July 10, 2025

July 10, 2025

It's a little chilly this morning. I wonder if you are also holding a cup of hot coffee, wondering whether to have a muffin. In northern states, fall has already begun to creep in; in places like Miami, the sun is still shining and kids are still chasing the tail end of summer on the beach.

Perhaps you’re planning a family trip, or maybe you’re fully focused on advancing an important project. No matter where you are, the rhythm of life constantly reminds us of one thing: we must cherish the beauty of the present while also preparing for the future, especially in this increasingly uncertain market environment, where we need to prepare our finances and strategies in advance.

I often think that the real fun of investing does not entirely come from the results themselves.

When a trade ultimately yields a profit, the sense of fulfillment is indeed fleeting and direct; but what truly captivates me is the process of preparation, judgment, and waiting that precedes it.

It is a sense of inner conquest, where you sift through a vast amount of information, set the pace, and quietly wait for your opportunity.

It is this process that makes investing both challenging and meaningful.

For me, the appeal of investing is not just about “making money,” but about continuously improving self-awareness and judgment through each preparation process.

Do you share similar feelings?

For example, if you participated in my teaching and practical sharing sessions in the community over the past two weeks, take a moment to reflect:

Have you had any epiphanies about a particular detail? Have you begun to learn how to analyze independently? Have you gained a sense of composure when it comes to “trading”?

I look forward to hearing your feedback here.

It can be a reflection or a simple feeling.

Let's use genuine interaction to confirm that investing is not just a solitary act, but also a journey of collective growth.

Yes, as soon as you join the community, our investment education advisor will contact you immediately to help you familiarize yourself with the course structure and content. Her role is like that of a personal learning assistant, helping you better understand the pace, grasp the key points, and guide you in gradually building your own investment framework.

Regarding our community courses, I would like to make a clear commitment here:

Over the next six months, I will consistently and systematically deliver high-quality investment content, accompanying you step by step in enhancing your understanding and building your own trading mindset system.

These courses are currently available free of charge to community members.

Of course, at some point in the future, we may transition them to paid content, but I will formally notify you in advance and provide you with ample time to make your decision, so please rest assured.

Although you are now getting a free learning opportunity, I would like to emphasize one point:

The knowledge value conveyed by all of this content is completely comparable to the system value of the top $100,000 investment course

Content covers:

Macro trend analysis

US stock sector analysis and interpretation of capital flows

Visual teaching of charts and technical signals

Explanation of real-market strategies (including entry logic and exit points)

Review of selected targets and thinking training

Every piece of content is a summary of my years of market experience, with one goal: to help you truly enhance your independent judgment and build the confidence to “win on your own.”

Now I would like to ask you—

Beyond this content, what other areas would you like me to cover?

From recent market trends, although the index has occasionally rebounded, overall sentiment remains hesitant, and the momentum of capital inflows has yet to coalesce into a cohesive force. This suggests that most investors are still awaiting a clearer directional signal.

Meanwhile, the VIX volatility index has continued to decline, appearing calm on the surface but more akin to suppressed momentum building. Experience has taught me that such “quiet phases” often harbor opportunities for market reversals. At this stage, blindly attacking is less effective than calmly observing.

I have always adhered to a core principle: do not chase gains, do not cling to highs, prioritize defense, and use structural attacks as a supplement.

Rather than betting on short-term speculation, it is better to use data to identify assets with genuine value support—this is the underlying logic for navigating volatility and achieving steady returns.

Friends, we are now entering today's Thursday class time.

This is our first formal introduction to the topic of option buyer strategies. I know that for many beginners, this is both a completely new concept and a gateway to the professional trading world.

In today's class, we will explore three key points together:

How to identify market signals suitable for buyer operations?

What is the structure of buyer options, and what kind of trading mindset are they suitable for?

How do we balance risk and reward in actual operations to avoid being swayed by market sentiment?

The appeal of options trading lies not in its complexity but in the flexible decision-making space it offers investors. However, precisely because of this, you must possess clear logic and risk awareness to truly master and utilize it.

