July 28, 2025

July 28, 2025

Good morning, friends. Today is Monday, and a new trading week has begun. Let's start with the current market dynamics, think rationally and prepare First, let's look at the macroeconomic background. Last week, US stocks closed strongly, with the S&P 500 and Nasdaq reaching new record highs, reflecting the market's confidence in corporate earnings and policy expectations. This week, the market's focus will be on two key areas: First, the Federal Reserve will hold a policy meeting on July 30. The market generally expects interest rates to remain unchanged, but whether Powell will send a “dovish” signal at the post-meeting press conference will be key to the market’s direction. Second, the July nonfarm payrolls report will be released this Friday, which is an important economic indicator for determining the pace of interest rate cuts. Currently, according to the Core X quantitative trading system's forecast, U.S. nonfarm payrolls for July are expected to increase by 108,000, down from 147,000 in June, with the unemployment rate expected to remain at 4.1%. If the data continues to show weakness, it will further strengthen market bets on a rate cut starting in September. Meanwhile, the U.S. will also release the preliminary second-quarter GDP data on July 29, with an expected annualized growth rate of 2.5%, rebounding from the negative growth rate in the first quarter.

Additionally, it is worth noting that the United States and Japan signed a new bilateral trade agreement over the weekend, with Japan committing to invest hundreds of billions of dollars in the US economy over the coming years. This news boosted global market sentiment. Today, the three major US stock index futures rose slightly before the market opened, with the Dow Jones futures up approximately 0.47%, the S&P 500 up 0.4%, and the Nasdaq up 0.24%.

What does all this mean for us?

It reminds us that market trends are driven not only by corporate fundamentals but also by the interplay between macroeconomic policies, capital flows, and market expectations. In such a context, blindly chasing price increases is not a mature investment approach. Instead, we need to analyze data, interpret policies, and wait for clear signals to gradually build our investment positions.

Today's strategy focuses on rationality and patience. We are not rushing to act but using the CoreX system to identify key signals. The core of the strategy lies in waiting for policy confirmation, preparing in advance, and making rational investments.

Although the market generally expects the Federal Reserve to begin cutting interest rates at the September Federal Open Market Committee (FOMC) meeting, and some institutions have even begun betting that the cumulative interest rate cut this year could reach 100 basis points, we should recognize that this is not merely a policy adjustment, but may also mark a turning point in the future direction of the stock market.

This week marks the beginning of a critical turning point. Every judgment and strategy we make will determine the success rate for the coming quarter and even longer-term cycles.

Have you already formulated a plan for this new phase?

Do you know how to manage the risks of your current holdings amid market volatility and gradually build a high-probability investment portfolio?

If you feel uncertain, don’t worry—our investment education courses are specifically designed to provide long-term investors like you and me with a steady pace and rational strategies.

