July 9, 2025

July 9, 2025

Good morning, everyone!

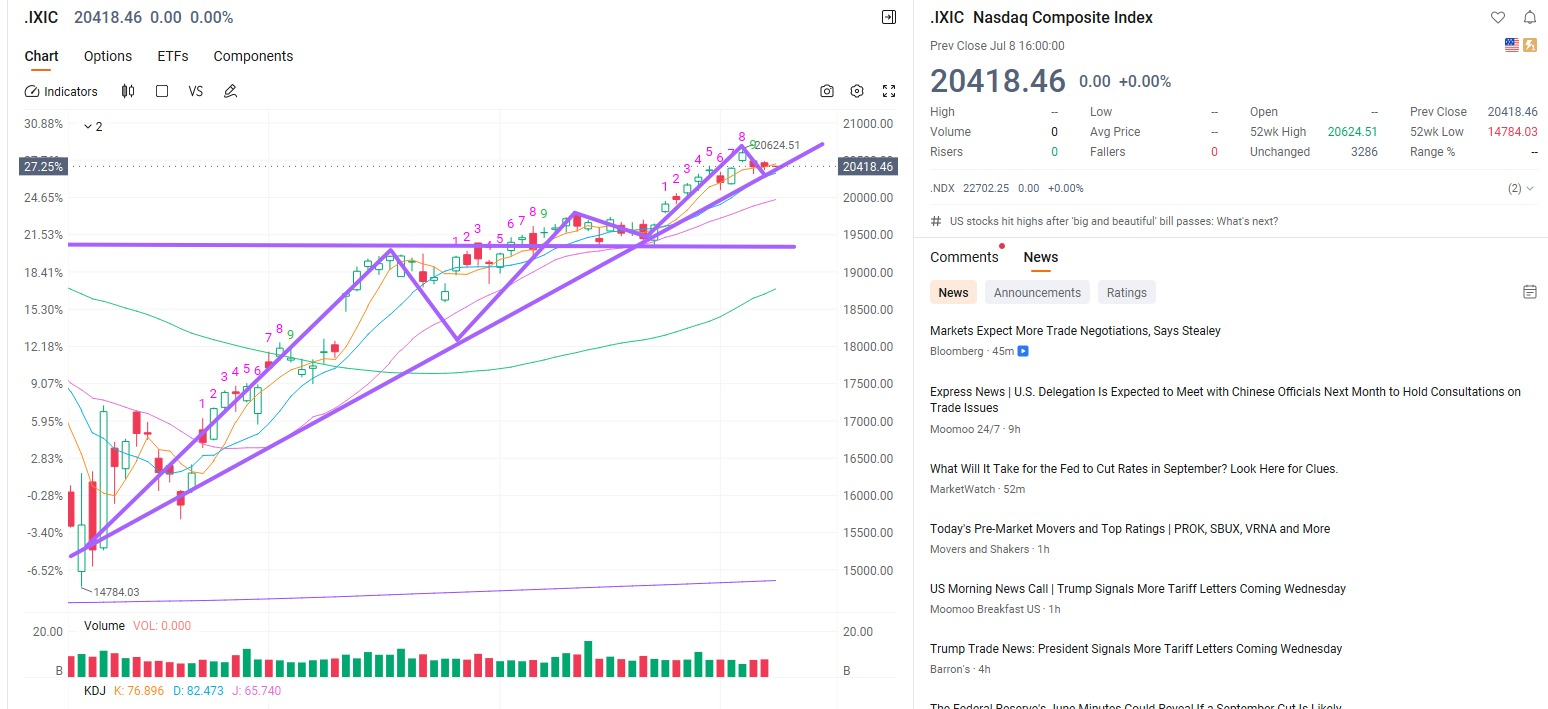

On Wednesday, the market continued to fluctuate, with the three major indexes showing mixed results. Overall, investors remained cautious, with the market continuing to fluctuate and the three major indexes showing mixed results. Sentiment was cautious and trading volume was low. The current market situation is like the still air before a storm, seemingly calm but actually brewing dramatic changes. True investors never wait for the wind to blow before opening their umbrellas.