This class is just the beginning.

From today onward, I will guide you step by step to deeply understand the underlying logic of options trading and help you build your own judgment system.

So please focus, be serious, and don't hesitate to ask questions.

True growth does not lie in “understanding a case study,” but in whether you can use your own logic to review every trading opportunity.

Welcome to this journey, and I look forward to seeing you take your first step on this path of learning.

Example:

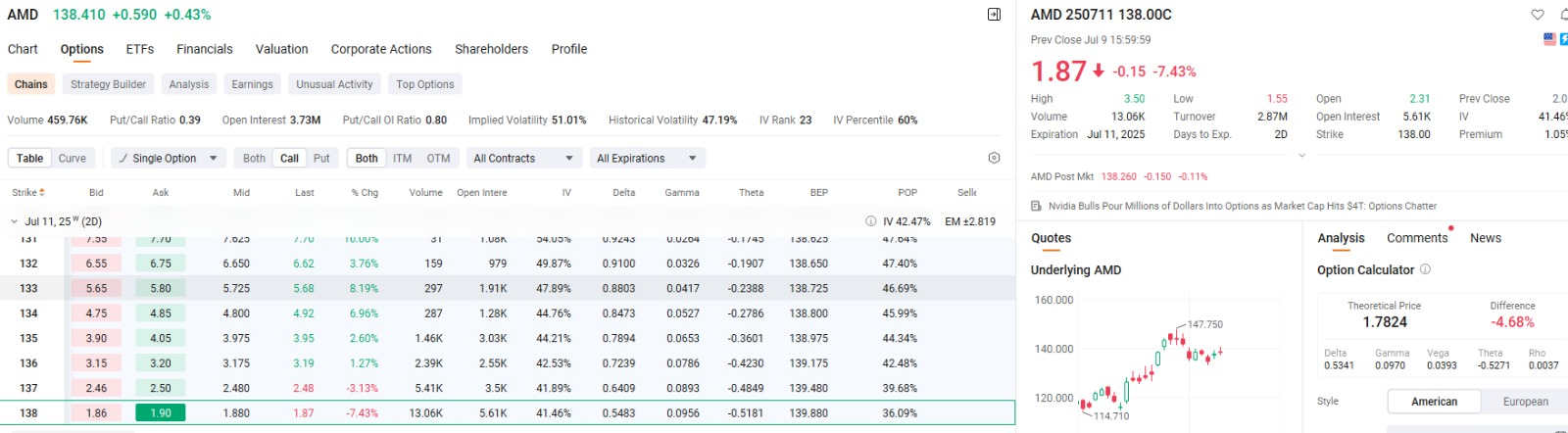

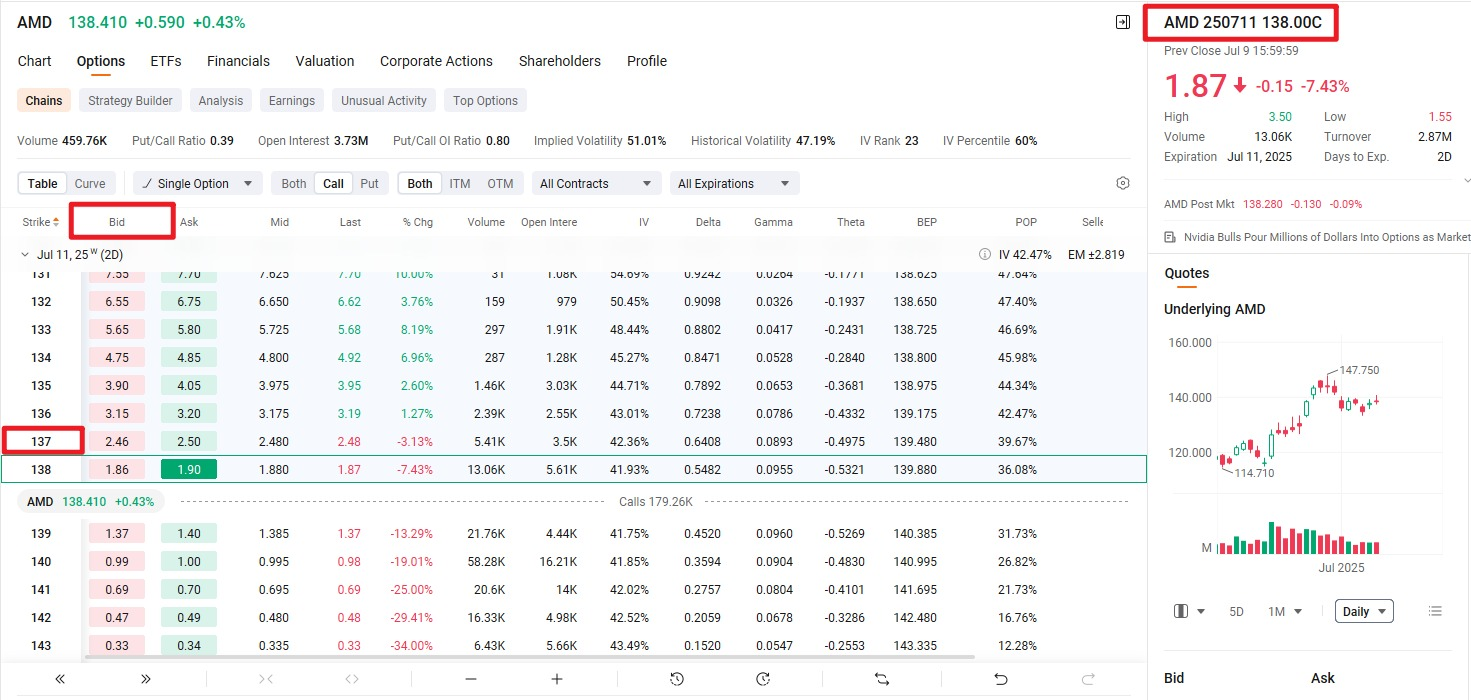

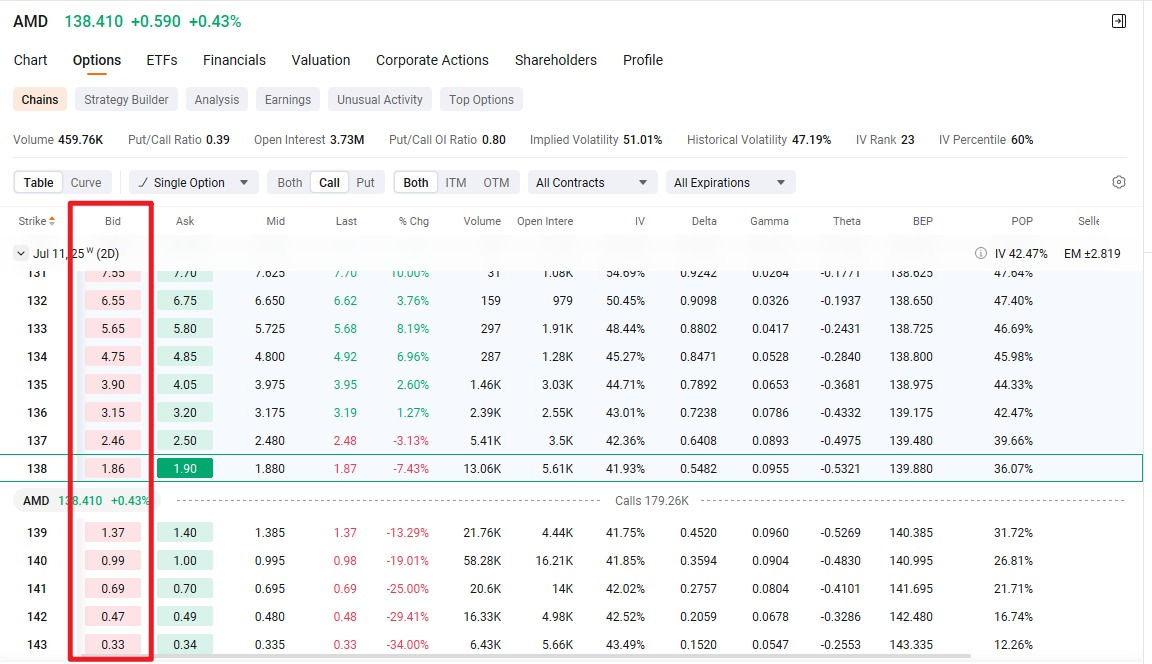

The signal code for this stock option: BUY AMD 250711 138.00 CALL

How can you quickly understand this option signal?

BUY: Represents the buyer, i.e., the party paying the premium;

AMD: Represents the stock code, meaning this is an option product for this stock;

250711: Represents the exercise date of the option, i.e., the expiration date of the option contract;

138.00: Represents the exercise price of the option, meaning that after the exercise date expires, I will exercise the right to obtain this stock at this price.

CALL: Represents a call option, indicating the view that the stock price will rise above $138.00;

When you receive a series of option codes, you should be able to quickly grasp the key information. Have you learned this?

So, when you participate as a buyer (BUY) of options, you should understand that after the option is executed, you can exercise your right early, meaning you don't have to wait until the expiration date. You can sell the option contract in your trading account, which is one of the options available during an upward trend;

