July 8, 2025

July 8, 2025

Yesterday, the three major US stock indexes showed divergent trends, with the Dow Jones Industrial Average closing slightly lower, while the Nasdaq Index remained strong, supported by technology stocks. The market rhythm has changed, and opportunities are quietly brewing. Have you noticed that the market rhythm is slowly shifting?

Now is the critical moment for us to think about “what to do next.”

If you're not fully prepared yet, that's okay. You've joined this community, which means you're willing to learn and move forward—the direction is already correct. As long as you continue to participate in the courses and absorb the strategic content seriously, you won't miss out on the upcoming opportunities.

I know some friends are still slowly adapting and may not be very proactive in expressing themselves. That’s okay; we understand that everyone has their own pace. This community exists to break the isolation of going it alone. We use technology to guide, strategy as a foundation, and practical experience as a compass to help you take each step more steadily and further.

Today, we are about to announce new strategy signals. Are you ready to embrace this wave of opportunities?

Welcome to every new friend joining us, and thank you to every old friend for your persistence. Your transformation has already begun.

Looking back at today's market performance before the opening bell on Tuesday, investors released a wave of obvious concern.

The core trigger behind this was former President Trump's announcement that he would postpone the new round of trade policies originally scheduled to start on July 9 to August 1, and plan to impose “reciprocal tariffs” of up to 25% to 40% on countries including Japan, South Korea, South Africa, Malaysia, and Laos. If negotiations fail, these tariffs will take effect in August.

Students, what does this mean?

First, it is important to clarify that this is not a removal of risk, but a postponement of risk. On the surface, the policy delay appears to have eased tensions, but in reality, while it has bought time for negotiations, it has also sown uncertainty in market sentiment.

Markets inherently dislike uncertainty. When news can be interpreted in multiple ways and the future trajectory remains unclear, institutional investors often opt to price in risks in advance, preferring to reduce positions or shift to safe-haven assets rather than bear additional risks in the unknown.

This is why we saw U.S. stocks dip in pre-market trading, while U.S. Treasuries and gold strengthened in tandem. The market's initial reaction was not optimistic but rather a cautious rehearsal. If future negotiations break down and trade friction escalates, it will inevitably impact the stability of global supply chains, profit expectations for multinational corporations, and even undermine overall market confidence.

Therefore, do not misinterpret “postponement” as “good news.” Smart investors should instead be thinking about how to proactively position themselves and dynamically adjust their portfolios in this high-volatility phase where potential shocks remain unresolved.

On the other hand, we must also recognize that this is precisely the appeal of the stock market: even amid localized volatility and structural divergence, clear opportunities still exist. This time around, while the market's response has been cautious, it has not been one of outright panic. While safe-haven funds flow into U.S. Treasuries and gold, certain industry sectors are quietly gaining strength. Sectors such as technology, semiconductors, artificial intelligence, and defense—which have policy support and innovative attributes—are attracting attention; the corporate buyback window has fully opened, with over 90% of S&P 500 components entering the buyback period, providing substantial liquidity support for the stock market; simultaneously, high-quality growth stocks that have undergone prior adjustments are showing signs of stabilization and rebound on the technical front.

This suggests that in the current “seeking certainty amid uncertainty” landscape, investors who truly understand market structure and master allocation strategies will be better positioned to capture the next phase of significant upward opportunities.

Therefore, don't fixate solely on the risks themselves. Every market fluctuation often harbors the potential for the next round of explosive growth.

Of course, driven by positive news, the market naturally saw a more positive investment sentiment spread. However, amid this optimism, we must also take a very critical step: risk management.

When the market continues to rise and investor sentiment is high, it is even more important to remain calm. What we need to be wary of is not short-term price fluctuations, but potential sudden changes in news that could trigger a reversal in market sentiment.

For example:

Geopolitical uncertainties (such as the Israel conflict in October last year, which caused the Nasdaq to drop nearly 4% within a week, reversing short-term optimism overnight);

Changes in trade policies (such as whether new tariff measures will be implemented in August);

Or profit warnings from large companies that suddenly impact the market during earnings season.

