July 18, 2025

July 18, 2025

After an exciting night, we are now facing a set of economic data that is extremely critical to the market. Do you know how they performed? What market signals do they convey?

Many friends may ask:

Why does the cryptocurrency market react so strongly to these data?

Why does every fluctuation in inflation, retail, employment, and other data trigger such intense volatility in crypto assets?

This is one of the questions we will explore today.

In addition, as a mature investor, we should also have the ability to anticipate market sentiment. Beyond technical signals like candlestick charts, what “leading indicators” should we observe? How do we interpret the market expectations behind the data? How do we turn this information into a trading plan?

Welcome to newcomers! Veterans, please feel free to share your insights and experiences. We are entering the critical moment of Friday trading—the culmination of the week's rhythm and the starting point for next week's planning.

It's time to sharpen our judgment and strategy. Let's dive into today's market practical training session with enthusiasm!

Friends, Friday's market undoubtedly sent a strong positive signal.

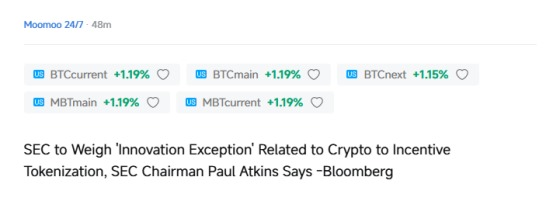

Yesterday, the U.S. House of Representatives passed three important bills closely related to cryptocurrency: the Genius Act, the Anti-CBDC Surveillance Act, and the Digital Asset Market Clarity Act. Among these, the Genius Act has already been passed by the Senate and now only awaits the president's signature to become law.

What does this mean?

Stablecoin regulation is moving toward compliance. As digital assets pegged to the US dollar, stablecoins play a crucial role in the future financial system. This legislative progress has injected clear regulatory expectations into the market and signals that cryptocurrency is gradually moving toward the core of mainstream finance.

As a result, the stock market saw a rebound on Friday, with US stocks rising and market sentiment improving significantly, dispelling the hesitation and caution of the previous days.

What I am more concerned about is—have you participated in this round of policy opportunities? Have you adjusted your holdings according to our strategy? Have you benefited from it?

Remember, every major policy implementation is the starting point for market revaluation. Only investors with leading insights and decisive execution can seize the initiative.

In the next session, we will further dissect the investment opportunities behind this policy and focus on which sectors may benefit first.

Based on this week's economic data, my conclusion from a comprehensive analysis using the CoreX system is:

Although there are some concerns about an economic recession in the market, these concerns may be exaggerated at present.

As long as inflation continues to decline, there is still room for adjustment in market expectations for interest rate cuts.

However, it is important to note that if inflation resurges, especially if it exceeds expectations, the Federal Reserve may not have sufficient room for maneuver, which would pose a challenge to the market.

Therefore, we can make a clear judgment: inflation remains the key factor determining the future trajectory of the U.S. economy and stock market.

Based on the current data signals, I believe that the overall trend of U.S. stocks over the next month will remain optimistic.

This is precisely why, when formulating trading strategies, we must closely monitor data and respond flexibly.

Why is the digital currency market so sensitive to US economic data?

In recent months, cryptocurrency prices have been “highly sensitive” to US economic data because investors prefer stable assets over riskier ones.

My core interpretation is: U.S. economic data underpins the direction of the U.S. stock market. Positive economic data leads to strong stock market performance, indicating that listed companies are reflecting expectations of economic growth;

At this point, if there is sufficient market liquidity, it is a significant positive for the cryptocurrency market,

as the cryptocurrency market is pegged to the U.S. dollar, specifically USDT.

When the Federal Reserve implements interest rate cuts, U.S. Treasury bonds are sold off, affecting the decline in the U.S. dollar index, thereby causing the U.S. dollar exchange rate to fall, which in turn drives the rise in the digital currency market; This is why, once the Federal Reserve implements interest rate cuts, the greatest benefit goes to digital currencies, especially BTC, which benefits the most!

Do you currently own them?

So when you join the community, you have access to all the stock strategies, which are the market conclusions I have drawn based on various economic data and investment experience. The results obtained by combining the current economic environment and the Federal Reserve's monetary policy:

