July 7, 2025

July 7, 2025

Looking back at last week's rally, especially the S&P 500 Index (.SPX) surging 2.3% in a single day—its largest gain since November 2022—this warrants careful consideration.

Looking back to last Monday, the market's panic could almost be described as “spreading,” with news headlines using alarming language. However, we have seen this scenario many times before: whenever the VIX index surges to extreme levels, it often marks the market's bottom. Fear itself is the bottom.

So, has Monday's rebound already come to an end?

My assessment is as follows:

The historical high reached by U.S. stocks in July is likely to become the peak for the year and will not be surpassed. What we are currently witnessing is merely a rebound within a larger downtrend, a typical bear market rally.

Over the next one or two weeks, the intraday volatility of the index will gradually narrow, and implied volatility will also decline significantly. However, it is important to note that the market has not yet fully stabilized, and there is a high probability of another downturn in the future, possibly even breaking below last Monday's low—though this will not happen immediately.

From now on, patience is the most important quality for investors.

Therefore, going into Monday, I anticipate that the market will face a new round of selling pressure after the rebound. Technically, the gap formed during the previous rally is now acting as a resistance zone. In such a scenario, the market often experiences a certain degree of emotional selling. Thus, volatility on Monday is a normal occurrence.

So, how should we formulate our trading strategy for Monday?

First, continue holding the high-quality portfolio shared by Professor Bird Grant.

These allocations are backed by a well-thought-out portfolio strategy, covering Treasury-like assets, high-dividend sectors, high-volatility individual stocks, and digital currency-related concepts. Together, they form a stable portfolio capable of withstanding volatile market conditions, making it one of the most reliable allocations you can rely on at present.

Second, if you feel uncertain about the stocks you hold, don't get stuck in confusion on your own.

You can directly message your investment education advisor, who will connect you with our analyst team. They will provide you with specific stock analysis and trading strategies. You don't have to figure it out alone—we are here to help you.

Would you like to participate in such support services?

If you are a new member, welcome!

I am Blake Shaw, founder and mentor of NextLeap Management Consulting Services Co., Ltd. I am delighted that you have joined our community.

Once you join, you will receive a private message from our dedicated investment education advisor. Please remember to reply to her, and you will receive a small welcome gift prepared especially for you.

In addition, you can visit our official website: https://www.nextleap.vip/

Here, you can learn more about who we are, what we do, and why we are so passionate about investment education. We firmly believe that knowledge is your best defense tool in the investment market and your sharpest weapon.

If you have any questions or suggestions, you can also contact your investment education advisor at any time. She will assist you in resolving issues and guide you toward more stable progress.

We are an investment education institution based in New York, USA. As everyone knows, in the United States, most institutions are primarily focused on public welfare and charitable causes. However, in recent years, “investment education institutions” have become increasingly widespread, and there is a very reasonable logic behind this trend.

As the most developed financial nation in the world, the United States has the most mature and regulated investment market. In such an environment, the popularization of investment knowledge is no longer an option but a necessity. Currently, there are approximately 1,300 to 1,500 investment education institutions across the United States, all sharing the common mission of helping the public improve their financial literacy, enhance investment decision-making, and even promote higher-quality investment collaborations.

The vast majority of these institutions operate on a fee-based model:

This includes providing market analysis, investment strategy guidance, and even assisting in establishing investment partnerships. Typically, when participants achieve returns, they support the institution's ongoing operations through fees or donations.

So the question arises—

why are we currently sharing this content for free within our community?

This stems from our core philosophy:

we firmly believe that education should be accessible, especially when you are just beginning your journey into the world of investing.

We are willing to help you grow and see results first—

when you truly benefit, you will naturally understand the meaning of “giving back,” and that is where real change begins.

Why does my investment education institution need to conduct comprehensive online promotion?

1. To prepare for our application to the US Internal Revenue Service (IRS) for 501(c)(3) non-profit tax-exempt status by 2025, which requires a broad public participation base.

2. To promote brand building and long-term reputation dissemination for the investment education institution.

3. To promote our financial technology AI tool CoreX to a broader investor audience and convey its true value.

4. To disseminate responsible modern investment concepts and continuously enhance our annual credit rating and reputation as a professional institution.