Of course, you can also wait until the expiration date to exercise the right directly. This is the charm of American-style options and one of the main reasons why many people enjoy participating in options trading—it offers a high degree of flexibility.

So, how should we understand the theory behind early exercise and expiration exercise?

Assume you participated in the option signal: BUY AMD 250711 138.00 CALL

On Thursday, you participated in the option, and the AMD stock price on Thursday was 138.00.

The corresponding option price at the time of purchase should have been 0.78 USD, but on Thursday, the option price had already reached 2.46 USD. This indicates that the price of the AMD option you purchased has risen to the price you expected on Thursday, 138.00 USD.

In fact, the option has not expired (July 11), but you can choose to sell the option today and lock in the profit.

This is permitted by the option rules, do you understand?

So how much is the profit of exercising the option in advance?

It will be determined according to the real-time trading price of the option, such as the price setting of the above option.

when purchased, the option price (premium per share) was $0.78;

if exercised early before expiration, the selling price was $2.46.

Option price difference: $2.46 - $0.78 = $1.68 per share.

When you purchase one AMD option contract on Thursday, you effectively gain the right to 100 shares.

Your total profit: 1.68 × 100 shares = $168!

If you purchase 2 option contracts, the total profit = $336, and so on!

The core of this profit comes from the accuracy of your judgment that AMD will rise.

Do you now understand the profit generated by exercising the option early, even though the option contract has not yet expired but has reached the exercise price?

As shown in the chart, when you participate in stock options, the price of the option also fluctuates with market conditions. You need to seize the opportunity. When you are confident that it exists, you can obtain the best purchase price and the best selling price.

However, if you do not exercise your option in advance, or if you forget to exercise it in advance due to work-related factors, and it expires automatically, will the effect be the same?

The answer is no. Why?

Because if, at expiration, the stock price happens to be exactly at $137 (according to the aforementioned hypothetical option signal criteria), you would not exercise the option because you would not have made a profit, and you would have lost the initial premium paid: 0.78 × 100 = $78!

This is what an option with no value at expiration looks like. Do you understand now?

Another scenario is when the stock AMD expires on July 11, and its price is exactly $137!

Your strike price is $138.00, so your option has value.

The profit from automatic exercise at this point is: $138 - $137 = $1

Profit from 1 option: 1 × 100 = $100; $100 - $78 = $22 net profit.

The premium of $78 is deducted as the cost of purchasing the option.