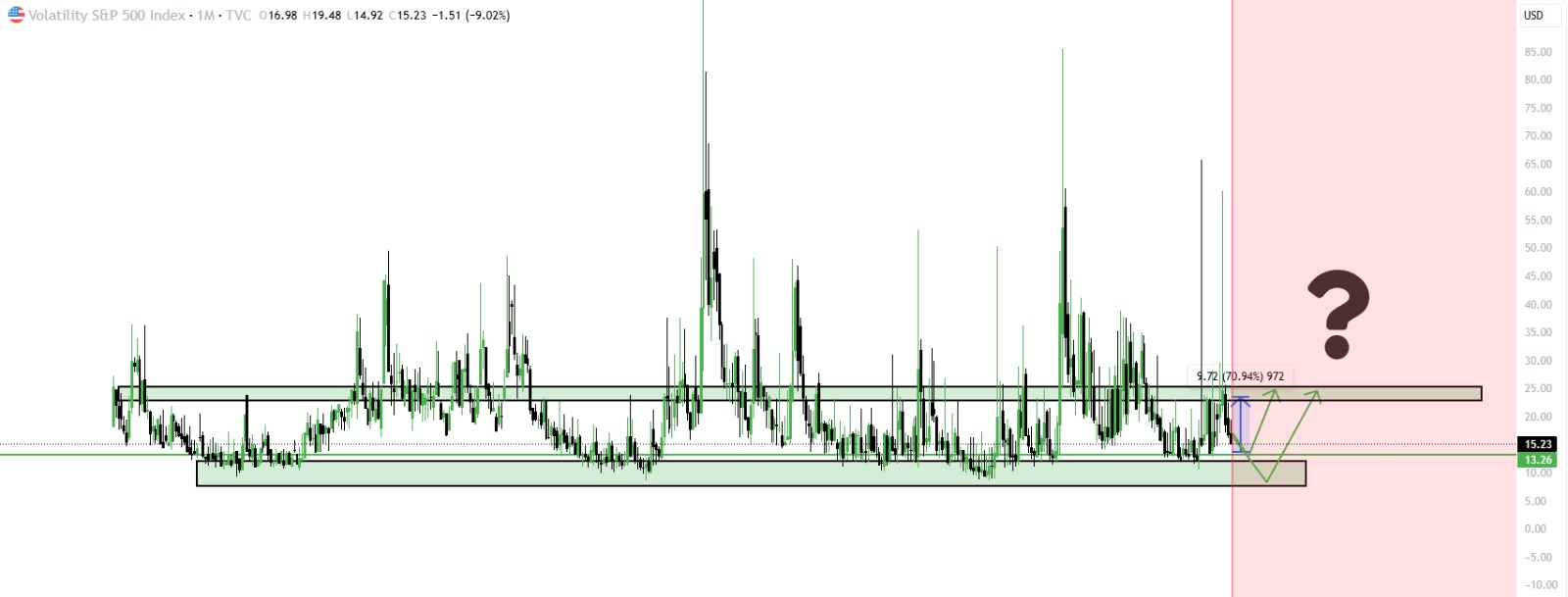

Looking back at last Friday's class, the period from late July to September has historically been the most volatile and trend-turning phase for the US stock market. Historical data shows that this period is not a window of smooth transition, but rather a critical point where market changes accelerate.

So how should we respond?

The answer is clear: during this phase, opportunities and risks coexist. The key is not to blindly chase highs or panic-sell, but to identify the right direction, keep pace with the market, and proactively prepare and manage your positions.

Looking at today's actual situation: On Monday morning, futures for the three major U.S. stock indices were generally lower, while the VIX fear index rose slightly. This indicates that the market is entering a period of increasing uncertainty, with sentiment becoming more cautious.

This is not necessarily a bad thing; rather, it reminds us to focus more closely on the signals ahead, especially this week's macroeconomic data and policy developments. Once market sentiment is released or negative news is exhausted, it becomes a critical juncture to seize the next wave of market opportunities.

We often say that history does not simply repeat itself, but it always reappears in a similar rhythm. Looking at Monday morning trading, the three major US stock indexes fell again. This is actually the market's reaction to this week's key economic data—especially the series of “leading” indicators ahead of the nonfarm payrolls report, which are attracting widespread attention.

So, what is NFP data?

NFP stands for “nonfarm payrolls report,” one of the most important official reports on the US labor market. It directly influences the market's assessment of the economy's health. The data is released on the first Friday of each month and often triggers significant volatility in stock markets, bond markets, and even cryptocurrency markets.

However, the day before the NFP data is released, there is another important signal: the ADP employment data, often referred to as the “mini-NFP.”

ADP (Automatic Data Processing) data is released by a large U.S. payroll processing company and reflects changes in private-sector employment. Since it is released earlier than the NFP, it is often used as a “leading indicator” for the nonfarm report. While it does not always align perfectly with the NFP, historical data shows it plays a crucial role in shaping market expectations.

This is why the market is already feeling tense today—everyone is waiting for Thursday's ADP data release to see if it will provide early “clues” about the direction of this month's nonfarm report.

