July 16, 2025

July 16, 2025

I'm Blake Shaw from NextLeap Investing and Teaching, and as a co-founder and mentor here, I'm so excited to meet with you again on such a morning of possibilities.

You may be from different states in the U.S., with different life experiences and financial backgrounds. But we've come together because we share a common belief - we all believe that it's entirely possible to change one's control over one's future wealth through long-term, rational, and strategic investing. This belief is not just talk, it's a choice, a choice that is willing to put in the work to learn and persevere.

Today is the middle of the week, Wednesday. The rhythms of the markets are beginning to emerge, and a variety of data, sentiments and signals are gradually being laid out. At a time like this, I want you to think not about “should I chase” or “should I bottom”, but a deeper question:

How can I continue to expand my profitability while keeping my risk under control?

By the way, I want to clarify one thing for everyone:

The community courses with you on Monday and Tuesday were temporarily cancelled. It was not because we forgot or postponed the arrangement, but because we were holding the third quarter quarterly strategic meeting of NextLeap Management Consulting Services Co., Ltd.

As a research-driven, strategy-oriented organization, every quarter we review and iterate on the pace of the market, our investment path, our client services, and our content. And this time, our strategy for Q3 will be more pragmatic, more systematic, and more groundbreaking than Q1 and Q2.

We see that the market is undergoing a structural shift, and investors' demands for information, strategies and services are increasing. Therefore, in the next quarter, we will continue to upgrade our teaching content, practical strategies and community operation methods, with only one goal in mind: to enable you to still maintain your advantage and pace in this evolving market.

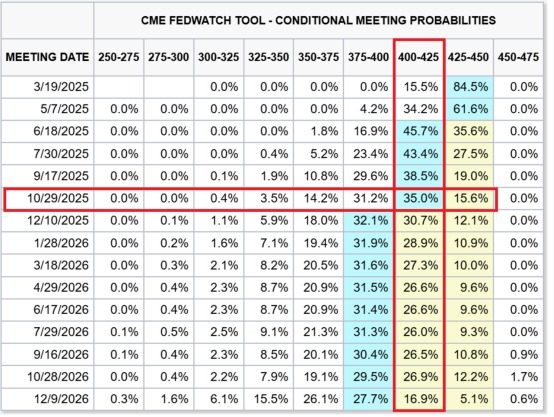

According to current expectations, the June CPI data released this week, has initially reflected a new round of tariff policy brought about by inflationary pressures. Although the current data is still in a controlled range, but the market has begun to focus on the “interest rate window is approaching” to start a new game.

From a positive point of view, the signal released by this data is quite clear: inflation is still suppressed, the Fed in the September meeting to start the possibility of rate cuts are continuing to heat up. This also explains why U.S. stock futures were strong at the beginning of the week, and some core assets even reflected such expectations in advance.

In fact, as early as last week when the PPI (Producer Price Index) was lower than expected, the market has begun to deduce this transmission path: the cost side of the relief, the consumer side of the fall, the probability of interest rate cuts rise, risk appetite warming up, the stock market stronger.

But one thing that needs to be emphasized is that this does not mean that the market will continue to soar.

According to the forecast for June CPI details, with higher tariffs on goods such as copper and auto parts, this imported inflation could rise again in the third quarter. This would put substantial pressure on CPI and could upset the “optimistic path” of rate cuts at this stage.

So the real topic of discussion today is: can we let our guard down in a superficially favorable environment?

Or, the real masters, how to remain calm in the “seemingly optimistic”, the layout of the next step?

With this question in mind, let's enter today's lesson. Are you ready?

Today I want to remind you of one thing in particular: do not be misled by the surface performance of the data

The CPI data released this week, while overall in line with market expectations, may seem on the surface to be a favorable signal, but you may have noticed - the stock market did not rally as strongly as expected, but instead retreated after the good news.

Does this mean the market is worried about a recession brought on by falling inflation? Not really.

The real driver of this “good out of the anti-decline” phenomenon, is a core variable in the global arbitrage structure: the yen.

Let's go back to July 11 CPI released the moment - when the data released, the yen quickly appreciated, while U.S. stocks then fell. It's no coincidence that U.S. stocks have been highly linked to the yen's movements ever since.

