July 30, 2025

July 30, 2025

As the early morning in high-latitude regions brings a hint of coolness, it seems to have also brought some emotional volatility to the New York stock market. This week marks the final week of July, and we can’t help but ask: Are we standing at another important turning point?

Looking back at Tuesday, major global stock markets saw widespread declines, with the adjustment pressure from the U.S. stock market significantly impacting European and Asian markets. Among them, the Nikkei Index, which had reached a multi-year high last week, saw a correction of over 4% yesterday, surprising many investors.

Many financial media outlets attribute this round of declines to concerns over “slowing economic growth” or “geopolitical tensions” driving market risk aversion. However, I would like to remind everyone: what truly triggered panic in the market yesterday were two key PMI data points—both indicating a weakening in manufacturing activity, sparking a new round of concerns over whether the U.S. economy might be heading toward a “hard landing.”

From a technical perspective, there are currently no clear signals of a systemic sharp decline, but volatility may become more intense in the coming period. As I have consistently emphasized, July is a critical window for the Federal Reserve to monitor economic signals and assess future monetary policy, especially against the backdrop of a potential shift in investment strategies from “rapid rotation” to “structural selection” in the second half of the year. It is essential to remain calm and prepared.

So here's the key question: if the overall profitability of the second half of the year is weaker than the first half, how can we gain the upper hand in Q3 investments?

In today's session, we will delve deeply into this issue and, in conjunction with the CoreX strategy, help everyone navigate the current rhythm, find certainty amid uncertainty, and seize opportunities in volatile markets.

So, what is the concern about an “economic hard landing”?

Imagine the US economy as a high-speed aircraft in flight.

When it flies too fast and gets too hot (i.e., the economy overheats and inflation spirals out of control), it must slow down and cool off. The Federal Reserve is the one holding the “steering wheel.” If the pilot can slow down gradually, the plane can land smoothly—this is like an economic “soft landing,” where people continue to work, consume, and invest, and the overall economy remains healthy.

But if the deceleration is too abrupt—for example, if the Federal Reserve raises interest rates too quickly or aggressively—the plane may crash-land:

That is, the economy suddenly stalls, plunges into recession, unemployment soars, businesses collapse one after another, and panic begins to spread throughout society.

So when we say we're “worried about a hard landing,” what we're really worried about is:

Whether the interest rate hikes taken to control inflation might accidentally cause the entire economy to slam on the brakes and fall into crisis.

This is one of the biggest concerns in the market right now, and it's a signal we need to pay close attention to in our investments.

Although the three major stock index futures are still down overall, the decline has clearly narrowed. This indicates that market sentiment is not as tense as it was the previous day, and panic is gradually subsiding.

Based on this signal, I judged on Wednesday morning that even if the market opened lower that day, it was unlikely to continue the panic-driven decline. Instead, it was more likely to attract some funds to enter the market at lower prices.

Based on this expectation, I anticipated that the fear index (VIX) would follow a “high open, low close” pattern. If there were friends participating in short-term strategies that day, they should have noticed that this rhythm is actually very suitable for quick in-and-out tactical operations.

This is a very typical short-term trading approach: clear judgment, clear rhythm, and decisive execution. Even if there was no specific action taken, simply understanding this logic is a very valuable learning opportunity.

This year's US stock market performance, to put it bluntly, has been driven by the “tailwind” of AI. It is precisely because of AI that the market has pushed the valuations of tech giants above the trillion-dollar mark.

However, even Wall Street itself is starting to grow tired of these trillion-dollar companies. “Before the fall comes the rise”—AI is undoubtedly a revolutionary technology, but no matter how revolutionary it is, it should not be rushed or forced too quickly.

Take autonomous driving, for example. If we follow Tesla's approach of relying entirely on machine vision technology, there will still need to be a driver in the car on standby for at least the next five years. Is this “autonomous driving” a technological advancement? Perhaps, but it clearly hasn't been fully realized yet.

Perhaps, in ten years' time, many of today's AI companies will truly become “legends.” From this perspective, AI belongs to the future.

