August 8, 2025

August 8, 2025

Yesterday, the U.S. government dropped a bombshell—401(k) retirement plans will now allow investments in Bitcoin and private equity. This means your retirement funds are no longer locked into stocks and bonds but can now enter emerging asset classes with higher growth potential.

What does this mean?

It opens up new avenues for wealth appreciation, not only preserving principal but also creating greater growth potential for the future. However, remember that opportunities do not automatically turn into results—the key lies in having precise tools and clear methods. The CoreX quantitative trading system is such a tool: it automatically captures market signals, determines entry and exit timings, and transforms investing from “gut feelings” into a systematic, replicable profit model.

Therefore, in today's class, we will leverage this policy opportunity to explore how to organically combine stocks, options, U.S. Treasury bonds, and digital currencies to seize this golden window of opportunity that could transform retirement living.

A significant change is taking place in our retirement investment rules.

President Trump has just signed an executive order—from now on, your 401(k) account will not only be able to invest in stocks and bonds, but also in emerging assets such as Bitcoin and private equity.

This is no minor change—it opens a new door to wealth for our retirement. Imagine: the retirement savings you’ve worked so hard to accumulate no longer have to sit idle; they can now participate in markets with enormous growth potential.

This means your retirement account no longer has to passively follow the rhythm of traditional assets but can instead pursue higher returns in a more flexible and proactive manner—while maintaining safety, it also provides a genuine growth catalyst for your future.

Now, with President Trump's executive order, we can for the first time include assets like Bitcoin in 401(k) retirement accounts.

Imagine, in the coming years, your retirement savings no longer just following the stock market's ups and downs, but instead sharing in the growth dividends of this emerging asset class, giving you greater freedom and choice in your golden years.

Let's talk about private equity.

Many successful entrepreneurs and wealthy families have achieved enviable returns by investing in companies that are still growing rapidly. In the past, these opportunities were largely inaccessible to ordinary investors due to high entry barriers.

Now, this door has opened to us—you can fully participate through your 401(k) and share in the profits like the big players. In a few years, you may look back and be glad you took that step at this time.

Of course, a stable retirement requires more than just making money—it also demands proper planning. The greatest significance of this new policy is that it makes your 401(k) investments more flexible and diversified. You can tailor your asset allocation to suit your risk tolerance and goals. Whether you’re a conservative or aggressive investor, you now have more ways to seize opportunities.

We often say that one of the most important principles of investing is not to put all your eggs in one basket.

Now, being able to add emerging assets like cryptocurrency and private equity to your 401(k) is like adding a few more high-growth tracks to your investment portfolio. This way, even if the traditional stock market is volatile, you can use these high-growth assets to diversify your risk and make your account returns more stable and promising.

Trump's executive order is essentially a “shot in the arm” for our retirement accounts. It not only gives you the opportunity to participate in high-return investments but also truly opens the door to wealth growth. Imagine that in the future, your account not only preserves your principal but also grows steadily, meaning you'll have more choices and more freedom to plan your retirement life.

Opportunities come, but not everyone seizes them. But today, having heard this information, you have gained a head start.

The question is, will you choose to act, or continue to wait and see?

Looking back in a few years, I hope you will be the one who feels fortunate for the decisions you made today.

