, and we warmly welcome all new members to join us during this critical window of opportunity—to recognize trends, make the right choices, and stay ahead of the curve.

In the face of potential market volatility, how should we formulate strategies and seize trading opportunities?

First, the stock index currently shows a relatively strong low-opening, high-closing trend on Tuesday. Based on my judgment, the market is likely to experience slight volatility in the morning, mainly due to unclear policy signals. In such a consolidation phase, the market often accumulates momentum, laying the foundation for the next change in direction. We can anticipate that once the direction is confirmed, a more definitive upward trend will become the most likely outcome. Of course, even if a short-term correction occurs, there is no need for panic—in the current macroeconomic environment, what is more critical for our trading is not “when interest rates will be cut,” but “the magnitude of the rate cut.”

Additionally, according to the latest media alert from CNBC, U.S. President Trump will deliver a live address on CNBC's “Squawk Box” program this morning, covering topics including the economy, employment, Federal Reserve policy, and tariff issues. This will undoubtedly be the most significant unexpected variable before the market opens today and deserves our close attention.

Therefore, maintaining my trading strategy and continuing to follow my precise trading timing is the core capability to navigate volatility and seize opportunities.

Strategy 1: Trade using the VIX index to capitalize on opportunities arising from market volatility

The VIX index, often referred to as the “fear index,” is a key tool for measuring market expectations of future volatility. It reflects investors' predictions of the volatility of the S&P 500 index over the next 30 days, as published by the Chicago Board Options Exchange. In simple terms, it acts as the market's “heartbeat”—the faster it beats, the greater the volatility

The VIX value is essentially an annualized standard deviation, allowing us to estimate the daily market volatility. For example, if the S&P 500 index is at 3,600 points and the VIX index is 25%, the expected daily volatility is approximately 25 ÷ √252 ≈ 1.57%. This means the market could fluctuate by over 50 points daily—a highly actionable information window for short-term traders.

When the VIX rises rapidly, it often indicates heightened market panic, potentially leading to sharp short-term volatility, but it is also a critical moment to capture trading opportunities.

2. The Relationship Between the VIX Index and the S&P 500

Although the VIX Index does not directly track the ups and downs of the S&P 500, it serves as a “barometer” of market sentiment. The VIX reflects investors' expectations of market volatility over the next 30 days, making it an indirect measure of risk and uncertainty.

Historically, the VIX and the S&P 500 have typically shown a negative correlation: when the S&P 500 declines, the VIX often rises rapidly; conversely, when the market stabilizes or even rises, the VIX tends to decline. Why is this the case? Simply put—during market downturns, investor sentiment becomes increasingly anxious, leading them to purchase protective options to hedge risks, thereby driving up the VIX index.

Conversely, when market sentiment is optimistic and the market is stable, the demand for risk hedging decreases, and the VIX naturally declines.

In other words, a rise in the VIX does not necessarily mean the market will fall, but it often indicates that “concerns” are building up, and this is the source of signals we use to judge market turning points.

Although the VIX index cannot directly tell us what the market will be like tomorrow, it serves as a reliable indicator.

Historically, when the VIX index exceeds 40, it often signals the occurrence of a black swan event, leading to a sharp decline in stock prices.

During the subprime mortgage crisis on November 20, 2008, the VIX even reached 80.6.

Of course, panic and opportunity coexist. By leveraging the VIX index through long or short positions, one can capitalize on market movements for profit.

4. How to trade VIX?

Although the VIX index itself cannot be directly bought or sold, it provides us with clear trading opportunities.

When you anticipate that the market is about to experience significant volatility, especially before the release of major economic data or geopolitical risks, you can choose to go long on VIX-related products; when you judge that the market is about to return to stability and sentiment is calming down, you can choose to go short on VIX.

Why is the VIX better suited for capturing this rhythm? Because the VIX has a “mean reversion” characteristic—when it is significantly above its historical average, it typically reverts back to normal levels. This reversion trend is more predictable than the movements of the S&P 500, making it easier to forecast.

