July 21, 2025

July 21, 2025

Monday mornings always come with a sense of new beginnings. Whether you're brewing coffee in your kitchen or reviewing last week's profit and loss statements, I'm sure you all have the same question on your minds: “How will the market perform this week?”

In fact, we are standing at a delicate yet critical juncture. Market sentiment is undergoing a subtle yet significant shift—from high-sensitivity caution to a preparatory phase for structural rotation. While indices remain range-bound, there has been a clear shift in strength between sectors: capital is no longer blindly chasing gains but is instead focusing on areas backed by genuine performance, policy benefits, or undervaluation correction potential.

At this point, rather than chasing highs or cutting losses, what's more important is to establish your own “sense of direction” and “rhythm.” Just as a sailor faces the unpredictable sea, a master never waits for the wind to come; instead, they know how to read the waves, follow the trend, and maintain balance.

And this is precisely what we strive for every day in the NextLeap community: through knowledge, strategies, and trading rhythms, we help you see the main trend, hold the bottom line, and seize opportunities in every market cycle.

I never feel surprised by a successful investment, because I know it stems from the accumulation of calmness, perseverance, and belief cultivated in adversity.

Every victory is the result of research, focus, and effort. Just like the rise on Monday, I began analyzing the trend and developing risk management strategies before the market opened, striving to find the optimal portfolio composition.

This achievement is not just mine; it belongs to every partner in the community who has diligently studied and grown together. But remember—this is just the beginning. Short-term victories do not equate to long-term success.

Do you also believe this? True winners are those who stay true to their original aspirations and keep moving forward at every stage.

Although the market opened on Monday buoyed by optimistic data, the overall trend failed to sustain its upward momentum and saw a widespread decline. Why is this the case? We must understand this by examining the interplay between data and market structure.

First, the data itself was indeed strong:

June retail sales rose 0.6% month-on-month, far exceeding the expected 0.2%, with the rebound driven by spending on automobiles, clothing, and dining. The recovery in consumer spending demonstrates the resilience of the economy.

2. Initial jobless claims below expectations

Initial jobless claims fell to 221,000 last week, below the expected 233,000, indicating a solid job market. This suggests that concerns about an economic slowdown have further eased, while market expectations for a rate cut in September have increased, with some even predicting a rate cut of up to 50 basis points.

Pre-market observation today: Why are small-cap stocks (Russell 2000) outperforming large-cap stocks?

1. Additional interest rate cuts benefit small caps more significantly

Small companies often carry floating-rate debt, and when interest rates fall, their financing costs decrease rapidly, which directly improves their profit outlook. Experts point out that small-cap stocks are more likely to benefit from “interest rate dividends” than large-cap stocks.

2. More Attractive Valuations

Currently, the Russell 2000's valuation metrics (such as price-to-book ratio) are roughly half those of the S&P 500, indicating that small-cap stocks are undervalued. Once economic data improves or market sentiment turns positive, they have greater potential for a rebound.

3. Structural capital rotation

As the market anticipates interest rate cuts, retail investors and institutional funds are shifting from large-cap tech stocks to mid- and small-cap sectors, driving the Russell 2000 index to become the strongest-performing index today.