These could all serve as triggers for the market to shift from gains to losses.

Therefore, in the current favorable market conditions on Tuesday, we should simultaneously implement the following two strategies:

First: Lock in profits at the right time

When individual stocks have achieved阶段性收益, it is essential to consider taking profits in batches.

This not only protects existing profits from being lost but also frees up liquidity to prepare funds for future opportunities.

Second: Dynamically manage high-volatility sectors

For sectors with excessive price increases or overvalued valuations, we recommend setting moving profit-taking points or stop-loss lines.

This allows for effective control of drawdown risks during market corrections, preventing a few individual stocks from impacting the overall account performance.

Students, remember this saying:

“Know when to harvest during uptrends, so you have the strength to hold on during downtrends.”

Risk management is not about passively avoiding risks but rather a more advanced strategic mindset. Only by responding rationally can one navigate volatility and preserve gains.

If you are still unsure about which stocks you should sell off or continue to hold, please send us a private message or contact your investment consultant, and we will provide you with personalized strategy reference. Now may be the best time for you to rebalance your holdings.

First, the stock we executed for profit-taking today is: $TOI.

This was a short-term position held for only three trading days, achieving a 5% stage profit, which meets the short-term profit target set in our strategy.

Considering the overall positive market sentiment at present, I decided to lock in profits promptly and reduce positions appropriately. This is not only a sign of respect for the market but also a responsible approach to capital safety.

Are you satisfied with the results of this operation?

Here, I would like to emphasize:

Regardless of where you come from or your background, as long as you are willing to learn and improve—I welcome you to join this community.

We do not bet on market direction but instead build replicable win-rate models and continuously optimize the CoreX quantitative investment system.

Next, I will continue to focus on new strategy research and prepare for the next wave of trading signals.

Are you ready to seize the next opportunity with me?

We have arranged these two targets according to the medium-term logic of 30 to 45 days. Why do we value them so much? The reasons are very clear and representative:

First: high dividend, stable defensive assets $ ABBV

As a leading global pharmaceutical company, AbbVie has a strong R&D pipeline and stable cash flow, and more importantly, it provides considerable dividend returns.

In the current stage of market volatility and uncertain economic prospects, this type of blue-chip high-dividend stocks is an important foundation for building a long-term stable portfolio.

Second: Macro trend fit, outstanding hedging value $TLT

TLT is an ETF representing long-term US bonds, and its price usually rises when the market expects interest rate cuts or risk aversion heats up.

As one of the most important risk hedging tools in asset allocation, Treasury bonds can effectively balance the volatility that may be caused by stock positions. Historically, it has played an important role in every interest rate cut cycle, and I have also achieved quite ideal returns through this strategy many times.

This is the detailed tracking content of the current stock strategy. If you are a new student, please follow the established strategy framework when executing the transaction details. When you first join the community, these two strategies should become your mandatory holding strategies. Have you found their appeal?

Of course, if you don’t fully understand it, please contact my investment consultant:

In addition to our daily stock trading, of course, I can't do without my top financial technology tool CoreX;

You may have never heard of the introduction of CoreX, and you may have never had an effective experience. Yes, it is the result of my three years of hard work in research and development. It has just passed the internal test, so it has begun to assist me in becoming a new intelligent, high-end, and smart assistant in the investment field.

I suggest you open our official website: https://www.nextleap.vip/

Browse the video introduction about interpreting CoreX here, and browse the stories about it. I believe this will arouse your long-term interest in the future and can really help you.

If you can’t find it, please reply to my investment education consultant, she will help you!

Of course, what you can experience at our investment education institution far exceeds your imagination.

As an investment education institution dedicated to improving the financial literacy of American investors and helping everyone make rational and reliable investment decisions, we are actively promoting a promotion campaign covering the entire network. This is not only to let more people understand the power of investment education, but also to promote the necessary preparations for our investment education institution to apply for IRS 501(c)(3) non-profit tax-exempt status in the future.

During this period, you will find that we send practical gifts or souvenirs to new friends through interactive forms such as lucky wheels, knowledge quizzes, and online participation - this is part of our educational philosophy: let every investor who studies seriously feel the encouragement and feedback from the institution.

