July 13, 2025

July 13, 2025

Happy Sunday, folks! I'm Bird Grant of NextLeap Management Consulting

The markets may be closed for the weekend, but real traders never wait until Monday to start thinking. We're not placing bets on feelings or orders on fantasies - today, it's all about structure, signals and the path that reality can deliver. Just like at the Fed table, no one knows what the next card will be, but look at the market pricing, staring at the liquidity

changes, catching the timing of the shot, is the trader should do homework.

In the past two weeks, the market once thought that the rate cut is close - soft non-farm payrolls, inflation cooling, interest rate models have almost preset the “easing path”.

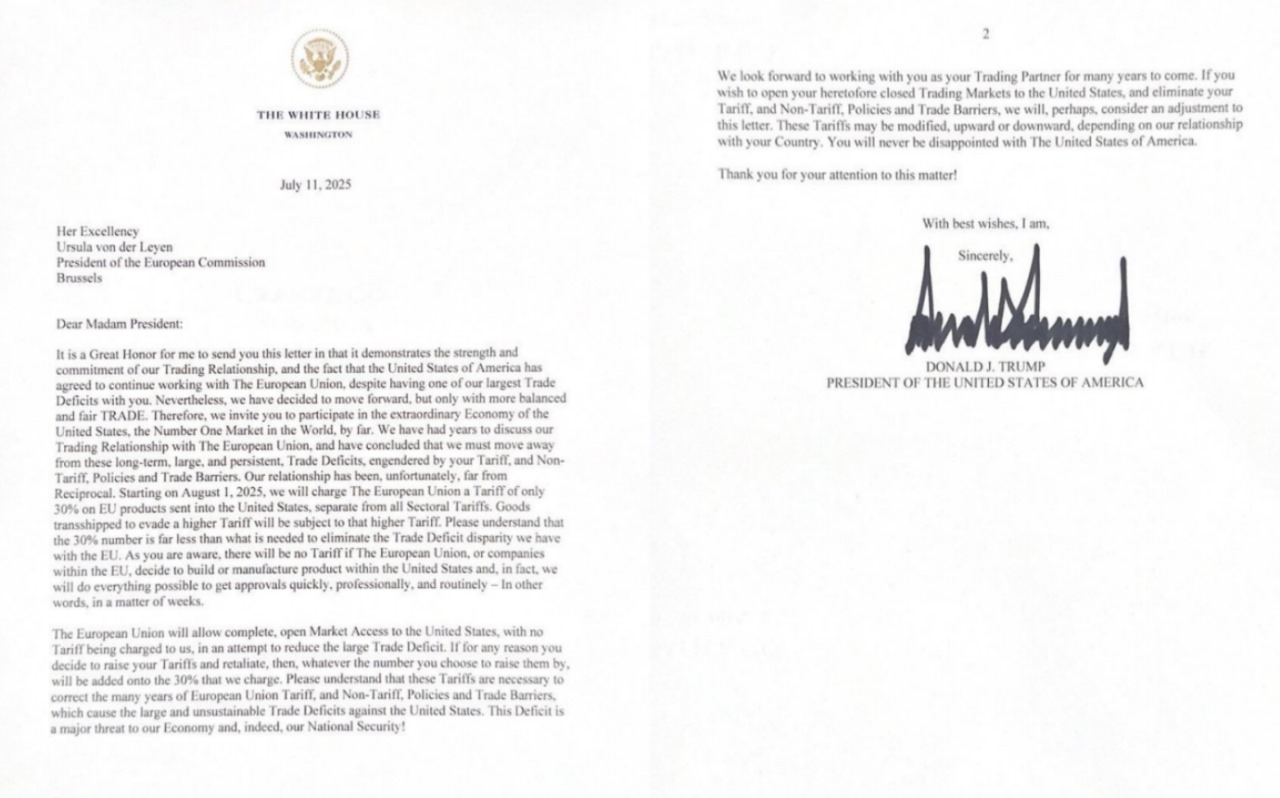

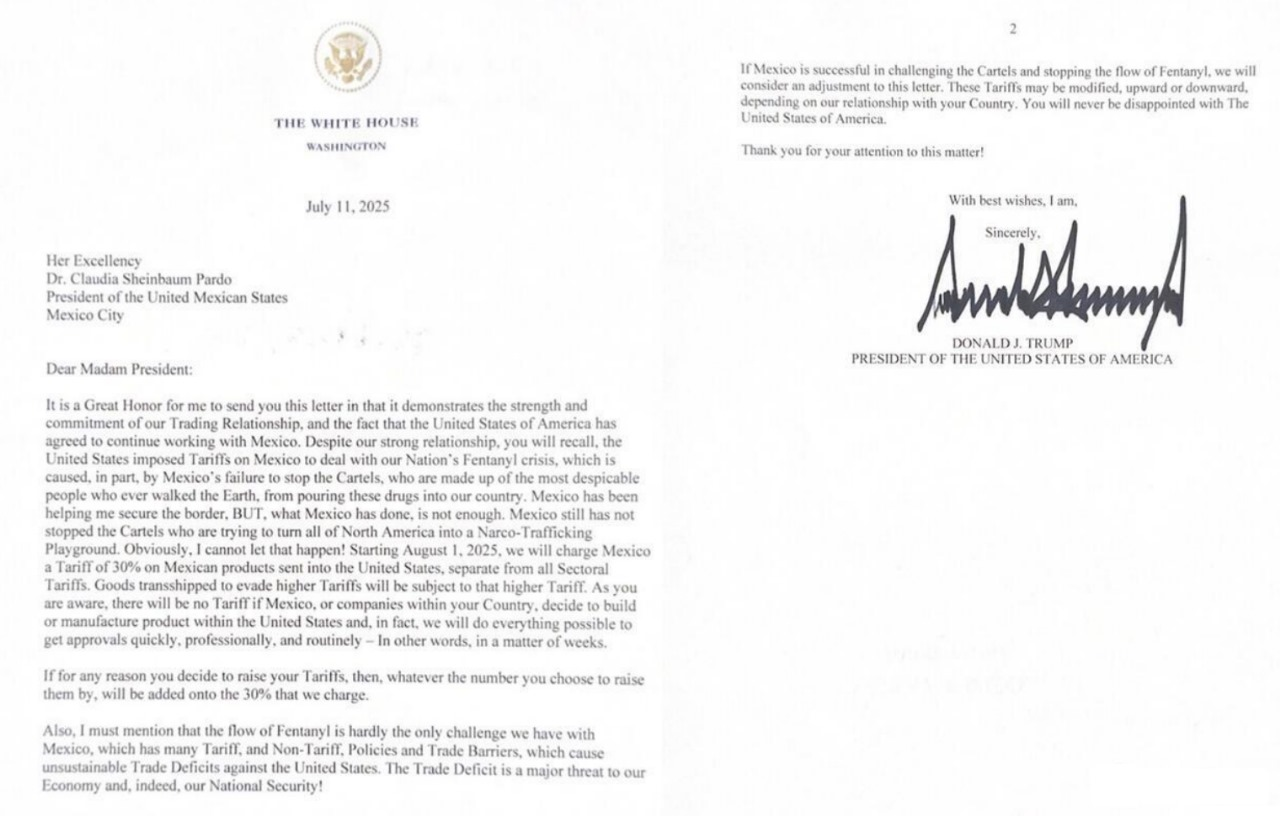

But just at this time, Trump threw a “tariff card”, also disrupted the original smooth pricing rhythm.

So what's the next step? Let's start with the basics: review this week's market movements - who's pulling back, who's betting, and who's waiting for the next round of signals?

U.S. stocks were generally shaky and weak this week. S&P 500 slightly pulled back 0.3%, the Nasdaq fell 0.2%, the Dow was the weakest performance, down more than 0.6%, small cap index Russell 2000 fell 1.3%. Although the index adjustment is not large, but the market as a whole showed a “high level of hesitation, the direction to be determined” atmosphere.