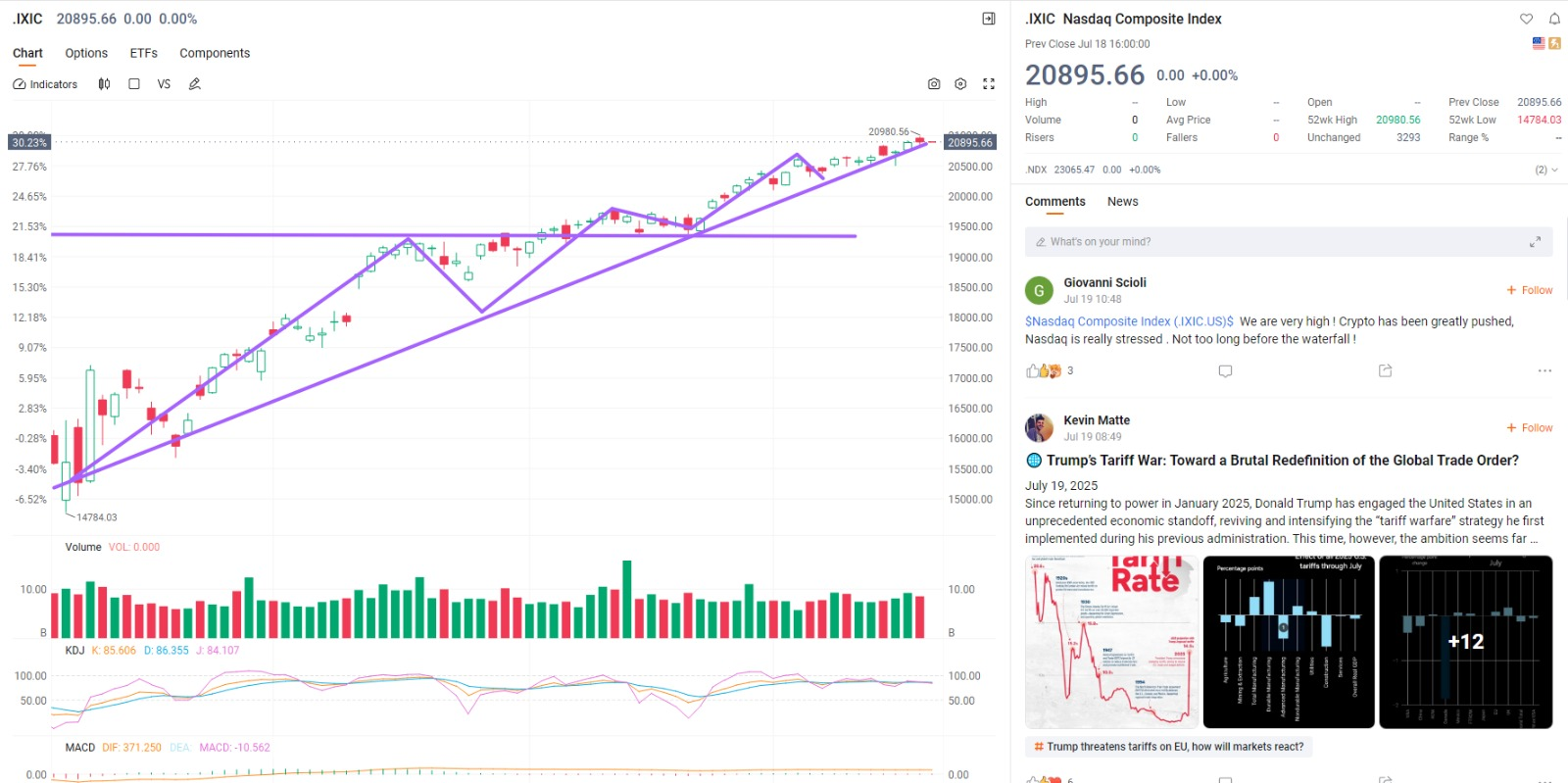

4. Additionally, the Nasdaq Composite Index (.IXIC) opened higher and rose sharply today, successfully breaking through the resistance line, indicating that the market may continue to surge in the short term. However, as the weekend approaches, there may be temporary volatility, possibly due to profit-taking, so there is no need to panic excessively.

If you are a long-time student of NextLeap, you may have already achieved substantial returns from the strategies implemented over the past two weeks. Many students have seen double-digit gains on their holdings during this round of the rebound. For them, now is the perfect time to partially reduce their positions, lock in profits, and wait for the next buying opportunity.

This is the strategy of a mature investor: first secure a profit, then wait for the next opportunity to buy low, and use compound interest to grow your profits into a larger snowball.

