July 22, 2025

July 22, 2025

On this Tuesday morning, the sun shines through the window, bringing with it the warmth and rhythm of midsummer. I wonder if you too have picked up a cup of hot coffee and begun your market observations for the day?

As investors, every morning is a fresh start for our strategies. For me, this means turning on my computer and immediately checking the movements of stock index futures—this is the starting point for my daily decision-making rhythm.

Today’s pre-market data is somewhat lackluster, continuing the downturn in market sentiment from

Monday. The heat from last weekend seems to have temporarily faded. What exactly is happening behind the scenes? And how should we respond appropriately?

It is precisely these fluctuations that test our understanding of the market and our ability to act. So, get your notebooks ready—we’ll dive into today’s pre-market signals together, clarify the influencing factors, and find our operational rhythm amid the volatility.

First, we are well aware that the Federal Reserve has not yet explicitly announced a rate cut in September, meaning that a rate cut is not a foregone conclusion. But why is the market beginning to frequently discuss rate cuts?

The reason is clear:

The recently released June CPI data showed that the year-on-year inflation rate fell to 2.7%, the lowest level in over two years;

Core inflation has also continued to decline, indicating that price pressures are easing;

Meanwhile, the economy remains resilient, particularly with strong retail and employment data.

Against this backdrop, the market is beginning to bet that the Federal Reserve will initiate a rate cut cycle in September. The current mainstream expectation is a 25-basis-point cut, though some institutions are speculating whether an unexpected 50-basis-point cut might be possible.

However, we must also remain rational.

I have studied Warren Buffett's investment strategy over the past few decades. Whether it was the significant reduction in holdings during the high inflation of the 1970s or the gradual withdrawal from the market in 2005 when valuations were high, there was one common thread: when he believed the stock market was overvalued and the risks far outweighed the rewards, he chose to hold a large amount of cash.

Now he is once again holding a record cash reserve. Does this signal his concerns about current market valuations? This is a warning sign that investors must be vigilant about—especially in the context of extremely high valuations in the tech sector and the market's extreme sensitivity to expectations of interest rate cuts.

So, today I want to tell you:

Being an investor who is both optimistic and vigilant is the mark of a truly mature winner

The market isn't afraid of emotions; it's afraid of losing judgment. I hope you move forward every day with awareness, not emotional trading.

In the past, whether it was the dot-com bubble of 2000 or the financial crisis of 2008, Buffett's reduction in holdings typically preceded the market by 1–2 years. He was not predicting a short-term collapse but rather recognizing that he could not find attractive buying opportunities at the time, so he chose to wait patiently.

So how should we interpret the current situation?

We should rationally acknowledge that certain sectors are indeed overvalued, particularly some AI-related concepts and popular tech stocks. However, we should also remain optimistic that the U.S. stock market as a whole has not spiraled out of control. Most blue-chip stocks with high dividends remain stable, and market volatility is a healthy part of the adjustment process.

As for Tuesday's market correction, I tend to view it as a reasonable release of short-term sentiment.

After last week's strong rebound, the market needed a technical correction to digest the gains, especially amid the busy earnings season and ongoing divergence over the Federal Reserve's policy path. The S&P 500 and Nasdaq both saw modest declines, with the tech sector leading the drop, and previously strong stocks like Tesla and Nvidia experiencing profit-taking. However, this is not a signal of a trend reversal.

In fact, I had already warned everyone last Thursday: when positive news is realized and expectations are met, the market often experiences “profit-taking.” This correction has confirmed that assessment.

Therefore, if you see your high-quality stocks correcting, you might as well treat it as a tactical “buying opportunity”—provided you have a sufficient understanding of industry trends and individual stock logic.

The current focus of the US stock market has shifted from “whether to cut interest rates” to “whether the rate cuts are sufficient,” especially as the September FOMC meeting approaches, inflation continues to ease, and employment data remains resilient.

This week, the market's primary focus is on the July 30 FOMC meeting and Powell's subsequent press conference.

The core question for the market is:

If inflation cools but there are no signs of an economic recession, will the Federal Reserve accelerate the pace of rate cuts? Some institutions are even beginning to predict that the likelihood of a 50-basis-point rate cut in September is increasing.

This has three implications for the stock market:

1. Technology and growth stocks will benefit first, as rate cuts mean lower financing costs and revised valuation models;

2. Small-cap stocks will perform strongly, especially the Russell 2000 Index, which has consistently outperformed the broader market, reflecting the market's optimistic expectations for an economic “soft landing”;

3. The dollar and gold are diverging in their trends, with the dollar under pressure but gold prices rising, indicating that the market has begun to “prepare” for a new round of asset repricing in anticipation of rate cuts.