The two core uncertainties currently facing the market deserve our special attention:

1. The delay in Trump's tariff policy merely postpones trade risks, which have not been resolved.

The new round of tariff measures originally scheduled to take effect on July 9 has been postponed to August 1. On the surface, this appears to be a temporary easing, but in essence, it merely pushes the risk forward. If negotiations break down, retaliatory tariffs of up to 40% could take full effect. This would directly impact global supply chains, corporate profit expectations, and even reshape the international trade landscape.

2. Copper prices have skyrocketed, reigniting inflation expectations and sparking policy concerns.

The expectation of Trump's policy to impose a 50% tariff on copper products has caused copper futures to surge by nearly 10%. This tariff-triggered chain reaction has not only altered raw material prices but also reshaped the direction of capital flight, thereby causing a ripple effect on corporate profits, consumer confidence, and even the Federal Reserve's policy path.

Under the influence of these two major variables, the market lacks clear upward momentum. Capital flows are particularly cautious, with hot sectors rotating rapidly. While index fluctuations appear minimal on the surface, the market is actually in a “compression phase before directional choice.”

In other words, the current market state resembles the calm before a storm, potentially laying the groundwork for the next trend. Especially the recent adjustments over the past two days may be accumulating momentum for the next significant volatility.

From the recent trend of stock indices, the market has entered a state of “high sensitivity and low certainty.” What influences the market is no longer just the cold economic data itself, but investors' dual concerns about “economic slowdown + sticky inflation.”

On the one hand, multiple indicators show that economic growth momentum is weakening, and the job market is also beginning to show signs of fatigue.

On the other hand, while prices for some raw materials have declined, inflation in core sectors such as energy, healthcare, and essential goods remains elevated, leaving businesses under significant cost pressure and with limited profit margins.

This is precisely the scenario we fear most: an economic slowdown coupled with high inflation—the classic “stagflation” pattern.

For the Federal Reserve, this is the most challenging scenario to manage; for the market, it suggests that valuation logic may need to be reevaluated.

In such a phase, blindly chasing highs and taking aggressive risks can easily lead to capital outflows. My personal operational strategy for July is:

Adhere to a “risk-averse + defensive” approach to address the risk of sudden systemic corrections.

If you want to stay steady in this market, there are two key points to keep in mind:

First, don't chase hot trends or emotions; look at fundamentals and cash flow stability.

Second, what will really bring you returns are high-quality stocks that can weather cycles and have intrinsic value, not short-term concept speculation.

In yesterday's morning session, I provided a detailed explanation of how to screen for such stocks and how to use portfolio allocation for defensive positioning.

Have you mastered these core principles?

If you're still unclear, feel free to ask questions after class, and we can discuss them further one-on-one.

Dear friends, today we are going to talk about a key topic: How to protect your assets when the market falls?

In the U.S. stock market, one of the most common hedging tools is the inverse ETF.

For example:

SQQQ: A 3x inverse product tracking the Nasdaq, suitable for capturing leveraged opportunities during rapid declines in tech stocks;

UVXY: An inverse tool tracking the volatility index, which often surges significantly during market panic.

If you are a short-term trader skilled at managing pace and risk, these tools can help you achieve contrarian returns during market corrections. However, it is important to note: they are not suitable for long-term holding, and positions and stop-loss orders must be strictly enforced.

For investors who prefer a more conservative strategy, I recommend focusing on U.S. long-term Treasury bond ETFs like TLT. These products attract sustained buying interest when market risk aversion rises, offering low volatility, stable returns, and providing a “defensive cushion” for portfolios during stock market downturns.