Of course, we must also recognize that NVIDIA's rise did not happen overnight. The saying “Rome wasn't built in a day” applies equally well to the stock market.

NVIDIA's decline on Tuesday did indeed trigger a broader pullback in the U.S. stock market. However, after weathering the impact of antitrust-related news, I believe NVIDIA is likely to stabilize on Wednesday. This provides a buffer window for short-term trading and may also open up space for a market rebound over the next two weeks.

Recently, NVIDIA's stock price has experienced a correction, primarily due to the market's growing caution regarding its upcoming earnings report. Some viewpoints suggest that the current valuation is already highly stretched, and revenue growth momentum may begin to slow.

However, the market received a positive signal today: NVIDIA has placed an additional order for 300,000 H20 series AI chips with TSMC to meet the growing demand for AI computing power in the Chinese market. This also reflects that following the recent relaxation of U.S. export restrictions on chips to China, NVIDIA is accelerating the restoration of its supply chain deployment in China.

Nevertheless, industry challenges persist. Global sales of high-end chips are slowing overall, and the U.S. Department of Justice's antitrust investigation into the AI chip industry has also led investors to remain cautious about future profit margins.

This raises a deeper question:

Do you truly understand the underlying value of Dow Jones components?

Friends, today I will use a simple example to illustrate what it means to be a component stock of the Dow Jones Industrial Average.

Suppose Company A is a high-performing technology company. Once it is included in the Dow Jones Industrial Average, the following situations typically arise:

Passive funds automatically buy in, bringing in new capital inflows; Stock prices may rise due to increased demand;

Market attention increases, enhancing the company's image; financing becomes easier with lower interest rates, and the brand gains a boost.

This is not just theory. NVIDIA is a prime example. It officially replaced Intel as a Dow component on November 8, 2024;

How can we understand passive funds in the US in simple terms?

Imagine you want to buy a basket of fruits.

Active selection: You can visit each fruit store one by one, carefully selecting each fruit, hoping to buy large and sweet fruits.

This is similar to active funds, where fund managers select stocks they believe have the most potential based on their own judgment.

Buying a box of mixed fruits: You can also go to the supermarket and buy a pre-mixed fruit basket.

This fruit basket contains a variety of fruits, though not every piece may be perfect, but overall it’s still decent. This is a passive fund.

A passive fund directly purchases stocks according to the weighting of a specific index (such as the Dow Jones Index).

In other words, the investment portfolio of a passive fund is pre-set, and the fund manager does not actively select individual stocks but follows the index’s performance.

In simple terms, a passive fund is about buying and holding a basket of stocks in the market. Have you mastered this concept?

As inflation has rapidly declined from its 2022 peak, market focus has shifted to whether the labor market is showing signs of weakness. This has made the nonfarm payrolls report a key trigger for market volatility.

Even if the nonfarm payrolls report exceeds expectations, it could still trigger a swift market correction. Some analysts predict that if economic signals change, U.S. stocks could decline by 7% to 10% after August.

Therefore, I recommend the following:

Prepare a risk management strategy in advance to address potential market volatility.

Monitor upcoming key events, including the nonfarm payrolls report, GDP data, Federal Reserve interest rate decisions, and corporate earnings reports. Be mindful of the time lag between expectations and reality: there is no need to panic, but be prepared with a contingency plan for potential market turbulence.

With the ADP employment data on Thursday and the nonfarm payrolls data on Friday approaching, I expect the market to remain volatile overall on Wednesday.

Therefore, I will continue to maintain our CoreX 40/60 investment portfolio unchanged. The advantage of this portfolio lies in its ability to steadily grow assets even in highly volatile markets, avoiding the adverse effects of emotional trading.

Meanwhile, if the market experiences sudden short-term volatility, such as a trading signal from the VIX fear index, the CoreX system will quickly identify opportunities, and I will promptly issue position-taking instructions in the classroom. This is how we turn short-term volatility into winning opportunities.