Similarly, the profit from 5 options: 1 × 500 = $500; $500 - $390 = $110 net profit.

Therefore, when you participate in options trading, it is relatively random and free!

Exercising the option at expiration provides a very good opportunity to generate additional profits from future time value. It reflects strong confidence in the stock's upward trend, but there is also the risk of receiving nothing at expiration and losing the premium.

Do you understand the risks and benefits of options at expiration?

Alright, whether you're a newcomer to the options market or a trader with some practical experience, I want to tell you:

The content I just explained is not merely technical jargon; these are the foundational skills you need to establish yourself in the market, make judgments, execute trades, and ultimately improve your win rate. You can choose to ignore them or persist in learning, but I hope you will take the time to walk this path of professional growth and truly transform knowledge into your trading results.

In our community, teaching is ongoing, and learning is continuous. We don't chase quick profits or create noise; the path we're taking is one that leads from understanding to ability, and from ability to victory. You're not here to be “cut down” by the market; you're here to become a winner through learning.

Friends, don't forget that this Friday, our community raffle event officially kicks off!

This is not just a casual interaction, but an exercise in transforming learning into reflection and then into action.

I firmly believe that true good fortune never comes by chance; it is the natural result of your consistent and earnest efforts.

By completing the following two simple exercises, you can obtain a raffle code to participate in our lucky wheel activity:

1. When you buy a call option and the underlying stock price rises simultaneously, would you exercise the option early? Please briefly explain your reasoning.

2. Please break down the following option trading instruction and explain its meaning: BUY ABBV 250711 195.00 PUT

The giveaway is not the goal; answering questions is a review, and participating is growth. Every action and every thought is a step toward becoming a mature trader.

I hope the next person to bring good luck home is you.

I am Blake Shaw, founder and mentor of NextLeap Management Consulting Services Co., Ltd.

It’s a pleasure to accompany you on this investment journey.

See you in class tomorrow—bring your thoughts and prepare for the next breakthrough moment.

——————————————————————————————————————————————————————————————

Good afternoon to all of you in the community ~ is your account lit up with a green profit light today? We locked in four consecutive stock gains today and I'm so bursting with excitement that I want to just pop the champagne! I'm Bird Grant from NextLeap Management Consulting with today's signal.

Blake Shaw professor just that class, does that land?

Every time I listen to him, I am like turning over a hidden combat manual - those we think rely on feeling, rely on the sixth sense to make the decision, in fact, there has long been a whole set of shelf can be supported by the logic of the actual battle.

You can call him a mentor, but in my eyes, Prof. Blake Shaw is more of a practical thinker who reconstructs the logic of investing from a systemic perspective. He does not tell you “this ticket can be bought”, but teaches you step by step: why this setup, when to start, how to control risk, how to confirm the trend.

He said: “Trading is not about betting right once, it's about whether you're ready for every time.”

He takes those complex models and structures and breaks them down into charts, signals and behavioral logic that we can read and understand. Each lesson, instead of cramming knowledge into your head, helps you build a sense of direction amidst the chaos.

For me, this is the fundamental reason why we are able to consistently build out a complete trading system. Because we believe: the investors who really go far are never the smartest, but the most systematic and willing to execute.

I don't just listen to him, I put his system directly into the actual operation, with Core X quantitative trading system, those who “understand but can't use” content, into you can see, follow, and do the implementation of the path.

Let's take a look at what Core X Quantitative Trading System has marked for us today. Clean exits, fresh entries, all supported by clear setups - not a bad day at the office.

$ALTN: The system recommended leaving the market with a full position after reaching a predetermined profit zone. With a +12% gain, the setup has completed the intended move. There is no re-entry signal at this time.

$ABBV: Defensive sector rotation resulted in a gradual closing of the position. The model gave a weak follow-through signal and closed the position for a +5% profit. This is consistent with the system's conservative treatment of healthcare flows in the absence of conviction.

$PLUG: The breakout leg went as expected. After triggering early last week, the system flagged a clean follow-through. Today's exit locked in solid gains and closed the position for a +26.7% profit, completing a nice trade with strong execution on entry, size and exit.