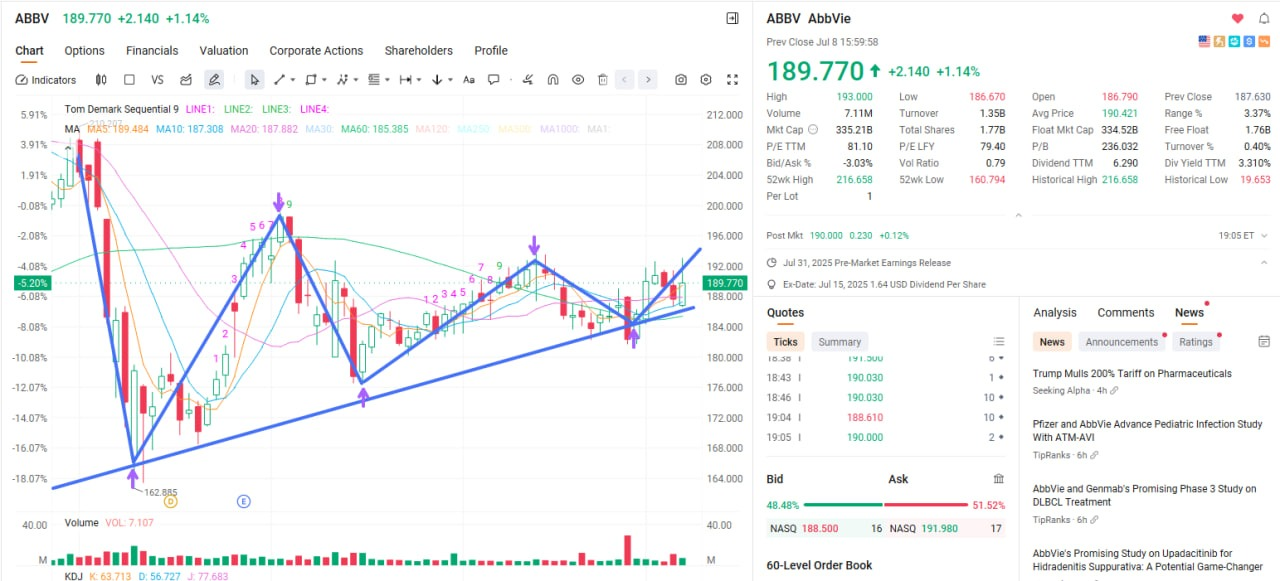

In recent live trading portfolios, $ABBV has demonstrated typical strong characteristics—amidst market volatility and pressure on major sectors, it has steadily risen and seen continuous volume increases, clearly attracting significant capital inflows.

In other words, truly mature investors never wait for the market to start falling before considering defensive strategies; instead, they always plan ahead—building positions when necessary and defending when required.

Of course, defense is not about avoidance; it is about identifying and capitalizing on those “counter-trend winners” that break through volatility.

Why are we confident in allocating to it?

Fundamentals: As a global leader in biopharmaceuticals, ABBV boasts stable cash flow and a high-barrier product pipeline, ensuring strong long-term profitability;

Technical analysis: After consolidating sideways, it effectively broke above key moving averages, with a healthy technical structure and sustained net inflows of major capital;

Catalytic logic: Upcoming earnings reports are expected to be optimistic, combined with its high dividend yield and “safe-haven preference,” creating multiple drivers.

Such assets with both “defensive + growth” characteristics are the core logic of our current strategic allocation.

In a volatile market, stock selection should not aim for aggressive breakthroughs but rather precise positioning. Selecting the right industry, managing positions effectively, and capturing strong sector rotations are the tactical touchpoints for achieving steady profits.

If you have not yet fully entered the market, please contact your investment education advisor as soon as possible. We will assist you in understanding the strategy, familiarizing yourself with the rhythm, and joining the market promptly.

Friends, what are US Treasury bonds and yields?

First, let's understand US Treasury bonds. These are bonds issued by the US federal government through the Treasury Department, which can be simply understood as borrowing money from around the world.

You can think of bonds as promissory notes, but these are backed by the creditworthiness of the U.S. government, making them highly valuable and reliable. Global institutions and other countries use them as a benchmark for measuring bond value and risk, which is extremely low, so people are willing to pay to purchase these bonds.

In other words, you are essentially receiving a promissory note from the U.S. Treasury stating that it owes you money. Do you understand how bonds are structured now?

As a return for lending money to the US Treasury, when you purchase 20-year bonds, the US government promises a yield equivalent to the Federal Reserve's federal benchmark interest rate.

This means that bond yields are volatile and change with expectations of the base interest rate. When the Federal Reserve is in a gradual interest rate hike cycle, bond yields will continue to rise.