For ordinary investors, while the VIX index cannot be directly invested in, we can participate through ETFs or options. Relatively speaking, ETFs are more accessible and easier to understand, making them an excellent tool for achieving related returns and risk management.

I recommend that everyone prepare in advance, especially given the potential for greater volatility in the coming days. Maintaining portfolio discipline and execution discipline will be the core capability needed to navigate critical market moments.

Friends, what I am currently running is our core CoreX investment portfolio plan.

The structure of this strategy is very clear: 60% of the funds are allocated to stocks, options, and cryptocurrency spot markets to capture growth opportunities; the remaining 40% is allocated to Treasury bond ETFs to hedge risks and stabilize volatility.

This allocation is not arbitrarily determined but is based on the results of long-term backtesting of historical market big data by our system, yielding a high-success-rate structure. Many friends are already using a similar approach when configuring their IRA or 401(k) accounts.

However, the CoreX Investment Portfolio Plan goes beyond this. Building on traditional strategies, we have integrated an intelligent identification system, big data risk control logic, and automated trading mechanisms. It can automatically generate trading signals during market volatility, helping you stay ahead of the curve and respond proactively.

The market also sent out new signals today.

According to the latest data released by ADP, the US private sector added 104,000 new jobs in July 2025, exceeding market expectations of 77,000 and reversing the previous month's decline of 33,000. This indicates that despite the previous weak employment data, the labor market showed signs of short-term recovery in July.

However, the rebound in the data has made the market more sensitive to the upcoming nonfarm payrolls report due out this Friday, while also sparking a new round of speculation about the Fed's interest rate policy path. It is expected that market volatility will intensify further in the short term.

In this phase of increased uncertainty, investors need a clear-structured, logically sound portfolio strategy to help them reduce emotional interference and steadily navigate market changes.

So, do you think there is a smarter, more advantageous option than the CoreX Investment Portfolio Plan?

