July 23, 2025

July 23, 2025

Today is the critical turning point of the week.

Although the overall market sentiment this morning appears stable, please pay special attention to Bitcoin, which remains the leading indicator. While most assets have yet to gain momentum, Bitcoin has quietly set the pace for the market, signaling that a new round of structural opportunities is brewing.

So take a moment to brew a cup of coffee, resist the urge to trade immediately, review your positions and notes from the past two days, and reflect: What signals are most worth observing and waiting for today?

Remember, investing is not a sprint—it’s a marathon about rhythm and patience.

If you're a new member of the NextLeap investment education community, welcome! I'm Blake Shaw, founder and mentor of the NextLeap community.

In this ever-changing market, we never rely on luck. Instead, we use knowledge and discipline to steadily build our path to success.

You might be wondering: What kind of organisation is the NextLeap Investor Education Community?

Our headquarters are located in New York City, the global hub of finance and education. We are currently applying for 501(c)(3) tax-exempt organisation status at the federal level. Once approved, this will mean greater transparency and standardisation in our operations, as well as access to additional policy support and educational resources. This will enable us to provide you with long-term, companion-style growth support.

In this noisy and anxious market, we remain focused on one thing:

Using systematic courses and practical strategies to help you build clear investment knowledge, strengthen your risk management skills and achieve sustainable wealth growth. Whether you are interested in stocks, options or digital assets, we have a comprehensive support system in place.

If you are not yet familiar with us, please visit our official website: https://www.nextleap.vip/.

This is the starting point for your journey towards professional investment education and cognitive transformation.

Clearly, joining the NextLeap investment education community is just one of the steps you've taken recently. It's also about experiencing first-hand what we're all about: providing professional, trustworthy and practical investment education.

We've always been committed to one thing.

Every penny we invest goes towards improving the learning experience and educational resources for our students.

We don't spend it on flashy adverts or to make ourselves look good — it all goes back to you, our learners.

Do you understand our intentions? At the same time, I will continue to provide you with clear, market-based trading strategies.

Whether you need advice on medium-term stock positioning or defensive options trading, our goal is to help you avoid risk, achieve steady growth and avoid extreme, uninformed speculation.

Today is Wednesday, which marks a critical point in our weekly learning and reflection process. Join me on the 'Option Risk Hedging Strategies' course to learn how we can use a proven system to protect your assets and increase their growth potential in today's complex and ever-changing market.

Friends, amid frequent market fluctuations, how can we protect existing profits and seize opportunities? Today, we will focus on practical operations and discuss how to use options before and after financial reports, using a high-frequency scenario as an example.

We will use PayPal (PYPL) as an example; it will release its financial report after the market closes on 29 July.

You may already hold the stock and be concerned about earnings missing expectations and a potential price decline. Alternatively, you may not have purchased it yet, but wish to capitalise on price volatility for short-term gains. Or perhaps you believe that the earnings report will face short-term pressure, but see long-term potential. These three scenarios require completely different approaches. Can options serve as your risk buffer? The key lies in understanding when and how to use them.

In today's lesson, I will address these core questions:

In which scenarios is option hedging truly effective?

What should you do if you are bullish in the long term but face short-term risks?

When is it unnecessary to deploy the 'big guns'?

Once you understand these concepts, you will no longer fear earnings report volatility, but instead learn to use tools to secure greater certainty for yourself.

Understanding these concepts, you will no longer fear financial statement fluctuations but instead learn to use tools to secure greater certainty for yourself.

Let's consider a realistic and classic example:

The company in the figure is one of the tech growth stocks currently attracting the most attention on Wall Street. The release of its latest quarterly financial report at the end of this month is one of the most anticipated moments in the market.

But the question remains:

It is not possible to be 100% certain that its financial report will exceed market expectations.

It is not possible to guarantee that the stock price will definitely rise significantly, even if the financial report exceeds expectations.

