August 6, 2025

August 6, 2025

I am Blake Shaw, founder of NextLeap Investment Education.

Here, we use CoreX and practical strategies to help you build a truly usable and replicable investment system.

Whether you are joining for the first time or have been with us all along, today's class will take you to a new level of understanding.

In an ever-changing market, the only thing we can rely on is continuous learning and system support.

Join us with questions and goals in mind—this class is not just about learning; it's the starting point for transforming your investment trajectory.

Ready? Let's get started!

Before the new day begins, I would like to remind everyone of an important policy signal.

Trump recently stated that he plans to announce tariffs of up to 250% on chip and drug imports within the next week or so.

This is not merely a trade issue but a signal of industrial strategy. Chips and drugs are core areas involving national security. If this policy is officially implemented, it will accelerate the return of domestic manufacturing to the United States and reshape the critical supply chain system.

As investors, we cannot simply stand by and watch; we must look beyond the surface and understand the essence of the matter. This heralds the emergence of several key trends:

First, the technology manufacturing and healthcare industries may see a new round of policy-driven opportunities;

Second, the United States' proactive position in global industrial competition will be further strengthened;

Third, capital will increasingly favor domestic core assets and strategic enterprises.

Americans have always been known for their pragmatism and determination, understanding how to leverage policy guidance, technological progress, and institutional development to safeguard their interests. It is this spirit that inspired me to establish an investment education system specifically designed for Americans.

The CoreX quantitative trading system I advocate aims to help every ordinary investor find rational trading methods and asset allocation strategies suited to their needs in the complex and ever-changing market.

Friends, I won’t promise to teach you all the secrets of investing in just one hour, but I can assure you that our direction is clear, and our goal is to achieve true mutual benefit.

At this stage, we are focusing on four core objectives:

First, applying for 501(c)(3) nonprofit organization certification from the U.S. Internal Revenue Service (IRS) for the 2025 fiscal year to ensure the legality and public benefit of our services;

Second, establishing NextLeap's professional image and social credibility among mainstream investment groups;

Third, we are fully promoting our self-developed AI financial tool—the CoreX trading system and its intelligent engine;

Fourth, we are establishing high-quality investment education standards, enhancing users' cognitive abilities, judgment, and adaptability in real markets through systematic courses and practical exercises.

I hope that here, you not only learn methods but also truly acquire the ability to take the initiative in real markets—this is precisely the original intention behind the establishment of NextLeap.

So, why are we currently offering free courses, token airdrops, cash gifts, and other no-cost stuff?

This is a key part of our investment education strategy:

On one hand, we give new users a free start to help more people take that first step with minimal cost.

On the other hand, we're still building our brand, so we're focusing on user engagement and satisfaction to build trust and get good reviews. We hope that after you truly understand and recognize our professional services, you will naturally transition to future potential collaborations and paid products.

In other words, today's free offerings are for a more stable win-win future.

We welcome every new partner who not only participates in learning but also deeply understands this “long-termism” educational revolution. In the future, we will continue to build your foundational investment capabilities through service excellence, professionalism, and transparency.

So, what exactly is the CoreX quantitative trading system?

CoreX is an advanced AI financial tool that I personally led the development of, distilling the essence of my decades of investment experience.

I have always believed that in this era of information overload and data-intensive environments, traditional investors find it increasingly difficult to rely on manual judgment to process vast amounts of data, extract key information, identify chart signals, and make rational decisions. Therefore, I needed a truly “thinking, summarizing, and memory-capable” intelligent system to assist in completing these complex financial tasks.

CoreX was created for this purpose, focusing on:

Efficiently identifying market chart patterns and technical signals;

Rapidly filtering and processing vast amounts of financial news and data;

Simulating and analyzing multiple trading paths to propose high-probability strategy recommendations;

Integrating with real accounts for live backtesting to create a complete closed-loop system of “strategy + execution + risk management”

For more technical details and the product story behind CoreX, please visit our official website: https://www.nextleap.vip

Friends, today I want to discuss an important market signal with you, which is also a question many people asked me last night.

Recently, the market has been experiencing extreme volatility around the question of whether the Federal Reserve will cut interest rates. One day the market is expected to rise, and the next day it quickly falls, forming a very typical “emotional roller coaster.” This is one of the main reasons why the three major US stock indices all closed lower yesterday.

As we all know, during such highly uncertain times, a single statement from Chairman Powell could be the key to a market turnaround. Therefore, many investors are focusing on his next statement, hoping to find signals of potential adjustments to monetary policy.

Now, the question arises: under such circumstances of escalating market panic, I would typically advise everyone to pay attention to risk-hedging tools, such as the SQQQ inverse ETF that short-sells the Nasdaq. But have you noticed that I did not recommend it yesterday nor provide an analysis? Why is that?

The answer is actually quite simple.