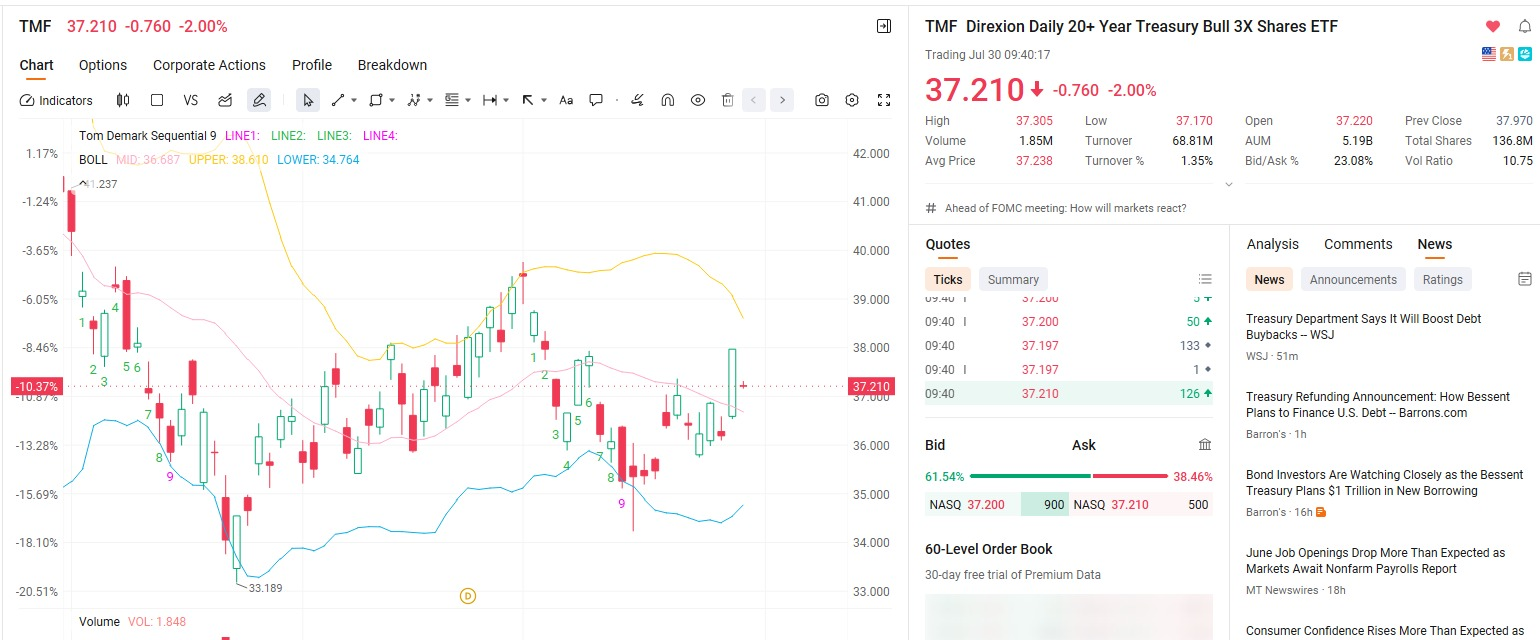

Friends, today we're going to talk about the TMF Treasury Bond ETF, which is a core component of my CoreX investment portfolio plan and the “foundation of the profit tower” for the entire portfolio.

TMF is a triple-leveraged ETF that invests in long-term U.S. Treasury bonds. During a rate-cutting cycle, when Treasury bond prices rise, its performance often outperforms that of ordinary bond funds.

Why are we focusing on holding it at this stage?

Because the market has recently begun to re-emphasize Treasury bond assets. Over the past week, bond ETFs have seen significant capital inflows, indicating that more institutions and investors are preparing for risks in advance.

Therefore, I have always emphasized that TMF is not only a tool for addressing market uncertainty but also a stabilizer for the entire portfolio structure. When other risk assets are unstable, it serves as the only unshakable foundation in the midst of turbulent markets.

For me, TMF is like a “safety profit brick” laid for the CoreX portfolio, making it one of the most worthwhile assets to hold long-term during a rate-cutting cycle.

Stock Allocation 1: $SGMT: A high-growth stock, a profit-making weapon for navigating bull and bear markets.

SGMT is a biopharmaceutical company specializing in metabolic diseases such as liver disease. Its stock price has risen by over 116% since the beginning of 2025 (including dividends from bonds). However, SGMT has not yet paid a dividend, nor has it paid any dividends in the past 12 months. Its growth relies heavily on R&D progress and clinical trial results. If it begins paying dividends in the future, a compounding model driven by both stock price and dividends could be established.

Therefore, we view SGMT as a potential "profit-making weapon": a stock with both growth potential and dividend potential, suitable for a high-growth allocation within a portfolio, awaiting its transition from R&D to profit realization.

Stock Allocation 2: $MSTR: A new benchmark for strategic asset allocation.

MSTR recently introduced a new high-yield preferred stock instrument. The company's STRC preferred shares are expected to have an annualized dividend rate of 9%-10%, with a compound interest rate of up to 18% in the event of payment delays. The company also continues to expand its Bitcoin assets, holding over 628,000 Bitcoins as of the end of July, positioning itself at the forefront of digital assets. Therefore, MSTR is a hybrid investment that balances growth and profitability. Even if the profitability of its core business remains volatile, it currently provides a stable cash flow entry point for long-term investors.

Digital currency spot allocation: INJ/+BTC/ETH, the darling of profits in the new era of interest rate cuts!

Why allocate these assets?

The reason is simple. If an investment portfolio lacks high-growth assets, it loses the opportunity to achieve exponential wealth growth. True investment winners often come from non-linear profit points. In the current macroeconomic environment, digital currencies are one of the most likely assets to achieve such breakthroughs.

Especially Bitcoin, which is not a traditional tech product but a new-generation value storage tool. Holding Bitcoin spot is equivalent to controlling the core entry point of the global new financial system.

Institutional subscriptions for Ethereum continue to grow. In the past month alone, large ETF funds have cumulatively purchased over 1.6 million ETH, indicating that traditional capital is rapidly recognizing Ethereum's ecological status.