Historically, strong earnings reports and robust guidance have often led to price increases, but this is not always the case. Even with impressive data, the market may respond poorly, or there could be a pullback as the positive news is priced in.

Now, imagine you are an investor.

Assume today is July 31st, and you hold 10,000 shares of this company's stock ($PYPL). What would you do? Protect your existing position and mitigate potential downside risk.

This attitude is not wrong. A long-term perspective and a calm mindset are vital qualities for any investor and are common traits among successful individuals.

Today, we will focus on the following:

If you currently hold 10,000 shares of PYPL, which is over one million dollars in a single position, would you still be willing to expose yourself entirely to the risk of the earnings report?

As an investor with substantial assets, we must acknowledge a fact:

Confidence and strategy can coexist.

That's why we've introduced options: not for speculation, but for prevention. They are the most flexible risk-mitigation tool at our disposal, providing a protective umbrella for large positions.

In today's lesson, we will guide you through:

Use options to build a safety buffer and make your investments more stable and controllable.

When faced with a similar situation, I use near-expiration options to hedge earnings risk.

Why?

We are not predicting a definite plummet in the stock price, but we are preparing for the worst-case scenario. Take the current holding of 10,000 shares of PayPal ($PYPL) as an example. This is a position worth over a million dollars. If the earnings report falls short of expectations, even a short-term decline will cause significant paper losses. I will use put options expiring on August 1 to establish a temporary protective layer.

The next question is:

We need to select the most cost-effective hedging tool.

Understand this core principle: options nearing expiration are often the cheapest. It's the same as products nearing their expiration date in a supermarket, which are discounted to clear inventory but still retain their intrinsic value.