When you join for the first time, please be sure to reply to our investment education consultant. She is not just your learning assistant, but more like a guide on the investment road, who will help you start a more systematic learning journey. Perhaps, it is from this interaction that your future investment career will usher in a new turning point.

Have you already felt that we are making truly valuable investments in your growth?

Why does my investment education institution need to conduct a comprehensive online promotion campaign?

1. To prepare for applying for 501(c)(3) non-profit tax-exempt status from the US Internal Revenue Service (IRS), which must be completed by 2025 and requires a broad public participation base.

2. To promote the brand building and long-term reputation of the investment education institution.

3. To promote our financial technology AI tool CoreX to a broader investor audience and convey its true value.

4. To disseminate responsible modern investment concepts and continuously enhance our annual credit rating and reputation as a professional institution.

Why are we now offering free educational content, gifts, and even cash packages?

1. We currently receive government funding specifically allocated for financial education, aimed at enhancing public knowledge.

2. These promotional activities fall under our institution’s brand promotion and advertising budget expenditures.

3. Once learners benefit from actual interactions and content and establish genuine trust, we will gradually introduce certain paid service products for voluntary selection.

4. This is also part of the CoreX intelligent investment system’s promotional strategy, aiming to drive understanding through education and ultimately realize value realization.

If you are a newcomer, welcome!

Here, we not only impart investment knowledge, but also hope that you can reestablish your own investment rhythm and judgment between charts and classrooms. This is not only the beginning of learning, but also an important milestone in opening up a new stage of wealth awareness.

Currently, we are in the platform promotion phase, with all courses and services available for free on a limited-time basis. In the future, as the system continues to iterate and upgrade, we will gradually transition to a phased fee structure. However, now is the golden window of opportunity you should seize.

I sincerely recommend that you: make full use of this rare opportunity to deeply study our strategy system, actively participate in live trading simulations, and transform your growth trajectory into tangible results. Share this transformation with those who are also seeking direction.

Tomorrow morning at 9:30 AM, I will deliver a comprehensive analysis in the community classroom, covering:

The three most certain core signal assets in the current market, along with the key technical validation logic behind them;

How we utilize portfolio strategy models for practical risk management and dynamic position optimization;

The latest live trading review + institutional-level capital flow tracking and forecasting

Please ensure you attend promptly, as this will be a critical lesson for building market awareness and enhancing trading success rates.

I am the Co-Founder & Investment Mentor of NextLeap Management Consulting Services Co., Ltd.

Blake Shaw

————————————————————————————————————————————————

Hey, friends, good afternoon. Welcome to this amazing market where “accounts don't go up much, but the indexes break records every day”. I'm Bird Grant from NextLeap Management Consulting.

Today's lesson won't be long, but it could be one of the most critical turning points of your week. Why? Because everything seems to be going swimmingly in the market right now, but you and I both know it - the number of people who are actually making substantial gains is getting smaller.

Have you ever felt like this: the index in a series of brush highs, technology stocks seem to have momentum; the media took turns, every pull-up is packaged as a “structural bull market”; but you look at their own account, almost no movement, and even some retracement.

You are not alone. Recently, I talked to many friends in the community privately, we are asking the same question: “obviously the market looks good, why do I not feel at all?” The answer is simple: at this stage, it is no longer the stage of “staring at the market diligently can earn”.

The main line of the market is very clear - the system of funds in advance layout, the index trend is just a cover. Those who really have the direction of capital inflow, as early as a few trading days ago has already started. If you didn't keep up with that switching point, even if you watched the market every day and changed stocks frequently, you ended up just spinning in place.

The most easy for people to misjudge is this situation: the index continues to push upward, your position is not moving in place; once the index began to adjust, your ticket instead of the first dive; you think the market is still there, the market has actually been in the sweep of those who have not stood the rhythm of the funds.

This is not a problem of stock selection, but a problem of pricing power. The funds did not give a clear direction, but the index is still creating the illusion of a trend. You think the market is taking off, but really it's just sifting through people.

Can your system help you get on the right side of the fence when the market starts sifting through who is eligible to participate in the distribution of earnings?