For the global economy, market expectations that the Federal Reserve will officially begin cutting interest rates in September are rapidly heating up. Over the past few weeks, numerous statements by Federal Reserve officials and economic data have indicated that current interest rates are significantly higher than the neutral range. The market generally expects that the September Federal Open Market Committee (FOMC) meeting will mark the first interest rate cut this year, with some institutions even predicting that the cumulative interest rate cut this year could be close to 100 basis points. This suggests that the second half of 2025 will enter a more accommodative monetary environment, with inflationary pressures also expected to ease further.

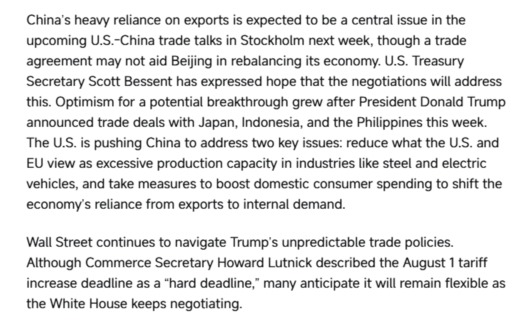

However, as interest rate expectations evolve, the global trade landscape is also rapidly changing, introducing more uncertainty into the market.

On July 23, the United States and Japan reached a trade agreement to reduce bilateral tariffs on automobiles and industrial goods, with Japan committing to provide the United States with a total of $550 billion in investment and loan programs.

Subsequently, the U.S. President's Office officially announced over the weekend a new trade agreement with the EU: on one hand, imposing a 15% tariff on certain EU imports; on the other hand, the EU will make large-scale purchases of U.S. energy and military equipment. The agreement is interpreted as aimed at “rebalancing the economic relationship across the Atlantic.”

So these major events send out two signals:

First, under expectations of monetary easing, global capital is seeking more certain channels for economic cooperation and safer asset allocation paths.

Second, uncertainty over trade policy may still be a potential driver of inflation. For example, if future tariff increases are fully implemented, they will directly push up import costs, which will ultimately be passed on to end consumers. For the U.S. economy, which is driven by consumption, this is undoubtedly a serious source of inflation risk that must be taken seriously.

Therefore, although the trend toward interest rate cuts has been largely established, the market must closely monitor whether developments in trade policy will impose new pressures on price stability. This is precisely why recent CPI, PCE, and PPI data are being closely watched by the market—these data not only influence the September interest rate decision but will also reshape the market's assessment of the future interest rate path.

Therefore, the market decline on Monday, driven by uncertainty surrounding the NFP data, reflects concerns that the labor market data closely monitored by the Federal Reserve fell short of expectations. However, the core factor behind this performance is panic-driven sentiment rather than a decline caused by actual economic data. As a result, such panic-driven selling often drives up the market's VIX fear index and increases demand for safe-haven trades.