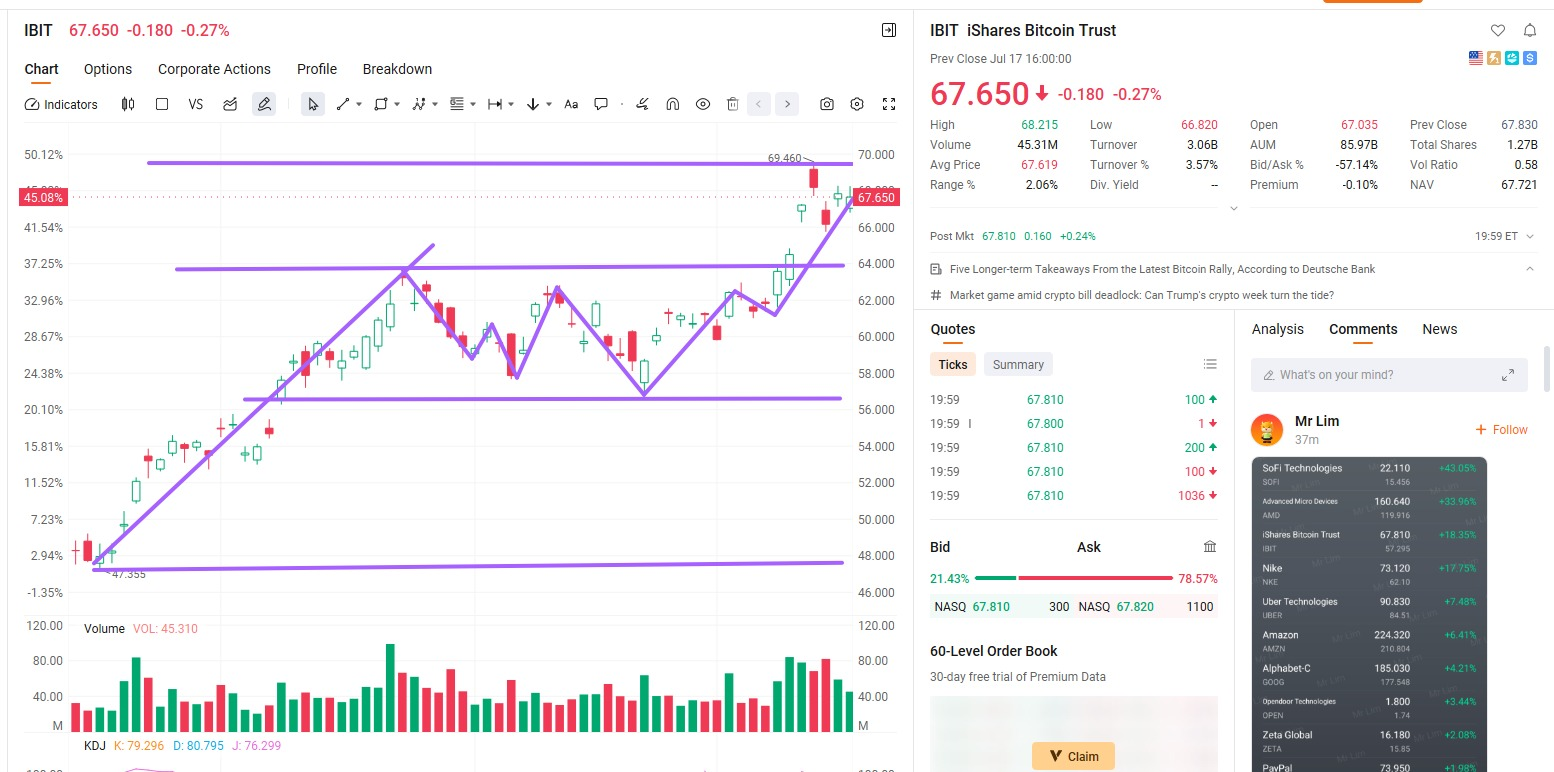

Imagine this: if I don't believe in the future price increase of BTC, why would I participate in the stock trading decisions for $IBIT/$HOOD? How could they possibly have value?

Take a look at $IBIT, the Bitcoin spot ETF issued by BlackRock. This fund directly holds over 300,000 BTC—yes, you heard that right, over 300,000;

Why would BlackRock purchase so many, and who would entrust their money to BlackRock for such purchases?

Firstly, BlackRock is the world's top asset management company with over $10 trillion in assets under management. Recently, BlackRock surpassed Grayscale to become the largest digital asset fund management company by total assets under management.

The Bitcoin spot ETF issued by BlackRock is IBIT;

Currently, those purchasing IBIT include not only you and me, but also Bank of America and Morgan Stanley.

It is one of the top five holders of IBIT;

Alright, do you understand now? Why is IBIT a must-have strategy for us?

Opening up this investment logic, hasn't Bank of America's asset management division conducted a comprehensive analysis of risk and return investment options?

Think about it: Morgan Stanley holds over 5.5 million shares of $IBIT. Do you think it's making decisions based solely on emotions?

If none of these apply, should the core $IBIT you currently hold become a firm belief, a powerful driving force, and a bold, sustained increase in purchases?

Yes! Although when you purchase $IBIT, you only indirectly hold Bitcoin spot through BlackRock;

However, that's okay;

If you have no understanding of Bitcoin, this is the best way; Unless you already have such trading experience and have gained sufficient knowledge in BTC spot trading, then directly owning it isn't a bad thing either;