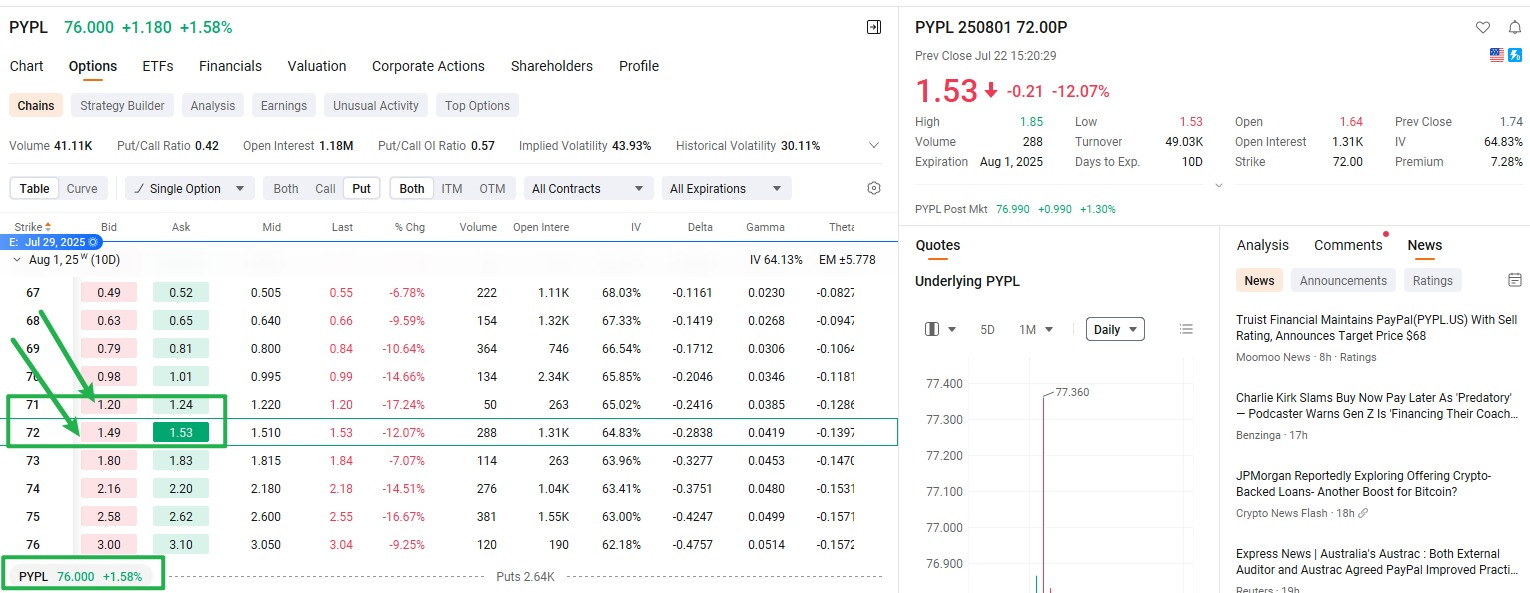

The diagram below shows a reference scenario (note: prices are not actual July 31 market conditions and are for illustrative purposes only). You will notice:

Put options are clear: the closer the strike price is to the current stock price, the higher the cost; the farther away it is, the cheaper it is, but the protective effect also decreases.

The key is to find the right balance between cost and protective effectiveness. It's like buying insurance for your home: you may never use it, but if something happens, it's your biggest source of reassurance.

Now let's look at how to use options to effectively hedge risk in the context of an upcoming earnings report.

You currently hold 10,000 shares of PayPal (PYPL) and you are confident that its earnings report will be positive, driving the stock price up. However, if the earnings report falls short of expectations, causing the stock price to plummet, you must establish a protective mechanism in advance.

Open the option chain for PYPL and focus on the put options that are about to expire. Select a put contract expiring on 1 August at an exercise price of $72. The current option price is $1.49.

This combination meets an important condition:

The calculation is simple: 72 (strike price) + 1.49 (option price) = 73.49, a figure that is below the current stock price of $76.

What does this mean? You can establish a critical protection zone for your position at minimal cost (less than $2 per share). If the stock price drops below this range, the option will trigger its protective effect, helping you lock in downside risk.

Now, we can establish a clear protection strategy:

You currently hold 10,000 shares of PayPal (PYPL). The most conservative defensive approach to the upcoming quarterly earnings report is to buy a put option. This should have an exercise price of $73 and an expiration date of 1 August 2025. This is not speculation; it is insurance for your large position.

The process is straightforward:

Each option contract represents 100 shares. You need to purchase 100 put contracts because you hold 10,000 shares.

The cost calculation is as follows:

Each option costs $1.49, so the total cost is:

It is clear that $1.49 multiplied by 100 multiplied by 100 equals $14,900.

You should use $14,900 to establish a protective mechanism for a position worth approximately $760,000.

Is it worth it? It's up to you:

You should use 2% of the cost to avoid the possibility of a sudden price drop.

If the earnings report is positive and PYPL rises, the premium loss is entirely within an acceptable range.

If the earnings report falls short of expectations and the stock price drops below 73, your options will kick in, helping you to significantly reduce losses.

The core of hedging thinking is simple: it's not about predicting market movements, but about preparing in advance for potential outcomes.

We are now going to conduct a simulation exercise. It is 31 July. You have implemented your option protection strategy for PayPal's earnings report. You hold 10,000 shares of PYPL and have purchased 100 put options with a strike price of $73 and an expiration date of 1 August. This is a typical "safety belt" strategy. It is not intended to predict the direction of the market. It is intended to provide a contingency plan for uncertainty.

Now, let's assume it's July 29 at 6:00 PM, the earnings report is released, and we'll simulate three possible scenarios:

First scenario: The earnings report significantly beats expectations, and the stock price surges.

PYPL surged by 10% after the market closed and then shot up a further 20% the next day.

The stock price surged from an initial $76 to a new high of $91.20.

The stock generates significant profits, and the PUT options expire worthless, resulting in a loss of $14,900 in option costs.

