July 11, 2025

July 11, 2025

As the morning sun streams through the windows and the air carries a hint of late summer freshness, we are following the rhythm of the seasons and entering the most vibrant time of the year. Soon, the green leaves in the garden will still be lush, but that vibrant energy reminds us that a new rhythm is about to begin.

Before the market opens today, index futures show a slight correction, which may signal that new volatility opportunities are brewing. Have you learned to accurately identify your trading entry points from these early-morning signals? Have you gradually built your own logical framework and trading rhythm through following my courses and live trading strategies?

Our daily stock and options practical exercises are not about seeking short-term thrills, but about truly mastering the ability to understand the market and trade steadily through repetition and optimization. Therefore, today we need to reflect:

Have you already gotten into the zone? Are you ready to use today's judgment to secure future returns?

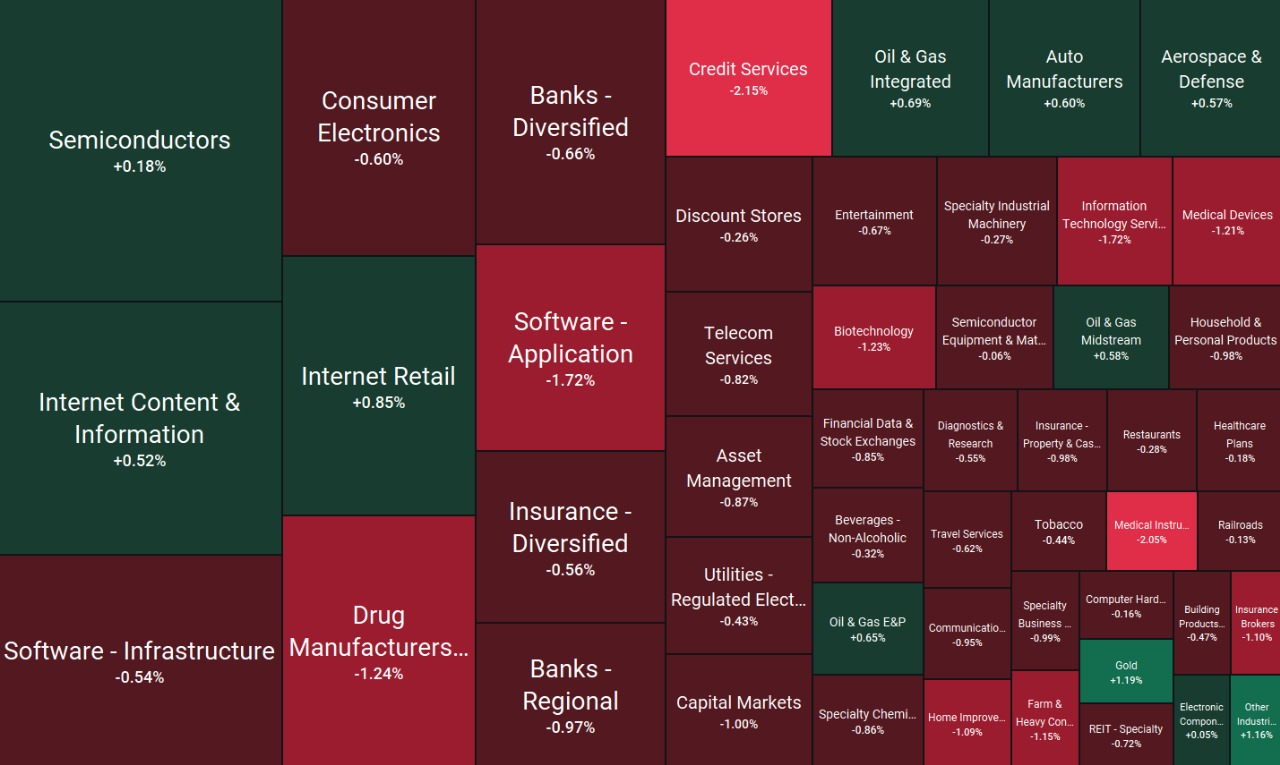

After Thursday's modest rise (S&P 500 up +0.27%), we see that technology stocks and aviation sectors continue to be the focus of funds. The market once again confirms a classic rule: When the VIX index soars significantly to a high level, it is often the peak of market panic and the starting point of a potential rebound.