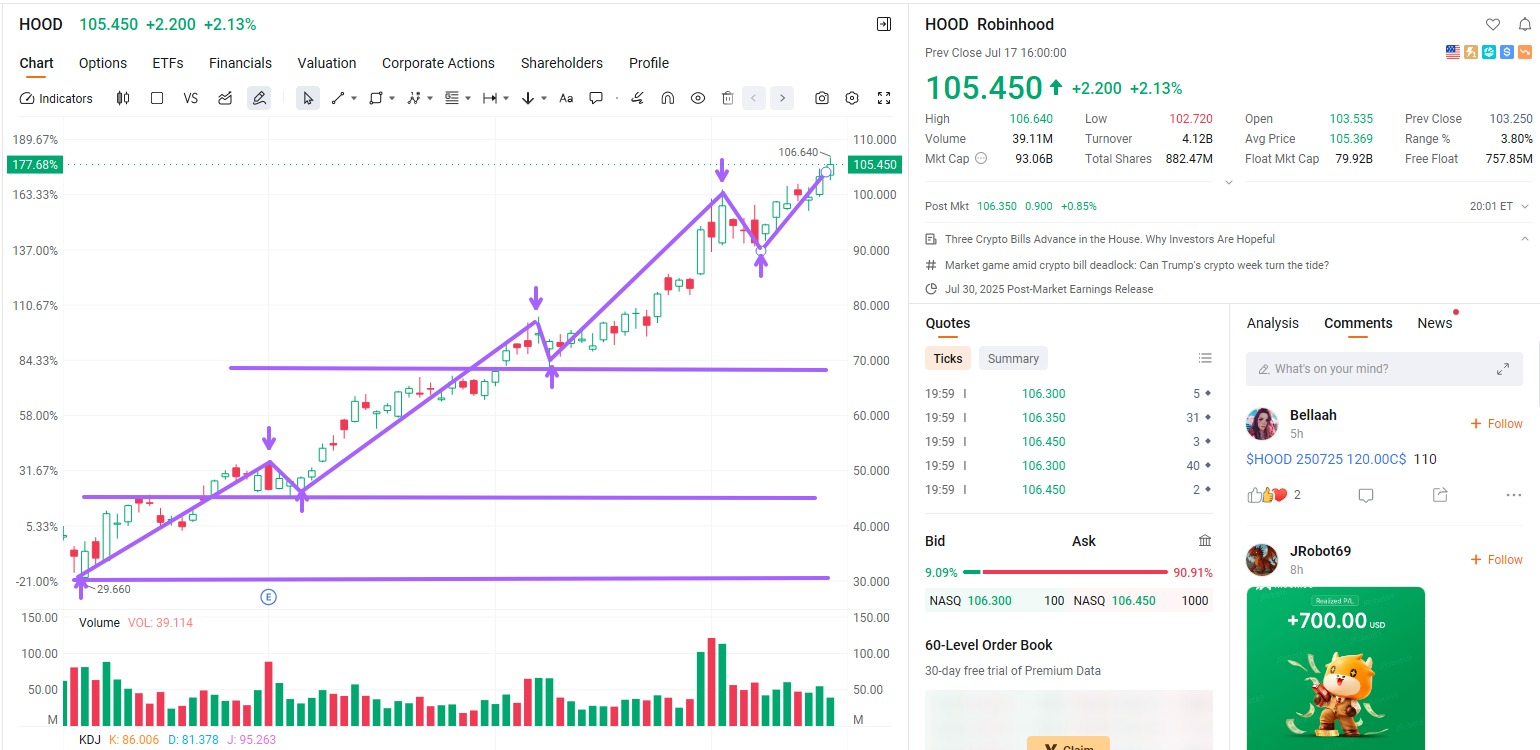

However, the $HOOD you purchased following my recommendation is indeed genuine!

Because here you have found the golden key to unlocking global wealth. As the most important global trading account representative in the U.S. currently, $HOOD integrates a triple trading model of stocks, options, and cryptocurrencies, combined with artificial intelligence to provide premium services. I believe that if you are its user, you will experience a level of comfort surpassing what I have described.

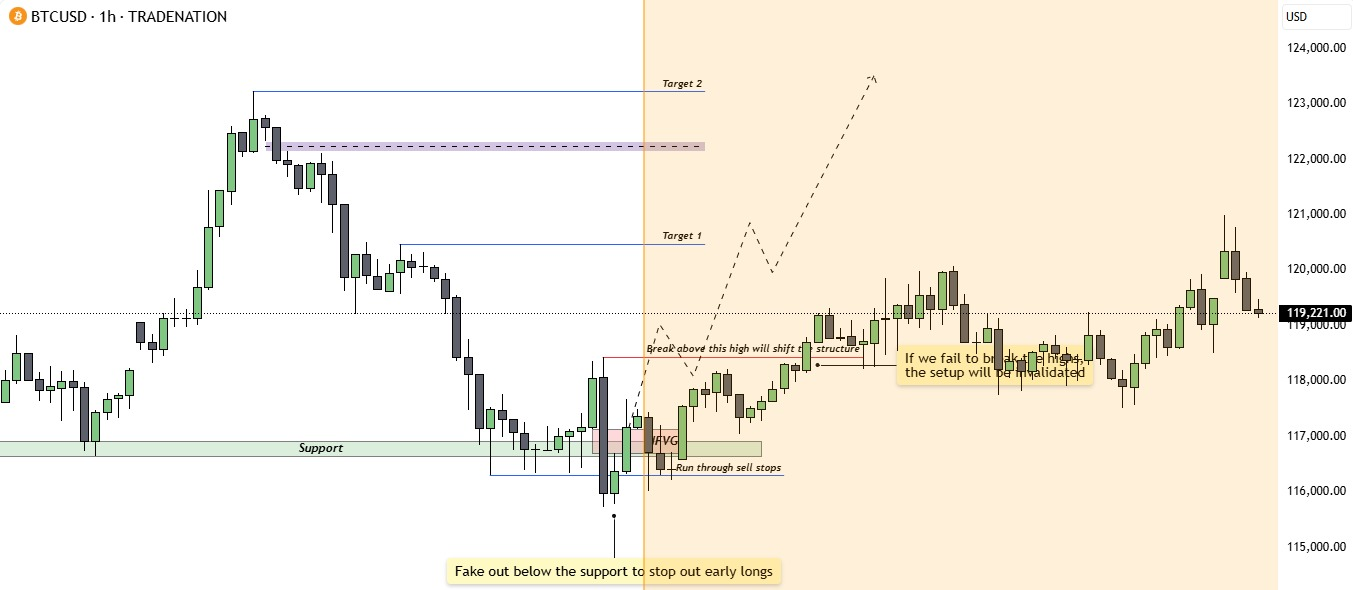

As shown in the chart above: $HOOD, the green candle chart has successfully broken through an important key level, and the stock price is surging like a rocket. In yesterday's Wednesday class, I provided a detailed analysis of Robinhood future and value, including the rapid growth of its Global Access account users, driven by the widespread attention on the cryptocurrency market;

Since following the trading strategy: the stock has achieved an 8% return.