If you are a new friend joining us for the first time today, welcome!

You are entering a community dedicated to “practical application + long-termism” in investment education. Here, we do not chase market trends; we believe that strategy and discipline lead to long-term, secure returns. All you need to do is study diligently, gradually validate what you learn, and boldly share your ideas and questions.

The investment world is filled with temptations and volatility, but we adhere to the principles of “safe profits, rational trading, and trend dominance.” This is the founding philosophy of NextLeap and the core vision we strive to promote through our free educational efforts. Yes, capital always seeks profit, but only those who can discern trends and capture the rhythm can remain invincible in the market. Joining us is your first step toward wise investing.

In this session, we will explore three key questions: When a company is about to release its financial report before or after the market closes, how can we use options strategies to manage risk and understand the true value behind such strategies?

Secondly, when preparing to trade a stock, should we directly purchase the underlying stock or participate through options for better cost-effectiveness?

Third, if we already hold a particular stock and are about to face earnings release, should we hedge in advance through options to control risk and lock in profits?

These questions all represent practical challenges that a mature investor must consider. Today’s lesson will help you understand the flexible application of options in complex markets, enabling you to manage risk and returns strategically and rhythmically, rather than just “guessing the direction.”

Ready? Let's begin today's lesson.

We are trading American-style options, which are currently the most mature and widely used method globally.

Therefore, we should be confident in this method.

The core of American-style options is that they offer greater flexibility and more exercise options. You can exercise your options early, at expiration, or refuse to exercise them, allowing you to make the most advantageous decision when trading options.

Another point is that options are rights to something in the future, not something you immediately possess.

It is similar to a reservation but not entirely the same.

After all, the premium may be lost entirely due to incorrect predictions.

So, is the premium too high or too low?