Real-time market analysis: Will today's rebound continue?

I. Hotspots continue to drive momentum

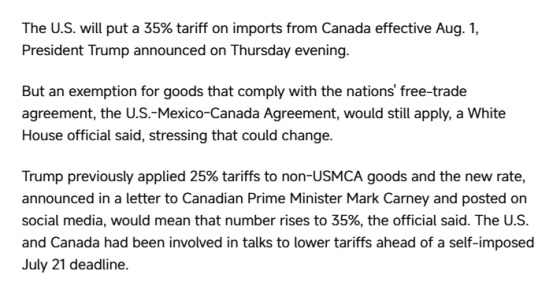

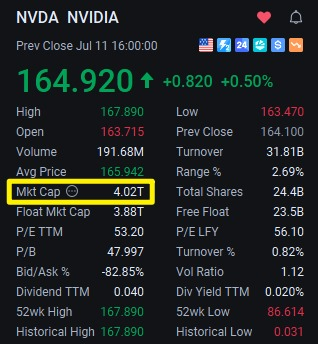

Despite Trump's announcement of plans to impose a 50% tariff on copper and Brazilian goods, the market reaction was relatively calm. Investors are more inclined to view this as a negotiating tactic, which has instead bolstered the continued strength of the tech sector. Nvidia once again hit a new all-time high, while Delta Air Lines' better-than-expected earnings report drove the aviation sector higher, becoming a new support point for the market.

2. Volatility has significantly declined, and sentiment is stabilizing

The VIX index quickly fell below 16 on Thursday, returning below the average line. This reflects that short-term market panic is easing, and volatility may gradually compress, providing a technical foundation for a short-term rebound but also suggesting that the risk of chasing highs is gradually increasing.

III. Structural repair is brewing after the rebound

I believe the current rally is a technical rebound following the downtrend, rather than a true trend reversal. I expect the index to enter a narrowing range of high and low volatility over the next one to two weeks, followed by a new round of adjustments. There is a possibility of breaking below the panic low point from Monday, but this process is likely to be mild and gradual.

Friday Trading Strategy Recommendations:

1. Maintain my current recommended portfolio structure.

My portfolio recommendations already include Treasury ETF, high-dividend blue chips, volatile growth stocks, and digital currency concept stocks with thematic flexibility. The advantage of this portfolio is that it is both offensive and defensive, able to defend against market volatility and respond quickly when opportunities arise.

If you have not yet established a defensive portfolio, now is an appropriate time to reallocate your holdings.

2. If you feel uncertain about the direction of your holdings or unsure about the trend of a particular stock, please contact your investment education advisor immediately. Our research team will provide personalized analysis and strategy recommendations to help you rebuild your confidence and decision-making framework. Are you interested in participating?

If you have already completed your position allocation according to the strategy I shared and actively followed my stock decision signals, then the upcoming market trend will be a phase of gradually accumulating results, as demonstrated by today's $PG. When the market rhythm aligns with our strategy, opportunities will unleash unexpected immense energy—this explosive power stems from your patience and preparation in the early stages.

Of course, if you are still uncertain about the direction or have just joined our community, please stay in touch with our investment advisor. She will not only serve as your dedicated mentor on your learning journey but also act as a vital bridge connecting you to community activities and surprise rewards, especially in the Lucky Wheel Draw—she is your lucky charm.

Note: The Lucky Wheel Draw will commence promptly at 4:30 PM this Friday!

If you have already participated in the course and successfully accumulated enough raffle codes, congratulations—you are already on the threshold of luck.

If this is your first time participating in such an activity, act now:

Open the classroom, study diligently, actively answer questions, and obtain raffle codes.

Stay in touch with your investment advisor to learn how to participate in our raffle activities.

Alright, friends, today we officially begin the practical application module of stock option trading.

Over the past two days, we have systematically reviewed the basics of option buyers, and I believe you now have a basic understanding of the role of option buyers in trading.

Today, we will take it a step further and apply this knowledge to practical operations, establishing a framework for understanding option applications from the perspective of the underlying stock.

First, remember: the essence of options is always closely tied to the underlying asset they are based on—the stock itself.