The reason behind this is that a large number of arbitrage positions financed in yen are being closed out quickly. In other words, big money is starting to pull out of risky assets to reduce overall exposure. This currency flows as the engine of the “wind control position reduction” behavior, directly affecting the short-term performance of U.S. stocks. So we must realize: at this stage, market sentiment and structure, far more decisive than a single economic data itself.

Therefore, the current market is not “failed to CPI”, but into a more complex linkage structure stage, in other words, the key to determine the strength of the next U.S. stock market trend is not in the CPI itself, but in the two core data to be released immediately after:

Retail sales data: reflecting the strength of consumer spending, it is an important indicator of economic activity;

Initial jobless claims: related to the resilience of the job market, is an important consideration of the Fed's policy path.

These two indicators, will directly affect the market on the “soft landing” or “second downside” judgment, will also become the next wave of market volatility “wind vane” as investors, we should be As investors, we should focus on the correlation between the data, changes in capital behavior and the integration of multi-dimensional signals to judge, rather than just based on a single piece of data to rush to the field!

Many friends are asking why the appreciation of the yen will lead to a decline in the U.S. stock market, when you really understand the logic of global capital flows, you will find that behind the implication of a very key asset U.S. debt (U.S. Treasuries)

Let's dissect this relationship:

First, Japan is one of the largest holders of U.S. debt in the world. When the yen appreciates, it means the yen rises against the dollar. In other words -

for fewer yen, you can buy the same amount of dollars, or the same value of U.S. debt.

As a simple example:

If you paid 15,000 yen for a $100 US bond when the yen was depreciating,

when the yen appreciated, you might be able to buy the same amount of US debt for only 14,000 yen.

The problem is here: the yen-denominated investors book generated exchange gains, U.S. bonds are more “cheap”, naturally prone to trigger some of the profit-taking or reallocation of action!

At the same time, the dollar exchange rate slipped, U.S. bond yields fell, U.S. bond prices rose, which attracted part of the original stock market in the funds to the bond market.

And once a large amount of money from the U.S. stock market into the U.S. debt, the stock market is prone to decline. This is why we often say:

“There is a degree of inverse relationship between stocks and bonds.”

When risk aversion rises and money pours into the bond market, U.S. stocks tend to be suppressed to some degree.

So, to summarize this chain of logic:

yen appreciation, dollar depreciation, U.S. bonds become more attractive , funds flow into U.S. bonds, the stock market is under pressure to pull back.

This is not a short-term coincidence, but the global financial system in the foreign exchange, bond market, stock market between the deep linkage reaction.

Do you understand the cause and effect logic behind this?

This is really worth our attention and learning “cross-market” thinking!

A rise in US bond prices means more money shifting to US bonds, which have a higher margin of safety and better profit opportunities, which stimulates a rise in the stock market, leading to a sell-off, which in turn leads to a fall in the stock market;

Similarly, when the dollar exchange rate falls and U.S. bond yields decline, it causes the dollar-anchored value, which measures the value of U.S. stocks, to fall, which leads to a decline in valuations, which in turn leads to a decline in stock prices;

That's the important relationship between them.

Do you now understand why one of the reasons came from the strong rise in the yen when U.S. stocks tumbled the previous two weeks?

Let's look at the logic:

The U.S. stock market has experienced a continuous rally, and technical indicators have begun to show signs of correction pressure. This is a natural market phenomenon, but it is only the first layer. The deeper risk lies in the fact that once the “certainty of rate cuts” is widely accepted by the market, investors will begin to worry about the implications behind it—such as: Is the economy really slowing down?

Are we approaching a recession?

Once a piece of good news is “fully priced in,” it ceases to be good news. A market without expectation gaps is often the point at which capital begins to flee and lock in profits.

So, can you see why I’ve been emphasizing the importance of allocating defensive assets?

U.S. Treasury ETF such as $TLT is the “safe haven” you can rely on in uncertain market conditions. Medical ETFs like $XLV can also provide a more stable yield curve during an economic slowdown.

Today is Wednesday, and the market is far from entering a panic phase. However, as investors, we need to think ahead and make rational plans to remain unshaken in the face of volatility.

If you haven't yet allocated U.S. Treasury ETFs, now is a good time to consider it. I urge you to allocate and buy them!

The June CPI data will be released on Tuesday (July 15), and the previous May CPI already showed that inflation is moving toward the target, rising only 2.4% year-on-year, in line with expectations and reflecting that inflation is continuing to cool. Under such circumstances, I expect the June CPI to remain at a low level (around 2.4–2.5%). which would undoubtedly reinforce market expectations regarding the Federal Reserve’s interest rate cut path for next year.