Therefore, friends, we are no longer discussing “whether there will be a rate cut,” but rather preparing in advance for the “rate cut magnitude and pace” negotiations.

This is the issue investors should be most concerned about at this moment.

Looking back at history, we can see that every time the Federal Reserve is about to make a policy shift, the market always reacts in advance, especially after the release of key economic data.

This time, the market's focus has shifted to whether there will be a two-step rate cut (50 basis points) in September.

Why is this question so important?

Because following the release of June retail sales data and CPI inflation figures last week, which both signaled a steady economy and continued inflationary pressures easing, market sentiment has rapidly improved.

In recent days, we have observed:

The Russell 2000 Index leading the market higher, as small-cap stocks are most sensitive to liquidity, indicating that the market is already anticipating easing expectations;

Bitcoin has returned above $119,000, as digital assets are extremely sensitive to liquidity easing and serve as a barometer of market risk appetite;

The US Dollar Index has weakened, and gold prices have continued to rise, indicating that capital is seeking safe havens following the peak in interest rates. The market is no longer concerned about whether there will be a rate cut, but rather weighing whether it will be a 50-basis-point or 100-basis-point cut.

Therefore, you can see that stock index futures declined slightly before the market opened on Tuesday, reflecting the market's short-term re-pricing of the direction of future policies. This is a normal consolidation and also a window of opportunity for long-term traders to re-enter the market.

This is what we should focus on—not sentiment, but signals.

Have you already understood these signals?

Of course, I am not just concerned today.

Historically, whenever the economy slows down and inflation falls, the Federal Reserve often sends out clearer signals of easing. The current situation is no exception—the market is closely watching the speeches of Vice Chair Jefferson, Board Member Cook, and the President of the St. Louis Federal Reserve to determine whether this “shift” has been established.

As investors, how should we respond?

It's simple: as the policy window approaches, short-term volatility is a normal phenomenon. At this stage, priority should be given to high-quality stocks, stable ETFs, the digital currency sector, and short-term Treasury bonds as investment tools.

Additionally, the nonfarm payroll data in early August and the July PCE report will be key determinants for the September rate cut. Now is not the time for panic; it is the critical moment to begin laying the groundwork for your “second-phase profit portfolio.”

Take a look at my live trading strategy portfolio—how should we track it today?

