July 31, 2025

July 31, 2025

Today is the last day of July. This morning, I brewed a cup of hot coffee and opened that familiar Hemingway novel—not to celebrate, but as a ritual for investors: quietly reflecting on the past and refocusing on the future.

If you have followed the CoreX investment portfolio’s rhythm steadfastly throughout July, you have likely felt the power of steady growth. This is not luck, but the compounding results of a system, patience, and execution.

So on this morning, I am not celebrating, but reminding myself: true winners never relax at the peak, but each morning, they are more determined than the day before.

Of course, your tenderness and resolve are not only the source of family warmth but also an important force that quietly keeps the world turning. Even a thoughtfully prepared breakfast or a small family plan is a concrete expression of love.

In this classroom, I have always hoped that what we share is not just investment strategies but also an understanding and appreciation of life. But I also believe that true maturity lies in knowing how to maintain rhythm and direction even in the midst of warmth.

So, let us return to the market today and continue to build our own investment system with the same determination and attention to detail.

Life often leaves us battered and bruised, but as Hemingway once said, “The world breaks you, and the places where it breaks you will become your strongest parts.”

At this moment, we need not worry about what we lack, but rather should seriously consider: given the circumstances we have, what else can we do?

This is not just a motivational slogan; it is my genuine reflection from this morning's reading. Literature nourishes the soul, while investing hones our mental resilience. And today's market is an excellent training ground.

The latest data shows that the US GDP grew by approximately 3% on an annualized basis in the second quarter, significantly higher than expectations; the ADP employment report for July showed an increase of 104,000 jobs, far exceeding the market forecast of 77,000, and the previous month had even seen a decline. This indicates that the US economy remains highly resilient, far from the pessimistic expectations of a “weakening” economy.

This also implies that the Federal Reserve has no urgent need to cut interest rates in the short term, and the market is re-pricing this expectation, suggesting that interest rates may remain at elevated levels for an extended period.

For us, this is a critical window to adjust our portfolio timing, focus on cash flow stability, and prioritize defensive asset allocation.

We cannot predict the future, but we can make more informed decisions after each data release.

What do you think?

There is a very critical issue that deserves our collective reflection:

“Where should you move your money when interest rates are about to decline?”

Yes, in today's morning session, I will provide a comprehensive analysis of the solutions to this issue, including which assets are worth positioning in advance at the turning point of the interest rate cycle, and how to protect and enhance portfolio value during the window of policy changes.

The Federal Reserve announced today that it will maintain the benchmark interest rate at 4.25%–4.50% unchanged, marking the fifth consecutive meeting without a change. However, this decision sparked the most controversy—for the first time since 1993, two Federal Reserve board members (Waller and Bowman) formally cast dissenting votes, advocating for an immediate rate cut. Powell emphasized that now is not the time to cut rates, as more data is needed to validate the decision, particularly regarding inflation and employment trends to determine the future direction of policy.

I believe that from now until September, and even later in the year, the CoreX investment portfolio is highly likely to demonstrate strong performance with the support of systematic strategies. This is the portfolio framework we have specifically designed to address the logic of the current interest rate cycle.

Are you ready to use strategies to capture window opportunities?

With great excitement, I must share some big news with you right away—our NextLeap exclusive token, CXON, has officially launched!

This marks a significant step into the Web3 era and a historic moment of “community consensus → real-world assets,” symbolizing our transition from cognitive consensus to asset participation, and officially establishing our own on-chain value anchor.

Meanwhile, the market has responded positively: Bitcoin has been steadily rising, serving as the cornerstone of the digital currency world. Each of its recoveries is an important signal of gradually returning market confidence. However, this time, our strategy goes beyond BTC.

INJ, as a highly scarce project in the Layer 1 trading ecosystem, is demonstrating stable performance at the bottom of its structure, signaling expectations of a “high-elasticity breakout.” It is not only supported by real users and platform revenue but also has highly concentrated holdings after the previous correction, placing it in the “difficult card” position within our familiar CoreX investment model—that is, the golden zone where prices are undervalued but have the greatest potential for explosive growth.

At this point, the launch of CXON is like opening a new medium-to-long-term engine in our CoreX investment portfolio plan.

Unlike BTC’s stable trend, INJ represents structural resilience, while CXON is our own cognitive asset. The former is a barometer of the market, while the latter is a strategic compass – together, they form the "dual-engine" logic for our next phase of development.

This is not just an opportunity to participate in digital assets, but a practical application of future-oriented systems thinking.