Comment: You earn less, but you have protection. The car insurance mindset is clear: it's better to have it and not need it than to need it and not have it.

Second scenario: The earnings report falls short of expectations, and the market reacts sharply.

The stock plunges 10% after hours and continues to decline by 20% the next day.

The stock price dropped to $60.80.

The stock's paper loss was well over $150,000, but the profit from the put options easily offset most of it.

Comment: Protective options absolutely demonstrate their value at this point. Let me be clear: this is about safeguarding the bottom line, not speculation.

Third scenario: The financial results are average, and the market is still cautious.

The stock price remains consistent, fluctuating only minimalily and maintaining close to its original price.

It is clear that the option value quickly drops to zero and the stock position remains unchanged.

It is clear that the loss is the option cost, and the gain is a confirmed risk-free outcome.

Commentary: Pay for stability. Ensure the market is risk-free. Maintain a calm mindset. Allow the strategy to fulfil its mission.

Congratulations! If you hold 10,000 shares of PYPL, you have made a great investment. The stock price has surged from $76 to around $91, netting a total paper gain of about $152,000 (760,000 x 20%).

But don't forget: you previously executed a protective put option, which cost $14,900.

Therefore, your net gain is $137,100.

Let me be clear: if you missed out on nearly $15,000, that is a loss.

I am certain that this is not a loss; it is a calculated victory under a prudent strategy.

You must not assume that every earnings report will go this smoothly.

The money you made today is based on the market's extra gift; the $14,900 you spent is the umbrella to protect against the unexpected. This is the risk management that all mature investors should be familiar with.

Buying health insurance is a no-brainer: you just know you're covered.

You won today, and you won beautifully. Is this result worth it?

But don't forget: you took protective measures in advance.

You purchased put options expiring on August 1 with a strike price of $73, costing $1.49 per option.

The stock price plummeted, and the value of this option surged significantly. You held 100 put options, which, if sold conservatively at $15 each, would generate a profit of $150,000. After deducting the premium of $14,900, you net approximately $135,000.

In other words, you would have faced a loss of $152,000. However, through options, you hedged nearly 90% of the risk. Protective options exist for a reason: to provide a fallback plan when things go wrong, not to predict the market correctly.

Remember this method, not these numbers:

In the face of uncertainty, only the truly mature investor will prepare a safety net in advance.

This is the most important takeaway from today's lesson.

If PayPal (PYPL) reports earnings that are largely in line with market expectations and the outlook for the future does not reveal any significant highlights or risks, the stock price will only experience minor fluctuations, moving up or down by less than 1%, and remain largely range-bound.

In this case, your stock would not lose substantially, but the put options you purchased as a hedge would likely lose value rapidly as they approach expiration, becoming virtually worthless.

You then have two options:

First option: Take action now and repurchase 10,000 shares of PYPL at the strike price of $73.

However, this typically requires additional margin, so you must decide based on your account's margin requirements with your broker.

The second option is clear: Let the option expire.

This means you lose the $14,900 paid for the option, effectively paying for the insurance premium without using it.

Here's a reference point: Historical data from the Core X quantitative trading system shows that there is a high probability that PYPL will experience a significant increase or decrease after releasing its earnings report, with almost no instances of sideways movement or no fluctuations.

In other words, while such option losses do exist, they are highly unlikely to occur.Would you be willing to spend $14,900 to protect a $760,000 position? This is a rational risk management decision.

This choice is not wrong; it is a wise insurance strategy.

You now understand the third scenario.

It won't cost you much, but more importantly, it gives you the ability to handle any possible outcome before the earnings report is released.

We focused on individual stocks that are about to release their financial reports and learned how to use options to add a safety net to our positions and establish a safety margin in uncertain times. This is not just a strategy exercise; it's also a chance to boost your knowledge.

It's Wednesday morning. Now is the time to slow down and review your progress.

You need to start building your own risk protection mechanism.