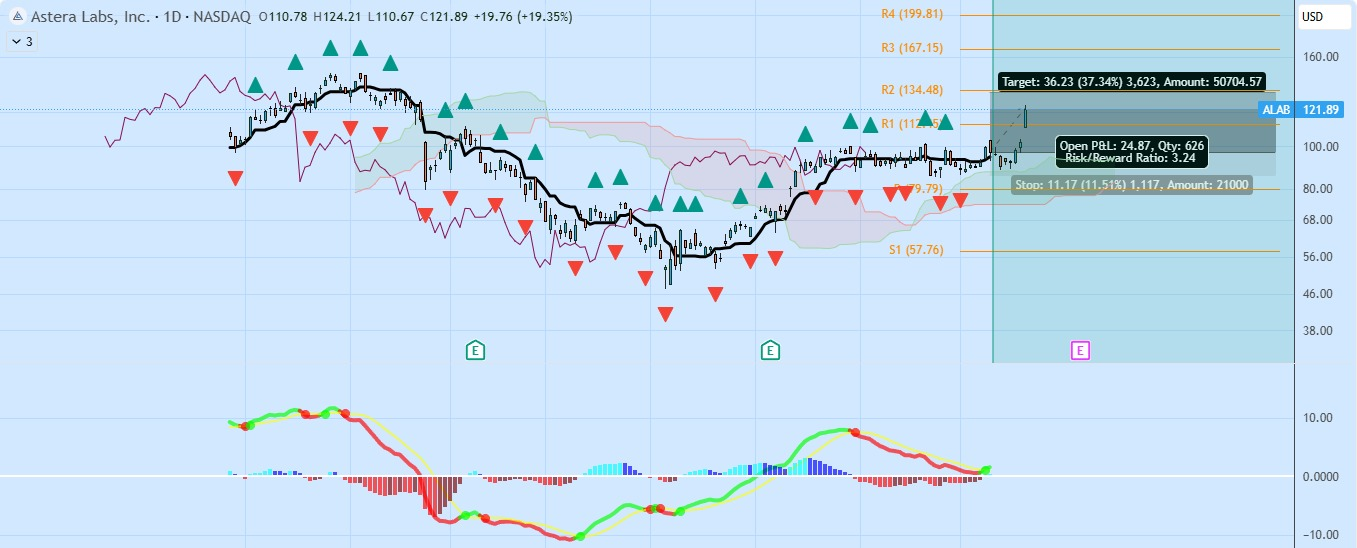

First, as shown in the figure, ALAB (Astera Labs) is a high-tech upstart with great growth potential. It benefits from the trend dividends of AI servers, cloud computing and high-speed interconnection of data centers, and is an indispensable link in the AI infrastructure chain.

Therefore, when trading, we should not only look at short-term ups and downs, but should adopt the method of rolling layout of call options, namely:

When the trend is upward, hold call options in stages;

After the rise, stop profit at highs and lock in profits;

When the callback occurs, quickly buy low and roll over positions

Why is it recommended to use call options? There are three reasons:

Leverage elasticity: ALAB itself has large fluctuations and strong elasticity, and options can magnify profit margins

Save money: No need to buy the underlying stock in full position, a small amount of cost can participate in large-band rises

Capture rhythm: The AI sector continues to be hot, and the rhythm of ALAB's repeated strength is suitable for the "high-selling and low-buying + option rolling" strategy

At present, ALAB's technical side is strong and the trading volume continues to increase. It is a golden window for stepping back and buying low after the trend is confirmed. Using options to participate in the rising market can not only improve the efficiency of capital use, but also achieve stable gaming and reduce risk exposure

Safety Strategy: Continue to Firmly Allocate to Treasury Bond ETFs — $TMF / $TLT

Friends, in the current market environment, we must talk about the issue of “security.” Why am I still confident in long-term Treasury bond ETFs (especially $TLT and $TMF)? Because they are not just investment targets, but also “ballast stones” for dealing with uncertainty.

1. Inflation cooling + expectations of rate cuts heating up again

The June CPI and core CPI data released last week showed:

CPI rose by only 2.7% year-on-year, while core CPI fell to 3.1%, hitting a new low in recent years. Meanwhile, retail sales exceeded expectations (up 0.6% month-on-month), reflecting the economy's resilience.

This sends a clear signal to the Federal Reserve: it can gradually begin cutting rates in the future without worrying about inflation resurging. The market now prices in over a 70% probability of a 25-basis-point rate cut in September, and is even considering an additional 1–2 rate cuts before year-end. For Treasury bonds, this is undoubtedly a strong positive.

II. Geopolitical Risks + Rising Safe-Haven Demand

Whether it's the tense situation in the Middle East, ongoing turmoil in Eastern Europe, or instability in the Asia-Pacific region, global capital is seeking safe havens. U.S. Treasury bonds remain the most trusted “safe asset” among global investors.

This means that even if stock markets experience volatility, Treasury prices may still rise, and products like $TMF (20-year Treasury 3x leverage) will be tools to capitalize on this trend.

Therefore, friends, in the current environment, at least 30% of your total portfolio should be allocated to Treasury-related ETFs.

This is not only to capitalize on potential interest rate cuts but also to add an extra layer of safety to your entire investment portfolio.

If you are an investor accumulating retirement funds or someone seeking steady growth amid market turbulence, $TLT / $TMF remain indispensable core holdings in this cycle.

I. Bitcoin price performance is strong, and institutional funds are accelerating inflows

Currently, the price of Bitcoin has soared to the range of US$117,000-119,000, and has achieved an increase of about 30% this year, far exceeding most traditional assets. It is a weathervane for the recovery of liquidity and risk appetite in the market. In the second quarter of this year, Bitcoin rose by nearly 30%, and its trend was significantly stronger than the market, becoming one of the most eye-catching assets

II. ETF funds have flowed in significantly, and institutional holdings have continued to grow

According to the latest quarterly 13F data, as of June 30, there were 1,199 professional institutions holding spot Bitcoin ETFs, an increase of more than 260 from the previous quarter

The proportion of institutional holdings has further increased, among which products such as WULF and FBTC have become the main configuration tools, showing the confidence of institutions in long-term Bitcoin configuration

III. Corporate treasuries are also increasing Bitcoin

Many US listed companies are using Bitcoin as corporate cash reserve assets. In the second quarter, these "company accounts" added more than 850,000 BTC in total, showing that corporate fund management has increased its acceptance of encrypted assets

Therefore, when we hold WULF (Prime Blockchain Inc.), we must have a long-term perspective and unwavering confidence.

