July 24, 2025

July 24, 2025

I’m Blake Shaw, co-founder and mentor at NextLeap Investment Education. Whether you are joining us for the first time or have been with us on this growth journey for a while, I am happy to meet you again today.

This is not an ordinary classroom, but a true investor's journey - together we will build perceptions, hone strategies, and establish systems. This is a path to long-term solid income, but also a cognitive upgrade and action training!

I know it's easy to promise, but not easy to deliver. So we welcome you to use your own standards to judge: is our teaching professional? Is our service attentive? Are our strategies practical? Because a truly trustworthy education stands the test of time and practice.

Today is Thursday, a day of steady and deep precipitation. If you come here with questions, I hope you leave with clarity, certainty and confidence!

Ready? Let's get started with today's content

Investment is never a boring numbers game, but a game full of wisdom and strategy

Today (Thursday) before the plate, U.S. stock futures were stronger across the board, and the main reason behind it is that the U.S. and Japan have reached a new trade agreement: tariffs were cut, and Japan also promised to inject $550 billion into the U.S. This not only releases a positive signal of warming global partnership, but also injects a shot in the arm for the U.S. economy, with Dow futures up about 1.14%, the S&P 500 up 0.78%, and the Nasdaq up 0.61%

But it's not a single positive that really determines the direction of the market. It's the upcoming annual Jackson Hole central bank meeting that is at the center of the market's attention. Chairman Powell's speech may reveal the tone of the Fed's future interest rate policy - hawkish or dovish, which will directly affect the asset valuation center of gravity

Therefore, today's pre-market, not only to observe the ups and downs, but also to sort out the ideas in advance, adjust the position of the golden window. Now is the time to ask yourself three key questions:

Is my portfolio benefiting from policy détente and global cooperation?

Is it ready to face divergent signals of rate hikes or easing?

What are the assets that could be definitive targets for the next phase?

The closer we get to the policy inflection point, the more important it is to remain calm and forward-looking, and leave the opportunities to those who are prepared!

Before we officially get into today's stock market trading topic, I would like to clarify with you once again our position and mission

What we carry out is an educational type of service for investors across the United States and combines with FinTech tools to promote the popularization of healthy and rational investment concepts. There are four core objectives behind this:

1. Commitment to applying for the Internal Revenue Service (IRS) 501(c)(3) nonprofit certification to achieve tax-exempt status for educational endeavors, so that more resources can truly be used to help investors grow;

2. Continuously build the brand influence of the Investment Education Foundation so that the public trusts us, relies on us, and sees us as a long-term partner in education and trading decisions;

3. Promote the practical application value of CoreX quantitative trading system, a financial technology tool, to assist investment judgment through AI and make decision-making more efficient and rational;

4.Advocating a new concept of investment education, not only to help individuals to improve the level of operation, but also to strive to obtain higher institutional evaluation and professional recognition in the industry.

We are not simply trading teaching, but to establish a “knowledge + tools + methodology” trinity system platform, to help you stand firm and go farther in the turbulent market!

So what is the Core X Quantitative Trading System?

It is not a set of cold program, but I personally led the development of the integration of decades of trading experience to create an intelligent trading assistant. In today's information-rich, fast-paced market, it has long been difficult to rely on human beings to perform key tasks - data analysis, trend identification, information screening, logical judgment ...... This is exactly where AI intervenes and highlights its value.

The core design of Core X is to transform my decades of investment strategies, trading models and risk control logic into an iterative, replicable and trainable intelligent system, and to realize the following key functions:

Automated collation of multi-source data and scoring of sentiment heat

Prioritization of real-time news, earnings reports and research reports

Chart pattern recognition and early warning of key technical levels

Strategy simulation, trading path optimization and backtesting Exercise

For those of us who have experienced multiple bull and bear cycles, Core X is not just a tool, it is a real time-saving, cognitive amplification, improve the winning rate of the wisdom of the partner!

It's very simple. You just need to open our daily “strategy update page”, behind every group of individual stock sorting, every signal marking, and every type of sector rotation suggestion, is the real-time output of Core X quantitative trading system. What you see is not a random recommendation, but the result of screening, comparing, and scoring from hundreds of variables.

If you want to know more about Core X's decision logic, training mechanism and advanced applications, please visit our official website: https://www.nextleap.vip.