If we take a closer look at last night's closing data, we'll see that the declines in the three major stock indices weren't actually that significant. Instead, it was “sentiment” that dropped first. In other words, this round of declines was more about investors panicking and selling off quickly in the short term, rather than a trend reversal.

In such a situation, blindly shorting the market can easily lead to the risk of “insufficient room,” especially if you choose the wrong entry point or hold on too tightly, which can result in losses.

Therefore, for me, the best strategy is to—stay patient, control the pace, and wait for more reliable trading opportunities to arise.

This is precisely the philosophy we repeatedly emphasize in the CoreX system: don't act based on “emotion,” but act based on “signals.”

Today's market resembles a phase where direction is gathering momentum. It is advisable to observe more and act less. True opportunities are earned through patience, not through rushing.

Friends, let us begin this day with this reflection. I wish you successful trades, and remember to continue learning and staying calm. Together, we will walk further on this path of long-termism.

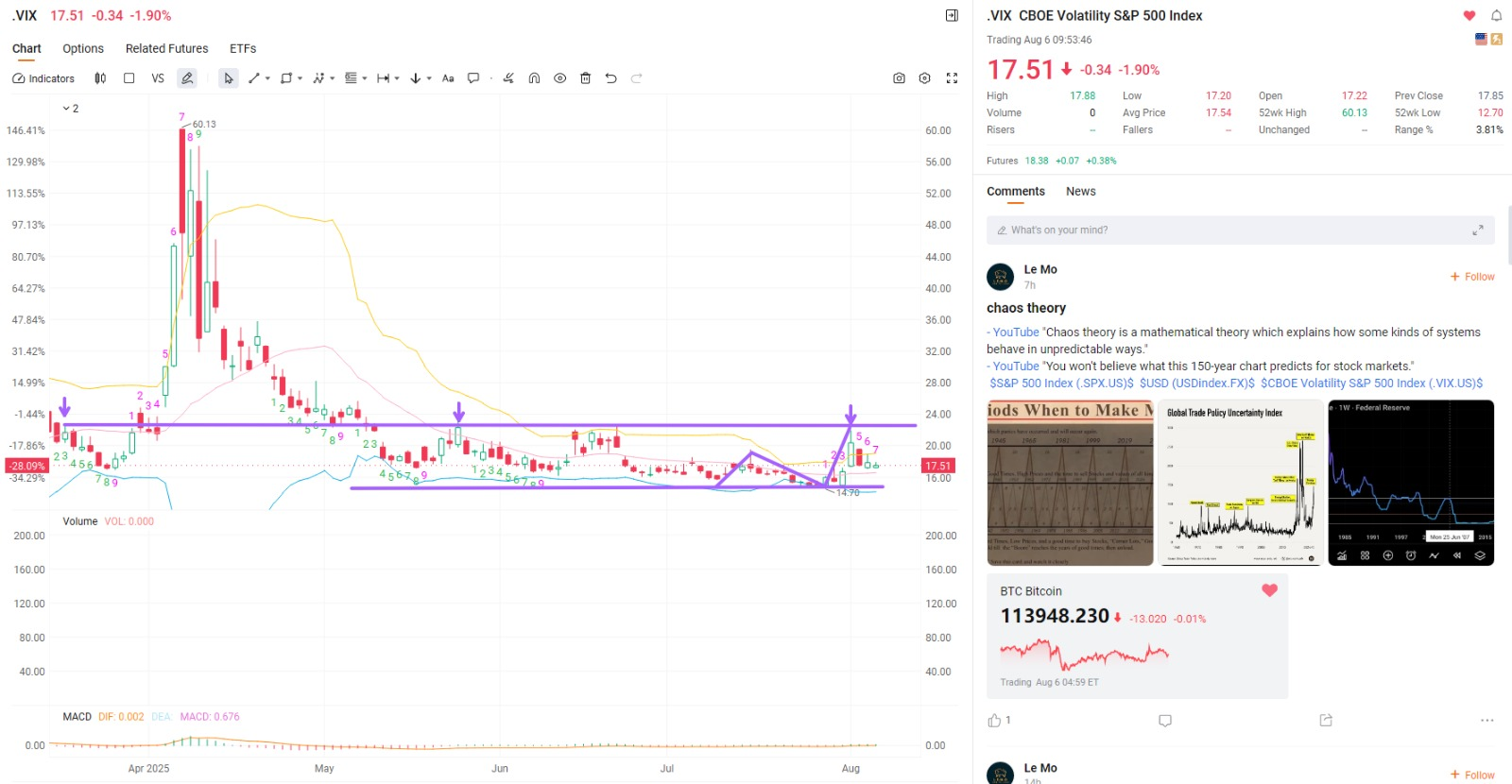

Regarding the VIX index, I will not elaborate further. In yesterday's morning class, you can review this section of the material through my investment education advisor after today's class.