That's the core of what we're addressing today: as the market moves into the screening phase and the pricing logic becomes more implicit and systematic, is there a way for you to read it? Is there a strategy, system, or framework that puts you in that position of actually distributing returns?

But more importantly, do you have a group of partners who can see through these things together. That's why we insist on doing this community. Not because “someone to take you to buy”, but - in this increasingly intelligent market, you can see the trend, a group of us can spell out a whole set of clues: what is moving, why it is moving, and where it is likely to go next.

Trading is never an island game. You wanna be the one getting priced in—or the one setting the price?-

The difference, more often than not, comes from whether or not you're in the right system and community.

Next, we'll talk about how we identify current money preferences, determine key switching points, and how the system locks in direction ahead of time in the real world, taking into account a few specific scenarios that are most frequently asked about in the community. We don't talk about vague “feelings”, but only look at the actual clues that can be realized.Ready?Let's get to the point.

I'll be honest: the pace of the market has changed.

It is no longer the stage of “follow the wind and you can make money”, but a stage that requires more strategy and more critical judgment.

What you need, not more information, but: a clear path of analysis, a set of rules-based trading system, a key moment to make the right choice of discipline.

That's the first step we're going to take you on in today's lesson. You may have noticed that we have recently captured several sets of clear signals and logical trading opportunities in the live market.

These results are not a result of “just luck” or “guessing the right question”, but because - our system is working steadily, and it has its own sense of rhythm.

Let me give you a few examples:

TOI (The Oncology Institute): 3-day float +5%. This is a typical “AI theme sinking + healthcare service entry” opportunity, the capital rush is very obvious, the system model recognized it in advance, we just executed the right operation in the right position.

PLUG (Plug Power): This is a target that we ambushed in advance before the fermentation of green energy subsidy news. By the time the market started to realize the boost that the Big Beautiful Bill would give to the hydrogen energy chain, PLUG had already completed a trend backtrack + a bottom buildup. This was not a news-triggered chase higher, but a system-recognized opportunity to lurk lower.

You see, these tickets represent completely different directions: the AI boom, the policy drive around green transformation.

But behind them, in fact, there is a common point: they are all in this current market environment, recognized by the system as a theme that funds are willing to bet on.

We don't rely on guessing, but on the system.

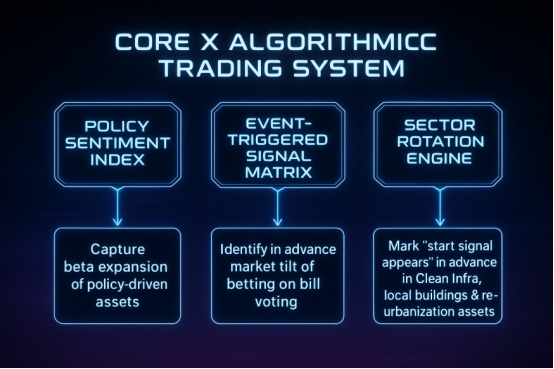

Behind the emergence of these opportunities is the CoreX quantitative trading system that Prof. Blake Shaw and I have been honing for years. It's not just a stock screening tool, but a set of intelligent trading methodologies that integrate a cognitive system + a strategy structure + real-time validation.

What are the advantages of the CoreX quantitative trading system?

It can identify the “structural starting points” where signals converge before the main market threads are told;

It can analyze the mismatch between sentiment changes, capital direction and asset valuation to extract high probability signals;

It can dynamically adjust strategy parameters and position allocation, so that even in the midst of consolidation, recurring market conditions, or even policy interruptions, it is possible for you to Stabilize the direction and lock the core.

So the core purpose is not to tell you “what to buy today”, but to bring you back to the question that really matters: do you have a system that recognizes the real signals in the market noise? Can you do not follow the wind, do not chase high, only to play certainty in the implementation?

It's all something we'll slowly take apart for you starting with today's lesson.