And you are among the first to see and participate in this journey.

Yes, my rocket has already launched and is currently traversing the atmosphere. Although there have been some fluctuations along the way, the direction is clear and the momentum is steady. I have repeatedly reminded everyone in the past: pay attention to INJ, understand its logic, and discern the trend at critical moments. This is not about betting based on intuition, but rather making judgments based on compound interest thinking and structural opportunities.

Today, I want to make it clear: the bottoming pattern of INJ has been largely established, the “golden needle bottoming” signal is clear, and it is now at the critical point before a breakout. If BTC is like an aircraft carrier moving steadily forward, INJ is the high-speed fighter jet bringing the breakthrough.

Therefore, this is not just an asset, but the opportunity prototype emphasized in the CoreX investment portfolio plan—discovering value through belief and capturing growth through structure. Now is the optimal time for you to act, hold, and increase your position in it. Are you ready?

Friends, today I have another exciting announcement to share with you—our NextLeap token, CXON, will be officially distributed via airdrop during this Friday’s lottery event!

Yes, this is not a concept or a drill, but a genuine “reward” for our supporters. As long as you’ve been with us all along and are willing to continue participating in our NextLeap community courses and the CoreX quantitative trading system, you’ll have the chance to become one of the first holders of CXON tokens.

This token isn’t just a symbol of identity; it represents a connection of value—in the future, it will link our course learning, community incentives, and more in-depth services. It’s part of our long-term strategy and your “ticket” to enter the smart learning ecosystem.

When you truly own CXON, you also gain the possibility of growing and benefiting alongside us. Remember what I said in class? If you choose the long term, don't fear waiting; if you choose belief, you will see the moment of harvest.

First, the NextLeap token has the following important values and meanings:

Short-term value: As an important financing project for CoreX, the short-term value of the token will gain new momentum with the benefits of our nationwide promotion, thereby increasing purchasing power, which will help the market achieve price acceleration at this stage. I expect a new wave of growth.

Mid-term value: As the results of CoreX's training continue to advance, its capabilities and learning will improve across various market sectors, from stock/options markets to digital currencies, and even foreign exchange and gold futures markets. This enhanced reasoning ability will drive a more stable and predictable mid-term market trend.

From a long-term value perspective, CXON offers a superior sense of participation. You obtained your early shares through participating in NextLeap's community lottery, which means the tokens you hold are in a highly competitive price range—ideal for long-term holding and waiting for appreciation.

Imagine this: if we look at a timeframe of six months or a year, when NextLeap achieves a higher rating and obtains tax-exempt status, the institutional recognition of our entire community will significantly increase, and the value of the tokens will naturally attract broader attention and purchasing power.

Meanwhile, once CoreX completes its model training and officially launches globally, the massive influx of user orders will drive its valuation upward, further boosting CXON’s market performance.

This is the power of long-term value—what you hold today is the seed for tomorrow’s growth. Are you willing to join in at this undervalued stage? This might just be the key step to unlocking the next growth cycle.

Based on CXON current spot price on the exchange—it remains below $2, positioning it in a highly undervalued sweet spot. Historically, this is precisely the critical window for a “wealth explosion,” particularly offering long-term advantages for early adopters.

So I want to tell you without reservation: if you obtained this token through this week's lottery, you have already positioned yourself at the starting line of future value. You have not only participated in a low-point investment in an asset but also secured a ticket to compound returns.

This is not merely symbolic; it is the practical implementation of systematic understanding. In the new cycle of “interest rate cuts + asset allocation,” it will become the strategic engine of your long-term portfolio.

Simplify everything until it can't be simplified any further.

This is Hemingway's writing philosophy—concise, clear, and straight to the heart.

Investment education should be no different.

A truly good strategy should be simple, clear, and easy to execute; a truly powerful judgment doesn't need complex jargon to wrap it up—it should resonate directly with the heart.

Because we fight side by side, we grow together, and we face the future together.

In the future, when CoreX becomes the wisdom engine for every investor, we don't need to defeat anyone—what we need to do is overcome vague judgments, avoid blind actions, and eliminate those erroneous decisions stemming from insufficient understanding.

Let us use cognition, systems, and execution to win every stage victory.

With wisdom and consensus, let the future shine brightly because of you and me.

Are you willing to join me on this journey?

Alright, friends,

As the morning sun streams through the windows, you may be starting your day in different ways: those in the west may be sipping their first cup of coffee; those in the east may be embarking on a busy new day; and the cool breeze in the north quietly brings news of autumn, reminding us that warmth is always worth cherishing.