Let’s illustrate this with an example:

Suppose today you are optimistic about a particular stock, such as $PG.

Assume the current stock price is $140, and you believe it may rise above $165 within the next two weeks.

Based on this assessment, you decide to directly purchase the stock itself.

Purchasing 100 shares would require a total cost of 140 × 100 = $14,000.

This operation is what we commonly refer to as the logic of holding the underlying stock: you have confidence in the underlying company, you are willing to bear the volatility, and you participate with full funds.

Now that you have mastered the basics of options trading, are you ready to start practicing?

The answer is yes. We can participate through a buyer's option strategy.

For example: Suppose you are optimistic that PG will rise to a target price of $165 within the next two weeks, i.e., before July 25. In that case, the option trading signal you can choose is: BUY PG 250725 165.00 CALL

Based on the current market price, the premium for this option is $1.20 per share, meaning you can establish this trade with a cost of $120. Compared to the $14,000 required to directly purchase PG shares, this approach significantly reduces capital investment, allowing you to pursue potential future gains with a smaller cost.

The logic behind this is simple yet extremely important:

If you were running a business, would you be willing to use lower costs to achieve the same or even greater results?

If you participate using options, it is an important tool for improving capital efficiency, controlling risk, and achieving leveraged returns. Once you understand this, the option buyer strategy is no longer just a concept but becomes a practical part of your trading toolkit.

Imagine this:

If a product is currently priced at $140 on the market, and you only need to pay $1.20 to obtain the right to purchase it at a predetermined price at some point in the future, that $1.20 expenditure is called the premium.

Doesn't that sound like a good deal? Of course, in our example, the product is actually a stock, $PG.

By using options, you can lock in future possibilities at a very low cost. If the stock rises to $165 as expected in two weeks, let’s first see how much profit you would make if you simply held the stock: $165 minus $140 equals a profit of $25 per share, with a total profit of $2,500 for 100 shares (here we temporarily ignore transaction fees and other factors).

The core logic is simple yet crucial: leveraging a small cost to unlock greater opportunities—that’s the appeal of options. This is the basic profit model of stock trading. Next, we’ll explore how costs and returns change when using options to achieve the same goal. This is where options truly shine.

Next, let's take a look at what the final profit would be if you participated in this transaction using options.

Let’s use the previous trading signal as an example: BUY PG 250725 165.00 CALL

Suppose that two weeks later, the stock price rises to $165 as expected, and your option contract also appreciates significantly. We assume that the selling price of this option in the market at that time was $30 (the actual price will change according to factors such as volatility and time value, and this is only for teaching reference)

How do you calculate your profit?

You purchased one option contract, which corresponds to 100 shares, at a cost of:

1.2 × 100 = $120

Two weeks later, you sold the option at a quoted price of $30:

30 × 100 = $3,000

Your net profit is: 3,000 - 120 = 2,880 USD.

This profit far exceeds what you could have earned by directly purchasing the underlying stock, yet your initial investment was only 120 USD. In other words, you leveraged nearly 2,500% profit potential with less than 1% of the cost.

Of course, if you initially purchased more than one option, as the number of contracts increases, the corresponding number of shares you control also increases, and the profit potential is naturally amplified.

This is precisely the appeal of options trading as a leveraged tool: low cost, high flexibility, and controllable risk. However, the prerequisite is that you must accurately assess the market direction and possess a clear risk management mindset.

Do you understand this logic?

This is the core concept we need to master today: how to participate in trading in a smarter way to maximize capital efficiency.

There is another very important concept you need to understand:

The option selling price we mentioned earlier is actually variable. Before the option expires, the market price will fluctuate based on factors such as the underlying stock price, volatility, and time value. Therefore, at that moment two weeks later, the selling price of this option could be $30, $40, or even as low as $20. The $30 we used is merely a hypothetical teaching example aimed at helping you grasp the calculation method for option profit models.

However, rest assured that in actual trading, you do not need to manually calculate each step as we are doing now. When you submit a buy or sell order in the trading software, once the trade is executed, the system will automatically calculate your profit or loss based on the execution price, and the profit will be reflected in your account in real time. You only need to focus on whether your judgment is correct and the timing is appropriate, without worrying about the calculation process.