Tell me: what's your plan for dealing with the volatility of the earnings season?

As a new member of the NextLeap investment education community, you are invited to continue participating in the upcoming learning and practical exercises.

If you are already on the path of growth, apply what you learned today to your account. Knowledge only creates value when it is put into action.

That concludes today's lesson.

Tomorrow morning, we will move on to the next part of the strategy framework. This will cover how to fly a kite in an upward-trending market. You will learn how to attack, how to position your portfolio, and how to add positions in line with the trend.

As Jim Collins said in From Good to Great:

The true starting point is not conquering the world, but solving your own problems.

I will accompany you on this journey of problem-solving and continuous improvement.

Have a great Wednesday, and see you tomorrow. Come back!

————————————————————————————————————————————————————————————————

Good afternoon, friends, I'm Bird Grant from NextLeap Management Consulting, LLC.

I'm honored that my friends in the community have given me this nickname - “Mr. Profit Hawk”. To be honest, I accept it with open arms.

Because the past two months have proven one thing: if you stick to the structure, track your behavior, and execute calmly - the results will come to you.

But as you well know - we were never about just getting a few trades right.

What we really wanted to build was a complete portfolio system that could consistently produce and adapt to different market states.

How to steadily grow your account with a set of structurally clear, behaviorally driven, volatility-adaptive portfolio models.

We'll make three things clear:

Portfolio structural framework: why are we so stratified? What role does each asset class play?

Execution Rhythm Design: When do we advance? When to contract? When to just watch and not move?

Behavioral logic behind the strategy: the portfolio is not a static allocation, but an execution system that dynamically responds to structure and signals.

Get ready, we are officially entering the content of today's lesson.

The first step in this portfolio is to organize a core class of positions that have the potential for active growth.

We're not looking for the hottest stocks in the market, but rather the kind of targets that are driven by policy, are not yet higher in price, are strengthening structurally, and have substantial upside in the next month or two.

These assets must satisfy three things at the same time:

Market direction is taking shape, funds are beginning to concentrate, and policy cooperation is strengthening consensus;

Prices have not been pushed full, valuations are not overdrawn, and the technical structure has not run its course, and there is still room for such targets to rise;

The trend has been initiated or entered the confirmation stage, the graphic structure is clear, the trigger signal is clear and can be executed directly.

We configure it as the core offensive component in the portfolio.

When the market enters the trend extension phase, it is the main source of pulling portfolio returns.

We don't bet the whole position on this type of asset, but we make sure it has three conditions: signals to read, trades to make, and gains to take.

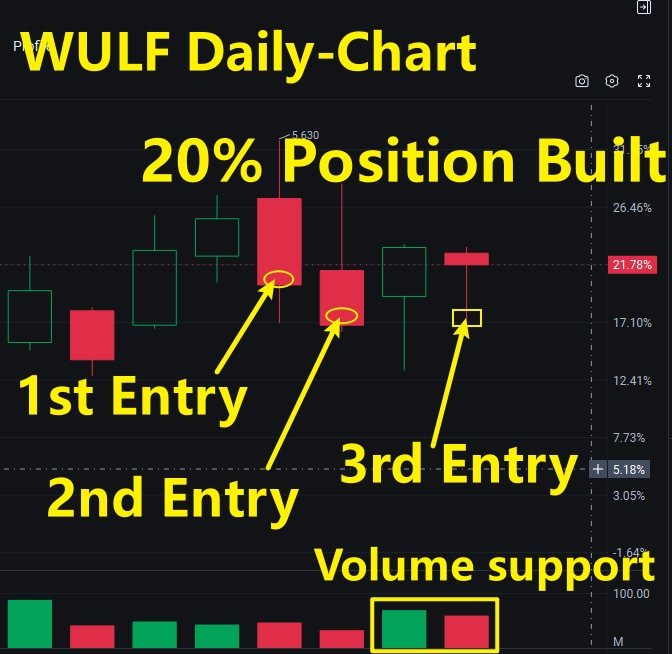

$WULF|Three times to build a position, not to chase, but to reconfirm the strategy

Our recent operation on $WULF is very clear: we started to build a position last Friday, followed up with an increase on Monday, gradually advanced the position according to the feedback from the market, and increased the position again at the opening today (Wednesday).