Based on the above explanation, you should understand that in stock market investing, whenever important meetings, decisions, or events are approaching, and unknown data or uncertain policies are about to be announced, this index tends to rise. Its rise stems from panic sentiment, much like your heartbeat—when your heart races and beats rapidly, that’s often the best expression of panic sentiment;

Alright! Since we know that panic leads to an increase, we can use historical averages to gain insight into important market conditions and market sentiment. What is market sentiment?

It is the collective judgment of all individual and institutional investors regarding the current market environment. Is that clear?

Since we are saying that a financial index product (.VIX) will rise, trading it should yield the best spread profit. Yes, this possibility may arise!

It is an index product, yes, an index, just like when we look at .SPX/.IXIC. We are judging a certain stock market trend, and as long as you follow this trend, you are correct!

Similarly, as long as the .VIX index rises, its corresponding ETF product will also rise. How can we understand this?

It's the same logic as when the price of BTC rises, the corresponding Bitcoin spot ETF and SOL also rise. Do you understand?

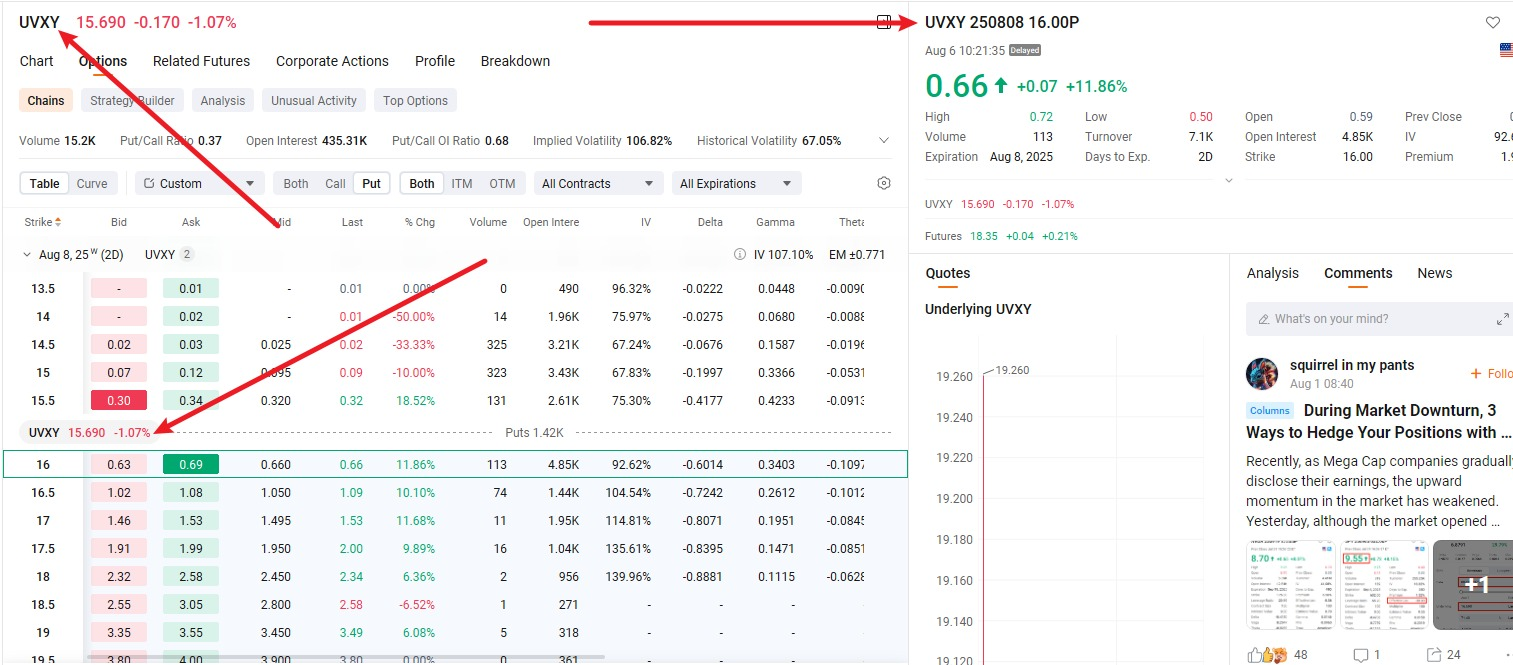

Therefore, when you see panic today and anticipate it, indicating that the VIX index will rise, then buy its ETF, which is UVXY, the strongest-performing ETF. As long as you buy it, you've succeeded!

Does the result prove my judgment?

Because its price will rise; its price rises with the rapid beating of the heart, and the price rises with the market's uncertainty and volatility;

If you master this concept, it will be the most valuable lesson in your US stock market investment journey. This skill will ensure your safety through every panic moment in the future!