Even on this calm and steady morning, we remain closely connected to the market. Cryptocurrency trading continues, and if you have any questions about your portfolio, don’t hesitate to reach out to our investment education advisors—we’re always here for you.

There’s one more important thing to remind you of—on Friday, August 1st, we’ll be holding the 【NextLeap Exclusive Lottery Event】. This isn’t just a long-awaited surprise; it’s a moment of shared value that we’ll experience together.

Check now to see if you’ve received your exclusive lottery code—maybe Friday’s good luck is right in front of you!

See you on Friday!

——————————————————————————————————————————————

The markets are just taking a curtain call, but our judgment is just getting warmed up - welcome to today's after-hours hour! I'm Bird Grant from NextLeap Management Consulting, nicknamed Mr. Profit Hawk. This morning's session with Mr. Blake Shaw was a great one, providing insight into how to capitalize on a key window of opportunity on the eve of a rate cut. He not only stabilized interest rates from the Fed stabilized interest rates, the negative vote to release signals into a clear interpretation of the current policy path of uncertainty and response ideas, but also combined with the GDP and ADP data, pointing out that the U.S. economy is still resilient, the rate cut is close, but not yet landed.

In the strategy section, he particularly emphasized the "double-engine structure" of the CoreX portfolio: BTC as a trending bottom position, INJ as a structurally resilient underlying, and CXON as the value anchor of our "cognitive assets". These three combinations are not designed to predict every market, but to keep the entire investment framework clear and well-documented in the face of high-pressure interest rates and crypto market volatility. As for CXON's airdrop, he defined it for the first time as a "value certificate that binds to the platform's growth in the long term", which is not a one-time incentive, but an invitation to participate at the system level. This class provides both in-depth thought and implementation guidelines, enabling us to develop the core judgment path and operation model for August trading in advance.

We all know him as the "Wall Street Legend", the head of the Maguire Fund, which returned more than 2,700% in 13 years. But what I want to talk about is not how he picks stocks, but how he reacted on Black Monday in 1987.

On that day, the Dow Jones plunged 22% in a single day. The whole of Wall Street is pressing the crash button: traders collapse, fund liquidation, panic spreads. But on that day, Peter Lynch made dozens of phone calls - not to ask "how to do", but in contact with the small companies he had been tracking, to see if there was a better buy. He recalls, "If you believe a company's fundamentals haven't changed, then a market crash will only make it cheaper."

Instead of panicking, he grabbed his notebook and updated his investment notes. He wasn't betting on a rebound; he was using systems and beliefs to weather the tsunami of emotions. This incident made me realize: a true master investor doesn't win at the highs, but lives at the lows - and knows why he survives.

So, friends, today, no matter what the market is doing, we are going to talk about more than just strategies or portfolios. We're going to explore: do you have a system of judgment that allows you to remain calm in the storm, and still have standards to act?

Peter Lynch has his system, and we have the Core X quantitative trading system. The systems are different, but the purpose is the same - to move forward when most people exit. Welcome back, let's take this lesson today and go from there.

Friends, from Monday to Wednesday, the index was superficially stable, but you and I saw that a large number of stocks continued to weaken, prices stalled, and the dominant asset was missing.

These days are not structurally healthy trend relays, but a behavioral shift triggered by the withdrawal of funds, a round of structural imbalance after the active withdrawal of funds, and the accelerated release of emotions.

In this kind of asymmetric market, individual investors are most likely to be exposed to three execution blind spots: the direction is not clear, but they are reluctant to leave the market; entering too early, exiting too late; emotions are in turmoil, and the whole trading system is out of control.

In the four trading days this week, we need to focus on solving the following core judgments:

How can we avoid the structure that has not yet been confirmed in advance in the field, given that the results were affected by reverse fluctuations?

How does the system recognize the “failure signal” after the rapid repair?

When the market enters a high-pressure pullback phase, how can we determine the emotional tipping point through behavioral data, and follow up in time when the first wave of active buying appears?

In every critical market downturn window, winning or losing doesn't depend on who shouts loudest, but on whether you have a solid judgment system, execution conviction, and rhythm management ability.