The current trading plan is to continue holding and maintain the current position. If you do not yet own it, wait for my better signal instructions!

Although you joined my NextLeap community a bit late, the best is yet to come. Remember to follow my community content and maintain communication with my investment education advisor to ensure you do not miss any valuable content!

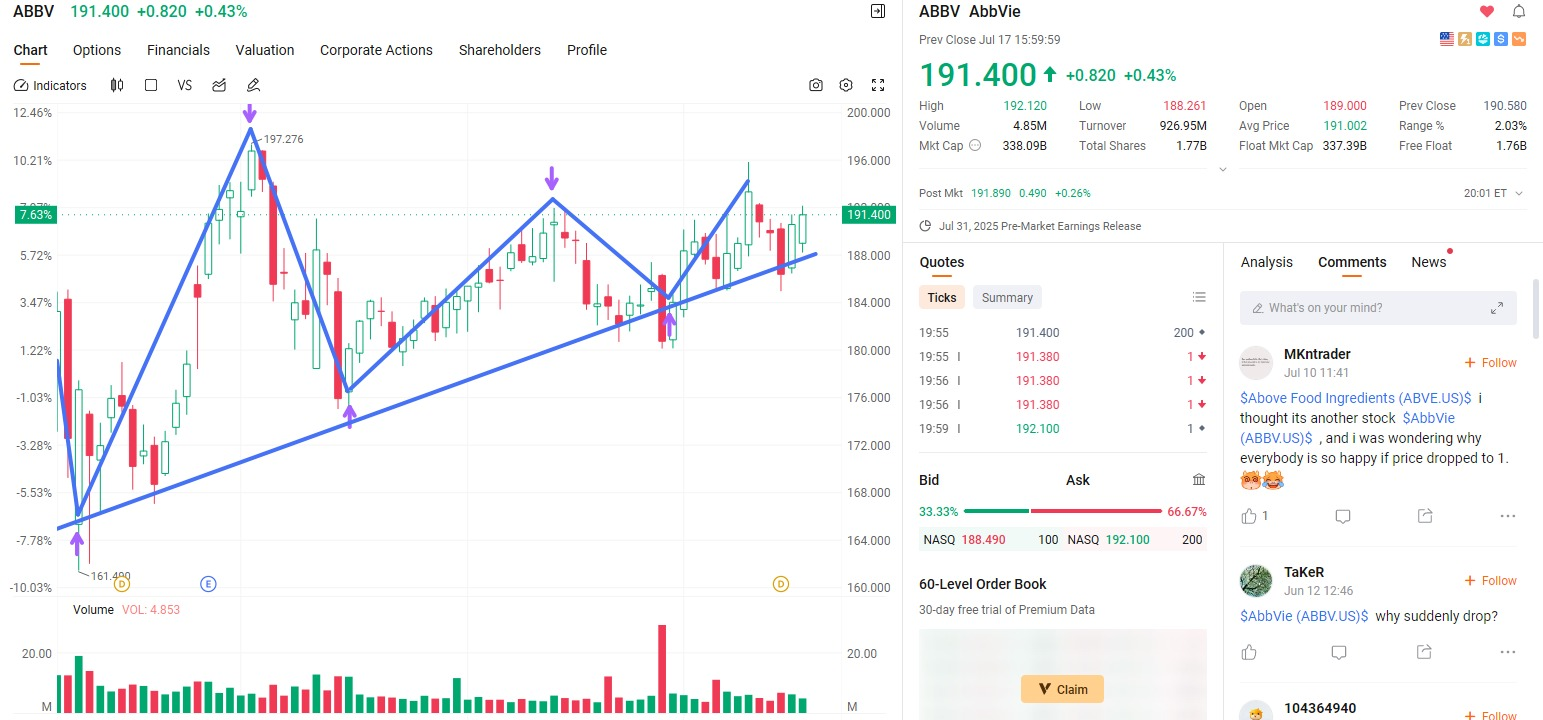

Take a look at $ABBV, which is currently maintaining an excellent upward trend. According to the chart, it opened high but then fell back, mainly due to increased market expectations of interest rate cuts. As a result, high-quality stocks with high dividends and strong growth potential are being affected by capital diversion. Today, the Russell 2000 Index saw the highest sentiment. a celebration for small-cap stocks, much like drought-stricken wheat in a field finally receiving much-needed rain. While this stock may experience some capital diversion, observing the chart reveals that each dip presents an excellent opportunity to buy

and add to your position. After at most two red candle stick declines, the stock will continue to rise!

Do you own it yet? If not, act quickly!