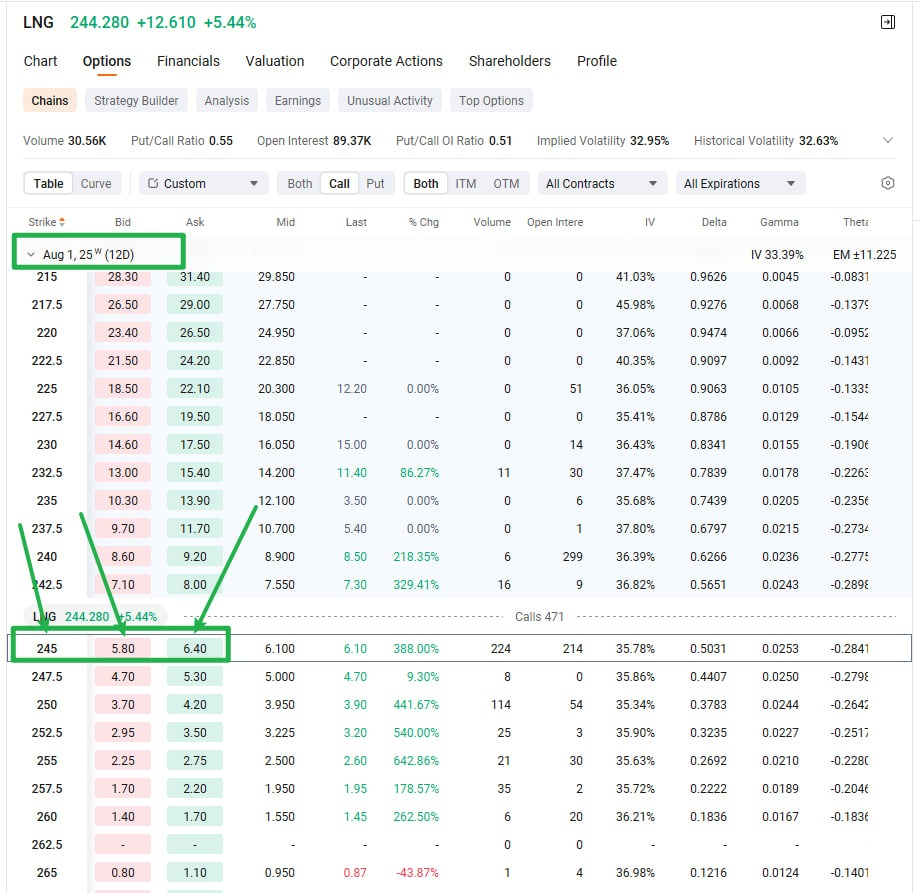

As shown in the figure: The time corresponding to the stock option, the corresponding exercise price, and the corresponding purchase and sale prices of the option are volatile and are the result of market trading.

*For example, the stock price corresponding to the option is $244!

*Assuming a call option expiring on 2500801 with a strike price of $245, the purchase cost is $5.80!

This implies a cost comparison:

When purchasing 1 share, the cost is $244!

When purchasing 100 shares, the cost is $24,400.

When purchasing 1 option, the cost is 100 × $5.80 = $520!

Yes, for the same 100 shares, the cost incurred is different!

520/24,400 = 0.0238, approximately 2.38% cost!

Therefore, the cost of the option premium may result in a complete loss if the direction is incorrect, but with such a 2.38% cost ratio, can you accept this small amount of risk?

Answering the first question: Option gambling on a company's financial report

There are two key points to this approach:

1. Based on common sense, you infer that a listed company's financial report will exceed expectations, leading to a rise in stock prices;

However, you are uncertain and unwilling to take the risk of purchasing the stock directly at a higher cost;

In this case, using options to participate is a way to control costs and adopt a strategic mindset. Therefore, opting for lower expenditure costs becomes the market's choice, making it the optimal strategy for participating in options;

For example, in the chart mentioned earlier, LNG uses a 2.38% stock price cost as the premium to participate in the transaction, which is such an uncertain strategic move;

Do you understand this point?

2. This type of financial report speculation strategy is better suited to call options rather than put options.

The reason is that the speculation targets the sharp rise or sharp fall in stock prices after the financial report is released.

Call options are the best way to control risk under incorrect assumptions.

This is because call options will only lose the premium, which is the maximum risk and will not exceed this risk limit.

This is in line with our definition of limited risk-taking!

Do you understand?

Of course, if the prediction is correct, it could yield several times the profit, which is the thrill of this earnings-based gambling strategy. Invest the least amount of money to experience a trade that could yield the greatest returns!

My view is that both are acceptable!

1: When you have limited time, I recommend directly purchasing the stock. After all, the stocks I share have undergone thorough research, and I am confident in my predictions for future prices. I make decisions based on objective analysis and trend interpretation.

Additionally, I will monitor its performance!

2. If you have ample time, frequently observe market trends, and have not yet developed a thorough understanding and foundation of trust in our community;

you need a way to verify, then options are the best method!

For example, last week I recommended participating in the $PG stock. Some of the new members here adopted an exploratory approach using options and achieved significant results. They expressed their gratitude and joy to my investment education advisor!

Therefore, the method of trading is not the focus. What matters is that you come here and achieve ultimate success—that is your goal and our service philosophy. Do you agree?