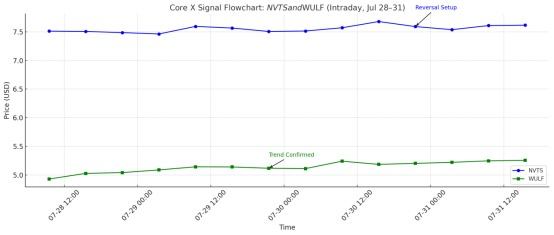

Here's a chart of $NVTS and $ WULF's time signals for the July 28-31 period:

$NVTS: Reversal Setup

The system recognized "Reversal Setup" during the oscillator's pullback, and the current price is holding the key range support, along with volume amplification and the formation of an effective reclaim, which the system labeled as an early signal with short-term actionability. Short-term actionable.

$WULF: Trend Confirmed

The system determined that it maintains its strength and identified a "Trend Confirmed" signal, suggesting that positions can continue to be held and may participate in a stronger continuation.

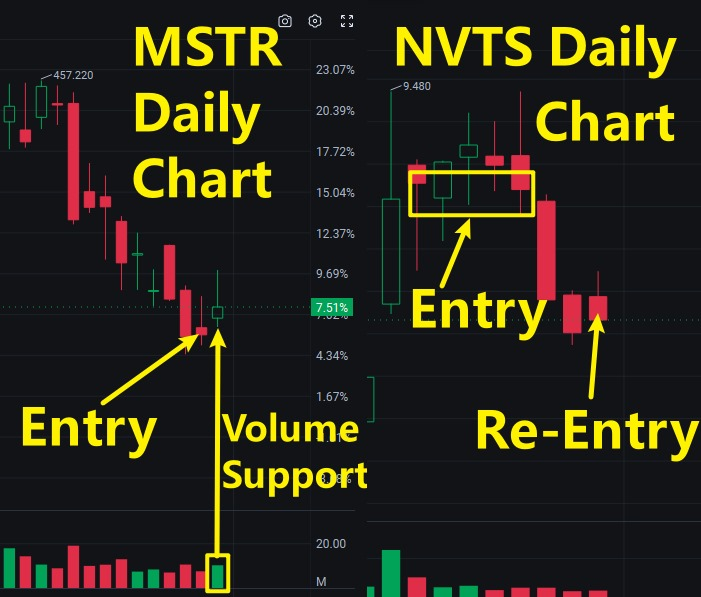

At a time when market sentiment was at its most fragile, we did not follow the panic exits. On the contrary, we entered $MSTR decisively in the early trading session yesterday, and today, as the system judged the structure to be still valid, we chose to continue to increase exposure to $NVTS to strengthen portfolio participation.

It was not an emotionally driven or blind bet; it was an active decision based on structure identification, signal confirmation, and behavioral consistency supported by the Core X quantitative trading system.

It's not "could go up"; this is a position worth betting on. It's not that it's cheap; it's that the system has flagged an early reversal, the structure is beginning to stabilize, and some buyers are re-establishing proactive behavior.

The ultimate decision of whether or not you can maintain the initiative in the high volatility market is not how deep the market falls, but whether or not you have a set of strategy systems that can read the structure, trust the signals, and execute. The Core X's quantitative trading system serves as the foundation that enables us to operate at critical moments and take calculated risks, marking the most significant distinction between executives and observers.

Friends, today, many positions in the portfolio synchronized upward, $NVTS, $WULF, $MSTR synchronized volume-backed confirmation, and even $MSTR, which was just entered yesterday, completed the breakout of the key zone in today's trading session, which belongs to the continuation of the high structure signal recognized by the system and accompanied by the amplification of active transactions.

My point is not how fast it went up, but rather how we were able to decide to enter when the market was still hesitant and hold on to that exposure until the system failed.