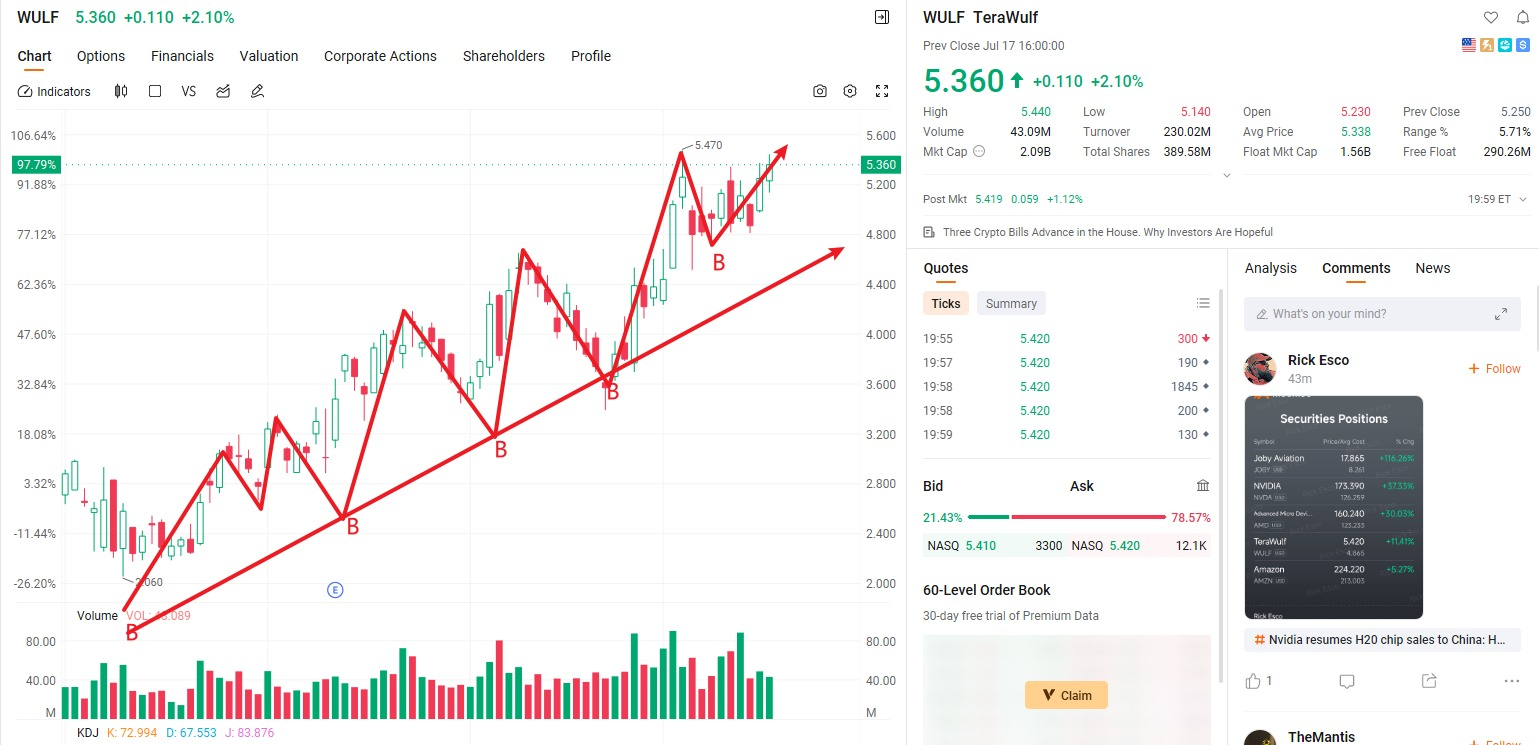

A better trading strategy: Buy $WULF. It is one of the most promising opportunities in the current market!

Why do I say that? Because as Bitcoin and cryptocurrencies move toward compliance and clean energy mining becomes an industry trend, TeraWulf Inc. is like the “Tesla of the green mining industry.” It combines three hot topics: blockchain technology, energy transition, and ESG investment.

WULF's business model is clear and transparent. Not only is its mining capacity continuously expanding, but more importantly, its power comes from nuclear and hydroelectric sources, making it sustainable, low-cost, and naturally competitive in the long term.

Looking at the charts, the recent candlestick patterns show a stable upward trend, with a very strong technical structure. Positions taken after a dip have already shown significant profits!

CoreX provided a clear signal yesterday, advising us to focus on the 4.90–5.30 range for positioning. Now you still have the opportunity,

have you already participated?

If you followed our timing strategy, you should have already achieved over 3% short-term returns, correct?