Currently, there are some tools available for trading VIX volatility, such as ETFs linked to it:

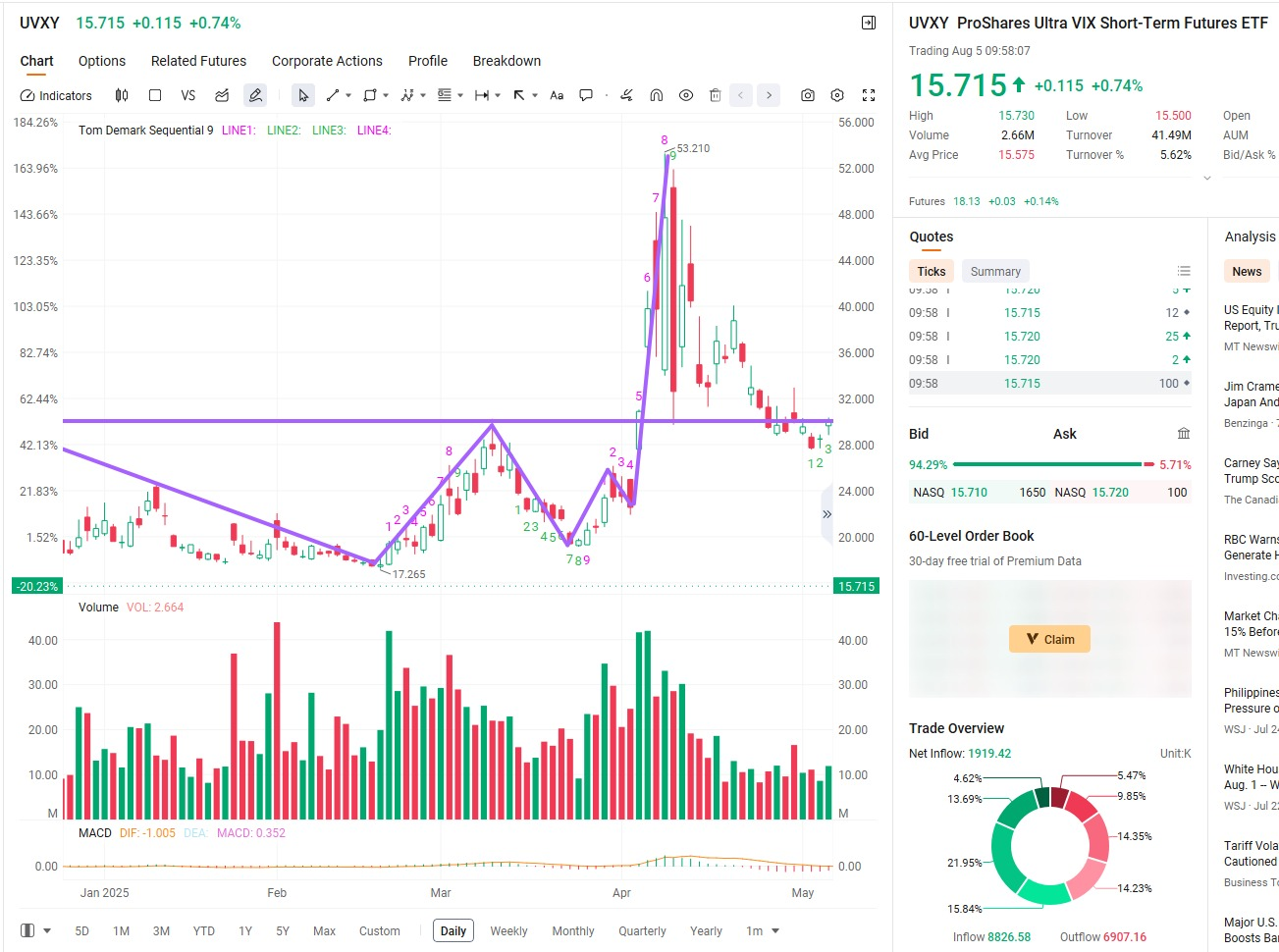

$UVXY (long volatility)

$VXX (tracks short-term VIX futures)

These tools act as amplifiers for “profiting from fear”—when others are worried about market risks, you can use your judgment of the rhythm to position yourself ahead of the curve for potential gains.