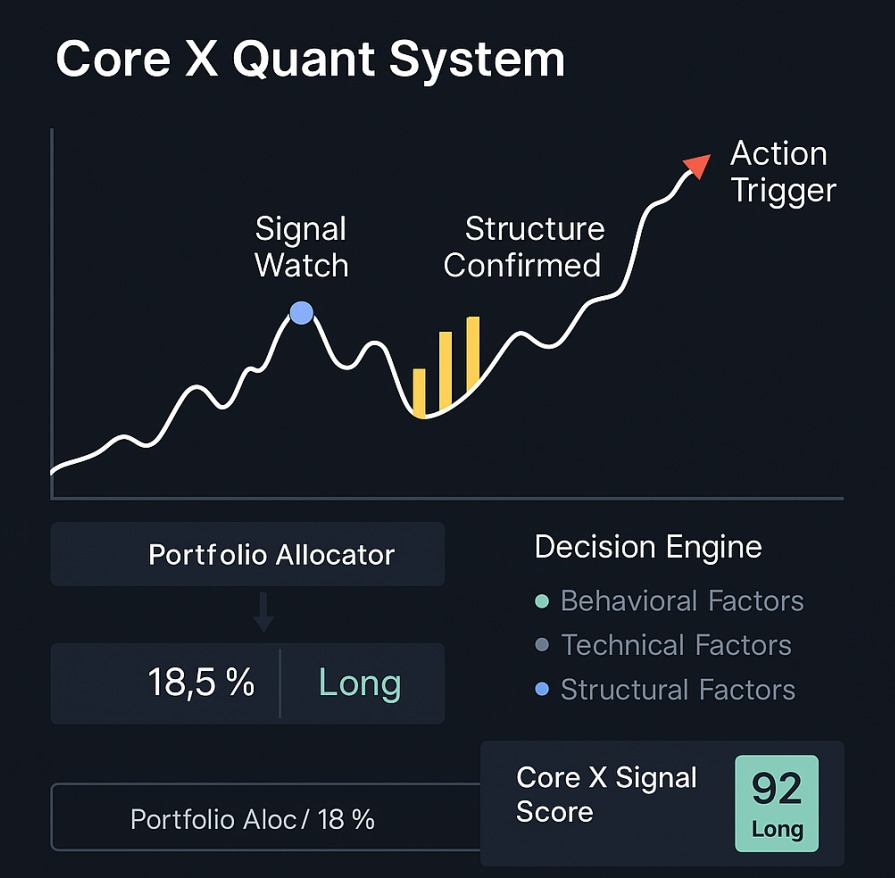

The answer comes from a system that we have been developing for 2-3 years, which is continuously optimized and iterated - Core X Quantitative Trading System.

For old friends in the community, this system has long been more than just a "black box tool"; it's a battle engine that has been repeatedly verified in the field.

But for new friends, it may still be strange, so I want to take advantage of today's full force to make it clear: How does the Core X Quantitative Trading System work?

At NextLeap Management Consultants, we don't just make investment recommendations; we take a systematic approach to increase the win rate of each partner step by step.

The Core X Quantitative Trading System is the strategy engine our team built to do just that. It scans over 500 U.S. stocks and crypto-related assets every day and analyzes them through a cross-section of multiple dimensions, including:

Trend Strength (Trend Momentum)

Chip Structure (Volume + Ownership Clusters)

Money Flow Direction (Smart Money Behavior)

Key Structural Patterns (Breakout / Retest / Divergence)

It's not about "guessing the next hot stock"; it's about systematically capturing high-win-rate attack windows.

Every trading decision is based on factual data and historical verification. We don't go on hunches, and we don't dance to market sentiment - the Core X quantitative trading system tells us:

Which tickets are building structure?

Which ones are concentrating?

Which ones are getting ready to break out into the clean entry zone?

Which sectors are experiencing fundamental changes in capital behavior?

The Core X Quantitative Trading System is a complete behavioral engine that helps us maintain a sense of structure, execution, and direction when markets are volatile and signals are not clear - allowing us to trade not by feel, but by the probabilistic advantage of systematic construction.

Precisely why: when most people are still hesitant to wait and see, the system has completed the signal confirmation, we can complete a practical layout in advance without relying on the premise of emotional judgment; when others are unthinkingly impulsive, we have the system to escort us.

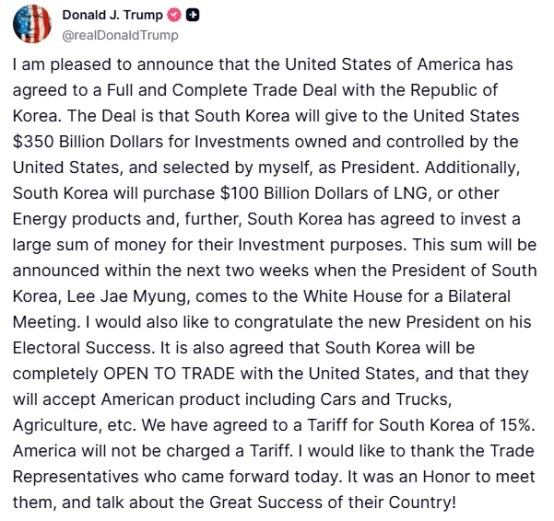

Just last night, President Trump personally announced a $350 billion investment deal with South Korea, with $100 billion in LNG and energy orders, and a reduction in tariffs from 25% to 15%. At the same time, the White House also simultaneously released a signal about "strengthening U.S. leadership in the digital financial technology sector.

