July 25, 2025

July 25, 2025

Today is the last trading day of the week, and it is also an important time for you to review your pace and make advance plans—don't let a major speech catch you unprepared when the market opens.

Let’s examine the underlying driving forces. Yesterday, the United States and Japan officially signed a major trade agreement: tariff reductions + commitments for hundreds of billions of dollars in investment. This has injected confidence into the U.S. economy and directly driven the pre-market rally today. This is not a “coincidental positive development,” but rather a bullish signal triggered by the convergence of policy expectations and global cooperation. This not only stabilizes supply chains but also sends a strong signal: U.S. manufacturing and economic development will receive greater support.

Following the announcement of this agreement, the S&P 500 rose by 0.07%, and the Nasdaq also saw a slight increase, with overall expectations turning positive.

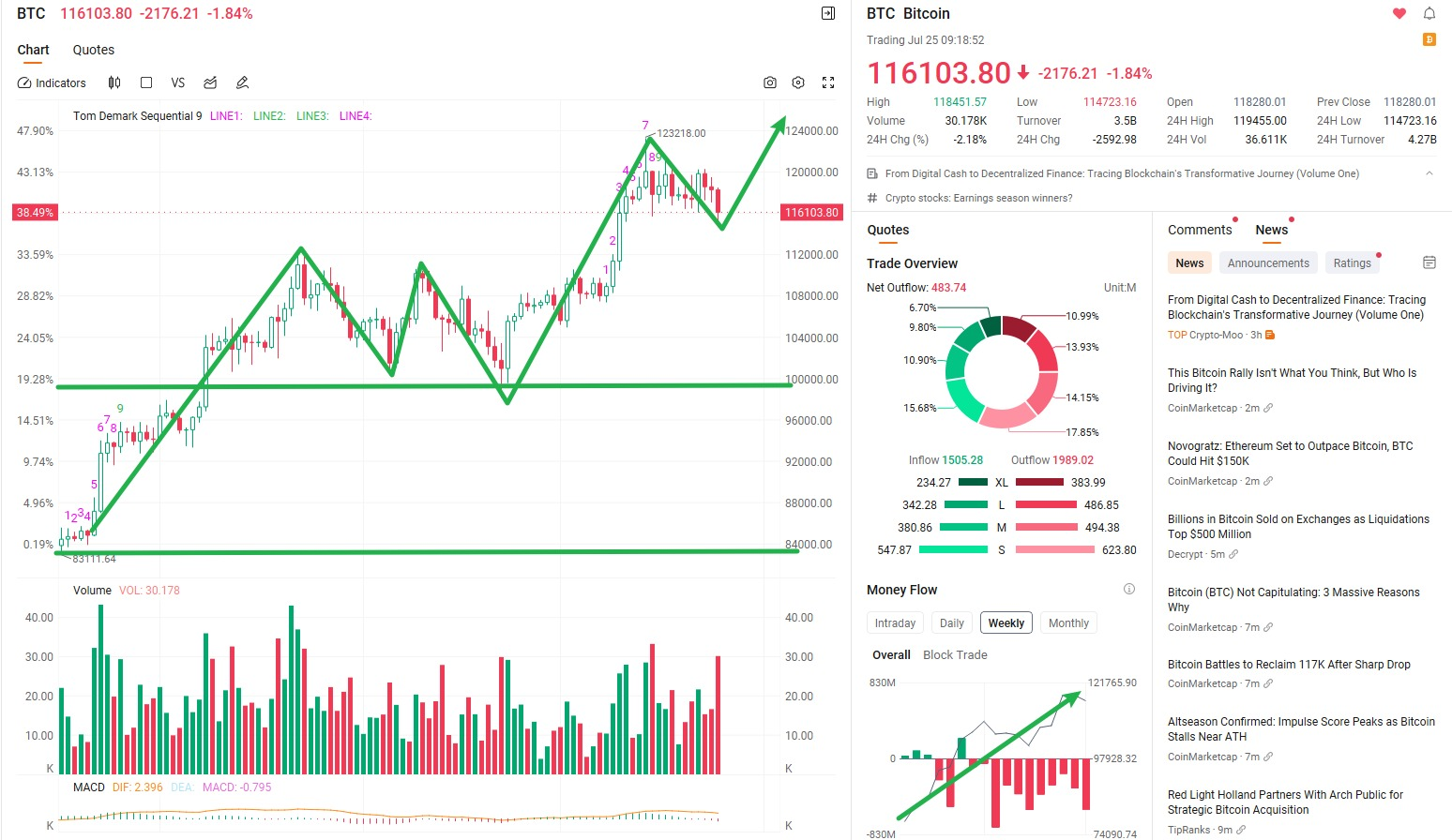

Meanwhile, Bitcoin prices remained in a mild range between 116K and 117K USD, with the digital currency market rebounding overall. This reflects investors' growing expectation that if interest rates are indeed cut in the future, market liquidity will be further released, and digital assets may become the first sector to benefit.