However, please note: a decline in inflation could spark concerns about a potential soft landing or recession for the economy. Upcoming retail sales and initial jobless claims data will further reveal whether consumption and employment are slowing in tandem.

Additionally, the market faces several risk factors this week, such as major bank earnings reports, trade policy developments, and further analysis of PPI data, all of which could trigger short-term volatility.

Therefore, my strategy remains stable: continue holding high-quality stocks with solid fundamentals and growth potential, while allocating to U.S. Treasury ETF ($TLT) to build a defensive asset structure. This portfolio can capture rebound opportunities while stabilizing returns during downturns.

The market will not move in one direction, but we can maintain control through clearer strategy allocation.

If you have any questions about this week's trading arrangements, please feel free to contact investment education advisor XXX, and we will help you navigate the volatility with confidence.

Yes, Core X currently delivers performance that exceeds expectations in terms of analysis and big data tracking. Based on multi-level validation and internal testing results, it has demonstrated intelligent comprehensive capabilities, including the following key features:

1. Intelligent automated trading management; completely liberating your investment trading activities, but requiring you to establish appropriate profit expectations and security settings,

2. Evaluating your investment behavior, including asset classification assessment; identifying the most suitable trading recommendations for you;

3. Big data aggregation covering stocks, U.S. Treasury bonds, options, cryptocurrencies, foreign exchange, and gold;

4. Reasoning-based recommendations: Core X derives optimized trading suggestions based on actual big data analysis;

5. Identification of chart signals and complex data to provide reliable and secure trading signals;

6. Automatic correction and optimization of errors, with security protection and error correction to enhance the success rate of signal-based trading. This is particularly suitable for options and currency trading, though further validation is required;

Would you like such a Core X?

Would you look forward to owning it?

Just like Luo Binghan's company, the future lies in using artificial intelligence to provide more complex personalized financial advice on a more efficient scale, while continuing to innovate in the cryptocurrency field.

Artificial intelligence has the potential to enhance retail investors' cryptocurrency trading strategies and risk management.

This is the first layer of significance behind the creation of Core X:

When my NextLeap Management Consulting Services Co., Ltd. aims to become a leading, valuable investment education brand in the United States, offering professional and experienced investment service strategies + decision signals, I not only need an outstanding team but also the cutting-edge technology products of Core X to secure a decisive advantage in the future and gain the ability to control the future of investment. Do you agree?

My students:

Whether you just joined us today or have been with the NextLeap community through multiple market cycles, it is always my great honor to walk this path with you. What we are building together is not just a knowledge system, but a belief, method, and practical ability for rational investment.

Perhaps you have already achieved some success in the market, or perhaps you are just getting started. But remember: investing is never a game for the faint of heart. It is a two-way battle—either you win or you learn; there is no consolation prize for a “middle ground.”

We aim to stand on the side of success, not through luck or following the crowd, but through systematic learning, independent thinking, and sustained execution. This is precisely the purpose of our ongoing learning and daily check-ins.

The moment you choose to keep learning and stay focused today is already laying the most important foundation for your future success rate. Investing is never just about calculations and numbers; it is a way of thinking, a replicable strategic logic. Thank you for your dedication and commitment, and thank you for choosing to be a proactive individual who takes responsibility for your own life.

See you tomorrow in class.

Come with questions, leave with confidence—that is the direction we strive toward every day.

____________________________________________________________________________________________________

Welcome, my friends, to today's “setup confirmation + strategy rehearsal” session. Good afternoon, I'm Bird Grant from NextLeap Management Consulting.

and I just got back from NextLeap's Q3 strategy session. Two days of closed-door discussions centered around one thing: how to maintain clarity of judgment and logical integrity in a continuously changing market environment.

Look at the market today, From a chaotic divergence in the early part of the day to a structural divergence in the late afternoon, the market is not coming out of a single trend, but rather it is repeatedly verifying - which pricing logic is still recognized and which directions are starting to fail.

For me, trading is not about covering all volatility or making perfect predictions, it is about coming up with judgments that can be validated and have coherence at key points.

This system of judgment does not rely on inspiration or heat, but is based on a long-term understanding of the dynamic relationship between funding behavior, liquidity structure and price response.

It is not those who guess the right direction, but those who consistently see what is happening behind every move and understand why it is happening, who can cut through this current market environment.