This is the key point of today's discussion: understand the structure, master the logic, and trading itself is actually quite straightforward—identify opportunities, make decisions, and then let the system execute the trades.

So why does the price volatility of options trading occur?

Imagine that an option is like a lottery ticket, which grants you the right to buy or sell a stock at a fixed price at a specific future date. Why does the price of this lottery ticket fluctuate?

As the expiration date approaches, the lottery ticket becomes less valuable: Options have an expiration date, just like food. The closer it gets to the expiration date, the lower its value.

This is because, if there is still a long time before the expiration date, the stock price has a lot of room to fluctuate, so the lottery ticket has greater potential value.

But if the expiration date is approaching, the stock price has less room to fluctuate, so the lottery ticket's value decreases.

Market perceptions of future uncertainty: If everyone believes that future stock price fluctuations will be significant, the value of this “ticket” will be higher. Because the greater the volatility, the higher the probability of winning.

Changes in interest rates: Interest rates act like water, influencing the entire market. When interest rates rise, people may prefer to save their money rather than buy options, causing option prices to decline.

So, if the stock price is below 165 but above 140 dollars two weeks later!

As long as it hasn't expired, you can exercise your option early based on the market price fluctuations to lock in profits.

The specific profit standard for early exercise is: when you sell the option, as long as the selling price is above 1.2 dollars, you can make a profit.

When the market price equals $1.2, it indicates that the stock has been trading sideways, neither rising nor falling. Choosing to sell here is to break even and avoid losses.

Only when the stock price falls below $140 will the option's market price potentially drop below $1.2. In such a scenario, regardless of how the stock price continues to decline, your maximum loss will be limited to the premium paid;

this is the safe failure protection boundary;

Summary of this lesson: We have provided a systematic explanation of the practical application of options trading. Remember, the core of options trading always hinges on your judgment of the future trend of a stock.

You need to think deeply about:

Within a certain time window in the future, will this stock rise, fall, or remain volatile?

The clearer your judgment, the more clear-cut your strategy will be.

If you judge that it will rise, BUY CALL will be your main strategy;

If you judge that it will fall, BUY PUT is the more appropriate choice.

This is precisely the core logic behind the option trading plan we are discussing. It is not gambling but a judgment process based on probability and logic.Although the option market does have characteristics of directional betting, unlike a casino, you can improve your win rate by researching a company's fundamentals, earnings expectations, market sentiment, quantitative systems, and more.

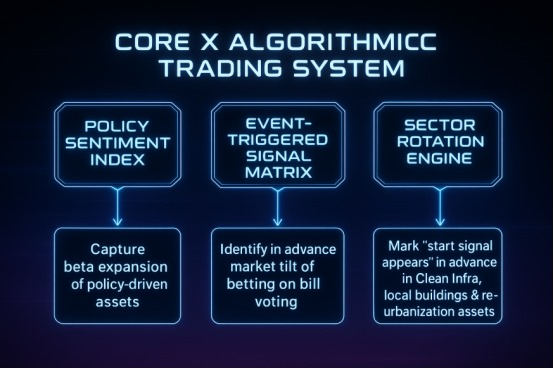

Especially when we combine corporate earnings forecasts with the CoreX quantitative trading system,

you will have a more data-driven, logically sound trading support mechanism, ensuring your judgments are not based on intuition but are well-founded, traceable, and reproducible.

Now I ask you—

After today's learning, do you have a clearer understanding of the practical application logic of options trading?

Can you begin to use this approach to build your own options trading framework?

Alright, friends, it's time for our lucky moment of the week!

As knowledge continues to accumulate and practical experience gradually unfolds, I believe you have come to realize that joining this learning community is a decision you can be proud of.

You are transitioning from an “information recipient” to a “strategy executor”;

you are also adapting to the rhythm—through daily learning and reflection, you are gradually building your own investment system.

Today's sharing is also specially prepared for those who missed the first session due to work or family commitments. I hope this ongoing support will help you catch up, maintain your progress, and regain your confidence. If you like this format, please continue to actively participate, and feel free to share it with others who are also eager to grow. If you need assistance, please contact the investment education advisor in the community:

Now, start your quiz task to win today's raffle code and participate in the lucky spin wheel:

1. If you believe $PG will rise to $165 by July 25, please write the corresponding option signal.

(Example: BUY AMD 250711 138.00 CALL)

2. Which stock did we focus on discussing in today's class?

3. Which new stock's position-building order has been reestablished?

Let's transform knowledge into action and win luck through action.