$COIN: Based on the triple setup of “Trend Adjustment + Volume Support + Reversal Confirmation”, the system triggered a new entry signal today. Entry action is recommended: monitor the strength of the confirmation over the next two trading days.

$TOI: Based on the early momentum convergence signals from the Core X Quantitative Trading System, the underlying completed its entry and pull-up during the short-term structural acceleration period. The short-term strategy target was achieved, closing the position for a gain of +18%, and the system is not recommending any further positions at this time. This trade demonstrates the system's ability to recognize and capture short-term momentum, with a clean execution rhythm and a high degree of consistency in signal-execution-cash.

Today's session: four of our stocks took profits - cleanly and profitably;

just bought $COIN and within a few minutes it was running above the cost line, and as soon as the system triggered, the price moved and went straight into the green zone.

Truly, this kind of operation is so rewarding, it's such a great feeling - the gains don't stop, the money is moving forward, and my whole body wants to stand up and applaud. This is not hit by luck, it is the result of signal + execution. At this point, I really can't help but do a dance to express the joyful and crazy mood!

The market is crazy, we are laughing. Today, it's really high.

So you will find that in this community:

At NextLeap, we have formed a set of mature teaching and practical synergistic mechanism: Prof. Blake Shaw leads the system architecture and strategy logic, and I and our team of executive consultants are responsible for transforming these concepts into a practical path that you can follow and do. This is not the cooperation of two people, but a set of team synergy, mechanism closed loop complete support system.

Each class, each chart, each review signal, are not to “speak brilliantly”, but in order to improve your implementation of the winning rate, shorten your trial and error costs.

Now, the professor has just opened the door of thinking, then I will take you step by step into the chart -

today's key signals, from the chart of the points, into the real action in your account.

If you've been following along for a while, you'll probably get the sense that we're not quite the same as your average investment education organization.NextLeap is about helping you build a truly actionable system of judgment. The real advantage is never how much news you read every day, but whether you can read the key signals and make a decision without hesitation when it's time to act.

This systematic logic tells you when to go out and when to wait; which opportunities are worth embracing and which risks must be bypassed; when it is necessary to protect yourself, and when it is time to decisively knock the position out. This is not to rely on the feeling of catching the market, nor is it a clinical pat on the head, but with a clear setup, a clear trigger and a stable implementation mechanism, to turn investment into a set of reusable operating procedures. What we build is a bridge - a bridge that allows you to move from passively accepting information and being led by the market to actively judging and taking the initiative. The real progress is not that you learn a few terms, but that you begin to follow a clear logic to judgment, to action, until every decision can afford your beliefs and positions.

NextLeap Management Consulting is the brainchild of two of our founders: Prof. Blake Shaw, who is not an “expert”, but has been in the field for 30 years, both in institutional macro strategy and in technology quantitative strategy. And deep plowing through the technology quantitative, his style is very direct - do not play false, do not talk about the concept of empty words, each class has a method, logic, and real-world deduction. And I, Bird Grant, is also the same person who has traveled the road of investment banking, funds, and tech startups. What we both agree on is that we need to stop thinking of investing as a gamble and turn it into a skill that you can understand and control.

That's why we developed the Core X quantitative trading system together. This is not a robot that sends signals, but a complete set of trading assistance system that can teach you to understand the market, dynamic adjustment, scientific risk control. You will see it in the real market to give buy and sell points, but more importantly, it will let you know why to do so - the structure of what appeared, the funds in how to move, you have to how to adjust the position, the position should be how to match. It is the “brain” of your trading system, but you are the one who makes the decision.