After the completion of the three executions, the underlying has accounted for 20% of the portfolio's total position.

The three strikes are not “chasing” but confirming:

This direction is not finished, the structure has not failed, the subject still has trading value.

Why do we repeatedly participate? There are four complete logic chains behind it:

1, macro level: three crypto bills are resetting the pricing mechanism of the market

Many people are still running after sentiment and price fluctuations, but we see it more clearly:

This is not a short-term issue, but a signal of pricing reconstruction from the three lines of regulation, finance and compliance that are advancing at the same time.

Its core impact is that crypto assets are officially included in the pool of allocable assets, institutions can enter the market, and the trading framework is being institutionalized.

The next market will no longer be guided by the price of Bitcoin, but rather by the re-pricing of the chain's infrastructure in terms of availability, deliverability, and schedule variance.

In the whole crypto theme, $WULF is not a coin speculation, nor is it an aggregation platform, it has a complete industrial chain positioning: physical mine, low power costs, continuous expansion of arithmetic power, and revenue structure linked to infrastructure construction.

Its financial results are a direct mapping of the industrialization of the chain, and it has been modeled by a segment of institutions as an available vehicle under the policy compliance allocation path.

The pricing of this category is shifting -

is no longer about “how long can it be speculated for”, but rather “can it be integrated into institutional systems”.

This means that the pricing basis for $WULF is shifting:

is no longer driven by themes, but is being modeled as a structural allocation vehicle.

Our first entry was on Friday, when price accompanied by a volume breakout formed the start signal for the entire setup.

Monday's backtracking held the key zone, and price stabilized with sustained buying, which is a further confirmation of the validity of the structure.

Today's (Wednesday) open was again on volume and pulled higher, and the intraday position increase was a follow-through operation on the continuation of the validated structure.

So this is not price chasing, but identifying setup initiation → backtest confirmation → structure reuse in the process of continuous amplification.

It's never the price we buy, it's the state confirmation + behavioral alignment window.

4, community implementation level: batch entry, structure driven, do not grab the time point

Last Friday was the start of the initial structure, old friends were the first to enter;

On Monday, the structure pullback after the formation of the second opportunity, new friends in that section of the completion of the cut;

Today, the structure continues, turnover amplification, more people synchronized follow-up.

This kind of layered execution is not accidental, but part of a systematic strategy:

We do not chase the same K-line, but rather enter by stage and advance by structure.

Each segment of participation, there is a corresponding position and behavioral basis.

What we are doing is the execution of a complete set of models, not a single bet:

Clear direction: we are betting on the reconstruction of crypto asset pricing logic, not short-term theme rotation;

The target is clear: $WULF belongs to the infrastructure route, has industrial attributes, and is being included in the compliance allocation list by institutions;

Real behavior: each round of operation is based on structural confirmation, readable price behavior, and valid trading channels;

Execution stability: phased participation, based on triggering action into the field, not chasing prices that have been detached from the structure, and not relying on pre-judgment into the field.

We will not force the price to enter because it is rising, but to participate when the structure is established, the risk is controllable, and the liquidity is available;

Nor will we exit because of mood swings, but in accordance with the system's definition of the confirmation mechanism to complete each entry and exit.

Prices often start ahead of market sentiment, and structures appear much earlier.

Really good execution, not by feeling judgment, but according to the structure of confirmation and behavioral signals according to the rules to advance.

Now that WULF is in the portfolio, the next step to take is to make a layout in the cryptocurrency space, where both Bitcoin and Ether have moved significantly off their structural bottoms and into higher ranges at this stage of the game.