Of course, when everything is certain, there is no need to pay attention to it; let it fluctuate and oscillate on its own, as it holds no value. In such cases, we observe stocks experiencing a vibrant rise. Therefore, you understand that the successful trading of this ETF is short-term, short-term, short-term! Absolutely do not mistake the trading direction or cycle!

Following today's lesson on the fear index and its market applications, we will now officially move on to the “advanced skills” section of the course.

Wednesday Lecture: Understanding the application of options in ETF trading. This lesson will help you gain a thorough understanding of these globally mature products in the US stock market and develop a very stable investment portfolio.

Options can span from stocks to ETF, futures, and even cryptocurrencies. Such knowledge accumulation will enable you to develop a comprehensive understanding in future investments, focusing on key points while considering the bigger picture.

This lesson is worth ten thousand dollars—as long as you can master it thoroughly! Come on! Join me in this moment of knowledge dissemination...

In the past, we have learned a great deal about the fundamentals of options and their applications. Today, we will advance to the application of options knowledge:

For example, when you purchase a stock or choose not to purchase it, do you have two options?

The first option is to directly purchase the underlying stock. This method requires full payment of funds—how much per share, how many shares purchased, and the total market value paid is that amount, correct?

The second approach is to use options, which are generally suitable for relatively short-term periods, such as 5 to 90 days.

If the timeframe is longer, product design limitations may prevent transactions from occurring.

This approach involves paying a small premium to potentially earn higher profits while accepting limited losses.

In other words, is this approach feasible for an ETF?

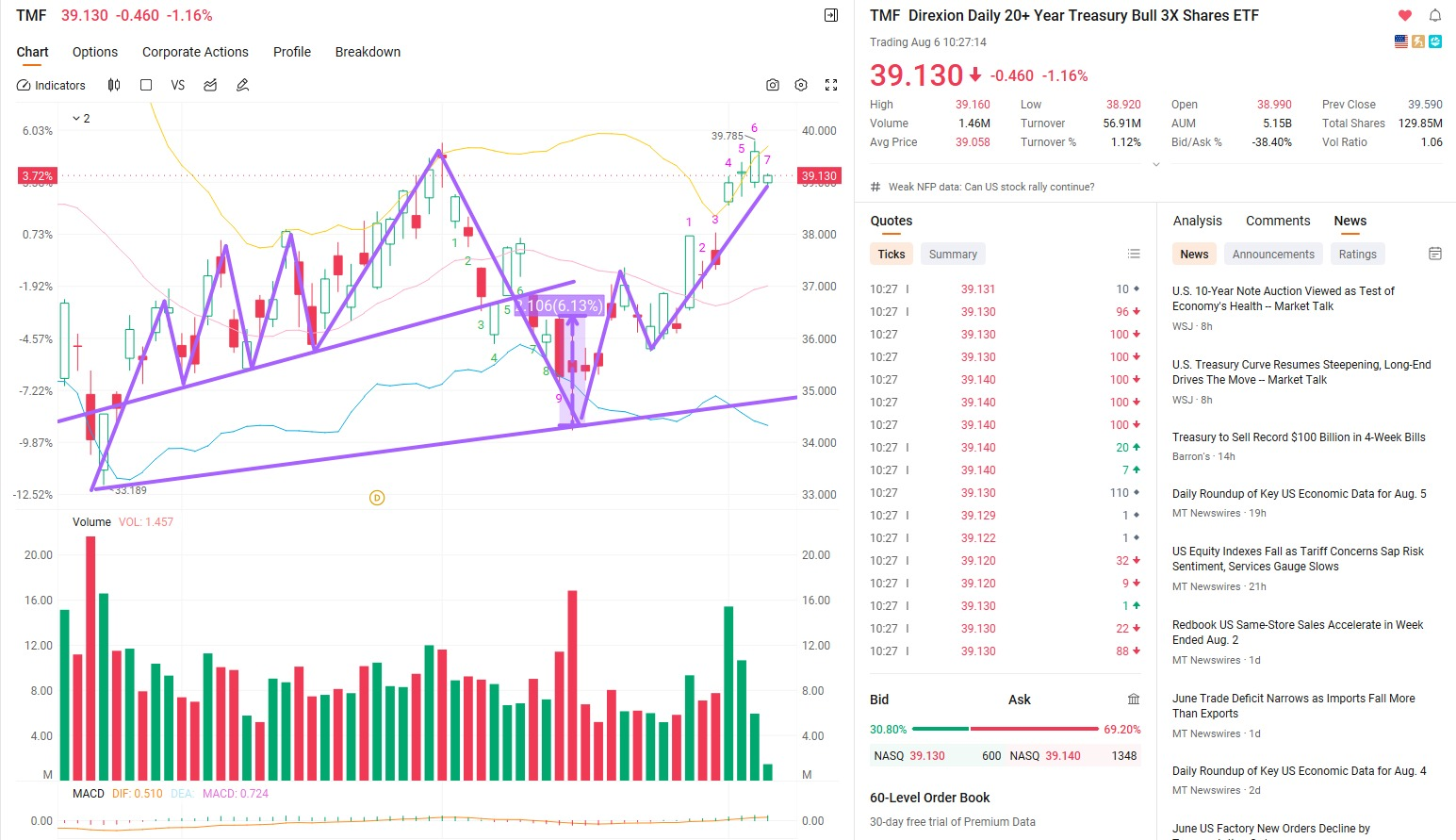

As shown in the chart: This is a 20-year Treasury bond ETF, with the code TMF/TLT.