Ever had one of those moments? A stock looks like it's starting to take off, and you just buy in and the price immediately turns around; or a name has been rising for a few days in a row, and you're finally ready to take the plunge, only to realize that the perfect buying point has long since passed.

When I trade, I never believe in relying on luck, much less waiting for someone else to give the answer.

Over the past thirty years, whether I've been doing global bond allocation or studying the rotation structure of the AI sector, I've insisted on one thing - the first reaction of the market is not based on feeling, but on judgmental modeling coupled with execution discipline.

What you see is me sharing five trades in class, but what I see, is the common chain of logic behind them:

Signal is the starting point, confirmation is the access certificate, the trade relies on execution, and the result relies on exit.

This set of logic process is not one day suddenly flash of insight, but I have spent decades, in the real market, bit by bit polished out of the operating system.

News may come out first, policy expectations may also be speculated in advance, but whether the market really accept, to see whether the price has responded, the funds have not followed.

Really worth trading, is when the news and trend synchronization signal, the market will do it.

We will not be carried away by the headline, nor will we make decisions because of emotions. We focus on, is the price behavior has not confirmed the logic - we only do one thing: to see whether the price behavior confirms the validity of the story.

Today, I will use these five real transactions to break down this judgment to tell you.

Structural Confirmation + Strategy Walkthrough: These Tickets Rise, Not by Chance , Before every breakout, there are signs - can you recognize them ahead of time?

You may be wondering: why are some of these tickets already on the move before they even hit the hot seat, before they even get into the mainstream spotlight?

Why others can always enter the field early, you are always up a large section before you begin to hesitate: now can still enter?

Today we take you to review is not a system, but five of our community most of our friends in July real trading participated in, and indeed out of the obvious up market stocks: $ PLUG, $ ABBV, $ ATLN, $ TOI, $ ANPA. they all have one thing in common behind - you see it! The moment it goes up, we see the signals that were sent before it even moved.

If you can read the way the SETUP appears, you will not be in a hurry when the market is up; if you know how to match the strategy conditions, you can enter the market before the opportunity is ripe.

Five stocks, five setups, each of which says the same trading logic.

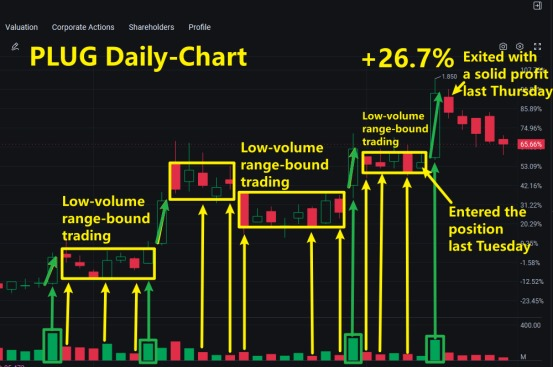

On July 4th, the Big Beautiful Bill officially hits the ground running. Last Monday I noticed $PLUG had an intraday movement. At that time, the new energy direction has been marketed for several days, many people chased the news, flocking to the popular stocks. But I didn't take the plunge right away - because in my opinion, the news itself can't be traded directly, what's really valuable is the way the market priced the news.

I caught three things that day:

The stock had just broken out of a key finishing zone, but the volume hadn't yet been effectively released;

Market sentiment was heating up, but consensus hadn't yet been formed;

and The buyer's take-up was stable, with no obvious panic selling.

This is a classic early signal—but it’s not actionable yet. Still waiting for confirmation.. My operation logic is: wait for the second confirmation action - either intraday active volume acceleration, or stabilization of the high level oscillation, or back to confirm the previous support.

By last Tuesday morning, before 11:14 ET, I observed that the pending order structure was significantly stronger and active buying began to release volume, so I then entered the market in batches.

The move accelerated last Wednesday with price zooming into space, structure confirmation, and synchronized inflows - all key conditions all aligned. On Thursday morning, I cashed in my profits as planned, landing +26.7% on the entire trade.

Pharmaceutical sector opens for rotation and $ABBV, as a high dividend paying large pharmaceutical company, attracts a portion of defensive funds to step in gradually. Although the overall trend is not aggressive, repeated oscillations within a clear range structure provide a good window for solid arbitrage.

System signals between high and low levels suggest potential arbitrage space, and the operation is centered on the combination of “clear structure + low volatility”. The round of trading in accordance with the settings to complete the swing operation,stable returns, retracement

controllable.