True technology does not replace judgment, but amplifies wisdom. You are only one attempt away from a high win rate trading model!

This is not a “money-spinning” or short-term marketing endeavor, but part of our overall strategy, which has four important starting points:

1. Seek government funding and policy support

As an educational non-profit organization, we are in the process of applying for IRS 501(c)(3) tax-exempt status. As an educational nonprofit, we are in the process of applying for IRS 501(c)(3) tax-exempt status. The accumulation of public service in the early stages of the program will help us to obtain government funding and credibility support.

2. Build brand credibility

We view this expenditure as a “brand building investment” - earning the trust of our users through free classes and benefits is more powerful than any advertisement.

3. Laying the foundation for future professional services

The current “free” is “worth paying for” in the future. When users recognize our concept and ability, they will naturally be willing to pay for advanced services and trading tools.

4. Support Core X product promotion strategy

Our financial technology tool, Core X, is a key part of our future service system. The first education service is the best platform for it to be displayed.

What is the greatest value of an investment teaching organization to you?

We are building not just a set of instructional programs, but a new structure for long-term wealth management.

Ultimately, we want to create a transparent, standardized, and tax-exempt wealth partnership between individual users and corporate clients.

To achieve this goal, we must demonstrate:

Continuous growth of our user base

Effective and efficient educational content

Stable and reliable financial model

Long-term sustainability of our business

This is exactly why famous tycoons such as Gates, Buffet, Soros, etc. have established their own educational institutions or charitable foundations:

They value not only charity, but also the ability to turn “trust capital” into “asset management”. They value not just charity, but a long-term mechanism to turn “trust capital” into “asset appreciation”.

Everything we do is to help you manage your wealth in a smarter way, and at the same time create a knowledge platform that you are willing to rely on for a long time and be proud of.

The reason I insist on sharing this trading knowledge and real-world strategies for free is because I want to earn your trust with real content. Even if you haven't spoken up in class today, that's totally fine - you can always tell our investment advisor about your questions or ideas. She will listen patiently and do her best to provide you with honest and helpful advice.

Next, let's review today's highlights:

Have you picked up on a few key action signals? Have you started to build your own investment logic and operating system?

So now, let's track today's stock trading strategy changes!

Key Position Tracking: $TMF/TLT + $XLV Three Stocks

After this Monday through Wednesday, we have completed the first phase of the layout. The remaining shares of the trade are now recommended to remain in place and there is no rush to add to the position.

When to re-enter? I expect the best time to add to the position may be next week. We will make a clearer judgment again based on the market signals at that time.

Remember: the greatest value of these two underlying stocks lies in “time” and “interest rates” - they are naturally suited to be allocated as medium- to long-term defensive assets in anticipation of interest rate cuts!

Individual stock alert: $XLV short-term strategy adjustment

$XLV has been consolidating at the high level for three consecutive days, combined with the historical trend, the short-term upward momentum is obviously weakening

If you are still holding this stock, today is a very critical decision point

Take advantage of the current high level opportunity, take profit, do not get attached to the battle

This is not only locking in profits, but also a kind of early defense against the possibility of market retracement

The next round of trading opportunities, we will wait for its technical surface to turn strong again before intervening. Do swing friends must remember: the market is never short of opportunities, the lack of disciplined execution!

This week's focus on increasing positions: Bitcoin-related digital assets (SOL)

1. Positive Macro Environment: Rate Cut Expectations Are Giving Digital Assets a Boost

This week, the market focus is on the upcoming speech by Federal Reserve Chairman Jerome Powell, who will debut at the annual meeting in Jackson Hole. The current market is widely expected to release a clearer signal on the path of interest rate cuts. Historical experience shows that once the easing expectations are formed, the first to benefit is often highly flexible, liquidity-sensitive assets, and digital assets are exactly this type of

Against this backdrop, we are gradually increasing our holdings in digital assets represented by SOL, not only as a forward-looking response to the policy cycle, but also as a strategic positioning for the next round of crypto sector “valuation restoration”.

2. Bitcoin's consolidation is solid, the market structure is not out of control

Currently, the price of bitcoin is oscillating around $118,700 (down 0.5% in the last 24 hours), although short-term fluctuations, the high level of horizontal trading is a strong performance, indicating that there is no outflow of funds in the market, and that the main force is holding stable positions, and the chips are not loosening.