Strategy 2: Profit Strategy for US Treasuries During a Rate Cut Cycle

1. How to trade when rate cuts are steadily implemented?

If the Federal Reserve is expected to steadily implement orderly monetary policy easing and rate cuts, the market will trade based on the “rate cut” logic. The following trading strategy can be adopted:

Interest rate cuts will lead to a decline in Treasury yields, which is positive for bond price increases. According to CoreX calculations, theoretically, each percentage point of interest rate cut may result in a roughly 15% increase in TLT prices. Therefore, we can go long on bonds by purchasing bond ETFs.

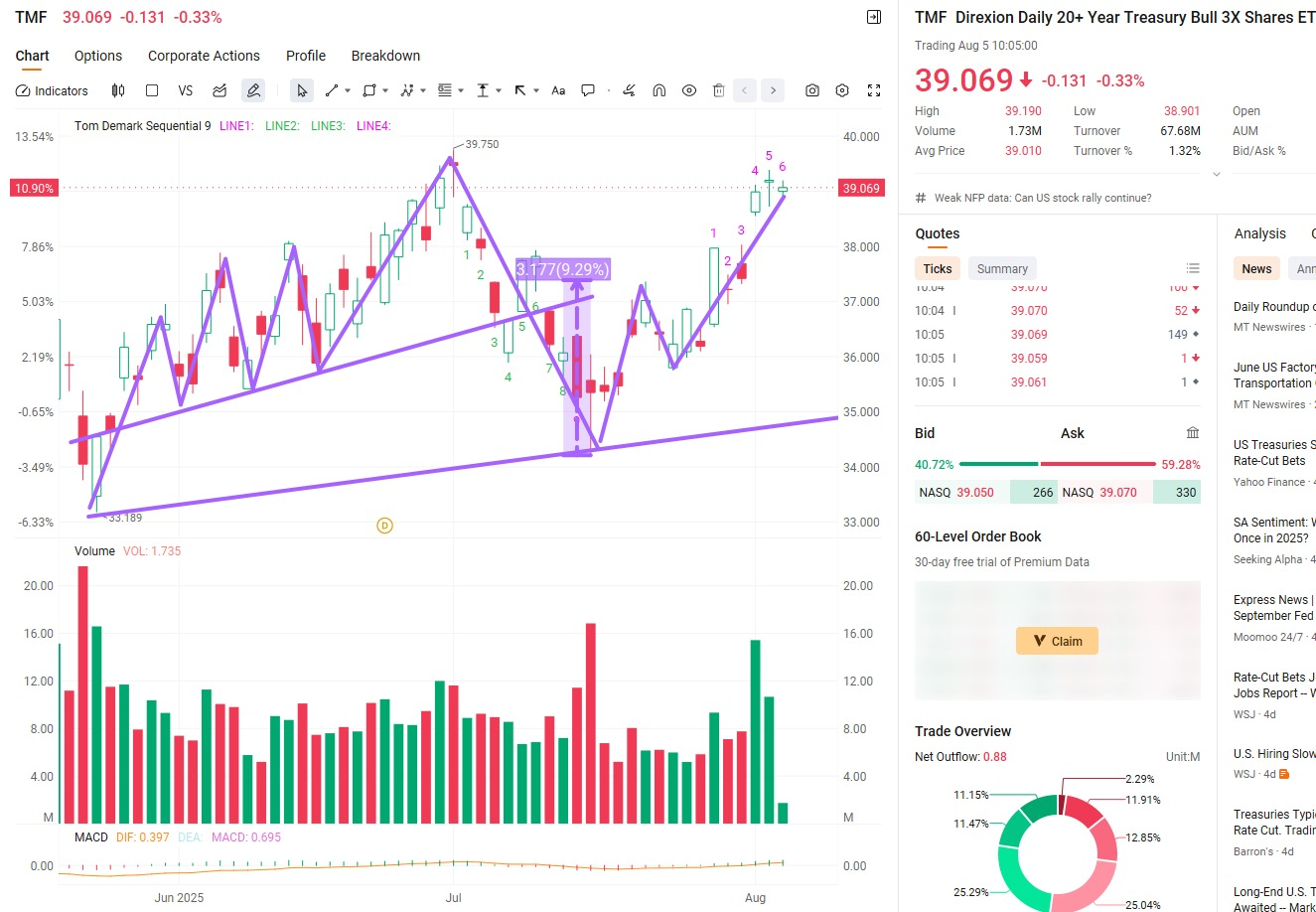

For example, I have consistently recommended and emphasized holding and increasing positions in: $TMF/$TLT.

In a volatile market, we can consider adopting a swing trading strategy, buying high and selling low.

However, considering that rate cuts are a long-term trend and will ultimately benefit bond prices, according to CoreX calculations, theoretically, each percentage point rate cut could increase the price of TLT by approximately 15%.

Therefore, we can continue to hold bond ETFs such as TLT/TMF and generate premium income by selling high-priced call options.

Assuming we believe TLT prices are unlikely to break above $100, we could hold 100 shares of TLT and

sell one TLT call option with a strike price of $100 and an expiration date of September 19. If the TLT price breaks above $100 by September 19, we could earn $119 in premium income per option over one month. What if we purchased 10 options, or 100 options?

The current market focus has shifted to the Jackson Hole Global Central Bank Annual Meeting on August 22–24. The Fed's interest rate cut path still needs more data validation, so today's strategy is: wait and see, and remain calm.

Continue holding:

Crypto proxy stocks: $WULF, $MARA, $MSTR

Short-term quality stocks: $NVTS, $SGMT, $RBOT, $BKR, $QBTS

Increase positions + hold:

$TMF / $TLT (U.S. Treasury bond positioning window)

Increase crypto positions: $SOL, $INJ (clear signs of structural breakout, with short-term flexibility)

Gold: Maintain sideways consolidation, with a wait-and-see approach, awaiting further clarification of policy signals.

In my community, investing is not just about trading; it is a journey of cognitive and cultural refinement.

The true market rally may begin in mid-to-late August—are you ready?