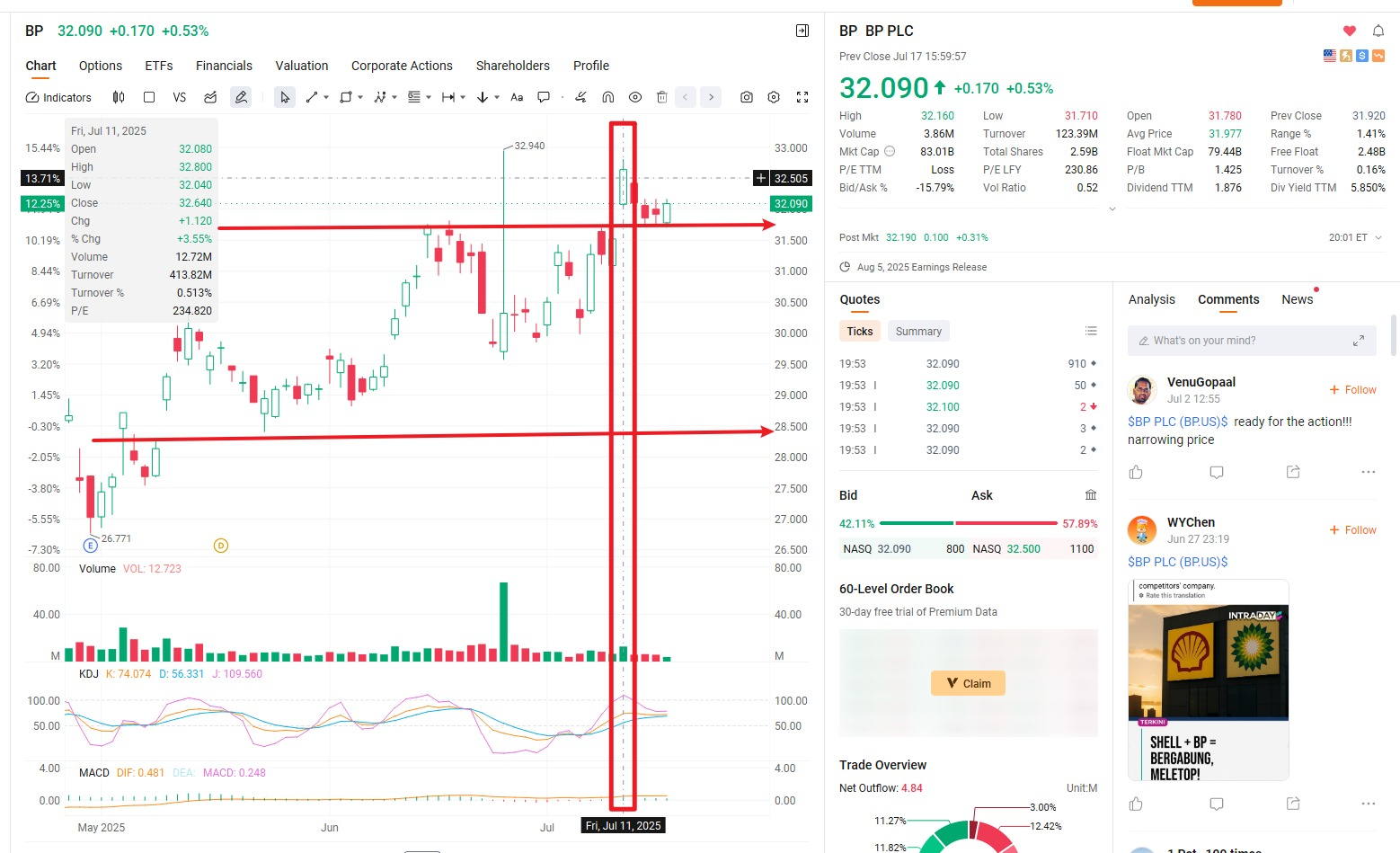

Guys, let's take a look at $BP today. Although its performance isn't the strongest, this is entirely in line with expectations—after last Friday's sharp rise, new investors are adjusting to the pace, so some short-term selling pressure is normal.

The key point is: BP's fundamentals are solid, its Q2 earnings report was excellent, and the stock price is steadily moving away from the pressure zone, with a breakout in the works.

My advice is simple: hold on patiently!

A breakout above $40 is just a matter of time. Today’s volatility is likely due to technical consolidation ahead of the July 18 call option expiration.

Remember, when the timing is right, profits will follow. Don’t rush into frequent trades—holding steady is the wise choice.

So, regarding the Treasury bond twins: $TMF/TLT, why haven't they risen yet?

Yes! This is an important risk hedging tool in my investment strategy portfolio.

How should we understand risk hedging tools?

When the stock market is performing well, it indicates that market funds are favoring risk-type investments, and risk appetite is rising. What is risk appetite?

It refers to the degree of preference for risk, or in other words, the willingness to take on more risk.

Therefore, Treasury bond ETFs, as safe-haven products, are like the Statue of Liberty here—trading with faith. As the eventual decision on interest rate cuts approaches, we will benefit from this. Now is not the time to reveal the answer!

Do you understand the reason for allocating it?

Of course, if you're new here, you might be wondering: What have we actually done, and why is everyone so excited today? Did I miss out on something important?

Don't worry, you're not too late!

The NextLeap community isn't just a flash in the pan. We're committed to promoting the SEC's safe investment philosophy and creating an educational platform that truly serves US investors. Our goal is clear: to help everyone grow from beginners to experts and ultimately achieve excellence.

As long as you are willing to participate, you can still get the opportunity to grow and have the opportunity to receive the exquisite gifts we have prepared.

Contact your investment education consultant now to receive the exquisite gifts!

If you are an old friend, thank you for your continued support and interaction.

If you are a new friend, welcome! Please visit our official website at https://www.nextleap.vip to learn about the mission of NextLeap Management Consulting Services Co., Ltd. and my personal story.

Our goal is simple—to help American investors improve their practical skills and deliver real results. If you are interested, please take a moment to explore our website.

Yes, folks, today's Friday market was as I expected—relatively quiet. This is typical of Wall Street's rhythm, as everyone is preparing for the weekend. But our NextLeap students are different—the afternoon is our golden time for learning and交流.

Whether you're here for the first time or already familiar with the place, please remain humble and sincere, and share your experiences and insights with new students. This is the core of our community culture.

Remember, the meaning of trading isn't just about winning once, but about becoming a long-term winner. This requires learning, growth, and the support of the community.

After the afternoon market closes, Professor Bird Grant will lead an engaging course discussion;

and today's lucky wheel might just bring you even more surprises!

Good afternoon, friends! I'm Bird Grant and welcome to our hands-on communication content here at NextLeap Information and Consulting, Inc.

This morning's session with Prof. Blake Shaw was fantastic. Shaw (Blake Shaw) Professor of the course is very exciting, you see he can in IBIT, TLT, HOOD these subjects in advance of the completion of the layout, not by feeling to choose the direction, but because he from the macro-liquidity,

regulatory trends to the asset structure of the whole line sorted out clearly, before decisively out.