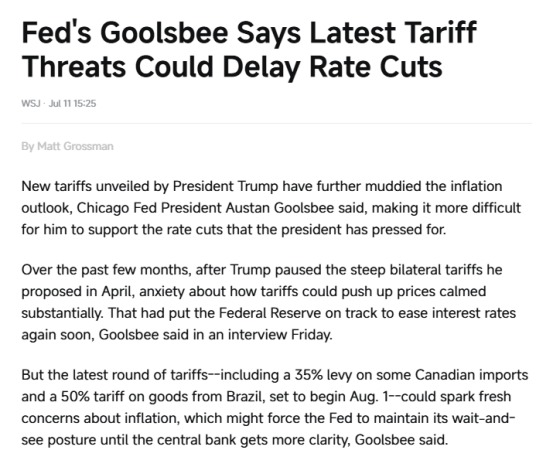

The immediate trigger for this round of declines was Trump's announcement that he would impose a new round of tariffs on goods from a number of countries, including Canada and Brazil. This makes the market to reassess the risk of imported inflation, originally in the non-farm payrolls weakened after the gradual warming of interest rate cuts expected to be obviously blocked. Systematic monitoring shows that: funds began to withdraw from the “loose trade”, back to the pricing of inflationary pressures correction; after the tariff policy officially landed, the Fed tends to first observe the inflation response, and only in the premise of confirming the stability of prices, will reconsider the easing operation.

At the same time, the flow of funds is also clearly cautious. According to Reuters data, net inflows into U.S. equity funds were only $2.1 billion this week, much lower than the previous week's $31.6 billion, reflecting a shift in fund sentiment from rapid position building to conservative wait-and-see. Technology and AI, although still strong, but the market's propulsion began to concentrate, the upside lack of plate linkage.

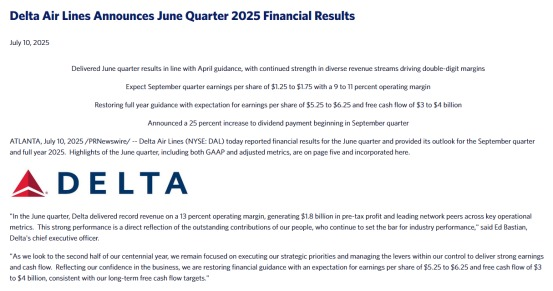

Some of the corporate earnings reports were solid, with Levi's and Delta Air Lines both delivering beat results, briefly boosting market sentiment. But overall, the trading session is still dominated by structural uncertainty, with funds more defensive and unwilling to make any rash moves. Coupled with the continued rise in U.S. bond yields this week (10-year rose to ~4.4%), high interest rates are dampening funds' willingness to allocate to higher-valued assets.

Looking ahead to next week, the market will officially welcome the opening of the earnings season. The performance of bank stocks and tech giants will have a direct impact on whether the market can regain momentum, especially at this sensitive point in time when “funds are cautious but not short of liquidity”.

Meanwhile, inflation data (CPI/PPI) will also be released next week. If the data show a slowdown in price increases but the lack of a decisive fall, the Fed is likely to remain on hold, continue to wait and see the path of inflation, rather than hastily press the button to lower interest rates.

But the question is - originally everything seems to pave the way to lower interest rates, so what exactly is the Fed afraid of?

This time, news of Trump's new round of tariffs has ignited inflation expectations. Markets previously favored a rate cut starting in September, but the latest signals are disrupting that path.

Now let's focus on two questions:

First, why did the market push back rate cut expectations instead once the tariffs came out?

Second, will trading get harder next week? Which directions are still doable and which should be closed for now?

Why the threat of tariffs is pushing back interest rate cuts.

Tariffs are essentially an external amplifier of inflation. The Fed is well aware of this: if rates were cut at this point and tariff-induced imported inflation subsequently reared its head, it would directly undermine recently established expectations of inflation stabilization, while also forcing the market to reevaluate the path of interest rate cuts and increasing uncertainty about policy interpretations.

The question now is not whether the data is strong enough, but whether the policy level can confirm that stability has taken root.

For the Fed, the rate cut is not only an operational move, but also a clear policy signal. Once the start of easing, we must ensure that it will not trigger a rebound in prices, and not let the market misinterpreted as “inflation risk has been lifted”.