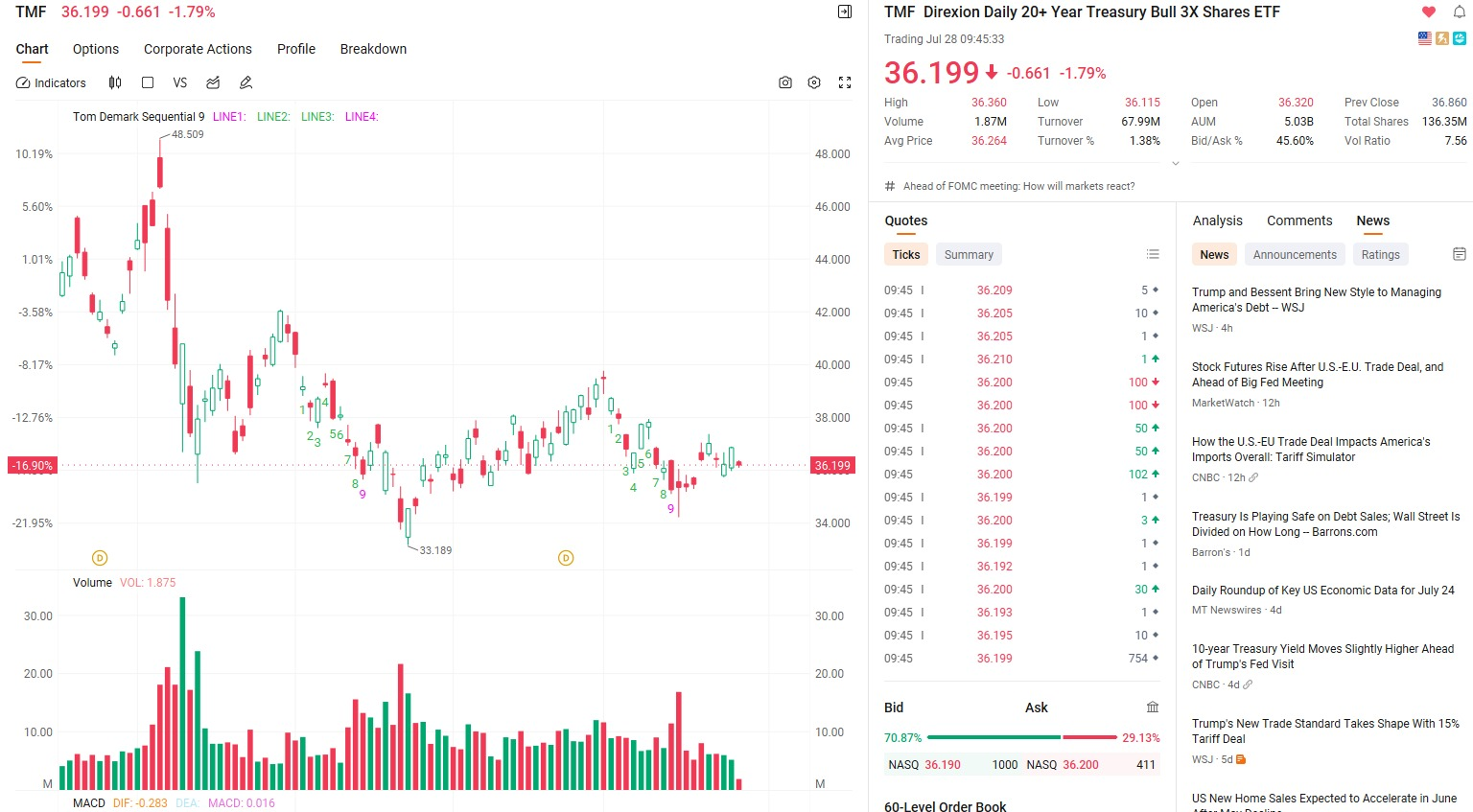

Of course, in my trading portfolio strategy, $TMF/TLT is a key component of my risk-hedging portfolio.

If you hold it, yes, it is safely shielding you from the panic today. As a Treasury ETF, it benefits from the decline in interest rates caused by rate cuts, thereby driving up Treasury prices.

Suppose you buy a movie ticket.

The higher the price of the ticket, the lower the “return” (i.e., the enjoyment of watching the movie) you get. This is because the higher the cost you pay (the ticket price), the higher your expectations for the movie, and if the movie fails to meet your expectations, you will be disappointed.

The same principle applies to US Treasury bonds

The price of U.S. Treasury bonds is the cost you pay when purchasing the bonds.

The yield on U.S. Treasury bonds is the return you receive from the bonds, i.e., the interest.

Impact on the stock market:

Rising U.S. Treasury bond yields: This indicates higher returns on bond investments, prompting investors to withdraw funds from the stock market and shift to bond investments, leading to a decline in stock prices.

Declining U.S. Treasury bond yields: This signifies an increased relative appeal of stock investments, prompting investors to shift from the bond market to the stock market, driving up stock prices.

However, when prices rise, new investors who purchase the bonds will receive relatively low interest income because they paid a higher price, but the coupon rate remains unchanged.