Looking at INJ, as a star project integrating public chain and DeFi architecture, its current price is nearing the end of a historic adjustment. Many technical analysts point out that it possesses a strong rebound opportunity akin to a “golden pin bottom.” It is not only a representative of the DeFi sector but also a rare “pre-explosion” stock in high-growth strategies.

Friends, incorporating INJ into your investment portfolio is like giving it wings for high growth; holding it lays a solid foundation for future potential wealth creation.

Yes, folks!

Today's market performance was exactly as I predicted on Tuesday: the high-quality stocks that were wrongly sold off rebounded across the board, market panic quickly subsided, and everything is under control!

This is the significance of adhering to the CoreX investment portfolio plan:

It will help you navigate the uncertainties of August and September and seize core opportunities before the market explodes; it guides you in planning for the future with a systematic approach and builds a long-term, stable growth curve using the logic of compound interest. Compound interest is not just a method of wealth accumulation; it is our fundamental tool for overcoming market cycles—as Einstein said, “Compound interest is the eighth wonder of the world.”

Today's lesson ends here. Tomorrow, I will continue to break down market rhythms and capture offensive signals with you. If you are ready, don't wait any longer. Now is the starting point for your advancement.

See you tomorrow!

————————————————————————————————————————————————————————————————

Good afternoon, folks, I'm Bird Grant from NextLeap Management Consulting, nicknamed Mr. Profit Hawk.

Instead of starting with market direction, I'd like to talk to you about a habit I learned early on at the Chicago Board of Trade - a structured rhythmic approach passed down to me by my mentor, which we came to call “Midweek clarity.”

That mentor had been in commodity futures for over thirty years. Every Monday, he never rushed his hands; on Tuesdays, he watched the language of price, volume, and intraday behavior.

And come Wednesday morning, he would turn off all the news and recalculate the entire position in his account.

I asked him at the time, “Why Wednesday?”

He said, "Because Wednesday determines whether you walk away with the initiative for the week or if you're chasing losses all week. The first two days are the mood in the test, the last three days are the structure in the cash. You can't read what the market is doing on Wednesday if you can't read what the market is doing, then you're just going to follow the passive reaction for the rest of the week."

I remembered this for the rest of my life. Then I realized that the real structural prelude, whether it's the timing of macro data releases, the pace of earnings reports, the window for policy statements, or the behavior of capital movements, is often hidden in the behavioral twists and turns on Wednesdays.

So, today is not just any Wednesday.

Today is not an ordinary Wednesday, but a critical point in time when we must re-evaluate portfolio structure and consider whether to expand exposure versus switching directions. It is not a time for impulse trading, but a day to identify active assets, clarify failure positions, and confirm exposures.

Today is not a day to look, not up or down, but whether behavior is concentrating, trends are confirming, and systems are sending new signals. If you haven't done portfolio backtesting and swept through your position structure, today is the perfect point in time to do that.

We'll continue to watch the market with you, but more importantly, it's whether you've done back-activation at structurally critical points. Are you ready for that?