So what is the biggest highlight in the market today? The answer, of course, is Powell's speech!

Although this is not the Jackson Hole Symposium held in August, Federal Reserve Chair Powell will deliver an important speech at a monetary policy meeting in Washington today at 10 a.m. Eastern Time, with the theme being “The Current Interest Rate Assessment Framework.” His stance will influence market expectations regarding the timing and magnitude of interest rate cuts. Global investors are closely watching to see if he will provide further signals about the future direction of interest rates, particularly the path of rate cuts.

What does this mean for us?

If you've been following our trading lessons, you'll know that during these policy-sensitive periods, the market may experience short-term volatility, but this is precisely an opportunity to hone your judgment and build trading confidence.

So, you don't necessarily need to make a trading move today. What's more important is to understand the underlying macroeconomic logic and gradually develop your own investment rhythm and strategy.

This has led the market to reassess the situation—future rate cuts may not only occur but could also be larger in magnitude than previously anticipated. The emergence of this “new consensus” is one of the reasons behind the noticeable improvement in pre-market sentiment today.

However, the moment the market is truly focused on is when Federal Reserve Chairman Jerome Powell delivers his “interest rate assessment” speech at 10 a.m. today.

This is the most significant policy signal window of the week.

While many officials have hinted that interest rates are too high, whether there will be an official shift will depend on Powell's statement.

If he leans dovish (supporting rate cuts), it will further confirm the current upward trend; if he leans hawkish, there may be short-term volatility. We will not chase highs, but if a “clear signal” is released, we will prepare to tactically increase positions in strong sectors.

Why are we placing particular emphasis on Federal Reserve Chair Jerome Powell's remarks today?

Because, based on past experience, every public statement by Powell is almost always interpreted by the market as a “preemptive signal” regarding the future direction of policy. If his tone leans toward dovishness (i.e., supporting rate cuts), market confidence is likely to rise rapidly, which would be a highly valuable signal for our current position management and scaling-in plans.

The June PCE price index will be released at the end of July, which is the Federal Reserve's most closely watched inflation indicator;

The August nonfarm payroll report and CPI inflation data will be released in early September. If either of these shows a significant deviation from expectations, it could trigger sharp short-term volatility;

Prior to that, U.S. stocks are likely to trade around “rate cut expectations.” At the same time, we should also pay close attention to core AI sector stocks, such as $ALAB, which will release its earnings report on August 5. If the earnings report and guidance are positive, it could lead tech stocks to launch a new round of gains, potentially reaching new highs for the year.

However, if short-term market hot money begins to withdraw from high-valuation growth stocks, then “risk-hedging assets” such as gold and Bitcoin may take over and strengthen, ushering in a wave of structural rotation.

In summary, we are currently in the core phase where “policy expectations + macroeconomic data + tech earnings reports” converge. As long as you grasp this overarching framework, you can make rational judgments in complex market conditions, seek steady gains, and find the rhythm and opportunities that truly suit you.

The direction of US stocks is likely to be set, with the market speculating on the extent of the move. For example, an interest rate cut is almost certain, but the exact amount will depend on the Fed's final decision.

Effective expectation management is a hallmark of a mature market.

I don't see any clear catalyst driving the market sell-off. It could be a temporary exit ahead of Nvidia's earnings report next week, or a move to seek safety ahead of Fed Chair Powell's speech.

I expect Powell will assure the market that the Fed will cut rates in September, but he will be vague about whether the cut will be 25 or 50 basis points.

For example, I suspect Powell will say he expects rate cuts to begin slowly, but will also emphasize that if they do see further weakness in the labor market, they can accelerate the pace.

Therefore, there is no need to worry about a significant decline in the market on Friday. I am bullish on the upward momentum in stocks, with the only uncertainty coming from the weekend digestion period, where market caution could lead to volatility. However, this will also be an excellent opportunity to enter the market!

Soros said: The reason my method works is not because I always make correct predictions, but because I promptly correct incorrect predictions.

A distinctive feature of my predictions is that I always anticipate events that will not come to pass.

Part of the reason is that markets can influence anticipated events.

Reflexivity does not have predetermined outcomes; outcomes are determined by the evolution of the process.