When the Federal Reserve is expected to enter a rate-cutting cycle, bond yields decline because the federal funds rate is decreasing. Therefore, bond yields fluctuate in response to expectations of rate hikes or cuts. Does this help you understand bond yields?

Before understanding bond prices, it is necessary to first understand the face value of a bond:

The face value of a U.S. Treasury bond refers to the amount stated on the bond, which is the principal that investors can recover when the bond matures.

Function: The face value serves as the basis for calculating bond interest and is also a reference point for bond prices.

The relationship between the price of a U.S. Treasury bond and its face value is dynamic and influenced by various factors.

For example, if you purchase a 10-year U.S. Treasury bond with a face value of $1,000, this represents the principal amount you are lending to the U.S. Treasury.

However, the price at which you purchase this bond is not always $1,000; it fluctuates with changes in interest rates.

Suppose there is a 10-year US Treasury bond with a face value of $1,000 and a coupon rate of 3%.

Scenario 1: If the market interest rate rises to 4%, investors will be more inclined to purchase newly issued bonds with higher interest rates, leading to a decline in demand for this 10-year US Treasury bond. As a result, its price will fall below $950, i.e., it will be issued at a discount.

Scenario 2: If market interest rates fall to 2%, investors would prefer to purchase this relatively higher-yielding bond, causing its price to rise above $1,050, i.e., a premium issuance.

Market interest rates represent the interest rate data available in the trading market;

This explains why, during a rate-hiking cycle, the market interest rate on U.S. Treasury bonds rises, yet demand for government bonds declines, causing their prices to fall below face value. If you happen to own such a bond and fail to sell it, you will incur a loss. This was one of the key triggers behind the run on and collapse of Silicon Valley Bank early last year:

For example, before the rate hike in early 2022, Silicon Valley Bank used depositor funds to purchase government bonds

Assume that at the time, a 10-year U.S. Treasury bond with a face value of $1,000 and a coupon rate of 3% was purchased.

After the interest rate hike was implemented, market interest rates rose, leading to a decline in demand and causing the bond's price to fall below its face value. Therefore, by early 2023, the $1,000 face value of this bond might only be able to be sold in the market for $850.

Therefore, when the Silicon Valley Bank run occurred, the bank could not sell the Treasury bonds to address the cash flow shortage, as selling would result in losses, indicating that the bank's savings funds had incurred investment losses. When selling became concentrated, bond prices continued to decline, creating a dual pressure on Silicon Valley Bank: it could not resolve the depositor run in the short term and faced losses from its Treasury bond investments, ultimately leading to bankruptcy.

Based on the analysis principles outlined above, the probability of the Federal Reserve raising interest rates is virtually zero, while expectations of a rate cut are all but certain, and we should see this materialize in September;

Given this scenario, consider a 10-year U.S. Treasury bond with a face value of $1,000 and a coupon rate of 5%.

It will soon become a hot commodity, so its market price will continue to rise above the face value. This is because investors are unwilling to accept newly issued Treasury bonds with coupon rates lower than the current rate, and the rush to buy will be a key factor driving its price higher.

So why would smart investors allocate to Treasury bond ETFs in a bear market?

Because ETFs, as exchange-traded bond investment funds, are important risk-averse and safe financial products, they are in high demand;

Consider this: a 10-year Treasury bond with a face value of $1,000 and a 5% interest rate—isn’t that a super-stable return?

Only when risks arise do people tend to seek the safety and security of Treasury bond yields. Once risks subside, the market will pursue investment targets offering higher profits and returns;

This is the investment opportunity presented by U.S. Treasury ETF investments, and the connection to the stock market downturn—can you understand that?

Friends, although the current market remains stable, true investors never relax during calm periods.

Every calm judgment and strategy review is a prelude to future returns.

To help everyone consolidate today's knowledge points, we will launch a “raffle” event this Friday.

Listen carefully to the lecture and think actively, and you will have the opportunity to obtain a special lucky code to participate in the raffle!

Today's interactive questions:

1. Why are high-dividend stocks and Treasury ETF more attractive in volatile markets?

2. What is the biggest risk factor affecting the market this Wednesday?

Please send your answers via private message to your investment education advisor, who will register you for the lottery.