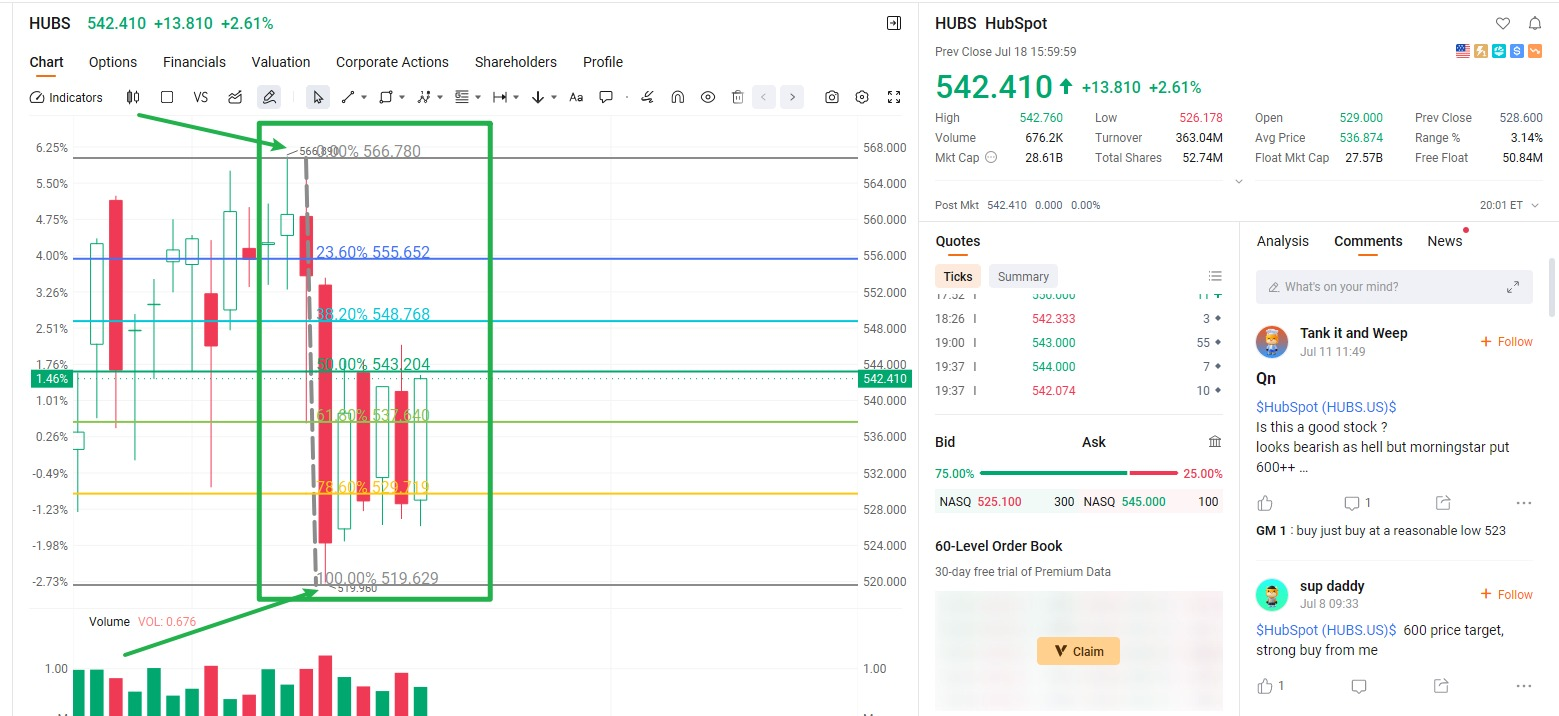

As shown in the example case: HUBS

Assume that before August 15, Harrison owned 500 shares of HUBS stock. However, when he learned that the stock would release its latest quarterly earnings report after the market closed on August 16, Harrison turned to options to hedge.

Assumed example: Holding 500 shares of HUBS stock at a cost of $540.

Before the market closed that day, he hedged against the potential risks of the earnings report with the following option signal: BUY HUBS 250815 520.00 PUT;

The option purchase price was $20 per share, and he purchased 5 options;

The earnings report after the market closed was worse than expected, and the stock price plummeted the next day. Did he successfully hedge the risk?

When financial reports fall short of expectations, it is an objective reality that is not caused by human error; accept reality!

The HUBS stock holdings fell as shown in the figure, with the lowest price reaching $520!

This means that the loss per share is $540 - $520 = $20!

$500 * $20 = $10,000!

This is Harrison's floating loss of $10,000 on his stock holdings.

At this point, the hedging options come into play!