They certainly have long-term logic that we recognize, but the short-term upside, the risk ratio, is not cost-effective.

So instead of chasing the main chain higher in this portfolio, we are using an alternative chain layout strategy, buying 5-10% of our capital into $SOL (Solana) at current prices.

Valuation substitution: Solana's current valuation level still has room for repair, and it has not yet fully risen with BTC and ETH, but the bottom structure has been constructed, and funds are starting to flow back.

Behavioral reinforcement on the chain: whether it's the development activity, chain transaction data, or ecological growth rate, Solana has shown a stronger self-driven nature than most Layer1s. It's not just hype, but behavioral level is really following up.

Position control: we are not pressing a full position, but using 5-10% as a tactical participation position in the portfolio - giving it space to run without affecting the stability of the main structure.

Instead of ignoring the liquidity changes in the crypto market and chasing at the highs, we chose to establish small test-based positions in areas where the structure is clear and the signals are valid.

If the subsequent BTC/ETH highs stagnate and money sinks, Solana is likely to be the money taker for the next round of on-chain structural market;

If the main chain continues to push higher, SOL will also profit as a high beta asset.

So we now give it a position, give it time, and the rest is determined by the structure.

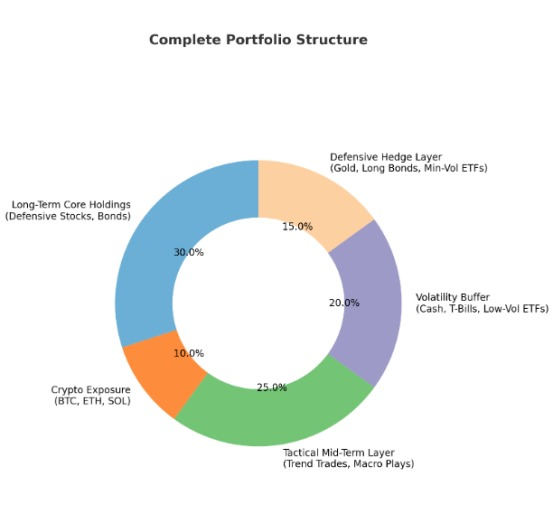

In addition to medium and long-term configuration and crypto direction, a complete trading portfolio should also have the following four components:

1, Volatility Buffer

is used to absorb short-term market fluctuations and keep the portfolio allocation from being disrupted by localized disturbances.

The purpose is to let the abnormal volatility of non-core assets will not be transmitted to the whole situation, so as to stabilize the capital framework.

2、Tactical Core Swings

Instead of relying on heavy betting on direction, it is a medium-term holding trade based on structural confirmation and executable cycles.

Through clear entry signals and stage exit logic, to promote stable growth in net value.

3、Inverse Protection Layer

Provides a buffer against retracement for highly resilient underlying in the portfolio.

The core purpose is not to cut off offensive positions when risk events occur, but to rely on hedging means to suppress portfolio volatility.

4, Short-Term Tactical Layer

Execute light positions, quick decision-making trading action, used to capture intraday or early trend asymmetric opportunities.

All transactions have clear trigger conditions, known exit points, positions can be recovered, emotions are not involved in decision-making.

The goal of this type of portfolio is not to “cover all markets”, but to ensure that: every layer has a role, every trade is justified, and every entry and exit is planned.

We've covered enough about portfolios for today.

The density of information is not low, and I realize that some of you may still need time to digest it.

We'll continue tomorrow and cover the parts that haven't been expanded upon yet.

“Whoever can be trusted with very little can also be trusted with much.”-Luke

True trust doesn't start when you get it right once.

Rather, it's your willingness to approach each small opportunity with system and discipline.

I'm Mr. Profit Hawk and we're going to stop here today, and we'll move on to tomorrow regarding portfolio structure, execution models, and trading tiers.

Thank you for your input today. We'll see you tomorrow.