What does the existence of an ETF signify?

It indicates that a mutual fund has raised funds to purchase 20-year Treasury bonds.

At the same time, this mutual fund will, in accordance with legal procedures, slice the fund into shares and list them on the stock exchange for trading.

Think back to when you purchased a mutual fund—did you simply hold onto it? However, once it becomes an ETF, it is approved for direct trading on the stock exchange, allowing its price to fluctuate.

Therefore, ETFs are also referred to as another form of stock. Yes, you can simply understand it as another form of stock.

The key difference is that stocks are issued by publicly traded companies and follow changes in the company's business operations, while ETFs follow the performance of the fund. In other words, the fund company's performance determines whether the ETF's price rises or falls.

Hypothetical example:

Suppose Stephen's farm has 10,000 dairy cows. You and I establish a mutual fund and raise $500 million. We focus on investing in this farm. As long as the cows' milk production and milk sales continue to improve, it means the fund is performing well!

Suppose the name of our mutual fund is A+B.

By listing it on the NASDAQ exchange, it becomes the A+B ETF.

It becomes a stock available for trading by all investors on the exchange—buying and selling!

Price fluctuations are influenced by supply, which is derived from the farm's operational performance!

The better the performance, the higher the milk production, and the better the milk sales, the more the A+B ETF can continue to reach new highs!

Do you understand now?

Since ETFs are similar to stocks and there is not much difference between them, they also aim for price volatility! Just as stocks can have options products, ETFs can also have options products.

How do you find the corresponding options products?

You need to open your own trading account/brokerage software and access the options section!

Enter the stock code or ETF code to view the relevant information!

For example, in the figure above: when I enter TMF, the options information page displayed is for Treasury ETF options;

when I enter UVXY, the options information page displayed is for volatility ETF options;

When I want to hedge, I need to take a reverse position,

When I want to go long, I BUY a CALL;

When I think it will decline in the future, I BUY a PUT;

This is the most advantageous representation of ETF product optionization. These important aspects are simple and straightforward to understand;

Have you learned it?

You could say that! Under the right conditions, Mars could also become an options product. Therefore, don’t be afraid of any financial product—the logic is the same, only the methods differ. The core purpose is to create price differentials and the fun of speculation.

After learning this lesson, when you obtain a stock code, ETF code, futures code, or even a cryptocurrency code (cryptocurrency options are currently under review, and we will see them soon),

you should understand that options products will be available for these as well;

Alright, folks! Thursday is the core of the competition, and today is just an important step in preparing your strategy and mastering the basics; try reviewing the following questions to win a lucky draw code!

1. Can the VIX fear index be invested in? If panic arises, would you first buy the ETF or the ETF options?

2. What events can cause the VIX to rise?

3. What conveniences does ETF optionization offer? What is your understanding of this?

Friends, don't rush to chase returns; instead, steady your footing and enter the market with thoughtful consideration.

See you tomorrow. Wishing you a steady, clear, and fruitful day today.

——————————————————————————————————————————————————————————————

Whether you're in the office, in your car, or doing a market review while sipping an iced Americano - welcome on time. Good afternoon, I'm Bird Grant from NextLeap Management Consulting, LLC, known as Mr. Profit Hawk. I'm over 50 years old, but my brain is faster than the market. Today's market didn't let me live up to this title. Although there were fluctuations during the day, our key positions, such as $APLD, $RBOT, $QBTS, and so on, still maintained a clear structure and signal continuity; Nothing disrupted the rhythm of the system, and our judgment remained stable.

I want to tell a little story: many people know Warren Buffett (Warren Buffett) in the financial history of the "Prophet of Omaha", but few people remember that he was in 1973 to 1975, that is, the years of economic stagflation + stock market crash years, almost by the market to the edge of the exit. At one point, he closed his investment partnership and moved most of his money into Berkshire. But you know what he did at that stage? Instead of looking for the following "hot stock" or chasing market fluctuations, he went back and sorted through the companies he knew, understood, and could hold on to - just like we're doing now.

He said, "Greed when others are fearful is not about emotion, it's about structure - you need to know why you're still there." I want to give you this exact quote today: We don't trade on passion, we trade on logic, systems, and conviction.

We're going to talk about what's happening in your account: did the system send a signal? Did you take action? Did the results materialize?