At the same time, the data on the chain shows that:

The net outflow of BTC on exchanges continues, indicating that the willingness of long-term holders has increased

The number of active addresses remains at a high level for the year, and user participation is still strong

This means that: even if the main coin does not go up, the market's confidence is still there, and the funds are waiting for the next opportunity to lay out the next step after the policy signals have been clarified.

3. Why SOL, the “double engine” of technology and liquidity

SOL is not only one of the best performers in Layer 1 infrastructure, but also its ecological applications (DePIN, AI interaction, mobile chain, payment protocols) are expanding rapidly, coupled with the capital's preference for “high beta assets”. The characteristics of “high-beta assets”, once bitcoin leads the market upward, SOL tends to have a greater flexibility space

Therefore, the current bitcoin shock does not change the strong structure, the funds have not fled, macro-positive superimposed on the policy catalyst, digital assets have strong rebound potential, SOL has ecological growth + elasticity to amplify the double advantage, is the medium-term holdings of the preferred, if Powell's statement of dovish, the plate will usher in a new round of the starting point of the main wave!

Friends, even if you are joining our community for the first time today, please remember—every transaction we have made in the past and every strategy we have practiced will inspire you at some point in the future. These are not fleeting inspirations, but the results of careful consideration and practical implementation, possessing real value and the resilience to withstand market cycles.

As long as you are willing to continue on this journey with us, and as long as you believe that this educational system can help you navigate your investment path with greater stability and reach further, then every effort we invest today will lay the foundation for your future gains.

This Friday, the Jackson Hole Central Bankers' Symposium will convene, marking one of the most critical policy windows of the quarter. We are preparing for a clearer expectation of interest rate cuts and have already outlined strategies to navigate uncertainty—when the winds of change blow, it is the best time for cognitive upgrading and strategic rebalancing.

Today's lesson may not instantly change your fate, but I hope it can illuminate the path ahead, providing you with the coordinates for judgment and progress in every market fluctuation.

Tomorrow's session will feature a forward-looking analysis of the Jackson Hole meeting and a new set of targets where offensive signals have emerged. If you are seeking opportunities for the next phase of your investment strategy, be sure to join us on time.

You are the discerning investor;

and I will continue to be your trusted companion on this journey.

See you tomorrow.

In the period when Peter Lynch was still managing the Magellan Fund, one day a young analyst excitedly ran to him and said, “Peter, I found a company that has huge room for growth, it just broke out today, and it will definitely more than double in the future, so can't we add to our position in advance?”

Peter Lynch did not deny him, but returned a very interesting sentence -

"It's not about how high it could go, it's about how well you understand it."

The biggest risk in the market, he says, isn't buying too slowly, it's pre-empting the understanding you haven't built yet.

It's a phrase I always remember.

Because whether you're trading bonds, tech stocks or AI themes, the real danger isn't that you're wrong, it's that you're overestimating your degree of certainty and betting your faith on a signal before it's confirmed.

Friends, in the past two months, those tickets we caught - TNGX, PLUG, RGTI, XBIO, ANPA, IONQ, including WULF and NVTS a while ago - were not rushed in by emotions, but rather System Identification + Strategy Execution + Signal Confirmation.

How did we do it, you ask? The answer is in the Peter Lynch quote from earlier:

Understanding precedes betting, and confirmation precedes impulse.

I'm honored that my friends in the community have given me this nickname - “Mr. Profit Hawk”. To be honest, I don't disagree.

Because the past two months have proven one thing: if you stick to the structure, track your behavior, and execute calmly - the results will come to you.

If you've heard this by now and are still interested in this structured way of thinking,

If you're still interested in all of this and would like to learn more about how we make our judgments, how we structure our trade paths, and how we execute each and every move - then welcome to the next phase of the If you are still interested and want to learn more about how we make judgments, how we structure our trading paths, how we execute each operation - then you are

welcome to move on to the next phase of the systematic program and really translate these methods into your own real trading ability.

Welcome to our website https://www.nextleap.vip

which not only organizes our investment philosophy and strategy models, but also contains a complete review of our recent trading cases.

https://www.youtube.com/@NextLeapOfficial

In it, you will see how we build portfolios, execute strategies, and control risk step-by-step from the market structure.