For us, there is such a professor who can turn policy trends into practical operational plans, and he is one of the very few people who can make the strategy successfully implemented in the real market. If you can truly understand the logic and execution path of this class, then you are already one step ahead of many people.

Before the open I noticed that money was starting to flow back into one asset class, and $WULF was right at that intersection that we predicted - policy signals, bitcoin movement, and repricing of the industry structure. So the driving logic behind our community's collective buying of $WULF this morning is clear.

On July 17, the U.S. House of Representatives passed three key pieces of crypto-related legislation: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. Of these, the GENIUS Act is expected to be officially signed by Trump this Friday.

These bills signal one thing: the U.S. is officially bringing crypto assets into the federal regulatory framework. And companies like $WULF, with their Bitcoin relevance and clean energy mining model, are stepping right into the heart of this policy push.

The reason we're taking the plunge is simple: the value of these stocks is being redefined, and the market, for one, is just beginning to realize it.

When it comes to stocks being redefined in terms of value, that's really what we've been doing throughout the month of July.

Behind every move we've made from $WULF to $COIN to $ANPA, we've not been chasing the heat, but rather responding to a core logic: the market is using new criteria to assess which assets are worth higher prices.

We've been talking about this system of judgment for two days in a row - from the structure of liquidity, to the direction of policy, to the changing patterns of market behavior. If you've been listening, it's time to get to the really critical question today:

Every position you have in your account right now, is it an active trading decision you're making as you look at the market?

Or are you being carried along by the volatility of the market, following the emotions of the temporary order?

I will not just tell you what to buy, what to sell. My task is to help you build a system that can independently determine the direction, understand market behavior, and grasp the timing of the transaction.

Remember, the market opportunity will not wait for people. The ones who ultimately leave gains are not the ones who shout loudly, but those who see and execute.

Position opened on Thursday, July 10, 2025 at an average price of ~$371

That morning, the Nasdaq was weak, the S&P had opened higher and lower, and Bitcoin was pulling back. The entire digital asset sector looked moody - but we're not making decisions on sentiment.

What we're looking at is something much more underlying:

I. Buy logic: not following the price, but seeing that pricing is changing

① The regulatory process is moving forward, but it is not yet priced into the marketplace

Just that week, the GENIUS Act and CLARITY Act entered the official agenda of the House of Representatives, and Congress has moved forward with the final voting process, which is not just headline, but the first formal push at the federal level to establish a regulatory framework for crypto assets.

Coinbase is one of the few companies that will benefit directly: its compliance attributes were already fine, the real point of change is when regulation hits the ground. From that moment on, liquidity can be released and valuation models can be rebuilt. It's not concept-driven, it's a formal shift in pricing mechanisms.

We know the market hasn't fully reacted yet, but the pricing anchor is already shifting.

② behavioral signals are also synchronized in place

As the intraday price dips to around $370, sell orders begin to weaken, buy orders begin to be placed continuously, and trading slows down but is not chaotic. In other words, this is not a panic pullback, but a withdrawal of assets from the upside, and funds that were not previously involved are coming in.

Last Thursday at 10:00 am, institutional accounts began to test positions, and on the day we saw support hold and buyers take steady positions, we decided to start building positions in batches in the $370-373 area.

What we want is never the “obvious breakout” that everyone is chasing, but rather a position where the structure is in place, but the market hasn't done anything about it yet.

Second, the position reduction strategy: policy delivery, structure in place, rhythm adjustment

By July 17, the House of Representatives passed two bills, the regulatory logic is officially in place. In the afternoon of the same day, $COIN strengthened significantly, reaching a high of around $395, back to the previous pressure band.

We made our first position reduction in the $394-395 area, not because the market was over, but because the round of valuation repricing that we had predicted was complete.

At the time:

Policy expectations have materialized;

Bitcoin failed to synchronize its volume, and the chain's money flow didn't keep up;

Structurally it was also approaching a pressure zone, not a position to continue to add to.

We chose to cash in part of the gains, the remaining positions continue to retain, waiting for the next confirmation node.

Third, this is not “see the right direction”, but read the part of the market has not reacted

$COIN The core of this transaction, not in how much it rose later, but in our identification:

When the policy began to turn, the structure began to take shape, and the market has not priced the time - - This is the window of active entry. -That's the window of opportunity to be proactive.

What you have to do is not follow the price, but know ahead of time what's going to be repriced, and then find that position and take it.

We weren't betting on the upside, we were looking for value that had the certainty to reprice. $COIN was one of the most standard opportunity models at the time.