The market will fluctuate, people will hesitate, but the system remains emotionless. Behind each of your serious participations is the training of your own more mature judgment. And the fact that you are still in this class today means you are serious.

We're ready. For the next few moments, pull your attention back and let's look together: which directions are changing? Which signals have been confirmed? Which positions should be adjusted?

We will start with the $SGMT buy logic, walk you through the technical and system dual-track structure, and then return to the layout of our entire 40/60 portfolio. We will explain how we use the system to control volatility, lock in profits, and sustain growth.

We don't chase the market when it moves; we don't chase it when it goes up, nor do we sell when it goes down. Instead, we follow the system signals and implement a set of proven operating methods that have been tested in the real market.

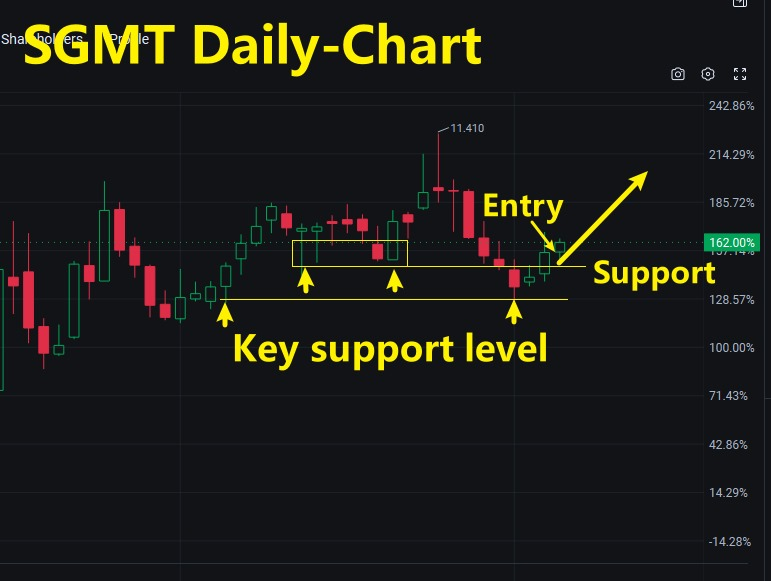

We chose to enter on $SGMT because the technical structure gave two clear signals:

First, the former low support is confirmed.

In the past few days, $SGMT has formed several downturns in the same area, and the bottom of the K-line has gradually risen, indicating that the buyers below are stable, and the short-side momentum has begun to decay. 8-8.7$ represents the area of the previous lows in the intensive turnover area. From the last steps back, it did not penetrate; the bottom of the structure is valid, serving as a typical "structural support" that provides a clear signal of structural confirmation for us. It is a clear structural confirmation signal for us.

Second, the momentum structure is in place to lift.

From the point of view of volume changes, funds began to shift from wait-and-see to active entry. Volume gradually enlarged, the price lifting process with substantial transactions, the past two trading days, volume appeared significantly enlarged, the center of gravity of the price lifted, showing that the low level of funds to intervene in the short side of the weakening of the suppression, which is not a rebound, it is the structure of the building.

So what kind of setup is this?

It is an executable setup with low risk and a clear stop-loss range. It is not a chase, but an active attack in a "controlled risk window" after the structure is confirmed.

Why do we still choose to attack when market sentiment is divergent?

Sentiment can be divergent, but the system does not carry it. The Core X system identifies setups based on the synchronized resonance of three key factors: momentum, support, and turnover behavior, rather than imagination. We do not rely on judging how the market "feels"; we only implement the behavioral structure that has occurred.

Corresponding to the Core X Quantitative Trading System signal:

Event-Triggered Signal Matrix flagged:

SGMT belongs to the "Edge Technology + Healthcare Convergence" sector. The recent expansion of blockchain infrastructure and rising interest in healthcare technology have driven this. The system has identified it as an event-driven sub-beneficiary theme.

Sector Rotation Engine Trigger:

Driven by the upward trend of AI+Semiconductor, the system detects that funds are extending from core technology to "high resilience fringe track", and SGMT is recognized as a structural follower beneficiary in small and mid-cap, entering the tracking pool and sending out initial momentum alerts.

Momentum factor turns positive, the system recognizes it as a "high latent value target," and sends out a position signal.

Put:

SGMT is not a mainline pioneer, but the system classifies it as a low-conviction, structure-following setup. With momentum, it is a candidate for execution that meets the criteria of the "Signal + Pattern" combination of this type of ticket.

After talking about $SGMT, you may have noticed one thing in common: whether it's $APLD, which locked in profits yesterday, $QBTS, which fell back today but is still structurally healthy, or even $SGMT and $RBOT, which we've just been tracking - they're not just stocks we pick up on a whim. Still, they represent the "offensive end" of our entire 40/60 portfolio. "They are not stocks we just picked up, but represent the" offensive end" of our entire 40/60 portfolio. Next, I'd like to talk to you about our portfolio structure.