Suppose there is a government bond with a face value of $1,000 and a coupon rate of 5%. If a stock market panic causes more funds to flow into Treasury bonds as a safe haven, you would need to pay $1,050 to purchase the same face value bond. This means the bond's future returns remain unchanged, but your cost has increased from $1,000 to $1,050, indicating that the bond's yield has decreased for you because your cost has risen.

Therefore, the yield on U.S. Treasury bonds is volatile and should be distinguished from the coupon rate of government bonds!

So, why do the prices of U.S. Treasury bond ETFs rise?

This is because when the Federal Reserve cuts interest rates, it means that the coupon rates of U.S. Treasury bonds will also decrease.

For example, before the rate cut, a $1,000 face value U.S. Treasury bond had a fixed interest rate of 5%. After the rate cut, the fixed interest rate of a $1,000 face value U.S. Treasury bond decreased to 4%.

This leads to the sale of Treasury bonds, causing their prices to continue to decline.

After the rate cut, a Treasury bond with a face value of $1,000 may only need to be purchased for $950. In other words: Although the rate cut reduces the coupon rate to 4%, I no longer need to pay $1,000; I only need to pay $950 to obtain the bond. Therefore, hasn’t the yield increased for me?

An ETF is a fund that specializes in investing in government bonds. By acquiring bonds at a lower cost, the fund's yield increases (improved profits), leading to an increase in the ETF's price!

Friends, can you now understand this relationship between price fluctuations?

So what exactly is the Core X 40/60 investment portfolio?

First: It includes long-term value-investing stock allocations and hedging transactions, holding stocks like $TMF as a safe core position.

Second: A high-quality stock holding plan and interest rate-sensitive stocks to prepare for the interest rate cut cycle, holding $ABBV.

Third: A digital currency spot value investment allocation based on the positive parabolic investment theory, aiming to achieve a super profit accumulation plan, holding SOL, XRP, and BTC/ETH spot positions.

Yes, this is the optimal winning strategy to navigate the turbulent period from August to September. Let us anticipate the outcomes, with all participants verifying and witnessing the ultimate success.

Don’t worry—this isn’t an unexpected “black swan” event, but rather the market’s concentrated reaction to recent interest rate expectations, employment data, and some geopolitical risks. This once again underscores the value and forward-thinking nature of our CoreX 40/60 investment portfolio. Its design philosophy is to provide robust defense and reasonable returns in such uncertain market conditions, helping investors truly achieve their “crossing the cycle” strategic objectives.

If you’ve already followed this plan in your investments, I’d like to say “congratulations”—you’re ahead of most people. If you’re still hesitating, I sincerely advise you not to miss out on the upcoming opportunities.

Tomorrow, I’ll provide an in-depth analysis, detailing the core logic of this portfolio, its asset allocation methods, and how it will protect and grow your capital amid market volatility over the next 3–5 months.

True winners are not those who never face challenges, but those who can maintain their rhythm amid the storms. Tomorrow, we will delve into how the CoreX investment portfolio navigates the market. Remember to tune in on time to prepare for Q3.

See you tomorrow morning. Don't be late—because we're preparing for the third quarter together.

__________________________________________________________________________________________________

In the lesson that just ended, mentor Blake Shaw once again showed his usual penetrating power. He didn't just read what is happening in the market, but also taught us: how to find a clear decision-making path with a systematic approach in the midst of complex volatility.

From the essential logic of interest rate trading, to the efficiency reconstruction of investment portfolios, to the changing role of chained assets in macro paths - he took us deeper into the underlying logic of capital flows with an extremely high density of information.

This is not only a lesson about strategy, but also a cognitive or reading structure reshaping training. In this market with more and more variables, his judgment and perspective are always as steady as a lighthouse.

Good afternoon, folks. I'm Bird Grant, From NextLeap Management Consulting Ltd. Nicknamed Mr. Profit Hawk, and welcome to a new week of strategy class.

To kick off today, I want to tell you about an interesting past event. It was 2019, and I was in Boston for a closed-door meeting of retirement funds. At that time, the Fed had just restarted easing policy, and the whole discussion in the room was “can rate cuts save an already weakening economic cycle or not”.