In the face of this level of expected policy shock, Core X Quantitative Trading System promptly recognizes key variable changes and quickly adjusts its asset screening and signal generation.

These two seemingly parallel news, in fact, behind the linkage of a more profound market logic: industry restructuring + energy exports + crypto technology three main lines of parallel development, Core X quantitative trading system in the first time after the release of the news synchronized to monitor the market reaction, and identified the following direction of the buyers quickly influx:

Energy infrastructure-related companies include LNG export chain producers and transportation companies.

Proxy crypto concept stocks: $MARA, $MSTR, $WULF, intraday structure turned strong.

U.S.-Korea supply chain cooperation: e.g., auto export parts, AI chips, and the server sector.

In the system's heat tracking model, $MARA, $MSTR, and $WULF are identified as the first round of institutional position building momentum to emerge after the news trigger. Subsequently, $NVTS also appears in the "News Driven + Structural Strength" double-scoring list.

The power of the Core X quantitative trading system lies in its ability to not only recognize news but also understand how the market responds to it - the core ability to turn "information" into "opportunity"—the core ability to turn "information" into "opportunities.

The Core X Quantitative Trading System is not some "mystery strategy package"; it represents three things: structured judgment, disciplined execution, and consistency in performance over time.

My friends, you can now see why we recognize signals before the market, make decisions faster, and have the ability to execute consistently.

So you see, we are not trading by luck, but are using a set of system capabilities to advance results consistently.

You follow the system, where every step is based on the signal, and data supports every trade. You will also find that we are pursuing not only the growth of the account curve but also the overall upgrade of the cognitive level and strategy capabilities.

And just because you have become part of this system, we are willing to share the most core value with you further. The logic behind the CXON token airdrop mechanism is not a welfare handout, but rather a way to recognize your identity and provide tangible proof of your participation in the cognitive system and long-term value structure.

You are not "receiving tokens"; you are receiving your first on-chain interest as a core member.

Now that CXON is officially on the starting line for value release, you've become a true co-builder of the system, and you're in the mix for every round of value growth that happens in the future.

One way to receive the CXON airdrop is by participating in our lottery event. We invite you to join in our community-oriented identity binding mission this Friday (that's tomorrow).

Not an ordinary interactive session, but an entry mechanism we have designed specifically for participants - you don't just have a chance to get CXON, but also to initiate on-chain equity, participate in strategy co-creation, and access the future investment system.

Please get in touch with your investment advisor as soon as possible to receive the lottery code. Every one of you who completes the binding action is part of the structural construction of the Core X quantitative trading system, which is not just a participation, but also the official start of you becoming a co-created member of the system.

Tomorrow is not just a task execution window, but the first trust established between you and the system.

Let's be clearer: what exactly is in it for you to receive the CXON Airdrop?

First of all, it's proof of your participation in the NextLeap community. We're not talking about “concepts”, we're talking about turning ‘contributions’ and “recognition” into tangible, quantifiable assets in your account. Not a short-term reward mechanism, but a passport to participate in our strategy co-creation, course progression, and asset management programs.

By owning CXON, you will gain:

Priority access to advanced account management modules

Priority in quota allocation for specific projects within the community (e.g., on-chain portfolios, co-built pools, etc.)

Early access to strategy model updates

Unlock access to proprietary trading signals or investment data

Participate in community decision-making and voting governance

And most importantly, as the system expands, the market value of CXON itself grows. CXON's market value grows

Next, all those who receive CXON airdrops will gain access to the deeper functionality of the system - see, no longer just price fluctuations up and down, but begin to understand: why the money enters the market, where the buyers are concentrated, in which section, and whether the current structure is still executable.

Not just a confirmation, but you choose to become a platform for long-term co-construction of the starting point - the value of the future, not only from the system, but also from the connection we create together. We never ask you how much you've made in the short term, but instead want to make sure that - in a system that's genuinely worth participating in for the long term - you've got a place of your own.

Choosing to participate at this stage means that you are preparing yourself for the next round of structure establishment. The CXON in your hands is not just an asset; it's your passport to link to the system, synchronize your rhythm, and participate in the distribution of value.

The system is ready, all you have to do is confirm your position - and access the future long-term relationships with action. We'll continue to update strategies, synchronize opportunities, and ensure your presence at every critical point.

You're welcome to be a part of the flow within the system. The next step starts now.

Have a great day tomorrow, and we'll be waiting for you to go live in the system. See you on Friday!