Every step you take with dedication will be rewarded by the market.

See you in class on Monday—don't let opportunities slip away!

————————————————————————————————————————————————————————————

Today is not about dozing off - it's about catching sobriety signals. Good afternoon, folks! I'm Bird Grant of NextLeap Management Consulting

The market isn't asleep yet, but some of you are already waiting for the next round of good fortune to jump out of the screen. But you know, it's not a lottery for luck - it's on whether or not you're reading the real signals.

Buying the stocks we've been giving you in recent days has been like an unannounced party, where the presents are wrapped and it's up to you to unwrap the surprise that says “cash out” at the right time.

Not everyone will get it, but those who are prepared will always have a higher probability of getting lucky.

Speaking of luck, isn't it a bit like our community sweepstakes? You just casually click on it, and the next moment the “You've won” message pops up, and you can only admit it - luck is indeed present.

In the past few events, many of my friends have been lucky winners, and the happiness of "It's really my turn! The word is spreading fast in the community. We'd like to thank everyone who has participated, your enthusiasm is what keeps us going.

I know some of you weren't able to participate in the interactive raffle in the afternoon, but had already listened carefully to Blake Shaw in the morning. I know some of you weren't able to participate in the interactive raffle this afternoon, but you had already listened to Blake Shaw's class in the morning - and that's a big step.

What we're trying to say is that the raffle is an important ritual, and participation in the course is the real path to growth.

Every time you listen and participate, you're helping yourself build a framework for judgment, so that what you learn today isn't just something you've heard, but something you'll actually keep, something you can use.

So today, don't forget to come back and enter the drawing. It doesn't matter if you won last time or not, what really matters is whether you're willing to take that step every time the opportunity arises.

The next one to win may be you.

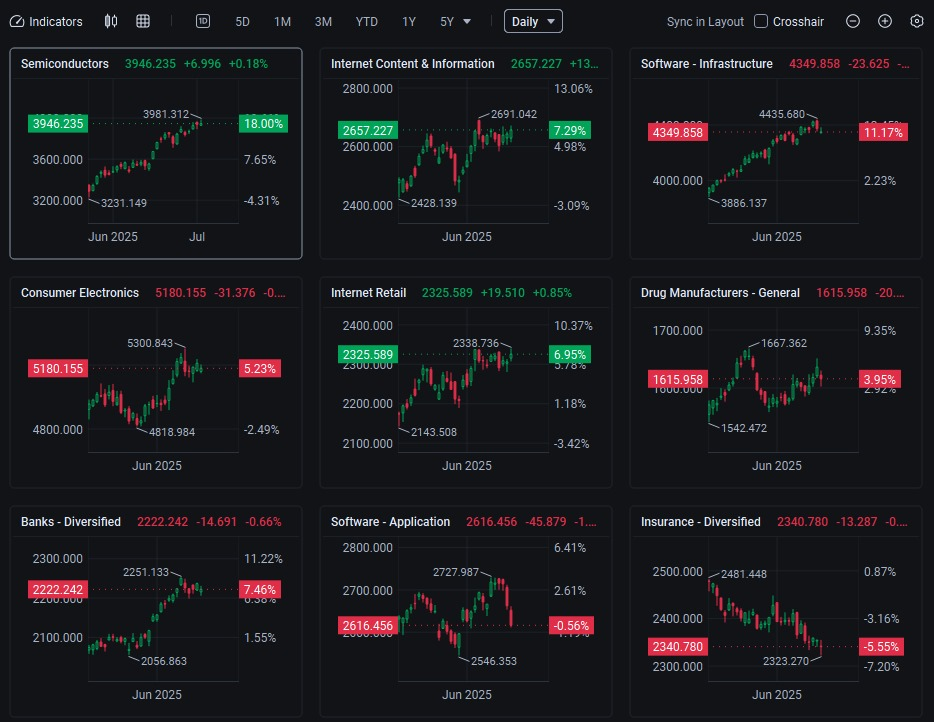

The raffle is over, and now, it's time to pull our attention back to the markets. The key points that Prof. Black talked about this morning are not just points of knowledge, but also a navigation chart for understanding capital movements and identifying trading opportunities. Have you noticed that lately the market has become more and more like a psychological test of “who can pretend not to be afraid of the negative”?