Each answer is a test of your knowledge; each participation may give you the confidence to make more informed decisions next time.

See you in class on Thursday—don’t let opportunities slip away in silence.

——————————————————————————————————————————————————————————

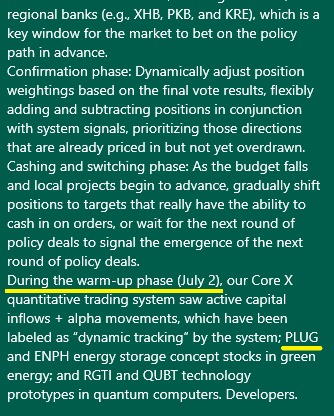

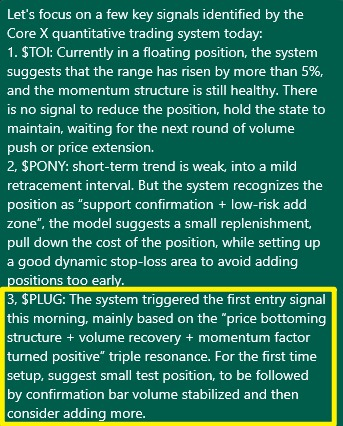

Happy Wednesday folks! $PLUG is crazy today, +25.35% - I'm just happy as hell!

We named it on Monday when we talked about the “Big Beautiful Bill”, the system was labeled early trigger,

Yesterday's signal was confirmed, and today it pulled off a direct blowout, which wasn't blindfolded, it was a signal + conviction of hard cash.

Really too happy - not because up more, but we saw the opportunity in advance, complete to get the results, but also with everyone to do the right.

This feeling is not only making money, but also the feeling of “all the judgments are correct”!

Good afternoon! I'm Bird Grant from NextLeap Management Consulting, LLC

I'm a little more excited than usual today. Why? Because it's the “Wednesday before the tipping point” - we're already calibrating our direction ahead of time while everyone else in the market is still trying to figure out if the market is going to move or not!

Tell a little story to start, in Boston, Massachusetts, there is an old trader, young mixed in the New York Stock Exchange, retired and settled in Cape Cod, he has a habit, every Wednesday with a small notebook and a cup of black coffee, sitting on the dockside to watch the market. He said, “Wednesdays are ‘half-time review day’-the day when you can tell who's warming up and who's really planning to run the whole game.”

Hear that, friends? Today isn't just any Wednesday - it's the kind of critical midpoint that determines whether or not you'll be able to lock in gains this week. We're gathering today not just to see how fast the market moves, but to make sure:

Is this leg of the market worth a serious bet?

The market is still uncertain, but are there assets starting to shine through the noise?

And is our Core X quantitative trading system once again recognizing early triggers and marking which directions deserve real attention?

Essentially, it would be a shame for you to miss today's lesson - real signals always appear when others are not yet aware of them. So, welcome to all the old friends and new partners on the line! Clear your mind, tune your screen, grab a cup of tea

We're going to get started - follow the setup, stay in the flow.

I know that this past June was a month of realizing results for many of us.

Old friends and new members of the community followed us to make several core strategy stocks, $TNGX, $JOBY, $RKLB, $XBIO, $LAES, $RGTI, $PLUG almost all of them realized real profits beyond expectations. What's more, this time the profit is not by chasing up and down, not betting on emotions, but a complete strategy judgment + system execution.

$PLUG blew right up today, +25.35%! Sorry, I'm really a bit excited. It's not luck, it's the result of our system staring, confirming, and executing ahead of time.

When we talked about the Big Beautiful Bill on Monday, Core X Quantitative Trading System marked $PLUG: Policy Driven + Early Trigger first, and at that moment we already knew that this ticket made the alternative list.

Yesterday's signal confirmation, Core X quantitative trading system gives clean entry zone, community old and new friends to follow up; today directly cash, realized amazing gains, it's crazy.

From anticipation to confirmation, from signal to execution, every step of the way was on point - it wasn't blindfolded, it was a triumph of system + execution discipline.

Remember: we never chase emotions, we chase setup clarity + signal confirmation + precise execution.

I am so happy with today's result. Not because it's up 25.35%, but because - once again - we saw it ahead of time. let's keep doing this. day by day, setup by setup.