Why are we currently offering free educational content, gifts, and even cash packages?

1. We have currently received government funding specifically allocated for financial education, aimed at enhancing public knowledge.

2. These promotional activities fall under our institution’s brand promotion and advertising budget expenditures.

3. Once learners benefit from actual interactions and content and establish genuine trust, we will gradually introduce certain paid service products for voluntary selection.

4. This is also part of the CoreX intelligent investment system’s promotional strategy, aiming to drive understanding through education and ultimately achieve value realization.

So, what exactly is CoreX?

If you've already visited our official website, you may have come across detailed information about it—including some explanatory videos to help you better understand its functions.

CoreX is a financial intelligence tool developed under the direct guidance of myself and Bird Grant. It integrates artificial intelligence technology, real-time data analysis, and multi-market investment logic, forming a powerful system that combines software and hardware.

What is its core function?

It can monitor and analyze data from global mainstream markets in real time—including US stocks, options, futures, European stock markets, Asian markets, cryptocurrencies, foreign exchange, and gold.

However, CoreX does more than just “collect data”; it also filters, infers, and identifies patterns, using dimensions such as price fluctuations, technical charts, and volatility data to provide intelligent predictive results and risk management strategy recommendations.

In other words, CoreX acts as your personal investment co-pilot—

it handles those complex, confusing, and difficult-to-judge market issues for you, so you no longer have to face them alone.

So now I ask you:

Are you ready to put CoreX through the real-world test of the market?

Students, technology has always existed to serve humanity.

That is why we plan to host an online sharing session to formally introduce all the features of CoreX to everyone.

Are you looking forward to it?

Yes, technology allows us to dive deep into the ocean and fly into space, but for me, the ultimate value of technology lies in:

It enables people to accumulate wealth with greater confidence and wisdom.

This is precisely the original intention and vision behind the creation of CoreX.

Do you also agree with this philosophy?

When you feel lost in stock investing,

need more comprehensive individual stock analysis, more precise data tracking, or more reliable performance forecasts, CoreX is designed to solve these problems.

Perhaps you don't have access to it yet, but rest assured, you will soon have the opportunity to experience it.

In the meantime, our investment education advisory team is already preparing for you, offering research, tools, strategies, and in-depth stock analysis services—this is the true purpose of joining this community.

Are you beginning to see the value unfolding?

Now that you understand the significance of our community and the “investment education” content we advocate, let's return to today's topic:

It's Monday. How can we make better and more stable investment decisions?

As I expected, the market experienced volatility after opening, which is a “confusing” pattern of fluctuations. In the face of such a market, my recommended response is very clear:

Stick to the trading portfolio strategy I have set.

High-dividend stocks: $ABBV

This is an individual stock with healthy technical trends and a solid fundamental profile. More importantly, it has a stable dividend-paying capability.

When you purchase such stocks, you typically have two sources of returns:

Capital gains from stock price appreciation and regular cash dividends from the company.

Sounds good, right?

Let's take a step back and think about it:

What are “high-dividend stocks”?

For novice investors, the first step is always “safety first.” So the best choice is often companies that are stable, consistently profitable, and willing to share profits with shareholders.

A “dividend” is a portion of a company’s profits, distributed to you quarterly, semi-annually, or annually—as long as you hold the stock. This reflects the company’s strength and responsibility, and is an important way to reward shareholders.

A “high-dividend stock,” like $ABBV, typically has a dividend yield of around 4.5% annually.

So ask yourself: Does the money you have in the bank still earn a 4.5% interest rate?

Will it still after future rate cuts?

As long as you hold such stocks, you have the right to receive dividends, which are typically distributed shortly after the quarterly earnings report is released.

Therefore, if you are a beginner, this is the foundational investment strategy you must learn and master.

Understand it, apply it, and your investment confidence will grow accordingly.

Today, I have prepared a special “welcome gift” for new students: the U.S. Treasury ETF ($TLT), which I currently consider to be an excellent investment option.

So, why am I particularly recommending this Treasury ETF?

First, Treasury bonds represent safety and trust, forming the foundation for long-term, stable investments.

When you purchase Treasury bonds, you are essentially lending money to the government for its development.