We also do not just give you a system on the finish. The platform will have a fixed daily pre-opening prediction, after the close of the review, the community has a consultant to help you sort out the rhythm, the mentor to help you dismantle the logic, and really accompany you to watch the market, to accompany you to learn, to accompany you to the actual combat. Now, we are still in the promotion period, and at the same time, we are also preparing to apply for IRS 501(c)(3) non-profit organization qualification, so all the courses and services are currently free to the community. You don't need to spend any money to enter a complete trading training closed loop, from cognitive enhancement to real trading optimization, the whole process of someone to bring, someone to speak, someone to verify.

So, if you happen to be looking for a place that can really help you grow, we welcome you to join NextLeap. no matter if you're a newbie just starting out, or a veteran player with several years of trading experience, as long as you're willing to learn, we're willing to give you what really works. The market changes every day, but you don't have to figure it out alone anymore.

So what the professor said is the underlying logic, and what I'm trying to do now is to turn this logic into a practical path that you can read, understand, execute, and verify over and over again.

What we're doing is allowing you to actually get on the field, rather than passively watching the market and missing every actionable moment.

If the amount of information just now is a bit too much, don't be in a hurry to memorize it all. What you need to do is not to memorize the details, but to catch the rhythm behind the system.

The Core X quantitative trading system has transformed the whole set of logic - the identification of setups, the triggering mechanism of signals, and the dynamic adjustment of positions - into a clear execution path.

Your task is one: watch how the system reads the tape, follow the flow when conviction shows up, and learn to make it your own.

We are not telling a story, we are making decisions with you. Every step is not just about making it clear, it is about making it; every judgment is not just about understanding it, it is about making it a natural reaction.

Listening in the community is just the starting point, real change begins the moment you start making decisions.

PLUG You saw the big rise, right? This is not an afterthought, but an early signal marked by the system last week: entry on Tuesday, confirmation on Wednesday, take profit on Thursday, a solid +26.7%.

$ALTN: Entry on July 1, clean cut today, locking in +12%, the system judged the structure to be complete and instructed a full exit.

$ABBV: light entry on Monday, medical sector setup matured and left the market today with a +5% gain, the system still maintains a stable handle.

$TOI: entered on July 2, experienced volatility after Core X quantitative trading system continued to track, today a strong pull-up, and finally cashed +18%. This is a complete verification of belief + execution.

If you're not keeping up, that's okay. This is not the end of the line, but a reminder that the next quality stock is in the pipeline, and the key is not whether you have the intelligence, but whether you have the execution.

It's not about blindly following orders, it's about using systematic stock picking logic, the professor's trading structure, coupled with the execution tempo I give you, to turn signals into actionable positions, and judgment into results. Whether you are new to the market, still figuring out the direction of the novice, or have experienced several rounds of retracement, understand that trading is far more than just “buy and sell” of the old players.

What we build is not an inspiration-driven game, but a system of replicable, followable, executable paths. This is the step from “waiting for the next lecture” to “making the next sure stock”.

Following us is not about proving how right you are, it's about moving in time, doing it cleanly, and going further. So don't leave these opportunities at the “listening” level - you can start today.

You don't need to wait for the perfect timing, and you don't need to make all the right judgments at once.

That's how real trading starts. And it's your move now.

Many people think that trading is about waiting for the market to come; but real growth often happens the moment you start to act on signals. It's not about waiting for the market to shine, it's about igniting your beliefs and taking that step.

Because if you know the path, but still choose not to go, that knowledge can not bring results.

At the end of today's course, I would like to ask you two questions:

In your past trading experience, there is not a moment, you clearly “understand the logic”, but because there is no clear implementation system and missed an opportunity to make money?

What made you hesitate? Is it uncertainty about the judgment? Or do you not trust the Core X Quantitative Trading System?

Good friends, today's communication is here, thank you for seriously follow every paragraph of logic, every signal.

We will continue tomorrow, good luck is not gone, the market is still giving entry signals, the real opportunity, always reserved for those who are prepared.

Don't forget - this Friday is the community lottery day, look for the investment consultant to get the lottery code, when the profits start to cash, have you ever thought - the next person named by the Core X quantitative trading system, will it be you?

Get a good night's rest and we'll see you in the markets tomorrow!