Teaching dismantling: Facing non-mainstream sectors, how to find a sound operating logic?

Step 1: Identify Structural Zones

When the trend is not clear and sentiment is not high, the market is more likely to enter a sideways consolidation zone. The $ABBV trend is clearly in an oscillatory channel with clear structural boundaries, providing predictable entry and exit points for arbitrage.

Step 2: Confirmation of capital style switching

When the high beta direction of technology and AI enters a consolidation period, the market will appear “rotational defense”. Funds begin to shift to high dividend, low valuation, low volatility of the pharmaceutical / consumer leaders, the formation of a solid inflow.

Step 3: Execute in a steady state trading manner

In the face of non-strong trend targets, the operation strategy should be more in favor of “buy low and sell high” rather than “trend following”. Narrowing expectations, increasing tolerance for error, and strengthening discipline are at the core of oscillator arbitrage.

From entry to exit, four days, cash profit +5%!

We've covered a lot of ground today, so I don't want to cram too much into one sitting, so let's leave some room to digest.

Tomorrow we will continue to break down:

$ATLN is based on what core logic to achieve +12%;

$TOI and how to capture this round of +18% trading opportunities.

$ANPA | +80%: systemic warnings ahead, liquidity vacuum amplifies this rally.

$COIN | 2-Day +6%: Signal first, buy confirmation, cash in on the trend.

For those of you in the community, remember to lock in tomorrow's lesson. We'll continue to break down the key logic behind the real world and help you put these methods to work in real trades.

The first link: what ticket to buy tomorrow, not to see who is hot, but to see who is clear.

At the end of the course, we will push the key stocks to watch for the next trading day and tell you clearly:

Why does it deserve to be watched?

Which structural phase is it currently in?

What kind of trend is the real signal to make a move?

The second link: what can be done, what should wait, can not rely on feeling points.

Not all movements are worth trading, and not every rally can be followed.

We'll teach you to recognize executable structures and break down three types of real signals:

Structural Confirmation: Is it a starter uptrend, or a false breakout?

Financial follow-through: is it real buying coming in, or is there no sustained buying?

Sentiment Strength: is it an early layout, or is it the last leg of the chase?

The third link: judgment is never a problem, the difficult thing is: into the field enough to be accurate, out enough decisive, position can be controlled.

Many people do not understand, but can not move, into the slow, out of the chaos.

We will take you to dismantle the three cores of the implementation: how to enter? Not a bet on, but in batches to build positions, confirm the structure, control position risk; how to get out? Not betting on the high point, but according to the preset range gradually cash, pull open the profit and loss ratio; how to follow? Different types of trends require different ways of holding positions. You can't use the trend-chasing approach to deal with sideways stocks, nor can you take the rally perspective to deal with a setup that has just broken through.

In addition to making clear why and how a few stocks we've operated recently were established and accepted by the market,

we're going to bring forward today an underlying that is currently out of the mainstream - IOCQ.

It's not making any big moves at the moment, but its price performance over the past few days has been very clear: volatility compression, tightly controlled volume, and no There is no noise whatsoever. On the surface, it looks like the price is not moving up, but in reality, money is quietly entering the market and preparing for the next move.

From my perspective, this is exactly the kind of setup that deserves to be flagged in advance; it's not attracting attention, and it's not creating a sentiment driver, but the trading behavior itself is brewing a direction.

The point is not to guess when it will go up, but to see: does it have a good enough reason to be the next name to be pushed by the money.

I don't need it to move today. What I want is this: to give confirmation at the right time, with real price behavior. Right now, it's standing on the edge of that possibility. Tomorrow, we're ready to move in.

If you agree on one thing: the rise is not because of news, policy or sentiment, but because structure and money are driving it, then it's time for you to start with this lesson and really build the habit of executing ‘from logic to action’.

"Jesus said, 'Anyone who hears these words of mine and does them is like a man who built his house on the rock.'

It's not enough to hear it; the real difference is whether you do it or not."

The market is no different - it never rewards those who only analyze, only those who dare to execute.

That's all for today and we'll continue tomorrow: making the signals clear and the process complete.

Rest well. Tomorrow, we trade with clarity.

Before we end today's sharing, I would like to leave you with a question:

In my course today, which stock did I explicitly name as a stock to consider buying tomorrow?