And I believe in this country and its future—this money will be used for infrastructure development, healthcare, defense, education, and other critical areas.

Each of us actually benefits from the outcomes of Treasury bonds in our daily lives.

Therefore, in my view, purchasing Treasury bonds is not only a rational investment decision but also a vote of confidence in the nation's future.

Second, Treasury bonds symbolize the nation's creditworthiness.

They are backed by the U.S. government's credit, ensuring safety and stability.

More importantly, we are currently on the brink of a potential interest rate cut cycle.

Once rate cuts begin, the prices of government bonds typically rise.

Why is this the case? Because the price of government bonds and their yields have an inverse relationship—a topic we will delve into in greater detail in upcoming lessons. Be sure to stay tuned to the community.

So, if you agree with my assessment and believe that rate cuts may indeed be on the horizon,

now is the optimal time to allocate your portfolio to $TLT.

Have you already taken action?

It is clear that investor sentiment in the market is not particularly high today, as it is Monday.

However, precisely because of this, it is an excellent opportunity for us to focus on learning, accumulating knowledge, and growing.

The fact that you've read this far shows that you're persevering, growing, and gradually becoming a better version of yourself.

Investing isn't always exciting; sometimes it's dull and repetitive.

But it's precisely through this process of accumulation that we gradually come to understand the value of knowledge. Eventually, when we apply what we've learned to achieve results, that moment feels like discovering our own “new continent.”

This is what I've always emphasized:

By sticking to your strategy, staying consistently engaged, and steadily accumulating, you can achieve long-term, stable returns.

My goal is simple:

to maximize profits with a safe and stable portfolio.

Does this align with your financial goals?

This afternoon, our community learning session will continue our educational journey!

Professor Bird Grant will deliver an engaging and practical course. Are you ready to participate?

For new members who have just joined—welcome to this community filled with a growth-oriented atmosphere!

And for our long-time members who have been with us—please also assist the new friends, working together to create a mutually supportive and positive learning environment.

Every learning session lays a solid foundation for your future investments.

See you this afternoon, students!

___________________________________________________________________________________________________

The afternoon market is like a summer cloud - fast changing and full of signals, we need to keep our eyes peeled. Good afternoon, everyone!

Professor Blake Shaw this morning's course is very exciting, not only to clarify the current market macro logic, but also pointed out a few very operational value of the main line of direction. For me, these contents not only confirmed our previous judgment, but also let us have a clearer judgment logic on how to do the next step, which direction to stare at.

This morning, Prof. Blake Shaw mentioned two directions to keep an eye on: one is the high dividend ABBV, and the other is the $TLT Treasury allocation that he particularly emphasized. This is not a purely defensive strategy, but rather an early pricing of the future path of interest rate cuts, which is a typical “interest rate cut trade”. Some of the underlying stocks we bought earlier are actually following this logic.

So what's next? Where might the next batch of high-quality opportunities come from? The answer is hidden in the Big Beautiful Bill that was just signed. It's not as simple as a piece of paper policy, but a comprehensive capital reallocation covering energy, technology, defense, and re-urbanization. With so many potential directions to benefit, how do we choose?

When the official signing ceremony of the Big Beautiful Bill was held at 5 p.m. EST on July 4, a B-2 stealth bomber roared over Washington. That was not just a ceremonial design, but a clear signal to the world: this is a strategic move with national security as the underlying logic and reshaping industries as the core goal.

This is not just a budget bill, it's the starting point for a policy orientation, a recapitalization, and an industry reshuffle.

Wall Street sees it clearly - when military, clean energy, AI computing, and re-urbanization are all written into the budget directive at the same time, the market will have to re-answer the question: who will be able to translate the policy vision into real growth delivery?

The headlines do grab everyone's attention, but if you want to really read where the market is going, you have to look at where the money is flowing. Rather than responding to the headlines, markets are placing bets on the next chapter of the story. Want to know what they're betting on? Then you have to figure out - what this “big beautiful bill” is really driving?

The next thing you're probably thinking is that the “Big Beautiful Bill” sounds more like some kind of public health or urban greening policy, so how could it affect the capital markets?