Why?

Because the current cryptocurrency mining industry and blockchain infrastructure are gradually becoming the “energy core” of the digital age. As a professional Bitcoin mining company listed in the United States, WULF possesses a robust computing power expansion plan and cost advantages in electricity, thereby attracting the attention and strategic investments of mainstream institutions.

Data shows that as Bitcoin prices fluctuate upward, an increasing number of large capital sources such as hedge funds, mutual funds, and pension accounts are flowing into the cryptocurrency-related stock market, and WULF is one of the representative investment targets in this field. It is not merely following Bitcoin price fluctuations but is a “core asset” in the blockchain infrastructure sector.

Therefore, there is no need to overly focus on short-term price fluctuations around $5. Mature investors will gradually build positions when the market is indecisive. Whenever WULF experiences consecutive 2–3 days of adjustments, it presents an excellent opportunity to build positions at lower prices.

This is a trend-driven asset, and should be managed using trend-driven strategies. Consistent allocation and patient holding are key to ensuring future returns.

Yes, friends!

As expected, the overall market trend was weak on Tuesday, and technology stocks pulled back. After retail sales data exceeded expectations, the market began to reassess the possibility of a rate cut in September, and investors entered a wait-and-see period, waiting for more signals. This is a typical Wall Street rhythm-stop and observe first, and then make the next decision.

But for us, this is the best time to "learn" and "accumulate strength".

In the NextLeap investment community, the learning exchanges every afternoon are not only tactical discussions, but also opportunities for you to talk and grow with excellent investors. Whether you are a new friend or a partner along the way, we welcome you to participate in sharing with sincerity and continue to improve your cognition and practical ability.

Remember that market winners do not rely on temporary luck, but long-term judgment and systematic strategies. After the close of today, mentor Bird Grant will bring his independent insights on market rhythm and operation strategies. Welcome to attend on time!

In tomorrow's course, I will share the actual case of the "Second Phase Profit Model" to help you further consolidate the trading framework and move towards a more stable profit path. See you there!

————————————————————————————————————————————————————————————————

In 1974, Warren Buffett had just opened his office in Omaha. There was no social media, no TV interviews, and even his favorite Cherry Coke hadn't yet become his signature drink. Every afternoon, he just sat at a desk piled high with earnings reports, flipping through them and chewing on chips. One day, a young intern plucked up the courage to ask him, “Aren't you bored with all the earnings reports you read every day?”

Buffett laughed and said, "I'm not looking for fun, I'm looking for the ‘undervalued future’. What others see are past numbers, what I see, is value ten years from now." --This response has stuck with me because it speaks to the essence of trading:

The goal is not to chase prices, but to recognize the core of future pricing ahead of time when the market hasn't given a consensus.

So now, as we come to the end of this 5pm market and the emotional ups and downs are slowly settling, it's the right time to talk logic, read the signals, complete the layouts, and prepare for the next move.

Tuesday afternoon, hello everyone! My name is Bird Grant from NextLeap Management Consulting. Let's get into today's market review and action analysis.

I agree with Prof. Blake Shaw's breakdown of today's change in the market's center of gravity - liquidity is no longer a matter of speculation, but has entered the pricing phase. The focus has shifted from “will rates be cut” to “when, by how much, and what is the path of impact”, and the rules of the game are switching.

The evolution of each easing expectations, is a revaluation cycle of asset prices. The real concern is not whether sentiment is hot or not, but which assets are taking the lead and reflecting the policy path in advance.

In today's lesson, Blake Shaw demonstrated the changing sensitivities under different paths of interest rate cuts by combining several typical asset classes, including tech stocks, treasuries, and bitcoin. He emphasizes that at the core of trading, it's not about predicting the market's reaction, it's about understanding the pricing mechanism and getting your system to keep up with it.

This is a system-level cognitive update. Switching from emotion-driven to structural judgment, from staring at macro signals to recognizing price confirmation. This is not only a methodological upgrade, but also a watershed moment in real-world operations.

Whether you're looking at tech, watching Treasuries, or tracking digital assets, today Blake Shaw is the first to talk about how to do it. Prof. Blake Shaw delivered the core message, “It's not how market sentiment moves, it's how assets are priced.”