1. Only unforeseeable things are risks; predicted risks can actually influence the occurrence of negative outcomes.

2. All predicted risks have already been priced in and are reflected in stock price movements. Therefore, the saying “the candlestick chart contains everything” is not entirely without merit.

3. So-called reflexivity refers to how widespread perceptions can influence the course of events themselves, either reinforcing trends or, under shared anxiety about risks, preventing those risks from materializing.

On Friday, let's witness the success of this prediction together! More importantly, how have my held stock strategies performed?

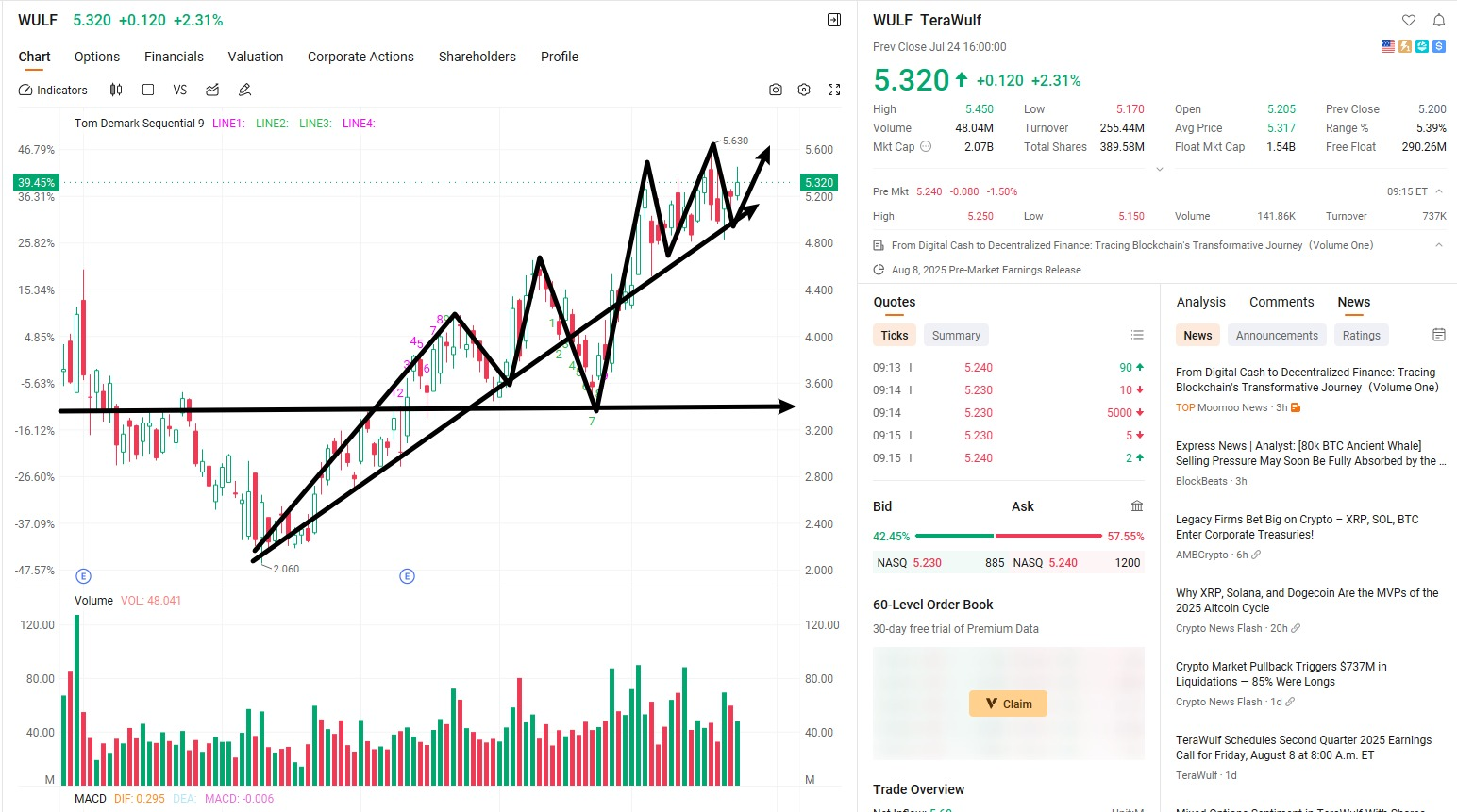

Friends, please pay special attention to the two stocks we are currently focusing on and firmly holding: $WULF and $NVTS.

Why choose them?

Because they represent two major trends: Bitcoin and semiconductor technology.