But it's not what the bill is called, it's what the market is pricing in - how federal spending is flowing, how government finances are expanding, and what industries are receiving structural dividends.

We look back at history: when the “infrastructure boom” stimulated not cement stocks, but Caterpillar and transportation ETFs; when the “Clean Energy Bill” after the landing, the real capital is a substantial increase in not environmental consulting firms, but electric vehicles and lithium mining.

Essentially illustrates a point: bet on the right direction, not read the news read fast, but to understand what the market is pricing. The policy is just a starting point, the key is who can “good expectations” into “profit realization”.

Can not see the core logic of policy pricing, it is easy to bet in the wrong direction, “Big Beautiful Bill” sounds more like some kind of public health or urban greening policy, how will affect the capital market?

It's easy to bet on the wrong direction when you don't see the core logic of policy pricing.

So we're going to dismantle the real logic of the market's bets on the “Big Beautiful Bill” in detail. That's why our community exists: not to help you follow sentiment up or down, but to help you break down the real logic of the market's pricing, and step into the box where the money is really betting.

Professor Blake Shaw's 30+ years of experience in the global markets, coupled with our self-developed Core X quantitative trading system, has been the first to identify the real direction behind the bill that could be revalued.

If you see good news, but don't know which piece the market is really buying, how to pick a direction, how to manage risk, then you need a system that can read the pricing logic even more.

You are welcome to join us in reading who the market wants to buy, who it dares to buy, and who it buys first.

To understand why the market quickly adjusted its position before and after the passage of the bill, the core lies in these four directions. On the surface, it is a seemingly “beautification of the country” bill, but in essence, it is a large-scale fiscal plan for the next decade, directing the flow of industrial capital. It focuses on four main areas: advanced manufacturing repatriation, strategic technology investment, federal procurement tilt, and green transition mechanisms.

In other words, the core goal of the “Big Beautiful Bill” is: through the federal financial investment, reshape the U.S. industrial structure. And what the market is betting on is the cash power and enforceability of these four main lines.

First,Advanced Manufacturing Returns

The federal government is directly injecting funds to support the return of key manufacturing industries such as semiconductors, AI hardware, and electric vehicles to U.S. soil. This constitutes a clear policy driver for local manufacturers, industrial equipment suppliers, automation solution providers, and industrial real estate developers. What investors expect: a double-round push of order growth and valuation upgrades.

Second, strategic technology investment

This is far more than just building factories. The government is increasing the layout of national strategic technology investment, focusing on AI, quantum computing, clean energy, military communications and other core areas. Funds are being laid out in advance with the accumulation of technology and industrial landing capacity of medium-sized technology companies and a new generation of innovative enterprises, centered on the battle for global technology dominance in the next decade.

Third, the federal procurement tilt

bill will be hundreds of billions of dollars of federal orders, through the project bidding directed to local small and medium-sized enterprises and technology innovation companies. Whoever wins these contracts will have the opportunity to see the dual drivers of revenue acceleration and valuation repricing. Competition is heating up fast, especially in high order density areas such as infrastructure, transportation, and digital public services.

Finally, Green Transit Mechanisms

Through subsidies, carbon credit markets, and policy incentives, governments are pushing traditional energy companies to accelerate their transformation while establishing long-term growth paths for clean energy companies. Whether it is new energy power plants, grid modernization, or carbon management systems, capital is being allocated around a long-term track with a policy moat.

The Big Beautiful Bill is not drawing a blueprint for the future - it is “spending today's money” to reconstruct tomorrow's industrial landscape. What the market is really betting on is never who speaks louder, but who can turn financial support into orders and policy advantages into growth engines.

At this moment, the entire community is most concerned about, in fact, only one question: who will be the next to cash the narrative into a real growth winner? Funds will really chase the rise, exactly which type of company?

The policy dividend landing is just the starting point, what really determines whether you can make that money or not is how the market is priced and how the money is bet. This is why we have always emphasized - Core X quantitative trading system value does not lie in chasing news, but in advance to see through the structural changes.

Core X quantitative trading system is not a news-driven chasing tool, its core lies in: through real-time tracking of capital flows, policy impulses and industry structure switching, to screen out high-quality targets with “policy benefits + fundamentals to realize the ability”.