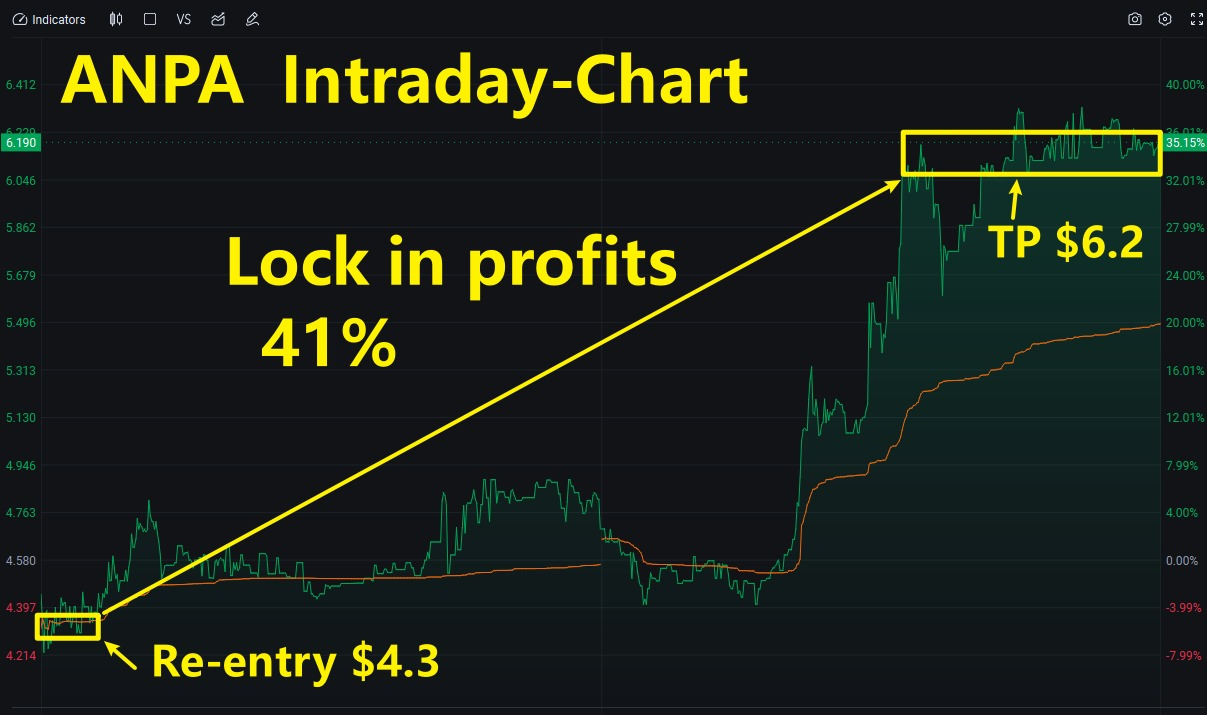

With the structural opportunity of $COIN out of the way, we're going to focus on another stock with a completely different style -- $ANPA, a short-term trade driven purely by market behavior.

$ANPA: Two short-term trades executed around liquidity behavior and structural response

This is not a speculative attempt to “pick up a bargain at the lows”, but rather a short-term strategy that we have proactively built when we identify specific price behavior, structural mismatches, and capital moves in tandem.

First trade

Date: July 15, 2025

Average price of position opened: $3.969 | Average price of position sold: $6.378 | Surplus: +60%.

During the intraday trading on July 15, we found signs of concentrated liquidity + triggered price structure in $ANPA during the scan.

Buyers started actively sweeping orders from the pooled bid.

Highly concentrated turnover in the timeframe, stable trading behavior

Among the SPACs, $ANPA is the one with the best buying efficiency.

There is no noise in the order structure, and it is actually placing orders-not just showing up, but stepping in.

Its buying behavior is the type that the system prefers: directional, executed, and consistent.

It's not the one that's up the most, but it's the one that's worth doing.

Date: July 16, 2025

Average price of position opened: $4.336 | Average price of position sold: $6.126 | Profit realized: +41%.

On the following day, we noticed again that $ANPA short-term retracement was confirmed with stable low pending orders, the buyers on the board are still active and there is no liquidity break.

The retracement is under control and trading is concentrated in key support areas

No major exit signals from previous positions.

Overall market capital remains focused on this type of structure

We restarted the position as price approached the $4.33-4.35 area, viewing it as a structural continuation test. There were no volume divergences on the upside and trading continued to be steady, so we took profit near $6.12.

Core Conclusion

We made these two trades based solely on the following three dimensions of consistency:

Is the price behavior directional?

Is the deal structure manageable?

Is there a sustained intent to participate?

This is not a “feel good” or “hot” trade, but a live strategy based on clear structure, readable behavior, and alignment of expectations with entry and exit points.

We don't ask how much it can go up, we just care:

The current price behavior, market feedback and trading structure, whether it supports our

This week we are trading two very different types of stocks: $COIN and $ANPA.

$COIN represents a “valuation anchor is changing” trade. We see policy moving forward, regulatory logic is clear, and we get in early before the mainstream money has priced itself out.

$ANPA is a different structure: restricted circulation, quick liquidity response, and more likely to see a short-term price reaction when market risk appetite picks up.

These two types of trades have different paths, but the basis of judgment is the same:

price behavior is clear, capital flows are concentrated, the structure has room to maneuver, and the market response is not yet complete. What we do is to take the initiative when these conditions hold.

This is what we want you to have the ability to -

not chasing up, not emotionally follow the single, but in each transaction, clearly determine whether it is worth doing, can not do, do in how to manage.

We've looked at $COIN and $ANPA, the re-anchoring of policy pricing on the one hand, and the quick reaction to short-term structure on the other, and it's the traders who can handle both trades well who are really starting to think systemically.

It's Friday afternoon - Wall Street is already turning off its terminals early and switching to “weekend mode”.

I'm going to go for a bike ride with my family along the Hudson River and find a small town brewpub for a not-so-healthy dinner to slow down my nervous system that's been running too fast the last few days.

If you had a good trading week, congratulations and celebration;

If you're still a little chagrined, that's okay, the market is always waiting for the next tomorrow.

I wish you a weekend that's more stable than the S&P and freer than Bitcoin's volatility.

We'll see you on Sunday, don't miss me too much.