We are not stuck in theory or logic, but the system is deployed in the real market, with clear judgment mechanism, trading rules and fund management, which is being verified, implemented and iterated in the market.

If you haven't seen it yet, we recommend clicking on it after today's course.

We return to today's market execution.

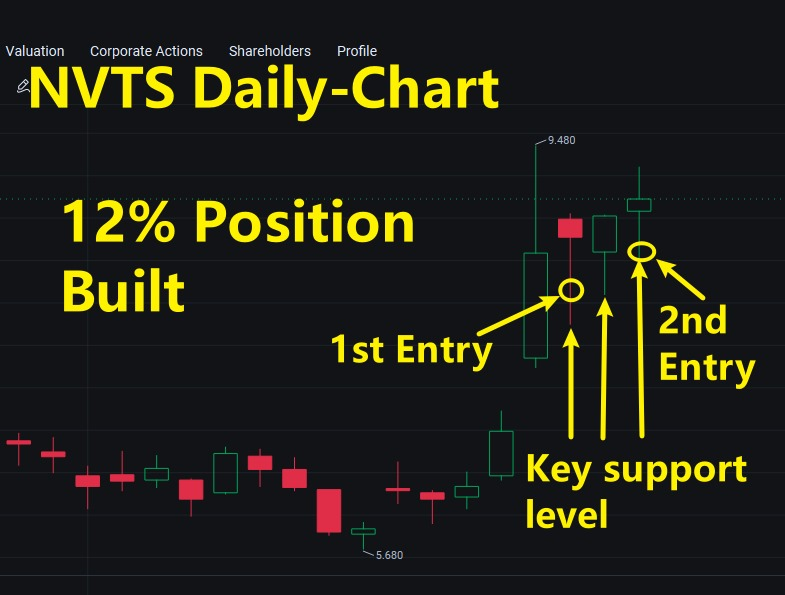

$NVTS is the underlying we focused on during the session, which triggered a structural confirmation yesterday, and we continued to build a position as planned at today's open.

$NVTS|Two Positions, Double Stage Layout After Structural Confirmation

In today's early trading session (Thursday), we completed the second stage of our position in $NVTS.

After two executions, the underlying has accounted for 10-12% of the portfolio's total position.

Some of you asked: didn't we already buy it on Tuesday?

The first entry was on Tuesday, when it was triggered by a volume breakout;

today, it is pullback After holding the range, buyers entered again, and the behavior continues to advance.

The whole setup from trigger to confirmation, from price defense to capital reset, out of a clear behavioral closed loop.

We are not repeating bets, nor are we filling positions along the way.

This is a trade done in segments, using two opportunities within the structure to complete a full setup engagement.

Let's be clear:

This is not a covered position, much less an emotional entry driven by price.

This is the second stage of intervention after the structure continues to advance and the signal is completed and confirmed.

We are not making a move because it went up, but because it is still following the structure and we are still on track.

Background Logic: From the beginning, the reason for including $NVTS in the portfolio was not the technical pattern, but its position in the industrial path.

Our concern is not how it moves in the short term, but what policy logic is connected behind it and what capital demand flows into it.

It is the new node in the chain from data centers to power chips where capital pricing logic is migrating.

The company is at the intersection of three policy paths:

The expansion of AI data centers will bring the need for systematic reconfiguration of power supply;

Industrial manufacturing upgrades + clean energy deployment are driving power efficiency as a core cost variable;

U.S.-based semiconductor policy support is beginning to accelerate the localization of the manufacturing chain.

We are not chasing the “next hot topic”.

What we are looking for is this:

Already have the technology and industry participation;

Is being funded by the initial position;

Not yet fully revalued.

$NVTS is such a structural asset -

It stands at the intersection of power supply, arithmetic and local manufacturing, and has entered early allocation, but pricing is still not complete.

The first position we took at $8.2 was not because of a prediction that the price would go up immediately,

but because the structure had entered the early breakout zone, where the price broke out of the consolidation zone and started to approach the previous highs, and what we wanted to do was to complete the initial deployment of the position before the confirmation took place.