Whether it is a mid-sized technology stock driven by the bill, or a key link in the industry chain that is gaining capital,

Core X quantitative trading system can accurately locate in the golden zone where “the story is starting to ferment but the market has not yet priced it”.

Speaking of which, you may also be wondering - how exactly does the Core X Quantitative Trading System capture these policy trading signals?

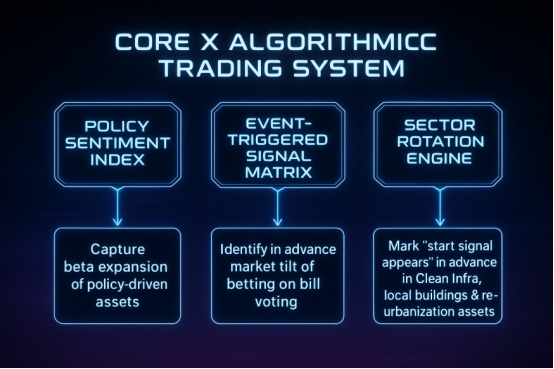

Let's look at it in terms of the Core X Quantitative Trading System's model structure:

Policy Sentiment Index → Captures beta expansion of policy-driven assets

Event-Triggered Signal Matrix → Identifies in advance the direction of the tilt of the market's money towards voting on bills

Sector Rotation Sector Rotation Engine → Early flagging of “start signals” in Clean Infra, Local Building, and Re-Urbanization assets

This combination of three indicators is what sets the Core X Quantitative Trading System apart from traditional quantitative models. It doesn't just track price fluctuations, it reads the evolutionary path of institutional variables and collective expectations that actually drive pricing.

We don't make decisions by following the news. What really puts us ahead of the curve is the Core X Quantitative Trading System's three analytics modules, which capture where money is betting before policy expectations are fully reflected in prices.

You'll find that it's often not the words of the bill itself that really drive the market, but rather the fact that the market is trading ahead of time on the path it might take to land. And we have to think about the question is - how to this “policy trading logic”, into the account of real returns?

Whether you are a short-term trader or a medium-term investor, this type of bill-driven market can basically be broken down into three phases of strategic opportunities:

Pre-heating phase: Prior to the bill vote, pay attention to whether funds start to lay out early in the direction of CleanTech, building materials, and regional banks (e.g., XHB, PKB, and KRE), which is a key window for the market to bet on the policy path in advance.

Confirmation phase: Dynamically adjust position weightings based on the final vote results, flexibly adding and subtracting positions in conjunction with system signals, prioritizing those directions that are already priced in but not yet overdrawn.

Cashing and switching phase: As the budget falls and local projects begin to advance, gradually shift positions to targets that really have the ability to cash in on orders, or wait for the next round of policy deals to signal the emergence of the next round of policy deals.

During the warm-up phase (July 2), our Core X quantitative trading system saw active capital inflows + alpha movements, which have been labeled as “dynamic tracking” by the system; PLUG and ENPH energy storage concept stocks in green energy; and RGTI and QUBT technology prototypes in quantum computers. Developers.

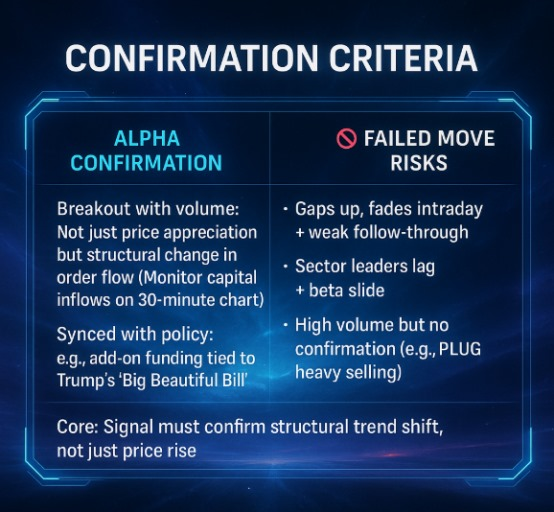

The focus of our attention now is not whether the stock price has pulled up, but rather - whether the funding structure has really changed. If a stock breaks above a previous high, accompanied by significant volume expansion, this is usually not a sign of follow-through, but rather a sign that active capital is beginning to enter the market and build a position. Especially in the 30-minute K-line structure, you can see a clear source of dominant buying, that is more convincing intervention. More importantly - this kind of movement must be linked to the current policy logic.