So they would rather slow down a little bit, see clearly a little bit, but also do not want to because the market urges tight, it is easy to touch that “interest rate cut button”.

The real question to ask is: it's not that there are no opportunities next week, but it's more about picking a direction: which signals are still valid? Which ones to actively exit?

The answer is: current trades are indeed more challenging, but the point is not to exit, but to pick and choose and execute with precision.

It's not that there is no direction, but the structure is becoming complex and the cost of confirmation is increasing. Inflation, interest rates, tariffs, policy expectations, these variables are now simultaneous and interlocking, the market is no longer a straight line driven by a single logic. The market is still moving, but there is less and less real money to bet on the direction; individual stocks are moving, but not in a uniform direction.

The market is now only chasing certainty - not all rallies form valid trends, and not every rally has a confirming signal.

The question now is not whether you can guess the right direction, but rather: every time you place an order, there is a clear, verifiable trading logic behind it, and whether it has been confirmed by the signals of the Core X quantitative trading system.

What we do is not to predict, not to chase the news, but to execute the trading signals that have been verified by the Core X Quantitative Trading System, to use data to drive decision-making, and to use the rules to filter out the noise.

To be clear: next week's disk will be significantly more difficult to execute and less maneuverable. Not because there is no opportunity, but because the market no longer tolerates fuzzy judgment and random strikes.

The question now is not whether you can guess the right direction, but rather: every time you place an order, there is a clear, verifiable trading logic behind it, and whether it has been confirmed by the signals of the Core X quantitative trading system.

What we do is not to predict, not to chase the news, but to execute the trading signals that have been verified by the Core X Quantitative Trading System, to use data to drive decision-making, and to use the rules to filter out the noise.

The market has been willing to give a little bit of results over the past few weeks for getting in late and chasing high. But that period of tolerance is ending. But now the market is starting to directly penalize all operations that lack certainty:

Get in too late and the market is over;

Get in too early and you can easily be forced to stop due to a false breakout;

Even if the judgment is correct, it will still be difficult to make a profit if the execution is not done correctly.

What we see now is a highly filtered market. The system also clearly judged: there is no setup, no signal of the subject, fluctuations are very false, easy to be drawn away; no trend direction, all noise; no confirmation of the pattern, simply does not have trading value.

So, the key question for next week is: are you doing it in a direction that the market actually recognizes? Or is it just something you thought would go up?

Because at this stage, there is no middle ground. You're either following a trend confirmed by Core X Quantitative Trading Systems, or you're betting on a market rally.

This is not the time to “try and see”. This is the time to only go in the direction that is confirmed, only go in the direction that Core X Quantitative scores high, and exclude the rest.

The question you should ask yourself is not “has this ticket fallen enough”, but rather: is there volume to match? Is there any real money buying, and is the Core X Quantitative Trading System marking signals?

If none of these things, then the best action is not to take action. There is no trend to not participate in, no signal to short positions. The market environment tends to be harsh, only with clear logic and clear implementation of the trading behavior to reward; on the contrary, the risk of rapid liquidation and profit withdrawal.

You know what it's like? It's like applying to college. Some people don't look at the requirements and don't prepare, they just think, “This is a good school, I'll take the plunge”. So they apply to a dozen or so schools at the same time, and they don't get a single acceptance.

And really get a famous school offer people, do is completely different things: they study the criteria, confirm the match, prepare letters of recommendation, optimize the material, communicate with the admissions office in advance - all actions are around the selected schools to do all the preparation.

The same goes for trading. It's not a blind vote, it's not chance, it's systematic judgment + signal confirmation + strategy matching.

The market is not a charity. It leaves profit margins only for traders who are truly prepared, correctly oriented and clearly executed. The rest of us will be asked to leave the table.

We are out of the “you can make money by feeling it” phase, and now it's all about logic, Core X quantitative trading systems, and execution.

Next week, the markets are still open, but the margin for error is being tightened. I wish you all to maintain clear judgment, precise execution, and steady progress in the complex environment - we will see you next week.