An institutional trading director stood up and said a sentence, I remember to this day: “If you wait until interest rates really down to adjust the position, then you have missed the market the lightest section.”

It was a statement that no one shows approval at the time, but six months later, the market started to storm - and their portfolio of funds, which was already ahead of schedule, had already completed its exposure to tech and crypto concepts.

On Wednesday, the Federal Reserve will announce its latest interest rate resolution. The market is widely expected to keep current interest rates unchanged, but from the rhythm, the rate cut window is very close.

At the same time, tariff policy uncertainty is still continuing to ferment, overlaid with a large number of heavyweight earnings reports will be announced soon, the entire market is in a highly sensitive, easy to amplify the reaction of the point in time.

In the first hour of trading, the overall volatility of U.S. stocks amplified, and the Dow Jones index showed a rapid downward movement, driving a large number of stocks to short-term adjustments.

Two positions in our portfolio - $NVTS and $WULF - both saw sharp fluctuations:

$NVTS opened quickly higher, reaching +8% at one point, but then followed the market back down and is still within structural support territory;

$WULF was up over 4% at one point, then declined following general weakness in the sector, with early gains suppressed by market sentiment.

But the more important question behind this is are we having problems executing our strategy? The answer is no.

$NVTS itself is a structural trend stock, the high belongs to the system within the elasticity of the release, it today's rise is not the subject matter of speculation, but the past two weeks after the structure of the construction of the natural release;

The pullback is fast, but still above the key support line, the system signal has not been invalidated

If you are following the system to set up a position, this pullback is well within the range of permissible fluctuations.

In essence, the market is pricing in its medium-term imagination around the combination of “blockchain mining and energy cost control”;

The task of this underlying in the portfolio is not to play defense, but to take the edge of the offense, follow the main line, and capture the amplification segment;

The current position has not fallen below the system's “behavioral confirmation zone”, does not constitute the basis for strategy adjustment.

So how do we deal with these types of market mood swings?

Do not react emotionally, do not stop early, do not misjudge the structure;

Observe volume + support confirmation to determine if it is an “effective retracement” or a “structural failure”;

Most importantly: execution is part of portfolio management, and positions are always calmer than emotions.

This type of disk today is the fundamental reason why we constructed the 40/60 portfolio strategy.

As you can see - even if certain assets are under pressure, there is still room for hedging and dynamic adjustments within the portfolio.

Let's wait until this afternoon when we look at the structural signals again and see if there is any new action in the money flows before we make the next adjustments.

Don't get carried away by sentiment, we make decisions within the portfolio structure.

Today we will of course talk about these hot spots related to the stock market, but we do not stop at the level of “going up fast”.

We are more concerned about which hot spots have structural continuity and which are just mood swings.

The real decision of your account performance, is not “bet on which vote”, but whether you have the portfolio structure to build a stable, accurate direction to step on, capital allocation to do orderly.

Let's talk about the recent events.

On the U.S. side, the U.S. first signed a tariff agreement with Japan, reducing the previous 25% import tax to 15%, in exchange for Japan's commitment to invest up to 550 billion dollars in the U.S. over the next few years, and the U.S. side will also be able to take “90% of the profit share”.

Then and the European Union also negotiated a new round of agreements, the United States agreed to charge only 15% tariffs (originally Trump opened up to 30%), in exchange, is Europe in the energy and military procurement of large orders.

To put it bluntly, this round of “tariff negotiations” looks like relaxation, but in fact it is reorganizing the United States' own supply chain, pulling resources back to the internal, profit lock external

Meanwhile, the real show is yet to come - the

Wednesday's Fed meeting is a key turning point. Although the probability is that interest rates will not move, but Powell will say what, the market is waiting for this signal:

Are they ready to cut rates, or continue to delay? This is the core of the pricing of the September rate cut deal can really hit the ground running.

There is also an easily overlooked variable - the possible reopening of the US-China trade talks, and if this matter falls into place, the industry's sensitivity to macro volatility, stocks, and commodity stocks will have a significant impact.