Whenever the Federal Reserve enters a rate-cutting cycle, the released liquidity often first drives the rise of digital assets. Bitcoin, as a scarce asset, has steadily recovered from its 2022 low. Once the rate-cutting signal is clear, BTC is expected to surge toward new historical highs—potentially reaching $125,000.

$WULF is a high-quality company in the Bitcoin mining sector, with cost advantages and high flexibility; while $NVTS is a growth-oriented company in the AI and chip sector, poised to see valuation upgrades in a loose policy environment.

If you are unfamiliar with direct Bitcoin investments, you can participate in the digital asset market through $WULF or ETF tools, or focus on long-term opportunities in core cryptocurrencies like ETH and SOL.

The market favors those who are prepared. Once you understand the underlying logic of policies, trends, and tools, this round of wealth opportunities may belong to you. If you haven't yet positioned yourself, you can use market volatility and adjustments to test the waters with a small position, or gradually participate in these two structural opportunities through phased position-building.

What's next for Bitcoin?

From a technical chart perspective, Bitcoin remains in a medium-term uptrend, with its structure intact. However, what truly determines the next major rally is not just the chart, but macroeconomic policy—with interest rate cuts looming, where will capital flow?

This is the core variable we must focus on.

As the Federal Reserve continues to signal a dovish stance, the probability of interest rate cuts being initiated this year is steadily increasing. Historical experience shows that during periods of liquidity injection, capital inevitably seeks out “safe yet highly elastic” havens.

In the past, it was gold. Stable, traditional, but with limited elasticity.

Now, it is Bitcoin. It is scarce, highly liquid, and enjoys strong global consensus. More importantly—it has become the epitome of “free assets” in the eyes of the new generation of investors. This “cross-border, cross-generational, cross-policy” capital-attracting logic is precisely the fundamental reason why Bitcoin may stand out in the next market cycle.

If you are not yet ready to directly allocate to BTC, you can also consider investing in Bitcoin mining stocks like $WULF. It combines the growth potential of digital assets while retaining the liquidity of stock trading, making it one of the most cost-effective options for mainstream capital seeking a “flexible and adaptable” strategy.

Friends, let's participate in the market in a more interesting way: today is Friday, and we're going to try a new options trading strategy, taking advantage of current hot topics to find unique opportunities.

You may have noticed that the US and Japan have just signed an important bilateral trade agreement. According to public information, Japan plans to invest hundreds of billions of dollars in the US economy over the next few years. This not only boosts global confidence in the U.S. manufacturing sector but also sparks market expectations for a revaluation of tech stocks and high-growth companies.

Driven by this positive news, U.S. stock index futures opened higher across the board this morning, with the Dow Jones up approximately 0.5%, the S&P 500 up 0.3%, and the Nasdaq following suit with a slight gain. This presents us with a new strategic opportunity.