Since he purchased put options, when the stock price actually fell, he made a profit;

the next day, the corresponding selling price of the option became $150 per share.

Therefore, the hedging option profit is:

$150 - $20 = $130, the net profit per option;

Purchasing 5 options means the profit is 130 × 100 × 5 = $65,000

Therefore, ignoring transaction fees, the hedging option yielded a profit of $65,000, perfectly offsetting the stock's loss!

This means the stock will not be damaged by the decline caused by this earnings report event, perfectly hedging the risk.

This is the charm of options for hedging risk! Have you mastered it?

Of course, in practice, option hedging may have some discrepancies in the data, but the core idea is correct. The key is not to perfectly predict every point, but whether you have established an effective risk control mindset. As long as you master this method, you are already on the right track.

Alright, friends,

reinforce today's learning content. Every time you answer a question, it's an opportunity to reinforce and elevate your understanding. The more diligent you are, the more certain the market's response will be. Complete the following questions and send your answers to your investment education advisor to receive your progress rewards:

1. What do you think was the primary driving force behind today's market rally?

2. Among the stocks you currently hold, which one has performed the most satisfactorily for you?

3. Among the three options application methods we discussed, which one do you most agree with? Why?

You can send your answers to our investment education advisor. This is not only a review but also the first step in your growth.

Remember: Every morning's learning is to help you make judgments more calmly and confidently when the market truly opens.

See you tomorrow morning!

Hey, hey, Monday afternoon everyone! The market's getting a little interesting, the coffee's just right - it's been a great day of networking! I'm Bird Grant from NextLeap Management Consulting.

If you've ever been to Old City Philadelphia around Independence Day, you've seen the crack in the Liberty Bell. It hasn't been repaired in over 200 years - not only because it's a historical artifact, but because the crack itself is a reminder that

Freedom isn't unlimited, it has to be defined and protected within an institutional framework. defined and protected.

The three encryption bills we're talking about today are really about the same thing.

The CLARITY Act defines who you are;

the GENIUS Act determines who gets federal budget money;

the DIGIT Act determines who stays at the poker table, and who is excluded from the market for that matter.

It's not a tightening of regulations, it's the market coming to terms with who gets to stay and who isn't allowed to play.

It's not “government regulation”, it's - regulation is clear, the flow of money is clear, and enforcement standards are on the table.

The criteria for judging which assets are eligible to be priced, which companies can be allocated by institutions, and which agreements will be kicked out of the game have switched.

Today we're going to talk about how these three bills are changing the rules of the game, and who is already one step ahead under the new rules.

When many people see the words “crypto bill”, they may subconsciously think: is this only related to the cryptocurrency industry? But really smart investors don't think that way. What they're asking is - will these new rules suddenly make certain companies legal, valuable and institutionalized?

We've seen this too many times in the past: Circle took advantage of the Stablecoin Act to rush to an IPO and quadrupled in a month; PLUG rode the green energy subsidy lane of the Keep It Big Beautiful Act, and we cut right to the core logic for a clean eat of +26.78%. These gains were not piled up by hotspots, but by understanding the underlying logic of the policy in advance.

While most people are still waiting for the media to “confirm that the market is not already priced in”, those with judgment have already completed their layouts and begun to cash in on their gains. Today's lesson, we do not talk about emotions, do not talk about concepts, we focus on the most central thing - how to turn the system on the eve of the precise identification of those who are being revalued subject, and decisive implementation of the operation.

And now, these three crypto bills are driving the market towards a new way of pricing:

The CLARITY Act draws regulatory boundaries and gives assets a legal identity;

The GENIUS Act is truly backed by money on the financial end;

The DIGIT Act establishes on-chain transparency mechanisms, allowing institutions to finally dare touch DeFi.

This is not just a governance of the crypto world, but a “re-marking” of the entire capital market: which assets can be included in institutional allocations? Which companies are being repriced? Which platforms will move from the gray zone to the right track, with higher multipliers? This is the key point we want to make clear today.