And the fact that we were able to eat the trade so cleanly this time is not just because the Core X quantitative trading system is awesome, it's also because - we are in sync with the overall judgment of the market.

The logic behind this has long been taught in the strategies of Prof. Blake Shaw. He repeatedly emphasized a core judgment:

In recent times, the market has continued to be in a high churn state, with frequent switching of topics.

On the surface, the tape is very lively, but most of the moves lack follow-through, no continuity. A lot of directions just flash a little on the fire, really have follow-through and structural support setup few and far between.

Professor reminded everyone: in this market condition, the focus has long been not “who first found what”, but -

who can sharpen the read, align sizing with conviction, align sizing with conviction, and structure the portfolio around what’s working.

At the end of the day, it's a time to test portfolio management skills. Not casting a net, but screening assets with clear criteria and allocating positions according to systematic signals is our core strategy for dealing with high uncertainty markets. The focus is not on who reacts fast or rushes hard, but rather - who can execute stably and go on for the long term. Investing is not a sprint, but a journey about judgment, discipline and consistency.

This is a statement I strongly agree with. The current state of the market has moved from “news speculation” to the “system” stage. Two key variables are reshaping the market landscape: tariff risk, although temporarily mitigated, is far from over; and policy volatility remains a potential pitfall. With the acceleration of copper prices, renewed market expectations of inflation, and the consequent re-pricing of interest rate paths, the market is reweighing - which assets are worth holding and which risks are no longer undervalued.

On the surface, the indices are oscillating, the current market is still in a compressed range prior to trend confirmation, volatility is narrowing but the signal is not yet clear, momentum is building and the next leg of the move depends on who breaks the stalemate first.

As my long-time and most trusted strategic partner, Prof. Blake Shaw has always emphasized one core philosophy:

“Markets are not to be predicted, they are to be understood, dismantled, and responded to with systems.”

He has constructed a unique and pragmatic investment philosophy based on his precise judgment, strict risk control system, and firm adherence to the logic of long-term compounding.

This has not only made him a frontrunner in real-world trading, but has also made him a true role model to follow in the minds of many - an investor with vision, insight and human warmth.

Many of the systematic trading principles we use today are based on the theoretical foundations he laid in his early years of quantitative modeling and strategy evolution training in Chicago.

From signal identification to portfolio management, from risk hedging to execution discipline, Blake Shaw's approach to systematic trading is based on his early training in quantitative modeling and strategy evolution in Chicago. Prof. Blake Shaw builds not just models, but a structure of capabilities to think about the markets, deal with uncertainty, and go for the long haul.

Many friends for the first time really feel - investment, not luck, is the method; not talent, is Core X quantitative trading system. Because the results are visible, there are many people privately asked me this question: "You already have such a strong quantitative trading system, why do you want to teach others for free? Why don't you charge for it? Why don't you even provide information, set up incentives for lucky draws, and support various ancillary services?"

Today, I would like to spend a little time to respond to this matter seriously - why do we do investment education? And why do we insist on making it free?

In case you didn't know, there are roughly 1,300 to 1,500 investment education-oriented organizations in the United States today. Most of them have a similar business model: charge for membership, sell courses, recommend advisors, or sell financial products. This is the mainstream of the market, and it makes perfect sense. We, however, have taken a different path from the beginning.

What we choose to do is: open all core strategy courses to the public for free, led by Prof. Blake Shaw, build Core X quantitative trading system, provide real-time executable trading signals and fund flow tracking, and at the same time, build a three-tier synergistic cognitive growth system that integrates community support, quantitative system and structured teaching.

This is not for charity, nor for short-term heat, but because we have a clear and firm goal: what we want to do, is a real investment education platform with a public service mission.

Right now, we are actively moving forward with filing our 501(c)(3) nonprofit tax-exempt qualification application with the Internal Revenue Service (IRS).

The requirements for this certification are very stringent - to qualify, organizations must meet three mandatory criteria: their services must be offered to the general public, not to paid members with high thresholds; the content offered must be “educational” in nature and not for profit; and all The use of operating funds, budgets, and allocation of resources must be transparent and auditable, and contribute to the public interest.