At that time, the volume has not exploded, but the behavior of pending orders is stable, the main buy continues,

the overall behavior has not been fully released, but the price has entered the structure of the “can participate in the zone”.

The logic of this type of operation is clear: first establish a light observation position, wait for the structure to be confirmed, and then execute the second stage of the expansion of the operation.

Prices opened lower in early trading, stepped back to $8.457 and rebounded quickly,

we see the key structural signals appearing:

Pullback range is under control, the price did not fall below the previous pivot range,

intraday low pending orders gradually moved up, buyers began to take the initiative to layout,

volume maintains enlargement, order flow is stable, indicating that the funds did not leave the market.

In this position, the setup enters the confirmation stage, and we execute the second position according to the structure plan.

This is not an add-on, but a layout action completed in segments according to the system.

What does this mean?

Money has not been withdrawn, order flow has remained stable and the structure has not been disrupted.

Prices are holding key areas, transactions continue to strengthen, and the entire setup is still effectively advancing.

This is exactly the second stage of our planned intervention window:

The structure is confirmed, market behavior matches expectations, and conditions are in place for the trend to continue to evolve into an unfolding trend.

We reopened the position after the open, not because price moved, but because the structure was still valid and the trading framework allowed us to expand the position.

This is not “following the rally”, nor reacting to sentiment, but rather a systematic approach to move forward as planned.

The $NVTS trade is a typical two-stage position building model in our strategy system:

Stage 1: In the initial breakout position, the structure has just been established to establish a light position to lock in the right to participate, while retaining the space for subsequent adjustments;

The second stage: when the trend continues, the behavior continues, the key signals are all fulfilled, we expand the position according to the plan, to complete the overall layout.

The key to this model is: judgment from the price behavior, do not rely on speculation; implementation based on confirmation signals, rather than emotional reaction.

It can be used over and over again, especially for these three types of targets:

High volatility (fast price reaction, ample trading space)

Clearly influenced by policy (with capital flows and regulatory direction)

Clear structure (clean graphs, readable behavior, clear risk points)

What we want to do is never to chase or press positions, but to turn uncertain market conditions into disciplined operational opportunities with a clear, executable strategy structure.

In the current portfolio, $NVTS plays a triple role:

Growth Driving Positions: Long-term growth logic that is expected to drive medium-term expansion of the NAV based on structural clarity;

Highly flexible trading unit: a trading asset with quick price reaction and a sense of direction, used to amplify portfolio performance in key windows;

Policy-linked assets: with a high degree of policy adaptability, able to respond to changes in external variables in real time.

It assumes the execution role of flexible position adjustment and dynamic rebalancing in the portfolio.

We are not looking at the price to talk, but at how the structure evolves, whether the behavior is in place, whether the risk is controllable.

The real value of trading is never in predicting the outcome, but in the ability to get the process right over and over again.

If it keeps going, we keep following.

If it goes sideways, we back off by the rules.

It's not a bet, it's an action.

We're never betting on where the market will go, we're betting that when structure emerges, we're ready, able to recognize it, able to execute it, and move forward with the rules.

That's the value that $NVTS provides - not because it's the hottest, or the loudest, but because it fits our trading principles:

Clear enough, readable enough, and executable enough.

What the market does is its freedom;

Whether we can get in and out with evidence is our responsibility.

When an opportunity arises, we don't hesitate; when the direction is vague, we don't force intervention.

We believe that the market is never short of sound, but what is truly valuable is always judgment that can be executed, systems that can be validated, and logic that can be reused.

$NVTS is a choice - not to choose a stock, but to choose a way of trading that only follows the structure and does not rely on feelings to make decisions.

What path to take is the freedom of the market, how to take it, is the trader's conviction.

Speaking of which, if you've gotten used to this approach: Judge, then execute, operate logically, don't follow the ups and downs of your emotions -

then congratulations, you're not “participating in the market” anymore, you're building your own system.

That's exactly what we are doing right now, and that's where we are going every step of the way.

“If ye say yea, say yea; if ye say nay, say nay: but if ye speak more, ye are of the evil one.” --Matthew

What we do is to make every transaction say “yes” - if the structure is valid, yes; if the behavior goes astray, no.

I'm Mr. Profit Hawk.

That's it for today's communication. That's it for today's communication. We don't judge by emotion, we confirm by action.

See you tomorrow.