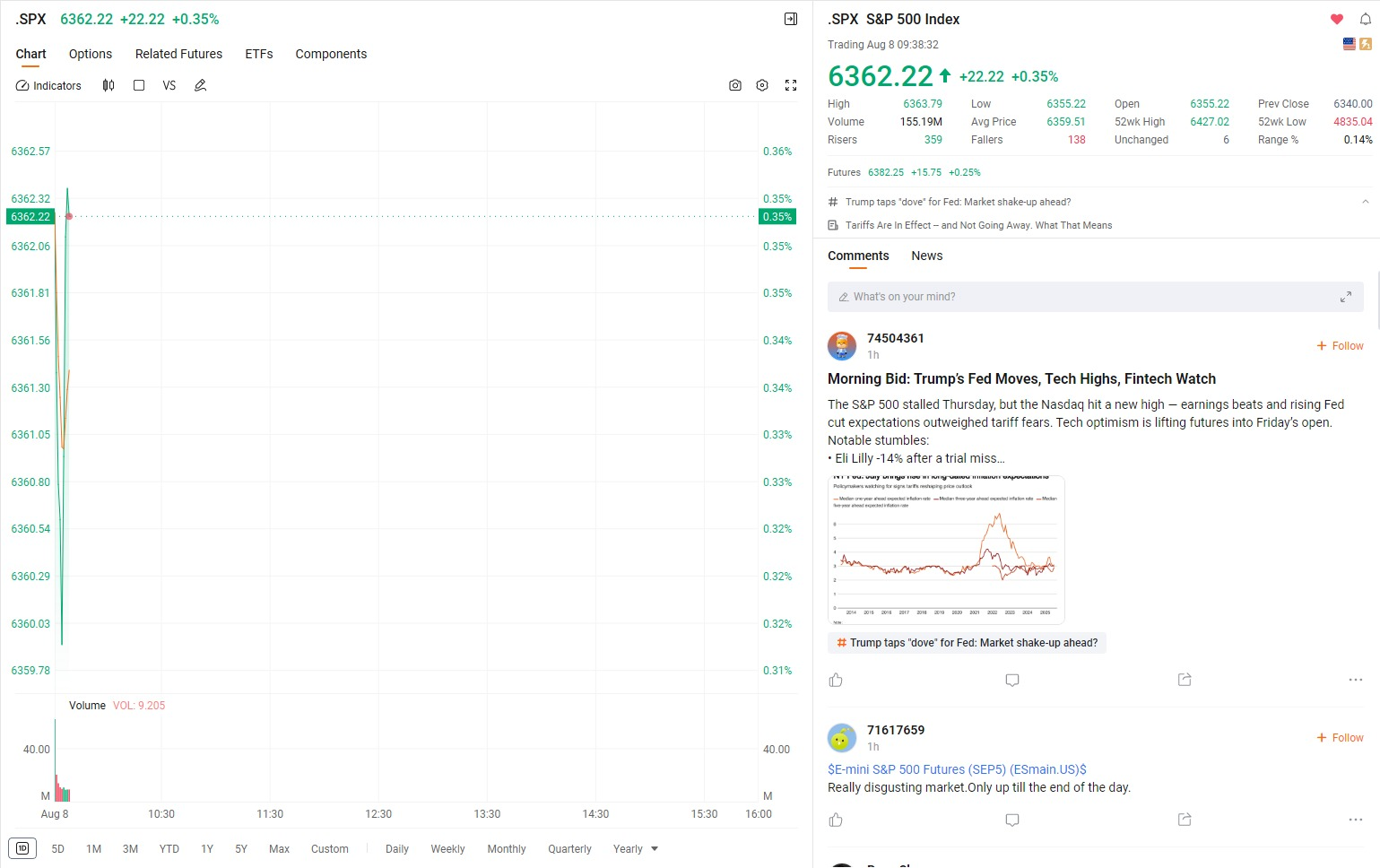

Additionally, Trump's announcement that 401(k) plans can invest in cryptocurrencies has sparked concerns among institutions about increased market volatility in the future, which could impact corporate profits and valuations. As the second-quarter earnings season enters its peak, the market will amplify both positive and negative news, leading to more frequent fluctuations.

In this unstable environment, the safety margin for short-term trading is indeed low. My advice is simple: sell all profitable positions on Friday to lock in profits. If the market adjusts next week, take the opportunity to buy quality assets at lower prices. This strategy not only avoids the uncertainty risks over the weekend but also preserves flexible capital to capitalize on the next opportunity.

Friends, the financial investment genius George Soros once said, “As a market participant, I am concerned with investment value and the maximization of profits; as a citizen, I am concerned with social value, including human peace, freedom of thought, and social justice.”

Yesterday, the Trump administration announced significant changes to 401(k) retirement account policies, allowing alternative assets such as cryptocurrencies to be included as investment options. For us, this presents a rare opportunity to better leverage the potential of these emerging markets through flexible asset allocation.

As a rapidly developing asset class, cryptocurrencies are offering substantial returns to many investors, and we should seize this opportunity to continue growing our wealth in this market.

What concerns me more is how to maximize investment profits during this period. We cannot directly participate in political decision-making, but what we can obtain are tangible market profits and wealth growth—that is, actual returns from investments. It is these returns that enable our wealth to continue to appreciate and achieve financial freedom.

We are currently moving toward an exciting goal, with successful profits within reach. Dear partners, how much have you already gained?

Feel free to share with me, or if you missed the opportunity, let us know. Only through mutual sharing and communication can our investment journey become more fulfilling and further enhance the value of long-term collaboration.

Friends, in addition to the profits generated by the CoreX 40/60 investment portfolio, you should also pay attention to the CXON tokens in your possession. Their price has been steadily rising, and the trend is becoming increasingly healthy. There are two core factors driving this upward movement:

First, the growing influence and trust accumulated by the NextLeap educational institution;

Second, the profit validation and continuous optimization of the CoreX system in real-world trading. Every profit made and every improvement in analytical capabilities serves as a solid foundation for the price’s upward momentum.

Looking back at this week, while CoreX cannot pinpoint every percentage point, the results are real and replicable. I believe that in the near future—perhaps even as soon as next week—the CXON price will have the opportunity to break through the 1.2 USD threshold. This is not merely numerical growth but a value-driven outcome achieved through the collective efforts of our members and institutions.

So, I ask you: How many CXON tokens do you currently hold? Do you want to accumulate more before the breakout?

If the answer is “yes,” then act now while the price remains within a reasonable range, moderately increase your position, and position yourself for the next upward trend. Opportunities don't wait, especially those driven by real results.

On this heartwarming Friday, let's talk about an intriguing story.

Soros' financial prowess is legendary—his wealth once exceeded the GDP of 42 countries. This is not just a number, but proof of his decades of steady and efficient investing.

He has also fallen, but each time he has gotten back up, stronger than before. It is this ability to stand tall in the face of adversity that is the real reason for his longevity in the financial markets.

The market is not short of those who catch a lucky break, but those who truly weather the cycles are those who know how to reflect, adjust, and start anew. The weekend is the best time for reflection and preparation.

Action Recommendations

Friends, approach next week's investments with this mindset—whether it's CoreX's trading strategy or the CXON tokens in your hands, use a systematic approach to plan your moves. Let the next growth opportunity be part of your plan, not a matter of luck.

"I was born into poverty, but I will never accept dying in poverty! When opportunity knocks, never hesitate; God has given each of us opportunities, but He also tests us to see if we possess the foresight to anticipate these opportunities and the courage to seize them.

The CoreX 40/60 portfolio is our first step toward success. It is like a mountain calling us to climb, allowing us to overlook a broader world and endless possibilities.

May our weekends be fulfilling, healthy, and safe—and please take this time to review your holdings and financial plans.

On Monday, we will set out together to execute the next phase of our strategy, embracing even greater wealth and opportunities.