Our 40/60 Portfolio Structure | Dynamic Balance of Offense vs. Defense

The logic behind this structure is elementary - we don't rely on guessing what's going to go up or down, we rely on the system to identify risk structures and allocate position weights.

For example, the offensive side represents the assets we actively attack after the signal is confirmed. The underlying assets, such as $RBOT, $APLD, $QBTS, $SGMT, are all entered into the market after the system has given a clear signal and the momentum factor has turned positive. Gain cash, short-term, strong execution.

We are not betting on one side or the other, but instead we are dynamically balancing our positions amid volatility.

It's important to realize that we don't just have a "highlight reel" of strategies; we also have a "buffer mechanism" to deal with volatility. It is the key to going far in the real market - not just winning once, but repeatedly implementing and growing. The key to success in the real market lies in repeatedly implementing and growing, rather than just winning once.

For $NVTS, the price has now returned to the systematic structural support zone ($6.2-$6.5), which has been the area of recent volume buildup and an essential reference for the cost zone of the previous sideways platform. Several technical platforms are also positioning $6.20 as a key support level, where we still expect buying support to show up.

The signals identified by the system are in line with this logic: volume is shrinking in the pullback and consolidation phase; price is falling, but OBV is not clearly following the fall - indicating that there may be funds below to take over, which is "hidden sucking", and there is still potential for a reversal in the short term; it is currently close to the support zone, but there is no sign of a reversal yet. Currently, it is close to the support area, but there is no sign of a break.

From a technical point of view, this is a typical low-band sucker zone, not a systematically confirmed downward structure. If the price stabilizes in this area, a rebound may still follow.

Many of my friends have asked me:

"Bird, if your Core X quantitative trading system is so strong, why did you launch the CXON token?"

The Core X Quantitative Trading System is not a software product that can be sold once written; it is a system that requires continuous iteration in the real market.

What is CXON?

It's not a "coin"; it's the funding engine, functional passes, and equity index of the Core X quantitative trading system.

Behind each of its units, what is bound is not a concept, but a real strategy upgrade, a capital flow judgment model optimization, and a structural signal model expansion verification.