Let's examine two core logics:

1. Global liquidity easing will inject new momentum into digital assets

Once the Federal Reserve cuts interest rates, central banks in Europe, the UK, Canada, Australia, and other regions are likely to follow suit, ushering in a new round of global monetary easing. As pressure on domestic currencies to depreciate increases, capital will shift toward digital assets with anti-inflationary attributes. The exchange platform where CXON is listed is precisely at the core of this capital rotation, and is poised to attract significant liquidity inflows in the future, driving token value growth.

2. Accelerated implementation of investor education initiatives will inject practical value into the CXON token

As NextLeap expands nationwide, the number of community members is growing rapidly. Concurrently, as the influence of its strategic services expands, the financial investment capital it attracts is also growing steadily, enhancing the system's profitability and further strengthening the intrinsic value of CXON.

Friends, the wheels of history are turning once again, and we are standing at the threshold of a brand-new investment opportunity!

The chart you saw yesterday is the historical price chart of the CXON token from our NextLeap investment education community on the exchange. Behind this chart lie two key questions:

1. On which exchange is it currently listed?

2. As seen in the chart, it was officially listed as early as January 2025. Which other major exchanges will list it in the future?

The answer is clear:

When I launched the CXON listing plan in 2025, after extensive on-site inspections and technical evaluations, I ultimately chose to list it on the current exchange.

When I officially launched the CXON token listing plan in January 2025, the first decision I made was that I had to choose a truly trustworthy US-compliant trading platform.

This platform must meet three key criteria:

First, it must be a U.S.-based, regulated cryptocurrency exchange.

I insist on selecting platforms authorized and licensed by U.S. financial regulatory agencies (such as FinCEN or MSB) to ensure they hold the necessary compliance licenses specifically for virtual currency transactions. Only platforms with legitimate credentials can truly protect user asset security and possess the capability for long-term sustainable development.