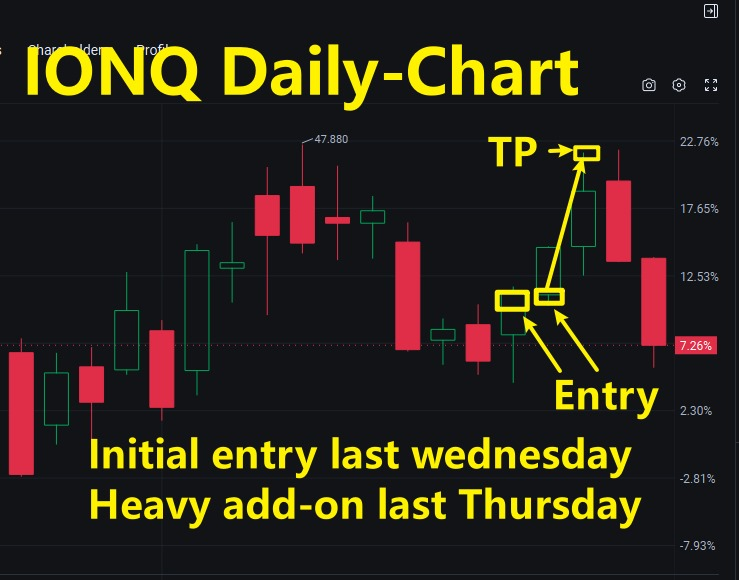

$IONQ|Clearly structured, crisply executed, a standard offensive trade

This $IONQ is a standard trade that we took when the signal was confirmed and we put our money in the bag when the structure was completed. There is no prediction and no chance. Each step is based on price behavior and execution timing, driven by the system, not by emotions.

Macro background: quantum computing joins AI infrastructure pricing chain

Over the past few weeks, the AI software sector has entered a consolidation zone, with leading funds beginning to slow down. At the same time, flow is shifting to downstream infrastructure, including arithmetic, data centers and quantum computing - which are at the heart of the current market repositioning and represent the next phase of pricing focus in the AI ecosystem.

$IONQ is in a key turning zone, signaling proactively ahead of most tech stocks. It is not a name that follows the sector's narrative, but a standalone underlying that is being prioritized for pricing by funds and exhibits high resilience characteristics.

Why close a position?

This is not a medium term trend trade, but a structured operation based on a short term setup. The logic of our entry was clear: we were looking for confirmation after the trigger, not for a multi-stage hold in this move.

This is a trade plan based on the premise of getting out clearly and cashing in quickly - not to “hold longer”, but to “hold the right position”.

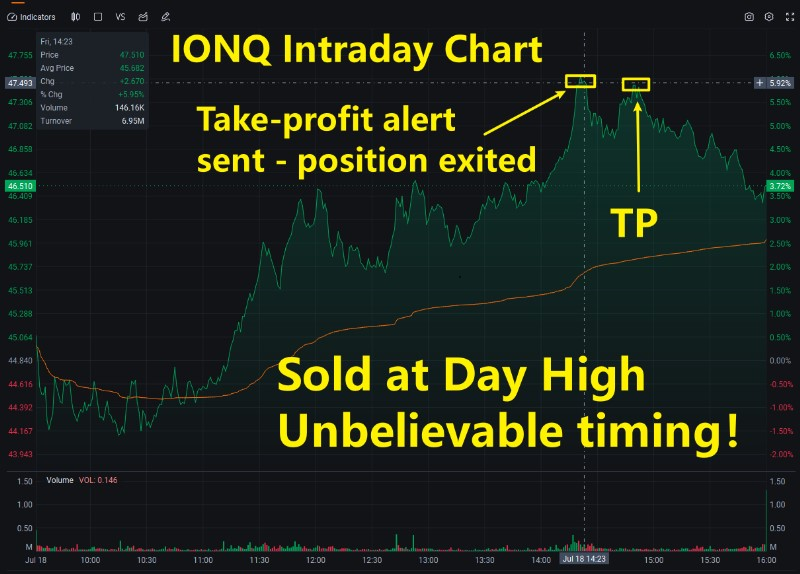

As the price moved above $47.46, we observed several key changes:

Buying momentum begins to wane: active pending orders are significantly reduced, transaction density declines, and money is no longer actively chasing the price;

Exit of the dominant force: the main buyers are no longer pushing the price higher and the price is locked in a narrow range repeatedly;

Lack of follow-through in the turnover structure: the volume release failed to continue, the overall flow shows a lack of new buying conviction, and the trend has lost continuity.

The current tape gives a clear conclusion: the setup is complete and price is in a directionless range. Continuing to hold is no longer a behavior covered by the trading system, but rather a subjective expectation - which is exactly why we chose to leave the market.