Meta, Microsoft, Amazon, and Apple are all set to report earnings next week, and we all know how many points these companies combined are propping up the indexes.

The direction of the market is likely to be determined not by what the broader market says, but by what these four companies say.

We are entering a “three main superimposed” high-density trading window - rising expectations for rate cuts, intensified policy talks, and concentrated earnings releases.

At this point, it's not so much about how many positions you have, but where you put them:

Is it a portfolio that has structure and can catch policy expectations?

Or no confirmation, rely on the feeling of betting on the direction of the bet?

And just when everyone is still discussing “down or not down”, we have already began to act--

Why are we directing capital to crypto proxy stocks rather than on-chain spot at this point in time?

Why do these stocks fit in the “volatility control + acceleration” position of the portfolio?

And more importantly: we don't buy a stock because it's “up”, but because it meets the Core X Quantitative Trading System's triple validation criteria of structure, behavior, and money path.

Market breakouts never happen when the whole market goes up, but when key steps in the portfolio are ahead of the curve.

Today's step is the beginning of our next round of account efficiency improvements.

Now, let's get the structure of $MARA together - it's not a thematic stock, it's an offensive component of the portfolio.

My advice is simple:

Look at the main themes, allocate cleanly, and make a good mix of highs and lows within the portfolio.

Over the next few days, we will continue to explain the signals, introduce new quality tickets, and also kick off the deployment of new modules in the chain portfolio.

The point is not who reacts the fastest, but who can follow the plan, execute consistently, don't get distracted, and keep pushing - ultimately pushing the portfolio to that state where it can produce consistently.

$MARA - not just a fast mover, but the “Accelerator Component” that should be in the portfolio

The stock we're going to talk about today is one that you've probably heard of - $MARA, Marathon Digital Holdings - but you probably don't know much about it.

First, what does this company do?

MARA is one of the largest bitcoin mining companies in the United States. You can think of it as Crypto's “mining infrastructure.” It doesn't produce tokens, it doesn't distribute chains, it doesn't run exchanges, and it does one thing:

It does one thing: it mines bitcoins with massive computing power. It has the largest cluster of bitcoin ASIC devices in the United States, with one of the highest computing power in the world, and it doesn't have DeFi's messy financial leverage. It's essentially a pure Beta trading asset that's extremely sensitive to the price of Bitcoin.

First of all, from the macro environment:

We are standing on the double resonance point of rising interest rate cut expectations + bitcoin's return to the upward structure. Crypto is a highly resilient asset class, and once liquidity starts to ease, Crypto's proxy assets tend to kick in before spot.

Then look at MARA itself:

Shares completed bottom retracement confirmation + liquidity release from last week;

System identified structural validity (Core X Quantitative Trading System breakout trigger line has been tested twice and not lost);

Money inflow data showed three consecutive days of positive lines + active buyers dominated turnover.

The key point is:

MARA is “the system allows you to do fast action” ticket, but not blind rush, is in the structure of the confirmation, capital response, the logic of the subject matter of the three lines of reasonable operation.

What role does it play in our portfolio?

We didn't get into it because it was going up fast, but because it happened to fill a “high volatility growth engine” position in the portfolio:

For Bitcoin Spot, we already hold $SOL on-chain assets;

For Treasury ETFs, we've already underpinned it with $TLT and $TMF;

The mid-tier portion of the portfolio is trending with $WULF and $NVTS. Allocation.

So what does the portfolio need?

It needs an attacking position that can run fast and furious during the expected liquidity release period, but with systematic control logic.

$MARA is our chosen component.

Not something to hold for peace of mind, but something that will propel your account forward.We're here today, and tomorrow we'll continue to track the connection between $MARA and Bitcoin, not hesitating when it's time to accelerate; the system will tell us when it's time to exit.

When it's time to exit, the system will tell us. When the signal is there, just execute. We'll be back at it tomorrow before the market opens. Don't get left behind.