Second, it must embrace innovative technology and the future of blockchain and decentralization.

In this rapidly evolving era, I place greater emphasis on whether an exchange has the capability to embrace cutting-edge technology—not only supporting traditional cryptocurrency trading but also having the capacity to support emerging decentralized finance (DeFi), NFTs, and Web3 asset ecosystems.

Third, it must support the development of fintech tools, particularly quantitative and AI trading systems.

As the CoreX system matures, our users will increasingly participate in the market through algorithmic models and AI-driven strategies. Therefore, this exchange must have a high-performance, open technical architecture capable of quickly integrating with external quantitative systems.

Based on the above three points, I ultimately chose to list the CXON token on this platform named Exchange Center.

From past operational performance, this platform not only ensures stable trading and compliance transparency but has also provided significant support in technical assistance, service response, and functional updates, giving me great confidence in the future expansion of the CXON ecosystem!

Of course, I can’t possibly explain all the underlying logic and operational mechanisms of this exchange in just one hour.

Similarly, you can’t possibly plan to spend just one hour here with me, right?

Because I believe that when you receive our CXON airdrop reward, you must understand three things:

Where does it come from?

Why does it have value?

Why does it have the potential to appreciate in value in the future?

Only when you truly understand all of this will CXON be more than just an “airdrop reward”—it will be the key to your next wealth opportunity.

Do you agree with this assessment?

I know that the future we seek lies in every step we take, being realized bit by bit within this investment education foundation community.

While others may still be drifting along with the crowd, you, as my student, must see the direction ahead of others.

You have not only gained knowledge but must also make the most suitable strategic plans for the “interest rate cut era.”

Are you ready for all of this?

Tomorrow, I will continue to reveal the true value of the CXON token, helping you truly prepare not only to claim it but also to hold it long-term and benefit from it.

Whether you're in your office, a coffee shop, or in your car right now, welcome to today's class, and good afternoon.