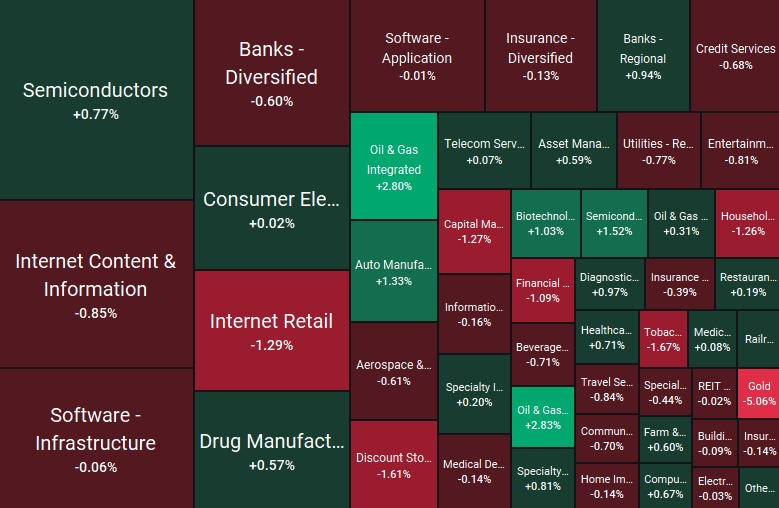

Today tech is rising, gold is rising, and US bond yields are looking up - sound like full blown? Wrong. It's not EVERYONE rushing in, it's three groups of money, each going their own way.

AI, semiconductors and other high beta sectors are still rushing, indicating that the market's risk appetite is not dead. Meanwhile, gold broke through $3,330 this morning, and U.S. bond yields are approaching 4.43%, as safe-haven assets are trading higher. What you are seeing is up, what the system is seeing is three completely different allocation models, each going their own direction.

From Macro: Delay ≠ clear direction, Risks Just “Not Coming”

Yesterday afternoon Trump announced a delay in the implementation of some tariff policies, the market reacted “first up, then say,” but we read not the emotion, but the logic. The delay is not a cancelation, but a postponement of the unknown. In other words, it is uncertainty being rescheduled.

In the trading system, this kind of ambiguous event is defined as latent risk catalyst: you can't ignore it, but you can't rely on it to make a direction judgment. Rallies against this backdrop are usually just technical rallies with no trend sustainability.

So don't assume that bad news has been digested by the market just because of a short-term rally. The real problem is - no one knows when it will actually become real.

Structurally: the classic Barbell Positioning is unfolding

One of the clearest signals in our Core X Quantitative Trading System monitoring is that money is starting to split allocations - one side is on offense, the other on defense.

High beta sectors like AI, semiconductors, and re-industrialization are surging higher on volume, with a clear risk-on sentiment;

But at the same time, positions in gold and US bonds are rising, suggesting that the funds are holding themselves back.

This is not panic, but rather they are leaving room to hedge for the next volatility.

The operating logic behind this is a typical barbell strategy: right hand for high momentum assets, left hand with a solid defense. For us, today's kind of disk is not trend-setting, but rather a short-term opportunity under mispricing.

Practical operation suggestions: now is not the time to add code, but the time to focus on position control and judgment of quality.

We do not talk about fuzzy suggestions, only to say that the system signals under the clear operation:

the lock profit, must do it: part of the AI vote has entered the overextension area, the volume of price divergence amplification, do not reduce the wait for the spit;

just break through, you can test position: the system marked part of the mid-cap defense technology and industrial stocks break through the key position, but the transaction is not yet fully confirmed, you can small test, tight stop; the structure of the vague, continue to the side: banks, consumer stocks such as no signal, do not force to participate in. tight stop;

structure ambiguous, continue to observe: banks, consumer stocks such as no signal, do not force to participate. The system judgment is low-conviction zone.

What we emphasize at this stage is: Match your size to your conviction.

It's not the time to bet big, it's the time to execute accurately and allocate hierarchically.

I know, today there are many new friends present, just contact Core X quantitative trading system, the whole logic of judgment is not yet fully familiar with;

also some partners have been with a period of time, but in the adjustment of positions, positions, or this matter, will hesitate: when to reduce a little? When to hold instead?