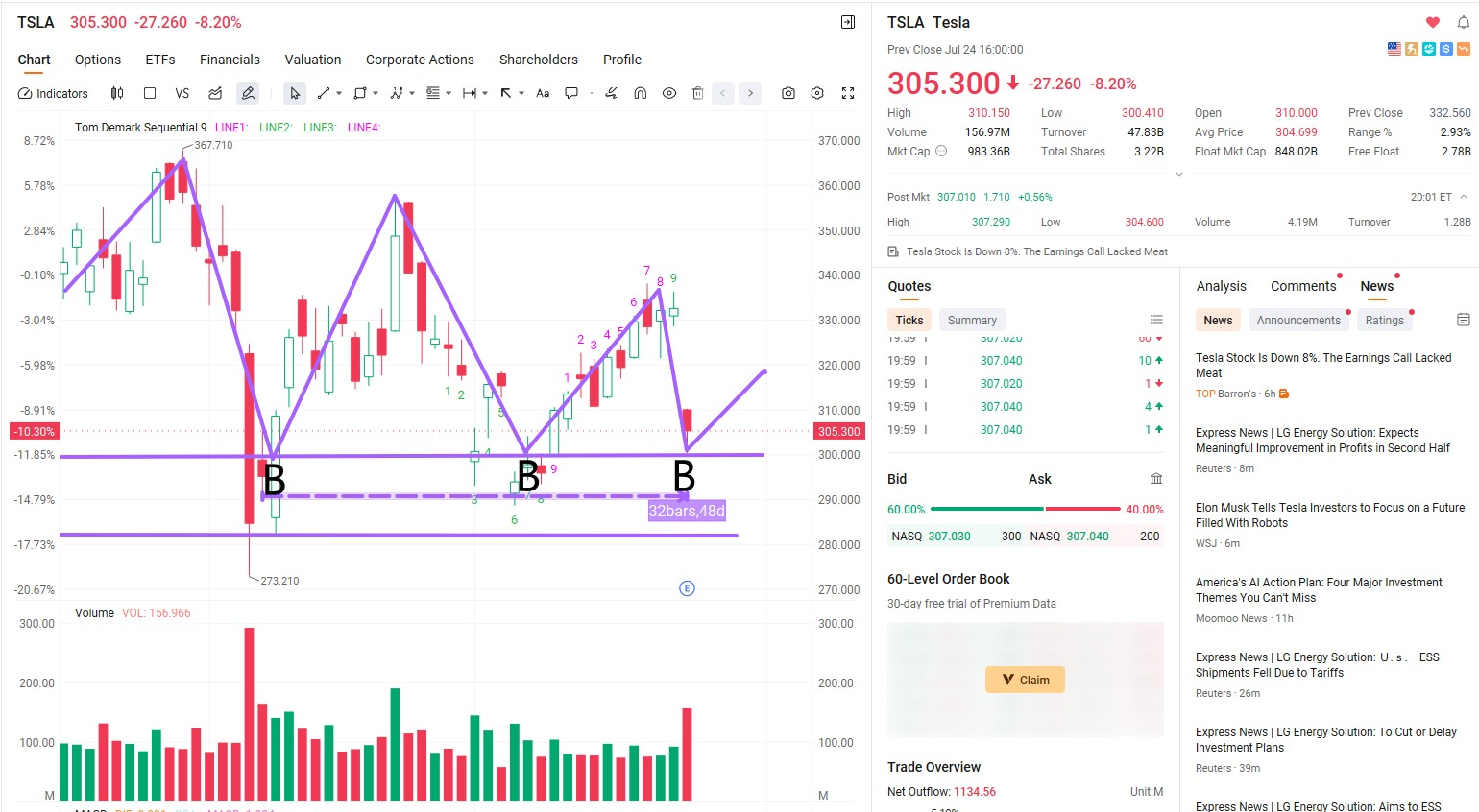

As shown in the chart, the positive news aligns with $TSLA's technical pattern, which fully meets the criteria for low-price value buying. Therefore, we will not trade the underlying stock today! Instead, we will participate via options:

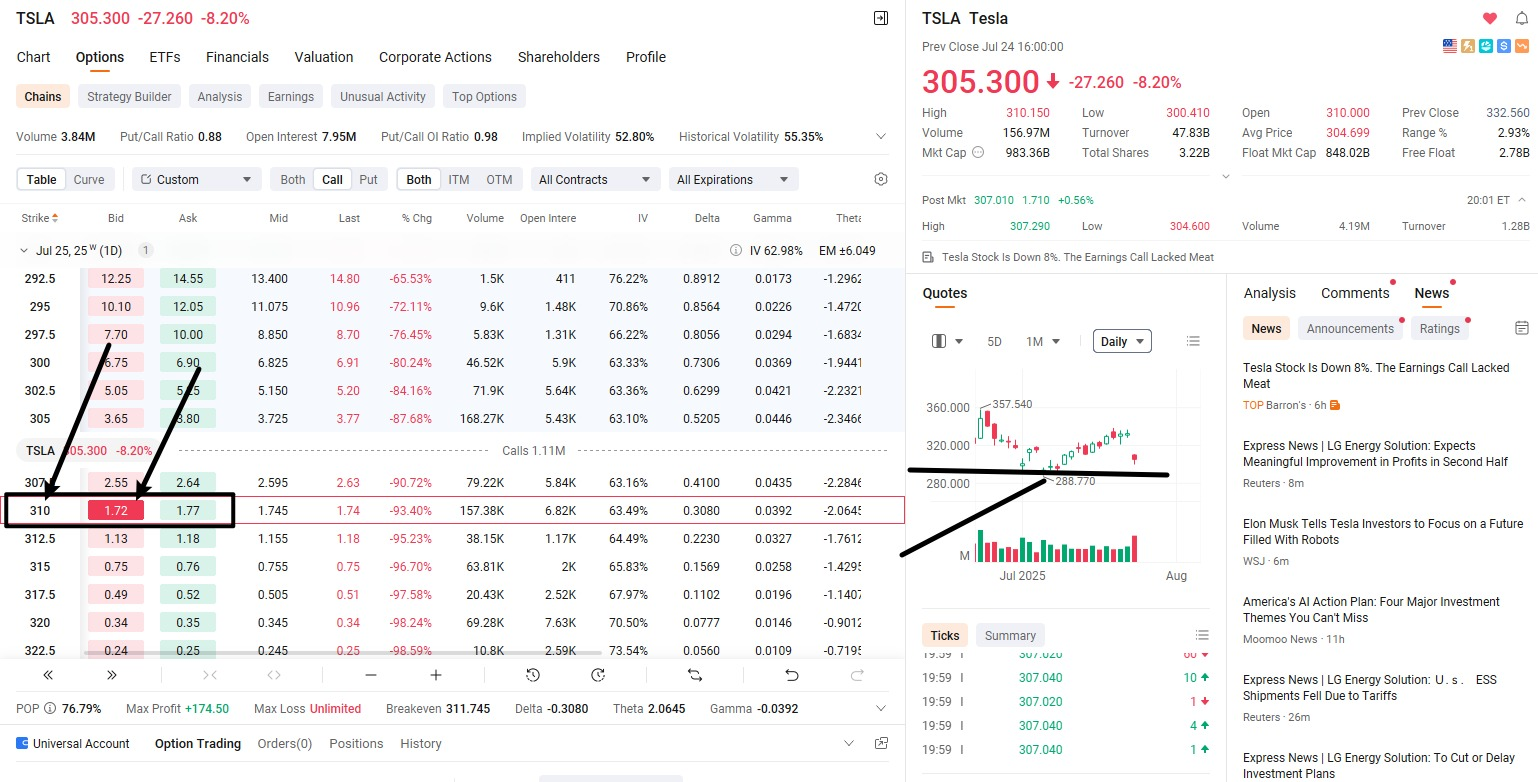

Option signal: BUY TSLA 250801 310.00 CALL;

We recommend participating with 5-30 options. The current premium is approximately $6.60 per option.

Let's break down the logic behind this options strategy:

From a technical chart perspective, $TSLA's stock price has historically formed support multiple times within the $300 to $305 range, creating a classic “psychological price band.” This indicates that the market has a strong consensus and reaction to this price level, and once it dips back into this zone, it often triggers capital inflows and short-term rebounds.

Meanwhile, the recently finalized US-Japan trade agreement has sent positive signals, with Japan planning to increase investment in the US economy in the future. This not only boosts market confidence but also holds promise for creating short-term opportunities in the technology and manufacturing sectors, including Tesla.

What is the biggest risk?

It's simple—it's the premium you pay for the options. If your directional judgment is incorrect, the maximum loss is limited to this premium, and the cost is controllable, as it is entirely up to you how many option contracts to purchase.

This trading method has been explained and demonstrated multiple times in our previous courses. It is suitable for flexible responses when specific event-driven scenarios or price support zones emerge. If you are unfamiliar with it, we recommend reviewing the previous course content to better grasp this strategic framework.

This week, we've gone from Monday's planning to Thursday's strategy to today's execution, each step taken with confidence and composure—we've not only won in the market, but also in our thinking and rhythm.

So, what is the right investment? Is it the numbers in your account? A successful trade? Or is it you, remaining calm and steadfast amid the volatility?

I firmly believe: when every decision is backed by clear logic, thorough preparation, and a mature mindset, then regardless of short-term gains or losses, it is a crucial step toward long-term success. Just like today, our composure wasn’t about luck—it was based on understanding the trend and planning ahead. Don’t forget, what truly brings you joy isn’t just the moment of profit, but your growing ability to judge the market and adapt to changes with increasing stability.

As the week comes to a close, the rhythm is nearing a critical point, and next week is highly likely to see a shift in the main trend. Therefore, please take some time this weekend to review your account, organize your positions, and set your rhythm in advance. Remember: the market never favors “chasing the wind”; it only rewards those who are prepared in advance.

Additionally, the NextLeap Community’s “Lucky Wheel” event for this Friday has begun. Check to see if you’ve received a new raffle code—maybe luck will strike when you’re fully engaged.

Have a great weekend, and we’ll see you next week!

__________________________________________________________________________________________________________

Good afternoon friends, my name is Bird Grant. I'm Bird Grant from NextLeap Management Consulting, LLC. Nicknamed Mr. Profit Hawk

Today I was driving alone on California's Highway 1.

The windows were half rolled down, the ocean breeze was pouring in, and the sun was shining. The car's Bluetooth was playing an old Jackson Browne song, with a light tempo, and I hummed a few lines to the beat.

I have no special arrangement, and I'm not going anywhere. It's just a very pure state of mind - you know you've done something right, and then the whole world lightens up.