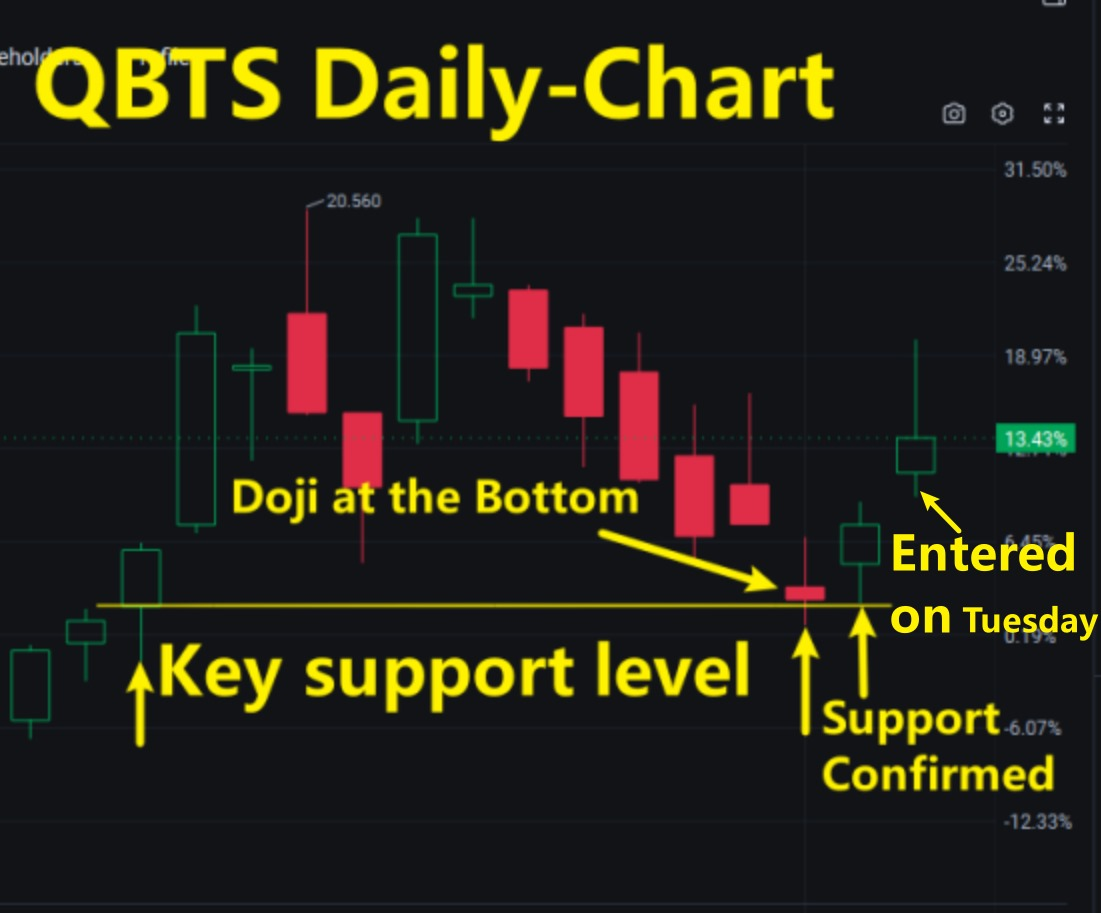

I'm Bird Grant from NextLeap Management Consulting, nicknamed Mr. Profit Hawk. That nickname has been proven by the market once again today: $APLD, which we bought yesterday, locked in a profit not long after the market opened this morning, with a profit of more than 13%; $QBTS, which we took you into early this morning at 17.57, pulled up to 11% at one point, and the system recognized it correctly and executed it beautifully. The $QBTS that we took you into at 17.57 in the early morning session today pulled up to 11% at one point, with the system recognizing it correctly and executing beautifully.

Honestly, today's market, I even feel like drinking black coffee with milk flavor. It's not luck; it's the signal from the system and the team's execution in place - the profit hits one by one.

Friends of the community, today's heart is mostly like this: not happy, but downright fired up. Some of you are smiling like you've just been invited into a VIP room; others say, "This feeling is happier than winning the Powerball." But I know what you're most excited about isn't making money - it's the fact that the system recognizes it in advance, we enter the market according to plan, and then everything moves forward as scripted.

It's called: the trade sings and the belief is realized.

These are not accidental, but rather an inspired outbreak. Today, I'll take you to see something: Is this market worth your time, energy, and money?

Your account of the ups and downs should not rely on the news mood decision. Instead, we should base it on a set of logic we can verify. We should also build a system with real implementations that we can use over the long term.

Because in this market, by intuition can not win ten years, but by logic, by an investment system, it is possible to accompany you to go far.

Many of my friends around me know that I am in finance, and also see that I built the Core X quantitative trading system with Blake Shaw. But few people know that I first realized the power of AI not on Wall Street or in a Stanford classroom, but when I was 15 years old at a used appliance repair store in Palo Alto.

I worked there that summer, and the owner, an old engineer, loved to fix TVs and talk about his "almost finished" machine: a system that could understand people and learn on its own. I didn't even understand assembly language at that time, but I remember he stopped soldering, looked up, and said to me, "In the future, whoever can make machines understand the world will be able to rewrite the way the world works."

At that moment, I planted a seed—an idea about AI that took root deep in my mind.

More than three decades later, AI is no longer just an ideal in a Silicon Valley garage, no longer just a buzzword in an academic report or an investor pitch deck; it's starting to hit the ground running. It's beginning to make its way into the income statement, into asset portfolios, and the heart of our trading decisions.

So when Blake Shaw and I decided to build the Core X quantitative trading system together, it was never about "being a stock screening tool". We wanted to solve a fundamental problem:

In a market that is bombarded with news, K-lines, and "AI concepts" every day, is it possible to build a system that truly understands the structure, anticipates the market's intentions, and takes you through the execution?

A system that translates "AI concepts" into real trading results?

What we want is not to predict the future, but to see the structure first, and then give the basis for implementation. Today's $QBTS is a good example.

Let's start with the technicals:

The near doji daily K-line on August 1 was key - it appeared in a low volatility range after a dip, indicating selling pressure had dried up and buying and selling forces were balanced, an early sign of a potential reversal.