Trump just threw out a new tariff action, according to logic, commodity stocks and manufacturing should “jump a little”, give a little market reaction, but the result is - almost no reaction, like nothing happened.

So today's investment market, do not talk about what “hesitation in the shock”. When the news came out, many people are still waiting, counting the impact, but have you noticed - some funds did not hesitate at all. They move faster, position more firmly, even heavier than usual. The market is still clamoring, and they've already started placing their bets.

Did you notice? The heaviest policy move of late didn't really come from the Fed or which organization sent out a blowout earnings report, but rather - Trump's sudden announcement that he's going to impose 50% tariffs on copper and some Brazilian goods.

Historically, based on past experience, the market usually reacts with short-term jitters after these kinds of major trade news releases, especially those in directions that are closely related to the global manufacturing chain and commodities. But this time it was completely different - there was no panic, there was no sharp fall, but instead tech stocks continued to move higher and the aviation sector as a whole pulled up.

Why? Because the funds quickly judged that this is not a real trade conflict, but Trump's release of negotiation signals, a tentative policy action, the intention is more to create momentum, rather than the immediate implementation of the policy.

Essentially, the news of the tariffs did not put substantial pressure on core technology, air transportation, and those strong companies that rely on fundamentals to support them. As we all quickly saw - the shakeout was not because the bad news hit down, but because the news came out and the market pressed it. The market didn't panic, the disk didn't smash, and prices held the key zone. What's really working is not the bearishness, but the market is confirming that the confidence is still there and the buying hasn't gone away.

So the direction we see is also very clear: technology stocks maintain their leading position; air transportation continues to be capitalized; companies with earnings reports that exceed expectations become the focus of trading extensions.

So I'd like to ask you a question today: after this conviction test, who did you see being quietly moved out of positions? And who, after the negative news, but out of a stronger new high trend? It's not the ups and downs that matter, it's being repriced by the money.

Who is being quietly moved out of positions?

In terms of Core X Quantitative Trading System, it's commodity concept stocks, materials stocks, and macro-driven stocks. Especially after Trump's policy plan to raise tariffs on copper and Brazilian commodities, these types of stocks have not followed suit, have not formed an effective defense, and have instead been marginalized by the market, suggesting that institutional funds are reducing their positions in global supply-sensitive assets

Who is moving out to new highs in the wake of bearishness instead?

--Tech leaders, earnings beaters, and airline assets. Two of the most typical:

Nvidia ($NVDA): another new all-time high, strong at the highs and not looking back, showing that the main AI thread has not been disturbed at all.

Delta Air Lines ($DAL): earnings report exceeded market expectations, driving the entire aviation sector collectively higher, the funds are concentrated in the direction of the performance has been given to cash.

Who gets repriced?

--Markets go up and down every day, but not every swing is worth your bid; these tickets don't necessarily go up the fastest, but they fall steadily, carry on, and can go back up too. The market looks not at the emotional reaction, but at the trading action - who is placing orders, who is adding to their positions, and who is standing firm and then moving on.

That's why you'll find that some directions get bought back by money repeatedly, even when there's no new news or heat.

That's not a coincidence, that's the repricing process. The price holds, the deal is steady, and over time the market will naturally take it as a pricing reference - not because of the heat, but because it stands.

Speaking of pricing, what we should really be focusing on this week is that the way the market is pricing is changing.

NVIDIA's market capitalization has reached $4 trillion, officially entering the “super pricing power club”. If you still think of NVIDIA as an overvalued tech stock, you may not have understood that the game has changed.

Behind the 4 trillion dollars is the depth of institutional bets on the entire ecological chain of AI, but also the confirmation of the logic of “arithmetic power is taken as the core of productivity” in the normalcy of hyperinflation and the continuous upward trend of labor costs.