For example, this round of the “Big Beautiful Bill” in the direction of infrastructure and green grid release of financial extension, for energy storage, smart grid, quantum computing and other technology assets, opened a clear funding layout window.

The next key signal to see if the market is for real or not - has the sector dominant stocks started to gain momentum.

If the core assets of the industry like FSLR, TSLA, IONQ are also synchronized power, it means that it is not a short-term in pulling small votes, but institutions are promoting a round of structural rotation.

On the other hand, if only the early high open, the plate quickly back down, volume did not keep up, it is likely to be a false start. That is mostly a false move.

A lot of votes after the release of volume closed at the low level, indeed, may be the funds in the withdrawal; but like PLUG such a policy linkage logic, but also in the technical level of the formation of the subject of the undertaking, but worth focusing on, waiting for the release of volume after the structure of the confirmation.

In the end, up or not is not our greatest concern, can not get out of the trend, is what we really want to confirm.

Confirmation leads to action, hesitation leads to wait and see, and ambiguity leads to downgrading. Strategy is not won by boldness, but by who has more judgment and who keeps the signal.

A word of caution - the market is not to “rise fast”, but “cash accurate”

The underlying logic of this round of opportunities does not lie in a vote suddenly rushed 30%, but:

funds with “exploratory position building” approach, in a "policy-led + technical “way, in a” policy guidance + technical prototype "resonance point in time, opened the speculative window.

Next, whether it can evolve from a short-term resonance into a trend channel depends on your Core X quantitative trading system, logical judgment and execution discipline to complete the verification.

This is not just a vote, but the entire market on the expectations and the flow of funds to re-bet, the market will not give it a chance because the name of the bill is “beautiful”, but as long as there is a budget, there is spending, there is the industry chain, then there is room for trading.

You don't need to know whether the bill is worth it or not, you only need to know - the market has already put its chips on it.

At the end of the day, trading is never just about market moves, it's about hearts and minds, expectations and choices.

The market is betting on this bill, betting on policy drivers, betting on industrial anchors.

But the question is: what are you betting on? And what is your basis?

This question reminds me of a scene Jesus saw in front of the temple ...... On one occasion, Jesus was in front of the temple and saw people putting their offerings into the silver vault. Some scattered the remaining gold coins in, loudly; others quietly put in two small copper coins, a widow. Jesus said to his disciples, “She has put in little, but all she has is all she has.”

It's the same with us in the marketplace: some people bet on news, emotions, and chips to follow; but it's not the “how much” that brings results, it's the beliefs and judgment systems behind what you put in.

Now that the Big Beautiful Bill has been passed, the market's money is on the line.

The key is not “am I catching up”, but - what you put in, is it a reaction to the wind, or is it a confirmation of the system?

Now it's your turn to think about how you would answer these three questions.

1,How does the Core X Quantitative Trading System capture the Big Beautiful Bill policy trading signals? Have you figured out the logic yet?

2,The market has been trading the logic of the Big Beautiful Bill for a few days now - do you know what four major directions the money is really betting on?

3,Which stocks in the CleanTech, Building Materials and Regional Banks directions is the Core X Quantitative Trading System flagging trade signals ahead of time? The system has recently targeted several stocks in the green energy sector that are still building momentum but have started to release start signals - do you know which ones?

If you will, this is what I really want to leave behind every time I accompany my friends in the community after a strategy review. Strategies will be constantly adjusted according to market structure, and the direction will switch with capital flows and policy expectations, but perception + execution + faith is what will take you through the market.

It's been a productive day of exchanges, and feel free to come back and continue the conversation anytime, my friends. I wish you precision, confidence, and reward in every step you take next.

A little advance warning! We have a raffle this Friday with all sorts of amazing prizes for you to win ~

Remember to contact your investment advisor for your raffle code, don't miss out!

By the way, the grand prize, like the market, belongs to those who are ready

We'll see you next time!