Combined with the daily pattern, this is a move that switches from a low-liquidity zone to a high-liquidity zone, with an upward shift in turnover density and buying dominance.

Combined with the naked K pattern, this near doji K line not only confirms the validity of the support below, but it is a classic "low risk intervention zone" in K line patterns.

The daily K chart reveals a former low support level, a bottom cross, and support that confirms the structural "low-risk intervention zone".

Before 9:30 am, the Core X Quantitative Trading System has hit two core signals on $APLD:

Momentum factor turned positive and turnover activity jumped, signaling the main force to build a position in advance.

2, at the same time, triggered our self-developed "sinking technology/quantum computing" sector structure initiation factor.

So we entered the market near 17.57, not because it is hot, but because the system thinks it is "ready".

Another example is yesterday's $APLD.

Friday's close formed a doji and daily K-line with a distinct long lower shadow, accompanied by a tiny entity and a close close to the opening price, indicating a brief equilibrium between the bulls and the shorts at the highs.

The long lower shadow partly reflects the rapid suppression in the early trading session, and then strong absorption by buyers at the lows, which managed to push the price back close to the opening range.

This pattern usually represents the release of short-term selling pressure and the beginning of a buyer's takeover, and is a classic short-term bottoming signal.

The price over the next two days ran above the low of that daily K and touched the previous pressure zone this morning, completing the first wave of the short-term reversal uptrend. A locked-in profit exit at the highs would have realized a gain of at least 13%.

If the community of friends still does not quite understand the technical graphics, it's time to find an investment adviser to get the relevant learning materials.

So you see, this is a textbook setup-to-profit trade:

The Core X quantitative trading system identified the structure stabilizing on Friday, the signal was confirmed on Monday, we executed a buy on Monday's open, and this morning the profit surfaced - 13%, locked in the profit, and exited, cleanly—no mood swings, no subjective speculation, nor any "betting" component.

We are not prophets; we make logical judgments and implement Core X's quantitative trading system signal quality. What you have is not a feeling of trading, but a set of structured strategy systems that can be used repeatedly and iteratively.

1, you are often in the market rushed up when the excitement in the field, the results of a fall back in being thrown out?

2, you are not every day to watch the disk, brush the news, but every time, it's the real time to do it, instead of being most hesitant?

3. Tools you have used a lot, technology you have learned a lot, and the results of the account are still being led by the market?

4, want to make their strategy model, but in the end, either do not stick to it, or have no feedback mechanism at all?

These problems are not due to insufficient effort, but rather the lack of a comprehensive system to support you throughout the process.

Let's talk about the Core X Quantitative Trading System - a system that doesn't "tell you what to buy", but helps you to re-establish your trading cognitive structure.

In response to the first question, you often find yourself rushed when the excitement in the field is high, and the results of a fall back are thrown out.

The Core X Quantitative Trading System uses structural signals to tell you when a trend has just begun, rather than waiting for everyone to see it. The system uses the trinity model of "Policy Factor + Sentiment Structure + Board Momentum" to capture the starting point without chasing the tail list.

In response to the second question, you don't watch the news every day, but when you do, it's a real-time opportunity to do so, rather than being most hesitant.

We do not rely on the "feeling"; instead, we look at the signal. Core X's quantitative trading system automatically identifies high-potential targets and provides a confirmation system. It eliminates guesswork, giving evidence to help you decide whether to act today or wait.

Core X integrates all the factors, data, and trend judgment to form a unified trading language. You don't need to open ten web pages to find the logic; the system puts "what you should pay attention to" in front of your eyes, simplifies the complexity, and executes to the end.

For the fourth problem, they aim to develop a strategy model; however, they often fail to adhere to it or lack a feedback mechanism altogether.

The Core X Quantitative Trading System features a comprehensive suite of tools, including a built-in strategy simulation module, backtesting system, live simulation, and wind tracking. This comprehensive package not only helps you identify the right and wrong moves but also enables you to review, adjust, and continue evolving your approach, execute a trade, and track progress.