In other words, we don't just teach you how to trade stocks - we are building a cognitive system that can support your continuous evolution for ten or twenty years:

a growth-oriented learning framework that investors can really use over and over again;

a real-world companion system that provides clear judgments and behavioral guidance in every market fluctuation.

But that's not all.

We have another core goal: to build a credible professional rating system and long-term brand reputation.

The reason we place so much emphasis on applying for 501(c)(3) non-profit status is precisely because of this deeper layout:

In a trading environment full of noise, over-marketing, and extremely high information density, the hardest thing is not to shout slogans, but to build trust that lasts through uncertainty. We don't rely on short-term rallies, we don't rely on betting on individual hot tickets to tell a story, we rely on -

stable, verifiable strategy models and system signals (professional edge)

help ordinary people really build understanding of the teaching logic (educational clarity)

every market fluctuations in the execution discipline (professional edge).

And speaking of which, we must mention a key figure - Prof. Blake Shaw. To many, he is a Stanford-born veteran investor; a strategy director who has led several major Wall Street funds; and a veteran strategist with 30 years of market experience.

But to us, he is the engine behind this platform.

He is the core designer of the Core X quantitative trading system, the first to integrate AI, big data and behavioral financial models, truly applied to the average investor in the trading system on the ground.

He always adheres to one principle: instead of just telling you to buy, we should let you understand the logic behind it, so that you can turn every trade into a reusable learning process; you can feel his structural thinking behind it in every class; and you can also see his prognosticating framework of recognizing the market direction weeks in advance in every system upgrade. He is not building a teaching platform, he is building - a system you can rely on-year in, year out

For us, the point of this class is not what you learn, but whether you begin to accept the logic of a higher standard of judgment - cognition determines behavior, and behavior shapes results.

The real change begins the moment you understand the power behind education. So what we do is not “teach you to speculate on stocks for free”, what we do is three things:

Let Core X quantitative trading system is not just a tool, but a bridge for you to know the investment world;

Let you no longer rely on “listening to the news”, but to really establish their own judgment system;

Let investment education, like basic medical care, become a cognitive right that every citizen should enjoy.

If you've ever thought that “investing is far from me” or “finance is only for those people” - the fact that you're here today is the first step in breaking through that bias. Our classes will remain free, but I sincerely hope you don't think of this as a perk - but rather as an invitation to cognitive upgrades, long-term growth, and strategic beliefs.

When we talk about investing, we're not just talking about yield curves and rates of return, we're talking about a way of understanding the world. Let me tell you a story about me - not from Wall Street, but it happened when I was just a few years into the business.

It was the early 90s and I was still working as a bond trader at an investment bank in San Francisco. There were no quantitative trading systems in the market at that time; everything was based on intuition and phone calls. My mentor was a 30-year veteran trader who seldom lectured and only told me one thing: “Bird, always remember, you're not dealing with price, you're dealing with human nature.”

One afternoon, the bond market suddenly swung violently. The price of a large position in a bond we were holding began to fall rapidly, and the entire floor of the trading room was thrown into a panic. I was ready to stop my losses while staring at the market, but my mentor came over, pressed my hand, and simply said, “Don't move. Look at how people react, not how prices jump.”

At that moment I didn't quite understand. But then I realized - that's not for you to bet on luck, but to remind you to look at the logic behind it: where does market sentiment come from? Is liquidity gathering or running away? The part beyond the data is the real threshold of judgment.

The reason why we do investment education today is not because “some people don't understand”, but because - without establishing your own judgment system, you can only ever be a follower of the market. And the real investor, must be the one who dares to remain calm in the chaos, in the hesitation to make decisions.

So today's lesson is not just about “how to invest”, but about whether you can start to believe that you can read the world, understand the market, and make quality decisions.

And we are here to help you accomplish this.

And finally I would like to ask a question to my community friends, if the market gives completely different signals than the news you see - which one would you prefer to believe?

🅐 News headlines

🅑 Real-time signals given by Core X quantitative trading system

🅒 Logic of judgment built by yourself

That's it for today, there's another special drawing waiting for you on Friday - on time! Go live, take the system judgment and a little bit of luck with you.