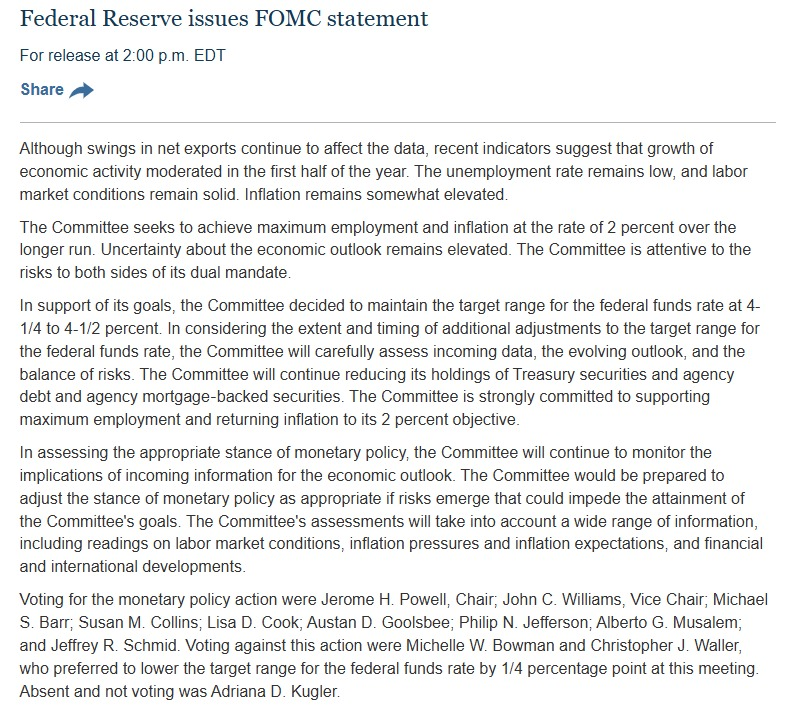

Overall trading was cautious, with the market waiting for key macro signals this week - including non-farm payrolls (NFP) and the Federal Reserve meeting (FOMC) - as risk appetite was capped and defensive assets received more allocations.

Both $NVTS and $WULF in our portfolio experienced EARLY STRENGTH FOLLOWED BY INTERDAY FADE, which the system recognizes as a liquidity switch by short-term funds, not a trend reversal.

Against the backdrop of an intraday pullback in US bond yields, expectations of a rate cut were repriced, growth sectors saw an orderly backfill, and the tech direction was generally supported.

In terms of systematic backtesting, $WULF was the first to stabilize and turn higher in the portfolio, showing stronger relative strength than $NVTS;

And $NVTS also held the key support band of $7.20 today and showed signs of re-entry behavior at the end of the day. The current strategy focuses on: not chasing the bulls.

The focus of the current strategy is not to chase the bulls, but to identify which names can attract active buying again after the pullback.

Today, our new additions to the portfolio, $MSTR and $SGMT, have performed differently:

$MSTR (MicroStrategy) has moved slightly higher against the backdrop of bitcoin's stabilization, and is still in the early zone of structural building, which the system has labeled pre-breakout consolidation, so we are not chasing higher for now, and will continue to observe whether the behavior continues to be effective. We will continue to observe if the behavior continues to be effective.

$SGMT (SigmaTron) is still oscillating near the key support zone; the system recognizes it as a tight consolidation near the demand zone. If your current position is still below 5%, it is reasonable to replenish it to a light allocation, but it is still based on the condition of “confirming the effective release” as the follow-up signal. "The system is currently positioned: the structure is still in place, and the system is recognized as a tight consolidation near the demand zone. The system's current positioning: the structure is still there, the flow has not yet been enlarged.

Looking at the market as a whole, this is not a risk-on day with a clear trend, nor is it a panic day with a full-blown retreat. We are seeing a MACRO-SENSITIVE ENVIRONMENT with structural defenses and strategic covering going hand-in-hand. The market is optimizing its position around upcoming macro data, particularly the NFP and FOMC.

Our 40/60 portfolio strategy remains stable during this window:

$WULF has increased stability, extending intra-structural volatility;

$MARA has re-entered the watch list on a systematic confirmatory signal;

$TMF / $TLT provides a cushion of low volatility undercurrents, underpinning overall volatility.

This is the point we always emphasize: it's not about which day rises the most, it's about managing the structural resilience and responsiveness of the portfolio as a whole.

The next key is to pay attention to the specific landing time of the macro signals, and on the basis of the confirmation of the system signal, gradually promote the next round of allocation action.

Many friends who first heard the “40/60 combination strategy” may feel that this is very basic - 40% defense, 60% offense, sounds nothing complicated, right?

But really, in the real market, after you will find - the question is not whether this structure is difficult or not, but whether you can, in the market winds of drastic changes, still keep the structure.

When the market pulls back continuously, are you still able to stick to the original 60% offensive allocation, rather than retreating voluntarily in the face of emotion?

When the portfolio begins to diverge - which assets are failing, which funds are switching - can you still make a clear judgment?