The GENIUS Act clarifies “who deserves federal funding”.

For the first time, the Act includes key modules such as blockchain technology, digital identity systems, and on-chain payment infrastructure in the federal budget and directly into the national strategic technology architecture. This not only means that the direction has been set, but also indicates that funding is being aligned and policy is shifting to substantive inputs.

The core signal has been very clear: the United States is no longer just allowing the development of cryptography, but to take the initiative to promote the landing, accelerate deployment, and compete for global dominance.

Any project that focuses on DID (Decentralized Identity), ZKP (Zero Knowledge Proof), and DePIN (Decentralized Physical Infrastructure Network) is likely to stand in the priority sequence of financial support. This opens a very golden policy window for teams doing on-chain identity, Web3 data protocols, and infrastructure building.

Most of the projects in these directions are still private and have not yet entered the public market.

The DIGIT Act is reshaping the definition of DeFi - it is no longer a “de-regulated zone” or a technology test bed, but a new financial ecosystem that needs to be institutionally aligned and transparently structured.

For the first time, the Act proposes a complete compliance framework for decentralized protocols, covering key players such as DAOs, governance modules, on-chain treasuries, and RWA (Real World Asset) holders. Core requirements include on-chain auditing capabilities, traceability of fund flows, integrated KYC interfaces, and clear and verifiable contract structures.

The focus is not on suppression, but on screening. The framework is essentially a structural upgrade of the infrastructure standards - whoever can align with this set of standards will gain access to compliant funding, higher valuation tolerance, and the ability to stay on the main stage for the long term.

DeFi is no longer synonymous with “de-regulation”, but is becoming a next-generation financial system that is accessible to institutions, verifiable in terms of data, and evaluable in terms of structure.

Most of the infrastructure projects that have real matchmaking capabilities are still in the private phase and have not yet entered the public markets or are operating as tokens.

For years, one of the biggest uncertainties facing the crypto market has been the ambiguity of regulatory attribution: which assets are securities are under the jurisdiction of the SEC; which are commodities are under the responsibility of the CFTC. The unclear regulatory boundaries have directly limited the entry of mainstream capital.

The bill introduces a usage-based categorization mechanism that defines the attributes of tokens and matches them with the appropriate regulatory requirements. This mechanism provides compliance definitions for trading platforms, custodians, and project teams, and improves the stability of market expectations.

This is not “deregulation”, but rather a restructuring - giving assets a pricing anchor through clear and predictable classification criteria and opening the path to compliance for institutional participation.

Coinbase (COIN)

As the largest compliant crypto exchange in the US with BitLicense, SEC registration, and public financial statements, it will be the first port of entry for funds to flow in once the regulatory boundaries are clear.

Robinhood (HOOD)

has been extremely cautious about crypto asset placement in the past due to the uncertain regulatory environment. With the passage of the CLARITY Act, it can liberalize token trading, wallet services on a larger scale and valuation logic will shift.

Bakkt Holdings (BKKT)

Focused on custodian + clearing institutional-grade infrastructure, it will become a scarce candidate for custodian solutions if its regulatory status is clear.

The market is still circling the wagons, we have moved on: no longer ask “which line to watch”, but to identify -

which directions are being included in the next round of legitimate pricing system.

This is not macro talk. We're giving the answer in action.

Last Friday, we opened our first position in $WULF;

Today, Monday, we confirmed that the signal has continued, and we're doing it again just as the morning trading session opens - our most direct response to the change in pricing.

Not betting on news, not waiting for consensus, but taking the lead when the structure takes shape.

As Jesus said, “Whoever has ears, let them hear.”

The person who hears the sound is not the one with good ears, but the one who has judgment, execution, and a system in his heart.

Today we have struck and $WULF is the first signal of the week.

Next, the market will continue to give direction and we will continue to act based on strict logic.

That's all for today.

Get ready as we continue to run ahead of pricing changes tomorrow.