No watching the market, no swiping the phone, no strategy.

But I know in my heart especially: our July portfolio is making money, the system's judgment is not wrong, the signal stepped on, the execution did. This state of affairs, not often, but once there, even if one is driving alone, the heart is smiling.

This week's lucky draw has been launched, friends remember to contact your investment advisor in time to get your lucky draw code to participate. Congratulations to those who have already won, we will complete the distribution of prizes tonight, please pay attention to check receipt.

For those who have not participated yet, there is no need to hurry, the lucky draw is just a formality, participation itself is the real sense of existence in the community. It's not just an easy interaction, it's part of our weekly content rhythm. We will open the next round of activities, remember to stay tuned, don't miss the next surprise moment.

Why am I so excited today? Because our entire July portfolio, all in the money, and not just a little bit, is a real structural victory.

We are not relying on blind blind, nor chase hot speculation, we are relying on the system signal, planning ahead, batch into the field, dynamic management, the three different directions of the ticket combination into a simultaneous power of the profit engine.

In particular, $ANPA, from the time we opened a position at $3.969, has eight times doubled in nine trading days today - this was not luck or hype, this was a clean system win.

We caught the structure, waited for the signal, controlled the position, and then executed to the end.

There is no chasing high, no guessing the direction, no fear of missing - all rely on the system to predict in advance, the results of natural cash.

For the entire community, this is not just a profit, but a validation of collective belief. We proved one thing: when the strategy, system, behavior all aligned, profits simply can not stop.

And now, a new window to watch is opening.

There's a new stock that's just come into our view -- $FIG -- that's getting ready for an IPO, and the behavioral structure is beginning to emerge as money starts to test the waters.

Whether it will replicate the earnings explosion curve of $ANPA, we can't say yet.

But as long as the structure is in place and the signal is confirmed, we will still respond in the same way:

Do not rely on feelings, do not touch emotions, only do can cash judgment.

The entire portfolio is now in a clear state: $SOL provides the main trend exposure to the crypto sector, $WULF is a mid-trend position in the Energy + Mining dual cycle, and $NVTS is the most structurally complete and signaling growth structure in tech.

The current position structure within the portfolio is as follows:

$WULF at 20% is our main driver in the crypto sector;

$NVTS at 12% is a growth-oriented propulsion unit in the tech direction; and

$SOL at 5% is used to supplement structural participation in the crypto direction.

The community can check their current positions against

If there is a large deviation, it is recommended to refer to the portfolio structure to make corresponding adjustments, to ensure that you are not “participating in the view”, but really keep up with the pace of the portfolio's execution.

And now, I want to talk to you about a more critical question -

We are not having this session to celebrate the last profit.

The real question to ask is: where is the next profit, where is it?

I can tell you clearly: we are already preparing a new deal.

It hasn't started yet, but all the early signals have surfaced:

Volume is starting to come in, the price range is tightening, and money is testing the lows to get in - the overall behavioral structure is almost identical to the pattern that was in place prior to $ANPA's initiation.

This is not a “bet”, this is the next bullet we are going to use the portfolio to improve the efficiency of the attack.

I'll officially show you where it is next week, but until then - I want you to get the $SOL, $WULF, $NVTS combination in place. Once the new signal is triggered, we must get in early, lay out our positions as planned, and take the initiative in our hands instead of being pushed around by the market.

But to me, it's not just another explosive opportunity.

It represents one thing: our ability to consistently translate our system capabilities into real-world results at the portfolio level.

It's not a trade opportunity to be caught on the fly; it's a growth engine in our portfolio that has been extrapolated and confirmed with a clear mandate. We chose it, not because it is a beautiful short-term trend, but because it has the triple resonance of structure, logic and capital behavior, which happens to be highly consistent with our current portfolio objectives. At this stage of the game, it's about finding the asset unit that can really pull the portfolio's earnings curve. Its value is not in how stunning the gains are, but in the fact that it can materially increase the growth rate of our account once the trend continues.

It falls in the direction of crypto assets, and we have now completed our initial position planning and will officially announce the name of the underlying next week and push the buy range in tandem. This is not a concept trade captured on the fly, but a carefully planned acceleration unit in the portfolio.

For those concerned about the direction of structural growth, this is an allocation opportunity to keep an eye on. We will also be the first to remind you to follow through on the execution once it enters the release phase.

So why should our portfolio accelerate?

Because we do not rely on the index to make money, we rely on -

In the macro logic has not yet landed, in advance to identify which assets have entered the “interest rate trading” rhythm, and the precise allocation of the portfolio approach, so that the system rhythm superimposed on the structure of the asset, the formation of the actual acceleration! The actual accelerated profit.