This is not just a number, but a clear signal: it has turned from an “AI concept stock” into a pricing reference for the whole market. Funds use it to judge direction, compare valuations, and plan positions. It is not just going up, but “leading how to go up”. In abundant liquidity, it led the rise; in the risk release, it bottomed out. Its trend, more and more like the “market thermometer”.

This week, the main character of the U.S. stock market, without any doubt, is NVIDIA. market capitalization officially stood at 4 trillion U.S. dollars, not only a digital leap, but also a shift in the logic of market pricing. It has long since left the category of “growth sector representative stock”, and is now one of the assets that really holds the pricing power in the entire U.S. stock structure.

As long as its trend is not destroyed, the AI industry chain will attract attention again. From the underlying hardware and arithmetic systems, to software services and end-use applications, funds will begin to go back and verify which segments still hold up to the pricing logic. The market's focus will follow suit, and the flow within the sector will become more directional.

On the other side of the coin, directions like utilities, traditional healthcare, and consumer blue chips have seen little overall volatility.

Funding behavior has given the attitude - not a comprehensive net, but focus on assets with high certainty and clear logic.

Looking at the overall flow, this week's market is very typical: the index is moving, but the real driving force is the few high-weighted technology stocks.

Most sectors have no volume, no signals, and no buying to follow.

The market is narrowing down its choices to only those directions that are still priced in and still have active buying.

The names that aren't trading, aren't signaling, and aren't being followed, don't hold your breath to see them.

The market has given feedback - they are not in the game this round.

The key is not how many sectors the market has risen, but rather your ability to recognize:

which directions are actually buying, signaling, and in consensus, and which are not yet in a position to participate.

That's what we built the Core X quantitative trading system to do - to help you identify which assets are worth betting on and which ones to skip when the market is in turmoil.

Instead of disrupting the main thread, the tariff news made some overlooked opportunities easier to recognize.

A couple of the tickets that our Core X Quantitative Trading System locked in this week were triggered in just such an environment. You can see - $PLUG was flagged after the news, completed signal confirmation on Monday, entered the market directly on Tuesday, followed by volume acceleration on the third day, cashing in profit of +26%; $TOI belongs to the high-beta biotech breakout type players, the low level of shrinkage oscillator for many days, once the signal is confirmed, it is an instant amplified return. Once the signal is confirmed, it is an instant amplification return.

At the same time, the signals of $ABBV and $ATLN are the choices for institutions to reprice their long-term positions - one is the value repair window under the high dividend and stable cash flow, and the other is the extended trading driven by the construction of AI data center in the European direction. Both are not short-term sentiment driven moves, but rather the type of positions that are slowly being built up, but the structure is extremely stable, and the Core X quantitative trading system uses an “asset repricing” strategy model to capture it.

You call this luck? No, the more confusion there is, the easier it is for Core X to recognize which assets are being repriced, and we are just following the model into the answer zone. The key to true alpha is never how you react on the spot, but whether or not you are in a position to recognize signals in advance.

So, with all the noise in the news, don't rush to make a decision. See how the money moves, how the price moves, and then see how our Core X system reacts. The real alpha is not the one that shouts loudly, but the one that has clear signals and established trading structure. The real alpha is often hidden in the names that no one is watching, but are quietly marked by the money - and the Core X quantitative trading system is the pair of eyes that can pick out these signals and turn them into positions in the first place.

Instead of guessing direction, it uses a model to identify offsetting signals between money flow, price structure and trading behavior. When you see a breakout, it has already marked it; a pullback that you are still hesitant about, it has already completed its judgment - it's time to get out or skip. The system doesn't wait for the market to move before it speaks, it puts the possibilities on the table first when the signals are just forming.

For us, it's not just a tool, it's the most trusted underlying judgment system we have in times of market uncertainty.

$COIN entered the market yesterday on the Core X Quantitative Trading System signal, pushed up quickly during the session, and exited successfully at today's high. This is not a coincidence, the Core X Quantitative Trading System once again recognized a clear tradable short term opportunity and executed it efficiently. So stop asking if the market will give you the answer - ask yourself if you are prepared to read the signals. As it is written, “He who has ears to hear, let him hear.” The real wisdom and signals have actually been spoken, the key is do you have the ability to hear, listen and then act on them? We'll see you next week.