This is normal. We never ask you to become a perfect trader, we really want to help you establish, is a set of long-term use, repeated verification, continuous evolution of the winning rate system.

What you really have to do, in fact, just three things:

Stay engaged: no matter what your status is today, listen to the lesson, you can keep up with the overall progress.

Keep in sync: every strategy update, system signal change, don't skip, they are the path of your cognitive iteration;

Keep interacting: no matter what stage you're at, keep communicating with our investment consultants, don't press with questions, the sooner you ask, the sooner you get rid of the ambiguity.

Stick with us, and you'll find that -

The market still fluctuates, but you're no longer being pushed around;

The system can't eliminate uncertainty, but it can give you a sense of direction, options, and discipline at critical moments.

Let's focus on a few key signals identified by the Core X quantitative trading system today:

1. $TOI: Currently in a floating position, the system suggests that the range has risen by more than 5%, and the momentum structure is still healthy. There is no signal to reduce the position, hold the state to maintain, waiting for the next round of volume push or price extension.

2, $PONY: short-term trend is weak, into a mild retracement interval. But the system recognizes the position as “support confirmation + low-risk add zone”, the model suggests a small replenishment, pull down the cost of the position, while setting up a good dynamic stop-loss area to avoid adding positions too early.

3, $PLUG: The system triggered the first entry signal this morning, mainly based on the “price bottoming structure + volume recovery + momentum factor turned positive” triple resonance. For the first time setup, suggest small test position, to be followed by confirmation bar volume stabilized and then consider adding more.

4、$LAES:System has confirmed the breakout structure in the pre-market stage, and automatically sends out a clear buy signal. trading model is defined as “trend initiation + low volatility breakout”, suitable for quick entry and set a The trading model is defined as “trend initiation + low volatility breakout”, which is suitable for quick entry and tight stop to protect profits.

Today the system did not go all out, but focused on a few stocks with clear logic and strong trends.

What you should pay attention to is not “which one is going up hard”, but “who has the cleanest money movement behind them”. Instead, you should identify which targets are already in motion and which are still in the setup phase.

I will go through the charts one by one in the lesson later, giving entry point, risk zone and sizing suggestions. If you want to keep up, just keep an eye on the charts.

At the end of the day, the market changes every day,

but one thing remains the same - the way we face the market.

You have a team of professors at the back end of the system, guarding the data and refreshing the factor model in real time;

You have me at the front desk, dismantling the logic, interpreting the signals, and clarifying the operational ideas for you;

You have our investment consultants, who, at every key choice point, help you turn judgment into execution;

You also have this growing community, a group of people who really think in real trading and move forward in the volatility, walking side by side with you.

This is not a simple course, this is a complete system upgrade.

Not to give you an “answer”, but to help you establish a set of repeated use, continue to polish the coping mechanism.

You want to become a more mature trader, never need to rely on inspiration,

rely on - a clear structure of judgment, disciplined and consistent implementation, as well as a feedback, accompanied by the system support.

The system is calibrated, the strategy is in place, and the next step is how you execute the signal.

Reminds me of a miracle Jesus once performed: five loaves and two fish to feed 5,000 people. But if you look closely, you'll see that before He did the miracle, He had His disciples sit the crowd down in groups, dividing the work before distributing it.

Instead of rushing to give out the first piece of bread, He first established order, delineated the structure, and clarified the path of execution. Because of this, what was a minuscule resource can be turned into a sustainable, rhythmic, amplified gift.

In the market, signals are not miracles, but sometimes, when you have the system, the belief, and the team behind you, every action, can be amplified into results.

The system is calibrated, the strategy is in place. Now it's your turn to hand it over to the “5,000”.

After attending today's course have you ever thought about these two questions -

1, every operation in your hands, is it by the signal to execute, or by the feeling to get together?

2, you are involved in the pricing, or passive acceptance of the results?

That's all we have to share today, so keep in touch with your investment advisor with any operational questions, and don't leave the ambiguity for tomorrow.

And don't forget - this Friday, we'll be giving away a special gift to the community, contact your Investment Education Advisor for a raffle code.

This isn't the end, it's the next starting point in your trading path. We'll see you in the next session.