Once the market enters the “expectation-driven + policy loosening” phase, assets will not rise evenly, but only the most sensitive to the interest rate path, the lightest structure of the fastest running assets.

The cryptocurrency structure we have selected is not just a theme, it is a portfolio-driven asset that the system recognizes as “high momentum, high resilience, and structurally clear”.

This is the core reason why it drives portfolio efficiency.

Political signals have accelerated the pace of all this

Trump's recent moves have been very interesting. He pushed for the return of tariffs (even naming some imported industries to be hit), and at the same time began to pressure Powell to “cut interest rates”.

This is not a contradiction, but has a deeper logic:

Tariffs are an inflation generator, pushing up short-term price expectations;

Interest rate cuts are liquidity releasers, used as a hedge against the risk of economic downturns or financial tightening.

Trump is trying to build his version of the “re-industrialization + re-relaxation” structure -

on the surface to create a strong signal, in essence, hope that through low interest rates with high protection to enhance domestic industrial profits and capital market performance.

This forces the market to price in advance the script of “policy incoherence but good for risk assets”.

Political signals have accelerated the pace of all this

Trump's recent moves have been very interesting. He pushed for the return of tariffs (even naming some imported industries to be hit), and at the same time began to pressure Powell to “cut interest rates”.

This is not a contradiction, but has a deeper logic:

Tariffs are an inflation generator, pushing up short-term price expectations;

Interest rate cuts are liquidity releasers, used as a hedge against the risk of economic downturns or financial tightening.

Trump is trying to build his version of the “re-industrialization + re-relaxation” structure -

on the surface to create a strong signal, in essence, hope that through low interest rates with high protection to enhance domestic industrial profits and capital market performance.

This forces the market to price in advance the script of “policy incoherence but good for risk assets”.

Instead of waiting for an official announcement from the Fed, the market has taken the initiative to enter a rate cut trade

Gold, Bitcoin, long-dated bonds, and growth tech stocks are all showing signs of synchronized behavior with volume amplification, higher prices, and trend reinforcement.

Markets are pricing in medium-term expectations for these assets at an accelerated pace, capital inflows are beginning to take on continuity, and the overall behavioral structure is moving from observation to confirmation;

Inflation data fell moderately, giving the market “Fed dare not tighten” signal window;

The kernel of the rate cut deal is “funds are willing to pay for the future in advance”, that is, pricing efficiency is improving, which is the hotbed of portfolio acceleration.

Trump and Powell's policy collision is essentially a combination of “create inflation + excuse to cut interest rates”.

Trump pushed forward a new round of tariffs, ostensibly to fight protectionism, the essence may be intended to create localized inflationary pressures;

At the same time, he openly pressured Powell to demand interest rate cuts, to create a pre-election liquidity release space;

This is not a policy out of control, but a typical maneuver:

in the release of pressure on one side, while creating a sense of tension, through the contrast effect to create local fluctuations, to guide the market to actively expect the policy turn.

The purpose of this type of asymmetric signal is not direct easing, but to let the market react in advance.

For capital behavior, this often means that a window is being shaped, rather than already open.

Because we are in a phase of deep macro-structural repricing.There is a divergence at the policy level - one side releasing disruptive signals and the other hinting at path shifts;

The money level is starting to move ahead, making allocation switches ahead of the news that hits the ground;

And asset prices, in tandem, are reflecting this asymmetric structural change.This is not sentiment pushing up, but structure-driven earnings window is opening.

When the market is still waiting for confirmation, our portfolio, already in action.

Expectations for rate cuts are rising, not in sentiment, but in pricing logic

US bond yields continue to fall, and fed funds rate futures have brought forward expectations for the first cut in 2024 to the current year;

Asset classes are shifting in tandem to a “liquidity-driven” framework: high duration, high valuation sectors are leading the rally;

Markets are rallying around the idea that "a rate cut is not a matter of whether or not it will happen. "Markets are trading around the idea that it is not a matter of if, but when, how many and how interest rate cuts will affect asset classes.

We're not just talking about judging direction,

but rather: how to position ahead of the turn to give positions the power to act and cash in before the turn comes.

The strategy framework has been unfolded and the next trade is in the target zone.

Portfolio advancement doesn't rely on emotion or luck.

It relies on the system's mastery of rhythm, adherence to position, and respect for signals.

Thank you all for your focus tonight.

What we are doing is not a week's worth of wins and losses, but the layout of an entire growth curve.

That's it for now. I'll see you on Sunday.