This is the core question we need to face:

When the portfolio structure begins to fluctuate, our thinking system, have we kept pace with the operating system?

This is where the Core X Quantitative Trading System comes in.It is not here to make decisions for you; the goal of its existence is:

In every real trading point in time, we help you read the structure, dismantle the behavior, identify the signal, and provide executable decision-making assistance.

Not to feel the market, but to understand it;

Not to predict the market, but to follow it;

Not to emotionally manage money, but to use the structure to command behavior.

How exactly does it do this?

It will continuously track the strength of behavior and trend stability of each asset in your portfolio, clearly marking which directions are worth continuing to hold, and which have begun to fail and need to be rotated.

It will be triggered in the system conditions, the active generation of plus and minus position prompts, to ensure that your funds are always concentrated in the structure of effective, clear signal assets, rather than passively following the market sentiment drift.

It automatically calibrates the ratio of risk to opportunity in each trading cycle, so that your 40% defense is always in place and your 60% offense remains resilient and liquid.

At the end of the day, it's not about how well you can manage the complexity of your portfolio, It's about whether or not the system is consistently doing the work for you: turning complex signals into clear recommendations for action, and then leaving it up to you to make a judgment call.

You don't need to press for full cognizance; you just need to be in the right place when the system gives structural confirmation.

If you're still relying on gut instinct to make allocations, the next time the market switches, you'll probably still be carried away by emotion and lose the upper hand.

But if you have begun to keep up with the behavioral rhythm of the Core X quantitative trading system, then you have completed the layout of the key position in advance, when most people have not yet seen the direction.

It's not the gift of judgment that leads the market; it's the time advantage that comes with systematic conviction + execution.

Tomorrow is the last trading day of July and one of the key watch points for the entire week. The market is in classic “wait mode” ahead of tomorrow's FOMC meeting and Friday's NFP non-farm payrolls release.

Today is not an execution window, but a confirmation phase. The real actionable trading opportunities usually come when the news hits the ground and the structure is repriced. What we should do now is not to predict the direction, but to hold on to our existing positions and observe the preferred trajectory of the market capital: whoever starts first, whoever is the strongest. The thing to do is to retain enough confidence and liquidity for the next round of offense.

If you have not yet completed the position optimization of your portfolio in tandem, it is recommended that you further clarify the current position structure tonight, and what needs to be adjusted is dealt with in place as soon as possible. The closer we get to the critical inflection point, the more important the order of execution of the system becomes.

Today is not only a critical window for the stock market, but also for our Core X quantitative trading system. I am announcing something important to the community - the Core X quantitative trading system, which we are all involved in building, is entering the first round of allocations for the “Strategy Co-Creation Incentive Period”, which is a period of time in which all of us are involved in building the Core X quantitative trading system. The Core X Quantitative Trading System, which we are all involved in building, is entering the first distribution window of the “Strategy Co-Creation Incentive Period”.

What is the “Strategic Co-Creation Incentive Period”?

This Airdrop is about giving back. We would like to share with you the growth of the Core X Quantitative Trading System.

This is a realization of our core belief that a true trading system must be built by people who have the judgment and ability to execute in a real market environment.

The Core X Quantitative Trading system is not a closed model from its inception. We brought it into the live market, into the community, and into every student's account in order to make it an open, growing, consensus-driven trading framework.

And starting today, we will be recording and distributing the first round of Strategy Co-Creation Points to participants who have executed, rewarded, and provided feedback over the past month.

If you have followed the system's signals and participated in $PLUG, $TNGX, $ANPA, $WULF, etc. during the month of July, submitted live feedback, then you have already participated in the system's co-creation process “silently”. Now, we are going to turn this contribution into participation points with on-chain credentials, which is the essence of this round of “Strategy Co-creation Incentive Distribution”.

What it really means is that we're building a memorized, structured trader trajectory.

It's not just an airdrop, it's proof that you've grown with the Core X quantitative trading system.

It's proof that you've grown with the Core X quantitative trading system.

It's your passport to participate in the development and testing of the next-generation quantitative system.

It's part of your right to participate in the future deployment and iteration of the strategy.