That's why we say: Core X quantitative trading system is not a toolbox, it's a cognitive system; it doesn't give you the answer, it takes you to build your judgment.

In addition to these FAQs we just mentioned, if there are other things you're unsure about in your investing process, or if you're feeling a little stuck when it comes to execution, feel free to let your investment advisor know.

I'll set aside a set amount of time each week to dedicate to answering fundamental questions from the community. I'll respond directly to the important ones, and we'll also schedule one-on-one communication when needed.

You don't have to worry about whether the questions you ask are "professional enough". As long as you participate seriously in this system, we will take your growth seriously every step of the way.

What we do is not one-way teaching. Instead, we are working with you to establish a set of trading capabilities that are effective, sustainable, and adaptable to market changes.

Blake Shaw and I are leading the effort to build the Core X quantitative trading system. together with engineers, investors, and educators from various fields, have built the Core X quantitative trading system, which provides real-time executable trading signals and capital flow tracking, and at the same time, creates a three-tier synergistic cognitive growth system integrating community support, quantitative system, and structured teaching.

It's not for charity, nor short-term heat, but because we have a clear and firm goal: to create a real investment education platform with a public service mission. Right now, we are actively moving forward with filing our 501(c)(3) nonprofit tax-exempt qualification application with the Internal Revenue Service (IRS).

The requirements for this certification are very stringent - to qualify, organizations must meet three mandatory criteria: their services must be offered to the general public, not to paid members with high thresholds; the content provided must be "educational" in nature and not for profit; and all The use of operating funds, budgets, and allocation of resources must be transparent and auditable, and contribute to the public good.

In other words, we're not just teaching people how to trade stocks - we're building a cognitive system that can support your continued evolution for a decade or two:

We are developing a cognitive system designed to support your continuous evolution over a ten- to twenty-year period. This system comprises a growth-oriented learning framework that investors can utilize repeatedly, and a real-world companion system that offers clear judgment and behavioral guidance in response to every market fluctuation.

The reason why we do investment education today is not because "someone does not understand", but because, to establish their judgment system, you can only ever be a follower of the market. The real investor must be the one who dares to stay calm in the chaos and make decisions despite hesitation.

Today's lesson isn't just about "how to invest"; it's about whether you can start to believe that you can read the world, understand the market, and make quality decisions.

The birth of the Core X quantitative trading system is not just a project, a model, or a product attempt for me; it is more like a belief I buried when I was young, which has finally broken through the ground and sprouted.

The bottom layer of this system is AI, with its core being judgment. What it aims to connect is a bridge between a generation of traders and the future world.

I don't want to walk this journey alone. I hope that you, who are listening to this lesson, walk through this process with me, witness the growth of a system, and witness your growth.

1. Do you realize that what makes a trading account grow steadily is not which stock, but what kind of underlying system?

The way you trade now is by judging emotions, or by the structure of the system?

2. Today, we have taken you through the technical structure of QBTS, the entry and exit rhythms of APLD, and how the Core X system recognizes setups, triggers signals, and locks in profits. The question is - can you replicate this "structural judgment" in your account?

3. NextLeap is in the process of applying for IRS 501(c)(3) nonprofit status.?

Are we trying to turn up the heat? Or are we trying to build a cognitive system that is truly investor-owned and can stay with you for a decade and even be passed on to the next generation?

If you already have an answer, don't let it stay just in your head. Inform one of our investment advisors immediately - we offer a CXON airdrop reward for every profound thinker and proactive participant.

It's not just an interactive task; it's a moment of connection between you and the system.

Because you're not here to "listen and see", you're here to participate and evolve together truly.

Every signal that is taken seriously will pay off for you in the future; every cognitive upgrade is a step up in your equity curve.

"For where your treasure is, there your heart will be also."-Matthew Where you put your heart, there your future will grow.

What you have chosen to participate in is not just an airdrop mission, but an actual growth process. cxon is a bond of trust between you and the system, and that trust begins to fall into place at this very moment today.

That's all for today. See you tomorrow!