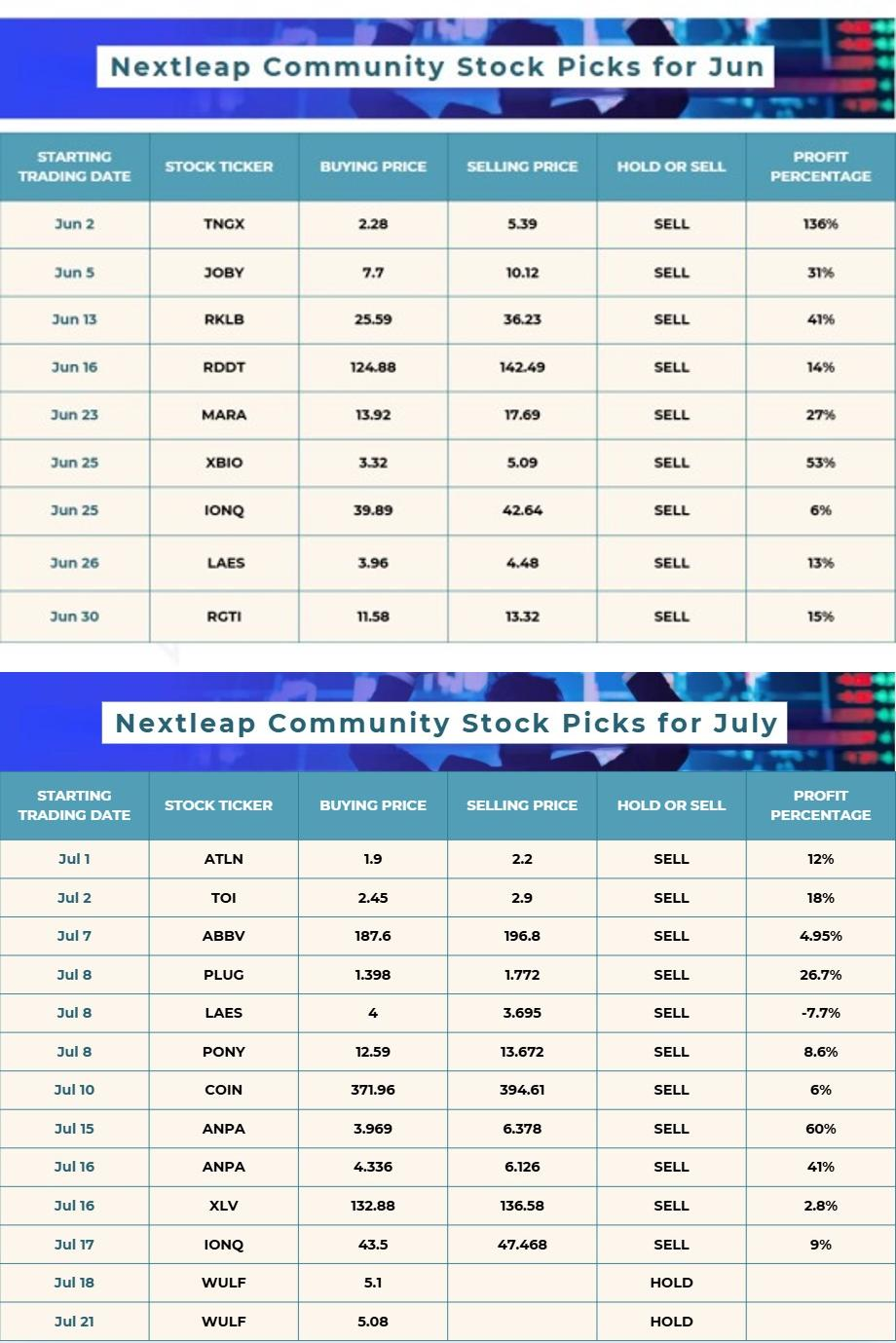

Just like the $TNGX, $JOBY, $TOI, $ANPA, $IONQ, $COIN, $APLD, $QBTS, $SGMT we are talking about today, their signals don't come out of thin air; they are all the result of the system's extensive training, continuous evolution, and data extrapolation over the past few months. And all this training and upgrading is itself an extremely costly process.

So who will pay for all this training? Not through selling courses or VC, but through the CXON mechanism we launched, so that those who have actively contributed to the system's growth will also have the opportunity to benefit from its future commercialization.

The CXON you are holding now is not just a token, but an index of the growth track of the AI trading system, a "on-chain ticket" that binds the growth of the system, and a voucher for your real participation in the market training and system co-construction.

And this "credential" is being repriced by the market because of the system's performance - the stronger the system's capability today, the thicker the underlying anchor value of CXON.

So what we're doing today is not just buying a ticket and selling a ticket. What you're looking at is how the whole system works, how it profits, how it grows, how it feeds.

And you - do you already have a structural ticket to participate in the future of this system?

You're probably already wondering, How do I get involved?

CXON is not about robbing or throwing ads. We only welcome people who have participated in the system. You come to learn, practice, and participate in building, and only then does the system welcome you to join the ranks of co-builders.

So right now, there are three main ways you can get your hands on CXON:

1. Daily Task Participation Mechanism

Every day you sign in and like the content of the community course, you will accumulate the number of CXON you can receive. It's the first step in "binding the system behavior", and also the most basic cognitive participation.

2. Daily Interaction Rewards

Questions and interactions in courses, feedback, and suggestions on live trading - as long as you are an active participant, we will issue interaction rewards, which are issued directly in CXON.

3. Weekly Community Drawing on Fridays

We will open the drawing every Friday. To participate, look for the Investment Consultant to obtain the drawing code. If you win the CXON, please get in touch with the Investment Consultant to arrange the CXON binding airdrop.

You asked me, "How much of these can I claim?" It's simple: the sooner you participate, the sooner you bind, the more consistently you use the system, the more generous your airdrops will be.

Whoever gets more is not only buying more, but also because they are seeing, keeping up, and going the distance.

The sooner you get the system to recognize you as a real participant, the more you contribute now, the larger your share when we commercialize the system in the future.

To put it more bluntly: the system is constantly being validated by real transactions, and the token value is built up step by step during the validation process; you, on the other hand, have already taken up a good position and are just waiting for the moment when the system is cashed in.

If you are still not sure whether you have completed the qualification, how much you can claim, or what steps are still missing, don't be entangled; directly find your investment advisor, and they will be very willing to help you figure out these things.

Now is the time for the value puddle; now is the window to tie into the system and become a co-builder.

Finally, I would like to ask three questions of the community for today's program.

Question 1: Do you know what the core function of CXON tokens is?

Question 2: Do you know what ways you can get CXON? (Name at least two)

Question 3: Do you rely on your feelings or follow the signals of the Core X Quantitative Trading System in making investment decisions?

If you answer the question seriously, please get in touch with your investment advisor in time, and we will issue CXON airdrop rewards for you.

We are building a system that will last 10 years!

You're not "betting on a ticket"; you're participating in the entire process of a system's growth curve.

The Core X Quantitative Trading System is the real-life embodiment of AI in the financial world, and CXON is the bridge to realizing its value.

As Proverbs says, "In all your getting, get understanding."

The Core X Quantitative Trading System is continually updated and refined, and the right to participate is in your hands.

That's all we have for today's lesson - the system is still running and the opportunity is still present. We'll see you in the next lesson.