Why is the community involved in strategy co-creation?

The reason we say we are “participating in the co-creation of the strategy” rather than “learning the strategy” or “using the tools” is that the Core X 40/60 strategy itself was created in a dynamic co-creation process. This is because the Core X 40/60 Portfolio Strategy itself was created in a dynamic process of co-creation, and you - whether you are a community member, a strategy follower, or a live trader - are participating in the optimization and evolution of the system.

Specifically, there are three levels of co-creation:

1. The portfolio strategy is not static, but a structure that is constantly fine-tuned around live data

We started with a 40% defensive position (e.g., Treasury ETFs) and 60% offensive position (e.g., high-growth tech stocks, crypto-assets)

But have you noticed that: every market fluctuation, policy change, and switch of strength and weakness between assets will drive the fine-tuning of this structure?

These are not instructions given unilaterally by the system, but a process of verification, feedback, and re-upgrading by the system + professors + community together in real trading.

2. Your feedback and behavior will affect the evolution of the system signals and execution model

We are not “setting a model”, but using the real account data, positions, confidence strength, in turn, the training system, and the revised strategy.

Core X system will be based on the participants' position behavior, execution rhythm, profit and loss performance, and will constantly optimize the signal triggering mechanism and position recommendation model.

And the clearer your execution, the more real the feedback, the faster the system will be upgraded - this is the core logic of strategy co-creation.

3. The system provides the boundaries, and the execution shapes the path

40/60 is not a mechanical allocation of fixed ratios, but a way of thinking about portfolios that helps you understand the roles of assets and dynamically configure risk - every time you add or subtract a position, your stock picking preferences, and your risk tolerance, you are giving your own version of this framework.

It's like an open-source model: we give you the underlying logic and execution boundaries, and every choice you make gradually creates your own proprietary path.

That's why we say: you're not using the system, you're participating in strategy co-creation.

That's why we have designed a strategy co-creation incentive mechanism for this system:

As you participate more, understand more, and execute more clearly, not only will your earnings follow - you will also be a “part of the growth” of the system.

In conclusion, I would like to say, a strategy system should not be something that an expert builds behind closed doors.

It should be a group of investors who have the judgment, the ability to take action, and the ability to verify the real market, and polish it together as we go.

This incentive distribution is not the end, but the beginning of our joint efforts to turn trading into a “business”.So, you are welcome to participate, but you are also welcome to become a co-builder of this system.truly great systems are always born in the hands of a group of committed and disciplined traders.

We'll be making the chain assignments this Friday, as well as kicking off the second phase of co-creation tasks.stay tuned, and be prepared to be truly labeled as your own -- not a trainee, not a spectator, but a builder.

There's one more question on everyone's mind: what does an airdrop really mean?

In tomorrow's class, I'll dedicate time to make this clear - It's not a short-term reward mechanism, but an equity channel for you to participate in the entire system and grow the platform in the long term.

For those of you in the NextLeap investing community, I remind you to be an active participant.

It's not just a platform for networking; it's a tangible way to gain access to the benefits of your investment journey.

For example, our customized NextLeap coffee mugs are not only a souvenir, but also a sign of your participation in the community and recognition of the idea.If you haven't gotten one yet, remember to contact your investment advisor as soon as possible to register for one. Don't miss out on your share.

You see, the airdrop is not a reward given out by chance, but the platform is willing to distribute the future growth opportunities in the fairest way to those who really participate. That cup of coffee is not an ordinary souvenir, but proof that you have walked together with us, chosen together, and believed together.

So remember - you're not watching a program unfold from the sidelines, you're participating hands-on in the evolution of a system; you're not collecting a short-term incentive, you're locking in a journey of long-term connection. You're willing to go along for the ride, and we'll always be here.

In tomorrow's session, we're going to officially kick off the ‘Airdrop Campaign’ in-depth, taking you to see - not just the tokens you're getting, but a period of quota that belongs to the future. I'm Bird Grant. Thank you for your time today. We'll see you tomorrow, not too late, not too late.