Looking back at this trade, the entry point was almost perfect, the trend, the pace, the liquidity were all on point.

We took profit at $47.468 and exited the position, locking in a +9% profit. This is not out of emotion, nor is it about risk prediction, but based on our judgment of the trading cycle - the setup has been completed, the signal has been honored, and it is no longer cost-effective to continue to hold.

When the structure is complete, the trade is over.

We follow, is based on data trading model, not on the market continue to strong fantasy. It is this discipline of execution that allows us to remain proactive in high volatility targets, rather than being led by price behavior.

We prefer you to focus not on the +9% gain, but on these three principles of execution that can be verified over and over again:

Don't make a move without confirmation

Setups are not completed, and you don't enter a trade without a clear signal. The market does not owe you the opportunity to trade, you should not rely on guessing to Bo direction.

Signal from the disk behavior, not the title, not the subject matter

The decision to trade, is the funds in the disk how to move, rather than what the news said, how hot the narrative.

setup End, trade over

No greedy extensions, no self-persuasion, and no dragging out time to gamble on possibilities. Execute until it is realized, and exit without a signal.

The significance of this $IONQ is not in the upside, but in the fact that it clearly reproduces the underlying logic we insist on:

Identify Structure → Follow Behavior → Precise Execution.

It's not about guessing the direction or betting on luck.

It is a clean shot, management in place, the system says.

The key to sustained profitability is never in judgment, but in execution.

June and July, we completed more than a dozen real trading operations, in and out are very clean.

Every trade had a clear reason, positions were controlled, the pace was not delayed, not robbed, what should be done was done, and what should be withdrawn was withdrawn in a timely manner.

From GNTX, RGTI to ATLN and IONQ, they are all typical structured trades:

Confirmation before moving, retreat after the rise, the whole section of the execution did not deviate, no emotional action, and did not do more than one.

Someone shared a screenshot of their account saying, “I've never traded with such certainty.”

A friend broke out the champagne and said he'd buy the professor a Cherry Coke + Double Whiskey.

A friend commented, "Bird Grant is the Profit Hawk, knowing two weeks in advance who will go up. It's the hawk that sees the opportunity, swoops in with precision, and walks away with the profit."

Someone was playing Started from the Bottom at home and went crazy, making videos while saying:

"Let's go-this time we're not on the sidelines. We're the ones making it work. We're the ones making it work."

One person left a comment, “My family was shocked at this gain and I decided to invite my friends over for a ‘Account Flip Red Party’ over the weekend.”

While this feedback is certainly encouraging, we are more interested in whether the

system delivers on its logical structure and execution quality in the real world.

It's not about luck, it's not about what just happens to work, it's about the consistency of execution and the stability of judgment of our logic system as it continues to operate in a real market environment.

We had good returns in June and July, yes - but that's not the end of it.

It's not a “battle won,” it's the beginning of a compounding trajectory we've just entered.

What really determines the outcome is whether you can put the right logic, clear execution, over and over again without running out of steam.

Our goal is never to “catch a round of market”.

What we really want to build is a complete set of sustainable output, still effective in different market environments, cross-asset trading system.

So it's not a stage win. It's the completion of the first phase - we're just entering the main channel of real growth.

This portfolio is a multi-strategy driven live structure covering value allocation, medium term swing, short term execution, options trading and crypto assets.

Each section serves a different function - some are risk averse, some are focused on capturing opportunities, and some are designed to deal with extreme volatility.

The core of the portfolio is not betting on direction, but creating a profitable system that produces consistent output, is compounded over time, and can be executed.

The core objective of this portfolio is:

Protect principal and preserve offense in a highly volatile and uncertain environment.

deploying multiple directions quickly to actively unleash offensive capabilities when market windows open.

It is a state of positional active offense + opportunity focused capture, not emotional trading or passive follow-through.

Jesus said, “If anyone wants to build a building, will he not first sit down and count the cost, whether he can build it or not?”--Luke

It is that sitting down and counting that we are doing now.

Not to win a ticker, but to build a building that will stand.

That's what we're doing today, and that's the benchmark for our actions every day for the rest of our lives.

You want results, so let's start with structure.

Speaking of which, I've actually arranged a little get-together tonight - to celebrate the solid results of June and July,

is meeting a few friends for dinner and drinks. Account numbers are fine to look at, but more importantly:

How did we get it there, and can we keep doing it.

That's all for today. See you tomorrow.